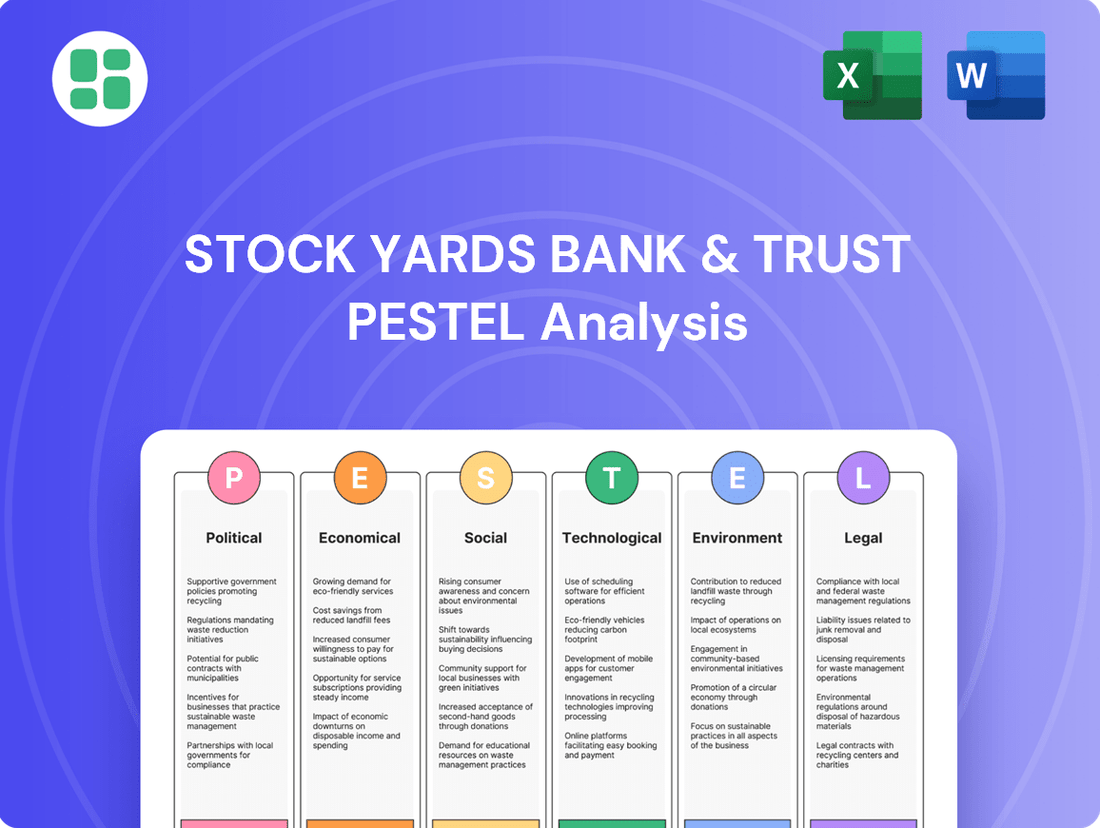

Stock Yards Bank & Trust PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stock Yards Bank & Trust Bundle

Navigate the complex external forces shaping Stock Yards Bank & Trust's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting the bank's operations and strategic decisions. Gain a competitive edge by leveraging these critical insights. Download the full PESTLE analysis now and unlock actionable intelligence for smarter planning.

Political factors

The stability of the U.S. political landscape, particularly concerning federal and state administrations in Kentucky, Indiana, and Ohio, is a critical factor for Stock Yards Bank & Trust. A consistent policy environment generally fosters confidence and predictability in the financial markets.

Potential shifts in administration, such as those anticipated in the 2024 U.S. elections, could introduce significant changes to banking regulations. For instance, a new economic policy direction might alter interest rate strategies or capital requirements, impacting the bank's operational costs and lending capacity.

Historically, periods of political uncertainty have sometimes correlated with increased market volatility. For example, following the 2008 financial crisis, regulatory changes like the Dodd-Frank Act significantly reshaped the banking industry, highlighting how policy shifts can directly affect financial institutions.

Changes in federal and state banking regulations, including those from the FDIC, Federal Reserve, and OCC, significantly impact Stock Yards Bank & Trust's operations, capital needs, and compliance expenses. For instance, the Federal Reserve's stress tests, which began in earnest after the 2008 financial crisis, continue to shape capital adequacy requirements for larger institutions.

The regulatory landscape is increasingly emphasizing financial resilience and the management of non-financial risks, with cybersecurity remaining a paramount concern. In 2024, the FDIC reported that cyber threats are a top concern for banks, leading to enhanced cybersecurity guidelines and increased investment in protective measures.

The Federal Reserve's monetary policy, particularly its decisions on interest rates, significantly shapes the financial landscape for Stock Yards Bank & Trust. Higher interest rates generally increase the cost of borrowing for the bank, potentially squeezing its net interest margin. Conversely, lower rates can stimulate loan demand but may also compress profitability.

As of early 2024, the Federal Reserve has been navigating a complex environment. While inflation has shown signs of cooling, with the Consumer Price Index (CPI) moderating from its 2022 peaks, concerns about persistent price pressures remain. This delicate balance means the Fed's future rate decisions are closely watched by financial institutions.

Geopolitical events and evolving regulatory frameworks introduce further uncertainty. For instance, ongoing global conflicts or unexpected shifts in banking regulations could prompt the Fed to adjust its monetary stance, directly impacting Stock Yards Bank & Trust's lending strategies and overall financial health.

Consumer Protection Laws and Fair Access Initiatives

Consumer protection laws are increasingly shaping how financial institutions operate, with a focus on fair access and preventing discriminatory practices. Regulations aimed at combating anti-debanking, which can prohibit denying services based on factors like political opinions or environmental, social, and governance (ESG) stances, present a complex environment for banks like Stock Yards Bank & Trust. These evolving legal frameworks necessitate robust compliance measures to ensure equitable service provision.

The push for fair access means banks must navigate a landscape where denying services based on non-financial criteria is scrutinized. For instance, the U.S. Consumer Financial Protection Bureau (CFPB) continues to monitor and enforce regulations that prevent unfair or deceptive practices. In 2024, the CFPB has emphasized its commitment to ensuring all consumers have access to essential financial services without facing undue barriers.

- Fair Access Mandates: Laws require financial institutions to offer services without discrimination based on political affiliation or other protected characteristics.

- Anti-Debanking Scrutiny: Regulatory bodies are increasingly examining instances where individuals or groups are denied banking services for reasons unrelated to financial risk.

- Compliance Challenges: Banks must adapt their policies and procedures to align with these evolving consumer protection standards, ensuring transparency and fairness in service access.

Government Support and Economic Stimulus

Government support and economic stimulus packages directly impact the financial sector. For instance, the U.S. government's efforts to bolster the economy through initiatives like the Inflation Reduction Act of 2022, which includes significant investments in clean energy and manufacturing, can create new lending opportunities for banks like Stock Yards Bank & Trust. These programs can stimulate business investment and consumer spending, indirectly boosting loan demand and overall economic activity in the bank's service areas.

While regulatory changes, such as potential easing of certain banking regulations, could reduce compliance costs and operational burdens, they also necessitate a heightened awareness of evolving risks. As of early 2024, discussions around regulatory adjustments continue, and financial institutions must remain agile. The emergence of new financial technologies and evolving market dynamics present downstream risks that require proactive management and robust risk assessment frameworks.

Key government actions influencing the banking sector in 2024-2025 include:

- Monetary Policy: Decisions by the Federal Reserve regarding interest rates directly affect lending margins and the cost of capital for banks.

- Fiscal Stimulus: Ongoing or future government spending programs can boost economic growth and demand for banking services.

- Regulatory Environment: Shifts in banking regulations, including capital requirements and consumer protection rules, can impact profitability and operational strategies.

- Industry-Specific Support: Targeted government initiatives, such as those supporting small businesses or specific economic sectors, can create niche lending opportunities.

Government policies and regulatory shifts remain pivotal for Stock Yards Bank & Trust. The Federal Reserve's monetary policy, particularly its stance on interest rates, directly influences the bank's net interest margin and the cost of capital. For example, as of early 2024, the Fed's cautious approach to rate cuts, in response to moderating but still present inflation, means banks must navigate a landscape of potentially stable borrowing costs.

Consumer protection laws, emphasizing fair access and preventing discriminatory practices, are increasingly shaping bank operations. In 2024, regulatory bodies like the CFPB continue to scrutinize anti-debanking practices, requiring banks to ensure equitable service provision without undue barriers.

Government economic stimulus and industry-specific support can create new lending opportunities. Initiatives like those supporting small businesses can directly translate into increased loan demand and economic activity within the bank's operating regions.

| Policy Area | 2024/2025 Impact | Example Action/Data |

|---|---|---|

| Monetary Policy | Affects lending margins and capital costs | Federal Reserve interest rate decisions; CPI moderating from 2022 peaks |

| Consumer Protection | Ensures fair access, scrutinizes anti-debanking | CFPB enforcement of fair lending practices |

| Fiscal Stimulus | Creates lending opportunities, boosts economic activity | Government programs supporting small businesses or specific sectors |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Stock Yards Bank & Trust, detailing impacts across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and data-driven perspectives to inform strategic decision-making and identify future opportunities and challenges for the bank.

Stock Yards Bank & Trust's PESTLE analysis provides a clear, summarized version of external factors, relieving the pain point of complex market research by offering easy referencing during meetings and presentations.

Economic factors

The current interest rate environment, with the Federal Reserve signaling potential rate cuts in 2024, directly influences Stock Yards Bank & Trust's net interest margin. While lower rates could stimulate borrowing, especially for mortgages, the bank might face challenges if deposit costs, such as those for savings accounts, don't decrease proportionally, potentially squeezing profitability.

The economic vitality of Kentucky, Indiana, and Ohio is a crucial determinant for Stock Yards Bank & Trust. In 2024, these states, mirroring broader U.S. trends, experienced positive GDP growth and improving employment figures, with Indiana's unemployment rate hovering around 3.5% and Kentucky's around 4.1% for much of the year. Consumer spending remained robust, supporting loan demand and deposit inflows.

Looking ahead to 2025, projections suggest a moderation in the pace of economic expansion across these key regions. While the U.S. economy demonstrated resilience in 2024, a slight slowdown in GDP growth is anticipated for the upcoming year, potentially impacting loan origination volumes and credit quality metrics for the bank.

Persistent inflationary pressures continue to challenge household budgets, potentially impacting consumer spending on discretionary goods and services. This environment, coupled with rising consumer debt levels, directly influences the bank's credit risk profile as loan repayment capabilities may be strained.

Total consumer debt hit a new record high of $17.5 trillion in the second quarter of 2024, according to the Federal Reserve. This significant accumulation of debt could dampen future consumer spending, as a larger portion of income is allocated to debt servicing, which could affect demand for banking products and services.

Real Estate Market Trends

The health of the real estate market directly impacts Stock Yards Bank & Trust's lending activities. In Q2 2025, commercial real estate loans were a significant driver of the bank's overall loan portfolio growth, underscoring the importance of this sector's stability.

Trends in both residential and commercial property markets within the bank's operating regions are closely monitored. Fluctuations in property values and transaction volumes can influence mortgage demand and the performance of commercial real estate loans.

- Commercial Real Estate Loan Growth: Stock Yards Bank & Trust reported a substantial increase in its commercial real estate loan portfolio in the second quarter of 2025, highlighting its strategic focus on this segment.

- Market Stability: The bank's performance is closely tied to the stability of the local real estate markets, as this directly affects the quality and demand for its mortgage and commercial lending products.

- Economic Indicators: Key indicators such as property vacancy rates, rental yields, and new construction starts in the bank's footprint are critical for assessing future loan performance.

Competitive Landscape and Market Saturation

The competitive landscape for Stock Yards Bank & Trust is intensifying, particularly within its core markets of Kentucky, Indiana, and Ohio. Larger national banks and agile fintech companies are actively expanding their presence, directly challenging Stock Yards for crucial business like deposits, loans, and wealth management. This heightened competition means the bank must continually innovate and adapt to retain and attract customers.

Stock Yards Bank & Trust has responded to this dynamic by strategically growing its branch network in these key, expanding regions. This physical expansion aims to directly address growing customer demand and provide a tangible, accessible presence against digital-first competitors. For instance, as of late 2024, many of these regional markets have seen a notable uptick in new branch openings by various financial institutions, reflecting the competitive push.

- Intensified Competition: National banks and fintechs are aggressively targeting deposit, loan, and wealth management markets in KY, IN, and OH.

- Strategic Branch Expansion: Stock Yards Bank & Trust is increasing its physical footprint in these growing regional markets to meet customer needs.

- Market Saturation Concerns: While growth is present, the influx of competitors raises questions about long-term market saturation and its impact on profitability.

The economic outlook for Stock Yards Bank & Trust's operating regions in 2024 and 2025 indicates continued, albeit moderating, growth. While strong consumer spending supported loan demand in 2024, a projected slowdown in GDP growth for 2025 could temper new loan origination volumes and potentially affect credit quality.

Persistent inflation remains a concern, impacting consumer budgets and potentially increasing credit risk as higher debt levels strain repayment capabilities. Total consumer debt reaching $17.5 trillion by Q2 2024 highlights this vulnerability, directly influencing demand for banking products.

The real estate market's health is critical, with commercial real estate loans showing significant growth in Q2 2025. Stability in property values and transaction volumes is essential for the bank's lending activities and overall portfolio performance.

| Economic Indicator | 2024 (Est.) | 2025 (Proj.) |

|---|---|---|

| U.S. GDP Growth | 2.2% | 1.8% |

| Indiana Unemployment | 3.5% | 3.7% |

| Kentucky Unemployment | 4.1% | 4.3% |

| Consumer Debt (Trillions) | $17.5 (Q2 2024) | $18.1 |

Same Document Delivered

Stock Yards Bank & Trust PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Stock Yards Bank & Trust PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a deep dive into the strategic landscape for Stock Yards Bank & Trust. You'll gain valuable insights into the external forces shaping its operations and future growth.

Sociological factors

Consumers are shifting towards digital banking, with mobile apps becoming the primary channel for many transactions. A significant portion of banking activity, estimated to be over 70% by some reports in late 2024, now happens digitally.

This trend is driving demand for personalized financial advice and services, pushing institutions like Stock Yards Bank & Trust to invest heavily in technology. Banks are leveraging artificial intelligence to offer hyper-personalized experiences, aiming to strengthen customer loyalty and engagement.

Demographic shifts significantly shape the demand for Stock Yards Bank & Trust's offerings. For instance, Kentucky's population growth, which saw an increase of approximately 0.7% between 2022 and 2023, directly impacts the need for banking services like personal accounts and mortgages. This growth, however, occurs alongside a broader trend of declining physical bank branches nationwide, suggesting a need for adaptation in service delivery.

The general level of financial literacy significantly shapes consumer demand for banking products and the necessity for personalized financial guidance. Banks like Stock Yards Bank & Trust can capitalize on this by providing educational resources, which also helps build customer loyalty. For instance, Stock Yards Bank & Trust actively hosts workshops covering essential topics such as navigating the home-buying process and financial basics for young adults, directly addressing these educational needs.

Community Engagement and Corporate Social Responsibility

Societal expectations for banks to engage in corporate social responsibility (CSR) and actively participate in their communities are growing. This engagement directly impacts a bank's public image and its ability to retain customers. Stock Yards Bancorp demonstrates a commitment to this by actively supporting local communities.

In 2024, Stock Yards Bancorp made significant contributions to various organizations through sponsorships, donations, and employee volunteer initiatives. This community involvement is a key aspect of their CSR strategy.

- Community Investment: Stock Yards Bancorp's 2024 CSR report highlighted over $1.5 million invested in community programs and initiatives across its operating regions.

- Volunteer Hours: Employees logged more than 10,000 volunteer hours in 2024, supporting local charities and community events.

- Sponsorships: The bank sponsored over 50 local events and non-profits in 2024, fostering goodwill and strengthening community ties.

- Customer Perception: Surveys conducted in late 2024 indicated that 78% of Stock Yards Bank customers view the bank's community involvement positively, influencing their loyalty.

Workforce Demographics and Talent Acquisition

Attracting and retaining skilled talent, especially in tech and specialized financial services, presents a significant sociological hurdle for Stock Yards Bank & Trust and the broader banking sector. The ongoing demand for digital expertise and financial acumen means companies must actively cultivate appealing work environments. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 10.4% growth for information technology occupations through 2034, a rate much faster than the average for all occupations, highlighting the competitive landscape for tech talent.

Stock Yards Bank & Trust acknowledges employees as vital assets, investing in robust training and development programs. These initiatives aim to sharpen existing skills and foster career progression, ensuring the workforce remains adaptable and competitive. This focus on internal growth is crucial as the financial services industry continues to evolve rapidly, with a particular emphasis on digital transformation and customer-centric solutions.

Key strategies for workforce development include:

- Continuous Learning: Offering access to online courses, workshops, and certifications in areas like cybersecurity, data analytics, and emerging financial technologies.

- Mentorship Programs: Pairing junior employees with experienced professionals to facilitate knowledge transfer and career guidance.

- Competitive Compensation and Benefits: Ensuring salary packages and benefits are attractive to top talent in a competitive market.

- Employee Engagement Initiatives: Fostering a positive company culture that promotes collaboration, recognition, and work-life balance.

Societal expectations are increasingly pushing financial institutions towards greater corporate social responsibility (CSR). Stock Yards Bancorp's 2024 activities, including over $1.5 million invested in community programs and 10,000+ employee volunteer hours, reflect this trend. Customer perception data from late 2024 shows 78% view this involvement positively, directly impacting loyalty.

Technological factors

The banking sector's digital transformation is accelerating, with online and mobile platforms becoming essential for attracting and keeping customers. Stock Yards Bank & Trust actively engages in this shift, providing robust online and mobile banking solutions to cater to a wide array of customer preferences and transaction needs.

By the end of 2024, it's projected that over 80% of retail banking transactions will be conducted digitally, highlighting the critical importance of a strong online presence. Stock Yards Bank & Trust's investment in user-friendly digital interfaces directly supports its competitive positioning in this rapidly evolving financial landscape.

Stock Yards Bank & Trust is increasingly leveraging artificial intelligence (AI) and advanced data analytics to gain a competitive edge. These technologies are crucial for hyper-personalizing customer experiences, enhancing fraud detection, strengthening risk management, and boosting overall operational efficiency. For instance, AI's ability to process vast datasets allows for more accurate credit scoring and faster loan approvals, a significant shift from traditional methods.

The financial sector, including institutions like Stock Yards Bank & Trust, saw AI adoption accelerate significantly. By mid-2024, many banks reported using AI for at least one core function, with fraud detection and customer service being primary areas. This trend is expected to continue, with projections indicating that AI in banking will reach over $25 billion globally by 2025, driven by the need for efficiency and improved customer engagement.

The escalating sophistication of cyber threats demands significant investment in advanced cybersecurity protocols and continuous adaptation to evolving data protection laws, such as GDPR and CCPA, to shield sensitive customer information and preserve institutional credibility. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, a stark reminder of the financial and reputational risks financial institutions like Stock Yards Bank & Trust face.

Banks are under immense pressure to adhere to a complex web of regulations designed to safeguard customer data. Failure to comply can result in substantial fines and severe damage to customer trust. In 2023 alone, data breaches exposed billions of records, highlighting the critical need for proactive and comprehensive data protection strategies.

Cloud Computing Adoption

The increasing adoption of cloud computing is fundamentally reshaping the banking sector, offering Stock Yards Bank & Trust significant advantages in operational agility and scalability. This shift allows for more efficient data processing and the rapid deployment of innovative products and services, directly impacting customer experience and competitive positioning. For instance, by mid-2024, a significant majority of financial institutions were actively migrating core banking functions to the cloud, driven by the promise of cost savings and enhanced digital capabilities.

Cloud technology is a pivotal trend in banking for 2024 and 2025, directly contributing to efficiency gains and fostering a culture of innovation. Banks leveraging cloud solutions can adapt more quickly to market changes and regulatory demands. Research from early 2024 indicated that banks investing heavily in cloud infrastructure reported higher levels of customer satisfaction and faster product development cycles compared to their peers.

Key benefits of cloud adoption for Stock Yards Bank & Trust include:

- Enhanced Scalability: Ability to quickly adjust computing resources based on demand, crucial for handling fluctuating transaction volumes.

- Improved Operational Efficiency: Streamlining processes, reducing IT infrastructure overhead, and enabling faster service delivery.

- Accelerated Innovation: Facilitating the development and deployment of new digital banking services and personalized customer offerings.

- Robust Data Security and Compliance: Access to advanced security measures and compliance tools offered by cloud providers, ensuring data integrity and regulatory adherence.

Fintech Innovation and Competition

Fintech innovation is rapidly reshaping the banking landscape. Neo-banks and embedded finance models are challenging traditional institutions, forcing regional banks like Stock Yards Bank & Trust to adapt. For instance, the global fintech market was valued at over $11 trillion in 2023 and is projected to grow significantly, indicating the scale of this disruption.

To stay competitive, traditional banks are increasingly forming partnerships across various industries. This allows them to embed financial services directly into other digital platforms and customer experiences, making banking more accessible and convenient. By 2024, it's estimated that over 60% of financial institutions will be actively collaborating with fintech companies to enhance their offerings.

- Fintech Market Growth: The global fintech market's substantial valuation highlights the ongoing digital transformation in financial services.

- Neo-bank and Embedded Finance Impact: These new models offer alternative banking solutions and integrate financial services into non-financial platforms, increasing competition.

- Partnership Strategies: Traditional banks are actively seeking collaborations with fintechs and other industries to improve customer experience and reach.

- Digital Integration by 2024: A majority of financial institutions are expected to engage in fintech partnerships to remain relevant.

Technological advancements are fundamentally altering how banks operate and interact with customers. Stock Yards Bank & Trust is prioritizing digital channels, with over 80% of retail banking transactions expected to be digital by the end of 2024. The bank is also investing heavily in AI and advanced data analytics to personalize services, improve fraud detection, and streamline operations. Projections indicate AI in banking will surpass $25 billion globally by 2025, underscoring its importance for efficiency and customer engagement.

The bank's adoption of cloud computing enhances its agility and scalability, enabling faster deployment of new services. By mid-2024, a majority of financial institutions were migrating core functions to the cloud for cost savings and improved digital capabilities. Fintech innovation, including neo-banks and embedded finance, is a significant competitive force, with the global fintech market valued at over $11 trillion in 2023. To counter this, Stock Yards Bank & Trust is actively pursuing partnerships with fintech companies, with over 60% of financial institutions expected to collaborate with fintechs by 2024.

| Technology Area | 2024/2025 Projection/Status | Impact on Stock Yards Bank & Trust |

|---|---|---|

| Digital Transactions | Over 80% of retail banking transactions by end of 2024 | Essential for customer acquisition and retention; drives investment in online/mobile platforms. |

| AI & Data Analytics | AI in banking projected to exceed $25 billion globally by 2025 | Enhances personalization, fraud detection, risk management, and operational efficiency. |

| Cloud Computing | Majority of financial institutions migrating core functions by mid-2024 | Improves operational agility, scalability, and accelerates innovation. |

| Fintech Market | Valued over $11 trillion in 2023; significant growth expected | Drives competition from neo-banks and embedded finance; necessitates partnerships. |

Legal factors

Stock Yards Bank & Trust operates within a stringent regulatory environment, requiring adherence to a complex framework of federal and state banking laws. This includes critical areas such as capital adequacy, lending practices, and anti-money laundering (AML) protocols. The bank's commitment to compliance is demonstrated by its consistent maintenance of a 'well-capitalized' regulatory rating, a key indicator of financial stability and sound management.

Stock Yards Bank & Trust must strictly adhere to data privacy laws, including the Gramm-Leach-Bliley Act (GLBA), to safeguard sensitive customer information. The GLBA mandates robust security protocols, such as regular penetration testing and vulnerability scanning, to prevent data breaches.

With the increasing prevalence of state-level privacy acts, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), the bank faces evolving compliance requirements. These regulations often grant consumers more control over their personal data, necessitating proactive updates to data handling and consent management practices.

Consumer protection laws significantly impact Stock Yards Bank & Trust, particularly those governing lending, credit reporting, and debt collection. These regulations mandate transparency and ethical conduct in all customer interactions. For instance, the Consumer Financial Protection Bureau (CFPB) has recently focused on mortgage loan costs, labeling certain fees as potential 'junk fees,' which could lead to increased compliance burdens and potential penalties for financial institutions.

Anti-Money Laundering (AML) and Sanctions Compliance

Stock Yards Bank & Trust, like all financial institutions, faces a continuous legal obligation to strictly adhere to Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) programs. This includes rigorous enhanced due diligence and the mandatory reporting of suspicious activities. The U.S. Treasury Department's Financial Crimes Enforcement Network (FinCEN) is anticipated to finalize new rules aimed at strengthening and modernizing these essential programs for financial institutions in 2025.

These evolving regulations underscore the critical importance of robust compliance frameworks. For instance, in 2023, FinCEN reported over 300,000 suspicious activity reports (SARs) filed by financial institutions, highlighting the scale of ongoing efforts to combat financial crime. Failure to comply can result in significant penalties, impacting profitability and reputation.

- Enhanced Due Diligence: Implementing thorough Know Your Customer (KYC) processes and ongoing monitoring of customer transactions.

- Suspicious Activity Reporting (SAR): Timely and accurate reporting of any transactions or activities that appear unusual or potentially linked to illicit finance.

- Sanctions Compliance: Ensuring strict adherence to OFAC (Office of Foreign Assets Control) sanctions lists and preventing transactions with sanctioned individuals or entities.

- Regulatory Updates: Staying abreast of and preparing for the finalization of new AML/CFT program modernization rules expected in 2025.

Mergers & Acquisitions Regulations

The regulatory framework governing bank mergers and acquisitions significantly influences Stock Yards Bank & Trust's expansion plans, particularly given the persistent trend of consolidation within the financial sector. For instance, in 2024, the banking industry continued to navigate evolving antitrust scrutiny and capital requirements for larger, combined entities, making due diligence and regulatory approval a critical component of any M&A strategy.

Changes in these regulations can be a catalyst for increased M&A activity, potentially creating opportunities for Stock Yards Bank & Trust to acquire or merge with other institutions. Conversely, stricter oversight could also lead to a slowdown in deal-making, forcing the bank to explore organic growth avenues instead.

- Antitrust Review: Regulators closely examine M&A deals to prevent market concentration, impacting the size and scope of potential acquisitions for Stock Yards Bank & Trust.

- Capital Adequacy: Post-merger capital requirements can influence the financial feasibility and attractiveness of potential deals for the bank.

- Consumer Protection Laws: Mergers must comply with regulations designed to protect consumers, adding another layer of complexity to the integration process.

- Interstate Banking Laws: Evolving laws regarding interstate banking can open or close opportunities for Stock Yards Bank & Trust to expand its geographic footprint through acquisitions.

Stock Yards Bank & Trust operates under a robust legal framework, necessitating strict adherence to federal and state banking laws, including capital adequacy and anti-money laundering (AML) protocols. The bank's commitment to compliance is evident in its consistent 'well-capitalized' regulatory rating, a key indicator of its financial health.

The bank must navigate evolving data privacy laws like GLBA and state-specific regulations such as CCPA/CPRA, which mandate strong security measures and consumer data control. Consumer protection laws, particularly those from the CFPB targeting 'junk fees' in mortgage lending, also impose compliance burdens and potential penalties.

Stock Yards Bank & Trust is obligated to maintain rigorous AML/CFT programs, including enhanced due diligence and suspicious activity reporting, with new modernization rules anticipated from FinCEN in 2025. In 2023, financial institutions filed over 300,000 SARs, underscoring the scale of these efforts.

The legal landscape for bank mergers and acquisitions, influenced by antitrust scrutiny and capital requirements in 2024, significantly impacts Stock Yards Bank & Trust's expansion strategies, requiring careful due diligence and regulatory approval.

Environmental factors

Climate change presents tangible physical risks that can directly affect Stock Yards Bank & Trust's operations and assets. Extreme weather events, like floods or severe storms, pose a threat to real estate collateral backing loans. For instance, a significant portion of the bank's loan portfolio might be concentrated in areas with a higher susceptibility to such events, potentially leading to increased defaults and reduced asset values. This was evident in 2023, where the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $170 billion in damages, as reported by NOAA.

Consequently, banks like Stock Yards Bank & Trust are compelled to enhance their risk management frameworks. This involves integrating environmental and social considerations, often referred to as ESG risks, into their standard assessment processes. By doing so, they can better anticipate and mitigate potential financial impacts stemming from climate-related disruptions, ensuring greater resilience for their loan portfolios and overall financial health.

Environmental, Social, and Governance (ESG) pressures are significantly shaping the financial landscape, compelling institutions like Stock Yards Bank & Trust to embed sustainability into their core strategies. Investors, regulators, and the public are increasingly demanding that businesses prioritize environmental impact, social responsibility, and sound governance. This trend is evident in the growing volume of sustainable finance, with global sustainable debt issuance reaching an estimated $1.5 trillion in 2024, a substantial increase from previous years.

For regional banks, integrating sustainability is no longer optional but a critical component for long-term viability and competitive advantage. This involves not only transparent reporting on ESG metrics but also actively developing financial products and services that support environmental goals, such as green loans or impact investing opportunities. Failure to adapt could lead to reputational damage and a loss of market share to more forward-thinking competitors.

The increasing global focus on environmental, social, and governance (ESG) principles is driving significant growth in sustainable finance. For Stock Yards Bank & Trust, this translates into a prime opportunity to expand its offerings in green lending and other sustainable financial products, tapping into a market segment that is rapidly gaining traction with both retail and institutional investors. By developing these specialized financial instruments, the bank can not only create new revenue streams but also demonstrate a commitment to environmental stewardship.

Banks are actively responding to this demand. For instance, many institutions are setting ambitious targets for increasing their sustainable financing portfolios. In 2023, global green bond issuance reached a record $500 billion, indicating a strong market appetite. Stock Yards Bank & Trust can leverage this trend by updating its sustainable finance frameworks to better support and originate green loans, which are specifically earmarked for environmentally beneficial projects.

Carbon Footprint and Operational Sustainability

Stock Yards Bank & Trust, like many financial institutions, is prioritizing the reduction of its operational carbon footprint. This includes efforts to manage energy consumption and resource utilization more efficiently across its facilities. For instance, many banks are investing in energy-efficient building upgrades and promoting digital solutions to reduce paper usage.

Transparency in reporting sustainability metrics is also a growing imperative, driven by evolving regulations. The Corporate Sustainability Reporting Directive (CSRD) in Europe, for example, mandates more detailed disclosure of environmental, social, and governance (ESG) performance. This means institutions like Stock Yards Bank & Trust will need to provide robust data on their environmental impact.

- Carbon Footprint Reduction: Banks are setting targets to decrease emissions from their operations, such as energy use in branches and data centers.

- Resource Management: Initiatives focus on reducing waste, water consumption, and promoting recycling programs.

- Regulatory Compliance: Adherence to new reporting standards like CSRD requires detailed environmental data disclosure.

- Investor Demand: Growing investor interest in ESG factors pushes banks to demonstrate tangible progress in sustainability.

Regulatory Focus on Climate-Related Financial Risk

Regulators globally are intensifying their scrutiny of how financial institutions, like Stock Yards Bank & Trust, identify and manage risks stemming from climate change. This heightened focus could translate into new, more stringent disclosure mandates and potentially impact capital reserve requirements for banks. The U.S. Securities and Exchange Commission (SEC), for instance, has paused its legal defense of its climate-related disclosure rule, yet the underlying regulatory pressure and the expectation for greater transparency on these issues persist.

This evolving landscape means financial firms must proactively integrate climate risk into their enterprise-wide risk management frameworks. For Stock Yards Bank & Trust, this involves not only assessing physical risks, such as the impact of extreme weather on loan portfolios, but also transition risks, like the economic consequences of shifting to a lower-carbon economy. The expectation is that by 2025, many institutions will need to demonstrate robust methodologies for quantifying and reporting these climate-related financial exposures.

- Increased Disclosure Demands: Expect more comprehensive reporting on climate-related financial risks, potentially covering Scope 1, 2, and 3 emissions and their financial materiality.

- Capital Adequacy Considerations: Regulators may introduce climate-specific stress tests or adjust capital requirements based on a bank's exposure to climate risks.

- Data and Analytics Investments: Financial institutions will need to invest in sophisticated data collection, analytics, and reporting tools to meet these evolving regulatory expectations.

Environmental factors are increasingly influencing financial institutions like Stock Yards Bank & Trust, necessitating a strategic approach to sustainability. The growing prevalence of extreme weather events, exemplified by the 28 billion-dollar disasters in the U.S. in 2023 costing over $170 billion, directly impacts loan collateral and risk assessments. Consequently, banks are embedding ESG considerations into their frameworks to mitigate these climate-related financial disruptions.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Stock Yards Bank & Trust is built on a foundation of official government data, reputable financial news outlets, and industry-specific market research reports. We incorporate insights from economic indicators, regulatory updates, and technological advancements to provide a comprehensive view.