Suburban Propane Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Suburban Propane Bundle

Curious about Suburban Propane's market position? This glimpse into their BCG Matrix reveals how their diverse offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't settle for a partial view; unlock the full strategic potential.

Purchase the complete Suburban Propane BCG Matrix to gain a crystal-clear understanding of each product's performance and market share. Armed with this detailed analysis, you'll be empowered to make informed decisions about resource allocation and future investments.

This is your opportunity to move beyond speculation and embrace data-driven strategy. Invest in the full BCG Matrix report today and equip yourself with the insights needed to navigate the competitive landscape and drive Suburban Propane's success.

Stars

Suburban Propane's Renewable Natural Gas (RNG) segment is a clear Star in its BCG Matrix. The company is making substantial investments, with planned capital expenditures for new RNG facilities in fiscal 2024 and 2025. This strategic focus is driven by the booming demand for decarbonization solutions and supportive regulatory incentives.

The company's commitment to RNG is reflected in its increasing production volumes. For instance, Suburban Propane reported a significant increase in RNG production in its fiscal 2023 year, a trend expected to continue. This high-growth potential, despite current capital intensity, positions RNG as a key driver for future market leadership.

Suburban Propane's strategic investments in renewable dimethyl ether (rDME), notably through its collaboration with Oberon Fuels, highlight a significant commitment to the burgeoning low-carbon fuel sector. This partnership aims to leverage rDME's environmental advantages and its compatibility with existing propane infrastructure, placing Suburban Propane as a key player in the energy transition. The company's foresight in this area is expected to yield substantial market share growth as rDME adoption accelerates.

Suburban Propane actively pursues strategic acquisitions to bolster its market presence. Recent examples include acquiring businesses in New Mexico and Arizona, which directly boosted retail propane gallons sold and broadened their customer reach. These moves are designed to solidify their position in expanding territories and consolidate their standing in established areas, driving overall expansion.

Hydrogen Energy Ventures (H2GP Sponsorship)

Suburban Propane's sponsorship of the Hydrogen Grand Prix (H2GP) through its Suburban Renewables arm marks a strategic investment in the burgeoning hydrogen sector. This initiative positions the company as an early adopter in a high-growth market, aiming to establish leadership in future energy solutions.

- Early Market Entry: H2GP sponsorship signifies Suburban Propane's commitment to exploring and investing in the hydrogen economy, a sector projected for significant expansion.

- Strategic Positioning: This venture allows the company to gain early insights and build relationships within the developing hydrogen value chain.

- Future Growth Potential: Investments in hydrogen are seen as crucial for long-term energy transition, offering substantial future growth opportunities.

Diversification into Deregulated Natural Gas and Electricity

Suburban Propane's strategic move into deregulated natural gas and electricity markets positions it within a sector experiencing significant growth due to ongoing deregulation. This expansion leverages their existing infrastructure and customer relationships, providing a strong foundation for capturing market share in these evolving energy services.

The company's involvement in these deregulated segments, while specific market share data isn't publicly detailed, signifies a promising avenue for future revenue growth. As more regions embrace energy market deregulation, opportunities for companies like Suburban Propane to offer diversified energy solutions increase.

- Leveraging Existing Infrastructure: Suburban Propane can utilize its extensive distribution network for propane to efficiently serve customers in the natural gas and electricity sectors.

- Customer Base Expansion: The company's established customer relationships provide a ready market for cross-selling new energy services.

- Growth Potential in Deregulated Markets: The ongoing trend of energy deregulation creates a fertile ground for companies to expand their service offerings and capture new market segments.

- Diversification Strategy: Entering these markets represents a key component of Suburban Propane's diversification strategy, reducing reliance on a single energy source.

Suburban Propane's investment in Renewable Natural Gas (RNG) and strategic partnerships like the one with Oberon Fuels for renewable dimethyl ether (rDME) position these as Stars in its BCG Matrix. The company's commitment to decarbonization solutions is backed by significant capital expenditures in fiscal 2024 and 2025 for new RNG facilities. This focus on high-growth, environmentally conscious energy sources, coupled with increasing production volumes and early-stage investments in hydrogen through initiatives like the Hydrogen Grand Prix sponsorship, underscores their potential for market leadership in the evolving energy landscape.

| Segment | BCG Category | Key Drivers | Recent Performance/Investment |

|---|---|---|---|

| Renewable Natural Gas (RNG) | Star | Decarbonization demand, regulatory incentives, increasing production | Planned CapEx for new facilities (FY24-25), significant increase in FY23 production |

| Renewable Dimethyl Ether (rDME) | Star | Environmental advantages, compatibility with existing infrastructure | Collaboration with Oberon Fuels, aiming for substantial market share growth |

| Hydrogen | Star | Emerging high-growth market, future energy solutions | Sponsorship of Hydrogen Grand Prix (H2GP) through Suburban Renewables |

| Deregulated Natural Gas & Electricity | Star | Market deregulation, leveraging existing infrastructure and customer base | Expansion into deregulated markets, providing diversified energy solutions |

What is included in the product

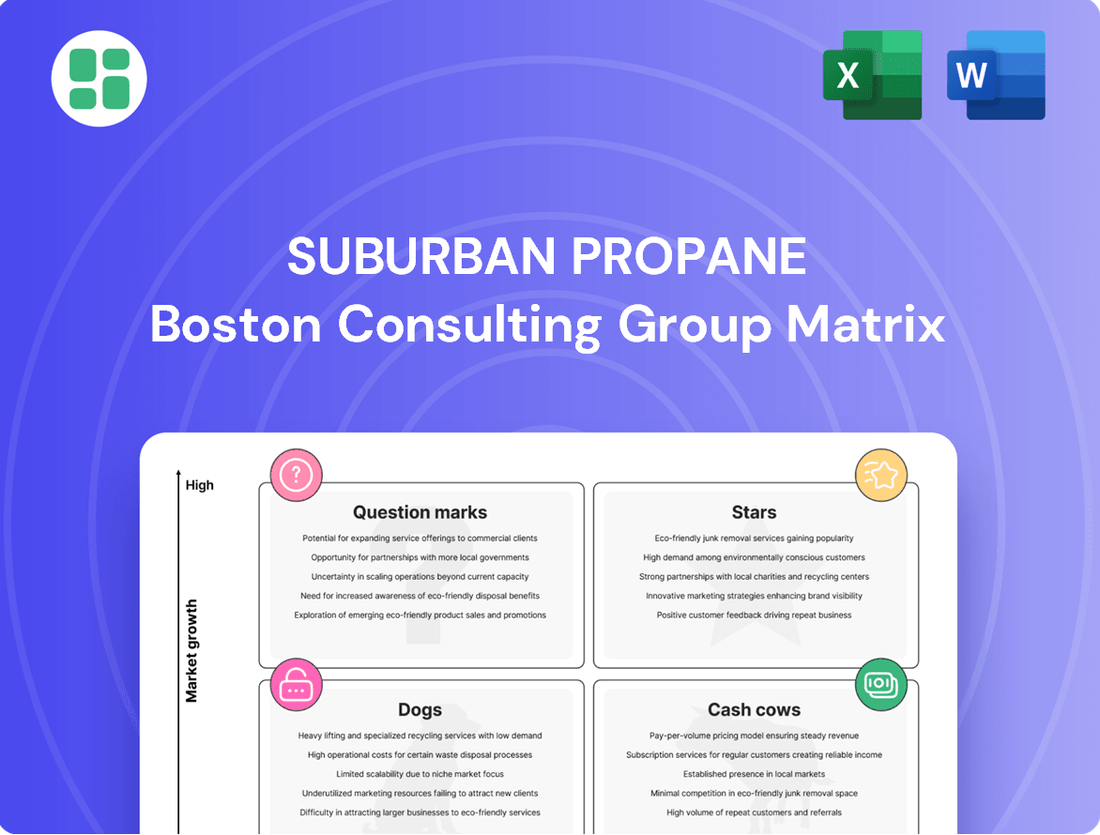

The Suburban Propane BCG Matrix provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs within their business.

The Suburban Propane BCG Matrix offers a clear, visual snapshot of business unit performance, simplifying complex data into actionable insights.

Cash Cows

Suburban Propane's core retail propane distribution business is a classic cash cow. This mature segment, operating across 42 states, enjoys a strong market position and consistent demand. In 2023, this segment was instrumental in generating the company's robust cash flow, allowing for reinvestment and strategic growth initiatives.

Suburban Propane's fuel oil and refined fuels distribution segment operates as a classic Cash Cow. This segment holds a significant market share in a mature, low-growth industry, consistently generating substantial cash flow for the company.

The company's extensive distribution network and established customer base provide a stable revenue stream. For instance, in 2023, Suburban Propane reported that its energy distribution segment, which includes refined fuels, accounted for a significant portion of its total revenue, demonstrating its reliable performance.

The sale, installation, and servicing of home heating and energy equipment is a strong performer for Suburban Propane. This segment is a cash cow, generating consistent revenue and healthy profit margins. In 2024, the demand for reliable heating solutions, coupled with the need for regular maintenance, solidified this business unit's position.

Established Customer Base and Network

Suburban Propane's established customer base and extensive network are key strengths, positioning it firmly within the Cash Cows quadrant of the BCG Matrix. The company serves approximately 1 million customers, spanning residential, commercial, governmental, industrial, and agricultural sectors, with operations across 700 locations.

This broad reach fosters significant customer loyalty within mature markets, ensuring a consistent and predictable demand for its core propane and fuel products. Such stability translates directly into high and reliable cash flows, a hallmark of Cash Cow businesses.

- Customer Reach: Approximately 1 million customers across 700 locations.

- Market Position: Strong presence in mature, stable markets.

- Revenue Generation: Consistent demand for core products leads to predictable, high cash flows.

- Loyalty Factor: Broad network and established relationships drive customer retention.

Efficient Supply Chain and Logistics

Suburban Propane's efficient supply chain and logistics are a significant strength, acting as a key driver for its Cash Cow status. The company leverages decades of experience in navigating the complexities of propane distribution, even through fluctuating commodity prices. This deep-seated operational expertise translates directly into cost control and reliable delivery, crucial in a mature market.

This operational efficiency allows Suburban Propane to maintain healthy profit margins. For instance, in 2023, the company reported a gross profit margin of approximately 26.7%, reflecting its ability to manage product costs effectively through its robust logistics network. This consistent profitability generates substantial cash flow, which is vital for reinvestment and shareholder returns.

- Established Infrastructure: Suburban Propane benefits from a well-developed network of storage facilities and transportation assets, enabling efficient product movement.

- Commodity Cycle Management: Long-standing experience allows for astute management of propane procurement and inventory, mitigating risks associated with price volatility.

- Cost Control: Operational efficiencies directly contribute to lower per-unit delivery costs, enhancing overall profitability.

- Market Maturity: The stable demand in the propane market, coupled with efficient operations, ensures consistent and predictable cash generation.

Suburban Propane's core business segments, particularly retail propane and fuel oil distribution, are firmly positioned as Cash Cows. These operations benefit from a mature market with stable demand, supported by an extensive distribution network and a loyal customer base of approximately 1 million individuals and businesses across 700 locations.

The company's strong market position in these segments consistently generates substantial and predictable cash flow. This financial stability is further bolstered by operational efficiencies, such as effective supply chain management and commodity price navigation, which contribute to healthy profit margins. For instance, Suburban Propane's gross profit margin in 2023 was around 26.7%, a testament to its cost control capabilities.

The sale, installation, and servicing of home heating and energy equipment also represent a significant Cash Cow. This segment capitalizes on the ongoing need for reliable energy solutions and maintenance, ensuring consistent revenue and robust profit generation. The consistent performance of these units allows for reinvestment and shareholder returns, characteristic of successful Cash Cows.

| Segment | BCG Category | Key Strengths | 2023 Performance Indicator |

| Retail Propane Distribution | Cash Cow | Extensive network, loyal customer base, stable demand | Significant contributor to robust cash flow |

| Fuel Oil & Refined Fuels Distribution | Cash Cow | Significant market share, mature industry, consistent cash generation | Accounted for a substantial portion of total revenue |

| Home Heating & Energy Equipment | Cash Cow | Consistent revenue, healthy profit margins, ongoing demand | Solidified position due to demand for reliable solutions |

What You See Is What You Get

Suburban Propane BCG Matrix

The BCG Matrix preview you are currently viewing is the complete and final document you will receive upon purchase. This means you can confidently assess the strategic insights and professional formatting without any alterations or watermarks. The analysis presented here is precisely what you will download, ready for immediate application in your business strategy discussions or planning sessions.

Dogs

Certain Suburban Propane regional operations, particularly those in warmer climates, faced significant headwinds in 2024 due to unseasonably warm weather. This directly impacted heat-related demand, leading to lower propane volumes sold and consequently, reduced profitability in these core business segments.

These underperforming regions, characterized by low growth and diminished earnings, require strategic attention. For instance, areas with a higher reliance on seasonal heating, if experiencing a prolonged mild winter, could see revenue declines. While specific regional profit figures for 2024 are proprietary, industry-wide data from the U.S. Energy Information Administration (EIA) indicated that residential and commercial sectors, heavily influenced by weather, saw fluctuating demand throughout the year.

Suburban Propane's legacy equipment or services with declining demand represent its "Dogs" in the BCG Matrix. These are offerings, perhaps older propane tank models or installation services that are being superseded by newer, more efficient technologies or alternative energy sources. Their market share is likely small, and the growth prospects are minimal, meaning they don't contribute much to the company's overall growth or profitability.

For instance, if Suburban Propane still offers certain older appliance conversions that are no longer popular due to the rise of electric or natural gas alternatives, these would fit the Dog category. The demand for these specific services has been steadily decreasing. In 2024, the broader trend in the energy sector shows a significant shift towards electrification and renewable energy, further pressuring legacy propane-dependent equipment.

Suburban Propane's presence in very small, non-strategic niche markets, where its market share is limited and the market itself is experiencing minimal growth, can be categorized as Dogs. These segments may not warrant the allocation of significant resources given their low contribution to the company's overall expansion or financial performance. For instance, if a niche market generated less than 0.5% of Suburban Propane's total revenue in 2024, and that market was projected to grow by less than 1% annually, it would fit this description.

Inefficient or Outdated Infrastructure Assets

Inefficient or outdated infrastructure assets, such as aging propane storage tanks or underutilized distribution pipelines, could be categorized as Dogs within Suburban Propane's BCG Matrix. These assets often require significant capital for upgrades or face increasing operational costs due to their age, while serving markets with diminishing demand for traditional fuels.

For example, a propane distribution network primarily serving a region experiencing a permanent decline in residential propane use due to electrification trends would represent a Dog. Maintaining these legacy systems drains resources that could be invested in more promising growth areas, such as renewable natural gas or expanded service offerings.

- Aging Infrastructure: An estimated 20% of U.S. natural gas distribution pipelines are over 60 years old, indicating a broader industry challenge of maintaining aging infrastructure that also affects propane.

- Declining Demand Markets: Areas with a high adoption rate of electric heating or a significant population exodus will see reduced demand for propane, making associated infrastructure less profitable.

- High Maintenance Costs: Older assets typically incur higher maintenance and repair costs, eating into profit margins and hindering potential reinvestment in growth initiatives.

Unsuccessful Pilot Programs or Niche Investments

Unsuccessful pilot programs or niche investments within Suburban Propane’s portfolio, especially those in low-growth segments, would fall into the Dogs category. These are initiatives that, despite initial investment, have failed to capture significant market share or demonstrate a clear path to profitability. For example, a past pilot program exploring a highly specialized, low-demand industrial gas distribution in a saturated regional market might have shown minimal uptake.

Such ventures, if they haven't shown a turnaround by mid-2025, would be prime candidates for divestment or significant scaling back. Consider a hypothetical scenario where a small investment in a niche biofuel blending operation, aimed at a very specific agricultural sector, yielded less than 1% market penetration by 2024 and projected growth remained stagnant.

- Low Market Penetration: A pilot program for residential propane delivery in a remote, sparsely populated area might have only secured a handful of customers, representing a negligible market share.

- Stagnant Revenue Growth: An investment in a niche propane appliance repair service for a declining model of heater might have shown flat or declining revenue figures throughout 2023 and 2024.

- High Operating Costs Relative to Returns: A small-scale venture into propane autogas conversion for a limited fleet of vehicles could be a Dog if the conversion costs and operational overhead consistently outweighed the fuel savings and demand.

- Lack of Scalability: A pilot program focused on a unique, localized propane refill station model that proved difficult and expensive to replicate in other areas would also fit this classification.

Suburban Propane's "Dogs" represent business units or offerings with low market share in low-growth markets. These are often legacy products or services facing declining demand, such as older propane appliance models or distribution in areas with significant population decline or a strong shift to alternative energy sources. For example, a niche market generating less than 0.5% of total revenue with projected annual growth under 1% would fit this category. These segments require careful management to avoid draining resources from more promising ventures.

Aging infrastructure, like pipelines over 60 years old, which is common in the broader energy sector, also falls into the Dog category for Suburban Propane. These assets incur high maintenance costs and serve markets with diminishing demand, making them less profitable and hindering reinvestment. A prime example would be a propane distribution network in a region experiencing a permanent decline in residential propane use due to electrification trends.

Unsuccessful pilot programs or niche investments that have failed to gain traction or show a clear path to profitability by mid-2025 are also classified as Dogs. These might include specialized industrial gas distribution in saturated markets or biofuel blending operations with minimal market penetration, such as less than 1% by 2024, and stagnant growth projections.

These "Dog" segments are characterized by low revenue growth, high operating costs relative to returns, and often a lack of scalability, making them candidates for divestment or significant scaling back to optimize resource allocation.

Question Marks

Suburban Propane's exploration into emerging renewable energy technologies, particularly in nascent hydrogen production methods, positions these ventures as Question Marks within its BCG Matrix. These are markets with substantial growth potential, but the company's current footprint is minimal, necessitating substantial capital allocation to assess their future trajectory and potential to evolve into Stars.

New geographic market expansions for deregulated energy, particularly in natural gas and electricity, represent potential Stars for Suburban Propane. These markets, where the company is actively building its customer base, offer significant growth opportunities. For instance, by mid-2024, several states had completed or were nearing the full deregulation of their energy markets, creating fertile ground for new entrants.

While these new territories show promise, Suburban Propane's current market share is low, indicating these are indeed Stars requiring substantial investment. The company is likely allocating significant capital towards marketing campaigns and infrastructure development to capture a larger portion of these emerging markets. This investment is crucial for establishing a strong foothold before competitors solidify their positions.

Investing in advanced biofuels beyond RNG and rDME represents a significant strategic pivot for Suburban Propane, placing these initiatives in the Question Marks category of the BCG Matrix. These are high-risk, high-reward ventures in nascent, rapidly evolving sustainable energy markets.

The global advanced biofuels market is projected to grow substantially, with some estimates suggesting a CAGR of over 10% in the coming years, indicating significant future potential but also current uncertainty. For instance, the market for sustainable aviation fuel (SAF), a key advanced biofuel, is expected to reach tens of billions of dollars by 2030, but its widespread adoption and profitability remain in flux.

Suburban Propane's commitment to R&D in areas like cellulosic ethanol, algae-based fuels, or synthetic fuels derived from biomass positions them to capture future market share. However, these technologies often face challenges with scalability, cost-competitiveness against fossil fuels, and regulatory support, making their future success a question mark.

Smart Home and Energy Management Solutions

Smart home and advanced energy management solutions would likely be classified as Stars or Question Marks for Suburban Propane, depending on the specific market segment and the company's investment strategy. This sector is experiencing robust growth, with the global smart home market projected to reach over $200 billion by 2025, according to various industry reports. Suburban Propane would likely enter this market with a low initial market share, necessitating significant investment in research and development, marketing, and customer education to gain traction.

For these ventures to succeed, Suburban Propane would need to focus on developing integrated solutions that offer tangible benefits like energy savings and enhanced convenience for their customers. The company would also need to build strategic partnerships with technology providers and smart device manufacturers to offer a comprehensive and user-friendly experience.

- Market Growth: The smart home market is expanding rapidly, with significant potential for future revenue streams.

- Investment Needs: High upfront investment in technology, talent, and marketing is crucial for market entry and growth.

- Competitive Landscape: Suburban Propane would face established players and new entrants, requiring a differentiated value proposition.

- Customer Adoption: Educating consumers on the benefits and ease of use of these solutions will be key to widespread adoption.

Strategic Partnerships in Untapped Green Energy Sectors

Forming strategic partnerships or making early-stage investments in nascent green energy sectors, like advanced geothermal or green hydrogen production, where Suburban Propane currently lacks direct market share but sees high growth potential, would classify these ventures as Stars or Question Marks within a BCG Matrix framework. These areas represent significant diversification opportunities, though they demand substantial capital and carry inherent market adoption risks. For instance, the global green hydrogen market was valued at approximately USD 2.4 billion in 2023 and is projected to reach USD 57.9 billion by 2032, indicating substantial growth potential.

- Star/Question Mark Classification: Ventures into high-growth, low-market-share green energy sectors.

- Strategic Rationale: Diversification and future growth through early-stage investment or partnerships.

- Capital Commitment & Risk: Requires significant investment with uncertain outcomes due to market immaturity.

- Market Example: Green hydrogen sector growth projections highlight the potential of such untapped areas.

Suburban Propane's investments in emerging renewable energy technologies, such as early-stage hydrogen production and advanced biofuels beyond current offerings, are categorized as Question Marks. These represent high-growth potential markets where the company has a minimal current presence, requiring significant capital to explore their future viability and potential to become market leaders.

These ventures are characterized by substantial market growth prospects but also high uncertainty regarding technological maturity and market adoption. For example, the global green hydrogen market is expected to see significant expansion, with projections indicating a substantial increase in value by the end of the decade, yet its widespread commercialization is still developing.

The company's focus on these areas necessitates considerable investment in research and development, pilot projects, and market analysis to determine their long-term strategic fit and potential for competitive advantage.

The success of these Question Mark initiatives hinges on Suburban Propane's ability to navigate technological hurdles, secure regulatory support, and achieve cost-competitiveness in rapidly evolving sustainable energy landscapes.

BCG Matrix Data Sources

Our Suburban Propane BCG Matrix leverages a blend of financial disclosures, industry growth forecasts, and competitive market analysis to accurately position each business segment.