Universal Technical Institute SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Universal Technical Institute Bundle

Universal Technical Institute (UTI) faces a dynamic landscape, with strong brand recognition and a focus on in-demand skilled trades as key strengths. However, it must navigate evolving educational models and potential competition.

Want the full story behind UTI's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Universal Technical Institute (UTI) is showing impressive financial strength. In the second quarter of fiscal year 2025, their revenue jumped 12.6% compared to the previous year, reaching $207.4 million. This growth isn't just on the top line; net income saw a significant surge of 47.0%.

The company's operational efficiency is also highlighted by a substantial 27.8% increase in adjusted EBITDA. Building on this momentum, UTI has confidently raised its full-year guidance for fiscal 2025, projecting continued growth across key performance indicators like revenue and new student enrollment.

Universal Technical Institute (UTI) is demonstrating impressive momentum in attracting new students. In the second quarter of 2025, new student starts surged by 21.4% compared to the previous year, reaching a total of 6,650. This significant increase highlights the growing demand for UTI's specialized training programs.

Furthermore, the overall number of active full-time students also saw a healthy increase of 10.3% year-over-year. This sustained growth in enrollment indicates effective admissions strategies and a strong appeal of UTI's educational offerings to prospective students.

Universal Technical Institute (UTI) is strategically diversifying its program offerings to tap into high-demand sectors. This includes the planned launch of four new electrical training programs in July 2025, expanding beyond its core automotive and diesel specializations. This diversification is a key component of its 'North Star Strategy,' which aims for overall growth and optimization.

The company is also expanding its physical presence, with plans to grow its campus footprint. This expansion, coupled with new program development in areas like skilled trades and healthcare, broadens UTI's appeal and market reach. These moves are designed to position UTI to capitalize on evolving workforce needs.

Extensive Industry Partnerships

Universal Technical Institute (UTI) boasts extensive industry partnerships, connecting with over 10,000 dealerships and repair facilities. These collaborations are vital, ensuring UTI's curriculum stays current with the latest automotive technology and diagnostic tools. For instance, in 2023, UTI reported that over 85% of its graduates were employed within six months of completing their programs, a testament to the strength of these industry ties.

These deep-rooted relationships translate directly into student success. Manufacturers like Ford, General Motors, and Mercedes-Benz actively participate in UTI's programs, providing specialized training and equipment. This access to cutting-edge technology means UTI students are learning on the same systems they'll encounter in the field. Furthermore, these partnerships facilitate direct hiring pipelines, with many employers actively recruiting at UTI campuses through dedicated job fairs.

The benefits of these extensive partnerships are clear:

- Curriculum Relevance: Partnerships ensure training aligns with the evolving demands of the automotive and diesel industries.

- Access to Technology: Students gain hands-on experience with state-of-the-art tools and equipment from leading manufacturers.

- Enhanced Job Placement: Strong employer relationships lead to high graduation employment rates, with active recruitment on campus.

- Industry Endorsement: Collaborations with major brands like NASCAR and Peterbilt lend credibility and specialized training opportunities.

Addressing High Workforce Demand

Universal Technical Institute (UTI) is strategically positioned to benefit from the significant demand for skilled technicians across various industries. The company's core mission directly tackles the persistent shortage of qualified professionals in sectors like transportation, skilled trades, and healthcare. This strong alignment with labor market needs is a key strength, as employers actively seek graduates with practical, job-ready skills.

The demand for automotive, diesel, and especially emerging technology technicians, such as those specializing in electric vehicles (EVs), continues to surge. UTI's curriculum is specifically designed to meet these evolving industry requirements, ensuring its students are equipped with the in-demand competencies that employers are actively seeking. For instance, as of early 2024, the U.S. Bureau of Labor Statistics projected a 6% growth in automotive service technician and mechanic employment from 2022 to 2032, faster than the average for all occupations.

- Addresses Critical Technician Shortages: UTI directly targets the deficit of skilled workers in transportation, skilled trades, and healthcare.

- High Demand for Graduates: The market consistently shows a strong need for automotive, diesel, and EV specialists.

- Industry-Relevant Training Programs: UTI's curriculum focuses on equipping students with skills employers actively seek.

- Projected Employment Growth: The automotive sector, a key focus for UTI, is expected to see continued job growth, with the U.S. Bureau of Labor Statistics predicting a 6% increase in automotive service technician roles between 2022 and 2032.

UTI's financial performance is robust, with Q2 FY2025 revenue up 12.6% year-over-year to $207.4 million and net income soaring 47.0%. This strong financial footing is complemented by a significant 21.4% increase in new student starts in Q2 FY2025, totaling 6,650, demonstrating effective marketing and program appeal. The company's strategic diversification into high-demand sectors, including new electrical training programs launching in July 2025, further solidifies its market position and future growth potential.

| Metric | Q2 FY2025 | Year-over-Year Change |

|---|---|---|

| Revenue | $207.4 million | +12.6% |

| Net Income | N/A | +47.0% |

| New Student Starts | 6,650 | +21.4% |

| Active Full-Time Students | N/A | +10.3% |

What is included in the product

Delivers a strategic overview of Universal Technical Institute’s internal and external business factors, identifying its strengths in skilled trades education and opportunities in high-demand industries, while acknowledging weaknesses in student retention and threats from economic downturns.

Simplifies complex strategic analysis by highlighting UTI's strengths and weaknesses, enabling targeted solutions for enrollment and retention challenges.

Weaknesses

Universal Technical Institute's (UTI) primary vulnerability lies in its heavy reliance on student enrollment numbers. While the company saw a 10.4% increase in new student starts in the first quarter of fiscal year 2024 compared to the prior year, this dependence makes it susceptible to external factors. Any downturn in the economy or shifts in how vocational training is perceived could significantly reduce enrollment, directly impacting UTI's financial health.

As a for-profit institution, Universal Technical Institute's (UTI) tuition can be substantial, potentially deterring some students and raising concerns about the burden of student debt. For example, in 2023, average program costs at UTI could range from $30,000 to over $40,000, depending on the specific program and campus. This significant investment requires careful consideration of the return on investment, especially when compared to less expensive vocational or community college options.

Universal Technical Institute (UTI) faces robust competition from a wide array of educational avenues. Community colleges, for instance, frequently provide comparable vocational programs at a more accessible price point, appealing to budget-conscious students. This cost-effectiveness can pose a significant challenge for UTI, especially when students weigh tuition fees against the perceived value of specialized private institutions.

Regulatory Scrutiny on For-Profit Education

Universal Technical Institute (UTI), like other institutions in the for-profit education sector, operates under the watchful eye of regulators. This scrutiny often centers on critical areas such as student success rates, how financial aid is administered, and the transparency of marketing campaigns. For instance, in 2023, the Department of Education continued to emphasize accountability for institutions receiving federal student aid, a trend expected to persist through 2024 and into 2025.

While shifts in the political climate could potentially ease some pressures, the possibility of ongoing oversight and new policy implementations remains a significant concern. Such changes could introduce operational complexities or impose financial constraints on UTI's business model. For example, stricter gainful employment regulations, which were a focus in previous years, could be revisited or modified, impacting program offerings and enrollment strategies.

- Increased Oversight: For-profit education has historically been a target for regulatory review, impacting areas like student outcomes and financial aid.

- Potential Policy Changes: Evolving regulations, potentially influenced by political shifts, could create operational hurdles or financial limitations for UTI.

- Focus on Accountability: Federal agencies continue to emphasize institutional accountability, particularly concerning student success and debt-to-earnings ratios.

- Marketing Scrutiny: Regulators often examine marketing practices to ensure accurate representation of program outcomes and job placement rates.

Capital Expenditure for Expansion

Universal Technical Institute's (UTI) strategic focus on expansion, dubbed its 'North Star Strategy', demands considerable capital for new campus openings and broadening program offerings. This significant investment, while crucial for long-term growth, can place pressure on immediate financial performance and available cash. For instance, in fiscal year 2023, UTI reported capital expenditures of $65.4 million, a notable increase from $47.4 million in 2022, reflecting these expansionary efforts.

Successfully executing these ambitious expansion plans is paramount to mitigating the short-term financial impacts. Any delays or cost overruns in new campus launches or program development could strain cash flow and profitability. The company's ability to manage these expenditures effectively and ensure the successful ramp-up of new initiatives will be key.

- Significant Capital Outlay: The 'North Star Strategy' necessitates substantial investments in new campuses and program development, directly impacting capital expenditure.

- Short-Term Financial Strain: While driving future growth, these investments can temporarily reduce profitability and cash flow, requiring astute financial oversight.

- Execution Risk: The success of expansion hinges on efficient execution of new campus launches and program rollouts to avoid financial setbacks.

Universal Technical Institute's (UTI) reliance on student enrollment presents a significant vulnerability. Despite a 10.4% increase in new student starts in Q1 FY2024, any economic downturn or negative perception of vocational training could severely impact enrollment and, consequently, UTI's financial stability.

The high cost of UTI's programs, with average tuition ranging from $30,000 to over $40,000 in 2023, can be a deterrent. This substantial investment necessitates a strong return on investment for students, especially when compared to more affordable alternatives like community colleges, which offer similar vocational training at lower price points.

UTI faces intense competition from various educational providers, including community colleges and other vocational schools. The cost-effectiveness of these competitors can pose a challenge for UTI, as students weigh the financial commitment against the perceived value of specialized private institutions.

As a for-profit institution, UTI is subject to regulatory scrutiny, particularly regarding student success rates, financial aid administration, and marketing practices. The Department of Education's continued emphasis on accountability for institutions receiving federal aid, a trend expected through 2024-2025, means potential policy changes could introduce operational complexities or financial constraints.

UTI's 'North Star Strategy' for expansion requires substantial capital, with capital expenditures rising to $65.4 million in FY2023 from $47.4 million in FY2022. This significant investment, while aimed at future growth, can strain current profitability and cash flow, making efficient execution of new campus launches and program rollouts critical to mitigate financial risks.

What You See Is What You Get

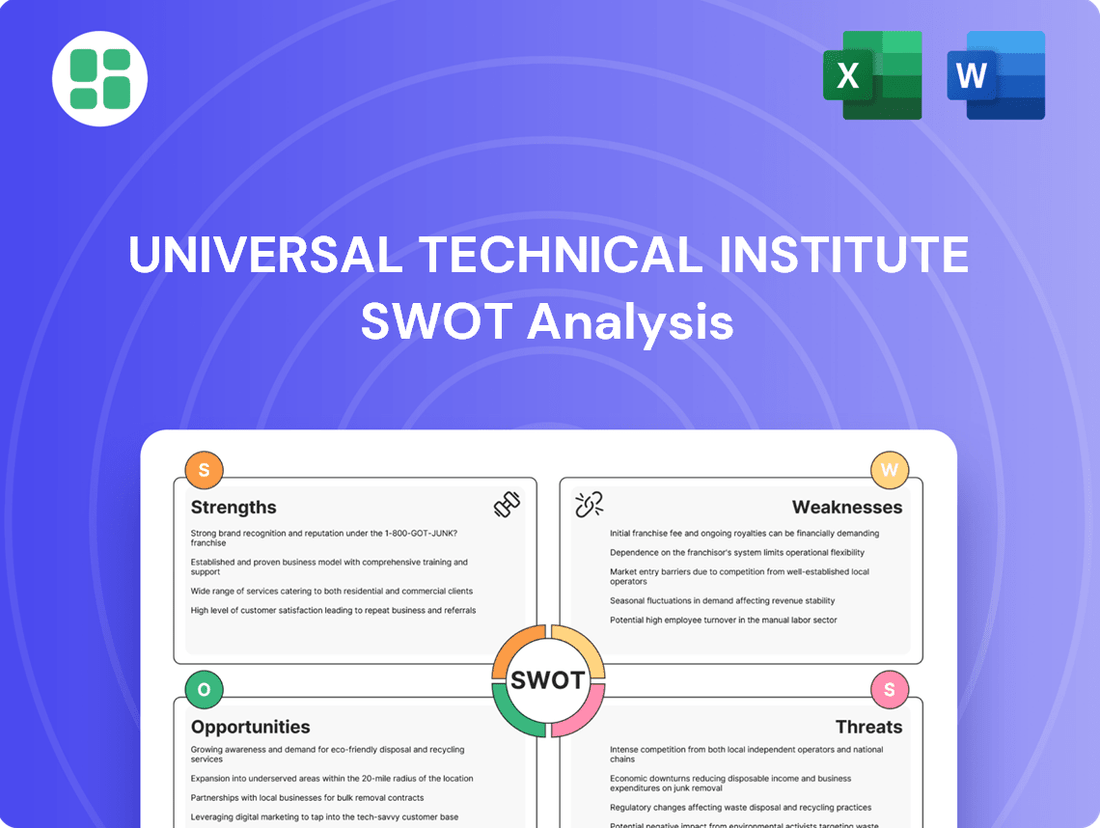

Universal Technical Institute SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report breaks down Universal Technical Institute's Strengths, Weaknesses, Opportunities, and Threats. It's designed to provide actionable insights for strategic planning.

Opportunities

The rapid advancement of technologies like electric vehicles (EVs), renewable energy, and advanced automation presents a substantial opportunity for Universal Technical Institute (UTI). As these sectors grow, so does the need for skilled technicians. For instance, the global EV market is projected to reach over $1.5 trillion by 2030, signaling a massive demand for EV-trained mechanics. UTI can capitalize on this by expanding its specialized training programs, ensuring its graduates are well-equipped for these emerging, high-paying careers.

Universal Technical Institute (UTI) is actively pursuing strategic acquisitions, with a notable focus on expanding its footprint in healthcare education via its Concorde Career Colleges. This move aims to diversify its offerings and tap into a growing market. For instance, in fiscal year 2023, Concorde’s revenue saw a significant increase, indicating the potential of such strategic expansions.

Furthermore, UTI is prioritizing the development of robust corporate partnerships. Recent collaborations, such as those established for HVACR and electrical training programs with leading industry companies, are designed to create tailored curricula and secure direct employment pathways for graduates. These partnerships are crucial for ensuring UTI’s programs remain relevant and responsive to evolving industry demands, directly impacting graduate placement rates.

Universal Technical Institute's strategic plan to introduce at least six new programs annually at its current locations, beginning in fiscal year 2025, is a significant opportunity. This programmatic expansion aims to broaden its educational offerings and meet evolving industry demands.

Furthermore, the company's commitment to opening a minimum of two new campuses each year through fiscal year 2029, with planned locations including Atlanta and San Antonio, presents a clear path for geographic growth. These new campuses will allow UTI to tap into new customer bases and address skilled labor shortages in diverse regions.

Leveraging Workforce Shortages

The significant and ongoing shortage of skilled trades professionals across numerous industries presents a substantial opportunity for Universal Technical Institute (UTI). This persistent demand creates a favorable environment for UTI's career-focused training programs.

UTI is well-positioned to capitalize on this trend by highlighting its curriculum as a direct route to lucrative and sought-after careers. This strategy can attract students eager for hands-on, practical education that addresses a critical national skills gap. For instance, the U.S. Bureau of Labor Statistics projected that employment for diesel mechanics, a key UTI program, was expected to grow 8% from 2022 to 2032, faster than the average for all occupations.

- Addressing Critical Skills Gaps: The demand for skilled technicians in fields like automotive, diesel, and advanced manufacturing continues to outpace supply, creating immediate job opportunities for graduates.

- Enhanced Enrollment Potential: As industries actively recruit, UTI can leverage this by showcasing its role in filling these vital positions, potentially boosting student interest and enrollment numbers.

- Industry Partnerships: The workforce shortage encourages stronger partnerships with employers seeking qualified candidates, which can lead to improved job placement rates and curriculum alignment.

Potential for Favorable Policy Environment

The landscape of federal education policy presents a significant opportunity for Universal Technical Institute (UTI). Discussions are actively underway regarding the redirection of federal funding towards trade schools, a move that could substantially benefit institutions like UTI. Furthermore, potential shifts in regulations impacting for-profit colleges might ease existing burdens and broaden access to vital federal student aid for vocational training programs. This potential policy tailwind could translate into increased enrollment and a more robust financial footing.

This favorable policy shift could manifest in several ways:

- Increased Federal Investment: A potential reallocation of federal dollars towards vocational and technical education could directly boost UTI's funding streams. For instance, the Bipartisan Infrastructure Law, enacted in 2021, signaled a growing federal commitment to skilled trades, with billions allocated for infrastructure projects requiring a trained workforce.

- Regulatory Streamlining: Changes to regulations governing for-profit institutions could reduce administrative overhead and compliance costs for UTI, allowing for greater focus on educational delivery and student support.

- Expanded Student Aid Access: Easing restrictions or expanding eligibility for federal student aid programs for students pursuing vocational training would make UTI's programs more accessible and affordable, potentially driving higher enrollment numbers.

The growing demand for skilled trades, fueled by an aging workforce and technological advancements, presents a significant opportunity for UTI. For instance, the U.S. Department of Labor projects a 5% growth in the skilled trades sector between 2022 and 2032, indicating a consistent need for trained professionals. UTI's focus on these high-demand areas positions it to attract students seeking stable, well-paying careers.

UTI's strategic expansion into new program areas and geographic locations, such as the planned campuses in Atlanta and San Antonio, offers substantial growth potential. This allows the institute to tap into underserved markets and address regional skills gaps. For example, the projected growth in the HVACR sector, with an estimated 6% increase in jobs by 2032, highlights the demand for specialized training that UTI can provide in these new areas.

The ongoing trend of companies prioritizing hands-on, practical training for their employees creates a strong opportunity for UTI to expand its corporate partnership programs. These collaborations ensure curriculum relevance and provide direct hiring pipelines for graduates. The increasing investment in workforce development by major corporations, exemplified by partnerships in the automotive and advanced manufacturing sectors, underscores the value of UTI's career-focused education model.

Threats

Universal Technical Institute (UTI) contends with significant competition from traditional community colleges and public vocational schools. These institutions frequently boast lower tuition fees, making them appear more budget-friendly and accessible to a broader student base. This can directly impact UTI's enrollment figures and its standing in the market.

Economic downturns pose a significant threat to Universal Technical Institute (UTI). During recessions or periods of high inflation, potential students often face affordability challenges. This can make it harder for them to pay tuition or secure student loans, directly impacting enrollment numbers. For instance, if consumer confidence drops and job security becomes a concern, individuals might postpone or cancel plans for vocational training.

Rising costs across the board, including education and everyday living expenses, further exacerbate these affordability concerns. Prospective students are increasingly wary of accumulating substantial student debt, especially if they perceive uncertain job market outcomes post-graduation. This heightened awareness of financial risk could lead many to opt out of post-secondary education altogether, a direct threat to UTI's student pipeline.

The rapid pace of technological change presents a significant threat. Industries like automotive, with the shift to electric vehicles (EVs), and advanced manufacturing demand constant curriculum updates. For instance, the automotive industry saw a significant increase in EV sales in 2023, with global sales reaching over 13 million units, highlighting the need for specialized training.

Failure to adapt quickly means Universal Technical Institute's (UTI) programs could become outdated, directly impacting graduate employability. This necessitates substantial and ongoing investment in new equipment, updated course materials, and continuous professional development for instructors to ensure graduates possess the most relevant skills for the 2024-2025 job market.

Negative Public Perception of For-Profit Education

The for-profit education sector, including institutions like Universal Technical Institute (UTI), can face a persistent negative public perception. This stigma often stems from historical issues like aggressive recruitment tactics, concerns over high student loan burdens, and sometimes questioned job placement success rates. For instance, in 2023, reports highlighted ongoing scrutiny of for-profit colleges regarding student outcomes and debt-to-earnings ratios, which can impact overall industry trust.

This negative sentiment can directly affect UTI's ability to attract prospective students. If potential students or their families are wary of the for-profit model due to these broader industry concerns, it could lead to decreased enrollment numbers. This perception challenge requires ongoing efforts to demonstrate value and transparency in UTI's programs and graduate success.

The potential impact is significant, as a lack of public trust can translate into tangible business challenges:

- Reduced student enrollment: Negative perceptions can deter prospective students from choosing UTI.

- Increased regulatory scrutiny: Broader industry issues can lead to tighter regulations that affect operations.

- Difficulty in attracting talent: A negative reputation might also make it harder to recruit qualified instructors and staff.

Evolving Regulatory Landscape

The for-profit education sector, including Universal Technical Institute (UTI), faces ongoing uncertainty due to a constantly changing regulatory environment. Shifts in government administrations and evolving public policy priorities can lead to new or revised regulations that directly impact operations. For instance, changes to gainful employment rules or borrower defense claims could increase compliance burdens or limit access to crucial federal student aid, a significant revenue source for institutions like UTI. In 2024, discussions around student loan forgiveness and oversight of for-profit institutions intensified, highlighting the sensitivity of this sector to political winds.

These regulatory shifts can translate into tangible financial impacts. Increased compliance costs, such as the need for more robust record-keeping or additional staff to manage new reporting requirements, can strain budgets. Furthermore, tighter restrictions on federal funding, which accounted for a substantial portion of revenue for many for-profit schools in recent years, could necessitate significant operational adjustments or even lead to a reduction in student enrollment capacity. The potential for adverse regulatory changes remains a persistent threat to UTI's financial stability and strategic planning.

- Increased compliance costs: New regulations often require investments in technology, personnel, and training to ensure adherence.

- Potential funding restrictions: Changes to federal aid programs could limit the number of eligible students or the amount of funding available.

- Reputational risk: Negative regulatory actions can damage an institution's reputation, impacting enrollment and partnerships.

The competitive landscape is intensifying, with community colleges and public vocational schools offering lower tuition, directly challenging UTI's market position and enrollment. Economic downturns also pose a threat, as affordability issues and student loan concerns can deter prospective students, impacting enrollment numbers significantly. For instance, a slowdown in consumer spending during economic uncertainty could directly reduce the pool of individuals seeking vocational training.

Technological advancements, particularly in fields like electric vehicles, demand constant curriculum updates, requiring substantial investment to maintain program relevance and graduate employability. The for-profit education sector also faces negative public perception, stemming from past issues and ongoing scrutiny of student outcomes, which can deter enrollment and necessitate proactive efforts to build trust.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point (2023-2025) |

|---|---|---|---|

| Competition | Lower-cost alternatives (community colleges, public vocational schools) | Reduced enrollment, market share erosion | Community colleges often have tuition rates that are a fraction of private vocational schools. |

| Economic Factors | Economic downturns, inflation, affordability concerns | Decreased enrollment, difficulty securing student loans | Consumer confidence indices can indicate potential shifts in discretionary spending on education. |

| Industry Changes | Rapid technological advancements (e.g., EV adoption) | Outdated curriculum, reduced graduate employability | Global EV sales surpassed 13 million units in 2023, underscoring the need for specialized training. |

| Reputation | Negative public perception of for-profit education | Lower enrollment, difficulty attracting talent | Ongoing discussions in 2023-2024 regarding for-profit college debt-to-earnings ratios impact industry trust. |

| Regulatory Environment | Changing government regulations, policy shifts | Increased compliance costs, potential funding restrictions | Intensified scrutiny of for-profit institutions and student loan policies in 2024. |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including Universal Technical Institute's official financial filings, comprehensive market research reports, and expert opinions from industry analysts to provide a well-rounded strategic overview.