UPM-Kymmene PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UPM-Kymmene Bundle

Navigate the complex external forces shaping UPM-Kymmene's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and evolving social trends are impacting the company's strategic direction. Download the full report to gain actionable insights and sharpen your competitive edge.

Political factors

Government policies and trade regulations significantly shape UPM-Kymmene's global footprint. International trade agreements, such as the EU's trade deals with various countries, impact the import and export of forest products and raw materials, influencing UPM's market access and cost structures. For instance, changes in tariffs or the implementation of protectionist measures by major economic blocs can directly affect UPM's profitability and the stability of its extensive supply chains, as seen in past trade disputes affecting global commodity flows.

Forestry and land use legislation significantly shapes UPM-Kymmene's operational landscape. Regulations concerning sustainable forestry practices, such as those mandated by the EU's Forest Strategy for 2030, directly influence harvesting volumes and methods. For instance, stricter biodiversity conservation requirements can limit access to certain forest areas, impacting raw material availability and potentially increasing sourcing costs.

National and regional laws governing logging rights and land use are critical for UPM-Kymmene's operational permits. Changes in these regulations, perhaps related to carbon sequestration targets or protected land designations, could affect the company's ability to secure necessary permits for its mills and forest management activities. In 2023, UPM managed approximately 10% of its total sourced wood volume from its own forests, highlighting the direct link between land use legislation and its core operations.

Government incentives and mandates are increasingly shaping the bioeconomy landscape. For instance, the European Union's renewable energy directive aims for a 42.5% share of renewables in gross final energy consumption by 2030, with a further push towards 45%. This creates a favorable environment for companies like UPM-Kymmene, whose biofuels and bio-based products directly contribute to these targets.

Policies promoting the circular economy and decarbonization are opening new avenues for UPM-Kymmene's offerings. The company's focus on sustainable forestry and the production of pulp, paper, and biofuels aligns well with global efforts to reduce carbon footprints. For example, UPM's advanced biofuels are crucial for sectors looking to decarbonize, potentially boosting demand and influencing investment in new production capacities.

Political Stability and Geopolitical Risks

Political stability in UPM-Kymmene's key operating regions, such as Finland, Germany, and China, directly impacts its operational continuity and market access. Geopolitical tensions, like those in Eastern Europe, can disrupt raw material sourcing and logistics, as seen with increased energy costs affecting the broader European industrial sector in 2024. Uncertainty surrounding trade policies and potential tariffs, particularly concerning China's role as both a market and a supplier, also presents a risk to UPM's global supply chain and profitability.

Significant shifts in government leadership or policy direction can lead to sudden changes in environmental regulations or taxation, affecting UPM's cost structure and investment decisions. For instance, the 2024 EU Green Deal initiatives continue to shape the regulatory landscape for forest products, requiring ongoing adaptation from companies like UPM. Conversely, stable political environments foster predictable business conditions, encouraging long-term investments in new facilities or market expansion.

- Geopolitical Tensions: Ongoing conflicts or trade disputes can disrupt UPM's access to critical raw materials and impact demand in affected regions.

- Regulatory Environment: Changes in environmental, trade, or labor laws in UPM's operating countries can significantly alter business costs and market competitiveness.

- Government Stability: Political instability in key markets can lead to supply chain disruptions and create uncertainty for UPM's investments and sales channels.

- Trade Policies: Shifting trade agreements and tariffs, particularly between major economic blocs, directly influence the cost and availability of UPM's products globally.

Environmental and Climate Policy Frameworks

Governmental commitments to climate action significantly shape UPM-Kymmene's operating environment. Policies like carbon pricing mechanisms, such as the EU Emissions Trading System (ETS), directly impact the cost of fossil fuel-based energy, encouraging investments in renewable energy sources and energy efficiency. For instance, the EU ETS saw carbon prices fluctuate, reaching an average of €88.6 per tonne in 2023, a substantial increase from previous years, directly affecting industries with significant carbon footprints.

Stricter environmental standards, including those related to water quality, biodiversity, and waste management, necessitate ongoing compliance efforts and capital expenditures. UPM-Kymmene's strategic focus on biobased products and circular economy principles aligns with these evolving regulatory landscapes, positioning the company to benefit from the transition to a greener economy. The company reported a 4% reduction in its Scope 1 and 2 emissions intensity in 2023 compared to 2022, demonstrating progress in its sustainability targets.

- EU Carbon Border Adjustment Mechanism (CBAM): This policy, phased in from October 2023, will impact imported goods based on their embedded carbon emissions, potentially influencing raw material sourcing and competitiveness for companies operating within or exporting to the EU.

- Renewable Energy Directives: EU targets for renewable energy deployment, such as the goal of 42.5% renewable energy by 2030, create opportunities for companies like UPM-Kymmene that generate renewable energy from biomass and forest residues.

- Biodiversity Protection Regulations: Increased focus on protecting biodiversity and forest ecosystems may lead to more stringent requirements for sustainable forest management practices, influencing UPM-Kymmene's raw material supply chain.

- Circular Economy Initiatives: Policies promoting a circular economy, such as extended producer responsibility and targets for recycled content, encourage the development of innovative, recyclable, and biobased materials.

Government policies and international trade agreements significantly influence UPM-Kymmene's global operations and market access. For instance, the EU's renewable energy targets, aiming for 42.5% renewables by 2030, create a favorable environment for UPM's biofuels and bio-based products. However, geopolitical tensions and shifting trade policies, particularly concerning major economic blocs like China, can disrupt supply chains and impact profitability, as seen with increased energy costs affecting European industries in 2024.

Changes in forestry and land use legislation directly affect UPM-Kymmene's raw material sourcing and operational permits. Stricter biodiversity conservation rules, like those under the EU's Forest Strategy for 2030, can limit harvesting and increase costs. In 2023, UPM managed about 10% of its sourced wood from its own forests, underscoring the direct impact of land use regulations on its core business.

Government incentives for decarbonization and circular economy initiatives present significant opportunities for UPM-Kymmene. Policies promoting carbon reduction, such as the EU Emissions Trading System (ETS) where carbon prices averaged €88.6 per tonne in 2023, encourage UPM's investments in renewable energy and bio-based products. The company's commitment to sustainability is reflected in its 4% reduction in Scope 1 and 2 emissions intensity in 2023.

| Policy Area | Example | Impact on UPM-Kymmene |

|---|---|---|

| Renewable Energy Targets | EU target of 42.5% renewables by 2030 | Favorable for biofuels and bio-based products |

| Carbon Pricing | EU ETS (avg. €88.6/tonne in 2023) | Incentivizes energy efficiency and renewable energy investments |

| Forestry Regulations | EU Forest Strategy for 2030 (biodiversity) | Potential impact on raw material availability and costs |

| Trade Policies | Shifting global trade agreements | Affects market access, supply chains, and profitability |

What is included in the product

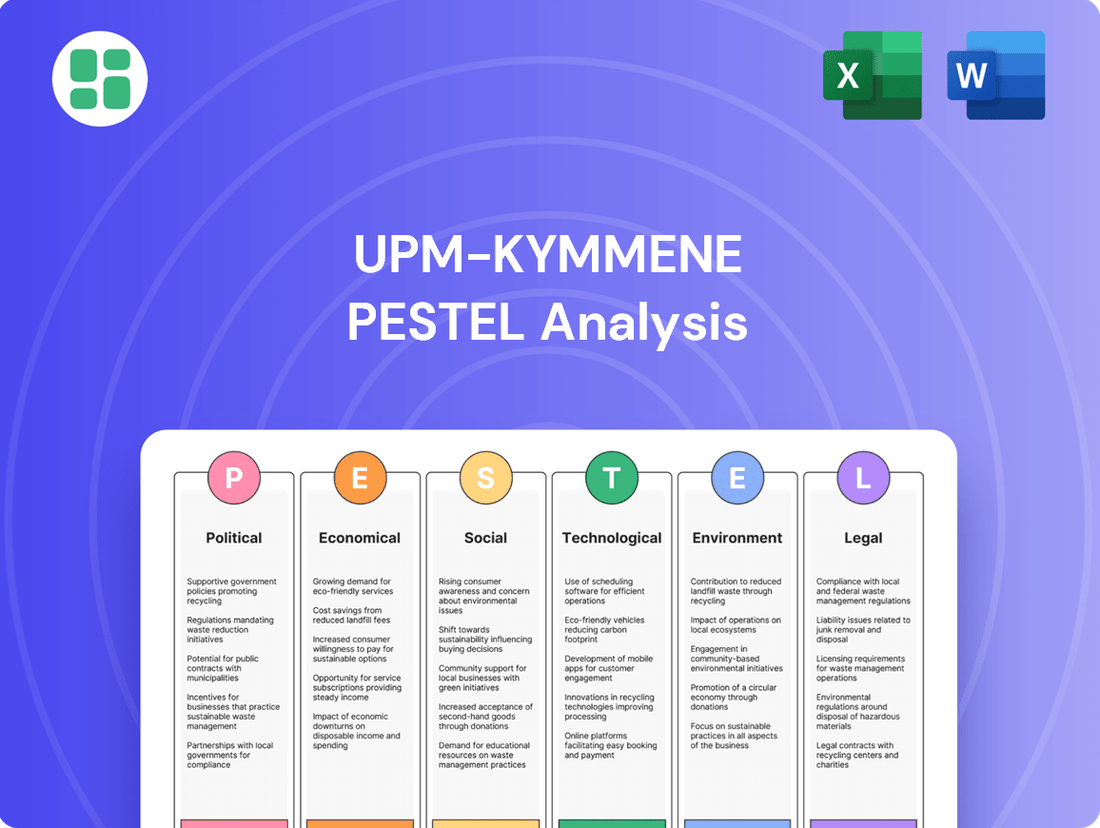

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting UPM-Kymmene, offering a comprehensive understanding of its operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions by highlighting key external factors impacting UPM-Kymmene.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the critical PESTLE influences on UPM-Kymmene's operations and strategy.

Economic factors

Global economic growth significantly impacts UPM-Kymmene's sales. When economies expand, demand for packaging, paper, and building materials generally increases, boosting UPM's sales volumes and potentially its pricing power. Conversely, economic slowdowns can lead to reduced demand and pressure on prices.

Industrial production figures offer a direct correlation. For instance, a strong global industrial output in 2024, projected by the IMF to grow by 3.1% in 2024, signals robust activity in sectors that utilize UPM's products, such as construction and manufacturing, thereby supporting higher sales for UPM's timber and composite materials.

The World Bank forecasts global GDP growth of 2.4% for 2024 and 2.7% for 2025. This moderate but positive growth trajectory suggests a stable, albeit not booming, environment for UPM-Kymmene, indicating continued demand for its diverse product range, from pulp to specialty papers.

Fluctuations in the cost of essential inputs like wood fiber, chemicals, and energy directly impact UPM-Kymmene's operational expenses. For instance, a surge in natural gas prices, which saw significant volatility throughout 2024, can substantially increase energy costs for UPM's mills.

These price swings in raw materials and energy can squeeze profit margins if not managed effectively. UPM-Kymmene's competitiveness relies on its ability to absorb or pass on these cost increases, making robust procurement strategies and financial hedging crucial to mitigate risks associated with commodity price volatility.

Currency exchange rate movements significantly impact UPM-Kymmene's global operations. Fluctuations in the Euro versus currencies like the US Dollar can alter the cost of raw materials sourced internationally and the revenue generated from sales in those markets. For instance, a stronger Euro can make UPM-Kymmene's exports more expensive for foreign buyers, potentially dampening demand.

In 2024, the Euro experienced volatility against major trading partners. A weaker Euro generally benefits UPM-Kymmene by increasing the competitiveness of its products abroad and making imported inputs cheaper. Conversely, a strengthening Euro can pressure profit margins by reducing the value of foreign earnings when translated back into Euros and increasing the cost of imported materials.

UPM-Kymmene's financial reports often detail the effects of currency hedging strategies to mitigate these risks. For example, in Q1 2024, the company reported that currency impacts had a moderate negative effect on its operating profit due to the translation of foreign subsidiaries' results.

Interest Rates and Access to Capital

Interest rates significantly impact UPM-Kymmene's financial flexibility. Higher rates increase the cost of borrowing, making it more expensive to finance new projects or manage existing debt. Conversely, lower rates reduce borrowing costs, potentially encouraging investment in capital expenditures and strategic growth opportunities like acquisitions or expansions.

For instance, if the European Central Bank (ECB) maintains or raises its key interest rates in 2024/2025, UPM-Kymmene's cost of capital for new investments, such as upgrading its pulp mills or expanding its biocomposite production, will likely increase. This could lead to a re-evaluation of project viability.

- Impact on Debt Servicing: Rising interest rates directly increase the cost of servicing UPM-Kymmene's outstanding debt, potentially reducing profitability.

- Capital Expenditure Decisions: Higher borrowing costs can delay or scale back planned capital expenditures, affecting long-term growth and competitiveness.

- Acquisition Costs: The cost of financing potential acquisitions becomes more substantial in a high-interest-rate environment, potentially limiting strategic M&A activity.

- Access to Capital Markets: While UPM-Kymmene has strong access to capital, persistently high rates could tighten lending conditions or increase the cost of issuing new bonds.

Consumer Spending and Market Demand Shifts

Consumer spending patterns are significantly influencing UPM-Kymmene's market position. For instance, a growing preference for sustainable packaging solutions presents a substantial opportunity for UPM's specialty papers and packaging materials divisions. This shift is driven by heightened environmental awareness among consumers.

Conversely, the persistent decline in demand for graphic papers, particularly in developed markets, poses a challenge. UPM reported a decrease in its Communication Papers segment's revenue in recent periods, reflecting this trend. The company is actively adapting by focusing on higher-growth areas.

Key shifts impacting UPM-Kymmene include:

- Growing demand for bio-based materials: Consumers are increasingly seeking products made from renewable resources, benefiting UPM's biocomposites and biochemicals businesses.

- Digitalization impacting print media: The ongoing shift from print to digital continues to suppress demand for graphic papers, UPM's traditional stronghold.

- E-commerce growth driving packaging needs: The surge in online retail has boosted demand for efficient and sustainable packaging, aligning with UPM's strategic investments in this sector.

- Interest in renewable energy solutions: UPM's involvement in biofuels, such as UPM BioVerno, taps into consumer and governmental support for cleaner energy alternatives.

Global economic growth, projected at 2.4% by the World Bank for 2024 and 2.7% for 2025, directly influences UPM-Kymmene's sales volumes and pricing power across its diverse product segments. Industrial production, with a 3.1% IMF forecast for global growth in 2024, signals demand for UPM's materials in construction and manufacturing. However, currency fluctuations, as seen with the Euro's volatility in 2024, can impact export competitiveness and the value of foreign earnings, with a weaker Euro generally benefiting UPM's international sales.

Interest rates significantly affect UPM-Kymmene's borrowing costs and capital expenditure decisions. For instance, if the ECB maintains higher rates in 2024/2025, the cost of financing new projects, such as mill upgrades, will increase. Consumer preferences are also a key economic factor, with a growing demand for sustainable packaging benefiting UPM's specialty papers, while the continued digitalization trend suppresses demand for graphic papers.

| Economic Factor | 2024/2025 Data/Projection | Impact on UPM-Kymmene |

|---|---|---|

| Global GDP Growth | 2.4% (2024), 2.7% (2025) - World Bank | Supports stable demand for products; moderate growth environment. |

| Industrial Production Growth | 3.1% (2024) - IMF | Indicates demand for materials in construction and manufacturing. |

| Energy Costs (e.g., Natural Gas) | Volatile throughout 2024 | Increases operational expenses, impacting profit margins if not managed. |

| Currency Exchange Rates (EUR vs. USD) | Volatile in 2024 | Affects export competitiveness and value of foreign earnings; weaker EUR generally beneficial. |

| Interest Rates (ECB Key Rates) | Potential for maintenance or increases in 2024/2025 | Increases cost of borrowing for capital expenditures and debt servicing. |

Preview Before You Purchase

UPM-Kymmene PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of UPM-Kymmene delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into how these external forces shape UPM-Kymmene's business landscape, providing a solid foundation for strategic planning and risk assessment.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed analysis will equip you with a thorough understanding of the opportunities and threats UPM-Kymmene faces in the global market.

Sociological factors

Consumers increasingly favor products with a low environmental impact, driving demand for sustainable options. UPM-Kymmene's dedication to responsible forestry and certified products directly addresses this trend. For instance, their bio-based packaging solutions are gaining traction as consumers seek alternatives to single-use plastics.

This preference for eco-conscious goods translates into tangible market advantages. By offering certified materials and innovative bio-solutions, UPM-Kymmene can bolster its brand image and capture a larger share of the growing green market. In 2024, the global sustainable packaging market was projected to reach over $300 billion, highlighting the significant opportunity.

Public perception of forest industries significantly impacts companies like UPM-Kymmene. Growing concerns about deforestation and biodiversity loss can create challenges for their social license to operate. For instance, in 2023, a significant portion of consumers expressed increased worry about the sustainability of paper products, influencing purchasing decisions.

UPM-Kymmene must therefore prioritize transparent communication regarding its forest management practices and environmental impact. Proactive engagement in responsible sourcing and conservation efforts is crucial to maintain public trust. The company's 2024 sustainability reports highlight investments in reforestation projects, aiming to address these public concerns directly.

UPM-Kymmene's operational efficiency is significantly influenced by workforce demographics. In 2024, many developed nations where UPM operates, like Finland and Germany, face an aging workforce, with a notable percentage of skilled workers approaching retirement age. This trend, coupled with lower birth rates, can lead to a shrinking pool of available labor, particularly for specialized roles in forestry and advanced manufacturing.

Competition for specialized skills remains a key challenge. For instance, the demand for bioeconomy experts, data scientists in process optimization, and skilled machine operators is high across the industry. In 2025, UPM must contend with this competition, which can drive up labor costs and impact recruitment timelines, potentially delaying new project implementations or upgrades at their mills.

Shifts in educational attainment also play a role. While overall educational levels are rising, there's a growing need for vocational training and apprenticeships to fill practical roles. UPM's ability to attract and retain talent with the right technical skills, from forest management to pulp and paper production, is crucial for maintaining its competitive edge and ensuring smooth operations in 2024 and beyond.

Health, Safety, and Well-being Standards

Societal expectations and regulatory pressures concerning occupational health and safety in industrial settings significantly influence companies like UPM-Kymmene. Adherence to stringent health, safety, and well-being standards is not merely a compliance issue but a strategic imperative. UPM-Kymmene's dedication to robust safety protocols, comprehensive employee well-being programs, and fostering a strong safety culture is vital for attracting and retaining skilled talent, ensuring consistent productivity, and reinforcing its image as a responsible corporate citizen.

In 2023, UPM reported a lost time injury frequency rate (LTIFR) of 2.5 per million working hours, demonstrating a continued focus on workplace safety. This commitment directly impacts the company's ability to maintain operational efficiency and appeal to a workforce that increasingly prioritizes secure and healthy work environments. A proactive approach to well-being can also mitigate risks associated with employee turnover and absenteeism, contributing to long-term business resilience.

- Employee Well-being Programs: UPM invests in initiatives that support physical and mental health, aiming to reduce stress and enhance overall employee satisfaction.

- Safety Culture: The company actively promotes a mindset where safety is everyone's responsibility, encouraging reporting of near misses and proactive hazard identification.

- Regulatory Compliance: UPM ensures its operations meet or exceed all relevant national and international health and safety regulations, preventing potential fines and reputational damage.

- Talent Attraction: A strong safety record and commitment to well-being are key differentiators in attracting and retaining top talent in the competitive forest industry labor market.

Urbanization and Rural Community Relations

Urbanization presents a significant sociological factor for UPM-Kymmene, as the global trend sees populations increasingly concentrated in cities. This demographic shift can impact rural communities where UPM often operates, potentially leading to labor shortages and changes in local economies. For instance, as of 2023, the United Nations reported that over 57% of the world's population lived in urban areas, a figure projected to rise.

UPM-Kymmene's position as a major employer in many rural areas means maintaining positive community relations is crucial. This involves not only creating local jobs but also actively engaging with residents and demonstrating responsible resource management. The company's commitment to sustainable forestry practices, for example, directly addresses concerns about land use and environmental impact in these communities.

The company's economic contribution is vital for the sustainability of these rural regions. UPM's operations can be a cornerstone of local employment, influencing the overall well-being and stability of these communities.

- Demographic Shift: Global urbanization continues, impacting rural workforce availability and community dynamics.

- Economic Contribution: UPM's role as a significant employer in rural areas necessitates strong local economic support.

- Community Engagement: Maintaining positive relationships requires proactive dialogue and addressing local concerns regarding resource management.

- Job Creation: UPM's investment in rural areas directly supports local employment and economic resilience.

The increasing global focus on ethical consumption and corporate social responsibility significantly shapes consumer choices and brand perception. UPM-Kymmene's commitment to sustainable practices, such as its certified forest management and development of bio-based products, directly aligns with these evolving societal values. In 2024, consumer surveys indicated that over 60% of individuals considered a company's ethical standing when making purchasing decisions, particularly for products derived from natural resources.

This societal shift creates both opportunities and challenges. Companies demonstrating strong ethical credentials, like UPM-Kymmene's focus on responsible sourcing and community engagement, can build stronger brand loyalty and attract environmentally conscious customers. Conversely, negative perceptions regarding environmental impact or labor practices can quickly damage reputation and market share. UPM's proactive reporting on its sustainability efforts, including its 2024 progress on reducing greenhouse gas emissions by 25% compared to 2015 levels, aims to reinforce its ethical standing.

The company's social license to operate is intrinsically linked to public trust and acceptance of its operations. UPM-Kymmene's engagement with local communities, transparency in its forest management, and contributions to rural economies are critical for maintaining this trust. For instance, in 2023, UPM initiated several community dialogue forums across its operational regions to address local concerns and foster collaborative relationships, recognizing that strong community ties are fundamental to long-term success.

Technological factors

Technological factors are significantly reshaping the pulp and paper industry, and UPM-Kymmene is at the forefront of these advancements. Innovations in production processes are key to enhancing efficiency, cutting costs, and boosting product quality. For instance, the integration of advanced automation and digitalization across UPM-Kymmene's mills is streamlining operations, leading to higher yields and reduced energy consumption. This technological leap also enables the development of novel paper and board grades tailored to evolving market demands.

In 2024, UPM-Kymmene continued to invest in modernizing its production facilities. Their commitment to digitalization is evident in the implementation of smart factory solutions, which optimize resource allocation and predictive maintenance. These efforts are projected to yield significant cost savings, with some industry reports suggesting that advanced automation can reduce operational expenses by up to 15% in large-scale manufacturing. Furthermore, the company's focus on new processing techniques, such as enhanced pulping methods, aims to improve fiber quality and reduce the environmental footprint of their products, aligning with sustainability goals and market preferences for eco-friendly materials.

Breakthroughs in biochemistry and materials science are fueling the development of new bio-based products and materials from wood fiber and biomass. This is a significant technological shift.

UPM-Kymmene's strategic investments in research and development for biofuels, biochemicals, and advanced composites are designed to leverage these advancements. For instance, their focus on cellulosic ethanol and biochemicals aims to create value from forest resources beyond traditional paper products.

This diversification strategy is crucial for UPM-Kymmene to open new, high-growth markets and reduce its dependence on the mature paper industry. In 2023, UPM reported that its Biofuels business generated €1.1 billion in revenue, showcasing the growing importance of these new product segments.

UPM-Kymmene is increasingly integrating digital technologies like AI, IoT, and big data analytics across its operations. This digitalization is crucial for optimizing processes, from raw material sourcing to final product delivery. For instance, in 2024, UPM reported significant advancements in its smart factory initiatives, aiming to boost efficiency by up to 15% through real-time data analysis and predictive maintenance.

Leveraging these technologies allows UPM-Kymmene to achieve predictive maintenance, reducing downtime and associated costs. Optimized logistics, powered by real-time tracking and analytics, ensure efficient transportation and inventory management. In 2025, the company plans to expand its IoT sensor network across its forestry operations, providing enhanced supply chain visibility and enabling more sustainable resource management.

Renewable Energy and Energy Efficiency Technologies

UPM-Kymmene is actively investing in renewable energy and energy efficiency technologies to bolster its sustainability and cost-effectiveness. Innovations in biomass energy, a core area for UPM, alongside advancements in wind and solar power, are crucial for reducing reliance on fossil fuels. For instance, UPM's own bio-based energy solutions, like those utilizing forest residues, directly contribute to lowering its carbon footprint.

These strategic investments are designed to achieve several key objectives for UPM-Kymmene. By enhancing energy efficiency in its pulp and paper manufacturing processes, the company can significantly decrease operational expenses. Furthermore, increasing energy self-sufficiency through renewables strengthens its resilience against energy market volatility.

- Biomass Power: UPM continues to leverage its extensive forest resources for bioenergy production, a significant portion of its energy needs.

- Energy Efficiency: Investments in modernizing machinery and optimizing production lines aim to reduce energy consumption per unit of output.

- Carbon Footprint Reduction: Transitioning to renewable energy sources is central to UPM's commitment to achieving ambitious climate targets.

- Energy Self-Sufficiency: The company's focus on on-site energy generation enhances operational stability and reduces exposure to external energy price fluctuations.

Sustainable Forestry and Resource Management Technologies

Technological advancements are revolutionizing how UPM-Kymmene manages its forest resources. Satellite imagery and drone technology provide real-time data on forest health, growth patterns, and potential threats like disease or fire, allowing for more precise and efficient interventions. In 2024, UPM continued to invest in digital solutions for enhanced forest inventory and planning, aiming to optimize yield and minimize environmental impact.

Advanced genetic research plays a crucial role in developing tree varieties that are more resilient to climate change and disease, while also improving growth rates and wood quality. Data analytics further empowers UPM by processing vast amounts of information from these technologies to inform strategic decisions on planting, harvesting, and conservation efforts. For instance, UPM's commitment to sustainable forestry in 2025 is underpinned by its use of predictive analytics to forecast timber availability and optimize logistics.

- Satellite and Drone Monitoring: UPM utilizes these technologies for detailed forest health assessments, covering millions of hectares annually.

- Genetic Improvement Programs: Investments in research aim to enhance tree resilience and productivity, contributing to a more sustainable resource base.

- Data Analytics for Optimization: UPM leverages big data to improve resource tracking, biodiversity monitoring, and operational efficiency in its forestry operations.

- Digital Forest Management Platforms: These integrated systems allow for comprehensive planning and execution of sustainable forestry practices.

Technological advancements are driving efficiency and innovation at UPM-Kymmene. Investments in digitalization and smart factory solutions, as seen in 2024, aim to boost operational efficiency by up to 15% through real-time data analysis and predictive maintenance. These technologies are crucial for optimizing resource allocation and reducing energy consumption across their mills.

The company is also leveraging breakthroughs in biochemistry and materials science to develop new bio-based products, such as biofuels and biochemicals, from forest resources. This diversification is key to accessing high-growth markets, with UPM's Biofuels business alone generating €1.1 billion in revenue in 2023.

Furthermore, UPM-Kymmene is enhancing its forest management through technologies like satellite imagery and drone monitoring, providing real-time data for improved planning and sustainability. Advanced genetic research and data analytics are also being employed to develop more resilient tree varieties and optimize resource utilization, with a focus on sustainable forestry practices continuing into 2025.

Legal factors

UPM-Kymmene operates under a complex web of national and international environmental regulations. These laws dictate limits on air and water emissions, mandate proper waste management, and control the use of chemicals. For instance, the EU's Industrial Emissions Directive (IED) sets stringent operational standards for large industrial installations like UPM's mills, requiring adherence to Best Available Techniques (BAT).

Compliance with these evolving environmental permits and standards is a significant operational factor for UPM-Kymmene. Meeting increasingly stringent emissions targets, such as those aimed at reducing greenhouse gases or improving water quality, often necessitates substantial capital expenditure. These investments are typically directed towards advanced pollution control technologies and the implementation of more sustainable production processes to minimize environmental impact and avoid potential penalties.

UPM-Kymmene operates within a complex web of forestry and land ownership laws across its global operations. These regulations govern everything from acquiring land for forest plantations to the specific rules for harvesting timber and managing forests sustainably. For instance, in Finland, UPM-Kymmene adheres to the Forest Act, which emphasizes sustainable forestry practices and landowner rights. The company's commitment to legal and ethical sourcing is paramount, requiring careful navigation of varying land tenure systems and indigenous rights, as seen in its operations in Uruguay where land use regulations are particularly stringent.

UPM-Kymmene must adhere to stringent product safety and quality standards across its diverse portfolio, encompassing everything from paper and packaging materials to advanced biofuels. Compliance with global regulations, such as those set by the European Chemicals Agency (ECHA) for substances used in their products, is paramount for maintaining market access and consumer confidence. Failure to meet these standards, for instance, could lead to product recalls or fines, impacting UPM-Kymmene's reputation and financial performance; in 2023, the company reported revenue of €10.2 billion, underscoring the scale of its operations and the potential impact of regulatory non-compliance.

Labor Laws and Employment Regulations

UPM-Kymmene operates under a complex web of labor laws and employment regulations across its global footprint, impacting everything from minimum wages to workplace safety standards. Adherence to these diverse legal frameworks is crucial for maintaining fair employment practices and upholding collective bargaining agreements. For instance, in Finland, UPM-Kymmene must comply with the Employment Contracts Act and the Occupational Safety and Health Act, which set benchmarks for working conditions and employee rights. The company's commitment to these regulations helps mitigate the risk of legal disputes and safeguards its reputation as a responsible employer.

Navigating these regulations requires continuous vigilance and adaptation. In 2023, the International Labour Organization reported that over 100 countries had ratified core labor conventions, highlighting the global trend towards stronger worker protections. UPM-Kymmene's global workforce, spread across continents, means the company must stay informed about evolving legislation in each operating region. This includes understanding local nuances in areas like:

- Worker Rights: Ensuring fair treatment, non-discrimination, and freedom of association.

- Wages and Working Conditions: Complying with minimum wage laws and regulations on working hours, breaks, and leave.

- Occupational Health and Safety: Implementing robust safety protocols to prevent workplace accidents and ensure a healthy environment, with global manufacturing companies investing billions annually in safety improvements.

- Collective Bargaining: Respecting and engaging with trade unions and employee representative bodies.

Competition and Anti-Trust Laws

Competition and anti-trust laws are crucial for UPM-Kymmene, a significant global player in the forest industry. These regulations aim to prevent monopolies and ensure fair play in the marketplace. UPM-Kymmene must meticulously ensure its operations, including potential mergers, acquisitions, and pricing, adhere to these laws to steer clear of hefty fines and legal battles, thereby safeguarding a competitive market landscape.

For instance, the European Union's General Court upheld a €15 million fine against UPM in 2021 for its role in a cartel in the label paper market, highlighting the strict enforcement of anti-trust regulations. This underscores the need for constant vigilance in pricing strategies and market conduct.

- Mergers and Acquisitions Scrutiny: UPM-Kymmene's proposed acquisitions are subject to review by competition authorities globally, such as the European Commission and the U.S. Federal Trade Commission, to prevent undue market concentration.

- Pricing Practices: The company must avoid price-fixing or collusive behavior with competitors, as demonstrated by past investigations into cartel activities within the paper industry.

- Market Dominance: UPM-Kymmene needs to manage its market share in various product segments to avoid accusations of abusing a dominant position, which could lead to regulatory intervention and penalties.

- Compliance Investment: Significant resources are allocated annually to legal and compliance teams to monitor and ensure adherence to evolving competition laws across its operating regions.

Legal factors significantly shape UPM-Kymmene's operations, particularly concerning environmental regulations and forestry laws. Strict adherence to emission standards, as mandated by directives like the EU's Industrial Emissions Directive, requires continuous investment in pollution control technologies. Furthermore, navigating diverse national forestry laws, from land acquisition to sustainable harvesting, is critical for responsible resource management.

Product safety and labor laws also present key legal considerations. UPM-Kymmene must comply with global chemical regulations and maintain high product quality standards to ensure market access and consumer trust. Simultaneously, upholding diverse labor laws across its international workforce, covering everything from wages to occupational safety, is essential for ethical employment practices and risk mitigation.

Antitrust and competition laws are paramount for a global player like UPM-Kymmene. The company must avoid anti-competitive practices, such as price-fixing, and its mergers and acquisitions are subject to scrutiny by authorities to prevent market dominance. Past penalties, like the €15 million fine in 2021 for cartel involvement, underscore the rigorous enforcement in this area.

Environmental factors

Climate change presents significant challenges for UPM-Kymmene, particularly concerning its forest resources. Altered growing seasons and increased frequency of forest fires, as observed in recent years with heightened wildfire activity across Europe and North America, directly impact timber availability and quality. For instance, the 2023 wildfire season saw extensive damage in Canada, a key region for forestry.

UPM-Kymmene must proactively assess these climate-related risks to its supply chain and operational continuity. This involves understanding how changing precipitation patterns and temperature shifts affect forest growth and health, and consequently, the availability of raw materials for its mills.

Implementing robust adaptation strategies is crucial for long-term sustainability. This includes investing in climate-resilient tree species, improving forest management practices to mitigate fire risks, and diversifying sourcing regions to reduce reliance on areas most vulnerable to climate impacts. UPM's commitment to sustainable forestry, including its ambitious targets for forest carbon sequestration, is central to navigating these environmental shifts.

UPM-Kymmene's commitment to biodiversity conservation is crucial for maintaining the health of the ecosystems where it operates. By implementing responsible forestry practices, the company actively works to preserve habitats and restore ecological functions. This approach not only supports environmental stewardship but also aligns with growing stakeholder expectations for sustainable land management.

In 2023, UPM reported that 96% of its forest areas were covered by certified sustainable forest management systems, demonstrating a strong framework for biodiversity protection. These certifications often include specific requirements for habitat preservation and the protection of endangered species, ensuring that UPM's operations contribute positively to the natural environment.

UPM-Kymmene's core business hinges on the availability of wood fiber and water, making resource scarcity a critical environmental factor. In 2023, UPM reported that approximately 70% of its wood sourcing came from certified forests, underscoring a commitment to sustainable forestry practices. The company's strategy emphasizes efficient water usage, with targets to reduce water consumption per tonne of pulp and paper produced.

Waste Management and Circular Economy Initiatives

UPM-Kymmene is actively engaged in waste management and circular economy initiatives to enhance its sustainability profile. The company focuses on minimizing waste generation across its operations and promotes recycling as a core principle. For instance, UPM's bio-refineries are designed to maximize the utilization of raw materials, converting by-products into valuable resources.

Their strategies include transforming waste streams into energy, a practice that contributes to both resource efficiency and reduced reliance on fossil fuels. In 2023, UPM reported that over 90% of its energy consumption was from renewable or recycled sources, underscoring their commitment to a circular approach.

Furthermore, UPM is exploring the use of recycled fibers in its paper and packaging products, aiming to close material loops. Their product design also considers end-of-life recyclability, aligning with global efforts to reduce landfill waste and promote a more sustainable consumption model.

- Waste-to-Energy Conversion: UPM utilizes biomass residues from its production processes to generate energy, reducing waste and emissions.

- Recycled Fiber Integration: The company incorporates recycled fibers into its paper and packaging solutions, promoting resource circularity.

- Product Design for Recyclability: UPM designs products with their end-of-life in mind, facilitating easier recycling and material recovery.

- Resource Efficiency: In 2023, UPM achieved a recycling rate of 96% for its operational waste, demonstrating a strong focus on resource efficiency.

Pollution Control and Emissions Reduction

UPM-Kymmene is actively investing in advanced technologies to significantly curb pollution from its industrial activities. This includes substantial efforts in reducing greenhouse gas emissions across its operations, a key focus for the company's environmental strategy. For instance, UPM aims to achieve a 60% reduction in its own fossil fuel related emissions by 2030 compared to 2015 levels, with a specific target of cutting Scope 1 and 2 emissions by 46.5% by 2030.

The company's commitment extends to minimizing discharges into water bodies, implementing state-of-the-art wastewater treatment processes. UPM also focuses on reducing other pollutants impacting soil and air quality, aligning with stringent environmental regulations and its own sustainability goals. These initiatives underscore UPM's dedication to environmental stewardship and operational excellence.

Key initiatives and achievements include:

- Investment in advanced emission control technologies: UPM continuously upgrades its facilities to meet and exceed air quality standards.

- Water stewardship programs: Implementing best practices for wastewater management to protect aquatic ecosystems.

- Circular economy principles: Promoting resource efficiency and waste reduction throughout the value chain.

- Renewable energy integration: Increasing the use of renewable energy sources to power its operations, thereby lowering its carbon footprint.

Climate change poses a direct threat to UPM-Kymmene's forest resources, impacting timber availability and quality through altered growing seasons and increased wildfire risks. For example, the 2023 wildfire season saw significant damage in key forestry regions like Canada. UPM's adaptation strategies, including investing in climate-resilient tree species and enhancing forest management, are vital for supply chain continuity and long-term sustainability.

UPM-Kymmene's commitment to biodiversity is demonstrated by 96% of its forest areas being covered by certified sustainable forest management systems in 2023, ensuring habitat preservation. The company's reliance on wood fiber and water makes resource scarcity a critical factor, with 70% of its wood sourced from certified forests in 2023 and a focus on efficient water usage. Furthermore, UPM champions waste management and circular economy initiatives, with over 90% of its energy consumption coming from renewable or recycled sources in 2023.

UPM-Kymmene is actively reducing pollution, aiming for a 46.5% reduction in Scope 1 and 2 emissions by 2030 compared to 2015 levels. This includes investing in advanced emission control technologies and robust water stewardship programs. The company's circular economy principles are evident in its waste-to-energy conversion and integration of recycled fibers, with a 96% operational waste recycling rate achieved in 2023.

PESTLE Analysis Data Sources

Our PESTLE analysis for UPM-Kymmene is grounded in data from official government publications, international organizations, and reputable industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.