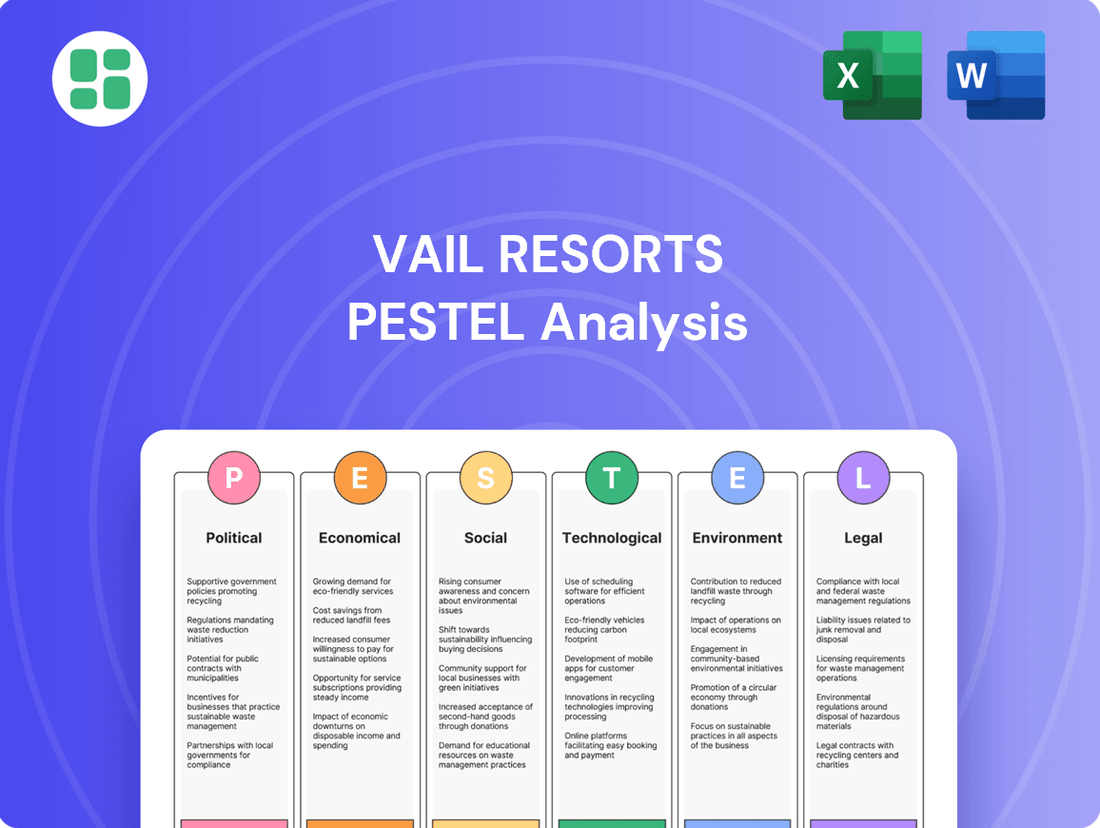

Vail Resorts PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vail Resorts Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Vail Resorts's future. From shifting consumer preferences to evolving climate policies, understanding these external forces is key to strategic advantage. Download our comprehensive PESTLE analysis to gain actionable intelligence and navigate the dynamic landscape of the ski resort industry.

Political factors

Vail Resorts' extensive operations, often on leased federal lands like national forests, make it highly sensitive to evolving government regulations on land use. Changes in permitting, environmental reviews, or land management policies directly influence its capacity for new infrastructure, terrain expansion, or lodging development, impacting strategic growth plans.

Government policies significantly shape international tourism to Vail Resorts. For instance, relaxed visa requirements or the absence of stringent travel advisories can boost visitor numbers. In 2023, the US saw a notable increase in international arrivals, contributing to a stronger tourism season, which directly benefits resorts like Vail.

Geopolitical stability plays a crucial role; periods of unrest or complex bilateral relations can deter international travel. Conversely, strong diplomatic ties and open borders encourage cross-border movement. For example, Canada's tourism sector, a key market for Vail Resorts, often benefits from favorable trade agreements and a stable political climate, attracting a diverse range of international visitors.

Vail Resorts' reliance on a seasonal workforce, often including international talent, makes it particularly vulnerable to shifts in labor laws and immigration policies. For instance, changes to visa programs or increased minimum wage requirements directly impact operating expenses and the ability to staff resorts adequately during peak periods. In 2023, the U.S. saw continued debate around guest worker programs, and while specific impacts on Vail's 2024/2025 season are still unfolding, potential increases in labor costs are a significant consideration.

Tax Policies and Fiscal Incentives

Changes in corporate tax rates, such as the U.S. federal corporate tax rate which was reduced from 35% to 21% in 2018, directly affect Vail Resorts' net income. Property taxes on its extensive land holdings and any specific tourism-related levies in states like Colorado or Utah can also alter operational costs and investment strategies.

Conversely, government support can be a significant boon. For instance, if a state offers tax credits for renewable energy installations at resorts, this could encourage Vail to invest in sustainable infrastructure. Similarly, incentives for developing local infrastructure or creating jobs could offset development costs for new projects or expansions.

- Corporate Tax Impact: A 1% change in the U.S. federal corporate tax rate can shift Vail Resorts' annual tax liability by tens of millions of dollars, influencing profit margins.

- Property Tax Burden: In 2023, property taxes represented a notable operating expense for Vail Resorts, varying significantly by locale and impacting the cost of maintaining its vast mountain properties.

- Incentive Opportunities: Potential tax incentives for sustainable tourism, such as those explored by Colorado in 2024 to promote eco-friendly travel, could reduce capital expenditure for environmental upgrades.

Political Stability and Local Governance

Vail Resorts' operations are significantly influenced by the political stability of its resort locations and the attitudes of local governments. For instance, in Colorado, where Vail Resorts has a substantial presence, local elections and county commissioner decisions can directly impact land use permits and environmental regulations. A shift towards more restrictive local governance could slow down or halt expansion projects, as seen in past debates over development in mountain communities.

Changes in local leadership or political priorities can directly affect zoning laws, development approvals, and public support for resort operations. For example, a new mayor or county executive might prioritize different aspects of community development, potentially impacting Vail's ability to secure permits for new lifts or real estate ventures. This was evident in the discussions surrounding the proposed expansion at Park City Mountain Resort in Utah, where local political discourse played a role in the approval process.

- Political Stability: Regions with stable political environments generally offer more predictable operating conditions for Vail Resorts.

- Local Governance: The disposition of local governments towards tourism and large-scale resort development is a key factor.

- Regulatory Impact: Shifts in local leadership can lead to changes in zoning, development approvals, and environmental compliance.

- Community Relations: Positive relationships with local authorities are crucial for maintaining operational continuity and public support.

Government land leases, particularly with the U.S. Forest Service, are critical for Vail Resorts' operational footprint, with renewals and terms subject to political negotiation and potential policy shifts. For instance, the 2024/2025 ski season will be influenced by ongoing federal land management discussions. Furthermore, shifts in international relations and trade policies can significantly impact the influx of foreign tourists, a vital revenue stream for Vail Resorts, as seen in the recovery of international travel post-pandemic.

Changes in U.S. federal and state tax policies directly affect Vail Resorts' profitability and investment capacity. For example, potential adjustments to corporate tax rates or the introduction of new tourism-specific levies in key states like Colorado or Utah could alter the company's financial outlook for 2024 and beyond. Additionally, the political climate surrounding labor laws and immigration policies impacts Vail's ability to secure seasonal workers, a crucial element for its operational success during peak seasons.

| Factor | Impact on Vail Resorts | Data Point/Trend (2024/2025 Focus) |

| Land Leases | Operational continuity and expansion potential | Ongoing U.S. Forest Service lease renewals and land management policy reviews. |

| International Relations | Tourism volume and revenue | Continued recovery in international travel to the U.S. in late 2023 and early 2024, with projections for further growth. |

| Tax Policy | Profitability and investment decisions | Potential for U.S. federal corporate tax rate adjustments; state-specific tourism taxes in Colorado and Utah under review. |

| Labor & Immigration | Workforce availability and operating costs | Continued debate on guest worker programs and minimum wage impacts on seasonal staffing for the 2024/2025 season. |

What is included in the product

This PESTLE analysis of Vail Resorts examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, highlighting key trends and their strategic implications.

It provides a comprehensive overview of the external landscape, enabling informed decision-making for navigating industry challenges and capitalizing on emerging opportunities.

A concise PESTLE analysis for Vail Resorts offers a clear, actionable overview of external factors impacting the business, simplifying strategic decision-making and reducing the complexity of market analysis.

Economic factors

Consumer discretionary spending is a critical driver for Vail Resorts, as ski vacations and resort experiences are typically non-essential purchases. In 2024, many economies are navigating persistent inflation, which can erode household purchasing power and make leisure activities like ski trips a lower priority for consumers. For instance, the U.S. Consumer Price Index (CPI) showed a notable increase in early 2024, impacting the affordability of such discretionary expenditures.

The strength of consumer confidence directly correlates with the willingness to spend on leisure. A dip in confidence, often tied to economic uncertainty or job market concerns, can lead to reduced demand for Vail Resorts' products, including Epic Passes and on-mountain services. As of mid-2024, consumer sentiment surveys indicate a cautious outlook in several key markets, suggesting potential headwinds for discretionary spending.

Persistent inflation continues to be a significant headwind for Vail Resorts, directly impacting its operating costs. For instance, in the fiscal year ending July 31, 2024, the company likely faced elevated expenses for wages, energy, and supplies. The Consumer Price Index (CPI) in the United States saw an annual increase of 3.3% in May 2024, indicating ongoing inflationary pressures that translate to higher costs for snowmaking fuel, lift operations, and employee compensation.

Managing these escalating expenses while keeping lift ticket and pass prices attractive presents a considerable challenge. Vail Resorts must balance the need to pass on increased costs to consumers with maintaining its market share and customer loyalty. If cost increases outpace price adjustments, profit margins could be compressed, necessitating a focus on operational efficiencies and strategic revenue management to offset these pressures.

Vail Resorts' international presence in Canada and Australia means it's directly impacted by exchange rate shifts. For example, if the US dollar strengthens significantly against the Canadian dollar, revenue earned in Canada translates to fewer US dollars, potentially hurting profitability. This also makes Vail's US resorts pricier for Canadian visitors, potentially dampening demand.

Conversely, a weaker US dollar could boost the profitability of Canadian and Australian operations when repatriated. However, it might also make Vail's US resorts more attractive to international tourists. In 2023, the US dollar generally remained strong against many major currencies, a trend that continued into early 2024, posing a headwind for companies with significant international revenue streams like Vail Resorts.

Interest Rates and Capital Expenditures

Changes in interest rates significantly influence Vail Resorts' ability to fund capital expenditures. For instance, the Federal Reserve's monetary policy decisions directly impact borrowing costs. As of early 2024, the Federal Funds Rate has remained elevated, making it more expensive for companies like Vail Resorts to finance large projects such as new lift construction or significant property upgrades.

Higher interest rates translate to increased debt servicing costs. This financial pressure can lead Vail Resorts to re-evaluate or postpone capital investment plans. For example, a project with an initial projected return might become less attractive if the cost of borrowing rises substantially, potentially impacting the company's long-term competitive advantage and guest experience.

- Increased Borrowing Costs: Higher interest rates directly increase the cost of debt for Vail Resorts, impacting the feasibility of new projects.

- Impact on Investment Decisions: Elevated rates can lead to delays or reductions in capital expenditures for resort improvements and expansion.

- Future Growth Implications: Reduced investment in infrastructure and amenities due to higher interest rates could hinder future revenue growth and market positioning.

Impact of Global Economic Downturns

Global economic downturns significantly impact Vail Resorts. A recession often translates to reduced discretionary spending, directly affecting travel and leisure activities. For instance, during periods of economic contraction, consumers tend to cut back on non-essential expenses like ski vacations, leading to lower ticket sales and lodging revenue.

The company's reliance on a global customer base means that economic instability in key markets, such as North America and Europe, can have a pronounced effect. A slowdown in consumer confidence and disposable income worldwide can dampen demand for destination resorts. For example, a projected global GDP growth slowdown in 2024-2025 could see a noticeable dip in international visitation numbers.

- Reduced Travel Spending: Economic uncertainty typically leads to decreased consumer confidence and a pullback in discretionary spending, impacting travel and leisure budgets.

- Lower Corporate Bookings: During downturns, companies often reduce spending on corporate events and retreats, affecting Vail Resorts' group business.

- Weakened Demand for Premium Experiences: As economic conditions worsen, demand for high-cost leisure activities like luxury ski holidays may decline.

Consumer spending habits are directly influenced by economic conditions, with inflation and interest rates playing key roles. Persistent inflation, as seen with the U.S. CPI at 3.3% year-over-year in May 2024, erodes purchasing power, making discretionary spending on ski vacations a tougher choice for many households. Furthermore, elevated interest rates, with the Federal Funds Rate remaining high in early 2024, increase borrowing costs for both consumers and companies like Vail Resorts, potentially impacting investment in new amenities and overall affordability.

What You See Is What You Get

Vail Resorts PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Vail Resorts delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Understand the external forces shaping the future of this leading ski resort operator.

Sociological factors

Consumer tastes are shifting, with a growing appetite for outdoor activities, personal well-being, and memorable travel experiences. This trend directly impacts how much people want to visit places like Vail Resorts. For instance, in 2024, the outdoor recreation industry continued its robust growth, with spending projected to reach new highs, indicating a strong underlying demand for the types of experiences Vail provides.

Beyond just skiing, there's a noticeable rise in interest for a broader range of mountain sports, from mountain biking in the summer to hiking and climbing. Travelers are also increasingly seeking out more eco-friendly and genuine travel adventures. This means Vail Resorts needs to continually update its services and how it communicates with customers to appeal to a wider audience and stay competitive in the evolving travel landscape.

Demographic shifts, like an aging population in core markets and evolving youth engagement with winter sports, directly influence long-term participation in skiing and snowboarding. For instance, in 2023, the average age of skiers and snowboarders in the US remained relatively stable, but a slight decline in participation among those under 25 was observed, highlighting a need for strategic adaptation.

Vail Resorts must proactively address these trends. This could involve diversifying resort activities to cater to a wider age spectrum, perhaps through enhanced summer offerings or year-round experiences. Investing in initiatives designed to attract and retain younger generations in mountain sports is also crucial for sustained growth.

Public health concerns, such as those amplified during the COVID-19 pandemic, directly shape how people travel and their comfort level in crowded environments like ski resorts. Vail Resorts experienced this firsthand, with operational adjustments and capacity limits impacting revenue streams during peak periods. For instance, in the fiscal year 2021, while revenue recovered significantly, the lingering effects of health protocols continued to influence guest experience and operational planning.

Social Responsibility and Community Engagement

Societal expectations for corporate social responsibility are intensifying, placing Vail Resorts' dedication to local communities, fair labor, and ethical operations under a microscope. In 2024, the company continued its focus on environmental stewardship and community investment, with initiatives like the EpicPromise program aiming to support local economies and environmental conservation efforts across its resorts.

Positive community relations and active participation in local projects can significantly bolster Vail Resorts' brand image and cultivate goodwill. For instance, their commitment to employee well-being, including competitive wages and benefits, plays a crucial role in maintaining a positive workforce and community perception. In 2023, Vail Resorts reported investing $15 million in employee wages and benefits, a testament to their focus on social responsibility.

- Growing Scrutiny: Increased public and stakeholder demand for corporate accountability in social and environmental impact.

- Brand Reputation: Positive community engagement enhances brand loyalty and mitigates potential opposition.

- Employee Well-being: Fair labor practices and benefits contribute to a strong workforce and positive community relations.

- Investment in Communities: Programs like EpicPromise demonstrate a tangible commitment to local economic and environmental health.

Workforce Availability and Lifestyle Trends

Vail Resorts relies heavily on a seasonal workforce, but evolving lifestyle preferences and economic pressures are making recruitment tougher. Many potential employees are seeking more stable year-round employment or are priced out of housing in popular resort areas. For instance, in 2024, housing costs in many mountain towns continue to be a significant barrier, with median home prices often exceeding $1 million, making it difficult for seasonal workers to find affordable accommodation.

Addressing these workforce availability challenges requires strategic adjustments. Vail Resorts has been investing in employee housing initiatives, aiming to provide more accessible living options. They are also looking at enhancing compensation and benefits to remain competitive in the labor market. Fostering a strong company culture that values its employees is also key to improving retention rates amidst these trends.

- Seasonal Workforce Dependency: Vail Resorts' operational success hinges on securing a consistent pool of seasonal workers, particularly for its peak winter and summer seasons.

- Housing Affordability Crisis: Rising housing costs in resort communities present a major hurdle for attracting and retaining staff, impacting recruitment efforts.

- Lifestyle Shifts: Changing worker expectations regarding work-life balance and job stability can influence the appeal of seasonal employment.

- Competitive Labor Market: Vail Resorts faces competition for talent not only from other ski resorts but also from various industries seeking to fill roles.

Societal expectations for corporate social responsibility are growing, with increased scrutiny on Vail Resorts' impact on local communities and its labor practices. In 2024, the company continued its commitment to environmental initiatives and community support through programs like EpicPromise, which aims to bolster local economies and conservation efforts across its resort portfolio.

Positive community relationships and active engagement in local projects are vital for enhancing Vail Resorts' brand image and fostering goodwill. Their focus on employee well-being, including competitive wages and benefits, is crucial for maintaining a satisfied workforce and a positive community perception. For instance, Vail Resorts reported investing $15 million in employee wages and benefits in 2023, underscoring their dedication to social responsibility.

| Societal Factor | Vail Resorts' Response/Impact | 2023/2024 Data Point |

|---|---|---|

| Corporate Social Responsibility | Increased demand for accountability in social and environmental impact. | EpicPromise program continued focus on environmental stewardship and community investment. |

| Community Relations | Positive engagement enhances brand loyalty and mitigates opposition. | Investment of $15 million in employee wages and benefits. |

| Employee Well-being | Fair labor practices contribute to a strong workforce and positive community relations. | Focus on competitive wages and benefits to attract and retain staff. |

Technological factors

Vail Resorts' operational success hinges on technological advancements, particularly in snowmaking. In the 2023-2024 season, the company continued to invest in more efficient snow guns and automated systems, aiming to reduce water and energy consumption while maximizing snow coverage. This focus is crucial for maintaining consistent operating conditions, especially as climate change introduces greater weather variability.

Beyond snowmaking, Vail Resorts is actively upgrading its lift infrastructure and grooming fleet. For instance, the company has been progressively replacing older chairlifts with high-speed, high-capacity models, enhancing guest flow and reducing wait times. These investments, often in the tens of millions of dollars per resort, not only improve the guest experience but also contribute to operational efficiency and sustainability by using less energy.

Vail Resorts is heavily investing in the digitalization of guest services, a trend that has accelerated significantly. Their Epic Pass mobile app, for example, allows guests to manage their passes, view real-time lift line wait times, and access resort information, enhancing convenience. This digital push is crucial for streamlining operations and personalizing the guest experience, directly impacting customer satisfaction and loyalty.

Vail Resorts leverages sophisticated data analytics to understand guest behavior, preferences, and spending habits. This allows for highly personalized marketing efforts and dynamic pricing, aiming to boost revenue per visitor.

In the 2023 fiscal year, Vail Resorts reported a 9% increase in total revenue, reaching $3.7 billion, partly attributed to their data-driven strategies enhancing guest experience and targeted promotions.

The company's data insights inform operational decisions, such as staffing levels and inventory management, ensuring resources are efficiently deployed across its numerous resorts, ultimately improving the guest journey and operational efficiency.

Emerging Technologies for Safety and Operations

Vail Resorts is heavily investing in technology to bolster safety and operational efficiency. For instance, advanced sensor systems are being integrated into lift operations to monitor performance and predict potential issues, aiming to prevent downtime and enhance guest security. This focus on technological advancement is crucial in an industry where safety is paramount.

The company is also leveraging innovations in avalanche mitigation, employing tools that utilize real-time data and predictive modeling to manage snowpack stability. This proactive approach, supported by sophisticated weather forecasting, directly contributes to safer skiing conditions for guests and a more secure working environment for employees. Vail Resorts' commitment to these technologies underscores its dedication to operational excellence and risk management.

Furthermore, Vail Resorts is exploring and implementing cutting-edge energy management systems. These systems are designed to optimize energy consumption across its resorts, a move that not only reduces operational costs but also significantly lowers the company's environmental footprint. By embracing these technological solutions, Vail Resorts is positioning itself as a leader in sustainable and reliable mountain operations.

- Advanced Sensor Systems: Monitoring lift operations in real-time to enhance guest safety and operational reliability.

- Avalanche Mitigation Tools: Utilizing predictive modeling and real-time data for proactive snowpack management.

- Energy Management Systems: Implementing innovations to reduce energy consumption and environmental impact.

- Predictive Maintenance: Employing technology to forecast equipment needs, minimizing downtime and improving efficiency.

Cybersecurity and Data Privacy

Vail Resorts' increasing reliance on digital platforms for guest data, transactions, and operational control makes cybersecurity and data privacy paramount. A significant data breach could severely damage guest trust and lead to substantial financial penalties. For instance, in 2023, the global average cost of a data breach reached $4.45 million, according to IBM’s Cost of a Data Breach Report.

Robust cybersecurity measures are therefore essential. Vail Resorts must protect sensitive customer information, like booking details and payment data, to prevent service disruptions. Compliance with evolving data protection regulations, such as GDPR and CCPA, is also critical. Failure to comply can result in hefty fines, impacting profitability.

- Cybersecurity Investment: Vail Resorts likely invests heavily in advanced threat detection and prevention systems.

- Data Privacy Compliance: Adherence to regulations like GDPR is crucial for maintaining customer trust and avoiding legal repercussions.

- Reputational Risk: A data breach could significantly harm Vail Resorts' brand image and customer loyalty.

- Operational Continuity: Protecting digital infrastructure ensures the smooth operation of ticketing, resort management, and guest services.

Technological advancements are central to Vail Resorts' strategy, enhancing both guest experience and operational efficiency. The company's ongoing investment in advanced snowmaking technology, including more efficient snow guns and automated systems, aims to optimize snow coverage and reduce resource consumption, a critical factor given increasing weather variability.

Digitalization plays a key role, with the Epic Pass app streamlining guest interactions and providing real-time resort information. Vail Resorts also utilizes sophisticated data analytics to personalize marketing and pricing strategies, as evidenced by their 9% revenue increase to $3.7 billion in fiscal year 2023, partly driven by these data-informed approaches.

Safety and operational reliability are bolstered through advanced sensor systems in lift operations and innovative avalanche mitigation tools employing predictive modeling. Furthermore, the implementation of cutting-edge energy management systems underscores a commitment to sustainability and cost reduction.

However, this digital reliance necessitates robust cybersecurity measures to protect sensitive guest data, with the global average cost of a data breach at $4.45 million in 2023, highlighting the significant financial and reputational risks associated with data breaches and the importance of compliance with privacy regulations.

Legal factors

Vail Resorts navigates a complex web of land use and environmental regulations, especially given many of its properties sit on public lands or in ecologically sensitive zones. For instance, in 2023, the U.S. Forest Service continued to review and issue special use permits for ski areas, a process that can involve extensive environmental impact assessments. Failure to comply with federal, state, and local rules on zoning, building, and environmental protection, including habitat conservation and water quality standards, can jeopardize operational licenses and permits, impacting expansion and day-to-day activities.

Vail Resorts operates under stringent health and safety regulations, encompassing everything from ski lift maintenance and slope preparation to clear signage and robust emergency response plans. These legal mandates are crucial for safeguarding guests and staff, mitigating potential liabilities, and preventing penalties or shutdowns by oversight agencies.

For instance, the Occupational Safety and Health Administration (OSHA) sets standards that impact resort operations, and while specific resort-related OSHA fines are not publicly detailed for Vail Resorts in 2024 or 2025, the general trend shows a focus on workplace safety across industries. In 2023, OSHA reported over 5,000 workplace fatalities nationwide, underscoring the importance of compliance.

Vail Resorts, a major employer with both permanent and seasonal workers, faces significant challenges in adhering to diverse labor and employment legislation. This encompasses adhering to federal and state minimum wage requirements, which can vary by location and impact operational costs. For instance, in 2024, many states saw increases in their minimum wages, with some reaching $15 or more per hour, directly affecting Vail's staffing expenses.

Compliance with overtime rules, workplace safety standards like OSHA regulations, and anti-discrimination statutes are crucial for managing human resources and mitigating legal risks. Furthermore, the company must navigate specific rules concerning seasonal worker visas, such as the H-2B program, which are vital for staffing during peak periods but are subject to quotas and regulatory changes. In 2024, the H-2B visa cap saw continued demand, highlighting the importance of these programs for businesses like Vail Resorts.

Consumer Protection and Liability Laws

Vail Resorts operates under stringent consumer protection laws, particularly concerning the transparent pricing, marketing, and terms of its popular Epic Pass. For instance, in 2024, the company continued to emphasize clear communication regarding pass benefits and restrictions to avoid deceptive practices. Liability laws are also a significant concern, given the inherent risks associated with ski resorts.

The company must maintain robust risk management strategies and adequate insurance to address potential accidents and injuries on its properties. In 2023, Vail Resorts reported $55 million in insurance recoveries related to property and casualty claims, highlighting the ongoing need for comprehensive coverage. Clear waivers are crucial for mitigating legal exposure from guest claims, a standard practice across the industry to manage liability.

- Consumer Protection: Laws mandate transparency in pricing, marketing, and terms for products like the Epic Pass, ensuring fair practices for consumers.

- Liability Management: Resort operations are subject to laws governing accidents and injuries, requiring strong risk management and insurance.

- Mitigation Strategies: Vail Resorts utilizes clear waivers and comprehensive insurance policies to minimize legal exposure from guest claims.

- Financial Impact: In 2023, insurance recoveries of $55 million underscore the significant financial implications of managing property and casualty claims.

Antitrust and Competition Laws

Vail Resorts' substantial market presence, particularly with its popular Epic Pass, positions it under the watchful eye of antitrust and competition regulators in key markets like the United States, Canada, and Australia. Concerns could surface around maintaining fair competition, especially regarding pricing strategies and any future acquisitions that might consolidate market power.

The company must navigate these legal frameworks diligently. For instance, in the US, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively monitor industries for monopolistic practices. While specific recent enforcement actions against Vail Resorts are not publicly detailed as of early 2025, the general regulatory environment emphasizes preventing undue market concentration.

- Market Share Scrutiny: Vail Resorts' significant footprint in the ski resort industry could attract regulatory attention, especially concerning its dominant position in certain regions.

- Pricing and Pass Products: The pricing models and bundling strategies of products like the Epic Pass may be subject to review to ensure they do not stifle competition or unfairly disadvantage consumers.

- Acquisition Oversight: Any future mergers or acquisitions by Vail Resorts will likely undergo thorough antitrust review to assess their impact on market competition.

- International Compliance: Operating across multiple countries necessitates adherence to diverse antitrust regulations in Canada and Australia, each with its own enforcement bodies and criteria.

Vail Resorts must adhere to a complex array of consumer protection laws, particularly concerning the transparent marketing and terms of its Epic Pass. For instance, in 2024, the company continued to emphasize clear communication regarding pass benefits and restrictions to avoid deceptive practices. Liability laws are also a significant concern, given the inherent risks associated with ski resorts, necessitating robust risk management and insurance. In 2023, Vail Resorts reported $55 million in insurance recoveries related to property and casualty claims, underscoring the ongoing need for comprehensive coverage and clear waivers to mitigate legal exposure.

Environmental factors

Climate change presents a substantial long-term risk to Vail Resorts, directly affecting its primary operations by altering natural snowfall patterns, the duration of ski seasons, and the overall quality of snow. For instance, the 2023-2024 season saw varied snowfall across its resorts, with some experiencing below-average conditions early on, underscoring this vulnerability.

The consequence of reduced natural snow is a heightened dependence on expensive and energy-consuming snowmaking technologies. This increased operational cost impacts profitability. Furthermore, shorter ski seasons directly translate to fewer visitor days, potentially leading to a significant dip in revenue, necessitating strategic investments in adaptation measures to bolster resilience against these environmental shifts.

Water scarcity poses a direct threat to Vail Resorts' core operations, particularly snowmaking. Drought conditions in mountain regions, which are becoming more frequent, can significantly limit the availability of water needed to create the snow base for skiing and snowboarding. This directly impacts revenue and guest experience.

Vail Resorts must navigate complex water rights and implement robust water management strategies. Investing in water-saving technologies for snowmaking, such as advanced snow guns that use less water, is crucial for both operational sustainability and compliance with environmental regulations. For instance, in the 2023-2024 season, many resorts faced challenges due to lower-than-average snowfall, highlighting the importance of artificial snowmaking capabilities.

Vail Resorts operates in ecologically sensitive mountain regions, necessitating careful management of its environmental impact and active participation in conservation. This includes adhering to regulations designed to protect endangered species, wetlands, and other vital habitats.

Proactive biodiversity initiatives are essential for Vail Resorts to maintain its operating permits and cultivate positive relationships with stakeholders, including local communities and environmental groups. For instance, in the 2023 fiscal year, Vail Resorts reported investing $25 million in environmental initiatives, demonstrating a commitment to these crucial conservation efforts.

Waste Management and Sustainability Initiatives

Vail Resorts' extensive operations, serving millions of visitors annually, inherently generate significant waste. The company is thus compelled to implement comprehensive waste management strategies. These include robust recycling programs, food waste composting initiatives, and ongoing efforts to reduce overall waste generation across its mountain resorts and lodging properties. For instance, in the 2023 fiscal year, Vail Resorts reported diverting 37% of its waste from landfills through these programs.

Stakeholder pressure for enhanced corporate sustainability is a growing environmental factor. This translates into increasing expectations for Vail Resorts to actively reduce its carbon footprint, transition towards renewable energy sources for its operations, and champion eco-friendly practices throughout its vast portfolio. The company has set ambitious goals, aiming for net zero operational emissions by 2030, with a commitment to powering 100% of its operations with renewable energy by 2025.

- Waste Diversion Rate: 37% of waste diverted from landfills in FY2023.

- Net Zero Goal: Aiming for net zero operational emissions by 2030.

- Renewable Energy Target: 100% renewable energy for operations by 2025.

- Sustainability Investments: Significant capital allocated to on-mountain environmental projects.

Regulatory Pressures for Carbon Footprint Reduction

Vail Resorts faces increasing regulatory pressure to reduce its carbon footprint, a trend amplified by growing public demand for corporate environmental responsibility. This translates into potential future carbon taxes and more stringent emissions standards, directly impacting operational costs and strategic planning.

To navigate these environmental factors, Vail Resorts is compelled to invest in energy efficiency across its properties, explore sustainable transportation options for guests and employees, and actively pursue renewable energy sources. These initiatives are crucial not only for meeting internal environmental targets but also for maintaining its social license to operate and appealing to an increasingly eco-conscious customer base.

- Regulatory Scrutiny: Governments worldwide are implementing stricter environmental regulations, including potential carbon pricing mechanisms.

- Operational Adaptation: Vail Resorts must adapt by investing in energy-efficient technologies and sustainable practices to comply with evolving standards.

- Renewable Energy Push: The company is incentivized to increase its reliance on renewable energy sources, such as solar and wind power, to lower its carbon emissions.

Climate change significantly impacts Vail Resorts, threatening natural snowfall and ski season length, as seen in the variable conditions of the 2023-2024 season. This necessitates increased reliance on costly snowmaking, directly affecting profitability and revenue through fewer visitor days.

Water scarcity is another critical environmental challenge, particularly for snowmaking operations, with drought conditions increasingly impacting water availability. Vail Resorts must manage water rights and invest in water-saving technologies, like advanced snow guns, to ensure operational continuity and regulatory compliance.

Vail Resorts is committed to environmental stewardship, investing $25 million in conservation efforts in fiscal year 2023 and aiming for net-zero operational emissions by 2030. The company also targets powering 100% of its operations with renewable energy by 2025, demonstrating a proactive approach to sustainability.

The company diverts 37% of its waste from landfills through robust recycling and composting programs, as reported in FY2023. These efforts are crucial for managing the substantial waste generated by millions of annual visitors and meeting growing stakeholder expectations for corporate environmental responsibility.

| Environmental Factor | Impact on Vail Resorts | Vail Resorts' Response/Data |

|---|---|---|

| Climate Change & Snowfall | Reduced natural snow, shorter seasons, increased snowmaking costs. | Variable snowfall in 2023-2024 season. |

| Water Scarcity | Limits snowmaking capabilities, impacting operations and revenue. | Investment in water-saving snowmaking technology. |

| Biodiversity & Conservation | Need to protect sensitive mountain ecosystems and maintain operating permits. | $25 million invested in environmental initiatives (FY2023). |

| Waste Management | Significant waste generation from operations and visitors. | 37% waste diversion from landfills (FY2023). |

| Carbon Footprint & Renewables | Regulatory pressure and stakeholder demand for reduced emissions. | Net zero goal by 2030; 100% renewable energy by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Vail Resorts is built on a robust foundation of data from official government tourism statistics, economic indicators from financial institutions, and industry-specific market research reports. We also incorporate insights from environmental impact assessments and analyses of leisure and travel consumer behavior.