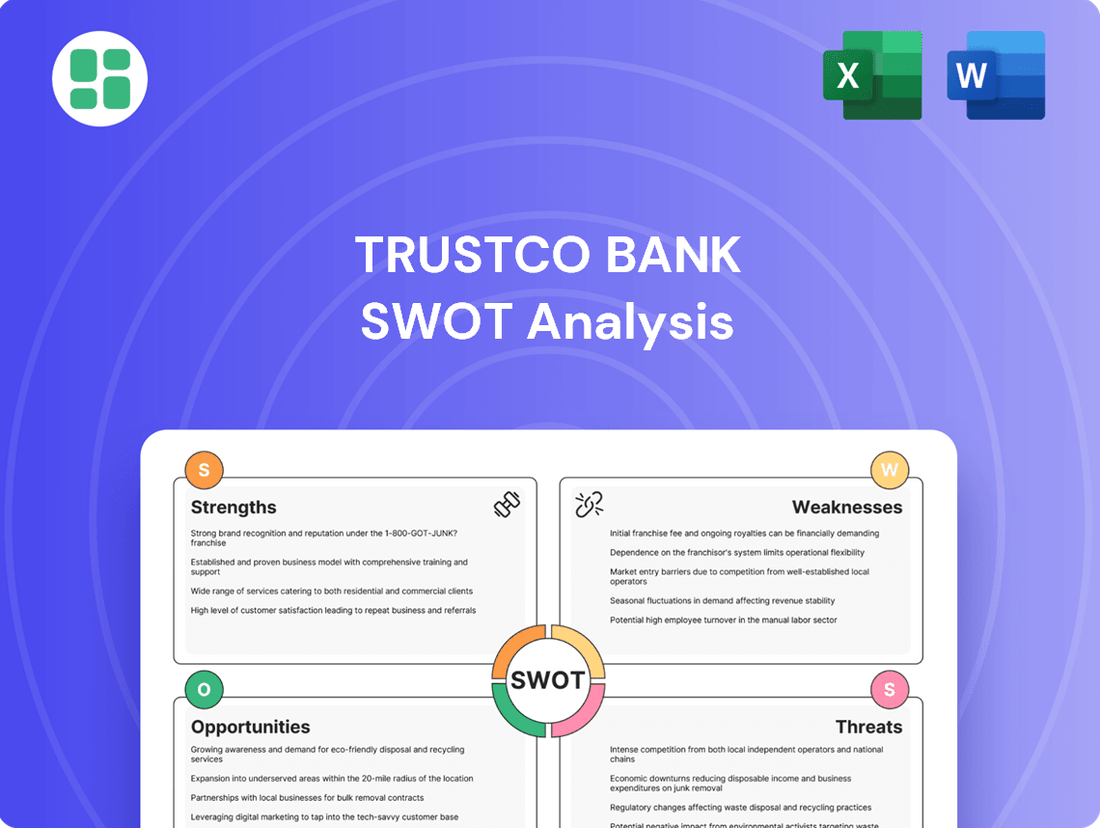

TrustCo Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TrustCo Bank Bundle

TrustCo Bank possesses significant strengths in its established customer base and regional brand recognition, but faces competitive pressures and evolving digital banking demands. Our comprehensive SWOT analysis delves into these crucial factors, providing a clear roadmap for strategic decision-making.

Want the full story behind TrustCo Bank’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

TrustCo Bank boasts a wide array of financial services, encompassing everything from basic deposit accounts to complex trust and investment management. This comprehensive approach means they're not just a place to save money; they also offer commercial, residential, and consumer loans, alongside wealth management. This diversification is key, as it spreads risk across different income sources.

The bank's strategy of offering a full spectrum of financial products significantly boosts customer loyalty. When clients can manage all their financial needs under one roof, they are less likely to look elsewhere. This integrated service model builds stronger, longer-lasting relationships.

Evidence of this success is clear in their Q1 and Q2 2025 performance. The wealth management and financial services divisions, in particular, experienced notable growth during this period. This indicates that their diversified offerings are not only attracting customers but are also proving to be profitable, contributing positively to the bank's overall financial health.

TrustCo Bank has showcased impressive financial results, with net income climbing 17.7% in the first quarter of 2025 and a further 19.8% in the second quarter of 2025 when compared to the same periods last year. This consistent growth highlights the bank's operational efficiency and market responsiveness.

The bank's capital position is equally robust, evidenced by its consolidated equity to assets ratio improving to 10.85% in Q1 2025 and 10.91% in Q2 2025. This upward trend signifies a strengthening balance sheet and a well-capitalized institution.

This strong financial health provides TrustCo Bank with the flexibility to pursue value-enhancing strategies, such as implementing stock repurchase programs. Such actions can further bolster shareholder returns and signal confidence in the bank's future prospects.

TrustCo Bank is experiencing robust expansion in its core banking operations, evident in the significant growth of both its loan and deposit portfolios. In the first half of 2025, average loans saw an impressive increase of over $100 million per quarter, culminating in an all-time high of $5.1 billion by Q2 2025. This surge is attributed to strong demand across residential, commercial, and home equity lending segments.

This healthy loan growth is complemented by a concurrent rise in average deposits, signaling increased customer trust and a solidifying funding base for the bank. The sustained upward trend in both key metrics highlights TrustCo Bank's effective strategies in attracting and retaining customer relationships, underpinning its financial stability and capacity for future lending.

Geographic Presence Across Multiple States

TrustCo Bank's geographic footprint is a significant strength, with 136 offices spread across New York, Florida, Massachusetts, New Jersey, and Vermont. This multi-state presence allows for a wider market reach and helps diversify economic risks that might impact a single-state institution.

This expansive network is crucial for TrustCo Bank's strategy of fostering deep customer relationships. By establishing a presence in these five states, the bank cultivates a stable deposit base, which is essential for supporting its ongoing loan growth initiatives.

- Wider Market Reach: Operates 136 branches across five states, increasing customer acquisition potential.

- Risk Diversification: Exposure to different state economies reduces reliance on a single economic environment.

- Stable Deposit Base: Multi-state presence supports a diversified and reliable source of funding for lending.

- Relationship Banking Focus: Geographic spread facilitates the cultivation of long-term customer relationships in key markets.

Strong Asset Quality and Risk Management

TrustCo Bank demonstrates robust asset quality, consistently reporting low levels of non-performing loans (NPLs) compared to its total loan portfolio. This reflects a disciplined approach to credit underwriting and ongoing risk monitoring.

The bank's commitment to effective risk management is highlighted by its NPL ratio, which stood at a mere 0.37% in the first quarter of 2025 and improved further to 0.35% by the second quarter of 2025. This downward trend signifies successful mitigation of credit risks.

- Low Non-Performing Loans: NPLs to total loans at 0.37% (Q1 2025) and 0.35% (Q2 2025).

- Effective Risk Management: Demonstrated by the declining NPL ratio.

- Adequate Loan Loss Reserves: The allowance for credit losses provides strong coverage for potential loan impairments.

TrustCo Bank's diversified financial services, from basic accounts to wealth management, create a strong, integrated customer experience. This comprehensive offering fosters loyalty and reduces customer churn. The bank's Q1 and Q2 2025 results show significant growth in wealth management and financial services, underscoring the profitability of this strategy.

The bank's financial performance is a key strength, with net income increasing by 17.7% in Q1 2025 and 19.8% in Q2 2025 year-over-year. This consistent growth, coupled with an improving equity to assets ratio (10.85% in Q1 2025 to 10.91% in Q2 2025), indicates strong operational efficiency and a robust capital position. This financial health allows for strategic actions like stock repurchases, further enhancing shareholder value.

TrustCo Bank's expanding core operations are a testament to its success, with average loans growing by over $100 million per quarter in the first half of 2025, reaching $5.1 billion by Q2 2025. This growth is supported by a corresponding increase in deposits, reflecting enhanced customer trust and a stable funding base for continued lending activities across various segments.

The bank's strategic geographic footprint, with 136 branches across New York, Florida, Massachusetts, New Jersey, and Vermont, provides a significant advantage. This multi-state presence broadens market reach, diversifies economic risk, and cultivates a stable, reliable deposit base essential for supporting ongoing loan growth initiatives.

TrustCo Bank demonstrates exceptional asset quality, maintaining very low non-performing loan (NPL) ratios. The NPL ratio was 0.37% in Q1 2025 and improved to 0.35% in Q2 2025, reflecting disciplined credit underwriting and effective risk management. This strong asset quality is further supported by adequate loan loss reserves, ensuring resilience against potential credit impairments.

| Metric | Q1 2025 | Q2 2025 | Significance |

| Net Income Growth (YoY) | 17.7% | 19.8% | Demonstrates strong profitability and market responsiveness. |

| Equity to Assets Ratio | 10.85% | 10.91% | Indicates a strengthening balance sheet and solid capitalization. |

| Average Loans (H1 2025) | ~$4.95 Billion (Q1 Est.) | $5.1 Billion (Q2) | Highlights robust growth in core lending operations. |

| NPL Ratio | 0.37% | 0.35% | Showcases effective credit risk management and asset quality. |

What is included in the product

Delivers a strategic overview of TrustCo Bank’s internal capabilities and external market dynamics.

Offers a clear, actionable roadmap by highlighting TrustCo Bank's competitive advantages and areas for improvement, simplifying strategic decision-making.

Weaknesses

TrustCo's deep roots in the traditional banking model, while historically a strength, could become a significant weakness. Its revenue generation is still heavily tied to net interest income from loans and deposits, a model that may struggle to keep pace with evolving customer demands for digital-first financial experiences.

TrustCo Bank's operational footprint is heavily weighted towards the Northeast and Florida. This significant geographic concentration means the bank's performance is closely tied to the economic health of these specific regions. For instance, a downturn in the housing market or a slowdown in key industries within these states could disproportionately impact TrustCo's loan portfolio and overall profitability.

TrustCo Bank's traditional banking model makes it susceptible to shifts in interest rates. While they've navigated recent rate increases effectively, a sharp downturn in rates could compress their net interest margin. For instance, if the Federal Reserve were to lower the federal funds rate significantly in late 2024 or 2025, TrustCo's profitability could be directly impacted if they cannot adjust their lending and deposit rates quickly enough.

Increased Non-Interest Expenses

TrustCo Bank has faced challenges with rising non-interest expenses in recent quarters, potentially impacting its efficiency ratio. For instance, in Q1 2024, non-interest expenses saw a slight uptick compared to the previous year, although management remains focused on cost control initiatives. Sustained increases in operational costs, such as technology investments and personnel, could pressure overall profitability if not managed effectively.

Key factors contributing to this trend include:

- Technology Investments: Ongoing upgrades to digital platforms and cybersecurity measures contribute to higher operating costs.

- Personnel Costs: Increases in staffing levels or compensation packages can also drive up non-interest expenses.

- Regulatory Compliance: Evolving regulatory requirements often necessitate additional spending on compliance and reporting.

Limited Residential Loan Growth in Some Periods

While TrustCo Bank has seen overall loan growth, there have been periods of limited expansion in its residential loan portfolio. This could point to increased competition or specific market challenges within the mortgage sector. For instance, in the first quarter of 2024, TrustCo reported total loans of $5.4 billion, with residential mortgages representing a significant portion, but growth in this specific segment may have lagged behind other loan types.

A strong and consistently growing residential mortgage book is often a cornerstone for community banks. Despite an increase in home equity lines of credit, a more diversified and robust residential mortgage offering is crucial for sustained performance. This segment is vital for attracting and retaining customers and for generating stable interest income.

- Limited Residential Mortgage Growth: Specific quarters have shown slower growth in residential mortgages compared to other loan categories.

- Competitive Pressures: This limitation may stem from intense competition within the mortgage lending market.

- Importance of Diversification: A robust residential mortgage portfolio is key for community bank stability and growth.

- Home Equity Line of Credit (HELOC) Strength: While HELOCs have shown positive trends, they don't fully compensate for potential weakness in the core mortgage market.

TrustCo's heavy reliance on traditional banking, particularly net interest income, may hinder its ability to adapt to digital-first customer expectations. This model could struggle to keep pace with evolving financial service demands, potentially alienating a growing segment of the market. The bank's concentrated geographic footprint in the Northeast and Florida also exposes it to regional economic fluctuations, impacting its loan portfolio and profitability.

| Metric | Q1 2024 | Q1 2023 | Change |

|---|---|---|---|

| Total Loans ($B) | 5.4 | 5.2 | +3.8% |

| Non-Interest Expense ($M) | 78.5 | 76.2 | +3.0% |

| Net Interest Margin (%) | 3.15 | 3.05 | +0.10 pp |

Full Version Awaits

TrustCo Bank SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of TrustCo Bank's strategic position.

This is a real excerpt from the complete document, showcasing the professional quality and structure you can expect. Once purchased, you’ll receive the full, editable version of the TrustCo Bank SWOT analysis.

Opportunities

TrustCo Bank can capitalize on the banking industry's digital shift by further strengthening its online and mobile platforms. This focus on digital transformation is a key opportunity to not only streamline operations but also to broaden its customer base, particularly among younger, digitally native consumers.

By investing in cutting-edge technologies, TrustCo can expect to see improvements in how efficiently it operates and how far its services can reach. This proactive approach to digital capabilities is already supporting the bank's loan growth objectives, indicating a positive trajectory for future expansion.

TrustCo Bank's strategic move into commercial lending, including its recent expansion into banking services for the cannabis industry, highlights a key opportunity. This diversification not only broadens its revenue streams but also taps into potentially high-yield markets.

Further growth in commercial lending, especially targeting high-growth sectors or underserved niche markets within its existing operational footprint, presents a significant avenue for TrustCo. For instance, as of Q1 2024, commercial and industrial loans represented a substantial portion of the U.S. banking sector's loan portfolio, indicating strong demand.

Expanding into these areas can improve the overall quality and yield of TrustCo's loan portfolio. By carefully selecting and managing these specialized loans, the bank can achieve greater profitability and resilience against economic fluctuations.

TrustCo Bank's strong capital base, evidenced by its Tier 1 Capital Ratio of 15.2% as of Q1 2024, positions it well for strategic acquisitions. Targeting smaller community banks or fintech companies could accelerate market share growth and enhance technological offerings, creating valuable inorganic expansion opportunities.

These acquisitions could broaden TrustCo's geographic reach beyond its current strongholds in upstate New York and New England, potentially tapping into new customer segments. For instance, acquiring a fintech firm with a robust digital lending platform could significantly boost its competitive edge in the rapidly evolving financial services landscape.

Growth in Wealth Management and Trust Services

The wealth management and financial services sector is experiencing robust expansion, evident in rising fee income and growing assets under management. TrustCo Bank can leverage this trend by extending its high-margin services, including retirement planning, investment management, and trust administration, to both its current customer base and new clientele. This strategic focus aligns with increasing consumer demand for comprehensive financial guidance.

For instance, in 2024, the U.S. wealth management industry saw significant inflows, with many firms reporting double-digit percentage increases in assets under management. TrustCo Bank's opportunity lies in capturing a larger share of this market.

- Increased Demand: Growing consumer need for retirement planning and investment solutions.

- High-Margin Services: Wealth management and trust services typically offer better profit margins than traditional banking.

- Client Deepening: Opportunity to offer more services to existing TrustCo Bank customers, increasing wallet share.

- Market Expansion: Potential to attract new clients seeking specialized financial advice and trust services.

Favorable Interest Rate Environment for Deposit Costs

As the Federal Reserve signals potential interest rate reductions in 2025, TrustCo Bank is positioned to benefit from a more favorable interest rate environment. This shift could allow the bank to manage its deposit costs more effectively, potentially lowering the expense associated with interest-bearing liabilities.

A decrease in interest rates typically translates to reduced funding costs for banks. For TrustCo, this presents an opportunity to improve its net interest margin (NIM), the difference between the interest income generated and the interest paid out to its lenders and depositors. For instance, if TrustCo's average cost of interest-bearing deposits were to decrease by 25 basis points due to rate cuts, this could directly bolster its profitability.

- Reduced Funding Costs: Lower benchmark rates can decrease the interest TrustCo pays on savings accounts, money market accounts, and certificates of deposit.

- Enhanced Net Interest Margin (NIM): A decline in deposit costs, if not matched by a proportional decrease in loan yields, would expand the NIM, boosting profitability.

- Competitive Deposit Pricing: A favorable rate environment allows TrustCo to offer more competitive deposit rates, potentially attracting new customers and retaining existing ones.

- Improved Loan Demand: Lower interest rates often stimulate borrowing, which could lead to increased loan origination for TrustCo, further supporting revenue growth.

TrustCo Bank can leverage the growing demand for specialized financial services by expanding its wealth management and trust offerings. This aligns with the increasing consumer need for retirement planning and investment solutions, which typically yield higher profit margins than traditional banking. By deepening relationships with existing customers and attracting new clients seeking expert financial advice, TrustCo can significantly increase its wallet share and market presence.

Threats

TrustCo Bank faces significant headwinds from larger national banks boasting greater capital and market reach, alongside agile fintech firms rapidly capturing market share with specialized digital offerings. For instance, as of Q1 2024, the top five U.S. banks controlled over 50% of total industry assets, highlighting the scale disadvantage TrustCo contends with. This intense rivalry puts pressure on TrustCo to innovate and differentiate, potentially impacting customer acquisition and retention, especially among younger, digitally-oriented demographics, and squeezing profit margins.

Economic slowdowns or recessions in TrustCo Bank's core markets, the Northeast and Florida, pose a significant threat. Such downturns can directly impact borrowers, leading to higher loan default rates and a subsequent increase in non-performing loans for the bank.

While TrustCo Bank has historically maintained strong asset quality, a severe economic contraction could test this resilience. A substantial economic contraction, potentially impacting consumer spending and business investment, could challenge the bank's credit quality metrics and overall profitability.

For instance, if the US experiences a recession similar to the 2008 financial crisis, where GDP contracted by 4.3% in 2009, banks often see a sharp rise in loan loss provisions. In such a scenario, TrustCo Bank's net interest margin could be squeezed, and its ability to generate income from its loan portfolio would be directly affected.

TrustCo Bank, like all financial institutions, faces the ongoing challenge of navigating evolving regulatory landscapes. For instance, the U.S. banking sector saw significant regulatory attention in 2023 and 2024, with increased scrutiny on capital requirements and risk management following regional bank failures. These changes, including potential new rules on liquidity and stress testing, can directly increase TrustCo's compliance costs and operational complexity, potentially impacting profitability.

Cybersecurity Risks and Data Breaches

As a financial institution, TrustCo Bank faces significant cybersecurity risks, making it a prime target for cyberattacks and data breaches. The potential fallout from such incidents is substantial, encompassing not only considerable financial losses but also severe reputational damage and a critical erosion of customer trust. For instance, in 2023, the financial sector experienced a notable increase in ransomware attacks, with some institutions reporting millions in recovery costs and lost operational time.

The continuous need to invest in robust cybersecurity measures represents an ongoing and substantial operational cost for TrustCo Bank. These investments are crucial to protect sensitive customer data and maintain the integrity of financial transactions. The global average cost of a data breach in the financial sector reached $5.90 million in 2023, highlighting the significant financial commitment required to mitigate these threats effectively.

- Increased Sophistication of Cyber Threats: Attackers are constantly evolving their methods, requiring ongoing vigilance and adaptation of security protocols.

- Regulatory Compliance and Fines: Non-compliance with data protection regulations, such as GDPR or CCPA, can result in hefty fines, further exacerbating financial losses from a breach.

- Impact on Customer Loyalty: A data breach can severely damage customer confidence, leading to account closures and a long-term loss of business.

Fluctuations in Real Estate Markets

TrustCo Bank's significant exposure to residential and commercial real estate loans, a cornerstone of its portfolio, makes it particularly vulnerable to market shifts. For instance, in early 2024, national housing market forecasts indicated a potential slowdown in price appreciation, with some regions experiencing modest declines, directly impacting the collateral value of TrustCo's loans.

This volatility can translate into increased loan losses if borrowers default and the collateral value is insufficient to cover outstanding balances. Furthermore, a weakening real estate market typically dampens demand for new mortgages and commercial property financing, directly affecting TrustCo's future loan origination volumes and overall profitability.

- Real Estate Loan Concentration: A substantial portion of TrustCo's assets are tied to real estate, making it sensitive to market downturns.

- Collateral Value Erosion: Fluctuations can decrease the value of properties securing loans, increasing risk for the bank.

- Increased Loan Losses: Market volatility can lead to higher rates of default and subsequent losses on real estate loans.

- Reduced Loan Demand: A softening real estate market typically lowers demand for new mortgage and commercial lending.

TrustCo Bank faces intense competition from larger national banks and nimble fintech companies, which can pressure its market share and profit margins. For example, in Q1 2024, the top five U.S. banks held over 50% of industry assets, illustrating TrustCo's scale disadvantage. Additionally, economic downturns in its key markets, the Northeast and Florida, could lead to higher loan defaults and impact its asset quality metrics.

| Threat Category | Specific Risk | Impact on TrustCo Bank | Supporting Data/Context (2023-2024) |

|---|---|---|---|

| Competitive Landscape | Market Share Erosion by Larger Banks & Fintechs | Reduced customer acquisition, retention, and potential margin compression. | Top 5 U.S. banks held >50% of industry assets in Q1 2024. Fintechs continue to gain traction in specialized lending and payments. |

| Economic Conditions | Recessionary Pressures in Northeast & Florida | Increased loan defaults, higher non-performing loans, and reduced net interest margins. | A recession similar to 2008 (4.3% GDP contraction) could significantly increase loan loss provisions. |

| Regulatory Environment | Evolving Compliance Requirements | Increased operational costs, complexity, and potential impact on profitability. | Increased scrutiny on capital and risk management in 2023-2024 following regional bank failures. |

| Cybersecurity | Data Breaches & Cyberattacks | Financial losses, reputational damage, and erosion of customer trust. | Ransomware attacks in the financial sector increased in 2023, with average data breach costs reaching $5.90 million globally. |

| Real Estate Market Volatility | Concentration in Real Estate Loans | Increased loan losses due to collateral value erosion and reduced loan origination. | National housing forecasts for early 2024 indicated potential slowdowns in price appreciation, impacting collateral values. |

SWOT Analysis Data Sources

This TrustCo Bank SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to ensure a robust and insightful assessment.