STRATTEC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

STRATTEC Bundle

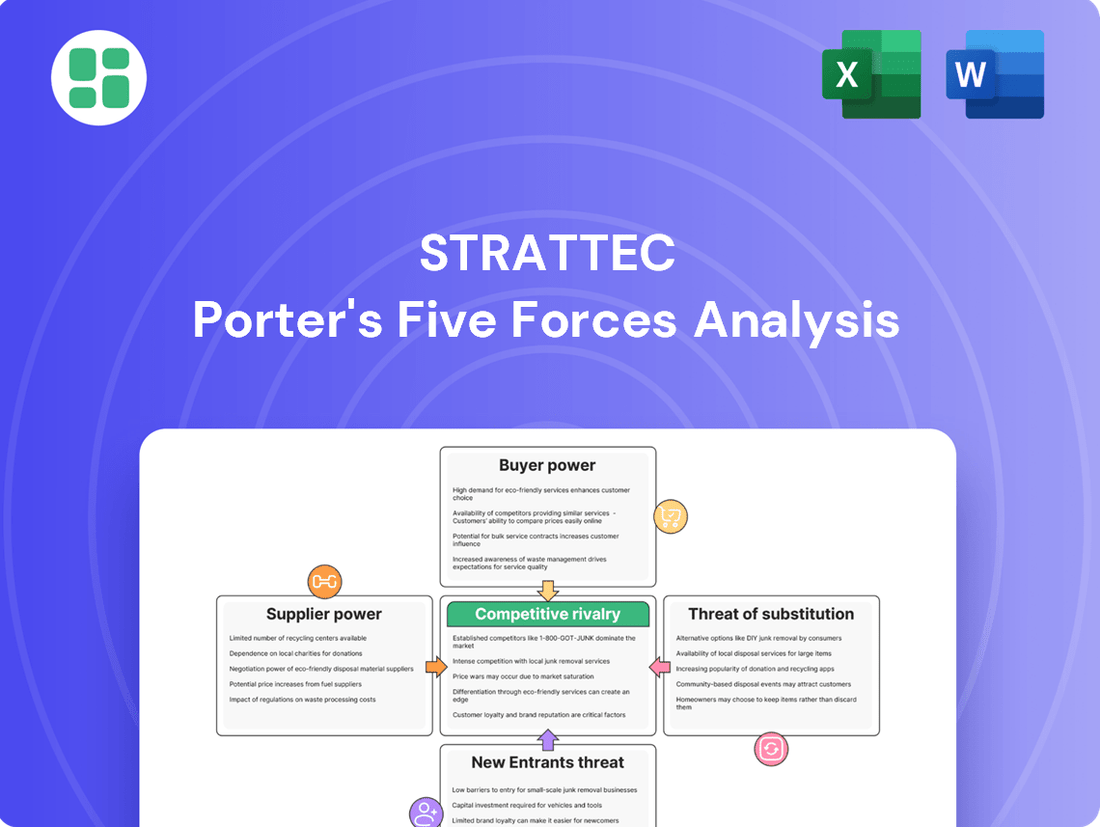

STRATTEC's competitive landscape is shaped by the interplay of buyer power, supplier leverage, the threat of new entrants, substitute products, and the intensity of rivalry. Understanding these forces is crucial for navigating the automotive components market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore STRATTEC’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

STRATTEC's reliance on a concentrated supplier base for essential materials like metals, plastics, and electronic components significantly impacts its bargaining power. When a few key suppliers dominate the market for specialized inputs, they can command higher prices, directly affecting STRATTEC's cost structure and profitability.

The automotive sector, including companies like STRATTEC, has navigated persistent shortages of critical components throughout 2024 and into 2025. For example, ongoing semiconductor chip scarcity and limited availability of specialized metals have empowered suppliers, allowing them to dictate terms and potentially increase their prices, squeezing margins for manufacturers.

The uniqueness of inputs significantly impacts STRATTEC's bargaining power with its suppliers. If STRATTEC relies on highly specialized or proprietary components, such as advanced microcontrollers for its automotive keyless entry systems, suppliers of these unique inputs gain considerable leverage. For example, a supplier holding a patent for a critical semiconductor component used in STRATTEC's latest security modules would have substantial pricing power.

The difficulty in substituting these specialized inputs further amplifies supplier strength. Developing alternative components often requires substantial research and development investment and time, which STRATTEC may not readily have. This reliance on a limited pool of suppliers for critical, non-substitutable parts means STRATTEC has less ability to negotiate favorable terms, potentially leading to higher component costs. In 2023, the automotive industry saw continued supply chain disruptions, particularly for advanced semiconductors, a trend that likely persisted into early 2024, highlighting the critical nature of unique input sourcing.

STRATTEC faces significant supplier bargaining power due to high switching costs. These costs encompass the expenses and effort involved in retooling manufacturing equipment, re-qualifying new components to meet stringent automotive standards, or even redesigning existing products to accommodate different supplier specifications. For instance, a shift to a new supplier for a critical electronic module might require extensive testing and validation, potentially delaying product launches and incurring substantial engineering costs.

These transition challenges directly limit STRATTEC's ability to easily move between suppliers, thereby strengthening the leverage of their existing partners. In 2024, the automotive industry continued to grapple with supply chain disruptions, making the reliability and established relationships with current suppliers even more valuable, further solidifying their bargaining position.

Threat of Forward Integration by Suppliers

If suppliers can and want to start making automotive access control products themselves, it's a big threat to STRATTEC. This could mean less business for STRATTEC and more direct competition coming from companies that currently supply them. For instance, a large tier-1 automotive supplier with existing manufacturing capabilities might see an opportunity to capture more value by moving into STRATTEC's product space.

However, this risk is often lessened because making automotive components is complex and requires a lot of money upfront. The automotive industry's stringent quality standards and the significant investment needed for specialized manufacturing equipment can be major barriers for suppliers looking to integrate forward. In 2024, the average capital expenditure for automotive manufacturers globally remained substantial, reflecting the ongoing need for advanced production facilities.

- Supplier Capability: Suppliers possessing advanced manufacturing technology and R&D capabilities are more likely to integrate forward.

- Market Attractiveness: High profit margins or significant market share growth potential in automotive access control would incentivize suppliers.

- Industry Barriers: The high capital investment and technical expertise required for automotive component production can deter forward integration.

Importance of STRATTEC to Suppliers

The bargaining power of suppliers to STRATTEC is significantly shaped by how crucial STRATTEC is as a customer. If STRATTEC accounts for a substantial percentage of a supplier's overall sales, that supplier will likely be more amenable to favorable pricing and contract terms to retain STRATTEC's business.

Conversely, if STRATTEC represents only a minor portion of a supplier's revenue, the supplier has less incentive to offer concessions. This dynamic means suppliers who depend heavily on STRATTEC may have diminished bargaining power, while those with a diverse customer base might wield more influence.

- Supplier Dependence: The degree to which a supplier relies on STRATTEC for its revenue directly impacts its willingness to negotiate.

- STRATTEC's Purchasing Volume: Larger orders from STRATTEC can give it more leverage in price discussions.

- Supplier's Market Position: A supplier with a dominant market share for a critical component may retain significant power, even if STRATTEC is a large customer.

STRATTEC's suppliers possess considerable bargaining power, largely due to the concentrated nature of the market for specialized automotive components and the high switching costs involved for STRATTEC. Persistent supply chain issues in 2024, particularly for semiconductors and rare earth metals, have further amplified supplier leverage, enabling them to dictate terms and potentially increase prices. This situation is exacerbated when suppliers hold patents for critical components, making substitution difficult and costly for STRATTEC.

| Factor | Impact on STRATTEC | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Supplier Concentration | High | Limited number of key suppliers for specialized electronics and metals. |

| Switching Costs | High | Retooling, re-qualification, and potential product redesign add significant expense and time. |

| Input Uniqueness/Patents | High | Suppliers with proprietary technology for critical components (e.g., advanced microcontrollers) gain pricing power. |

| Forward Integration Risk | Moderate | High capital investment and stringent quality standards in automotive manufacturing act as barriers for suppliers. |

| STRATTEC's Customer Importance | Variable | Depends on STRATTEC's purchase volume relative to supplier's total revenue. |

What is included in the product

STRATTEC's Porter's Five Forces analysis dissects the competitive intensity and profitability potential within the automotive security and access systems market.

STRATTEC's Porter's Five Forces analysis provides a clear, visual representation of competitive pressures, allowing for rapid identification of key strategic challenges and opportunities.

Customers Bargaining Power

STRATTEC's customer base is heavily weighted towards automotive original equipment manufacturers (OEMs). This means a significant portion of STRATTEC's revenue comes from a relatively small number of very large companies.

The automotive manufacturing sector is characterized by high customer concentration. For instance, in 2024, the top five global automotive manufacturers accounted for over 40% of worldwide vehicle production, highlighting the dominance of a few key players.

This concentration translates directly into substantial bargaining power for these OEMs. Because they purchase such vast quantities of components, like those STRATTEC provides, they can exert considerable pressure on pricing and terms.

STRATTEC's largest clients are major automotive manufacturers, both in North America and worldwide. These significant players are responsible for substantial purchase volumes.

Because these original equipment manufacturers (OEMs) buy in such large quantities, they possess considerable leverage. This allows them to negotiate for competitive pricing and more favorable contract terms, which can put downward pressure on STRATTEC's profitability.

For instance, in the fiscal year 2023, STRATTEC reported that its largest customer accounted for approximately 15.9% of its total net sales, highlighting the concentrated purchasing power of its key clients.

Original Equipment Manufacturers (OEMs) experience moderate switching costs when dealing with suppliers like STRATTEC. These costs primarily stem from the time and resources invested in integrating and validating new components into their existing product lines. For instance, automotive OEMs might need extensive re-testing and recalibration if they switch from one steering column supplier to another, a process that can take months and cost millions.

However, the bargaining power of these customers is amplified by the availability of multiple qualified suppliers in the market. This competitive landscape allows OEMs to negotiate favorable terms, as they can readily explore alternative sourcing options if STRATTEC's pricing or product performance becomes uncompetitive. OEMs are constantly driven to optimize their supply chains for cost efficiency and innovation, making switching a persistent consideration.

Threat of Backward Integration by OEMs

Automotive Original Equipment Manufacturers (OEMs) possess substantial manufacturing expertise, meaning they could potentially bring the production of certain access control components in-house. This capability, while less frequently exercised for highly specialized electronic systems, grants OEMs considerable bargaining power during negotiations with suppliers like STRATTEC. For instance, in 2024, the automotive industry continued to explore vertical integration strategies to secure supply chains and manage costs, a trend that puts pressure on component manufacturers.

The mere possibility of backward integration by OEMs serves as a potent negotiating tool, compelling suppliers to maintain competitive pricing and foster continuous innovation. This threat encourages STRATTEC to focus on efficiency and technological advancement to remain an indispensable partner. The automotive sector's ongoing drive for cost reduction, with many OEMs targeting single-digit percentage improvements in component costs year-over-year, underscores the intensity of this pressure.

- OEM Manufacturing Capabilities: OEMs have the infrastructure and know-how to produce many vehicle components, including access control parts.

- Negotiating Leverage: The threat of in-house production gives OEMs an edge in price and contract negotiations with suppliers.

- Supplier Imperative: This threat pushes companies like STRATTEC to prioritize cost-effectiveness and innovation to retain business.

Price Sensitivity of OEMs

The automotive industry's intensely competitive and cost-driven environment makes Original Equipment Manufacturers (OEMs) highly sensitive to pricing. This sensitivity directly influences STRATTEC's ability to set prices and maintain profitability, as OEMs actively seek cost reductions throughout their supply chains.

STRATTEC's financial performance, as reflected in its recent reports, highlights ongoing efforts to achieve pricing advantages and effectively manage its operational costs. This strategic focus is crucial for navigating the price pressures exerted by its OEM customers.

- OEMs' Demand for Cost Reduction: The automotive sector's competitive landscape compels OEMs to relentlessly pursue lower production costs, directly impacting suppliers like STRATTEC.

- STRATTEC's Pricing Power: The high price sensitivity of OEMs limits STRATTEC's leverage in price negotiations, potentially squeezing profit margins.

- Cost Management Initiatives: STRATTEC's reported focus on pricing benefits and cost management reflects a strategic response to OEM demands, aiming to preserve profitability.

STRATTEC's customer bargaining power is significant due to the concentrated nature of the automotive OEM market. These large buyers purchase in high volumes, giving them considerable leverage over pricing and terms. For instance, in fiscal year 2023, STRATTEC's largest customer represented approximately 15.9% of its total net sales, underscoring this concentration.

The availability of alternative suppliers and the OEMs' potential for backward integration further amplify their negotiating strength. This environment compels STRATTEC to focus on cost efficiency and innovation to remain competitive and retain its key automotive clients.

| Factor | Impact on STRATTEC | Supporting Data/Reasoning |

| Customer Concentration | High Bargaining Power | Largest customer accounted for 15.9% of net sales in FY2023. Top 5 global OEMs produced over 40% of vehicles in 2024. |

| Switching Costs | Moderate for OEMs | Integration and validation of new components can take months and cost millions. |

| Threat of Backward Integration | Increased Leverage for OEMs | OEMs explore vertical integration to secure supply chains and manage costs (2024 trend). |

| Price Sensitivity | Limits STRATTEC's Pricing Power | Automotive sector is cost-driven, with OEMs targeting single-digit percentage cost reductions annually. |

Preview the Actual Deliverable

STRATTEC Porter's Five Forces Analysis

This preview showcases the complete STRATTEC Porter's Five Forces Analysis you will receive immediately after purchase. The analysis delves into the competitive landscape of the automotive lock and key industry, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. You're looking at the actual document, fully formatted and ready for your strategic planning needs.

Rivalry Among Competitors

STRATTEC operates within the automotive access control market, a sector featuring numerous global competitors. This market includes a range of products, from traditional mechanical locks and keys to advanced electronic systems and power access solutions.

While STRATTEC boasts a significant history and strong connections with North American original equipment manufacturers (OEMs), it contends with other well-established automotive suppliers. For instance, in 2024, the global automotive market saw significant activity, with major players like Magna International and Continental AG also holding substantial market share in related component areas, indicating a competitive landscape.

The vehicle access control market is on a solid growth trajectory, with projections indicating a rise from $13.09 billion in 2025 to $19.84 billion by 2029. This represents a compound annual growth rate of 11%, which is a healthy expansion for the industry.

This robust growth rate can act as a buffer against intense competitive rivalry. With a larger market pie, there's more room for various companies to capture market share and achieve profitability without necessarily engaging in aggressive price wars or market share grabs.

However, it's important to note that growth isn't uniform across all segments. Some specialized areas within vehicle access control might be expanding at a much faster pace than others, creating pockets of intense competition where new entrants or innovative players could disrupt established players.

STRATTEC's competitive edge is significantly bolstered by its product differentiation, particularly in sophisticated electro-mechanical systems and advanced security features. Their expertise in engineering innovation, exemplified by passive entry passive start (PEPS) systems, allows them to offer higher-value content that moves beyond basic component supply.

This focus on unique and advanced technology directly impacts competitive rivalry by reducing the pressure for price-based competition. When customers value STRATTEC's specialized solutions, they are less likely to switch solely based on minor price differences, thereby mitigating direct rivalry among competitors.

Exit Barriers

High exit barriers in the automotive supplier industry, like specialized machinery and significant capital tied up in production facilities, can trap even struggling companies. This means firms might stay in the market longer than economically rational, intensifying competition as they fight for survival. For instance, a supplier heavily invested in a specific type of engine component might find it prohibitively expensive to repurpose those assets, forcing them to continue production even at low margins.

These barriers mean that even if a company is performing poorly, it may not be able to easily exit the market. This situation can lead to a more crowded competitive landscape, as companies that would otherwise cease operations remain active participants. Consider that in 2024, many automotive suppliers faced pressure from declining vehicle production in certain segments, yet the cost of shutting down plants and disposing of specialized equipment often outweighed the immediate benefits of exiting.

The persistence of these companies, driven by high exit barriers, directly fuels competitive rivalry. Firms are compelled to compete more aggressively on price, innovation, and service to win business and survive. This dynamic can suppress profitability across the board.

- Specialized Assets: Automotive suppliers often rely on highly specific machinery and tooling that have limited alternative uses, making liquidation difficult and costly.

- Long-Term Contracts: Many suppliers operate under multi-year agreements with major automakers, creating an obligation to continue production even when market conditions deteriorate.

- High Capital Investments: The initial outlay for setting up automotive manufacturing facilities is substantial, and the sunk costs make exiting a complex financial decision.

- Workforce Commitments: Significant investments in training and maintaining a skilled workforce can also act as an exit barrier, as severance costs and reputational damage from layoffs can be considerable.

Customer Loyalty and Switching Costs

STRATTEC's long-standing relationships with Original Equipment Manufacturers (OEMs), spanning over a century, cultivate significant customer loyalty. This deep integration makes it costly and time-consuming for OEMs to switch to alternative suppliers, creating a barrier to entry for competitors.

Despite this loyalty, OEMs are not static. They routinely assess their suppliers based on critical factors like operational efficiency, pricing competitiveness, and the adoption of cutting-edge technologies. This necessitates STRATTEC to consistently demonstrate its value proposition to retain its established customer base.

For instance, in 2023, the automotive industry saw a significant push for electrification and advanced driver-assistance systems (ADAS). Suppliers like STRATTEC that can offer innovative solutions in these areas are better positioned to maintain their OEM partnerships, while those lagging behind face increased pressure.

- Customer Loyalty: STRATTEC's 110+ year OEM relationships foster ingrained loyalty.

- Switching Costs: The complexity and investment involved in changing automotive suppliers create high switching costs.

- OEM Re-evaluation: OEMs regularly review suppliers on performance, cost, and technology.

- Demonstrating Value: STRATTEC must continuously innovate and prove its worth to maintain its market position.

Competitive rivalry within the automotive access control market is significant, with STRATTEC facing established global players. While industry growth offers some buffer, specialized segments can see intense competition from innovative firms. STRATTEC's focus on advanced electro-mechanical systems and unique features helps mitigate price-based rivalry by emphasizing value.

High exit barriers in automotive supply, such as specialized machinery and long-term contracts, mean companies may persist even with low profitability, intensifying competition. STRATTEC's deep OEM relationships foster loyalty, but continuous innovation is crucial as automakers regularly re-evaluate suppliers based on cost and technology, as seen with the industry's push for electrification in 2023.

| Competitor Type | Example Competitors | Impact on Rivalry |

|---|---|---|

| Established Global Suppliers | Magna International, Continental AG | Intensify competition due to market share and resources. |

| Specialized Technology Providers | Companies focusing on advanced electronic access | Can disrupt established players in niche growth areas. |

| New Entrants (Potential) | Tech firms entering automotive supply chain | Could increase rivalry through disruptive innovation. |

SSubstitutes Threaten

The threat of substitutes for traditional vehicle access systems is intensifying as new technologies emerge. Smartphone-based entry, biometric authentication like fingerprint and facial recognition, and cloud-based platforms are rapidly gaining traction in the automotive sector. These advancements offer consumers increasingly convenient and secure alternatives to physical keys or even current keyless entry fobs.

The automotive keyless entry system market is a prime example of this shift, projected for robust growth fueled by smart connectivity and ongoing technological innovation. For instance, the global automotive keyless entry market was valued at approximately USD 12.5 billion in 2023 and is anticipated to expand significantly in the coming years, indicating a strong consumer and manufacturer preference for these evolving access methods.

Substitutes such as phone-as-a-key technology and integrated digital key systems present a significant threat by offering superior convenience and seamless integration with a vehicle's ecosystem and personal smart devices. These advanced solutions allow for remote access and control, creating a more user-friendly experience that can accelerate their adoption. For instance, the automotive industry is increasingly focusing on connected car technologies, with many manufacturers actively developing or already implementing these digital key solutions, aiming to enhance customer engagement. This shift directly challenges STRATTEC's reliance on traditional mechanical and electronic key systems.

As new automotive technologies, like advanced driver-assistance systems (ADAS) or electric vehicle components, mature, their cost-effectiveness is improving, presenting a growing threat of substitution for STRATTEC's traditional lock and access systems. While initial investments in these newer technologies can be substantial, projected economies of scale and increased market adoption, particularly driven by regulatory mandates and consumer demand for safety and efficiency, are expected to lower their per-unit costs significantly. For instance, the global ADAS market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a substantial cost reduction trend as production volumes increase.

Consumer Acceptance and Adoption Rates

The willingness of consumers and Original Equipment Manufacturers (OEMs) to embrace new vehicle access technologies significantly influences the threat of substitutes. As of late 2024, the automotive industry is seeing a strong push towards digital key solutions, with a growing number of manufacturers integrating smartphone-based access into their premium models. This trend is directly linked to the increasing popularity of electric vehicles (EVs) and luxury segments, which are early adopters of such advanced features.

This shift is evident in market growth projections. The global vehicle access control market, encompassing these advanced systems, was valued at approximately $4.5 billion in 2023 and is projected to reach over $7.8 billion by 2028, indicating a substantial consumer and OEM appetite for these evolving technologies. The convenience and enhanced security offered by these substitutes are key drivers.

- Increasing demand for EVs and luxury vehicles fuels adoption of advanced access control.

- Smartphone-based digital keys are gaining traction as a primary substitute for traditional keys.

- The vehicle access control market is expected to grow substantially, reflecting consumer and OEM acceptance.

Regulatory and Security Standards

New regulatory standards or increased consumer concerns about cybersecurity can significantly impact the threat of substitutes for automotive security systems. For instance, if stricter data privacy laws are enacted, companies offering less secure or data-intensive solutions might face greater pressure to adapt or be replaced by more compliant alternatives. This could accelerate the adoption of advanced, more secure substitutes that meet these evolving requirements.

The automotive market is indeed experiencing a rise in vehicle theft, with reported motor vehicle thefts in the U.S. increasing by 10.4% in 2022 compared to 2021, according to FBI data. This trend directly fuels consumer demand for enhanced security, making more sophisticated anti-theft devices and connected car security services viable substitutes for traditional locking mechanisms. Companies that can demonstrate superior protection against modern theft techniques, such as relay attacks or CAN bus intrusions, will be better positioned.

The threat of substitutes is amplified by evolving technology and changing consumer expectations regarding vehicle security. As connected car technology advances, over-the-air updates for security patches and advanced remote monitoring systems become increasingly attractive alternatives to hardware-centric solutions. For example, the integration of biometric authentication, like fingerprint or facial recognition, into vehicle access systems presents a compelling substitute for traditional key fobs, offering enhanced convenience and security.

- Increased Cybersecurity Concerns: Growing awareness of vehicle hacking incidents pushes consumers towards solutions with robust digital security features.

- Regulatory Compliance: New regulations mandating specific security protocols or data handling practices can favor substitutes designed to meet these standards.

- Technological Advancements: Innovations like biometric access and advanced remote monitoring offer superior security and convenience, acting as strong substitutes.

- Rising Vehicle Theft Rates: The 10.4% increase in U.S. vehicle thefts in 2022 highlights the market's need for more effective security, driving demand for advanced substitutes.

The threat of substitutes for traditional vehicle access systems is significant and growing, driven by technological innovation and evolving consumer preferences. Smartphone-based entry, biometric authentication, and integrated digital key systems offer enhanced convenience and security, directly challenging legacy hardware. The automotive keyless entry market, valued at approximately USD 12.5 billion in 2023, illustrates this shift, with a projected expansion driven by smart connectivity.

| Substitute Technology | Key Benefits | Market Trend/Data Point |

|---|---|---|

| Smartphone-as-a-Key | Convenience, remote access, integration with personal devices | Growing adoption in premium vehicle segments |

| Biometric Authentication (Fingerprint, Facial Recognition) | Enhanced security, keyless convenience | Increasing integration in new vehicle models |

| Connected Car Security Services | Remote monitoring, over-the-air security updates | Driven by rising vehicle theft and cybersecurity concerns |

Entrants Threaten

Entering the automotive access control market, particularly for original equipment manufacturer (OEM) supply, demands significant capital. This includes substantial investments in state-of-the-art manufacturing facilities, specialized tooling, and robust research and development programs to meet evolving automotive standards. For instance, developing advanced electronic key systems involves millions in R&D and precision manufacturing capabilities.

STRATTEC's own journey, from mechanical to sophisticated electro-mechanical and electronic access control systems, illustrates the continuous and substantial investment necessary to remain competitive. This evolution necessitates ongoing capital allocation for new technologies and production upgrades, creating a formidable hurdle for potential new players aiming to enter this specialized sector.

Automotive original equipment manufacturers (OEMs) have rigorous and time-consuming qualification procedures for their suppliers. They often favor established partners due to paramount concerns about quality, reliability, and the stability of their supply chains. STRATTEC benefits significantly from its deep-seated relationships with these key customers, creating substantial barriers for any new competitors attempting to enter the market.

STRATTEC's substantial intellectual property portfolio, including numerous patents and deep-seated technical expertise in both mechanical and electronic access systems, presents a significant barrier to new entrants. Developing comparable proprietary technology requires immense R&D investment and time, making it difficult for newcomers to compete on innovation and product quality.

For instance, the automotive industry, a key market for STRATTEC, is characterized by long product development cycles and stringent quality requirements. A new entrant would need to replicate decades of accumulated knowledge and secure its own patent protection, a costly and lengthy endeavor, potentially costing millions in development and legal fees.

Economies of Scale and Experience Curve

STRATTEC benefits significantly from established economies of scale in its manufacturing processes. This means that as production volume increases, the cost per unit decreases, a crucial advantage in the high-volume automotive sector. For instance, in 2024, STRATTEC's ability to produce millions of units annually allows them to negotiate better raw material prices and optimize factory utilization, creating a substantial cost barrier for any newcomer.

Furthermore, STRATTEC has leveraged an extensive experience curve over its years of operation. This accumulated knowledge translates into more efficient production techniques, reduced waste, and improved product quality, all contributing to lower operational costs. New entrants would lack this deep well of experience, making it challenging to achieve comparable cost efficiencies and potentially forcing them to compete at a price point that erodes their profitability.

- Economies of Scale: STRATTEC's large-scale production in 2024 allows for cost advantages in purchasing and manufacturing that new entrants cannot easily replicate.

- Experience Curve: Decades of operational experience have refined STRATTEC's processes, leading to cost efficiencies and quality improvements that new competitors would take years to develop.

- Cost Competitiveness: The combined effect of economies of scale and experience makes it difficult for new entrants to compete on price in the cost-sensitive automotive supply chain.

Regulatory Hurdles and Safety Standards

The automotive sector presents significant barriers to entry due to rigorous regulatory requirements and stringent safety standards. New companies must invest heavily to comply with these evolving mandates, which often include extensive testing and certification processes. For instance, in 2024, the average cost for a new vehicle model to meet global safety regulations, such as those from NHTSA in the US or Euro NCAP in Europe, can easily run into tens of millions of dollars, a substantial hurdle for aspiring entrants.

Navigating this complex web of rules is a time-consuming and capital-intensive endeavor. New entrants face lengthy approval timelines, delaying market access and increasing upfront investment. This environment favors established players with existing infrastructure and expertise in regulatory compliance, effectively deterring many potential competitors from entering the market.

- Stringent Safety Regulations: Compliance with standards like FMVSS (Federal Motor Vehicle Safety Standards) in the US requires significant engineering and testing resources.

- Emissions Standards: Meeting evolving emissions targets, such as those outlined by the EPA or European Union, necessitates advanced powertrain technology and substantial R&D investment.

- Certification Costs: Obtaining necessary certifications for safety and environmental compliance can cost millions of dollars per vehicle model.

- Complexity of Global Standards: Companies aiming for international sales must navigate a patchwork of differing regulations across various markets, adding further complexity and cost.

The threat of new entrants into the automotive access control market, particularly for OEM supply, remains moderate to low. This is largely due to the substantial capital requirements for R&D, specialized manufacturing, and meeting rigorous OEM qualification processes. STRATTEC's established relationships, intellectual property, and economies of scale, bolstered by its 2024 operational capacity, create significant barriers.

The automotive industry's stringent regulatory environment, demanding extensive testing and certification, further deters new players. For instance, in 2024, compliance with global safety standards can cost tens of millions of dollars per model, a prohibitive expense for many potential entrants. This complexity favors established firms like STRATTEC that possess deep expertise in navigating these requirements.

| Barrier Type | Description | Impact on New Entrants | STRATTEC Advantage (2024) |

|---|---|---|---|

| Capital Requirements | High investment in R&D, manufacturing, and tooling. | Significant hurdle; requires substantial funding. | Established infrastructure and ongoing R&D investment. |

| OEM Qualification | Rigorous supplier vetting by automakers. | Time-consuming and difficult to penetrate. | Long-standing relationships and proven track record. |

| Intellectual Property | Patents and proprietary technology. | Requires costly development and legal protection. | Extensive patent portfolio and technical expertise. |

| Economies of Scale | Cost advantages from high-volume production. | New entrants struggle to match pricing. | Annual production in millions of units, enabling cost efficiencies. |

| Regulatory Compliance | Adherence to safety and emissions standards. | Costly and time-intensive certification processes. | Existing systems and expertise in navigating global regulations. |

Porter's Five Forces Analysis Data Sources

Our STRATTEC Porter's Five Forces analysis is built upon a robust foundation of data, including STRATTEC's annual reports and SEC filings, alongside industry-specific market research reports and automotive sector publications.