UPM-Kymmene Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

UPM-Kymmene Bundle

Curious about UPM-Kymmene's strategic product positioning? Our BCG Matrix analysis offers a glimpse into their market share and growth potential, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock the strategic advantages and make informed decisions about resource allocation and future investments, you need the full picture.

Don't settle for a partial view of UPM-Kymmene's product portfolio. Purchase the complete BCG Matrix report to gain detailed quadrant placements, understand the underlying data, and receive actionable recommendations. This is your opportunity to move beyond speculation and embrace data-driven strategy for UPM-Kymmene's success.

The full UPM-Kymmene BCG Matrix is your key to understanding their competitive landscape and identifying opportunities for growth and efficiency. Get instant access to this essential strategic tool and discover how to best leverage their product strengths and address weaknesses. Invest in clarity and strategic foresight today!

Stars

UPM Biochemicals' Leuna Biorefinery is a prime example of a Star within UPM-Kymmene's portfolio. This ambitious project, with integrated commercial production slated for the second half of 2025, is set to become a major player in the burgeoning market for sustainable chemicals. The facility will produce innovative products like bio-monoethylene glycol (BioMEG) and renewable functional fillers, derived from wood biomass.

This strategic investment taps into a high-growth sector driven by increasing global demand for environmentally friendly materials and a strong push towards decarbonization. UPM's commitment to this advanced biorefinery underscores its vision to lead in providing sustainable alternatives to fossil-based chemicals, positioning it for significant market share capture.

The Paso de los Toros pulp mill in Uruguay has achieved full production, a major milestone that significantly boosts UPM's overall pulp capacity. This expansion directly translates to higher delivery volumes for the company, strengthening its market presence.

This new facility is a world-class fiber platform, designed to optimize production efficiency and drive down costs within UPM Fibres. Such cost reductions are crucial for enhancing profitability and maintaining a competitive edge in the global market.

Looking ahead to 2025, the full-year operational impact of the Paso de los Toros mill is anticipated to further increase pulp deliveries. This will reinforce UPM's leading position in the renewable fibers sector, showcasing its commitment to sustainable and high-volume production.

UPM Raflatac, a key player in self-adhesive label materials and advanced solutions, has shown strong resilience and consistent sales growth. This segment is a significant contributor to UPM-Kymmene's overall performance.

Strategic acquisitions, including Grafityp and Metamark, have been pivotal in boosting UPM Raflatac's expansion within the graphics solutions market, solidifying its competitive standing. These moves underscore a commitment to market leadership.

The company is actively pursuing growth in rapidly expanding geographical areas like Southeast Asia. Investments in new production facilities in these regions are designed to capitalize on emerging market opportunities and enhance UPM Raflatac's global reach.

Sustainable Packaging Solutions

Sustainable Packaging Solutions, representing UPM-Kymmene's paper and paperboard materials, are poised for substantial growth. The global sustainable packaging market is anticipated to expand at a compound annual growth rate of 5.8% between 2025 and 2035, a trend UPM's products are well-suited to capture. These materials are leading the charge in eco-friendly packaging due to their inherent recyclability and broad consumer acceptance.

UPM's commitment to innovation in bio-based and compostable packaging directly addresses rising consumer demand for environmentally responsible options. This strategic focus also anticipates stricter environmental regulations, further solidifying the market position of their sustainable packaging solutions.

- Market Growth: Global sustainable packaging market projected to grow at a CAGR of 5.8% from 2025-2035.

- Material Dominance: Paper and paperboard materials are key players in the sustainable packaging sector.

- Consumer & Regulatory Drivers: UPM's bio-based and compostable alternatives cater to increasing eco-awareness and regulatory demands.

UPM Biofuels (Lappeenranta Biorefinery & SAF)

UPM Biofuels, anchored by its Lappeenranta biorefinery, is a key driver of UPM-Kymmene's expansion into sustainable fuels and chemicals. This facility transforms Crude Tall Oil (CTO) into advanced biofuels, serving both the transportation and petrochemical sectors.

The strategic emphasis on qualifying CTO-derived UPM biofuels as Sustainable Aviation Fuel (SAF) highlights significant growth potential within the burgeoning decarbonization solutions market. UPM is actively exploring debottlenecking opportunities to increase production capacity.

- UPM Biofuels' Lappeenranta Biorefinery: A cornerstone for UPM's sustainable fuel and chemical offerings.

- Focus on SAF: Qualifying CTO-derived biofuels as Sustainable Aviation Fuel targets a high-growth market.

- Decarbonization Solutions: Positioned to meet increasing global demand for alternatives to fossil fuels.

- Capacity Expansion: Ongoing efforts to debottleneck operations signal ambitious growth plans.

UPM Biochemicals' Leuna Biorefinery is a significant Star, focusing on high-growth sustainable chemicals like BioMEG. Its commercial production, starting in the latter half of 2025, targets the increasing demand for eco-friendly alternatives to fossil-based products.

The Paso de los Toros pulp mill in Uruguay represents another Star, having reached full production and significantly boosting UPM's pulp capacity. This world-class facility enhances operational efficiency and cost competitiveness within UPM Fibres.

UPM Raflatac, a leader in self-adhesive label materials, is a Star due to its consistent sales growth and strategic acquisitions like Grafityp and Metamark. Expansion into high-growth regions such as Southeast Asia further solidifies its position.

Sustainable Packaging Solutions, encompassing UPM's paper and paperboard, are Stars poised for substantial growth. The global sustainable packaging market is projected to expand at a 5.8% CAGR between 2025 and 2035, driven by consumer demand and regulatory shifts.

UPM Biofuels, with its Lappeenranta biorefinery, is a Star focused on advanced biofuels, particularly Sustainable Aviation Fuel (SAF). This segment capitalizes on the decarbonization trend, with ongoing efforts to increase production capacity.

| UPM-Kymmene Business Area | BCG Category | Key Growth Drivers | 2024/2025 Outlook |

|---|---|---|---|

| UPM Biochemicals (Leuna Biorefinery) | Star | Growing demand for sustainable chemicals, decarbonization initiatives | Commercial production slated for H2 2025 |

| UPM Fibres (Paso de los Toros) | Star | Increased pulp capacity, operational efficiency, cost reduction | Full production achieved, higher delivery volumes expected in 2025 |

| UPM Raflatac | Star | Consistent sales growth, strategic acquisitions, emerging market expansion | Strong resilience and expansion in graphics solutions and new geographies |

| UPM Specialty Papers (Sustainable Packaging) | Star | Growth in sustainable packaging market (5.8% CAGR 2025-2035), eco-friendly demand | Well-positioned to capture market share with bio-based and compostable solutions |

| UPM Biofuels | Star | Demand for sustainable fuels (SAF), decarbonization solutions | Focus on SAF qualification, exploring capacity expansion |

What is included in the product

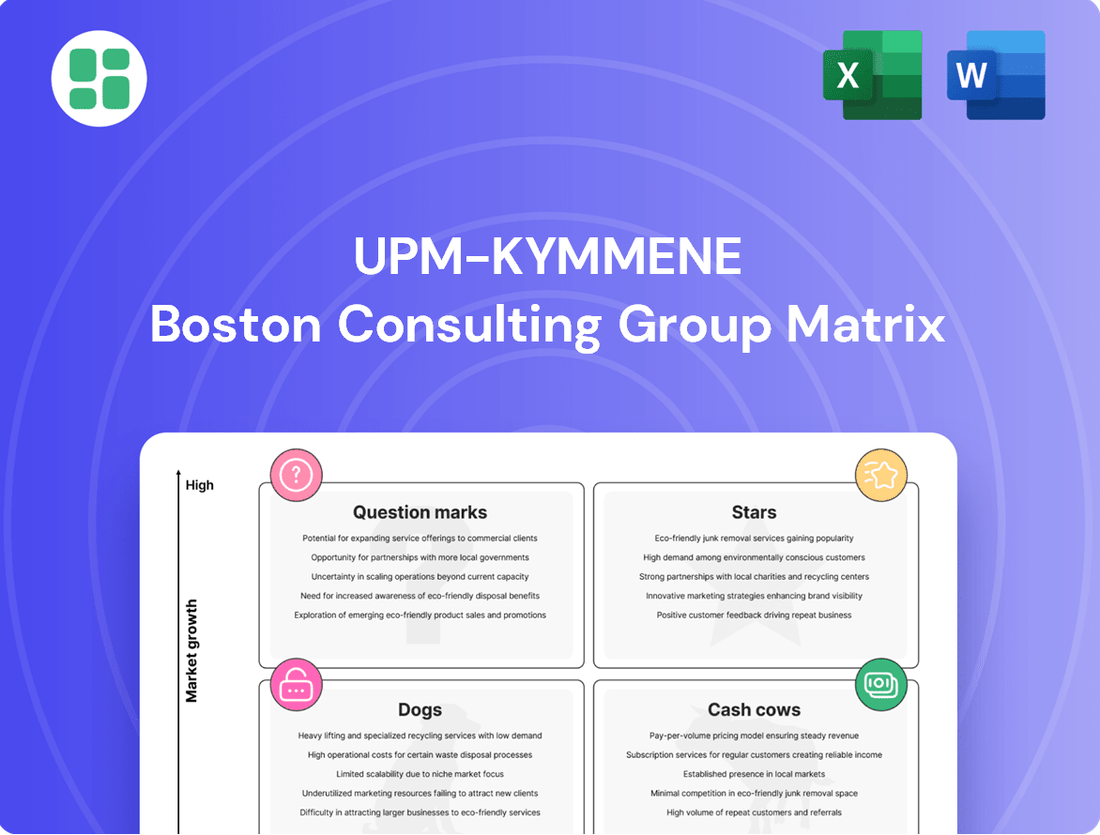

This BCG Matrix overview highlights which UPM-Kymmene business units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visualization for UPM-Kymmene's business units simplifies strategic decision-making.

This matrix helps identify areas needing investment or divestment, easing portfolio management.

Cash Cows

UPM's Finnish pulp operations, while contending with elevated wood costs, function as a cash cow. These established facilities are meticulously managed for robust profitability, underpinned by an efficient operational framework that ensures consistent cash generation.

These operations are vital for UPM's financial stability, enabling the company to sustain its prominent market position in the pulp sector. UPM actively works to protect and enhance profitability within this segment by continually refining and streamlining its operational processes.

UPM's traditional pulp production is a powerhouse, consistently generating substantial cash flow thanks to its world-class infrastructure and efficient operations. This segment acts as a vital financial bedrock for the company, enabling strategic investments in future growth initiatives. For instance, in 2023, UPM's pulp business reported an adjusted EBITDA of €1.6 billion, underscoring its robust cash-generating capabilities.

UPM Plywood, a component of UPM-Kymmene's portfolio, operates as a Cash Cow. The business has demonstrated consistent improvements in sales and delivery volumes, a clear sign of its stable market standing and dependable cash generation. This segment contributes reliably to UPM-Kymmene's overall revenue and profitability, even if it's not a high-growth sector.

While UPM Plywood may not be experiencing rapid expansion, its steady performance ensures a consistent inflow of cash. The company's strategic investments in bolstering infrastructure and implementing efficiency enhancements are crucial for preserving its competitive advantage and maintaining robust cash flow from this established business line.

UPM Specialty Papers (Established Segments)

UPM Specialty Papers' established segments, including certain label and release base papers, operate in mature markets. These areas exhibit moderate growth but are consistent contributors to UPM's overall earnings, functioning as reliable cash cows.

UPM commands a substantial market share in these established segments, particularly within the European market. This strong market position ensures a steady and predictable revenue stream, reinforcing their status as cash cows.

- Market Position: UPM is a leading player in European label and release base papers.

- Profitability: These segments consistently generate profits due to operational efficiencies.

- Contribution: They provide stable cash flow, supporting investments in other UPM business areas.

Ongoing initiatives focused on enhancing efficiency and competitiveness are crucial for sustaining the profitability of these mature segments. For instance, UPM has been investing in optimizing its production processes to maintain margins in these established product lines.

Electricity Production from Renewable Energy

UPM's 'Other' segment, largely comprising electricity production from renewable sources, acts as a reliable Cash Cow. This segment, a significant contributor to Finland's energy landscape as the second-largest producer, generates consistent and predictable revenue.

The company's commitment to fossil-free power generation assets underpins the stability of this income. While growth prospects are modest, the high reliability of these operations ensures a steady cash flow, which is crucial for funding other strategic initiatives within UPM.

- Stable Revenue: The renewable energy segment provides a predictable income stream, insulating UPM from market volatility in other sectors.

- Fossil-Free Generation: UPM's assets are geared towards sustainable energy, aligning with global trends and reducing carbon footprint.

- Support for Growth: Profits from this Cash Cow can be reinvested into UPM's higher-growth business areas, fostering overall company development.

UPM's Finnish pulp operations are a prime example of a cash cow within the BCG matrix. Despite facing higher wood costs, these established facilities are optimized for consistent profitability and reliable cash generation.

These operations are fundamental to UPM's financial health, allowing the company to maintain its strong market presence. UPM actively focuses on enhancing profitability in this sector through continuous process improvements.

The company's pulp segment is a significant cash generator, supported by its world-class infrastructure and efficient operations. This segment provides essential financial backing for UPM's strategic growth investments. For instance, UPM's pulp business reported an adjusted EBITDA of €1.6 billion in 2023, highlighting its substantial cash-generating capacity.

UPM Plywood also functions as a cash cow, demonstrating consistent growth in sales and deliveries, which signals a stable market position and dependable cash flow. This business reliably contributes to UPM-Kymmene's overall revenue and profitability, even without rapid expansion.

| Business Segment | BCG Category | Key Characteristics | Financial Contribution (2023 Data) |

|---|---|---|---|

| Finnish Pulp Operations | Cash Cow | Established, efficient, robust profitability | Adjusted EBITDA: €1.6 billion |

| UPM Plywood | Cash Cow | Stable market standing, consistent cash generation | Reliable revenue and profit contributor |

| Specialty Papers (Label & Release Base) | Cash Cow | Mature markets, strong European market share, operational efficiencies | Consistent earnings, stable revenue stream |

| Other (Renewable Energy) | Cash Cow | Second-largest electricity producer in Finland, fossil-free assets, high reliability | Predictable income stream, supports strategic initiatives |

What You See Is What You Get

UPM-Kymmene BCG Matrix

The UPM-Kymmene BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after your purchase. This means you get the full strategic analysis, ready for immediate application in your business planning or presentations. The report is professionally formatted and contains all the detailed insights derived from the BCG Matrix framework, ensuring you have a robust tool for evaluating UPM-Kymmene's business units.

Dogs

UPM Communication Papers, particularly its graphic paper segment including newsprint and fine paper, is experiencing a downturn. This is driven by a persistent structural oversupply in the market, which is leading to both reduced demand and lower selling prices for these products.

To address this challenging market, UPM has been actively managing its capacity. This has involved significant actions such as closing mills and retiring paper machines. The goal is to better align production with the remaining profitable demand in the graphic papers sector.

The graphic papers business is currently characterized as a cash trap for UPM. This means it consumes more cash than it generates, necessitating continuous adjustments and strategic divestitures to curb ongoing losses and improve the company's overall financial health.

UPM has been strategically shedding non-core assets, a move exemplified by the sale of UPM-Kymmene Austria GmbH. This divestment, along with the closure of its Hürth newsprint mill, signals a deliberate shift away from businesses that were not contributing significantly to the company's overall performance or strategic direction.

These actions are consistent with a company focusing its resources on more profitable and growth-oriented areas. By exiting these underperforming segments, UPM can reallocate capital and management attention to its core strengths, thereby improving overall efficiency and financial health.

UPM-Kymmene's legacy products, particularly those in the communication papers segment like uncoated fine paper, often face declining demand due to digitalization. These products typically exhibit low market share within their shrinking market, meaning they don't capture a significant portion of the remaining sales. For example, in 2023, UPM reported a continued decline in its specialty papers segment, which includes many of these legacy products, reflecting the ongoing market contraction.

These low-growth, low-share products are often cash drains or generate minimal cash flow, making them candidates for strategic review. UPM's approach is to actively manage capacity, ensuring it aligns with current and projected profitable demand in these challenging segments. This means adjusting production levels or even phasing out certain product lines if they become unprofitable.

Underperforming Regional Operations in Mature Segments

Certain regional operations or specific production units within mature segments of UPM-Kymmene, particularly those facing high costs or intense local competition, may be categorized as Dogs. These units often struggle to generate significant returns, dragging down overall profitability.

UPM's strategic moves, such as streamlining operations and consolidating production, indicate a deliberate effort to address these underperforming assets. For instance, the company has previously announced site closures or divestments to improve efficiency and focus on more profitable areas.

- High Cost Structures: Units in mature markets may have legacy cost structures that are difficult to reduce, making them less competitive.

- Intense Local Competition: Mature segments often experience saturation, leading to price wars and reduced margins for all players.

- Operational Inefficiencies: Older facilities might suffer from lower productivity or higher maintenance costs compared to newer, more advanced plants.

- Strategic Consolidation: UPM's actions to consolidate production from certain sites directly address the issue of underperforming regional operations to boost overall profitability.

Rotterdam Biofuels Refinery Project (Discontinued)

The Rotterdam Biofuels Refinery Project, a potential second biomass-to-fuels facility, was discontinued by UPM-Kymmene. This decision, made after initial investments and extended evaluations, strongly suggests the project was classified as a 'Dog' within the BCG Matrix. It was consuming capital without demonstrating clear commercial viability or a strong strategic fit for the company's future direction.

The withdrawal of the Rotterdam project highlights UPM-Kymmene's strategic pivot. By discontinuing this initiative, the company aimed to reallocate resources and sharpen its focus on more promising growth avenues within its biofuels portfolio. This move is typical for 'Dogs' in the BCG matrix, where continued investment is unlikely to yield significant returns.

- Project Status: Discontinued development of a second biomass-to-fuels refinery in Rotterdam.

- BCG Classification: Deemed a 'Dog' or potential future 'Dog' due to viability concerns.

- Financial Impact: Consumed capital without expected commercial returns, prompting withdrawal.

- Strategic Rationale: To refocus resources on more promising biofuels growth strategies.

UPM-Kymmene's legacy communication paper businesses, particularly those in mature markets, can be viewed as 'Dogs' in the BCG matrix. These segments often face declining demand due to digitalization and intense competition, leading to low market share and profitability. For instance, UPM's graphic paper business has seen reduced demand and prices, impacting its overall performance.

The company's strategic actions, such as mill closures and divestments like UPM-Kymmene Austria GmbH, are aimed at managing these underperforming assets. These moves are consistent with shedding businesses that are cash traps or generate minimal returns, allowing UPM to focus on more growth-oriented areas.

The discontinuation of the Rotterdam Biofuels Refinery Project is another example, signaling a move away from initiatives lacking clear commercial viability. This aligns with the 'Dog' strategy of divesting or minimizing investment in such ventures to reallocate capital effectively.

UPM's approach to these 'Dog' segments involves active capacity management and strategic exits to improve overall financial health and efficiency. This focus on streamlining operations and consolidating production helps mitigate losses from these mature, low-growth businesses.

| Segment | Market Growth | Market Share | BCG Classification | UPM Actions |

|---|---|---|---|---|

| Communication Papers (e.g., Newsprint, Fine Paper) | Low/Declining | Low | Dog | Mill closures, capacity reduction, divestments |

| Specialty Papers (partially legacy) | Low/Declining | Low | Dog | Strategic review, potential divestments |

| Rotterdam Biofuels Project (potential) | N/A (discontinued) | N/A | Dog | Project discontinuation, resource reallocation |

Question Marks

UPM-Kymmene's lignin-based Renewable Functional Fillers (RFF), produced at their new Leuna biorefinery, are positioned as a promising entrant in the market. These fillers are designed to substitute conventional carbon black and silica, particularly within the demanding rubber industry, including tire manufacturing. This represents a strategic move into a high-growth sector driven by the increasing global demand for sustainable materials.

The market for RFF is still in its nascent stages, indicating significant growth potential as industries actively seek eco-friendly alternatives to traditional petroleum-based products. For instance, the global tire market alone was valued at approximately $300 billion in 2023, with a growing segment prioritizing sustainability. However, UPM's RFF faces the challenge of establishing market share and requires substantial investment in marketing and production scaling to achieve widespread adoption.

Bio-Monoethylene Glycol (BioMEG) and Bio-Monopropylene Glycol (BioMPG) from UPM's Leuna biorefinery are positioned as potential stars in the BCG matrix. These bio-based glycols offer sustainable, 'drop-in' replacements for conventional MEG and MPG, crucial components in polyesters, fibers, and packaging. The market for sustainable chemicals is experiencing robust growth, creating a favorable environment for these innovative products.

Despite the expanding market for sustainable chemicals, UPM's current market share for BioMEG and BioMPG is relatively small. Significant capital investment will be necessary to scale production, build brand recognition, and establish a leading position in this emerging sector. The high investment requirement coupled with a currently low market share suggests these products are in the question mark phase, requiring strategic focus to transition into stars.

UPM is strategically positioning its Crude Tall Oil (CTO)-derived biofuels for Sustainable Aviation Fuel (SAF) certification, targeting a rapidly expanding market fueled by aviation's decarbonization mandates. This sector is projected to reach $11.3 billion by 2030, showcasing immense growth potential.

Currently, UPM is in the crucial qualification and commercialization phase, meaning its market share in SAF is nascent. This stage necessitates substantial investment in research and development, alongside strategic partnerships, to navigate the complex certification processes and establish a strong market presence.

Nanocellulose and Other Advanced Biomaterials

UPM is actively investing in scaling up production of nanocellulose, also known as cellulose nanofibrils (CNF) and cellulose nanocrystals (CNC). These advanced biomaterials are being developed for a range of high-value applications, including enhancing packaging, improving coatings, and creating new biocomposites.

The global nanocellulose market is experiencing significant expansion, with projections indicating robust growth in the coming years. This suggests that UPM is positioning itself within a high-growth potential market segment.

Despite the market's promising trajectory, UPM's market share in nanocellulose technology is still in its formative stages. The commercialization and broad application development of these materials necessitate substantial ongoing investment.

- Market Growth: The global nanocellulose market was valued at approximately USD 700 million in 2023 and is projected to reach over USD 2.5 billion by 2030, growing at a CAGR of around 20%.

- UPM's Strategy: UPM's focus on nanocellulose aligns with its strategy to diversify into high-value bio-based products beyond traditional pulp and paper.

- Investment Needs: Significant capital expenditure is required for research, development, and scaling production facilities to capture a meaningful share of this emerging market.

- Application Development: Continued investment is crucial for exploring and validating new applications, which will drive market adoption and UPM's competitive positioning.

New Wind and Solar Power Projects

UPM Energy is actively investigating the development of new wind and solar power projects on its extensive land holdings. This strategic move is designed to bolster its capacity for CO2-free electricity generation, aligning with the increasing global demand for sustainable energy solutions. The company is positioning itself to capitalize on the burgeoning green transition.

These nascent wind and solar ventures are currently in their initial exploration phases. While the potential for growth in the clean energy sector is substantial, the specific timelines for project completion and the eventual market share these initiatives will capture remain uncertain. This early stage necessitates significant investment in research and development, alongside careful strategic planning to navigate the evolving energy landscape.

- High Growth Potential: The expansion into wind and solar aligns with the strong market trend towards renewable energy, offering significant long-term growth opportunities.

- Capital Intensive: Developing these projects requires substantial upfront capital investment for land acquisition, technology, and infrastructure.

- Strategic Execution: Success hinges on UPM Energy's ability to effectively manage project development, secure necessary permits, and integrate new energy sources into the existing grid.

UPM's Bio-Monoethylene Glycol (BioMEG) and Bio-Monopropylene Glycol (BioMPG) products are currently in the Question Mark phase of the BCG matrix. While the market for sustainable chemicals is expanding rapidly, UPM's current market share in these specific bio-glycols is small.

Significant capital investment is required to scale production and build brand recognition for BioMEG and BioMPG. This high investment need, combined with a low current market share, necessitates strategic focus to help these products transition into Stars.

The success of these products hinges on UPM's ability to effectively compete in the growing sustainable chemicals market and secure a larger portion of it through targeted investments and marketing efforts.

| Product Category | BCG Phase | Market Growth | UPM Market Share | Investment Needs |

|---|---|---|---|---|

| BioMEG & BioMPG | Question Mark | High (Sustainable Chemicals) | Low | High |

BCG Matrix Data Sources

Our UPM-Kymmene BCG Matrix is built on comprehensive market intelligence, integrating financial disclosures, industry growth data, and competitor analysis to provide strategic clarity.