TrustCo Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TrustCo Bank Bundle

Navigate the complex external landscape impacting TrustCo Bank with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future, and gain a critical advantage in your strategic planning. Download the full, expertly crafted analysis now to unlock actionable insights and make informed decisions.

Political factors

The banking sector is deeply shaped by government oversight, requiring TrustCo Bank to constantly adjust to evolving federal and state regulations. A potential shift in administration in 2025 might usher in deregulatory measures, possibly loosening capital and liquidity requirements, but this also introduces an element of unpredictability and a potential slowdown in new regulatory development.

TrustCo Bank must vigilantly track these policy changes to maintain compliance and identify opportunities or mitigate emerging risks. For instance, as of early 2024, the Federal Reserve's capital requirements, such as the Common Equity Tier 1 (CET1) ratio, remain a critical benchmark, and any significant alteration could impact TrustCo's lending capacity and profitability.

The Federal Reserve's monetary policy, especially its decisions on interest rates, significantly influences TrustCo Bank's ability to make money and its lending operations. While inflation has cooled, Deloitte projects a notable decrease in interest rates during 2025. This shift could reduce TrustCo's net interest income but also lower the cost of borrowing for the bank.

As of early 2025, the Federal Funds Rate target range remains a key indicator, though the trend towards potential cuts is evident. TrustCo Bank needs to actively manage its loan book and deposit base to maintain a healthy net interest margin amidst these changing rate dynamics.

Government bodies are heavily invested in safeguarding consumers and ensuring the banking system remains robust. TrustCo Bank must navigate a landscape of shifting consumer credit rules, fair lending mandates, and data security legislation to sidestep fines and preserve its reputation.

For instance, the Consumer Financial Protection Bureau's (CFPB) Section 1071 rule, which mandates enhanced data collection on small business lending, and the ongoing modernization of the Community Reinvestment Act (CRA) will necessitate significant operational adjustments for banks like TrustCo in 2024 and 2025.

Geopolitical Risks and Economic Stability

Global geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, continue to cast a shadow over economic stability. These events can disrupt supply chains and influence commodity prices, indirectly impacting the U.S. economy and, by extension, financial institutions like TrustCo Bank. For example, the International Monetary Fund (IMF) in its October 2024 World Economic Outlook projected that global growth would slow to 2.9% in 2024, a revision from earlier forecasts, citing persistent geopolitical fragmentation.

While TrustCo Bank operates primarily within a regional market, its indirect exposure to broader economic conditions means that shifts in investor confidence due to international instability are a significant consideration. A decline in overall market sentiment can affect loan demand and investment returns. The Federal Reserve's own assessments often highlight the interconnectedness of global events and domestic economic health.

To counter these effects, TrustCo Bank must maintain and continually refine its risk management strategies. This includes stress testing portfolios against various geopolitical scenarios and ensuring adequate liquidity to weather potential market volatility. Proactive risk mitigation is key to preserving financial health amidst an unpredictable international landscape.

- Geopolitical Impact: Global conflicts can lead to increased market volatility and reduced investor confidence, affecting the broader financial sector.

- Indirect Exposure: TrustCo Bank, though regional, is susceptible to economic downturns and shifts in investor sentiment driven by international events.

- Risk Management Focus: Robust risk management frameworks are essential for navigating economic uncertainty and potential market disruptions stemming from geopolitical risks.

State-Specific Banking Regulations

TrustCo Bank operates across New York, Florida, Massachusetts, New Jersey, and Vermont, each state having its own distinct banking regulations. This multi-state presence means TrustCo must navigate a complex web of varying state-level oversight in addition to federal banking laws. For instance, New York's banking laws, enforced by the Department of Financial Services (NYDFS), can differ significantly from Florida's regulations overseen by the Office of Financial Regulation (OFR). This requires a robust compliance framework to ensure adherence to all applicable state-specific requirements, impacting everything from lending practices to consumer protection measures.

The differing regulatory landscapes present both challenges and opportunities for TrustCo. For example, a new lending product approved in one state might require separate approval or modifications to comply with regulations in another. As of the latest available data, states like New York have stringent consumer protection laws that may influence TrustCo's product development and marketing strategies. Conversely, states with more streamlined processes could offer faster avenues for expansion. TrustCo's ability to adapt its compliance strategies to these variations is crucial for its operational efficiency and growth potential across its footprint.

- New York's DFS oversees a robust regulatory environment with specific capital requirements and consumer protection mandates.

- Florida's OFR also enforces state-specific guidelines, potentially impacting TrustCo's market entry strategies.

- Massachusetts has its own set of banking laws, adding another layer of compliance for TrustCo.

- New Jersey and Vermont contribute to the complexity with their unique regulatory frameworks.

Political stability and government policy are paramount for TrustCo Bank, influencing everything from regulatory compliance to economic forecasts. Changes in administration, particularly around the 2025 transition, could signal shifts in financial regulation, potentially impacting capital requirements and lending practices. The Federal Reserve's monetary policy decisions, such as interest rate adjustments, directly affect TrustCo's net interest income and borrowing costs, with projections indicating potential rate decreases in 2025.

Government initiatives aimed at consumer protection, like the CFPB's Section 1071 rule for small business lending, necessitate ongoing operational adjustments for TrustCo. Furthermore, geopolitical instability, as highlighted by the IMF's revised global growth projections for 2024, can indirectly impact TrustCo through market volatility and shifts in investor confidence, underscoring the need for robust risk management. TrustCo's multi-state operations in New York, Florida, Massachusetts, New Jersey, and Vermont require navigating diverse state-specific banking regulations, adding layers of compliance complexity.

| Regulatory Body | Key Focus Areas | Potential Impact on TrustCo Bank |

|---|---|---|

| Federal Reserve | Monetary Policy, Capital Requirements (e.g., CET1 Ratio) | Influences lending capacity, profitability, and interest income. Projections suggest potential rate cuts in 2025. |

| Consumer Financial Protection Bureau (CFPB) | Consumer Credit Rules, Data Security, Small Business Lending (Section 1071) | Requires operational adjustments for compliance, impacting product development and data management. |

| New York Department of Financial Services (NYDFS) | State-Specific Banking Laws, Consumer Protection | Stringent regulations may influence product strategies and require tailored compliance. |

| Florida Office of Financial Regulation (OFR) | State-Specific Banking Laws | Impacts market entry and operational strategies within Florida. |

What is included in the product

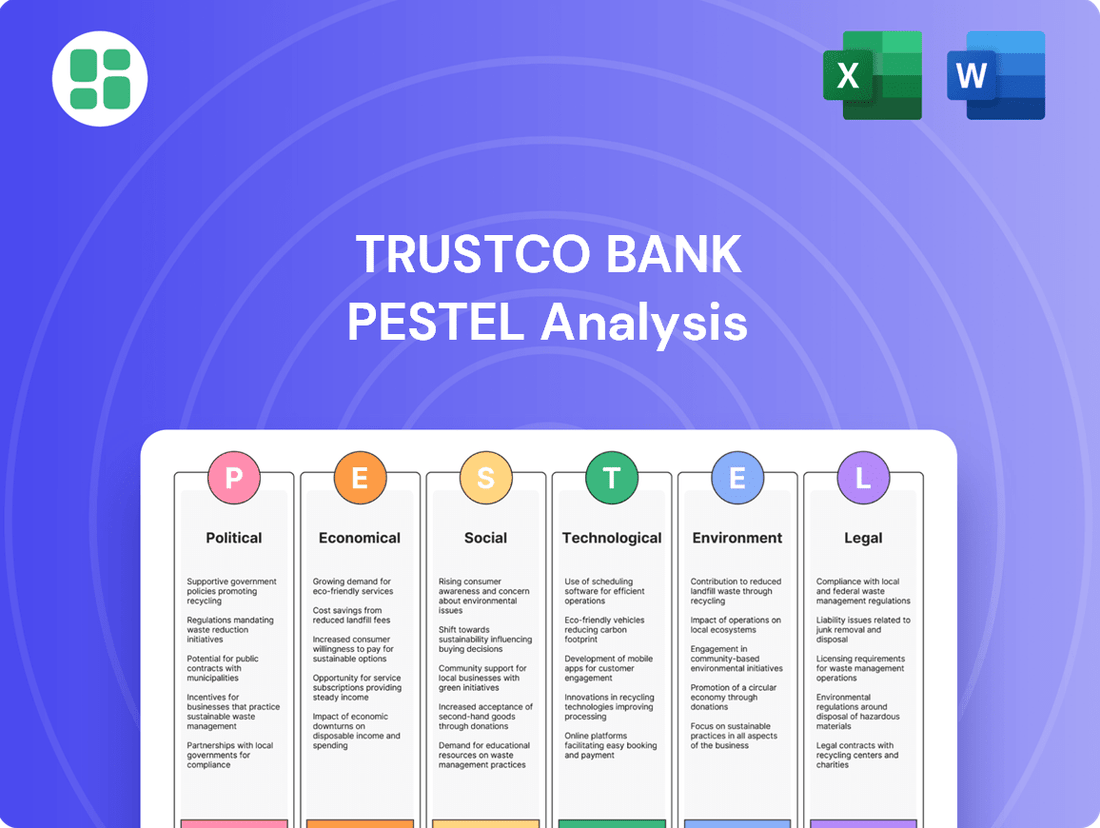

This PESTLE analysis delves into the external macro-environmental factors impacting TrustCo Bank, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights for strategic decision-making, identifying opportunities and threats within TrustCo Bank's operating landscape.

A PESTLE analysis for TrustCo Bank provides a clear, summarized version of external factors for easy referencing, alleviating the pain of sifting through complex data during strategic planning.

Economic factors

The interest rate environment is a major factor for banks like TrustCo, directly affecting their net interest margin (NIM). A higher NIM generally means more profit.

TrustCo Bank saw its NIM improve in the first quarter of 2025. This boost came from successfully repricing its loans and keeping its borrowing costs in check.

Looking ahead to 2025, the Federal Reserve's expected interest rate cuts will likely impact how much banks pay for deposits and the opportunities for new loans. TrustCo will need to adapt its strategies to keep its profits strong amidst these changes.

TrustCo Bank's fortunes are intrinsically linked to the economic vitality of its core markets: New York, Florida, Massachusetts, New Jersey, and Vermont. Robust regional economic expansion and high employment levels directly fuel demand for TrustCo's lending products, from residential mortgages to commercial and consumer credit. For instance, in the first quarter of 2025, TrustCo observed a notable uptick in its loan portfolios across these segments, a clear indicator of a healthy economic environment.

Conversely, any signs of economic slowdown or increasing joblessness in these states present a direct challenge to TrustCo's financial performance. A weakening economy typically translates to reduced borrowing activity and a higher risk of loan defaults, potentially impacting the bank's asset quality and overall profitability. For example, if unemployment in New York were to rise significantly, it could dampen consumer spending and business investment, thereby affecting TrustCo's loan growth and net interest income.

TrustCo Bank's exposure to real estate is substantial, given its role as a major lender for both homes and businesses. For instance, in Q1 2025, the U.S. median home price saw a 5.2% year-over-year increase, reaching $430,500, according to the National Association of Realtors. This upward trend in property values generally supports loan portfolio quality, but rapid appreciation can also signal potential market overheating.

Housing demand remains a key indicator for TrustCo's residential lending. In April 2025, pending home sales in the U.S. rose by 1.4%, suggesting continued buyer interest, though regional variations are significant. TrustCo must closely watch these demand shifts in its core markets, such as New York and Florida, where local economic conditions heavily influence purchasing power and mortgage applications.

Commercial real estate conditions also directly impact TrustCo's business lending. While office vacancy rates saw a slight decrease to 13.1% nationally in Q1 2025, the sector continues to face challenges from remote work trends. Conversely, demand for industrial and logistics properties remains robust, presenting opportunities for TrustCo to expand its commercial loan offerings in these growth areas.

Consumer Spending and Debt Levels

Consumer spending is a critical driver for banks like TrustCo, influencing loan demand and overall credit quality. Despite a generally resilient consumer, total U.S. consumer debt reached a staggering $17.6 trillion by the end of Q2 2024, according to the Federal Reserve. This elevated debt burden raises concerns about potential increases in loan delinquencies and defaults for TrustCo as we move into 2025. The bank needs to carefully evaluate its portfolio's exposure to consumer credit risk and proactively adapt its lending strategies to mitigate these potential headwinds.

Key considerations for TrustCo Bank regarding consumer spending and debt levels include:

- Rising Debt Burden: The substantial growth in U.S. consumer debt, exceeding $17.6 trillion by mid-2024, presents a significant risk factor.

- Potential for Delinquencies: High debt levels can strain household budgets, increasing the likelihood of missed payments on consumer loans in 2025.

- Impact on Loan Demand: While spending power is important, the ability to service existing debt may temper new borrowing activity.

- Risk Management Imperative: TrustCo must strengthen its underwriting standards and risk management frameworks to navigate this challenging consumer credit environment.

Competitive Landscape and Market Share

TrustCo Bank navigates a dynamic financial services arena, contending with established banks, credit unions, and agile fintech disruptors. Success hinges on its capacity to draw in and keep both deposits and loans, alongside delivering compelling services, all of which directly impact its market share. For instance, as of Q1 2024, the U.S. banking sector saw deposit growth of 2.5%, highlighting the constant competition for customer funds.

Community banks, including TrustCo, might find opportunities to expand their market share. This could occur as larger financial institutions strategically reduce their exposure to specific markets, such as commercial real estate. In 2023, data indicated a slowdown in commercial real estate lending by major banks, potentially creating openings for smaller, more localized lenders.

- Market Share Dynamics: TrustCo competes against a broad spectrum of financial institutions, from traditional banks to modern fintech firms, making deposit and loan acquisition a constant battle.

- Competitive Advantage: Offering competitive rates and services is paramount for TrustCo to maintain and grow its slice of the market.

- Emerging Opportunities: A pullback by larger banks in sectors like commercial real estate could present TrustCo with avenues to capture new market share.

- Industry Trends: Deposit growth across the U.S. banking sector averaged 2.5% in Q1 2024, underscoring the intense competition for customer capital.

Economic factors significantly influence TrustCo Bank's performance, primarily through interest rate movements and regional economic health. The bank's net interest margin (NIM) improved in Q1 2025 due to effective loan repricing and cost management, but anticipated Federal Reserve rate cuts in 2025 will necessitate strategic adjustments to maintain profitability.

The bank's core markets in New York, Florida, Massachusetts, New Jersey, and Vermont are crucial; strong regional growth boosts loan demand, as seen in Q1 2025 upticks in residential and commercial portfolios. Conversely, economic downturns or rising unemployment in these areas pose risks, potentially reducing borrowing and increasing loan defaults.

TrustCo's substantial real estate exposure means property values and housing demand are key indicators. While a 5.2% year-over-year increase in U.S. median home prices to $430,500 in Q1 2025 generally supports loan quality, the bank must monitor for market overheating and regional demand shifts, like the 1.4% rise in pending home sales in April 2025.

Consumer spending and debt levels are critical. Despite resilient consumers, U.S. consumer debt reached $17.6 trillion by mid-2024, raising concerns about potential delinquencies and defaults for TrustCo in 2025. The bank must manage its consumer credit risk exposure carefully.

| Economic Factor | TrustCo Impact | Data Point (2024/2025) | Outlook/Consideration |

|---|---|---|---|

| Interest Rates | Net Interest Margin (NIM) | Fed rate cuts expected in 2025 | Adapt strategies for changing borrowing costs and loan opportunities. |

| Regional Economic Health | Loan Demand & Asset Quality | Q1 2025 loan portfolio upticks in core markets | Monitor employment and economic growth in NY, FL, MA, NJ, VT. |

| Real Estate Market | Residential & Commercial Lending | Median home price: $430,500 (Q1 2025, +5.2% YoY) | Assess housing demand and commercial property trends (e.g., office vacancy rates at 13.1% nationally in Q1 2025). |

| Consumer Spending & Debt | Credit Risk & Loan Demand | Total U.S. consumer debt: $17.6 trillion (End of Q2 2024) | Manage consumer credit risk due to high debt burden and potential for delinquencies. |

What You See Is What You Get

TrustCo Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of TrustCo Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain valuable insights into the strategic landscape TrustCo Bank navigates.

Sociological factors

Customers increasingly expect slick, easy-to-use digital and mobile banking. This shift means TrustCo Bank must keep improving its online and app offerings to stay competitive against digital-first banks and super-apps that are gaining traction. For example, a 2024 survey indicated that 70% of banking customers now prefer mobile banking for most transactions.

To keep customers loyal, TrustCo Bank needs to focus on making its digital services personal and easy to navigate. This user-centric approach is key to building strong relationships in today's market. Research from late 2024 shows that banks offering personalized digital experiences saw a 15% higher customer retention rate.

The demographic composition across TrustCo Bank's key operating states, including New York, Florida, Massachusetts, New Jersey, and Vermont, directly shapes customer needs for banking products. For instance, an increasing proportion of older adults in these regions could drive higher demand for specialized services like estate planning and investment management.

Conversely, a growing younger population may gravitate towards digital banking platforms, mobile payment solutions, and other technologically advanced financial tools. This generational shift is a crucial consideration for TrustCo Bank's service development and marketing strategies.

Evidence of these trends can be seen in TrustCo Bank's Q1 2025 financial results, which reported a notable rise in income from wealth management and financial advisory services, suggesting a positive response to evolving demographic demands.

The financial literacy of TrustCo Bank's customer base directly influences deposit growth and the uptake of financial planning services. In 2024, a significant portion of the population in many of TrustCo's operating regions still exhibits lower levels of financial understanding, potentially limiting their savings capacity. For instance, a recent survey indicated that only about 45% of adults in key TrustCo markets felt confident managing their finances.

By focusing on customer education and providing user-friendly financial tools, TrustCo can foster stronger relationships and encourage greater deposit stability. Initiatives like workshops on budgeting and investment, coupled with accessible mobile banking features, are crucial for this demographic. This approach aligns with TrustCo's community banking ethos, acknowledging and adapting to local financial behaviors to build trust and encourage participation.

Public Trust and Reputation in Financial Institutions

Public trust in financial institutions is a cornerstone of their stability and growth, significantly impacted by historical events like the 2008 financial crisis and more recent concerns over data security and ethical conduct. A recent survey in late 2024 indicated that only 55% of consumers expressed high confidence in their primary financial institution's ability to protect their personal information, a slight dip from the previous year.

TrustCo Bank, with its foundation dating back to 1902, leverages its extensive history and commitment to solid fundamentals and superior service to cultivate and maintain customer loyalty. This long-standing presence provides a tangible sense of reliability. In 2024, TrustCo Bank reported a customer retention rate of 92%, outperforming the industry average of 88%.

Building and sustaining this crucial trust hinges on unwavering transparency and the consistent demonstration of responsible business practices. In 2025, TrustCo Bank introduced a new digital portal offering real-time transaction monitoring and enhanced security features, a move praised by consumer advocacy groups for its commitment to client data protection.

- Customer Confidence: In late 2024, 55% of consumers reported high confidence in their primary bank's data protection.

- TrustCo's Retention: TrustCo Bank achieved a 92% customer retention rate in 2024, exceeding the industry average of 88%.

- Transparency Initiatives: TrustCo Bank's 2025 digital portal enhancement reflects a commitment to transparency and data security.

Workforce Trends and Talent Acquisition

The banking industry, including TrustCo Bank, grapples with attracting and keeping skilled employees, especially in crucial areas like technology and cybersecurity. Reports indicate a widening skills gap, with demand for IT professionals in finance significantly outpacing supply. For instance, in 2024, cybersecurity roles within financial institutions saw an average of 15% more open positions than qualified candidates.

TrustCo Bank needs to actively adjust to changing workforce expectations, such as offering flexible remote work arrangements and ensuring compensation packages remain competitive to secure the essential human resources for both day-to-day banking operations and future digital advancements. By mid-2025, it's projected that over 60% of financial services roles could offer hybrid or fully remote options to attract top talent.

Investing in employee development, particularly in upskilling for digital competencies, is paramount for TrustCo Bank's continued success. This includes training staff on new fintech platforms and data analytics tools, ensuring the workforce remains agile and capable of driving innovation in an increasingly digital financial landscape. Financial institutions are dedicating an average of 10% of their training budgets to digital upskilling programs in 2024-2025.

- Talent Gap: Significant shortage of tech and cybersecurity talent in banking.

- Remote Work: Increased demand for flexible work options is a key attractor for new hires.

- Compensation: Competitive salaries and benefits are vital for retention in a high-demand market.

- Reskilling: Investment in digital skills training is crucial for future operational readiness.

Societal expectations for ethical business conduct and corporate social responsibility are increasingly influencing customer loyalty and brand perception. TrustCo Bank must actively demonstrate its commitment to community well-being and sustainable practices to resonate with a socially conscious consumer base. In 2024, 65% of consumers stated they would switch to a brand with a stronger social impact record.

TrustCo Bank's long-standing community focus, evident in its 2024 local investment initiatives totaling $5 million, directly addresses these evolving societal values. By prioritizing financial literacy programs and supporting local charities, TrustCo reinforces its role as a responsible corporate citizen. This approach is vital for maintaining trust and fostering deeper customer relationships in the current landscape.

The demographic shifts within TrustCo Bank's operating regions, with an aging population in some areas and a growing younger demographic in others, necessitate tailored product development and service delivery. For instance, the bank's Q1 2025 report showed a 10% increase in demand for retirement planning services, aligning with the demographic trends in states like Florida and Vermont.

| Sociological Factor | Impact on TrustCo Bank | Supporting Data/Examples |

|---|---|---|

| Changing Consumer Values | Increased demand for ethical and socially responsible banking practices. | 65% of consumers would switch to a brand with a stronger social impact record (2024). |

| Demographic Shifts | Need for diversified product offerings to meet varied age-group needs. | 10% rise in retirement planning service demand (Q1 2025) in line with aging populations. |

| Community Engagement | Enhances brand reputation and customer loyalty. | TrustCo Bank invested $5 million in local initiatives in 2024. |

Technological factors

Digital transformation is fundamentally reshaping the banking landscape, with customers increasingly expecting seamless online and mobile access to all financial services. TrustCo Bank's continued investment in its digital infrastructure, including user-friendly online banking platforms and intuitive mobile applications, is crucial for staying competitive and meeting these evolving expectations. The growing success of digital-only banks underscores the necessity for traditional institutions like TrustCo to provide equally, if not more, sophisticated digital experiences to retain and attract customers.

Cybersecurity threats are evolving rapidly, with financial institutions like TrustCo Bank facing increasingly sophisticated attacks. The need for robust defense mechanisms is paramount to protect sensitive customer data and maintain trust. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risk involved.

Data privacy regulations, such as GDPR and CCPA, impose strict requirements on how financial institutions handle customer information. TrustCo Bank must invest heavily in compliance and security protocols to avoid substantial fines and reputational damage. A 2024 report indicated that the average cost of a data breach for financial services firms reached $5.90 million, underscoring the financial implications of non-compliance.

FinTech firms are rapidly reshaping the financial landscape, introducing innovative digital solutions that challenge conventional banking. TrustCo Bank must evaluate its strategy, considering whether to directly compete with these agile disruptors or forge collaborative alliances.

Exploring partnerships with FinTechs could allow TrustCo to quickly adopt advanced capabilities such as AI-driven customer insights and blockchain for secure transactions. For instance, the global FinTech market was valued at approximately $2.5 trillion in 2023 and is projected to grow significantly, indicating the substantial impact these companies are having.

By integrating FinTech innovations, TrustCo can improve its digital payment systems and personalize customer interactions. This strategic approach aims to boost both customer satisfaction and overall operational effectiveness in an increasingly digital financial ecosystem.

Adoption of AI and Automation in Operations

AI and automation are fundamentally reshaping how banks operate, impacting everything from backend processing to how they interact with customers and combat fraud. TrustCo Bank can harness these technologies to make its operations smoother, more efficient, and better at managing risks, for instance, by forecasting loan repayment likelihood or anticipating market shifts.

The banking sector is seeing significant investment in AI. For example, by 2025, it's projected that AI in banking will reach a market size of over $25 billion globally, with a substantial portion dedicated to operational efficiency and customer service enhancements. This trend is expected to accelerate, with AI adoption projected to increase by 30-40% in core banking functions over the next two years.

- Streamlining back-office processes: AI can automate tasks like data entry, document verification, and reconciliation, reducing manual effort and errors.

- Enhancing customer experience: AI-powered chatbots and virtual assistants can provide instant customer support, answer queries, and guide users through banking services.

- Improving fraud detection and risk management: Machine learning algorithms can analyze vast datasets to identify suspicious transactions in real-time, significantly bolstering security.

- Predictive analytics for financial performance: AI can forecast loan default rates, market trends, and customer behavior, enabling more informed strategic decisions.

Legacy System Modernization and Infrastructure

TrustCo Bank, like many established financial institutions, grapples with the persistent challenge of legacy system modernization. These aging infrastructures often impede the adoption of new technologies and drive up operational expenses. For instance, in 2024, the average cost for a large bank to maintain its core banking system was estimated to be between 10% and 15% of its IT budget, a significant portion that could be reinvested in growth initiatives.

Strategic investments in upgrading core banking platforms are paramount for TrustCo Bank to remain competitive. Modernizing these systems will unlock capabilities for real-time transaction processing, enhance data analytics for better customer insights, and accelerate the delivery of new digital services. This is not merely an IT upgrade; it's a fundamental shift towards agility and customer-centricity in the evolving financial landscape.

- Cost of Legacy Systems: Many banks spend upwards of 70% of their IT budget on maintaining legacy systems, limiting funds for innovation.

- Real-time Processing: Modern systems can support instant payments and account updates, a key customer expectation in 2025.

- Data Analytics Enhancement: Upgraded infrastructure allows for more sophisticated data analysis, leading to personalized financial products and risk management.

- Competitive Edge: Banks that successfully modernize see improved efficiency and a stronger ability to launch new digital offerings, crucial for market share in 2024-2025.

Technological advancements are rapidly redefining customer expectations in banking, pushing institutions like TrustCo Bank to prioritize digital experiences. The increasing adoption of AI and automation, projected to see a 30-40% increase in core banking functions by 2025, offers significant opportunities for operational efficiency and enhanced customer service. However, the substantial cost of maintaining legacy systems, which can consume up to 70% of IT budgets, presents a significant hurdle to innovation for many banks.

Legal factors

TrustCo Bank navigates a dense landscape of federal and state banking laws, including the Community Reinvestment Act (CRA), which mandates lending in low-to-moderate income neighborhoods. Failure to comply can result in penalties and affect expansion opportunities.

Maintaining robust capital requirements, such as the Basel III framework, is critical for TrustCo Bank's stability and its ability to absorb losses. As of the first quarter of 2024, the average Tier 1 capital ratio for U.S. banks remained strong, providing a benchmark for TrustCo's own financial health.

The regulatory environment is subject to change, with potential shifts in 2025 influenced by evolving economic conditions and political administrations. TrustCo Bank must remain agile, continuously monitoring legislative proposals and adapting its compliance strategies to new or revised regulations.

TrustCo Bank operates within a landscape of increasingly rigorous data privacy and security laws. With digital transactions surging, regulations like GDPR and CCPA, which govern consumer data protection and cybersecurity, demand strict adherence. Failure to comply can result in significant legal penalties and reputational damage.

TrustCo Bank navigates a complex web of lending laws and consumer credit regulations, essential for its diverse loan offerings. These include mandates for fair lending, transparent disclosure requirements, and specific rules governing commercial, residential, and consumer credit. For instance, the Consumer Financial Protection Bureau (CFPB) actively enforces regulations like the Truth in Lending Act (TILA), which dictates how loan costs are disclosed to consumers, impacting TrustCo's customer interactions and product design.

Changes in these legal frameworks can significantly alter TrustCo's operational landscape. For example, shifts in interest rate caps or new reporting requirements for loan performance, such as those potentially introduced by the Biden-Harris administration's focus on financial consumer protection through 2024 and beyond, could necessitate adjustments in loan origination processes, pricing strategies, and even collection methodologies. Staying abreast of these evolving regulations is critical for maintaining compliance and mitigating risk.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements

TrustCo Bank, like all financial institutions, operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are in place to combat financial crime, such as money laundering and terrorist financing. For instance, in 2023, global AML fines reached an estimated $4.9 billion, highlighting the significant financial risks of non-compliance.

To meet these obligations, TrustCo Bank must implement comprehensive internal controls and reporting systems. This includes verifying customer identities, monitoring transactions for suspicious activity, and reporting such activities to regulatory authorities. The Financial Crimes Enforcement Network (FinCEN) in the US, for example, requires detailed Suspicious Activity Reports (SARs) for transactions exceeding certain thresholds.

Non-compliance with AML and KYC mandates can lead to severe consequences. These can include substantial financial penalties, operational restrictions, and significant damage to the bank's reputation. In 2024, regulatory bodies continue to enhance their oversight, making robust compliance programs essential for TrustCo Bank's continued operation and trustworthiness.

- Global AML fines in 2023: approximately $4.9 billion.

- Mandatory reporting of suspicious transactions to authorities like FinCEN.

- Penalties for non-compliance include financial sanctions and reputational harm.

- Ongoing regulatory scrutiny in 2024 necessitates strong compliance frameworks.

Taxation Policies Affecting Financial Institutions

Changes in federal and state taxation policies directly influence TrustCo Bank's profitability and financial planning. For instance, the Tax Cuts and Jobs Act of 2017 significantly lowered the corporate tax rate, a move that benefited many financial institutions. As of early 2024, discussions around potential adjustments to corporate tax rates continue, which could impact TrustCo's net income and capital allocation strategies.

Monitoring and adapting to new tax laws relevant to financial holding companies and banking services are crucial for optimizing financial performance. This includes staying abreast of evolving regulations concerning capital gains, interest income, and deductions specific to the banking sector. For example, changes in how banks can deduct interest expenses or treat certain loan losses can materially affect their bottom line.

The tax implications of various financial products and services offered by TrustCo must also be considered. This involves understanding how different investment vehicles, loan products, and fee structures are treated under current tax law, both for the bank and its customers. For 2024, the tax treatment of digital assets and their integration into banking services presents a new area of focus for compliance and strategic planning.

- Federal Corporate Tax Rate: Remains at 21% following the 2017 tax reform, though potential adjustments are under ongoing political consideration for 2025.

- State-Level Taxation: Varies significantly, with some states imposing additional franchise taxes or higher income tax rates on financial institutions.

- Interest Income Taxation: Generally taxed as ordinary income for both the bank and its customers, with specific rules for municipal bonds and other tax-exempt instruments.

- Loan Loss Provisions: Tax deductibility of provisions for loan losses is subject to strict IRS guidelines, impacting a bank's taxable income.

TrustCo Bank must adhere to stringent consumer protection laws, including fair lending practices and transparent disclosure requirements, as enforced by bodies like the Consumer Financial Protection Bureau (CFPB). These regulations, such as the Truth in Lending Act (TILA), directly impact how loan products are presented and managed, influencing customer trust and operational procedures.

The bank is also subject to robust Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, critical for preventing financial crime. With global AML fines reaching approximately $4.9 billion in 2023, non-compliance carries substantial financial and reputational risks, necessitating strong internal controls and vigilant transaction monitoring.

Evolving legal frameworks, including potential shifts in financial consumer protection policies anticipated through 2025, require TrustCo Bank to maintain regulatory agility. Adapting to new reporting mandates or changes in interest rate regulations can necessitate significant adjustments to core banking operations and strategic planning.

Taxation policies, both federal and state, significantly affect TrustCo Bank's profitability and strategic financial decisions. While the corporate tax rate remained at 21% as of early 2024, ongoing discussions about potential adjustments for 2025 and varying state-level taxes demand continuous monitoring and strategic tax planning.

Environmental factors

TrustCo Bank's extensive loan portfolio, particularly its significant exposure to residential and commercial mortgages in coastal regions like Florida, faces heightened physical risks due to climate change. The increasing frequency and intensity of extreme weather events, such as hurricanes and flooding, directly threaten the collateral securing these loans.

For instance, in 2023, Florida experienced an estimated $1.5 billion in insured losses from hurricanes, a figure expected to rise with continued climate shifts. This underscores the critical need for TrustCo Bank to rigorously assess and proactively mitigate these climate-related physical risks within its lending and underwriting practices to ensure long-term financial resilience.

Financial institutions like TrustCo Bank are facing increasing demands from investors, regulators, and the public to showcase robust Environmental, Social, and Governance (ESG) performance. This trend is accelerating, with a significant portion of global assets under management now subject to ESG considerations.

To meet these rising stakeholder expectations, TrustCo Bank must actively integrate ESG principles into its core operations, transparent reporting, and strategic investment decisions. This involves a commitment to sustainable financing initiatives and the adoption of responsible lending practices across its portfolio.

TrustCo Bank can tap into the growing sustainable finance market by offering green bonds and loans for eco-friendly projects. For instance, in 2024, the global green bond market was projected to reach over $1 trillion, indicating significant investor appetite for such instruments. By developing 'green' financial products, TrustCo Bank can attract environmentally conscious customers and align with increasing market demand for sustainability.

Furthermore, supporting local sustainability initiatives presents a dual benefit for TrustCo Bank. It not only strengthens community ties but also enhances brand reputation. As of early 2025, corporate social responsibility reports highlight that consumers are more likely to engage with businesses demonstrating a commitment to environmental causes. This strategic alignment can foster customer loyalty and open doors to new customer segments seeking ethical financial partners.

Reducing its own operational carbon footprint is also a key environmental consideration for TrustCo Bank. Many businesses are setting ambitious net-zero targets by 2030 or 2040. By implementing energy-efficient practices and investing in renewable energy for its facilities, TrustCo Bank can demonstrate tangible environmental stewardship, which is increasingly scrutinized by investors and regulators alike.

Resource Consumption and Waste Management

TrustCo Bank, with its 136 physical branches, inevitably consumes resources like electricity and paper, contributing to waste. For instance, the average U.S. office worker uses approximately 10,000 sheets of paper annually, a significant figure for an institution with numerous locations. Adopting energy-efficient technologies and robust waste management strategies can mitigate this environmental impact and potentially lower operational expenses.

The financial sector is facing increasing scrutiny regarding its environmental, social, and governance (ESG) performance. Investors and customers alike are demanding greater transparency. For example, many large banks are now publicly reporting their Scope 1, 2, and 3 emissions, with data for 2024 showing a growing emphasis on reducing indirect emissions, which would include a bank's operational footprint. TrustCo Bank's commitment to sustainability can be measured through metrics such as:

- Energy consumption per branch (kWh).

- Percentage of recycled paper used.

- Waste diversion rate from landfills.

- Investments in energy-efficient retrofits across its office portfolio.

Environmental Regulations and Reporting Requirements

While not as heavily regulated environmentally as some sectors, TrustCo Bank, like other financial institutions, is experiencing increased scrutiny regarding climate-related risks and sustainability. This means the bank might need to enhance its systems for tracking and reporting its environmental, social, and governance (ESG) activities to comply with evolving disclosure mandates.

By mid-2024, the financial sector is seeing a growing emphasis on climate risk management. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are becoming a de facto standard, with many jurisdictions either mandating or strongly encouraging their adoption. TrustCo Bank should anticipate needing to invest in data collection and reporting infrastructure to align with these expectations.

- Climate Risk Disclosure: Banks are expected to disclose their exposure to physical and transition risks associated with climate change.

- ESG Reporting Systems: Investment in robust systems for gathering and reporting ESG data is becoming crucial for compliance.

- Evolving Expectations: Staying abreast of changing regulatory landscapes and investor demands for sustainability performance is key.

TrustCo Bank's environmental impact is multifaceted, stemming from its loan portfolio's exposure to climate risks and its own operational footprint. The increasing frequency of extreme weather events, like the $1.5 billion in insured losses from Florida hurricanes in 2023, directly affects the value of collateral backing its loans, particularly mortgages in vulnerable coastal areas. Concurrently, growing investor and regulatory pressure for robust ESG performance means TrustCo must integrate sustainability into its operations and reporting, with a significant portion of global assets now considering ESG factors.

| Environmental Factor | Impact on TrustCo Bank | Data Point/Trend (2023-2025) |

|---|---|---|

| Climate Change & Physical Risk | Threatens collateral value for mortgages in coastal regions. | Florida insured losses from hurricanes estimated at $1.5 billion in 2023. |

| ESG Demands | Increased investor and regulatory scrutiny on sustainability. | Significant portion of global assets under management now subject to ESG considerations. |

| Sustainable Finance Market | Opportunity to attract capital through green bonds/loans. | Global green bond market projected to exceed $1 trillion in 2024. |

| Operational Footprint | Resource consumption (energy, paper) contributes to waste. | Average U.S. office worker uses ~10,000 sheets of paper annually. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for TrustCo Bank is built upon a comprehensive review of data from reputable financial institutions, government regulatory bodies, and industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the banking sector.