Vail Resorts SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vail Resorts Bundle

Vail Resorts boasts significant strengths in its brand recognition and extensive portfolio of premier ski destinations, but faces challenges from increasing competition and environmental concerns. Understanding these dynamics is crucial for any investor or strategist looking to navigate the winter sports industry.

Want the full story behind Vail Resorts' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Vail Resorts operates an extensive portfolio of 41 ski resorts across North America, Canada, and Australia, featuring renowned destinations like Vail Mountain and Whistler Blackcomb. This significant geographical diversification helps to smooth out performance, as varied weather patterns across its locations can offset localized challenges. The company's strategic expansion, including the recent acquisition of Crans-Montana Mountain Resort in Switzerland, further solidifies its global presence and appeal to international clientele.

The Epic Pass program is a major strength for Vail Resorts, acting as the bedrock of their business. It cultivates deep customer loyalty and ensures a steady stream of revenue before the ski season even begins. This program provides access to a vast network of resorts, which naturally encourages guests to return year after year, building a dedicated following.

For the 2024-2025 season, Vail Resorts saw a small dip in the number of Epic Passes sold. However, this was more than offset by an increase in the average selling price. This strategic pricing adjustment resulted in higher overall sales revenue for the pass program, underscoring its enduring value and Vail's ability to command premium pricing.

Vail Resorts' strength lies in its diversified revenue streams, extending far beyond just lift tickets and season passes. Income is substantially boosted by lodging, dining, retail operations, ski school programs, and even real estate ventures near its popular mountain destinations. This broad revenue base helps to smooth out income fluctuations, lessening the company's reliance solely on the winter ski season and its associated weather conditions.

Commitment to Sustainability and Innovation

Vail Resorts demonstrates a powerful commitment to environmental sustainability, setting an ambitious goal of achieving a 'Zero Operating Footprint' by 2030. This includes targets for net-zero emissions and zero waste sent to landfills. This dedication resonates with increasing consumer and investor demand for eco-conscious businesses, while also fostering operational improvements through investments in renewable energy and energy-efficient technologies. For instance, by the end of the 2023 fiscal year, Vail Resorts had already made significant progress, powering 100% of its operations with 100% renewable energy for the past three years.

Innovation is also a cornerstone of Vail Resorts' strategy, particularly in enhancing the guest experience. A prime example is the introduction of the My Epic Assistant AI bot, designed to provide guests with real-time information and support. This technological advancement aims to streamline interactions and improve overall satisfaction. The company also continually invests in its core product, with capital expenditures in the 2023 fiscal year reaching $328 million, primarily focused on enhancing the mountain experience and resort infrastructure.

Key initiatives supporting their sustainability and innovation strengths include:

- Renewable Energy Procurement: Sourcing 100% renewable energy for all operations since the 2020 fiscal year.

- Waste Reduction Programs: Implementing comprehensive programs to minimize waste sent to landfills across all resorts.

- Guest Experience Technology: Launching AI-powered tools like My Epic Assistant to improve guest service and information access.

- Capital Investments: Consistent investment in resort upgrades and new technologies to enhance the guest experience and operational efficiency.

Strategic Capital Investments

Vail Resorts demonstrates a significant strength through its strategic capital investments, consistently prioritizing enhancements to its mountain properties and the overall guest experience. For the calendar year 2025, the company has allocated over $250 million towards these initiatives.

These substantial investments are directed towards critical areas such as upgrading ski lifts, improving base area facilities, and advancing real estate development projects. This commitment ensures Vail Resorts maintains its reputation for world-class destinations and fuels its long-term growth trajectory.

- Significant 2025 Capital Plan: Over $250 million allocated for calendar year 2025.

- Focus Areas: Lift upgrades, base area improvements, and real estate developments.

- Strategic Impact: Maintains world-class status and supports future growth.

- Key Projects: Includes transformational work at Park City Mountain and Vail Mountain.

Vail Resorts possesses a formidable portfolio of 41 ski resorts globally, providing significant geographical diversification that mitigates localized weather risks. The company's innovative Epic Pass program fosters strong customer loyalty and ensures substantial pre-season revenue, with strategic pricing adjustments for the 2024-2025 season boosting overall sales despite a slight dip in pass volume.

Vail's diverse revenue streams, encompassing lodging, dining, retail, and ski schools, reduce reliance on lift ticket sales alone, providing financial stability. Their commitment to a 'Zero Operating Footprint' by 2030, evidenced by powering operations with 100% renewable energy for three consecutive years through fiscal year 2023, aligns with growing ESG demands and drives operational efficiencies.

Continuous investment in guest experience, exemplified by the My Epic Assistant AI bot and capital expenditures of $328 million in fiscal year 2023, enhances operational efficiency and guest satisfaction. The company plans over $250 million in capital investments for calendar year 2025, focusing on critical upgrades like lift modernization and base area improvements to maintain its premier destination status.

| Strength Category | Key Initiative/Asset | Impact/Data Point |

|---|---|---|

| Resort Portfolio | Global Resort Network (41 resorts) | Geographical diversification, broad customer reach |

| Loyalty Program | Epic Pass | Guaranteed revenue, customer retention |

| Revenue Diversification | Ancillary Services (Lodging, Dining, Retail) | Reduced seasonality dependence, stable income |

| Sustainability | Zero Operating Footprint by 2030; 100% Renewable Energy (FY23) | Enhanced brand reputation, operational efficiency |

| Innovation | My Epic Assistant AI; Capital Investments ($328M FY23) | Improved guest experience, modern infrastructure |

| Capital Allocation | 2025 Capital Plan ($250M+) | Resort upgrades, long-term growth |

What is included in the product

This SWOT analysis maps out Vail Resorts' market strengths, such as its extensive portfolio of world-class resorts and strong brand loyalty, against operational weaknesses like high fixed costs and reliance on favorable weather. It also identifies opportunities in emerging markets and potential for technological integration, while acknowledging threats from economic downturns, increasing competition, and environmental concerns.

Highlights key competitive advantages and potential threats, enabling proactive risk mitigation and opportunity capitalization.

Weaknesses

Vail Resorts carries a substantial debt burden, a consequence of its aggressive acquisition strategy aimed at portfolio expansion. As of the end of September 2023, the company's total long-term debt reached $1.47 billion.

This high leverage is a notable weakness, as the Net Debt-to-Equity Ratio is anticipated to climb substantially by 2027. Such increased financial leverage amplifies the company's financial risk profile.

The elevated debt levels could potentially constrain future cash flow, impacting the company's ability to invest in growth initiatives or weather economic downturns.

Vail Resorts' core business is intrinsically tied to natural snowfall and favorable weather. This dependence creates significant vulnerability, as demonstrated by the 2023-2024 season, which experienced a notable drop in skier visits directly linked to reduced snowfall. This reliance on Mother Nature introduces substantial volatility and inherent risk to their revenue streams.

Vail Resorts saw a dip in skier visits for the 2024-2025 season, even with higher lift ticket prices boosting revenue. This trend points to potential challenges in maintaining customer engagement and attracting skiers to their properties.

A concerning 2025 survey revealed that a notable portion of Epic Pass holders expressed reduced plans to visit after recent labor actions. Many indicated they might not renew their passes, directly impacting Vail's primary revenue stream and its ability to command premium pricing.

Operational Strains and Labor Shortages

Vail Resorts' aggressive cost-cutting, exemplified by its 2024 Resource Efficiency Transformation Plan which included a 14% cut to its corporate staff, risks deepening existing labor shortages. This strategy could also negatively impact guest loyalty.

The vulnerability of its labor model was starkly demonstrated by a 13-day ski patrol strike at Park City during the 2024-2025 season. This disruption led to significant operational issues, including terrain closures, which in turn caused financial losses and prompted class-action lawsuits.

Furthermore, an increased reliance on automation, while intended to improve efficiency, may inadvertently dilute Vail Resorts' core brand promise of delivering an 'Experience of a Lifetime'.

- Workforce Reduction: 14% corporate staff cut in 2024 Resource Efficiency Transformation Plan.

- Labor Unrest: 13-day ski patrol strike in Park City (late 2024-early 2025).

- Operational Impact: Terrain closures, financial losses, and legal challenges stemming from labor disputes.

- Brand Dilution Risk: Automation potentially undermining the 'Experience of a Lifetime' promise.

High Capital Expenditure Requirements

Vail Resorts faces a significant hurdle with its high capital expenditure requirements. Keeping a vast network of mountain resorts competitive demands continuous and substantial investment. This includes essential maintenance and upgrades to ensure a premium guest experience.

The financial strain of these necessary investments is considerable. For instance, Vail Resorts has earmarked approximately $249 million to $254 million for calendar year 2025. This budget covers core capital projects, expansion efforts in Europe, and various real estate developments, highlighting the scale of financial commitment required.

- Ongoing Investment Needs: Maintaining and upgrading a large portfolio of mountain resorts requires substantial ongoing capital investment.

- 2025 Capital Plan: The company plans to invest approximately $249 million to $254 million in calendar year 2025 for core capital, growth investments in Europe, and real estate projects.

- Financial Strain: These significant capital expenditures are necessary for competitiveness but can strain financial resources.

Vail Resorts' reliance on favorable weather conditions presents a significant vulnerability, as evidenced by the 2023-2024 season's reduced snowfall impacting skier visits. The company's 2024-2025 season also saw a decline in skier visits despite higher ticket prices, suggesting potential issues with customer engagement and pricing power.

Labor issues pose a substantial threat, with a 2025 survey indicating that a notable percentage of Epic Pass holders plan to reduce visits or not renew due to recent labor actions, directly impacting a key revenue stream. Furthermore, the 13-day ski patrol strike at Park City in late 2024-early 2025 led to operational disruptions, financial losses, and legal challenges, underscoring the fragility of its labor model.

The company's aggressive cost-cutting, including a 14% corporate staff reduction in 2024, risks exacerbating labor shortages and potentially alienating guests, while increased automation could dilute the brand's core promise of an 'Experience of a Lifetime'.

Vail Resorts also faces substantial capital expenditure demands, with a 2025 budget of $249 million to $254 million allocated for resort maintenance, upgrades, European expansion, and real estate projects, which could strain financial resources.

| Weakness | Description | Impact | Data Point/Example |

| Weather Dependency | Core business relies heavily on natural snowfall and favorable weather. | Revenue volatility, reduced skier visits. | 2023-2024 season saw reduced snowfall impacting skier visits. |

| Labor Relations & Workforce Strain | Risk of labor unrest, potential for strikes, and impact of cost-cutting on employee morale and guest experience. | Operational disruptions, financial losses, brand perception damage, reduced customer loyalty. | 13-day ski patrol strike at Park City (late 2024-early 2025); 14% corporate staff cut in 2024. |

| Customer Engagement & Pricing Power | Potential challenges in maintaining customer engagement and justifying premium pricing, especially post-labor disruptions. | Reduced pass renewals, lower skier visits despite price increases. | Survey indicated reduced visit plans and potential non-renewal of Epic Passes by some holders. |

| High Capital Expenditure Requirements | Need for continuous, substantial investment to maintain and upgrade a large portfolio of resorts. | Financial strain, potential limitation on other investments. | 2025 Capital Plan: $249 million to $254 million. |

What You See Is What You Get

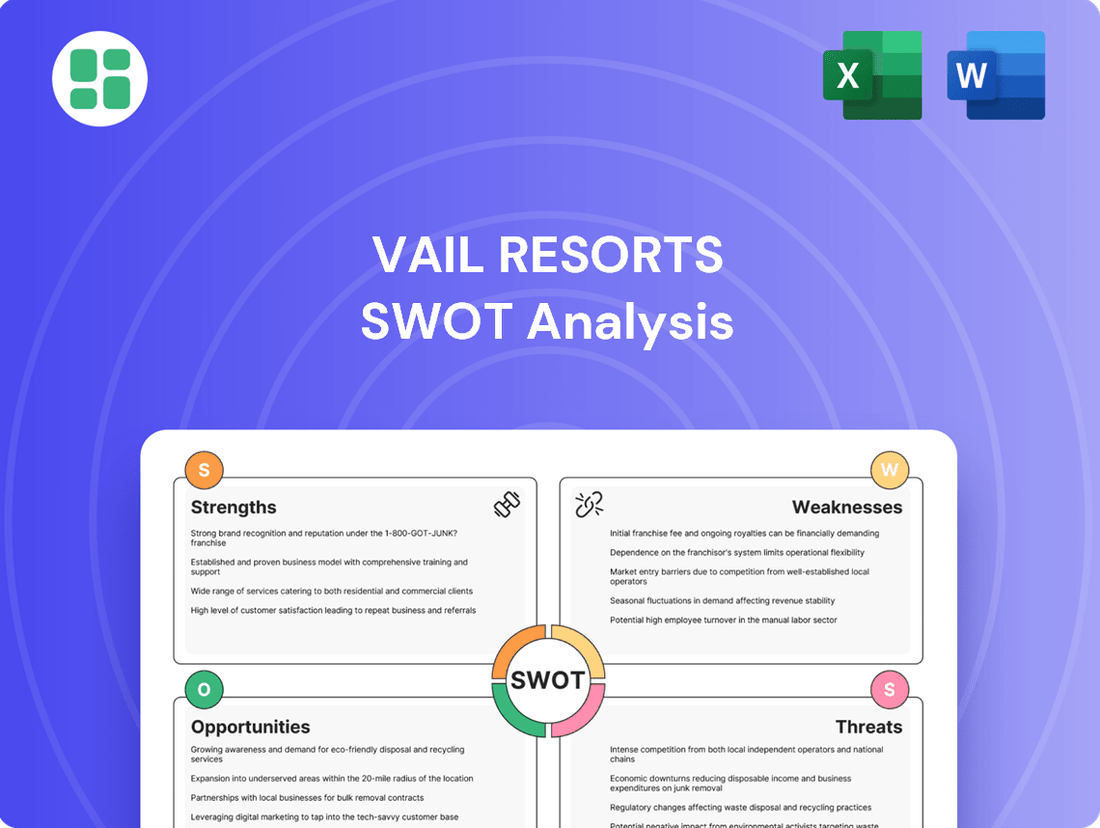

Vail Resorts SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This comprehensive report delves into Vail Resorts' Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a detailed examination of Vail Resorts' strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor the analysis to your specific needs.

Opportunities

Vail Resorts has a significant opportunity to expand its footprint across European ski markets, leveraging its proven acquisition and integration model. This geographic diversification offers a pathway to tap into new customer bases and revenue streams.

The company's strategic moves, such as the acquisition of Crans-Montana in Switzerland and enhanced access to Verbier 4 Vallées for its Epic Pass holders, underscore this commitment. These actions signal a clear intent to build a substantial presence in key European destinations.

Furthermore, targeting higher-altitude European resorts presents a strategic advantage. Such locations are often more resilient to climate change impacts, providing a natural hedge against the growing risks associated with warming temperatures and reduced snowfall in lower-lying areas.

Vail Resorts has a substantial opportunity to boost income beyond lift tickets by enhancing services like ski school, on-mountain dining, and equipment rentals. In the 2023 fiscal year, Vail reported that its "other revenue" segment, which includes these ancillary services, grew by 12.5% to $630.8 million, indicating strong consumer engagement with these offerings.

Expanding activities beyond the winter season presents another key growth avenue. By developing summer and shoulder-season attractions such as mountain biking trails, scenic gondola rides, and outdoor events, Vail can smooth out revenue fluctuations. For instance, the company has been actively investing in its summer operations, with mountain biking seeing particular growth, contributing to a more consistent revenue stream throughout the year.

Vail Resorts' robust data analytics capabilities, fueled by its integrated enterprise technology, present a significant opportunity to deeply personalize the guest journey. By analyzing data from all interactions, from booking to on-mountain experiences, Vail can refine its marketing and pricing strategies. For instance, in the 2023 fiscal year, Vail reported a 9% increase in total revenue to $3.96 billion, partly driven by data-informed decisions that improved guest spending and frequency.

Connecting customer information across every touchpoint allows for the delivery of highly tailored content and services, fostering greater guest satisfaction and loyalty. This could translate into personalized recommendations for activities, dining, or even optimal lift lines based on individual preferences and past behavior. Such hyper-personalization is crucial in an increasingly competitive leisure market, aiming to build stronger, lasting relationships with their customer base.

Technological Advancements and Digital Integration

Vail Resorts' continued investment in technology, exemplified by the My Epic Assistant AI bot and mobile pass access, presents a significant opportunity to boost operational efficiency and elevate guest experiences. This focus on digital integration streamlines processes, offers real-time updates, and enhances the overall guest journey, meeting modern consumer demands for seamless digital interactions.

For the 2023-2024 season, Vail Resorts reported a 7% increase in total lift ticket revenue compared to the prior year, underscoring the positive impact of enhanced digital platforms on guest engagement and spending. The My Epic app, a key component of their digital strategy, saw a 15% increase in active users during this period, facilitating easier access and personalized recommendations.

- Enhanced Guest Experience: Mobile pass access and AI-powered assistance reduce wait times and provide personalized support, improving overall satisfaction.

- Operational Efficiency: Digital tools streamline ticketing, information dissemination, and resort navigation, leading to smoother operations.

- Data-Driven Insights: Increased digital interaction provides valuable data for understanding guest behavior and preferences, enabling more targeted marketing and service improvements.

- Competitive Advantage: Staying ahead in digital integration differentiates Vail Resorts from competitors and attracts a tech-savvy customer base.

Real Estate Development in Resort Areas

Vail Resorts has a significant opportunity to expand its revenue through real estate development at its resort locations. For example, plans are underway for a new base village at Vail Mountain's West Lionshead area. This project is designed to incorporate lodging, dining options, and essential workforce housing, directly addressing community needs while creating new income avenues for the company.

These real estate ventures offer a dual benefit: they can generate substantial additional revenue streams beyond traditional ski operations and simultaneously enhance the overall guest experience by providing more amenities and integrated services. The development of new lodging and commercial spaces at prime resort locations is a strategic move to capture more of the tourist dollar.

Furthermore, this approach aligns with the growing trend of creating all-encompassing destination experiences. By developing adjacent properties, Vail Resorts can foster a stronger sense of community and provide vital resources like affordable housing for its employees. This not only improves operational efficiency but also boosts the local economy and resident satisfaction.

- New Base Village at Vail Mountain: Development includes lodging, restaurants, and workforce housing.

- Revenue Diversification: Creates additional income streams beyond lift tickets and season passes.

- Enhanced Guest Experience: Integrates amenities and services for a more complete resort visit.

- Community Benefits: Addresses local needs such as workforce housing shortages.

Vail Resorts can capitalize on the growing demand for year-round mountain experiences by expanding its summer and shoulder-season offerings. This includes developing more mountain biking trails, scenic gondola rides, and hosting events. For the 2023 fiscal year, the company saw growth in its other revenue segments, which encompass these activities, indicating strong customer interest.

The company's strategic investments in technology, such as its AI-powered My Epic Assistant and mobile pass access, present a significant opportunity to enhance operational efficiency and guest satisfaction. This digital integration streamlines processes and provides real-time information, aligning with consumer expectations for seamless digital interactions. In the 2023-2024 season, Vail Resorts saw a 7% increase in total lift ticket revenue, partly attributed to improved digital platforms.

Expanding its real estate development at resort locations offers another avenue for revenue growth. Projects like the new base village at Vail Mountain, incorporating lodging and dining, aim to create additional income streams and enhance the overall guest experience. This strategy diversifies revenue beyond traditional ski operations.

Vail Resorts has a substantial opportunity to increase revenue by expanding its presence in European ski markets, leveraging its proven acquisition and integration strategies. The company's recent moves, such as acquiring Crans-Montana in Switzerland, demonstrate this commitment to geographic diversification and tapping into new customer bases.

Threats

Climate change presents a substantial threat to Vail Resorts, directly impacting its core business. Warmer temperatures mean less natural snowfall, shorter ski seasons, and a greater need for costly artificial snowmaking. For instance, during the 2022-2023 season, Vail Resorts reported that unfavorable weather conditions, including lower snowfall in certain regions, contributed to a decline in skier visits compared to prior periods.

This reliance on artificial snowmaking escalates operational expenses significantly. The energy and water required for snowmaking are substantial, and as temperatures rise, the efficiency of this process can also decrease, further increasing costs. This trend puts pressure on Vail Resorts' profitability and raises questions about the long-term economic viability of its business model if climate change impacts continue to worsen without effective mitigation and adaptation strategies.

Vail Resorts, like many in the leisure and tourism sector, faces significant headwinds from economic downturns. A dip in consumer confidence and disposable income directly translates to less money available for non-essential activities such as ski vacations. For instance, if inflation continues to pressure household budgets through 2025, we could see a noticeable impact on travel bookings.

This sensitivity to discretionary spending means that when the economy slows, fewer people are likely to book expensive ski trips or purchase multi-day lift tickets. This reduction in demand can severely affect Vail Resorts' top-line revenue, as well as its profitability, especially considering the high fixed costs associated with operating ski resorts.

Vail Resorts faces significant pressure from rivals such as Alterra Mountain Company, which operates a comparable network of resorts, and numerous independent ski areas. This competitive landscape means Vail must constantly differentiate its offerings to retain its customer base and attract new visitors. For instance, Alterra's Ikon Pass directly competes with Vail's Epic Pass, offering access to a different but equally attractive set of destinations.

Competitors are not just other ski resorts; a broader array of leisure activities and vacation types vie for consumer discretionary spending. If Vail's focus on efficiency through cost-cutting or automation leads to a diminished guest experience, these alternative vacation options could become more appealing, eroding Vail's market share. For example, a decline in service quality could push travelers towards more personalized, boutique travel experiences.

Labor Relations and Workforce Stability

Vail Resorts faces ongoing threats from labor relations and workforce stability. The Park City ski patrol strike in late 2024 into early 2025 serves as a stark example, impacting operational continuity and potentially damaging the company's reputation.

Despite wage investments, deeper structural labor issues persist. The company's push towards automation, while aiming for efficiency, could alienate highly skilled employees, creating a talent deficit.

- Potential for service disruptions: A demotivated or understaffed workforce can lead to reduced service quality.

- Guest dissatisfaction: Service issues directly impact the guest experience, potentially leading to negative reviews and reduced repeat business.

- Increased legal risks: Poor labor practices or disputes can result in costly legal actions and settlements.

Regulatory Changes and Environmental Practices Scrutiny

Vail Resorts' reliance on public lands means it's directly impacted by evolving environmental regulations and permitting requirements. For instance, in 2024, the U.S. Forest Service continued to emphasize climate resilience in its land management plans, which could influence operating permits for ski resorts. Any shifts in land use policies or stricter environmental standards could impose significant compliance costs or even restrict operations, directly affecting revenue streams.

Increased scrutiny on Environmental, Social, and Governance (ESG) practices presents a notable threat. Investors and the public are paying closer attention to how companies manage their environmental footprint and social impact. Vail Resorts, with its extensive operations, faces pressure to demonstrate robust sustainability initiatives. Failure to meet these expectations could result in reputational damage, impacting customer loyalty and investor confidence, especially as sustainability becomes a key differentiator for consumers in 2024 and beyond.

- Regulatory Risk: Changes in environmental laws, such as those concerning water usage or habitat protection, could necessitate costly operational adjustments.

- Permitting Challenges: Delays or denials in renewing federal permits, crucial for operating on public lands, pose a direct threat to business continuity.

- ESG Scrutiny: Negative press or investor activism related to Vail's environmental performance, particularly concerning climate change impacts on ski seasons, could affect its brand image and market valuation.

- Compliance Costs: Meeting new or more stringent environmental standards, such as those related to emissions or waste management, will likely increase operational expenses.

Vail Resorts faces significant competitive pressure from entities like Alterra Mountain Company, whose Ikon Pass offers a compelling alternative to Vail's Epic Pass. This rivalry necessitates continuous innovation and investment to maintain market share and guest loyalty. Furthermore, a broader range of leisure activities competes for discretionary spending, meaning any decline in service quality could push consumers towards other vacation options.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Vail Resorts' official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.