Sun Pharma Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sun Pharma Industries Bundle

Sun Pharma Industries operates within a dynamic global landscape, constantly influenced by political stability, economic fluctuations, and evolving social attitudes towards healthcare. Understanding these external forces is crucial for strategic planning and identifying potential growth avenues.

Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence to navigate the complexities of the pharmaceutical market. Gain a competitive edge by understanding the technological advancements and regulatory shifts impacting Sun Pharma.

Don't get left behind; download the full PESTLE analysis now to unlock critical insights and empower your decision-making.

Political factors

Government healthcare policies, especially in India and major markets like the US and EU, are crucial for Sun Pharma. Shifts in healthcare spending, drug price regulations, and how treatments are reimbursed directly affect the company's earnings. For instance, India's push for affordable healthcare and programs like Ayushman Bharat, which aims to provide health insurance to millions, can boost access to medicines but also put pressure on the prices of essential drugs. In 2023, India's healthcare spending was projected to reach $132 billion, showing the scale of government influence.

The pharmaceutical industry, including Sun Pharma, operates under increasingly stringent and evolving regulatory frameworks. Agencies like the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and India's Central Drugs Standard Control Organisation (CDSCO) dictate everything from drug approval to manufacturing practices. Sun Pharma's ability to successfully navigate these complex pathways, including adherence to updated Good Manufacturing Practices (GMP) such as India's revised Schedule M, is paramount for market access and continued operations.

Non-compliance with these regulations can have severe repercussions. For instance, past US FDA actions, such as import alerts issued for certain Sun Pharma facilities, highlight the significant operational and financial challenges that can arise. These alerts can block the import of products into key markets, directly impacting revenue and market share, and necessitate substantial investment in remediation efforts to regain compliance.

Sun Pharma, like many global pharmaceutical players, navigates a complex web of international trade policies. Changes in trade agreements, the imposition of tariffs, or the introduction of protectionist measures can directly impact its ability to source raw materials and distribute finished products across its diverse markets. For instance, a shift in trade relations between India and the United States, two of Sun Pharma's significant markets, could lead to increased costs or restricted market access.

Geopolitical stability is another critical consideration. Political instability or conflicts in regions where Sun Pharma operates or sources key ingredients can disrupt its supply chain and manufacturing processes. The company's extensive global footprint, with operations in over 100 countries, makes it particularly vulnerable to such disruptions. For example, tensions in Eastern Europe or the Middle East could affect logistics and the availability of essential components.

Sun Pharma actively monitors and prepares for potential disruptions stemming from trade disputes and geopolitical uncertainties. This includes diversifying its supplier base and exploring alternative manufacturing locations to mitigate risks. The company's resilience strategy aims to ensure continuity of operations and maintain market access even amidst evolving global political landscapes.

Intellectual Property Rights (IPR) Protection

The robustness and enforcement of intellectual property rights (IPR), especially patent laws, are critical for Sun Pharma. Strong IPR protection safeguards their significant investments in research and development, particularly for novel and specialty pharmaceuticals. For instance, in 2023, India's pharmaceutical industry saw continued focus on strengthening patent examination processes, impacting how quickly new drug patents are granted and defended.

Evolving patent regulations necessitate strategic adjustments. Changes such as the introduction of stricter timelines for patent examination requests in India, observed in recent years, compel companies like Sun Pharma to proactively manage their intellectual property portfolios and adapt their R&D and commercialization strategies to align with these regulatory shifts.

- Patent Law Strength: The varying strength and enforcement of patent laws globally directly influence Sun Pharma's ability to protect its R&D expenditure on innovative drugs.

- IPR Enforcement: Effective enforcement mechanisms are crucial for preventing generic competition on patented products, thereby securing market exclusivity and recouping R&D costs.

- Regulatory Adaptations: Sun Pharma must continuously monitor and adapt to changes in patent rules, such as those impacting examination timelines in key markets like India, to maintain its competitive edge.

Promotion and Marketing Regulations

Political factors significantly shape Sun Pharma's promotional and marketing strategies through evolving regulations. India's Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024, for instance, mandates greater transparency and ethical conduct. This code directly impacts how Sun Pharma can engage with healthcare professionals, aiming to curb practices such as offering gifts or incentives.

Compliance with these stringent guidelines is paramount to avoid penalties and maintain brand integrity. The UCPMP 2024 emphasizes responsible marketing, requiring pharmaceutical companies to ensure their promotional materials are accurate and not misleading. This regulatory landscape necessitates a careful review of all marketing campaigns to align with ethical standards and legal requirements.

- UCPMP 2024: India's updated code for pharmaceutical marketing practices.

- Ethical Focus: Prohibits gifts and incentives to healthcare professionals.

- Transparency Mandate: Requires accurate and non-misleading promotional content.

- Compliance Risk: Non-adherence can lead to penalties and reputational damage.

Government policies on healthcare pricing and access, particularly in India and major markets like the US, directly impact Sun Pharma's revenue. India's focus on affordable medicines, exemplified by programs like Ayushman Bharat, while increasing access, can also exert downward pressure on drug prices. For example, India's healthcare spending was projected to reach $132 billion in 2023, underscoring the significant influence of government spending and policy.

Regulatory frameworks are critical; agencies like the US FDA and EMA set stringent standards for drug approval and manufacturing. Sun Pharma's adherence to evolving Good Manufacturing Practices (GMP), such as India's revised Schedule M, is vital for market access. Past import alerts from the US FDA for some Sun Pharma facilities demonstrate the substantial operational and financial risks of non-compliance.

Intellectual property rights (IPR) protection is paramount for Sun Pharma to safeguard its R&D investments. In 2023, India continued to strengthen its patent examination processes, affecting the speed of patent grants and defense. Adapting to changes, like stricter timelines for patent examination requests in India, is crucial for maintaining a competitive edge.

Political factors influence marketing through regulations like India's Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024. This code promotes transparency and ethical conduct, restricting practices like offering incentives to healthcare professionals and mandating accurate promotional content. Non-compliance risks penalties and reputational damage.

What is included in the product

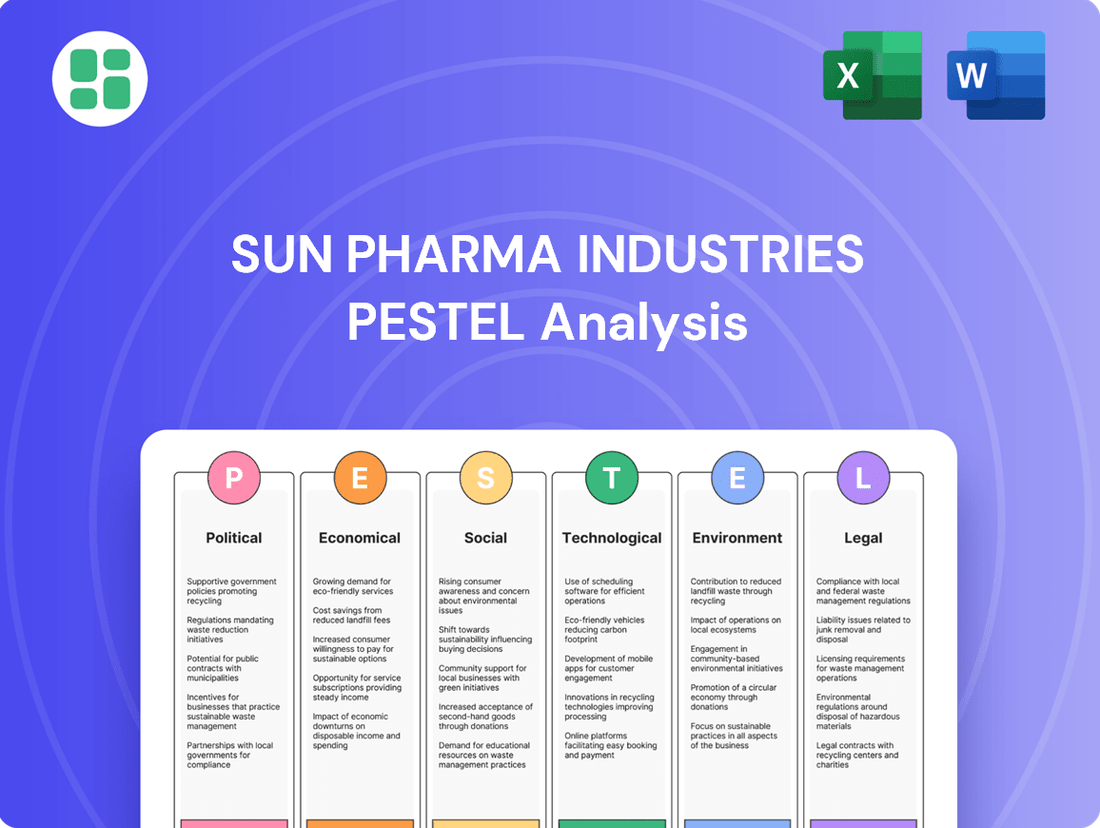

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Sun Pharma Industries across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into emerging threats and opportunities, enabling strategic decision-making for stakeholders.

Provides a concise version of Sun Pharma's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Easily shareable summary format ideal for quick alignment across teams or departments, translating Sun Pharma's PESTLE analysis into clear, understandable points for strategic discussions.

Economic factors

Global economic growth is projected to be around 2.7% in 2024, with a slight uptick to 2.9% in 2025, according to IMF estimates. This overall economic health directly influences healthcare spending. For Sun Pharma, strong growth in key markets like India and the United States, where disposable incomes tend to rise, translates to greater affordability and demand for pharmaceutical products.

Conversely, economic headwinds can significantly impact the sector. A slowdown in India, for instance, could dampen domestic demand, while a recession in the US might lead to increased price sensitivity among patients and payers, potentially affecting Sun Pharma's revenue streams from these crucial markets.

Inflationary pressures in key markets can significantly impact Sun Pharma's bottom line by increasing the cost of raw materials, manufacturing, and overall operations. For instance, India's retail inflation averaged around 5.5% in early 2024, a figure that can directly translate to higher input costs for the pharmaceutical giant.

Currency exchange rate volatility poses another challenge. As a global player, Sun Pharma's profitability is sensitive to fluctuations between the Indian Rupee (INR) and major currencies like the US Dollar (USD) and Euro (EUR). A weaker INR, for example, might boost reported export revenues but also increase the cost of imported components, creating a complex balancing act for profit margins.

Global healthcare expenditure is a significant driver for the pharmaceutical industry. In 2023, worldwide healthcare spending was projected to reach approximately $10 trillion, with a notable portion allocated to pharmaceuticals. This trend underscores the substantial market size for companies like Sun Pharma.

The increasing emphasis on affordable generics worldwide directly impacts Sun Pharma's business model. While this trend expands market access, it also intensifies pricing pressures on generic drug manufacturers. For instance, the US generic drug market alone is valued in the tens of billions of dollars annually, and competitive pricing is paramount.

Research and Development (R&D) Investment Trends

The economic climate significantly influences pharmaceutical research and development (R&D) investments. Sun Pharma's commitment to R&D remains strong, but economic slowdowns or rising operational costs could prompt a strategic review of its R&D allocations, particularly for innovative specialty medicines.

For fiscal year 2026, Sun Pharma anticipates its R&D expenditure to range between 6% and 8% of its total sales. This investment is strategically directed towards the development of specialty products, reflecting a forward-looking approach to market differentiation.

- Projected R&D Investment: Sun Pharma aims to invest 6-8% of sales in R&D for FY26.

- Strategic Focus: Increased emphasis on developing high-potential specialty products.

- Economic Sensitivity: R&D budgets may require adjustments based on broader economic conditions and cost pressures.

Competitive Landscape and Pricing Pressure

The pharmaceutical sector, particularly the generics market where Sun Pharma is a major player, is intensely competitive. This rivalry directly translates into significant pricing pressure, impacting profit margins. For instance, in the Indian generics market, price erosion can be substantial, with some molecules seeing double-digit percentage drops annually due to multiple players entering the fray.

Economic downturns can exacerbate this competitive environment. When economies slow, healthcare spending might be scrutinized more closely, leading to increased demand for lower-cost generics and intensifying the need for efficient operations. Companies like Sun Pharma must therefore focus on cost optimization and continuous innovation to defend their market share and maintain profitability amidst these economic headwinds.

- Intense Competition: The generics segment, a core area for Sun Pharma, faces constant pressure from numerous domestic and international players.

- Pricing Pressure: This competition directly leads to downward pressure on drug prices, affecting revenue and profitability.

- Economic Impact: Economic slowdowns can amplify competition by increasing demand for affordable medicines, forcing greater cost efficiency.

- Innovation as a Differentiator: Companies must innovate in manufacturing processes and product development to sustain market position and profitability.

Global economic growth forecasts, such as the IMF's 2.7% for 2024 and 2.9% for 2025, directly influence healthcare spending and pharmaceutical demand. Sun Pharma benefits from growth in markets like India and the US, but economic slowdowns can reduce affordability and increase price sensitivity, impacting revenue. Inflation, with India's retail inflation around 5.5% in early 2024, raises operational costs for raw materials and manufacturing, affecting profitability.

Currency fluctuations, particularly between the INR and USD/EUR, create complex challenges for Sun Pharma's global operations and profit margins. Increased global healthcare expenditure, projected to exceed $10 trillion in 2023, highlights the substantial market opportunity for pharmaceutical companies. However, the strong emphasis on affordable generics worldwide intensifies pricing pressure, a critical factor for Sun Pharma's business model in markets like the US, valued in the tens of billions.

Sun Pharma's R&D investment, targeted at 6-8% of sales for FY26, focuses on specialty products, a strategic move in a competitive landscape. The pharmaceutical sector, especially generics, faces intense competition leading to significant price erosion, with some Indian generics seeing double-digit annual drops. Economic downturns can amplify this by increasing demand for lower-cost options, necessitating cost optimization and continuous innovation for companies like Sun Pharma to maintain market share and profitability.

| Economic Factor | Impact on Sun Pharma | 2024/2025 Data Point |

| Global Economic Growth | Influences healthcare spending and demand for pharma products. | IMF projects 2.7% (2024) and 2.9% (2025) |

| Inflation | Increases raw material and operational costs. | India's retail inflation averaged ~5.5% (early 2024) |

| Currency Exchange Rates | Affects profitability of international sales and import costs. | INR vs USD/EUR volatility is a constant factor. |

| Healthcare Expenditure | Represents market size and growth potential. | Global spending projected over $10 trillion (2023) |

| Generics Market Trend | Drives demand but intensifies pricing pressure. | US generics market valued in tens of billions annually. |

What You See Is What You Get

Sun Pharma Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Sun Pharma Industries. This detailed breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to insights into the market dynamics and regulatory landscape affecting Sun Pharma.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a thorough strategic overview essential for understanding Sun Pharma's external environment.

Sociological factors

The global population is aging rapidly, with projections indicating that by 2050, nearly one in six people worldwide will be 65 or older. This demographic shift directly fuels demand for pharmaceuticals, particularly in areas like cardiology, neurology, and diabetes management, where age-related and chronic conditions are more prevalent. For Sun Pharma, this trend translates into a substantial growth opportunity, shaping its strategic decisions regarding product development and research investments.

Modern lifestyles are increasingly linked to the rise of chronic diseases like diabetes, cardiovascular issues, and respiratory illnesses. These conditions represent significant therapeutic areas for Sun Pharma, meaning the company must focus on developing and providing treatments for these widespread health challenges. For instance, the International Diabetes Federation reported over 537 million adults living with diabetes in 2021, a number projected to reach 643 million by 2030, directly impacting the demand for Sun Pharma's diabetes medications.

Growing health awareness, fueled by readily available information, is significantly reshaping patient expectations. Individuals now demand not just effective treatments but also high-quality, accessible medicines, pushing companies like Sun Pharma to innovate. This shift is evident in the increasing demand for personalized medicine and digital health solutions, with the global digital health market projected to reach over $660 billion by 2025.

Healthcare Access and Literacy

Societal factors, including healthcare access and literacy, significantly shape patient behavior and the demand for pharmaceuticals. Improved access to healthcare facilities and a greater understanding of health information can lead to better treatment adherence and increased utilization of medicines. Public trust in pharmaceutical companies also plays a crucial role in this dynamic.

Sun Pharma, with its substantial footprint in emerging economies, is well-positioned to capitalize on initiatives aimed at enhancing healthcare infrastructure and broadening access to essential medications. For instance, India's Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PMJAY) scheme, which aims to provide health insurance to over 500 million people, is expected to boost healthcare utilization and, consequently, demand for pharmaceuticals.

Furthermore, rising health literacy rates across many of Sun Pharma's key markets contribute to a more informed patient base. In India, government-led campaigns promoting disease awareness and preventive healthcare, alongside increasing internet penetration, are empowering individuals to take a more active role in their health management. This trend supports consistent demand for chronic disease medications, a significant segment for Sun Pharma.

Key societal influences impacting Sun Pharma include:

- Growing health awareness: Increased public focus on wellness and disease prevention drives demand for a wider range of treatments.

- Government health initiatives: Programs like India's PMJAY are expanding healthcare coverage, creating new patient pools.

- Digital health adoption: The rise of telemedicine and online health information empowers patients and can improve medication adherence.

- Socioeconomic development: Rising disposable incomes in emerging markets translate to greater capacity for healthcare spending.

Cultural Attitudes Towards Medicine and Treatment

Cultural beliefs significantly shape how people in different regions view and adopt medical treatments. In some cultures, there's a strong preference for traditional or alternative medicine, which can slow the uptake of conventional pharmaceuticals. For instance, while India has a growing acceptance of modern medicine, traditional Ayurvedic practices remain deeply ingrained for many, influencing their choices for chronic conditions.

Sun Pharma's success in diverse markets hinges on understanding these cultural attitudes. Their approach to marketing and product launches must be sensitive to local beliefs about health and healing. For example, a campaign promoting a new diabetes medication in a region where natural remedies are highly trusted would need to carefully bridge that gap, perhaps by highlighting clinical trial data or partnering with respected local health practitioners.

The perception of generic drugs also varies culturally. In some Western markets, generics are widely accepted due to cost-consciousness and robust regulatory oversight. However, in other regions, there might be a lingering skepticism about their efficacy compared to branded counterparts. Sun Pharma, as a major producer of generics, must tailor its messaging to build confidence and address these cultural perceptions.

Emerging therapies, such as biologics or gene therapies, also face cultural hurdles. Acceptance often depends on education and trust in the scientific process. Sun Pharma's strategy should include educational initiatives to foster understanding and acceptance of these advanced treatments, especially in markets where such technologies are relatively new.

Societal shifts, including an aging global population and the rise of chronic diseases, directly boost demand for Sun Pharma's core product lines. Increased health awareness and access to information empower patients, driving expectations for high-quality, accessible medicines. Government initiatives like India's PMJAY scheme are expanding healthcare access, creating significant new patient populations for pharmaceutical companies.

Cultural beliefs significantly influence treatment choices, with some regions favoring traditional medicine, impacting the adoption of conventional pharmaceuticals. Sun Pharma must navigate these diverse cultural attitudes, tailoring its marketing and product strategies to build trust and address varying perceptions of generic versus branded medications.

Technological factors

Breakthroughs in biotechnology, genomics, and AI-driven drug discovery are revolutionizing the pharmaceutical landscape, directly impacting Sun Pharma's pipeline. These advancements enable faster identification of drug targets and more efficient development of novel therapies. For instance, the increasing adoption of AI in drug discovery is projected to reduce the time and cost of bringing new drugs to market, a trend Sun Pharma is actively leveraging.

The pharmaceutical industry is undergoing a significant shift with the widespread adoption of digital tools and artificial intelligence. Sun Pharma is actively integrating these technologies to streamline its operations. For instance, AI is being leveraged to accelerate drug discovery, with some estimates suggesting it can reduce discovery timelines by up to 40%.

This digital transformation impacts every stage of the value chain. In clinical trials, AI can optimize patient selection and data analysis, potentially cutting trial durations. Sun Pharma's investment in digital infrastructure aims to enhance manufacturing efficiency and improve the precision of its supply chain, ensuring timely delivery of critical medicines.

Technological advancements like automation and robotics are transforming pharmaceutical manufacturing, promising increased efficiency and better quality control. Sun Pharma's investment in these areas, including exploring 3D printing for drug delivery, positions them to reduce production costs and improve product consistency. For instance, the global pharmaceutical automation market was valued at approximately $5.1 billion in 2023 and is projected to grow significantly, indicating a strong industry trend towards adopting these technologies.

Adhering to evolving Good Manufacturing Practices (GMP) and maintaining state-of-the-art facilities are critical for Sun Pharma to meet stringent global regulatory requirements. By investing in modern manufacturing infrastructure, the company can ensure scalability and maintain high quality standards across its diverse product portfolio, a key factor in its international market competitiveness.

Data Analytics and Real-World Evidence

Sun Pharma is increasingly leveraging big data analytics and real-world evidence (RWE) to sharpen its competitive edge. This technological shift allows for a more granular understanding of disease prevalence and treatment efficacy across diverse patient groups. For instance, by analyzing RWE, Sun Pharma can refine its clinical trial designs and identify unmet patient needs more effectively, potentially accelerating the development of new therapies.

The insights gleaned from RWE are crucial for optimizing market access strategies. By demonstrating the value of its products through real-world outcomes, Sun Pharma can negotiate more favorable pricing and reimbursement terms with payers. This data-driven approach is becoming paramount in a healthcare landscape that increasingly demands evidence of both clinical effectiveness and economic value.

Furthermore, advanced analytics bolster post-marketing surveillance. Sun Pharma can proactively monitor drug safety and identify potential adverse events or off-label uses more rapidly. This capability is vital for maintaining product integrity and ensuring patient safety, a non-negotiable aspect of pharmaceutical operations. The global RWE market is projected to reach significant figures, with some estimates placing it in the tens of billions of dollars by the late 2020s, underscoring its growing importance.

Key applications for Sun Pharma include:

- Enhanced clinical trial design and patient stratification.

- Improved identification of patient populations for targeted therapies.

- Data-backed market access and health economics outcomes research (HEOR).

- Proactive pharmacovigilance and safety monitoring.

Telemedicine and Digital Health Platforms

The telemedicine and digital health landscape is rapidly evolving, with significant implications for pharmaceutical companies like Sun Pharma. The global telemedicine market was valued at approximately USD 128.2 billion in 2023 and is projected to reach USD 455.8 billion by 2030, growing at a CAGR of 19.9%. This expansion is driven by increasing internet penetration, the adoption of smartphones, and a growing demand for convenient healthcare solutions.

Sun Pharma can capitalize on these trends by developing integrated healthcare solutions that combine its pharmaceutical offerings with digital platforms. This includes leveraging wearable devices and mobile health applications to monitor patient adherence, track treatment outcomes, and provide personalized support. For instance, a patient using a Sun Pharma medication for a chronic condition could utilize a connected device that transmits real-time data to their healthcare provider, allowing for proactive interventions and improved management of their health.

Furthermore, these technologies offer a pathway to expand access to Sun Pharma's products and services, particularly in underserved or remote regions. Digital health platforms can facilitate remote consultations, prescription fulfillment, and patient education, bridging geographical barriers and ensuring that more individuals benefit from quality healthcare. By 2025, it's estimated that over 75% of healthcare providers will be using some form of telemedicine, indicating a strong market readiness for such integrated approaches.

- Telemedicine Market Growth: Projected to reach USD 455.8 billion by 2030 from USD 128.2 billion in 2023, with a 19.9% CAGR.

- Digital Health Adoption: Over 75% of healthcare providers expected to use telemedicine by 2025.

- Key Drivers: Increased internet and smartphone usage, demand for convenient healthcare.

- Sun Pharma Opportunities: Integrated solutions, improved patient support, expanded remote access.

Technological advancements are fundamentally reshaping pharmaceutical research and development, with AI and big data analytics accelerating drug discovery and clinical trial efficiency. Sun Pharma's strategic investments in these areas, including leveraging real-world evidence (RWE), are crucial for identifying unmet needs and optimizing market access. The company's focus on digital transformation enhances manufacturing processes and supply chain precision, ensuring high-quality product delivery.

The company is also embracing digital health and telemedicine, recognizing the significant growth in these sectors. By integrating its pharmaceutical offerings with digital platforms, Sun Pharma aims to improve patient adherence and outcomes, particularly for chronic conditions. This strategic direction is supported by the substantial projected growth of the telemedicine market, which is expected to reach USD 455.8 billion by 2030, indicating a strong demand for accessible, technology-enabled healthcare solutions.

| Technological Factor | Impact on Sun Pharma | Supporting Data/Trend |

| AI in Drug Discovery | Accelerated R&D, reduced costs | AI can reduce discovery timelines by up to 40% |

| Real-World Evidence (RWE) | Sharpened competitive edge, improved market access | Global RWE market projected to reach tens of billions by late 2020s |

| Digital Health & Telemedicine | Expanded patient support, increased access | Telemedicine market projected to reach USD 455.8 billion by 2030 (19.9% CAGR) |

| Automation & Robotics | Increased manufacturing efficiency, better quality control | Global pharmaceutical automation market valued at ~$5.1 billion in 2023 |

Legal factors

Sun Pharma's product launch timelines and market success hinge on navigating complex drug approval processes. Regulatory bodies such as the US FDA, EMA, and India's CDSCO impose stringent requirements, with evolving guidelines, particularly for biologics, directly impacting commercial viability. For instance, the FDA's accelerated approval pathway, while offering faster market access, still involves rigorous post-market surveillance, a factor Sun Pharma must meticulously manage.

Patent and intellectual property laws are crucial for safeguarding Sun Pharma's innovations and research investments. These regulations cover patents, trademarks, and data exclusivity, ensuring a competitive edge. For instance, India's Patent (Amendment) Rules 2024 are designed to streamline patent processes and potentially affect market exclusivity periods for new drugs.

Sun Pharma, like all pharmaceutical manufacturers, operates under stringent manufacturing and quality control regulations. In India, for instance, the revised Schedule M norms, effective from 2023-2024, significantly elevate Good Manufacturing Practices (GMP) requirements for production facilities and processes. These regulations are designed to ensure product safety, efficacy, and consistency.

Adherence to these global standards is not optional; it's critical for market access. Failure to comply can lead to severe consequences, including regulatory scrutiny, import alerts from major markets like the US FDA, and damage to brand reputation. For example, in 2023, several Indian pharmaceutical companies faced import alerts, highlighting the ongoing challenges of maintaining compliance across diverse regulatory landscapes.

Sun Pharma must therefore maintain continuous investment in its quality management systems and manufacturing infrastructure. This includes upgrading facilities, implementing robust quality control measures, and ensuring all personnel are adequately trained. Such investments are essential to navigate the complex regulatory environment and maintain its position as a leading global pharmaceutical player, especially as regulatory bodies worldwide are increasingly vigilant.

Marketing and Promotion Compliance

Marketing and promotion within the pharmaceutical sector are heavily governed by legal frameworks. In India, the Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024 sets strict guidelines for how companies like Sun Pharma can advertise and promote their products. This code specifically targets and prohibits certain promotional activities, ensuring a more ethical approach to marketing.

Compliance with these regulations is not merely a formality; it's crucial for maintaining the company's reputation and operational integrity. The UCPMP 2024 also introduces accountability for company executives, meaning that breaches can have significant consequences beyond just the company itself. This underscores the importance of robust internal compliance mechanisms for Sun Pharma.

Key aspects of marketing and promotion compliance include:

- Adherence to the UCPMP 2024: Ensuring all promotional materials and activities align with the latest code, which came into effect in 2024.

- Prohibition of specific practices: Avoiding activities such as offering inducements to healthcare professionals or making unsubstantiated claims about product efficacy.

- Executive accountability: Recognizing that senior management can be held responsible for non-compliance, necessitating strong oversight.

- Ethical marketing standards: Upholding a commitment to transparency and responsible promotion to build trust with healthcare providers and patients.

Anti-Trust and Competition Laws

Anti-trust and competition laws are crucial for maintaining a level playing field in the pharmaceutical sector, preventing any single entity from dominating the market. Sun Pharma, given its global presence and strategic moves like the acquisition of Taro Pharmaceutical Industries, must meticulously adhere to these regulations in every country it operates. For instance, in 2023, Sun Pharma's stake in Taro reached over 79%, a significant consolidation that would have been scrutinized under various competition authorities.

Compliance ensures that Sun Pharma's business practices, from pricing strategies to market access agreements, do not stifle competition or lead to monopolistic advantages. Failure to comply can result in substantial fines and operational restrictions, impacting market share and profitability. The company's ongoing efforts to integrate acquisitions and expand its product portfolio are constantly assessed against these legal frameworks.

- Regulatory Scrutiny: Competition authorities worldwide, including the US Federal Trade Commission (FTC) and the European Commission, actively monitor mergers and acquisitions in the pharmaceutical industry.

- Market Dominance: Laws aim to prevent companies from abusing a dominant market position, which could involve unfair pricing or blocking competitors' access to essential resources.

- Compliance Costs: Sun Pharma incurs costs related to legal counsel, market analysis, and potential divestitures to ensure ongoing compliance with evolving anti-trust legislation.

Sun Pharma's operations are heavily influenced by evolving legal and regulatory landscapes globally. The company must navigate stringent drug approval processes, patent laws, and manufacturing standards to maintain market access and protect its intellectual property. Recent updates to Indian patent rules and manufacturing practices, like the revised Schedule M norms, necessitate continuous investment in quality and compliance.

Marketing and promotion are also legally constrained, with codes like India's UCPMP 2024 dictating ethical practices and holding executives accountable. Furthermore, anti-trust laws are critical, especially for a company like Sun Pharma with significant acquisitions, such as its increased stake in Taro Pharmaceutical Industries, requiring careful adherence to prevent market dominance and ensure fair competition.

Environmental factors

The pharmaceutical sector, including Sun Pharma, is under growing pressure to implement greener manufacturing processes. This means focusing on reducing energy use, cutting down on waste, and utilizing renewable energy. For instance, in fiscal year 2024, Sun Pharma reported a 10% increase in renewable energy sourcing across its manufacturing sites, aiming to further integrate solar power in its Indian facilities.

Stricter regulations around pharmaceutical waste disposal and effluent treatment are a major concern. For instance, India's Central Pollution Control Board (CPCB) has been tightening norms for hazardous waste management, impacting companies like Sun Pharma. These environmental standards demand substantial capital outlay for advanced pollution control systems.

Sun Pharma's commitment to environmental responsibility means investing in technologies to treat wastewater and control air emissions effectively. Failure to comply can lead to penalties and reputational damage. The company reported its environmental, social, and governance (ESG) performance, highlighting its efforts in waste management, though specific figures for pollution control investment in the 2024-2025 period are still emerging.

Climate change presents significant risks to Sun Pharma's operations, with extreme weather events potentially disrupting its global supply chain and manufacturing facilities. For instance, increased water scarcity in key operational regions could impact production processes, as seen in the pharmaceutical industry's reliance on water for various manufacturing stages. Sun Pharma's commitment to water stewardship, including targets for reducing water consumption, is crucial for mitigating these environmental pressures and ensuring operational continuity.

Product Lifecycle Management and Packaging

The pharmaceutical industry, including Sun Pharma, faces increasing pressure for sustainable packaging. Growing consumer awareness and stricter regulations are pushing for eco-friendly materials and responsible end-of-life management for products and their packaging. This environmental focus impacts how pharmaceuticals are presented and disposed of, requiring a shift towards greener alternatives.

Sun Pharma must actively investigate and implement sustainable packaging solutions. This involves considering the entire product lifecycle, from sourcing raw materials to the eventual disposal or recycling of packaging. The goal is to minimize environmental impact at every stage.

- Sustainable Materials: Exploring biodegradable, recyclable, or compostable packaging options for drugs and their secondary packaging.

- Reduced Waste: Implementing strategies to minimize packaging material usage without compromising product integrity or safety.

- End-of-Life Solutions: Developing or supporting programs for the responsible disposal and recycling of pharmaceutical packaging.

- Regulatory Compliance: Staying ahead of evolving environmental regulations concerning packaging and waste management in key markets.

Environmental, Social, and Governance (ESG) Reporting

Investor and stakeholder scrutiny of environmental, social, and governance (ESG) performance is intensifying, demanding clear and consistent reporting on environmental actions and objectives. Sun Pharma's recognition in the S&P Global Sustainability Yearbook 2025 underscores its dedication to ESG values and ethical operations.

This focus translates into a need for detailed disclosure on areas such as carbon emissions reduction, water management, and waste disposal. Companies like Sun Pharma are increasingly evaluated not just on financial returns but also on their environmental footprint and sustainability strategies.

- Sun Pharma's inclusion in the S&P Global Sustainability Yearbook 2025 signifies its strong ESG performance.

- Growing investor demand for transparency in environmental initiatives and targets.

- Emphasis on responsible business practices and measurable environmental impact reduction.

- The Yearbook's assessment covers a broad range of ESG criteria, reflecting a holistic approach to corporate responsibility.

Sun Pharma faces increasing pressure to adopt sustainable packaging, with growing consumer awareness and stricter regulations pushing for eco-friendly materials and responsible disposal. The company's commitment to environmental responsibility is highlighted by its inclusion in the S&P Global Sustainability Yearbook 2025, reflecting strong ESG performance.

The company is actively exploring biodegradable and recyclable packaging options to minimize its environmental footprint throughout the product lifecycle. This includes reducing packaging material usage and developing end-of-life solutions, aligning with evolving environmental regulations in key markets.

Sun Pharma's efforts in renewable energy sourcing saw a 10% increase in fiscal year 2024, with a focus on integrating solar power in its Indian facilities. This demonstrates a proactive approach to reducing energy consumption and its overall environmental impact.

Climate change poses a risk to Sun Pharma's global supply chain and manufacturing operations, particularly concerning water scarcity. The company is implementing water stewardship initiatives, including targets for reducing water consumption, to ensure operational continuity and mitigate environmental pressures.

| Environmental Focus Area | Sun Pharma's Action/Commitment | Data/Evidence |

|---|---|---|

| Renewable Energy | Increasing sourcing of renewable energy | 10% increase in FY24 |

| Waste Management | Implementing advanced pollution control systems | Tightening norms by CPCB impacting industry |

| Water Consumption | Reducing water usage in operations | Targets for water consumption reduction |

| Packaging | Exploring sustainable packaging solutions | Focus on biodegradable and recyclable materials |

| ESG Performance | Demonstrated commitment to ESG values | Inclusion in S&P Global Sustainability Yearbook 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Sun Pharma Industries is built on a comprehensive review of data from reputable financial news outlets, government regulatory filings, and leading pharmaceutical industry market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.