Universal Technical Institute Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Universal Technical Institute Bundle

Universal Technical Institute (UTI) faces a dynamic educational landscape shaped by several key forces. Understanding the bargaining power of its students and the threat of substitute educational providers is crucial for its strategic planning.

The complete report reveals the real forces shaping Universal Technical Institute’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Universal Technical Institute (UTI) faces a degree of bargaining power from its specialized equipment and curriculum providers. Companies like Snap-on, Pennzoil, NAPA, and Lincoln Electric supply essential tools and educational materials, and their unique offerings can create a dependency for UTI. For instance, in 2024, the automotive repair sector continued to see advancements in diagnostic equipment, making partnerships with leading tool manufacturers crucial for UTI's curriculum relevance.

The proprietary nature of certain manufacturer-specific advanced training (MSAT) programs further strengthens the position of these suppliers. These specialized programs, often requiring direct collaboration and specific certifications, mean that changes in pricing or terms from these key partners could directly affect UTI's operating costs and its capacity to deliver up-to-date, industry-aligned education.

Accreditation bodies like the Accrediting Commission of Career Schools and Colleges (ACCSC) and the Council on Occupational Education (COE) are powerful suppliers to Universal Technical Institute (UTI). Their approval is not just a formality; it's a gateway for UTI to operate legally, for students to access federal financial aid, and for graduates to become licensed and gain employment. These organizations set demanding standards that UTI must consistently meet, requiring ongoing investment in faculty, equipment, and program development to maintain their accreditation.

The demand for highly specialized instructors at Universal Technical Institute (UTI) is a significant factor influencing supplier bargaining power. With the automotive industry rapidly evolving, there's a premium on educators proficient in areas like electric vehicles (EVs), Advanced Driver-Assistance Systems (ADAS), and AI-driven diagnostics. This scarcity of specialized talent means instructors in these fields can command higher salaries and better benefits, directly impacting UTI's operating costs and recruitment efforts.

The continuous need for faculty upskilling further amplifies this power. As new technologies emerge and existing ones advance, UTI must invest in ongoing training for its instructors to ensure curriculum relevance. This commitment to faculty development, while crucial for educational quality, adds another layer of cost and dependence on skilled, adaptable educators, strengthening their position in negotiations.

Technology and Software Providers

The bargaining power of technology and software providers for Universal Technical Institute (UTI) is significant and growing. As the automotive and other skilled trades sectors become more technologically advanced, UTI's need for specialized software, diagnostic tools, and digital learning platforms from these tech companies increases. This reliance allows providers of proprietary or industry-standard systems to influence pricing through licensing fees, mandatory updates, and support costs.

UTI's strategic partnerships, like the one with TOPDON US for electric vehicle (EV) training tools, underscore this dependence. These collaborations are crucial for providing students with up-to-date skills, but they also mean UTI is subject to the terms and pricing set by these technology suppliers. The increasing complexity of vehicle systems, including advanced driver-assistance systems (ADAS) and EV powertrains, further solidifies the position of software and diagnostic tool providers.

- Increased Reliance: As automotive technology evolves, UTI's dependence on specialized software and diagnostic tools from tech providers grows, impacting operational costs.

- Proprietary Systems: Providers of unique or industry-standard software and hardware can leverage their position to negotiate favorable terms, including licensing and support fees.

- Strategic Partnerships: Collaborations, such as UTI's with TOPDON US for EV training, highlight the necessity of these tech suppliers and their potential bargaining influence.

- Cost Implications: Licensing fees, software updates, and ongoing support from technology vendors represent a substantial and potentially escalating cost for educational institutions like UTI.

Real Estate and Facility Owners

The bargaining power of real estate and facility owners for Universal Technical Institute (UTI) is a key consideration. With numerous campuses across the US, UTI relies heavily on these physical spaces for its educational operations. Landlords in prime locations can leverage their position to influence lease terms and rental costs.

In 2024, the commercial real estate market continued to present challenges, with rising property values in many urban and suburban areas where educational institutions often seek to locate. This can translate into higher lease rates for UTI. For instance, if a landlord owns a strategically located property suitable for a technical training center, they might have considerable leverage, especially if UTI has limited alternative sites available in that specific market.

- Lease Negotiations: Property owners can negotiate for higher rents or more favorable lease terms if demand for commercial space in a particular area is high.

- Facility Upgrades: Landlords may pass on the costs of necessary facility upgrades or modernization to tenants like UTI, particularly if the property requires significant investment to meet UTI's specific training needs.

- Location Dependence: UTI's need for accessible locations for student recruitment can empower landlords in desirable areas, as limited availability of suitable properties increases their bargaining strength.

The bargaining power of suppliers for Universal Technical Institute (UTI) is influenced by several factors, including specialized equipment providers, accreditation bodies, and the demand for skilled instructors. For instance, in 2024, the automotive industry's rapid technological advancements, particularly in areas like electric vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS), increased UTI's reliance on specific tool and software manufacturers. This reliance gives these suppliers leverage in pricing and terms.

Accreditation bodies like ACCSC and COE hold significant power as they are essential for UTI's legal operation and student financial aid access. Meeting their stringent standards requires continuous investment, making UTI dependent on maintaining these accreditations. Furthermore, the scarcity of instructors with expertise in emerging fields like EV technology in 2024 meant that these educators could command higher salaries, increasing UTI's labor costs and their bargaining power.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on UTI |

|---|---|---|

| Specialized Equipment & Technology Providers | Proprietary systems, industry-standard software, strategic partnerships (e.g., TOPDON US for EV training) | Increased operational costs through licensing fees, mandatory updates, and support. Dependence on curriculum relevance. |

| Accreditation Bodies (ACCSC, COE) | Essential for legal operation, student financial aid, and graduate employment. Setting demanding standards. | Requires ongoing investment in faculty, equipment, and programs to maintain accreditation. |

| Skilled Instructors (especially in emerging tech) | Scarcity of expertise in areas like EVs, ADAS, AI diagnostics. Need for continuous upskilling. | Higher salary demands, increased recruitment costs, and potential impact on program delivery if talent is unavailable. |

What is included in the product

This analysis delves into the competitive forces impacting Universal Technical Institute, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the technical education sector.

Instantly visualize competitive intensity across all five forces, enabling swift identification of key pressures impacting UTI's strategic positioning.

Customers Bargaining Power

The robust and increasing demand for skilled technicians across automotive, diesel, collision repair, and other specialized trades significantly bolsters the bargaining power of Universal Technical Institute (UTI) graduates. Industries are experiencing a critical shortage of qualified personnel, with projections indicating hundreds of thousands of new job openings annually through 2032 and continuing thereafter.

This substantial demand directly translates into improved employment opportunities and potentially higher starting salaries for UTI alumni. Consequently, graduates can leverage this strong job market to negotiate better terms and conditions, effectively increasing their value proposition to employers.

Prospective students have a wide array of educational options beyond Universal Technical Institute (UTI). These include community colleges offering foundational technical courses, other private vocational schools like Lincoln Tech and Ohio Technical College, and direct entry into apprenticeships or on-the-job training programs. Many manufacturers also provide their own internal training, further diversifying the landscape.

This abundance of alternatives grants students significant bargaining power. They can readily compare program costs, length of study, the practical relevance of the curriculum, and crucially, the job placement success rates of various institutions. For instance, community college programs might offer a lower tuition cost compared to private technical schools, while some apprenticeships provide immediate earning potential.

The significant cost of post-secondary technical education, like that offered by Universal Technical Institute (UTI), makes students acutely aware of tuition fees and their reliance on financial aid. In 2024, the average cost of a UTI program can range from $30,000 to $50,000, a substantial sum for most individuals.

Students' access to crucial federal student grants, loans, and scholarships is often tied to an institution's accreditation status. This dependency grants them considerable leverage, empowering them to favor accredited programs that offer greater financial accessibility and a clearer path to funding their education.

Focus on Return on Investment (ROI) and Career Outcomes

The bargaining power of customers, specifically students and their families, is significantly influenced by the perceived return on investment (ROI) and tangible career outcomes. In 2024, the cost of higher education continues to be a major concern, pushing prospective students to rigorously evaluate which institutions offer the best value for their money. This means schools with strong job placement rates, recognized industry certifications, and clear pathways to well-paying careers hold a distinct advantage.

Universal Technical Institute (UTI) directly addresses this by focusing on industry-aligned training and forging partnerships with manufacturers. These collaborations are crucial as they can lead to higher employment rates and better starting salaries for graduates. For instance, UTI's programs often lead to certifications highly sought after by employers in the automotive and diesel industries. However, if there's a perceived disconnect between the training provided and actual employer needs, or if job placement statistics falter, students' willingness to enroll could decrease, thereby increasing their bargaining power.

- Focus on ROI: Students and families are increasingly demanding clear evidence of educational ROI, scrutinizing tuition costs against projected earnings and career longevity.

- Career Outcome Emphasis: Strong job placement rates, industry-recognized certifications, and direct employer partnerships are key differentiators that influence student enrollment decisions.

- UTI's Strategy: UTI's emphasis on hands-on, industry-specific training aims to meet this demand by preparing students for immediate employment in skilled trades.

- Potential Weakness: Any perceived decline in graduate employability or employer satisfaction with UTI's graduates could empower students to negotiate for better value or seek alternative educational paths.

Flexibility and Online Learning Options

The growing acceptance of online learning and the demand for flexible study options significantly enhance customer bargaining power. Students can now more easily compare programs that accommodate their schedules and preferred learning styles, potentially reducing their reliance on any single institution.

While Universal Technical Institute (UTI) emphasizes hands-on training, the increasing availability of online or blended learning alternatives for foundational knowledge allows prospective students to explore other avenues. This can pressure UTI to adapt its offerings or pricing to remain competitive.

- Demand for Flexibility: Surveys indicate a significant portion of students, particularly adult learners, prioritize flexible scheduling and the ability to learn at their own pace.

- Online Component Influence: The presence of online modules or entirely online programs in related fields can influence student perceptions of value and convenience.

- Cost Comparison: Online programs often have lower overhead, enabling them to offer more competitive pricing, which customers can use as leverage.

Prospective students, acting as customers, wield significant bargaining power due to the high cost of vocational training and the availability of diverse educational alternatives. In 2024, with program costs at institutions like UTI potentially reaching $50,000, students are highly sensitive to value and return on investment.

This power is amplified by the critical shortage of skilled technicians, allowing graduates to negotiate favorable employment terms. For instance, the U.S. Bureau of Labor Statistics projected over 500,000 new job openings annually for automotive service technicians and mechanics through 2032.

Students can compare UTI's offerings against community colleges, other vocational schools, and apprenticeships, leveraging the transparency of program costs and placement rates to demand better value or seek more affordable options.

Preview Before You Purchase

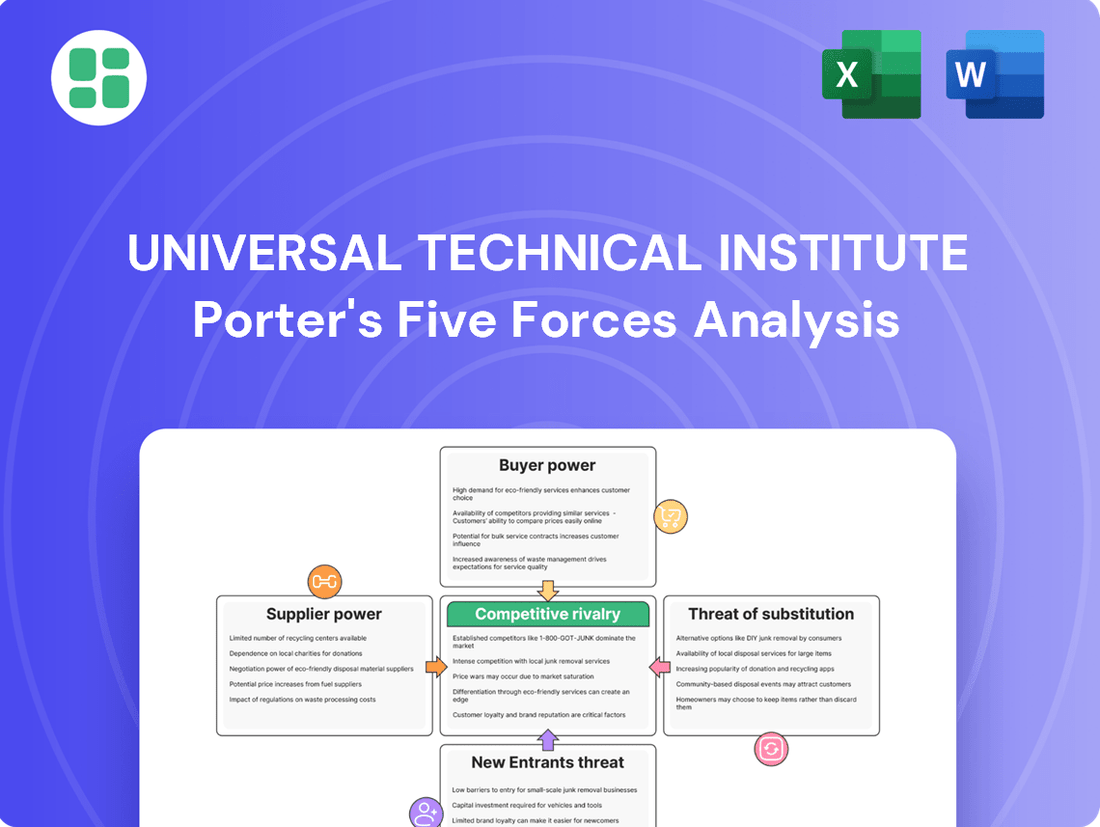

Universal Technical Institute Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape of Universal Technical Institute through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

Universal Technical Institute (UTI) operates in a highly competitive environment. Its rivals include other large private technical schools such as Lincoln Technical Institute and Adtalem Global Education, alongside institutions like Perdoceo Education and Stride. This broad spectrum of competitors necessitates a strong focus on differentiation.

The competitive pressure extends beyond private vocational schools to include community colleges and even traditional universities that are increasingly offering skilled trades programs. This diverse landscape forces UTI to continually refine its offerings, emphasizing specialized training, robust industry partnerships, and demonstrable student success to stand out.

The post-secondary education landscape is increasingly marked by consolidation. Universal Technical Institute (UTI) itself has been part of this trend, notably acquiring Concorde Career Colleges. This strategic move by UTI aimed to diversify its educational offerings, particularly by expanding into the healthcare sector, and to broaden its geographical footprint.

This industry consolidation intensifies rivalry among the larger, consolidated entities. As these organizations grow, they compete more fiercely for market share, often by developing more comprehensive program portfolios that cater to a wider range of student needs, including both traditional vocational trades and emerging healthcare fields.

The automotive sector, a key area for Universal Technical Institute (UTI), is seeing incredibly fast technological shifts. Think about electric vehicles (EVs), advanced driver-assistance systems (ADAS), and AI-powered diagnostics. These innovations mean training programs need constant updates and substantial investment in new equipment and instructor training.

Competitors that are quicker to incorporate these cutting-edge technologies into their curricula can gain a significant advantage. This dynamic puts pressure on UTI to consistently lead in offering education that directly aligns with current and future industry needs. For instance, the demand for EV technicians is projected to grow significantly, with some estimates suggesting a need for hundreds of thousands of new technicians by 2030.

Regional and Local Market Competition

While Universal Technical Institute (UTI) has a national presence, the real competitive heat often comes from regional and local trade schools and community colleges. These institutions offer more accessible alternatives for students, directly impacting UTI's enrollment numbers in specific areas. For instance, a strong local competitor can force UTI to ramp up its marketing and recruitment in that particular region to maintain its student base.

The intensity of this local rivalry can significantly influence UTI's operational strategies. When a geographic area is saturated with educational options, or a particularly well-regarded local school exists, UTI must adapt. This often means tailoring recruitment efforts and potentially adjusting program offerings to stand out.

- Geographic Saturation: Areas with a high density of vocational training providers increase competitive pressure.

- Local Competitor Strength: A dominant local school can siphon students through reputation or specialized programs.

- Enrollment Impact: Intense local competition can directly reduce enrollment rates for UTI campuses.

- Targeted Strategies: UTI must employ focused marketing and recruitment to counter strong regional rivals.

Reputation and Brand Recognition

Universal Technical Institute (UTI) faces intense competitive rivalry, where brand reputation and recognition are paramount. In the vocational education sector, a strong track record of student success and established employer partnerships are key differentiators.

Competitors, particularly those with deep roots and established local connections, present a significant challenge. UTI must consistently emphasize its robust industry collaborations, impressive job placement statistics, and the distinct value proposition of its specialized training programs to stand out.

- Brand Equity: A strong brand name in vocational training directly influences student enrollment and employer willingness to recruit graduates.

- Student Outcomes: High graduation rates and successful job placement are critical for building and maintaining a positive reputation. For instance, UTI reported a 79.6% job placement rate for eligible graduates in the fiscal year ending September 30, 2023.

- Industry Partnerships: Collaborations with major manufacturers and service providers, such as Ford, General Motors, and NASCAR, enhance program relevance and graduate employability, bolstering UTI's brand image.

- Alumni Network: A robust and active alumni network can provide valuable testimonials and career support, further strengthening brand recognition and trust.

Universal Technical Institute (UTI) faces significant competitive rivalry from both large national vocational schools and a growing number of community colleges and universities offering skilled trades programs. This broad competitive landscape necessitates a strong focus on differentiation through specialized training and industry partnerships.

The rapid technological advancements, particularly in areas like electric vehicles, demand constant curriculum updates and investment in new equipment, creating a competitive edge for institutions that adapt quickly. For example, the projected need for hundreds of thousands of EV technicians by 2030 underscores the urgency for relevant training.

Local competition also plays a crucial role, with regional schools often offering more accessible alternatives that can impact UTI's enrollment in specific geographic areas. This intensifies the need for targeted recruitment and tailored program offerings.

Brand reputation and student outcomes are critical differentiators in this market. UTI's reported 79.6% job placement rate for eligible graduates in fiscal year 2023 highlights the importance of strong student success metrics and industry collaborations.

| Competitor Type | Key Competitors | Competitive Factor | UTI's Response/Strategy | Example Data/Insight |

|---|---|---|---|---|

| National Vocational Schools | Lincoln Tech, Adtalem Global Education, Perdoceo Education | Program breadth, brand recognition, national reach | Focus on specialized training, industry partnerships, graduate outcomes | UTI's 79.6% job placement rate (FY2023) |

| Community Colleges & Universities | Local community colleges, state universities | Accessibility, cost, broader program offerings | Highlighting specialized curriculum, career services, higher earning potential | Increasing number of universities offering skilled trades programs |

| Regional/Local Trade Schools | Smaller, established local institutions | Local reputation, community ties, lower cost | Targeted marketing, unique program specializations, campus-specific recruitment | Impact on enrollment in specific geographic markets |

| Technological Advancement | Competitors adopting new tech faster | Curriculum relevance, equipment investment, instructor training | Continuous program updates, investment in EV and ADAS training | Projected shortage of hundreds of thousands of EV technicians by 2030 |

SSubstitutes Threaten

A significant substitute for formal post-secondary education like Universal Technical Institute (UTI) is direct entry into the workforce through apprenticeships or extensive on-the-job training. Many employers in skilled trades offer structured or informal training pathways. These allow individuals to earn while they learn, potentially bypassing the tuition costs and time commitment of a diploma or degree program.

For instance, in 2024, the U.S. Bureau of Labor Statistics reported that apprenticeships can lead to significant earning potential, with some apprentices earning over $60,000 annually by the end of their programs. This direct, experience-based learning model presents a compelling alternative to traditional schooling, especially for those seeking immediate employment and income.

Major manufacturers like Ford, General Motors, and Cummins operate their own specialized training academies. These programs offer direct, brand-specific instruction, acting as a significant substitute for Universal Technical Institute's Manufacturer-Specific Advanced Training (MSAT) offerings. For example, automotive giants often provide comprehensive, up-to-date curriculum directly to their authorized service centers.

The growing availability of shorter, focused certification programs and micro-credentials presents a significant threat of substitutes for Universal Technical Institute (UTI). These alternatives, often costing less and requiring less time, cater to individuals eager to acquire specific, job-ready skills quickly. For instance, online platforms and community colleges are increasingly offering specialized courses in areas like welding or HVAC, directly competing with UTI's longer, more comprehensive offerings. In 2024, the demand for upskilling and reskilling continues to rise, making these more accessible pathways attractive to a broad segment of the workforce.

Self-Directed Learning and Online Resources

The rise of self-directed learning through online platforms presents a growing threat to traditional technical education providers like Universal Technical Institute. While hands-on experience remains vital, individuals can now access a wealth of instructional videos, open-source technical manuals, and virtual simulations to acquire basic technical skills. This accessibility can diminish the perceived necessity of formal, comprehensive institutional training for certain entry-level positions.

For instance, platforms like YouTube host millions of hours of free content on automotive repair, welding, and HVAC systems. Companies like Coursera and edX also offer specialized courses, with some reporting significant growth in their technical skills programs. In 2024, the global e-learning market was projected to reach hundreds of billions of dollars, highlighting the significant shift towards accessible online education.

- Accessibility of Online Content: Free and low-cost online resources provide foundational knowledge in technical fields.

- Cost-Effectiveness: Self-directed learning often represents a significantly cheaper alternative to formal vocational schooling.

- Targeted Skill Acquisition: Individuals can focus on specific skills needed for particular job roles, bypassing broader curriculum requirements.

- Market Trends: The expanding e-learning market indicates a growing acceptance and utilization of online educational formats.

Military Technical Training

Military technical training presents a significant threat of substitutes for civilian vocational education providers like Universal Technical Institute. Many service members gain specialized, hands-on skills in areas such as mechanics, electronics, and aviation during their enlistment. This experience often equips them with practical expertise that can directly qualify them for entry-level positions in related civilian industries, bypassing the need for formal post-secondary technical schooling.

For instance, the U.S. Department of Defense invests billions annually in training programs across various technical disciplines. In 2023, a substantial portion of this budget was allocated to programs directly transferable to civilian sectors, such as advanced manufacturing and vehicle maintenance. This robust military training infrastructure means a continuous supply of skilled individuals entering the civilian workforce, many of whom may not consider traditional vocational schools as their primary path to employment.

- Military training offers practical, job-ready skills at no direct cost to the individual.

- Transition assistance programs often connect veterans with civilian employers seeking their technical expertise.

- The perceived value and rigor of military technical certifications can be a strong draw for both individuals and employers.

- In 2024, an estimated 200,000 service members transitioned to civilian life, many possessing technical skills acquired through military service.

The proliferation of shorter, more focused certification programs and micro-credentials poses a significant threat of substitutes for Universal Technical Institute (UTI). These alternatives are often more affordable and time-efficient, attracting individuals eager for quick, job-ready skills. In 2024, the demand for upskilling and reskilling continues to fuel the appeal of these accessible educational pathways.

Online learning platforms and community colleges are increasingly offering specialized courses in trades like welding and HVAC, directly competing with UTI's longer programs. This accessibility means individuals can acquire specific skills without the extensive commitment of a full vocational program.

The availability of free and low-cost online content, coupled with the growing global e-learning market, further strengthens the threat of substitutes. For instance, platforms like YouTube and Coursera provide vast resources for technical skill acquisition, making self-directed learning a viable alternative.

| Alternative Training Method | Key Characteristics | Potential Impact on UTI | 2024 Relevance |

|---|---|---|---|

| Apprenticeships/On-the-Job Training | Earn while you learn, practical experience, lower upfront cost | Direct competition for entry-level skilled positions | Over $60,000 annual earning potential reported for some apprentices |

| Manufacturer-Specific Training | Brand-specific, up-to-date curriculum, direct employer connection | Undercuts UTI's MSAT offerings | Major automotive and manufacturing companies invest heavily in these programs |

| Short Certifications/Micro-Credentials | Focused skills, lower cost, shorter duration | Appeals to time-sensitive learners | Growing demand for upskilling and reskilling |

| Self-Directed Online Learning | Accessible, low-cost, flexible | Provides foundational knowledge, potentially reducing need for formal schooling | Global e-learning market projected in hundreds of billions |

| Military Technical Training | Specialized, hands-on skills, no direct cost to individual | Provides a pipeline of skilled workers to civilian sector | Estimated 200,000 service members transitioned in 2024 with technical skills |

Entrants Threaten

Establishing a technical education institution like Universal Technical Institute (UTI) demands substantial initial capital. This includes the cost of specialized facilities, cutting-edge equipment such as automotive labs and welding stations, and robust technology infrastructure. For instance, in 2024, the cost of equipping a single automotive training bay can range from $50,000 to $100,000 or more, depending on the complexity and modernity of the tools. This significant financial hurdle acts as a powerful deterrent for potential new competitors seeking to enter the market with comparable, hands-on training programs.

Stringent accreditation and regulatory requirements significantly deter new entrants in the technical education sector. For instance, achieving and maintaining accreditation from bodies like ACCSC (Accrediting Commission of Career Schools and Colleges) involves rigorous standards and ongoing compliance, a process that can take years and substantial investment. This complexity, coupled with state licensing and federal oversight for programs like Title IV financial aid, creates a formidable barrier to entry, effectively limiting the number of new competitors able to establish themselves quickly and legitimately.

Universal Technical Institute (UTI) faces a moderate threat from new entrants due to the significant challenge of establishing industry partnerships. UTI's competitive edge is heavily reliant on its deep relationships with manufacturers and industry leaders, which ensure its curriculum remains current and provides direct job placement for its students. For instance, UTI has partnerships with major automotive and diesel manufacturers like Ford, General Motors, and Peterbilt, offering specialized training programs that are critical for graduate employability.

New competitors would find it exceptionally difficult and time-consuming to build comparable networks. These collaborations are not easily replicated and are fundamental to maintaining the relevance of training programs and securing employment opportunities for graduates. The effort required to forge and nurture these essential connections represents a substantial barrier to entry for any new vocational training provider aiming to compete with UTI's established ecosystem.

Brand Recognition and Reputation Building

The threat of new entrants into the skilled trades education sector is somewhat mitigated by the significant investment required for brand recognition and reputation building. Universal Technical Institute (UTI), with its decades of operation, has cultivated a strong brand identity and a reputation for quality training. This established presence makes it challenging for newcomers to attract students and gain the trust of employers who rely on a proven track record.

Newcomers face substantial hurdles in replicating UTI's established brand equity. Building trust with prospective students, their families, and the industry takes considerable time and extensive marketing campaigns. For instance, in 2024, UTI continued to emphasize its long-standing relationships with industry partners, a key differentiator that new institutions would struggle to replicate quickly.

- Brand Loyalty: Existing students and alumni often serve as brand advocates, reinforcing UTI's reputation.

- Industry Partnerships: UTI's established relationships with over 30 leading companies in the transportation, manufacturing, and energy industries provide a significant advantage.

- Marketing Investment: New entrants would need to commit substantial resources to marketing and advertising to even begin competing with UTI's brand awareness.

- Time to Credibility: Establishing the same level of credibility and employer recognition as UTI would likely take many years and consistent performance.

Challenges in Attracting and Retaining Qualified Faculty

New entrants to the technical education sector, like those looking to compete with Universal Technical Institute (UTI), face a significant hurdle in attracting and keeping qualified faculty. This is especially true for instructors with current expertise in fast-changing fields such as electric vehicles (EVs) and advanced driver-assistance systems (ADAS).

The demand for instructors who blend deep technical knowledge with effective teaching skills and valuable industry ties is high, making them a scarce resource. For instance, in 2024, the automotive industry continues its rapid shift towards electrification and autonomous technologies, creating a constant need for trainers fluent in these advanced areas. This scarcity directly impacts the ability of new institutions to establish robust training programs that can rival established players like UTI, which has a long-standing reputation and existing network of experienced instructors.

- Faculty Expertise Gap: A 2023 report indicated a national shortage of skilled trades instructors, with over 60% of surveyed technical schools reporting difficulty filling specialized teaching positions.

- Industry Relevance: The rapid evolution of automotive technology means that instructors require continuous professional development, a commitment that new entrants may struggle to fund and manage effectively compared to established institutions.

- Recruitment Costs: Attracting top-tier instructors often involves competitive salaries and benefits, adding substantial initial operating costs for new competitors entering the market.

The threat of new entrants for Universal Technical Institute (UTI) is moderate, primarily due to the high capital requirements and stringent regulatory landscape. Establishing a technical school necessitates significant investment in specialized facilities and equipment, with costs for equipping a single automotive training bay potentially reaching $50,000 to $100,000 in 2024. Furthermore, obtaining and maintaining accreditations and state licenses involves complex compliance processes, acting as a substantial barrier.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Universal Technical Institute leverages data from the company's SEC filings, investor presentations, and reputable industry research reports from sources like IBISWorld and Statista. This blend of primary and secondary data provides a comprehensive view of the competitive landscape.