TT Electronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TT Electronics Bundle

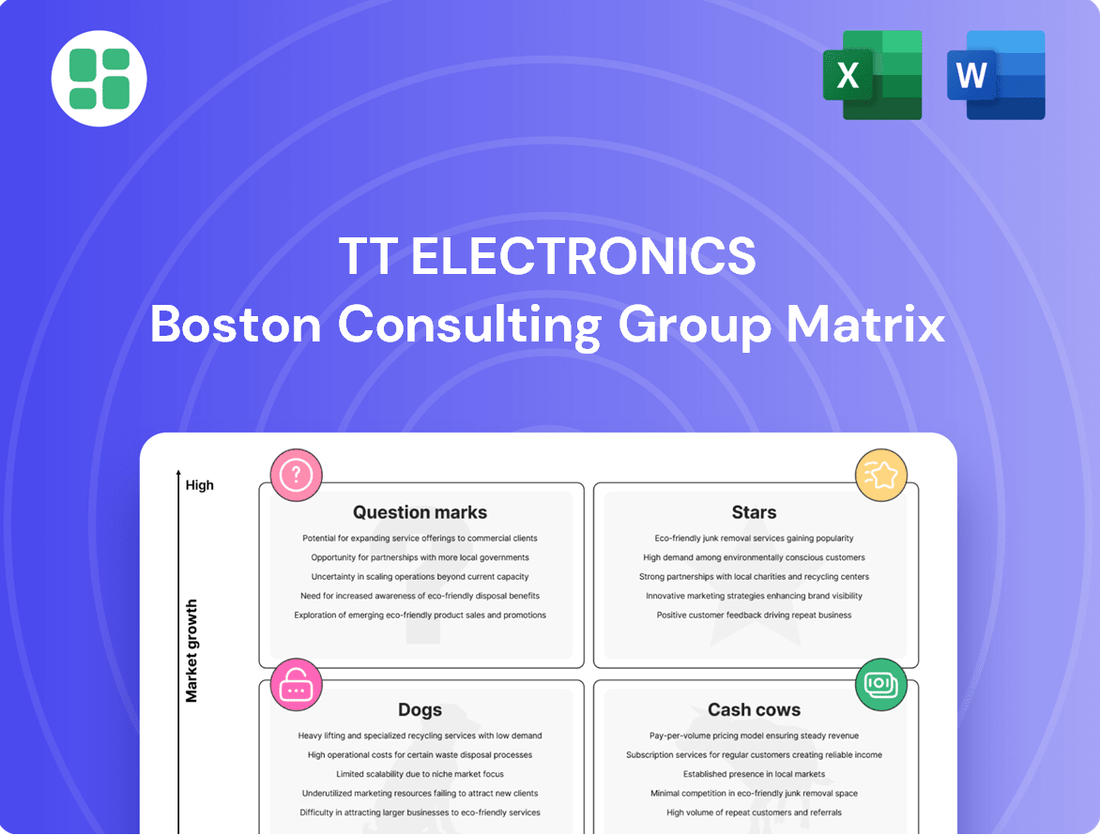

Unlock the strategic potential of TT Electronics with our comprehensive BCG Matrix analysis. Understand which of their products are market leaders (Stars), reliable profit generators (Cash Cows), potential growth areas needing investment (Question Marks), or underperforming assets (Dogs).

This preview offers a glimpse into TT Electronics' product portfolio's strategic positioning. For a complete, actionable understanding and to inform your investment decisions, purchase the full BCG Matrix report today.

Stars

TT Electronics' Advanced Medical Device Components segment is a strong performer, fitting the description of a Star in the BCG matrix. The company supplies high-reliability components essential for critical medical equipment, such as those used in neonatal care. Their involvement with Cardinal Health on the Kangaroo NTrainer™ System 2.0 exemplifies this focus.

This market is experiencing robust growth, driven by an aging global population and ongoing healthcare technology advancements. TT Electronics holds a significant market position due to the mission-critical nature of its engineered solutions and the demanding quality standards in the medical industry. Their ISO 13485 certification at the Mexicali EMS facility underscores their competitive edge in this expanding sector.

TT Electronics is making significant strides in high voltage power conversion for aerospace, evidenced by a recent grant from Innovate UK. This funding is specifically earmarked for developing advanced technologies crucial for next-generation aircraft. This strategic move aligns perfectly with the booming European aerospace and defense sector, which is experiencing accelerated growth.

The company's components are designed to offer substantial advantages in size, weight, and efficiency. These benefits are particularly critical for mission-essential systems found in both commercial and military aircraft. By focusing on these improvements, TT Electronics is solidifying its position as a key player in a dynamic and expanding market.

TT Electronics is strategically positioning itself within the electrification megatrend, developing advanced power management and sensing solutions vital for electric vehicles (EVs) and industrial automation. This segment is booming, fueled by a global push for sustainability and the widespread adoption of electric power.

The automotive electrification market alone was valued at approximately $260 billion in 2023 and is projected to reach over $1 trillion by 2030, indicating substantial growth potential. TT Electronics' significant R&D investments are geared towards capturing a substantial market share by delivering innovative, energy-efficient products that meet the evolving demands of these high-growth sectors.

Specialized Sensors for Automation

TT Electronics provides specialized sensors that are crucial for the expanding automation sector, fueled by Industry 4.0 and smart factory trends. These sensors are engineered for demanding, performance-critical roles, positioning TT Electronics as a key supplier for sophisticated automation. Their commitment to precision and dependability drives consistent demand for these vital components.

The global industrial automation market was valued at approximately $237.1 billion in 2023 and is projected to reach $396.1 billion by 2028, growing at a compound annual growth rate of 10.8%. TT Electronics' specialized sensors, designed for harsh environments and high accuracy, are well-positioned to capture a significant share of this expanding market.

- Market Growth: The industrial automation market is experiencing robust expansion, with significant investment in smart factory technologies.

- Critical Components: TT Electronics' sensors are essential for the precise operation of automated systems.

- Performance Focus: The emphasis on reliability and accuracy in their sensor designs ensures their relevance in high-stakes applications.

Defence and Combat Aircraft Components

TT Electronics' Defence and Combat Aircraft Components segment is a clear star in their BCG Matrix. The company recently announced multi-million-pound contracts for cable harness assemblies, specifically for combat aircraft and other naval and air combat programs. This highlights their substantial market share within the defense industry.

The defense market, especially in Europe, is experiencing a surge in investment. This trend directly benefits TT Electronics, as their high-reliability, mission-critical components are in high demand. For instance, European defense spending is projected to continue its upward trajectory, with many nations meeting or exceeding their NATO spending commitments.

TT Electronics' enduring relationships with major original equipment manufacturers (OEMs) in the defense sector further cement their star status. These partnerships ensure a consistent pipeline of business and reinforce their competitive advantage. Their ability to deliver specialized, dependable components makes them a preferred supplier for these critical applications.

- Strong Market Position: Multi-million-pound contracts for combat aircraft cable harnesses underscore TT Electronics' significant share in the defense sector.

- Accelerated Market Growth: Increased defense investment, particularly in Europe, fuels demand for their mission-critical components.

- Established OEM Relationships: Long-standing partnerships with leading defense OEMs provide a stable foundation and competitive edge.

- High-Reliability Components: The focus on mission-critical parts aligns perfectly with the stringent requirements of the defense industry.

TT Electronics' Medical Device Components segment is a prime example of a Star in the BCG matrix. The company's high-reliability components are vital for critical medical equipment, as seen in their work with Cardinal Health on the Kangaroo NTrainer™ System 2.0. This market is expanding rapidly due to an aging global population and advancements in healthcare technology.

TT Electronics' aerospace and defense business, particularly its high voltage power conversion for aircraft, is also a Star. A recent Innovate UK grant supports their development of advanced technologies for next-generation aircraft, aligning with the booming European aerospace and defense sector. Their components offer significant size, weight, and efficiency benefits crucial for mission-essential systems.

The company's specialized sensors for the automation sector, driven by Industry 4.0, are another Star. The global industrial automation market, valued at approximately $237.1 billion in 2023, is projected to reach $396.1 billion by 2028, with a CAGR of 10.8%. TT Electronics' sensors are designed for demanding, performance-critical roles, ensuring consistent demand.

TT Electronics' Defence and Combat Aircraft Components segment is a definitive Star, evidenced by multi-million-pound contracts for cable harness assemblies for combat aircraft and naval programs. The defense market, especially in Europe, is seeing increased investment, benefiting TT Electronics' high-demand, mission-critical components. Their strong relationships with major defense OEMs solidify their position.

| Segment | BCG Category | Key Growth Drivers | TT Electronics' Strength | Market Data (2023/2024 Estimates) |

|---|---|---|---|---|

| Medical Device Components | Star | Aging population, healthcare tech advancements | High-reliability, ISO 13485 certified components | Global medical device market projected to grow significantly |

| Aerospace & Defense Components | Star | Increased defense spending, next-gen aircraft development | Size, weight, and efficiency advantages in critical systems | European defense spending on the rise |

| Industrial Automation Sensors | Star | Industry 4.0, smart factory adoption | Precision, dependability in harsh environments | Industrial automation market valued at ~$237.1 billion |

| Defence & Combat Aircraft Components | Star | Geopolitical factors, increased defense investment | Multi-million-pound contracts, strong OEM relationships | Significant growth in European defense sector |

What is included in the product

TT Electronics BCG Matrix offers strategic insights into its product portfolio, highlighting which units to invest in, hold, or divest.

A clear, visual TT Electronics BCG Matrix quickly identifies underperforming units, alleviating the pain of wasted resources and strategic uncertainty.

Cash Cows

Standard industrial resistors and connectors within TT Electronics' portfolio likely function as cash cows. While the broader chip resistor market is experiencing moderate growth, these foundational components are essential across numerous industrial sectors, suggesting TT Electronics commands a substantial market share in these established product lines.

Their pervasive application in diverse industrial equipment ensures a consistent and predictable revenue stream. For instance, the global market for electronic components, which includes resistors and connectors, was projected to reach over $2.5 trillion by 2024, with industrial applications forming a significant portion.

Despite not being in high-growth segments, the enduring demand and TT Electronics' strong relationships with existing industrial customers translate into stable profitability and reliable cash flow generation, solidifying their cash cow status.

TT Electronics' legacy power supplies for general applications represent a classic cash cow within their portfolio. These products operate in a mature, low-growth market, yet they consistently deliver stable revenue thanks to their fundamental necessity in numerous industrial and commercial settings. The company's long-standing market presence ensures a reliable customer base for these essential components.

Capital allocation for this segment is strategically focused on efficiency improvements and production optimization, rather than significant expansion efforts. This approach maximizes profitability from an established product line. For instance, in 2024, TT Electronics reported that its power management division, which includes these legacy products, continued to be a significant contributor to overall revenue, demonstrating the enduring demand for reliable power solutions.

TT Electronics offers a wide range of basic circuit protection components, including fuses and overcurrent devices, catering to a large and stable market. These fundamental parts are critical for the operation of countless electronic systems.

While these foundational products are essential, they operate in a market characterized by lower growth and increasing commoditization when compared to more specialized electronic solutions. This means the demand is steady but not rapidly expanding.

TT Electronics holds a significant market share in these basic circuit protection components. This strong position allows the company to generate consistent cash flow, as these products require relatively low promotional investment to maintain their sales volume.

Standard Human Machine Interface (HMI) Solutions

TT Electronics' standard Human Machine Interface (HMI) solutions, such as control panel assemblies, are well-established products serving mature markets. These offerings are likely cash cows within the TT Electronics portfolio, generating consistent revenue due to their widespread adoption and long-standing customer relationships. The company's ability to deliver reliable, albeit not cutting-edge, HMI solutions in sectors with lengthy product lifecycles ensures a stable income stream.

These standard HMI products benefit from economies of scale in manufacturing and a predictable demand from industries with stable operational needs. For instance, TT Electronics reported that its Industrial Solutions segment, which includes many HMI applications, saw revenue growth in recent periods, underscoring the continued demand for these foundational components. The predictability of these revenue streams allows TT Electronics to allocate resources to more innovative, high-growth areas.

- Established Market Presence: Standard HMIs are prevalent in numerous industrial and commercial applications, offering a broad customer base.

- Predictable Revenue: Long design cycles and repeat business in mature markets contribute to consistent and reliable income.

- Operational Efficiency: Mature product lines often benefit from optimized manufacturing processes, leading to healthy profit margins.

- Foundation for Growth: The stable cash flow from these products supports investment in advanced HMI technologies and other R&D initiatives.

Mature Manufacturing Services (Non-NPI)

TT Electronics' Global Manufacturing Solutions, focusing on mature manufacturing services (non-NPI), acts as a cash cow within its business portfolio. These services, catering to established product lines and existing long-term contracts, are characterized by predictable demand and consistent revenue streams, minimizing the need for significant reinvestment in new product development.

The emphasis here is on optimizing operational efficiency and stringent cost management. This focus allows these mature manufacturing services to generate substantial and stable profits, directly contributing to TT Electronics' overall cash generation. For instance, in 2024, the company continued to leverage its expertise in these areas to secure and fulfill orders for well-established electronic components and assemblies, ensuring a reliable inflow of funds.

- Stable Revenue Generation: Mature manufacturing services benefit from predictable demand, ensuring consistent sales for established product lines.

- Profitability Through Efficiency: Operational excellence and cost control are key drivers of profitability in this segment.

- Cash Flow Contribution: These services are designed to be net cash generators, bolstering the company's financial reserves.

- Reduced R&D Burden: Unlike NPI, these services require minimal investment in research and development, further enhancing their cash-generating capacity.

TT Electronics' standard industrial resistors and connectors are prime examples of cash cows. These foundational components serve a vast array of industrial applications, ensuring a consistent and predictable revenue stream for the company. Their pervasive use across diverse equipment, coupled with TT Electronics' strong market share in these mature segments, translates into stable profitability and reliable cash flow generation, even in a moderately growing market.

The company's legacy power supplies for general applications also fit the cash cow profile. Operating in a low-growth, mature market, these products are essential across many industrial and commercial settings, providing a stable revenue base. TT Electronics' established market presence ensures a loyal customer base, and capital allocation focuses on optimizing efficiency rather than expansion, maximizing profits from this dependable product line.

Basic circuit protection components like fuses and overcurrent devices represent another cash cow category for TT Electronics. These essential parts are critical for countless electronic systems, operating within a large and stable market. Despite increasing commoditization, TT Electronics' significant market share allows for consistent cash flow generation with minimal promotional investment.

Standard Human Machine Interface (HMI) solutions, such as control panel assemblies, are well-established products in mature markets, acting as cash cows. Their widespread adoption and long-standing customer relationships generate consistent revenue. These standard HMIs benefit from manufacturing economies of scale and predictable demand, supporting investment in more advanced HMI technologies.

TT Electronics' Global Manufacturing Solutions, specifically those focused on mature manufacturing services (non-NPI), function as cash cows. These services, tied to established product lines and long-term contracts, offer predictable demand and consistent revenue with minimal reinvestment. The emphasis on operational efficiency and cost management in these areas ensures substantial and stable profits, bolstering the company's cash generation.

| Product Category | Market Characteristic | TT Electronics' Position | Cash Flow Contribution |

|---|---|---|---|

| Standard Industrial Resistors & Connectors | Mature, Moderate Growth | Significant Market Share | Stable & Predictable |

| Legacy Power Supplies (General Application) | Mature, Low Growth | Established Market Presence | Consistent Revenue |

| Basic Circuit Protection (Fuses, Overcurrent Devices) | Large, Stable, Increasing Commoditization | Significant Market Share | Consistent Cash Flow |

| Standard Human Machine Interface (HMI) Solutions | Mature Markets | Widespread Adoption, Long-Term Relationships | Stable Income Stream |

| Global Manufacturing Solutions (Non-NPI) | Mature Services, Long-Term Contracts | Operational Efficiency Focus | Substantial & Stable Profits |

What You See Is What You Get

TT Electronics BCG Matrix

The TT Electronics BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after completing your purchase. This means no watermarks, no demo content, and no hidden surprises – just the comprehensive strategic analysis ready for your immediate use. You can confidently assess the quality and content, knowing that the final file will be exactly as presented, enabling you to seamlessly integrate it into your business planning and decision-making processes.

Dogs

TT Electronics identified its North American commoditized basic component lines as a challenge within its portfolio. In 2024, the company recorded a substantial write-down for these segments, citing both weakened demand and internal operational issues. This suggests these product lines likely represent areas where TT Electronics holds a minor market position and competes fiercely, resulting in poor financial performance.

These commoditized offerings are characterized by low profitability, and potentially losses, due to intense market competition and the nature of the products themselves. TT Electronics is actively addressing these underperforming assets through a strategic initiative known as Project Dynamo, aiming to restructure and improve the situation.

Some of TT Electronics' older sensor product lines, those lacking advanced features or specialization for rapidly growing markets, could be classified as Dogs in the BCG Matrix. These products may be experiencing declining demand, potentially due to technological obsolescence as newer, more capable sensors emerge. For instance, basic analog sensors that were once standard might be replaced by digital or smart sensors in many applications.

The challenge with these Dog products is that continuing to invest in their development or even maintaining their production can divert resources from more promising areas. In 2024, the semiconductor industry, which heavily influences sensor technology, saw continued investment in AI-driven chip design and advanced materials, making older technologies even less competitive. TT Electronics would need to carefully assess the cost of maintaining these lines against their minimal market share and growth potential.

TT Electronics divested its operations in Cardiff, Hartlepool, and Dongguan during the first quarter of 2024. These particular business units reported a loss before tax in the period leading up to their sale.

The divestments suggest these were likely underperforming assets, characterized by limited market share within their respective industries. This strategic move aims to enhance the company's overall earnings quality and streamline its global operational structure.

By selling these units, TT Electronics freed up capital that was previously tied to these less productive operations, allowing for a more efficient allocation of resources towards growth areas.

Underperforming Manufacturing Sites (e.g., Cleveland, Kansas City)

TT Electronics' manufacturing sites in Cleveland and Kansas City are currently categorized as Dogs within its BCG Matrix. This designation stems from operational challenges and a less-than-ideal product portfolio at these North American locations. In 2024, these issues contributed to a substantial non-cash impairment of goodwill and fixed assets, highlighting their underperformance.

These specific sites exhibit both low market share and operational inefficiencies within markets that are experiencing slow growth or facing difficulties. Consequently, they consume valuable cash resources without generating sufficient returns to justify the investment.

- Operational Issues: Cleveland and Kansas City sites faced significant operational hurdles in 2024.

- Challenging Product Mix: A difficult product assortment further hampered performance.

- Financial Impact: These factors led to a non-cash impairment of goodwill and fixed assets totaling millions in 2024.

- Cash Drain: The sites consume cash with inadequate returns, impacting overall profitability.

While improvement plans are in motion for these locations, their current state represents a drag on TT Electronics' overall profitability. The company is actively working to address the underlying problems to turn these underperforming assets around.

Legacy Telecommunications/Computing Components

TT Electronics' legacy telecommunications and computing components, especially those designed for older infrastructure, are likely positioned as cash traps within the BCG matrix. These products operate in markets characterized by low growth and declining demand as technology advances and older hardware becomes obsolete. For instance, while the global telecom infrastructure market is projected to grow, the specific segment for legacy components faces contraction due to the shift towards 5G and newer networking standards.

These legacy offerings may represent a significant portion of TT Electronics' historical revenue but are now draining resources without offering substantial future growth potential. The company might be investing in maintaining production for these items, which yield diminishing returns as their market share erodes. This situation necessitates careful management to avoid continued investment in areas that do not align with future technological trends and market demands.

- Low Market Growth: The demand for components supporting outdated telecommunications and computing systems is steadily decreasing.

- Diminishing Returns: Continued investment in legacy product lines yields progressively smaller profits as the market shrinks.

- Eroding Market Share: As newer technologies emerge, TT Electronics' share in the legacy component market is likely to decline further.

- Resource Drain: These products can become cash traps, consuming capital and management attention that could be better allocated to growth areas.

TT Electronics' legacy sensor product lines and certain North American manufacturing sites, specifically Cleveland and Kansas City, are categorized as Dogs in their BCG Matrix. These segments are characterized by low market share, operational challenges, and declining demand, often due to technological obsolescence or intense competition. In 2024, these underperforming areas led to significant non-cash impairments of goodwill and fixed assets, underscoring their weak financial contribution.

These "Dog" segments, including divested units that reported losses prior to sale in early 2024, consume resources without generating substantial returns. The company's strategic initiative, Project Dynamo, aims to address these challenges, while divestments in 2024 freed up capital from less productive operations. The focus remains on reallocating resources to more promising growth areas within the portfolio.

| BCG Category | TT Electronics Examples | Characteristics | 2024 Impact |

|---|---|---|---|

| Dogs | Legacy Sensors, North American Sites (Cleveland, Kansas City) | Low market share, declining demand, operational issues, intense competition | Non-cash impairment of goodwill & fixed assets, cash drain |

| Dogs | Divested Operations (Cardiff, Hartlepool, Dongguan) | Reported losses before sale, limited market share | Capital freed up, improved earnings quality |

Question Marks

TT Electronics is strategically investing in advanced connectivity solutions, crucial for the burgeoning IoT and smart infrastructure sectors. These technologies facilitate wireless data transfer, forming the backbone of increasingly interconnected environments.

While the overall IoT market is experiencing robust growth, projected to reach $1.5 trillion by 2025, TT Electronics' current market share in specialized, advanced connectivity segments might be relatively small. This is typical for companies entering rapidly evolving, high-potential markets.

The development of these cutting-edge connectivity products demands substantial investment in research and development, alongside efforts to drive market adoption. For TT Electronics, these factors position its advanced connectivity solutions as potential Stars within the BCG matrix, requiring sustained focus to capture significant market share.

TT Electronics' exploration into next-generation optoelectronics for emerging applications aligns with its sustainability focus, potentially targeting high-growth sectors like advanced sensing for autonomous systems or medical diagnostics. These areas represent significant future opportunities, requiring substantial R&D investment to establish market presence.

TT Electronics' engagement in Advanced Air Mobility (AAM) through its Power Conversion sector positions it within a rapidly expanding, yet early-stage, market. This strategic move into AAM components, such as specialized power supplies and converters for eVTOLs and drones, taps into a sector projected for significant growth. For instance, the global AAM market was valued at approximately $12.1 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 30% through 2030, reaching an estimated $74.4 billion by then.

While the potential rewards are substantial, TT Electronics' current market share in this niche is likely modest. The company will need to invest heavily in research and development to create cutting-edge, reliable solutions that meet the stringent safety and performance requirements of future aerial vehicles. This investment is crucial for establishing a strong foothold and scaling production as the AAM industry matures and demand increases.

New Product Introduction (NPI) Centre of Excellence Ventures

TT Electronics' New Product Introduction (NPI) Centre of Excellence in Cleveland is a key driver for innovation, specializing in rapid prototyping and the smooth transition of new products into full-scale production. A prime example of their success is the collaboration on a neonatal care device, showcasing their ability to bring cutting-edge medical technology to market.

These NPI ventures, particularly those targeting high-growth sectors such as medical technology, are inherently positioned as 'Question Marks' within the BCG Matrix. This classification stems from their nascent market share, which is still under development, and the substantial investment in research and development resources they require. For instance, the medical electronics market, a key focus for TT Electronics, is projected to reach $77.4 billion in 2024, indicating significant growth potential but also intense competition for emerging products.

- Focus on High-Growth Markets: TT Electronics' NPI Centre of Excellence targets lucrative sectors like medical, which is experiencing robust expansion.

- 'Question Mark' Classification: New ventures in these markets are classified as 'Question Marks' due to their unproven market share and high resource consumption.

- Resource Intensive Development: Significant investment in R&D is characteristic of these NPI initiatives, aiming to establish a strong market foothold.

- Example in Neonatal Care: The successful development of a neonatal care device exemplifies the NPI Centre's capability in bringing advanced medical products to fruition.

Sustainable Technology Components for New Energy Markets

TT Electronics is strategically positioning itself to address the growing demand for sustainable technology components, particularly within emerging new energy markets. This focus extends beyond conventional electrification to encompass areas like green hydrogen production and advanced renewable energy solutions. These sectors represent significant future growth potential, aligning with TT Electronics' mission to solve technology challenges for a sustainable world.

While these nascent segments offer substantial opportunities, TT Electronics' current market share is likely modest, necessitating targeted investments. The company's approach to these high-growth, future-oriented markets will involve developing specialized components that can capture a meaningful portion of their evolving landscapes. For instance, in the burgeoning green hydrogen sector, key components might include advanced sensors for purity monitoring or high-reliability connectors for electrolyzer systems.

- Green Hydrogen Components: Development of specialized sensors for hydrogen purity, high-temperature resistant connectors for electrolyzers, and robust power management modules for fuel cell systems.

- Advanced Renewables: Focus on high-performance passive components for next-generation solar inverters, advanced materials for wind turbine control systems, and specialized sensors for tidal energy converters.

- Market Opportunity: The global green hydrogen market is projected to reach over $50 billion by 2030, while the renewable energy sector continues its rapid expansion, with solar and wind capacity additions consistently breaking records. For example, global renewable energy capacity additions reached a record 510 GW in 2023, a significant increase from previous years.

- Strategic Investment: TT Electronics will need to allocate capital for research and development, pilot projects, and potential acquisitions to establish a strong foothold in these specialized, fast-growing markets.

TT Electronics' new product introductions, particularly those targeting emerging sectors like medical technology, fit the 'Question Mark' profile in the BCG matrix. These initiatives require significant R&D investment due to their unproven market share and the need to establish a strong presence in competitive, high-growth areas. The medical electronics market, a key focus for TT, is projected to reach $77.4 billion in 2024, highlighting both the opportunity and the challenge.

These 'Question Marks' represent potential future Stars, but their success hinges on substantial capital allocation for development and market penetration. The company's NPI Centre of Excellence, exemplified by its work on neonatal care devices, demonstrates its capability to bring innovative medical technologies to market, a crucial step in transforming these 'Question Marks' into market leaders.

The strategic focus on these nascent, high-potential markets necessitates a careful balance of investment and risk. TT Electronics aims to leverage its R&D strengths to carve out market share, acknowledging that these ventures demand sustained resources to mature into profitable business segments.

The success of these 'Question Mark' products is vital for TT Electronics' long-term growth strategy, as they represent the company's commitment to innovation in rapidly evolving technological landscapes.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, industry growth rates, and competitive landscape analysis to provide a comprehensive view of business unit performance.