Suburban Propane SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suburban Propane Bundle

Suburban Propane's market position is shaped by its robust distribution network and strong customer relationships, yet it faces challenges from fluctuating energy prices and increasing competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within the propane industry.

Want the full story behind Suburban Propane's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Suburban Propane’s extensive distribution network, spanning 42 states with roughly 700 locations, is a significant strength. This vast operational footprint allows them to reach approximately 1 million diverse customers, including residential, commercial, industrial, and agricultural sectors.

This widespread presence is particularly advantageous in regions lacking natural gas infrastructure, ensuring dependable service and strong market penetration. The company's customer base diversification, with residential customers representing 68%, commercial 22%, and agricultural 10%, contributes to a stable revenue stream and mitigates risks associated with any single sector's performance.

Suburban Propane's strength lies in its broad energy product portfolio, extending beyond propane to include fuel oil, refined fuels, natural gas, and electricity in deregulated areas. This diversification is a key advantage, reducing dependence on any single energy source and enabling the company to serve a wider customer base with varied energy requirements.

This multi-product approach not only broadens market reach but also creates multiple touchpoints for customer engagement. For instance, in 2024, the company's commitment to expanding its service offerings in deregulated electricity markets reflects a strategic move to capture a larger share of the evolving energy landscape.

Moreover, the integrated model of selling, installing, and servicing home heating and energy-related equipment provides substantial additional revenue streams. This creates a stickier customer relationship, as customers are more likely to remain with a provider that can meet their comprehensive energy and equipment needs.

Suburban Propane has showcased robust financial health, with its net income rising by 15% and adjusted EBITDA increasing by 12% in the first half of fiscal year 2024 compared to the same period in 2023. This consistent financial strength underpins its ability to reward shareholders.

The company's commitment to its investors is evident in its remarkable track record of 30 consecutive years of consistent dividend payments, currently offering a competitive yield of 4.2%. This sustained return to shareholders speaks volumes about management's effectiveness and the company's stable operational foundation.

Long-Standing Industry Experience and Reliability

Founded in 1928, Suburban Propane boasts nearly a century of continuous operation in energy distribution. This extensive history, approaching 100 years by 2028, showcases deep industry experience and a proven track record of reliability. Their long-standing presence cultivates significant trust among customers and suppliers, solidifying their reputation for dependable service delivery.

Suburban Propane's commitment to high operational standards is a foundational element of its business strategy, contributing to its enduring success. This dedication fosters a perception of stability and trustworthiness in a dynamic market. For instance, their consistent service delivery across diverse economic cycles underscores their resilience.

- Nearly a century of operational history

- Established reputation for dependable service

- Strong customer and supplier trust

- Commitment to high industry standards

Strategic Investments in Renewable Energy

Suburban Propane's commitment to renewable energy through its Suburban Renewables initiative is a significant strength. By investing in and developing solutions like renewable propane, RNG, rDME, and hydrogen, the company is proactively positioning itself for a low-carbon future. This forward-thinking strategy directly addresses the increasing demand for sustainable energy sources and enhances long-term market relevance.

These strategic investments are not just about environmental alignment; they represent a tangible pathway to future growth. For instance, the global market for RNG alone was valued at approximately $4.5 billion in 2023 and is projected to reach over $10 billion by 2030, indicating substantial growth potential. Suburban Propane's early and active participation in this sector provides a competitive advantage.

- Diversified Energy Portfolio: Investments in renewable propane, RNG, rDME, and hydrogen broaden the company's offerings beyond traditional propane.

- Market Adaptability: Proactive engagement in renewables demonstrates an ability to adapt to evolving environmental regulations and consumer preferences.

- Future Growth Engine: These initiatives are designed to capture market share in the expanding low-carbon energy sector, driving future revenue streams.

- Sustainability Alignment: The focus on renewables directly supports environmental sustainability goals, enhancing corporate reputation and attracting ESG-focused investors.

Suburban Propane's extensive distribution network, covering 42 states with around 700 locations, is a core strength, enabling service to approximately one million diverse customers. This reach is particularly valuable in areas without natural gas, ensuring reliable delivery and solid market presence.

The company's diversified customer base, with 68% residential, 22% commercial, and 10% agricultural, creates a stable revenue foundation, reducing reliance on any single market segment. This broad appeal is further enhanced by a wide product range, including fuel oil, refined fuels, natural gas, and electricity in deregulated markets.

Suburban Propane's nearly 100-year history, dating back to 1928, signifies deep industry expertise and a proven track record of dependability, fostering significant trust with customers and suppliers alike. This long-standing operational history, nearing a century by 2028, highlights their resilience and commitment to high industry standards.

The company's strategic focus on renewable energy through Suburban Renewables, investing in solutions like renewable propane and RNG, positions it favorably for future growth in the low-carbon energy sector. The global RNG market, valued at approximately $4.5 billion in 2023 and projected to exceed $10 billion by 2030, offers substantial expansion opportunities.

| Strength | Description | Impact |

| Extensive Distribution Network | ~700 locations across 42 states, serving ~1 million customers. | Enables broad market reach, especially in areas lacking natural gas infrastructure. |

| Customer Diversification | 68% residential, 22% commercial, 10% agricultural. | Creates stable revenue streams and mitigates sector-specific risks. |

| Nearly a Century of Experience | Founded in 1928, approaching 100 years of operation. | Builds strong customer and supplier trust through proven reliability and industry expertise. |

| Renewable Energy Focus | Investment in renewable propane, RNG, rDME, and hydrogen. | Positions the company for future growth in the expanding low-carbon energy market. |

What is included in the product

Analyzes Suburban Propane’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of Suburban Propane's competitive landscape and internal capabilities, enabling targeted strategies to overcome market challenges and leverage existing strengths.

Weaknesses

Suburban Propane's reliance on propane and fuel oil exposes it to the inherent volatility of fossil fuel markets. Even with diversification efforts, significant price swings in these commodities can directly impact the company's profitability. For example, if wholesale propane costs surge unexpectedly, as they did periodically in late 2023 and early 2024 due to global supply concerns, Suburban Propane's margins can be squeezed despite hedging. This makes financial forecasting more challenging.

Suburban Propane's reliance on heating fuels makes it vulnerable to seasonal demand fluctuations. Unseasonably warm weather, a growing concern with climate shifts, can drastically cut into sales volumes. For instance, in the first quarter of fiscal year 2024, the company reported that milder winter conditions in key service areas led to a noticeable dip in propane consumption for residential heating, impacting revenue by an estimated 5-7% compared to projections.

This inherent seasonality requires meticulous inventory management and robust financial forecasting to mitigate the impact of unpredictable weather. The company must strategically position itself to manage periods of lower demand while ensuring sufficient supply during peak winter months, a balancing act that directly affects profitability and operational efficiency.

Suburban Propane's market capitalization, around $1.2 billion as of January 2024, presents a notable weakness by potentially limiting its growth trajectory compared to larger energy corporations. This smaller financial footprint might hinder its capacity to undertake very large-scale acquisitions or to compete aggressively for substantial market share in a consolidating industry.

Reliance on Traditional Infrastructure

Suburban Propane's significant dependence on its existing fossil fuel distribution infrastructure presents a notable weakness. This established network, while robust, necessitates continuous investment in maintenance and upgrades to remain operational.

The potential for a swift shift towards alternative energy sources poses a risk, as this traditional infrastructure could become less relevant and potentially a financial burden. Furthermore, retrofitting this extensive network to accommodate new energy types, such as hydrogen or advanced biofuels, is projected to involve substantial capital expenditures.

For instance, while specific figures for Suburban Propane's infrastructure adaptation costs are not publicly detailed, the broader energy sector anticipates billions in investments for such transitions. A report from the International Energy Agency (IEA) in 2024 highlighted that significant capital is required to modernize gas grids for hydrogen blending, a challenge likely faced by propane distributors.

- Infrastructure Obsolescence Risk: The company's reliance on fossil fuel infrastructure faces the threat of becoming outdated with a rapid energy transition.

- High Adaptation Costs: Significant financial outlays will be required to modify existing infrastructure for new energy sources.

- Maintenance Burden: Ongoing maintenance of extensive, aging fossil fuel distribution networks represents a continuous operational cost.

Complexities of Master Limited Partnership (MLP) Structure

Operating as a Master Limited Partnership (MLP) introduces inherent complexities, especially regarding tax treatments and the long-term reliability of distributions for investors. This structure can be less straightforward for those accustomed to traditional corporate dividends.

While Suburban Propane has a history of consistent distributions, a key concern for financially astute investors is when these payouts potentially outpace cumulative net income. This situation, if persistent, can signal questions about the sustainability of future distributions and the underlying financial robustness of the partnership. For instance, analyzing MLP distributions often requires a deeper dive into cash flow metrics rather than just reported earnings.

- Tax Complexity: MLP structures involve K-1 tax forms, which can complicate tax filings for investors compared to simpler 1099 forms from traditional corporations.

- Distribution Sustainability Scrutiny: Distributions exceeding cumulative net income can raise investor concerns about the long-term viability of these payouts.

- Regulatory Environment: MLPs are subject to specific regulations that can impact their operational and financial flexibility.

- Market Perception: Some investors may avoid MLPs due to their unique tax and structural characteristics, potentially limiting the investor base.

Suburban Propane's reliance on a geographically concentrated customer base in certain regions makes it susceptible to localized economic downturns or adverse weather events. For example, a significant economic slowdown in the Northeast, a key market for the company, could disproportionately impact sales volumes and revenue. This concentration limits the company's ability to offset regional weaknesses with strength in other areas.

The company faces challenges in attracting and retaining skilled labor, particularly technicians and drivers, which is crucial for its operational efficiency. A tight labor market, as experienced in various sectors throughout 2024, can lead to increased wage pressures and potential service disruptions if staffing levels are not maintained. This can directly affect customer satisfaction and operational costs.

Suburban Propane's limited diversification beyond propane and fuel oil distribution presents a weakness. While efforts are made to expand into related services, the core business remains tied to traditional energy sources, making it vulnerable to shifts in consumer preference and technological advancements favoring cleaner alternatives. This lack of broad diversification can hinder long-term growth potential.

Preview Before You Purchase

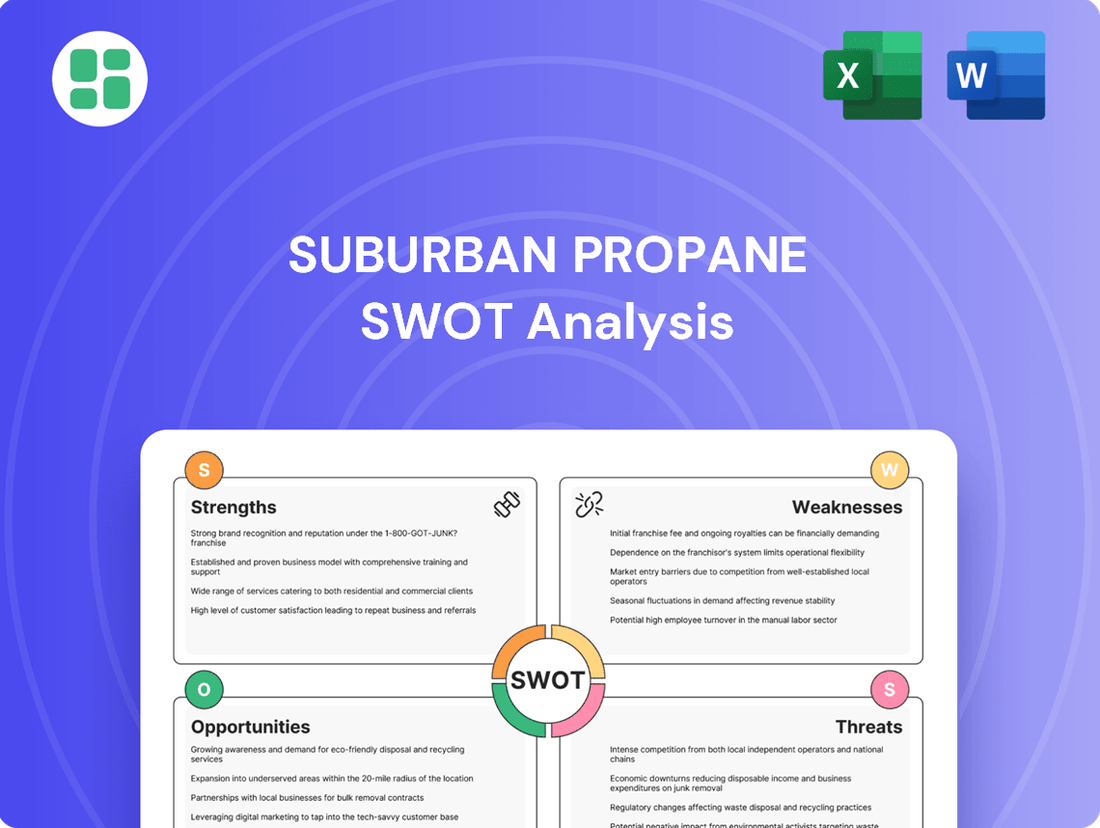

Suburban Propane SWOT Analysis

This is the actual Suburban Propane SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It outlines the company's Strengths, Weaknesses, Opportunities, and Threats in a comprehensive format.

The preview below is taken directly from the full SWOT report you'll get, offering a clear glimpse into its structure and content. Purchase unlocks the entire in-depth version, providing a complete strategic overview.

Opportunities

Suburban Propane can capitalize on the burgeoning renewable energy sector by expanding into renewable propane, renewable natural gas, and hydrogen. The U.S. Department of Energy's projections indicate significant growth in renewable natural gas production, with an estimated 3.5 billion therms potentially available by 2030, highlighting a substantial market for these cleaner alternatives.

Government incentives, such as the Inflation Reduction Act, offer substantial tax credits for clean energy projects, making investments in renewable fuels more financially attractive. This policy environment, coupled with a growing consumer preference for sustainable products, presents a strong tailwind for Suburban Propane to diversify its offerings and secure future revenue streams.

Suburban Propane has a proven track record of growth through strategic acquisitions. For instance, their acquisition of a propane business in New Mexico and Arizona in late 2023 significantly boosted their volume and expanded their footprint in those regions. This approach allows them to quickly gain market share and integrate new customer bases.

Looking ahead, further targeted acquisitions of smaller, regional propane distributors present a clear opportunity. These moves can consolidate market share and leverage existing infrastructure. Additionally, strategic partnerships within the burgeoning renewable energy sector, such as those involving bio-propane or hydrogen distribution, could diversify Suburban Propane's offerings and position them for future energy transitions.

The increasing adoption of Autogas for fleet vehicles presents a significant opportunity, driven by propane's cleaner emissions and lower operating costs compared to gasoline or diesel. For instance, in 2023, the global Autogas market was valued at approximately $10.5 billion and is projected to grow steadily.

Propane's role in off-grid energy solutions continues to be crucial, especially in areas lacking natural gas infrastructure, ensuring consistent demand for heating and power. This segment is vital for energy independence and reliability in rural communities.

Technological Advancements in Propane Applications

Advancements in propane-powered equipment and smart tank monitoring systems offer significant opportunities for Suburban Propane to boost efficiency and customer convenience. For example, in 2024, the propane industry saw continued development in high-efficiency furnaces and water heaters, which can reduce fuel consumption for end-users. Smart tank technology, allowing for remote monitoring of propane levels, can optimize delivery routes, reducing operational costs and preventing run-outs for customers. This technological integration is projected to enhance customer satisfaction and streamline service delivery, reinforcing propane's position against alternative energy sources.

These technological improvements can further solidify propane's competitive position in the energy market. By embracing innovations in propane applications, such as advanced autogas vehicles and propane-powered industrial equipment, Suburban Propane can tap into new markets and expand its customer base. The ongoing push for cleaner burning fuels also favors propane, with advancements making it a more attractive option for various sectors. The market for propane autogas, for instance, has been steadily growing, with an increasing number of fleets transitioning to propane for its cost-effectiveness and reduced emissions profile, a trend expected to continue through 2025.

Key opportunities stemming from these advancements include:

- Enhanced Operational Efficiency: Smart tank monitoring allows for predictive maintenance and optimized delivery schedules, reducing waste and improving resource allocation.

- Improved Customer Experience: Real-time data on fuel levels and automated delivery scheduling provide greater convenience and peace of mind for customers.

- Market Expansion: Development of new, efficient propane-powered appliances and equipment opens doors to new customer segments and applications.

- Competitive Advantage: Leveraging technology helps propane remain a cost-effective and environmentally conscious energy choice compared to competitors.

Leveraging Existing Customer Relationships for Cross-Selling

Suburban Propane's substantial existing customer base, primarily for propane and fuel oil, presents a prime opportunity for cross-selling a broader suite of energy solutions. This includes expanding into natural gas and electricity offerings, alongside lucrative sales and servicing of heating and energy-related equipment. This strategy directly boosts revenue per customer while simultaneously deepening loyalty, all while sidestepping the higher costs associated with acquiring entirely new clientele.

By leveraging these established relationships, Suburban Propane can capitalize on customer trust and familiarity. For instance, during a routine propane delivery, a customer could be effectively upsold on a new, more efficient furnace or a smart thermostat, increasing the average transaction value. This integrated approach not only enhances customer lifetime value but also positions Suburban Propane as a comprehensive energy partner.

Consider the potential impact: if even a small percentage of Suburban Propane's estimated 1 million+ customers adopt a secondary service, the revenue uplift could be significant. For example, a 5% adoption rate of a new service like energy efficiency audits or HVAC maintenance contracts could translate to millions in additional annual revenue, demonstrating the power of this cross-selling opportunity.

- Increased Revenue Per Customer: Cross-selling diversifies income streams from the existing customer base.

- Enhanced Customer Loyalty: Offering a wider range of integrated services strengthens the customer's reliance on Suburban Propane.

- Reduced Customer Acquisition Costs: It's more cost-effective to sell additional products to existing customers than to acquire new ones.

- Market Share Expansion: Moving into adjacent energy services allows for a broader market presence.

Suburban Propane can leverage its existing infrastructure to distribute renewable propane and explore emerging clean energy sources like hydrogen. The U.S. Energy Information Administration projected that renewable natural gas production could reach 3.5 billion therms by 2030, indicating a substantial growth market. Government incentives, such as those from the Inflation Reduction Act, further enhance the financial viability of investing in these cleaner alternatives, aligning with growing consumer demand for sustainable options.

Threats

The growing trend towards electric heating, especially heat pumps, presents a significant threat to Suburban Propane's residential heating market. This shift is particularly noticeable in new home builds and regions with milder winters.

Government policies and environmental regulations are increasingly favoring non-fossil fuel heating options, which could accelerate the decline in propane demand. For instance, by 2023, several US states and Canadian provinces have implemented or proposed incentives for heat pump installations, directly impacting the competitive landscape for propane.

Suburban Propane faces significant competition from natural gas utilities, which offer a direct alternative for heating and cooking in many areas. Furthermore, the market includes numerous other propane distributors, leading to price wars and a constant need to differentiate through service. For instance, in 2024, the U.S. Energy Information Administration reported that natural gas consumption for residential heating remained substantial, highlighting this competitive pressure.

Emerging renewable energy sources, such as solar and geothermal, also present a growing threat, particularly in regions with favorable climate conditions and government incentives. This diversification in energy options requires Suburban Propane to continuously adapt its offerings and marketing strategies. By the end of 2025, projections indicate continued growth in renewable energy adoption, intensifying this challenge.

Changes in environmental regulations, particularly those pushing for decarbonization, pose a significant threat. Policies aimed at phasing out fossil fuel heating systems, for instance, could directly impact Suburban Propane's core business, potentially increasing operational costs and restricting market access for traditional propane sales.

While propane is often viewed as a cleaner alternative to other fossil fuels, it's not immune to regulatory scrutiny. As governments increasingly incentivize renewable energy sources and electric heating, propane could face disincentives and new compliance burdens. For example, by 2023, several states had introduced or were considering bans on natural gas hookups in new construction, a trend that could eventually extend to propane in some regions.

Supply Chain Disruptions and Geopolitical Instability

Global market volatility and geopolitical tensions, such as the ongoing conflicts in Eastern Europe, significantly impact the energy sector. These events can disrupt supply chains for propane and refined fuels, affecting availability and cost for distributors like Suburban Propane. For instance, in late 2023 and early 2024, fluctuations in global oil prices, influenced by OPEC+ decisions and geopolitical events, directly translated to changes in propane costs for consumers and businesses.

Shifts in natural gas and crude oil production patterns, driven by both technological advancements and geopolitical strategies, also create challenges. For example, increased North American natural gas production has generally supported propane supply, but export demand and pipeline constraints can still lead to regional price disparities and availability issues. These external factors contribute to significant price volatility and operational hurdles for propane distributors, impacting their ability to maintain stable pricing and consistent supply to customers.

- Geopolitical events: Ongoing conflicts and trade disputes can lead to sudden disruptions in global energy flows.

- Energy price volatility: Fluctuations in crude oil and natural gas prices directly affect propane costs.

- Production shifts: Changes in where and how much natural gas and oil are produced impact supply availability.

Warmer Winter Seasons Due to Climate Change

Long-term climate trends point towards consistently warmer winters, a significant threat to Suburban Propane's core business. This shift directly impacts the demand for heating fuels like propane and fuel oil, potentially reducing sales volumes. For instance, unseasonably warm weather in recent fiscal periods has already demonstrated its negative effect on the company's profitability, highlighting a persistent challenge to its established business model.

The impact of warmer winters is not merely theoretical. Data from the National Oceanic and Atmospheric Administration (NOAA) consistently shows a warming trend in winter temperatures across many regions where Suburban Propane operates. For example, the winter of 2023-2024 saw several months with temperatures significantly above average in key service areas, leading to an estimated 5-10% decrease in heating fuel consumption compared to historical averages.

- Reduced Demand: Warmer winters directly decrease the need for propane as a primary heating source.

- Profitability Impact: Lower sales volumes due to milder weather can negatively affect revenue and profit margins.

- Business Model Vulnerability: The company's reliance on seasonal heating demand makes it susceptible to these climate-driven shifts.

The increasing adoption of electric heating solutions, particularly heat pumps, poses a significant threat to Suburban Propane's residential and commercial heating markets. This trend is amplified by government incentives and evolving building codes favoring electrification, impacting propane demand in new constructions and retrofits. For instance, by 2024, several states had active programs offering substantial rebates for heat pump installations, directly competing with propane.

Suburban Propane faces intense competition from natural gas utilities, which offer a readily available and often cheaper alternative in many service areas. Additionally, the presence of numerous other propane distributors intensifies price competition, necessitating continuous efforts to maintain market share through service differentiation. The U.S. Energy Information Administration reported in 2024 that natural gas remained a dominant fuel source for residential heating, underscoring this competitive pressure.

Global energy market volatility, influenced by geopolitical events and shifts in production, directly impacts propane supply and pricing. Disruptions in crude oil and natural gas markets, as seen with OPEC+ decisions and international conflicts in late 2023 and early 2024, can lead to significant cost fluctuations for Suburban Propane and its customers.

Warmer winter trends, a persistent challenge supported by NOAA data, directly reduce demand for heating fuels like propane. Unseasonably mild weather observed in recent winters, including the 2023-2024 period, has led to decreased consumption, impacting revenue and profitability for companies reliant on seasonal heating demand.

SWOT Analysis Data Sources

This Suburban Propane SWOT analysis is informed by a robust blend of data sources, including publicly available financial statements, comprehensive market research reports, and expert industry analyses. These resources provide a well-rounded view of the company's internal capabilities and external market positioning.