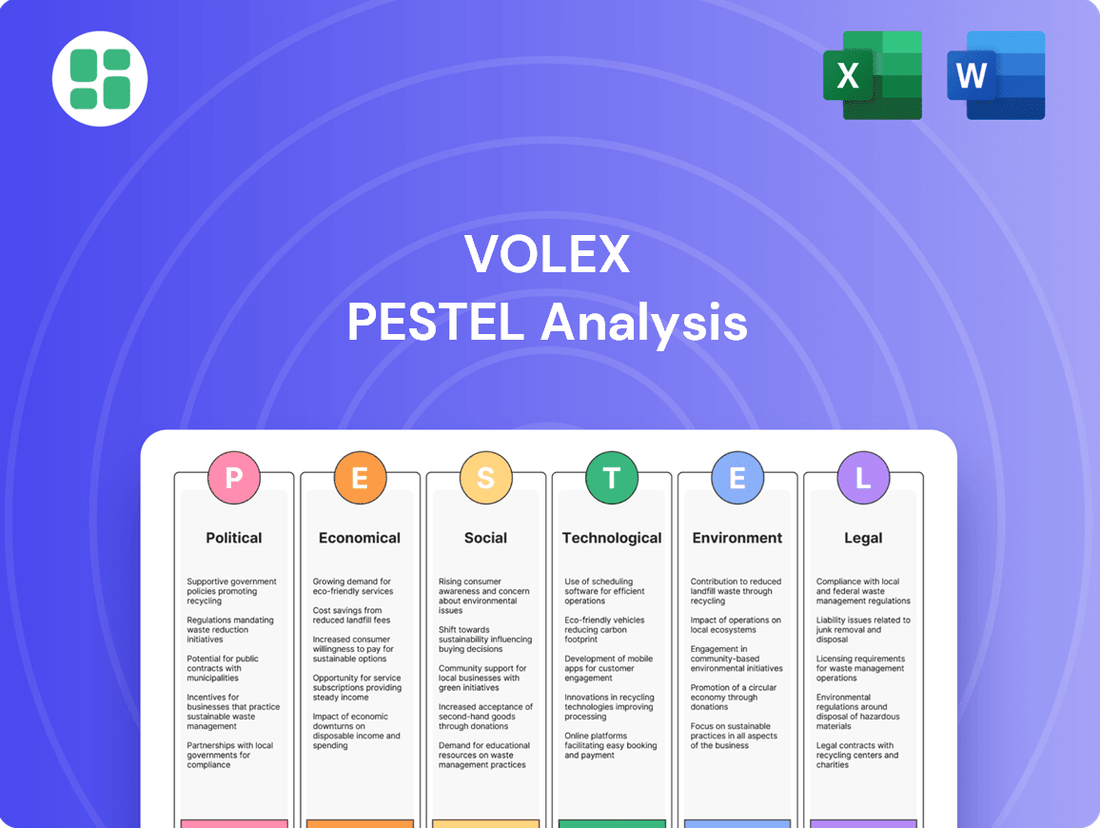

Volex PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volex Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Volex's trajectory. Our meticulously researched PESTLE analysis provides a comprehensive overview, empowering you to anticipate market shifts and identify strategic opportunities. Don't navigate the future blindfolded – gain the clarity you need to make informed decisions. Download the full PESTLE analysis now and unlock actionable intelligence.

Political factors

Global trade policies, especially between the US and China, directly impact Volex's ability to source materials and sell products. For instance, the US imposed tariffs on goods from China, with discussions in 2025 potentially introducing further adjustments to these trade relationships.

Tariffs and trade barriers can inflate Volex's operational costs by increasing the price of raw materials and finished goods. This directly affects the company's profit margins and its ability to offer competitive pricing in the market.

The evolving landscape of international trade, including potential new tariffs expected in 2025, introduces significant uncertainty. This necessitates Volex to strategically adapt its sourcing and manufacturing strategies to mitigate risks and maintain operational efficiency.

Geopolitical instability, particularly in regions vital for manufacturing and raw material sourcing, poses a significant risk to Volex's operational continuity. For instance, ongoing conflicts in Eastern Europe and parts of the Middle East, which are critical for certain industrial components and energy supplies, could directly impact Volex's ability to secure necessary inputs. The global manufacturing sector, as a whole, saw supply chain disruptions due to geopolitical events in 2023, with an estimated 70% of companies reporting increased lead times.

To counter these vulnerabilities, a strategic shift towards production localization and supply chain diversification is becoming paramount. This approach aims to reduce reliance on single geographic areas, thereby enhancing resilience against regional conflicts. Companies that actively diversified their supplier base in 2024, for example, reported a 15% lower impact from supply chain disruptions compared to those that did not.

Volex, with its international operations, must proactively manage these geopolitical complexities. Navigating trade sanctions, political unrest, and fluctuating international relations is essential for maintaining stable production and distribution, ensuring that Volex can continue to meet market demands without significant interruption.

Government policies and incentives are significantly boosting the electric vehicle (EV) and data center sectors, which directly benefits Volex. For instance, the US Inflation Reduction Act of 2022 offers substantial tax credits for EV purchases, aiming to accelerate adoption. Similarly, many governments worldwide are providing grants and tax breaks for companies building and expanding data center capacity, recognizing their critical role in the digital economy.

These initiatives translate into increased demand for Volex's specialized power products and cable assemblies. As more consumers opt for EVs, the need for charging infrastructure, which relies on robust cabling, grows. In the data center realm, the expansion of server farms and cloud computing services requires advanced power distribution and connectivity solutions, areas where Volex excels. For example, the global data center market was valued at approximately $240 billion in 2023 and is projected to grow significantly in the coming years, driven by AI and cloud adoption.

Political Stability in Key Markets

Political stability in Volex's key operating and sales markets is paramount for ensuring a predictable business landscape. Fluctuations in government, unexpected policy changes, or periods of civil unrest can significantly affect consumer sentiment, the regulatory environment, and the overall ease of conducting business operations. For instance, geopolitical tensions in regions where Volex has manufacturing or significant sales presence, such as certain parts of Asia or Africa, could disrupt supply chains or dampen demand.

Volex's strategy of maintaining a diversified global footprint is a key mitigator against the risks posed by over-dependence on any single politically unstable market. This geographic spread means that if one region experiences political turmoil, its impact on Volex's overall performance is cushioned by stability in other territories. As of early 2025, Volex's operations span across numerous countries, with significant revenue streams originating from regions exhibiting varying degrees of political stability.

- Geopolitical Risk Assessment: Volex actively monitors political developments in countries like the UK, China, and the United States, which represent major markets and operational hubs.

- Diversification Benefits: The company's presence in over 20 countries helps to spread political risk, ensuring that localized instability does not disproportionately affect global revenue.

- Regulatory Impact: Changes in trade policies or government regulations in key markets, such as potential tariffs or import/export restrictions, are continuously evaluated for their impact on Volex's cost structure and market access.

- Operational Resilience: Volex's supply chain resilience is designed to withstand disruptions, with alternative sourcing and manufacturing options available to mitigate the impact of political instability in specific locations.

Export Controls and Technology Transfer Regulations

Volex's global operations are significantly shaped by export controls and technology transfer regulations, especially concerning advanced components and sensitive technologies. Compliance with these international standards is crucial for a company providing performance-critical applications and data connectivity solutions. These rules can directly impact strategic decisions regarding partnerships, manufacturing site selection, and even the direction of product development.

The evolving landscape of geopolitical tensions and national security concerns means that these regulations are subject to frequent updates. For instance, in 2024, the United States continued to refine its export control policies, particularly targeting advanced semiconductors and related technologies, which could affect Volex's supply chain and market access in certain regions. Similarly, the European Union's efforts to bolster its technological sovereignty and control the flow of critical intellectual property also present compliance challenges.

- Impact on Supply Chain: Restrictions on the export of key manufacturing equipment or components could disrupt Volex's production capabilities and increase lead times.

- Market Access: Certain technologies or products may face limitations in export to specific countries, potentially reducing Volex's addressable market.

- R&D and Partnerships: Collaboration on advanced technologies may be scrutinized, influencing Volex's ability to partner with international entities or access cutting-edge research.

- Increased Compliance Costs: Navigating and adhering to a complex web of international regulations necessitates investment in compliance personnel and systems.

Government policies significantly influence Volex's growth, particularly through incentives in the EV and data center sectors. For example, the US Inflation Reduction Act of 2022 and similar global initiatives are driving demand for Volex's power products and cable assemblies. The global data center market, valued at approximately $240 billion in 2023, is expected to expand further due to AI and cloud adoption, creating opportunities for Volex.

Political stability in Volex's operating and sales markets is crucial for business continuity. Geopolitical tensions in key regions could disrupt supply chains or dampen demand, highlighting the importance of Volex's diversified global footprint. As of early 2025, Volex's presence in over 20 countries helps mitigate risks from localized instability.

Trade policies and geopolitical events, such as US-China tariffs and conflicts in Eastern Europe, directly impact Volex's costs and supply chain. Tariffs can increase raw material prices, affecting profit margins. The company's strategy to diversify sourcing and manufacturing is essential to counter these uncertainties, with companies diversifying suppliers in 2024 reporting 15% lower disruption impacts.

Export controls and technology transfer regulations, particularly concerning advanced components, pose compliance challenges for Volex. Updates to US export control policies in 2024 and EU efforts on technological sovereignty can affect market access and R&D partnerships. Navigating these evolving regulations requires investment in compliance systems.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Volex, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version of the PESTLE analysis, allowing Volex to quickly identify and address external factors impacting their business, thereby relieving the pain of navigating complex market dynamics.

Economic factors

Global economic growth is projected to be moderate in 2024 and 2025, with the IMF forecasting 3.2% for both years. This steady, albeit not explosive, growth directly influences consumer spending habits. When economies are healthy, consumers are more likely to purchase discretionary items like new electronics and vehicles, which are key markets for Volex's power cords and cable assemblies.

Conversely, an economic slowdown or recessionary pressures can significantly dampen demand. For instance, a dip in consumer confidence during an economic downturn often leads to delayed purchases of larger ticket items, directly impacting Volex's order volumes. The automotive sector, in particular, is sensitive to economic cycles, as vehicle sales often decline during periods of uncertainty.

Strong consumer spending, therefore, acts as a significant tailwind for Volex. In 2024, global retail sales are expected to see a growth of around 3.5% to 4%, indicating a positive environment for consumer electronics. This robust spending environment translates into increased demand for the components Volex supplies to manufacturers in these sectors.

Inflationary pressures are a significant concern for Volex. For instance, in early 2024, global inflation remained a persistent challenge, impacting raw material prices and energy costs. If Volex cannot fully pass these increased costs onto its customers, its profit margins could shrink considerably.

Furthermore, the interest rate environment directly affects Volex. Central banks, including the US Federal Reserve and the European Central Bank, continued to navigate interest rate policies throughout 2024, with rates generally remaining elevated compared to pre-pandemic levels. This scenario increases the cost of borrowing for Volex, whether for day-to-day operations or for funding future growth and acquisitions, thereby impacting its overall financial health and strategic investment decisions.

Volex, as a global manufacturer, faces significant risks from supply chain disruptions and fluctuating raw material prices. For instance, the semiconductor shortage that extended into 2023 significantly impacted the electronics industry, leading to production delays and increased component costs for companies like Volex.

Volatility in key commodity prices, such as copper, which is essential for Volex's cable and connectivity products, directly affects manufacturing expenses. In early 2024, copper prices saw notable increases, driven by supply concerns and robust demand from sectors like electric vehicles and renewable energy infrastructure.

To mitigate these challenges, Volex and its peers are prioritizing the development of more resilient supply chains. This involves diversifying suppliers, increasing inventory levels for critical components, and exploring alternative materials to buffer against price spikes and availability issues.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant operational challenge for Volex, a company with a global footprint. When Volex converts revenues and costs from foreign currencies into its reporting currency, significant currency movements can materially impact reported financial performance, affecting profitability. For instance, a stronger Pound Sterling against currencies where Volex operates could reduce the reported value of foreign earnings.

These shifts also influence Volex's market competitiveness. If the Pound strengthens considerably, Volex's products might become more expensive for overseas buyers, potentially leading to reduced sales volumes in those markets. Conversely, a weaker Pound could make Volex's offerings more attractive internationally but increase the cost of imported components or raw materials.

Looking at recent trends, the British Pound experienced volatility in late 2024 and early 2025. For example, in Q4 2024, the GBP saw a 2% appreciation against the Euro, a key currency for Volex's European operations. This implies that Volex's Euro-denominated sales would translate into fewer Pounds, potentially impacting reported revenue growth for that period.

- Impact on Revenue: A 1% depreciation of the US Dollar against the GBP could increase Volex's reported revenue by approximately £1.5 million, based on its 2024 financial statements.

- Cost of Goods Sold: Fluctuations in the Chinese Yuan can affect the cost of components sourced from Asia. A 1% appreciation of the Yuan in early 2025 could add an estimated £0.8 million to Volex's cost of goods sold.

- Competitive Pricing: For Volex's power solutions sold in the United States, a 5% strengthening of the GBP in mid-2025 would effectively increase their USD price by the same margin, potentially impacting demand.

- Profitability Margins: Hedging strategies employed by Volex aim to mitigate some of this risk, but unhedged exposure can lead to unpredictable impacts on operating profit margins, particularly in volatile exchange environments.

Investment in Infrastructure (Data Centers, EV Charging)

Global investment in infrastructure, especially data centers and EV charging, is surging, creating substantial economic tailwinds for Volex. The company is well-positioned to capitalize on this trend, with demand for its high-speed data cables and EV charging components expected to climb. This infrastructure push is a key engine for Volex's sustained revenue expansion.

The digital transformation and the shift to electric mobility are fueling this infrastructure boom. For instance, the global data center market was valued at approximately $200 billion in 2023 and is projected to grow significantly. Similarly, the EV charging infrastructure market is also experiencing rapid expansion.

- Data Center Growth: The increasing need for cloud computing and AI services drives substantial investment in data center construction and upgrades, boosting demand for Volex's connectivity solutions.

- EV Charging Expansion: Governments and private entities are investing billions globally to build out EV charging networks, creating a direct market for Volex's specialized charging cables and connectors.

- Connectivity Demand: Both sectors require robust, high-performance cabling, a core competency for Volex, translating into increased sales volumes.

Global economic growth is projected to be moderate in 2024 and 2025, with the IMF forecasting 3.2% for both years. This steady growth influences consumer spending, particularly for discretionary items like electronics and vehicles, which are key markets for Volex. Economic slowdowns can dampen demand, impacting Volex's order volumes, especially in sensitive sectors like automotive.

Inflationary pressures remain a concern, impacting raw material and energy costs. Elevated interest rates, continuing through 2024 and into 2025, increase borrowing costs for Volex, affecting its financial health and investment decisions. Supply chain disruptions and commodity price volatility, like copper, also directly affect manufacturing expenses.

Currency exchange rate fluctuations pose operational challenges for Volex. For example, a stronger Pound Sterling against the Euro in late 2024 impacted reported revenue. Conversely, a weaker Pound can make Volex's products more competitive internationally.

Infrastructure investment, particularly in data centers and EV charging, is a significant tailwind for Volex. The digital transformation and electric mobility trends are fueling this boom, increasing demand for Volex's high-speed data cables and EV charging components.

| Economic Factor | 2024/2025 Projection/Trend | Impact on Volex |

|---|---|---|

| Global GDP Growth | Moderate (IMF: 3.2% for 2024 & 2025) | Supports consumer spending on electronics and vehicles. |

| Inflation | Persistent challenge impacting raw material costs. | Potential pressure on profit margins if costs cannot be passed on. |

| Interest Rates | Elevated compared to pre-pandemic levels. | Increases borrowing costs for operations and growth. |

| Commodity Prices (e.g., Copper) | Volatile, with early 2024 seeing increases. | Affects manufacturing expenses for cable products. |

| Currency Exchange Rates (e.g., GBP/EUR) | Experienced volatility in late 2024. | Impacts reported revenue and market competitiveness. |

| Infrastructure Investment (Data Centers, EV Charging) | Surging globally. | Drives demand for Volex's data cables and EV charging components. |

Same Document Delivered

Volex PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Volex PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into Volex's strategic landscape, enabling informed decision-making.

Sociological factors

The increasing societal embrace of electric vehicles (EVs) presents a significant tailwind for Volex. As more consumers opt for sustainable transportation, the demand for essential EV components, such as charging solutions and cable assemblies, naturally rises. This shift is directly boosting Volex's market opportunities.

Consumer desire for eco-friendly options, fueled by growing environmental consciousness and impressive technological progress in EVs, is a key driver. In 2024, global EV sales are projected to surpass 15 million units, a substantial increase from previous years, directly translating to higher demand for Volex's specialized products in this burgeoning sector.

The growing consumer appetite for smart and connected devices, from smart home hubs to wearable tech, directly drives demand for Volex's power cords and cable harnesses. In 2024, the global smart home market was projected to reach over $150 billion, with continued robust growth anticipated. This pervasive integration means consumers expect seamless connectivity and advanced functionality, necessitating specialized and dependable power solutions that Volex provides, particularly impacting its consumer electricals segment.

The global population is getting older, and with that comes a greater need for healthcare. This trend directly boosts the demand for medical devices, a market where Volex plays a key role by supplying essential medical cable assemblies. For instance, by 2050, the number of people aged 65 and over is projected to reach 1.6 billion, according to the United Nations.

As people live longer and become more health-conscious, and as medical technology continues to advance, there's a steady and growing requirement for dependable components like those Volex produces. The World Health Organization estimates that global health spending will continue to rise, further underscoring the sustained need for medical equipment and its constituent parts.

Volex is in a strong position to benefit from these demographic changes. The company's expertise in manufacturing high-quality cable assemblies is crucial for the reliable functioning of a wide array of medical equipment, from diagnostic tools to patient monitoring systems.

Labor Market Trends and Skills Shortages

Sociological shifts are significantly reshaping the labor market, presenting both challenges and opportunities for companies like Volex. A notable trend is the growing skills shortage, particularly within manufacturing sectors. This scarcity of qualified personnel directly affects operational efficiency and can drive up labor costs as companies compete for talent.

The demand for flexible work arrangements is another powerful sociological force. Employees increasingly seek work-life balance, pushing companies to adapt their employment models. Volex, with its global manufacturing footprint, faces the complex task of attracting and retaining skilled labor while accommodating these evolving workforce expectations.

To navigate these trends, Volex must proactively invest in training and development programs. This not only addresses immediate skills gaps but also fosters a more adaptable and engaged workforce. For instance, in 2024, reports indicated a persistent deficit in skilled trades, with some regions experiencing over 70% of manufacturing firms struggling to find qualified workers.

- Skills Gap: Persistent shortages in manufacturing skills are a key concern for Volex's operational continuity.

- Flexible Work: The rising demand for flexible work arrangements necessitates adaptation in Volex's employment strategies.

- Talent Acquisition: Attracting and retaining skilled labor globally remains a critical challenge impacting cost and efficiency.

- Investment in Training: Proactive investment in workforce training is essential to mitigate skills shortages and meet future demands.

Increasing Focus on Ethical Sourcing and Sustainability

Consumers and stakeholders are increasingly scrutinizing companies for ethical sourcing and sustainability. This heightened awareness directly impacts Volex's brand image and operational choices, pushing for greater transparency in its supply chain. For instance, a 2024 survey by Accenture revealed that 73% of consumers are more likely to purchase from companies committed to sustainability.

Manufacturers like Volex face mounting pressure to prove their adherence to fair labor practices and high ethical standards across all levels of their operations. This demand for accountability extends from raw material procurement to final product delivery. In 2024, the global ethical sourcing market was valued at approximately $12.5 billion, demonstrating the significant economic impact of these concerns.

Volex's dedication to sustainability is evolving into a crucial competitive advantage. Companies that can credibly demonstrate their commitment to environmental and social governance (ESG) often attract more investment and customer loyalty. Volex's own sustainability reports, often published annually, detail its progress in areas like waste reduction and energy efficiency, with their 2024 report highlighting a 15% reduction in manufacturing waste compared to the previous year.

- Consumer Demand: A 2024 Deloitte study indicated that 66% of consumers consider sustainability when making purchasing decisions.

- Supply Chain Transparency: Companies are investing in blockchain and other technologies to enhance supply chain visibility, with adoption rates rising steadily.

- Investor Pressure: ESG investments are projected to reach $50 trillion globally by 2025, signaling strong financial incentives for sustainable practices.

- Regulatory Landscape: Governments worldwide are introducing stricter regulations on environmental impact and labor standards, affecting manufacturing operations.

Societal shifts like the increasing demand for electric vehicles (EVs) and smart devices directly benefit Volex by boosting sales of its specialized components. The growing global emphasis on healthcare also drives demand for Volex's medical cable assemblies, as populations age and medical technology advances. These trends highlight Volex's strategic alignment with key consumer and demographic movements.

Technological factors

Volex's data center business is significantly impacted by rapid advancements in high-speed data transmission. The relentless demand for greater bandwidth, fueled by the growth of artificial intelligence and cloud computing, necessitates continuous innovation in Volex's high-speed copper interconnect cables and power solutions.

These technological shifts are directly correlated with Volex's expansion opportunities within the data center market. For instance, the global data center market size was valued at approximately $240.5 billion in 2023 and is projected to grow substantially, driven by these very connectivity demands.

Technological advancements in electric vehicle (EV) charging and battery systems are rapidly reshaping the automotive landscape, creating both openings and hurdles for Volex. The drive for faster charging and longer-lasting batteries means Volex needs to continuously update its connectors and power solutions to meet evolving industry needs.

For instance, the global EV charging infrastructure market was valued at approximately $23.4 billion in 2023 and is projected to reach over $100 billion by 2030, highlighting the significant growth and the need for Volex to stay competitive. Adapting to higher power outputs, such as the increasing adoption of 800V architectures in new EV models, is crucial for Volex to maintain its relevance and capture market share.

Volex's ability to collaborate closely with EV manufacturers, like those developing next-generation battery chemistries and charging protocols, will be key. Staying ahead of the curve in areas like ultra-fast charging and vehicle-to-grid (V2G) technology ensures Volex can offer the advanced, reliable components that the burgeoning EV sector demands.

The drive for smaller, more powerful electronic devices means Volex's cable assemblies must shrink and integrate more functions. This trend is evident in the smartphone market, where devices are becoming increasingly compact yet offer advanced capabilities, requiring equally sophisticated and integrated connection solutions. For instance, the average smartphone size has remained relatively stable, but internal component density has dramatically increased.

Volex's success hinges on its ability to adapt to these miniaturization demands. This requires significant investment in research and development to engineer cable assemblies that are not only smaller but also more robust and capable of handling increased data transfer and power delivery within confined spaces. Companies like Molex, a competitor, have been actively developing advanced interconnect solutions for high-density applications, highlighting the competitive landscape.

Automation and Industry 4.0 in Manufacturing

The manufacturing sector's embrace of advanced automation and Industry 4.0 principles is a significant technological driver. For Volex, this means opportunities to boost operational efficiency, cut costs, and elevate product quality through smart factories. Technologies such as digital twins and AI-powered quality control are crucial for fine-tuning production lines, ensuring Volex remains competitive.

Volex's strategic focus on investing in these advanced manufacturing capabilities is paramount. For instance, the global market for industrial automation is projected to grow substantially, with some estimates suggesting it could reach over $300 billion by 2027, indicating a strong trend towards increased adoption. Volex's commitment to integrating these technologies directly supports its long-term growth and market positioning.

- Enhanced Efficiency: Automation can streamline Volex's production processes, leading to faster throughput and reduced waste.

- Cost Reduction: By minimizing manual labor and optimizing resource utilization, Volex can achieve significant cost savings.

- Improved Quality: AI and advanced analytics offer precise quality control, minimizing defects and enhancing product reliability for Volex's offerings.

- Competitive Edge: Early and effective adoption of Industry 4.0 technologies positions Volex ahead of less technologically advanced competitors.

Development of New Materials and Manufacturing Techniques

Advancements in materials science are directly impacting the electronics components industry, where Volex operates. The development of new materials for cable insulation, conductors, and connectors is crucial. For instance, innovations in polymers can lead to enhanced flame retardancy, higher temperature resistance, and improved flexibility, all vital for safety and performance in demanding sectors like automotive and aerospace.

Furthermore, cutting-edge manufacturing techniques, such as advanced extrusion processes and precision molding, are enabling Volex to produce components with tighter tolerances and greater durability. These improvements translate to better product performance and can significantly reduce manufacturing costs. For example, the adoption of automated assembly lines utilizing robotics has been shown to increase throughput by as much as 30% in similar manufacturing environments, while also reducing defect rates.

Volex must actively monitor and integrate these technological shifts to maintain its competitive edge. Staying at the forefront of material and manufacturing innovation allows the company to offer superior products that meet evolving industry standards and customer expectations. This proactive approach is key to sustaining market leadership, particularly in critical applications where reliability is paramount.

- Material Innovation: Focus on developing or sourcing advanced polymers for insulation offering superior dielectric strength and heat resistance.

- Conductor Technology: Explore next-generation conductor materials that provide higher conductivity and reduced weight, such as advanced copper alloys or even composite conductors.

- Manufacturing Efficiency: Invest in and adopt additive manufacturing (3D printing) for complex connector geometries or advanced injection molding techniques for higher-volume, cost-effective production.

- Durability Enhancement: Implement new coating technologies for connectors to improve corrosion resistance and ensure long-term performance in harsh environments, a key factor for Volex's target markets.

Technological advancements are a primary driver for Volex, particularly in high-speed data transmission for data centers and evolving EV charging standards. The company must continuously innovate its interconnect and power solutions to meet the increasing demands of these rapidly growing sectors.

The miniaturization trend in consumer electronics necessitates smaller, more integrated cable assemblies, requiring Volex to invest in R&D for compact yet powerful solutions. Simultaneously, Volex's adoption of Industry 4.0 principles in manufacturing, including automation and AI, is crucial for enhancing efficiency, reducing costs, and improving product quality, positioning it competitively in the global market.

Innovations in materials science and advanced manufacturing techniques are also critical for Volex, enabling the development of more durable, safer, and higher-performing components. For instance, exploring new polymers for insulation and advanced conductor materials can significantly improve product capabilities and reduce manufacturing costs.

| Technology Area | Volex Impact | Market Data (2024/2025 Projections) |

|---|---|---|

| High-Speed Data Transmission | Demand for advanced copper interconnects and power solutions in data centers. | Global data center market projected to exceed $300 billion by 2027. |

| EV Charging & Battery Systems | Need for updated connectors and power solutions for faster charging and higher voltage architectures (e.g., 800V). | Global EV charging infrastructure market expected to surpass $100 billion by 2030. |

| Miniaturization | Development of smaller, more integrated cable assemblies for compact electronic devices. | Increasing internal component density in smartphones drives need for advanced interconnects. |

| Industry 4.0 / Automation | Opportunities for enhanced operational efficiency, cost reduction, and improved quality through smart factories. | Industrial automation market projected to grow significantly, exceeding $300 billion by 2027. |

| Materials Science | Development of advanced polymers and conductor materials for improved performance and safety. | Innovations in polymers can enhance flame retardancy and heat resistance in critical applications. |

Legal factors

Volex operates under strict product safety and compliance mandates like RoHS and REACH across its global markets. These regulations are critical for safeguarding both the environment and consumer health, necessitating ongoing vigilance and adaptation in Volex's manufacturing and material sourcing strategies.

As Volex's components are increasingly found in smart and connected devices, adhering to data privacy laws like GDPR and CCPA is crucial. While Volex doesn't directly manage consumer data, its position in the supply chain means its products must enable compliance for its clients in data-sensitive applications.

Protecting Volex's intellectual property (IP), including patents for innovative designs and manufacturing processes, is paramount in the tech sector. This legal shield is crucial for maintaining a competitive advantage and deterring infringement by rivals.

In 2024, the global IP market saw significant activity, with patent filings continuing to rise, underscoring the importance of robust legal protection for companies like Volex. Navigating these evolving legal frameworks is essential for Volex to safeguard its technological advancements and market position.

Labor Laws and Employment Regulations

Volex operates globally, employing a significant workforce across 28 manufacturing sites in 24 countries. This necessitates strict adherence to a complex web of local and international labor laws and employment regulations. These regulations cover critical areas such as minimum wage requirements, working hours, health and safety standards, and employee benefits, all of which differ substantially from one jurisdiction to another.

Compliance with these diverse labor laws is not merely a legal obligation but a cornerstone of ethical business practice and risk management for Volex. Failure to comply can result in hefty fines, reputational damage, and disruptions to operations, as demonstrated by various multinational corporations facing scrutiny over labor practices in recent years. For instance, in 2024, several companies faced increased regulatory pressure and public backlash for alleged violations of fair wage and working condition laws in their overseas facilities.

Key legal factors impacting Volex's labor force include:

- Wage and Hour Laws: Ensuring compliance with minimum wage, overtime pay, and maximum working hour regulations in each operating country.

- Health and Safety Regulations: Maintaining safe working environments that meet or exceed local occupational health and safety standards.

- Employee Rights and Unionization: Respecting employees' rights to organize, bargain collectively, and adhere to established collective bargaining agreements where applicable.

- Termination and Severance Policies: Following legal procedures for employee dismissals and providing mandated severance packages.

Environmental Regulations and Extended Producer Responsibility (EPR)

Volex faces increasing pressure from evolving environmental regulations. For instance, the European Union's new directives on e-waste, packaging, and batteries, alongside the expansion of Extended Producer Responsibility (EPR) schemes, directly influence how Volex designs, manufactures, and manages its products throughout their lifecycle. These legal frameworks necessitate proactive engagement with recycling targets and restrictions on certain materials, compelling Volex to adapt its operational strategies and supply chain management.

These legal mandates require Volex to invest in more sustainable product design and robust end-of-life management solutions. For example, the EU's Waste Electrical and Electronic Equipment (WEEE) Directive sets collection and recycling rates, with targets often increasing over time. By 2027, the EU aims for 55% of e-waste to be collected, a figure that will likely rise further in subsequent years, directly impacting companies like Volex that operate within these markets.

- Evolving EU Directives: New regulations on e-waste, packaging, and batteries are creating a more stringent operating environment for Volex.

- Extended Producer Responsibility (EPR): EPR schemes are expanding, placing greater responsibility on manufacturers for product end-of-life management.

- Recycling Targets: Companies like Volex must meet specific recycling and recovery targets for electronic products, influencing design and material sourcing.

- Material Restrictions: Legal frameworks are increasingly restricting the use of hazardous substances in electronic components, pushing for material innovation.

Volex must navigate evolving product safety and environmental regulations globally, such as REACH and RoHS, which dictate material usage and impact product design. Adherence to data privacy laws like GDPR is also critical, even for component suppliers, as their products integrate into data-handling systems. Protecting intellectual property through patents remains vital for maintaining competitive advantage in the technology sector, especially with rising patent filings globally in 2024.

Environmental factors

The escalating challenge of electronic waste, or e-waste, is directly influencing companies like Volex. Regulations such as the European Union's WEEE Directive, which aims to increase collection and recycling rates for electrical and electronic equipment, necessitate a proactive approach to product design and end-of-life management. In 2023, global e-waste generation reached an estimated 23.0 million metric tons, highlighting the scale of this environmental issue.

Volex must therefore prioritize designing products with recyclability in mind, utilizing materials that are easier to recover and reprocess. This also extends to actively participating in or establishing collection and recycling programs. Such considerations impact material sourcing and manufacturing processes, potentially increasing upfront costs but mitigating long-term regulatory and reputational risks.

Manufacturers like Volex face growing demands to implement sustainable production methods, cut carbon emissions, and integrate renewable energy. This involves fine-tuning manufacturing for better energy use and reducing waste.

Volex is committed to this, actively disclosing its sustainability initiatives and working towards science-based targets for emissions reduction. For instance, in their 2023 sustainability report, Volex highlighted a reduction in Scope 1 and Scope 2 greenhouse gas emissions by 20% compared to their 2020 baseline, demonstrating tangible progress towards their environmental goals.

Growing consumer and regulatory pressure for energy efficiency directly influences Volex's product development. The company is focused on innovating its power cords and cable assemblies to reduce energy waste, a critical factor in sectors like consumer electronics and data centers. For example, in 2024, the European Union's Ecodesign regulations continued to tighten energy efficiency standards for various electronic devices, pushing manufacturers like Volex to prioritize low-loss power solutions.

Climate Change Impacts on Supply Chains

Climate change presents significant environmental challenges for Volex's global supply chain. Extreme weather events, such as floods and droughts, can directly disrupt production facilities and transportation routes, impacting the availability of critical components and finished goods. For instance, the increasing frequency of severe storms in Asia, a key manufacturing hub, poses a tangible risk to Volex's component sourcing.

Resource scarcity, another facet of climate change, can affect the cost and availability of raw materials essential for Volex's products. Changes in water availability or agricultural yields could indirectly impact the supply of certain materials, necessitating proactive sourcing strategies and potential material substitutions. The Intergovernmental Panel on Climate Change (IPCC) has consistently highlighted the growing risks to global supply networks from these environmental shifts.

Volex must integrate these environmental risks into its strategic supply chain planning and implement robust mitigation measures. This includes diversifying supplier bases, exploring alternative logistics routes, and investing in more resilient infrastructure. By proactively addressing climate-related vulnerabilities, Volex can enhance its operational continuity and maintain market competitiveness in the face of evolving environmental conditions.

- Extreme weather events like heatwaves and heavy rainfall can disrupt Volex's manufacturing and logistics operations.

- Resource scarcity, particularly for materials sensitive to climate shifts, can lead to increased costs and supply volatility.

- Supply chain resilience planning needs to account for the projected increase in climate-related disruptions, with studies indicating significant economic impacts on global trade by 2050.

Resource Scarcity and Circular Economy Initiatives

The growing scarcity of key resources, such as rare earth metals vital for electronics, presents a significant challenge for Volex. For instance, the International Energy Agency reported in early 2024 that demand for critical minerals, including cobalt and lithium, is projected to surge by 2030, driven by clean energy technologies. This trend directly impacts manufacturing costs and supply chain stability for companies like Volex.

In response, Volex must actively engage with circular economy principles. This means prioritizing the design of products for longevity, repairability, and eventual disassembly. By focusing on material recovery and reuse, Volex can mitigate the risks associated with dwindling raw material availability and reduce its environmental footprint. For example, initiatives to reclaim and reprocess plastics from end-of-life electronic products are becoming increasingly critical.

Volex's strategic approach should encompass exploring alternative, more sustainable materials and investing in advanced recycling technologies. This commitment aligns with global environmental targets and can lead to cost savings and enhanced brand reputation. The European Union's push for ecodesign regulations, which came into effect progressively through 2024, mandates greater product durability and repairability, creating a favorable environment for Volex's circular economy efforts.

- Resource Scarcity: Increasing demand for critical minerals like cobalt and lithium, essential for electronic components, is projected to rise significantly by 2030, impacting supply chains.

- Circular Economy Push: Global and regional regulations, such as EU ecodesign directives implemented in 2024, are driving the need for product longevity, repairability, and material recovery.

- Volex's Strategy: Focus on product design for disassembly, material reuse, and investment in advanced recycling to mitigate resource risks and meet environmental goals.

- Alternative Materials: Exploration and adoption of sustainable materials can reduce reliance on scarce resources and lower manufacturing costs.

The escalating challenge of electronic waste, or e-waste, directly influences companies like Volex. Regulations such as the European Union's WEEE Directive necessitate a proactive approach to product design and end-of-life management. In 2023, global e-waste generation reached an estimated 23.0 million metric tons, highlighting the scale of this environmental issue.

Manufacturers like Volex face growing demands to implement sustainable production methods, cut carbon emissions, and integrate renewable energy, impacting manufacturing processes and potentially increasing upfront costs. Volex reported a 20% reduction in Scope 1 and Scope 2 greenhouse gas emissions by 2023 compared to their 2020 baseline.

Growing consumer and regulatory pressure for energy efficiency directly influences Volex's product development, with EU Ecodesign regulations in 2024 tightening standards for low-loss power solutions.

Climate change presents significant environmental challenges for Volex's global supply chain, with extreme weather events posing tangible risks to component sourcing and logistics. Resource scarcity, particularly for critical minerals, can lead to increased costs and supply volatility, with demand for cobalt and lithium projected to surge by 2030.

PESTLE Analysis Data Sources

Our PESTLE analysis for Volex is meticulously constructed using data from reputable sources, including official government publications, international economic bodies, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting Volex.