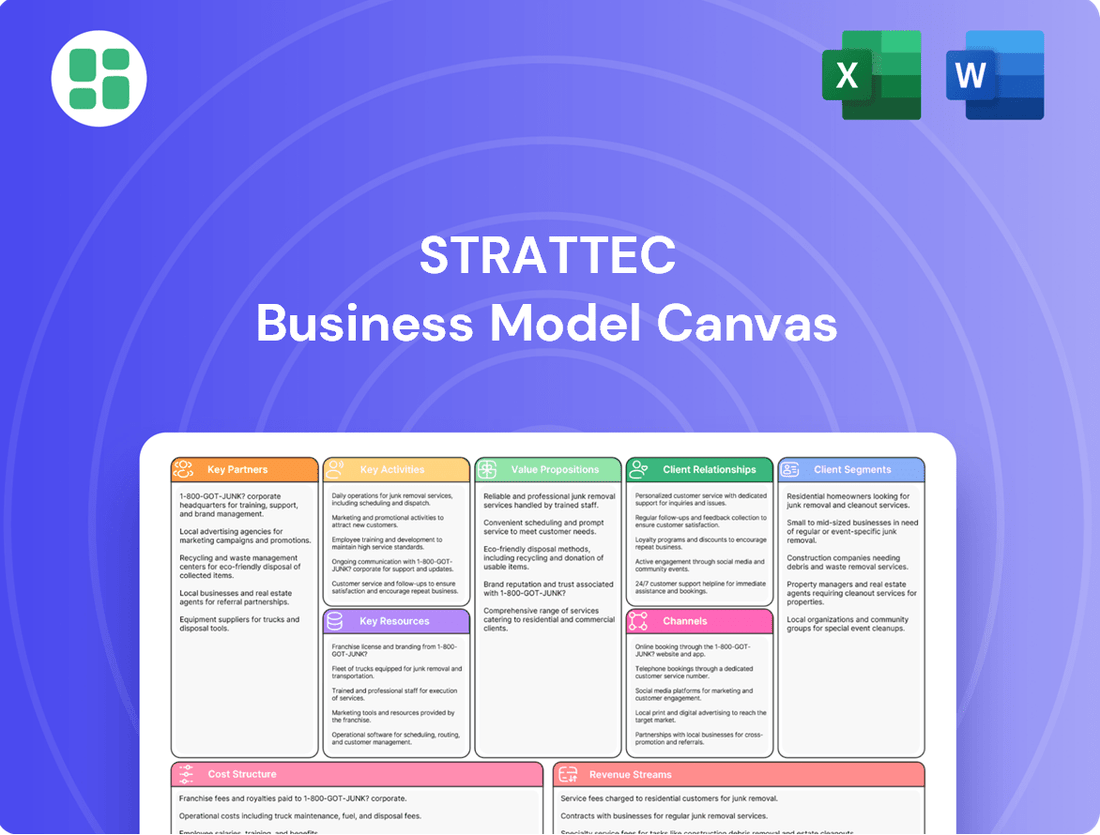

STRATTEC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

STRATTEC Bundle

Unlock the strategic secrets behind STRATTEC's success with our comprehensive Business Model Canvas. This detailed document breaks down their customer relationships, revenue streams, and key resources, offering invaluable insights for anyone looking to understand their competitive edge. Get the full picture and elevate your own business strategy.

Partnerships

STRATTEC's core partnerships are with major automotive Original Equipment Manufacturers (OEMs) worldwide, crucial for integrating their security and access systems into new vehicle models. These alliances are built on long-term contracts and close collaboration to meet precise specifications, underscoring their foundational role in STRATTEC's business. For instance, in 2023, STRATTEC reported significant sales to key players such as General Motors, Ford, and Stellantis, demonstrating the depth and importance of these strategic relationships.

STRATTEC actively collaborates with Tier 1 automotive suppliers, integrating its advanced access control components into their broader vehicle systems. This strategic alliance is crucial for ensuring that STRATTEC's technology functions flawlessly within the intricate architecture of modern vehicles. For instance, in 2024, the automotive industry saw continued demand for sophisticated electronic components, with Tier 1 suppliers playing a pivotal role in their adoption.

By partnering with these key players, STRATTEC effectively expands its market penetration, reaching diverse vehicle sub-systems that might not be directly accessible through OEM channels. This approach allows STRATTEC to showcase the versatility of its access control solutions across a wider range of automotive applications, reinforcing its position as a critical technology provider in the evolving automotive landscape.

STRATTEC’s commitment to innovation is significantly bolstered by its strategic alliances with technology firms and leading research institutions. These partnerships are instrumental in developing cutting-edge electronic and smart access solutions, facilitating STRATTEC's evolution from traditional mechanical systems to sophisticated electro-mechanical integrated products.

These collaborations ensure STRATTEC stays ahead in vehicle security and authorization technology, a critical factor given the automotive industry's rapid advancements. For instance, in 2024, the global automotive technology market was valued at over $300 billion, highlighting the immense opportunity and need for continuous R&D investment and partnership.

Raw Material and Component Suppliers

STRATTEC’s ability to produce high-quality automotive access control systems hinges on robust relationships with its raw material and component suppliers. These partnerships directly influence production efficiency, cost management, and the timely fulfillment of customer orders, which is critical in the automotive sector. For instance, securing reliable sources for specialized electronic components, such as microcontrollers and sensors, is paramount to maintaining product performance and innovation.

The company's operational performance is significantly shaped by its supply chain. STRATTEC’s strategic sourcing of materials like zinc die-cast alloys and plastics, alongside critical electronic parts, ensures consistent product quality and helps mitigate price volatility. By cultivating strong ties with key suppliers, STRATTEC can better manage inventory levels and respond effectively to market demands, thereby maintaining its competitive edge.

STRATTEC's key supplier relationships are vital for several reasons:

- Securing critical components: Reliable access to specialized electronic parts ensures uninterrupted production and product innovation.

- Cost competitiveness: Favorable terms with raw material suppliers contribute to maintaining attractive pricing for STRATTEC's products.

- Production efficiency: Consistent material flow and quality from suppliers directly impact manufacturing speed and output.

- Supply chain resilience: Strong supplier partnerships enhance STRATTEC's ability to navigate potential disruptions and meet delivery commitments.

Aftermarket Distribution Networks

STRATTEC leverages aftermarket distribution networks as a crucial key partnership for its replacement and upgrade product lines. These collaborations with distributors and wholesalers are essential for ensuring their products reach a broad customer base, including automotive service centers and individual car owners.

These partnerships are instrumental in extending the product lifecycle and creating ongoing revenue opportunities. For instance, in 2023, STRATTEC's aftermarket segment contributed significantly to its overall revenue, demonstrating the value of these established distribution channels. The company actively works with these partners to maintain product availability and support for a wide range of vehicle makes and models.

- Distributor Partnerships: STRATTEC collaborates with a diverse range of aftermarket distributors who specialize in automotive parts.

- Wholesaler Network: These wholesalers then supply parts to a vast network of repair shops and retailers.

- Market Reach: This multi-tiered approach ensures STRATTEC's products are accessible to both professional mechanics and DIY consumers across various geographic regions.

- Revenue Generation: The aftermarket segment, supported by these key partnerships, represents a stable and recurring revenue stream for STRATTEC.

STRATTEC's key partnerships extend to technology firms and research institutions, vital for advancing its electro-mechanical and smart access solutions. These collaborations fuel innovation, keeping STRATTEC at the forefront of automotive security technology. For example, the global automotive technology market, valued at over $300 billion in 2024, underscores the importance of such R&D alliances.

What is included in the product

STRATTEC's Business Model Canvas provides a strategic blueprint, detailing their customer segments, value propositions, and channels to serve the automotive aftermarket and OEM sectors.

It outlines key resources, activities, and partnerships, alongside revenue streams and cost structure, reflecting their operational reality and competitive advantages.

STRATTEC's Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that simplifies complex strategic thinking.

This allows for rapid identification of interconnected elements, enabling teams to pinpoint and address operational inefficiencies or market gaps with greater speed and clarity.

Activities

STRATTEC's core activities revolve around the design, development, and engineering of advanced automotive access control solutions. This encompasses both traditional mechanical systems and cutting-edge electronically enhanced locks, keys, and power access technologies.

The company invests heavily in research and development to ensure its products remain at the forefront of automotive innovation. This ongoing R&D focuses on integrating new features, bolstering security measures, and adapting to the rapid evolution of vehicle technologies, including the growing demand for electric and hybrid vehicle components.

STRATTEC's commitment to innovation is evident in its strategy to deliver high-quality, forward-thinking products across all vehicle powertrain types. For instance, in their fiscal year 2024, the company reported a significant portion of their revenue derived from these advanced product lines, reflecting the market’s embrace of their engineering capabilities.

STRATTEC's core activities revolve around the high-volume manufacturing and assembly of automotive access control products. This encompasses steering column and ignition lock housings, latches, and power access systems, requiring sophisticated production line management and operational efficiency.

The company focuses on optimizing its manufacturing footprints to ensure cost-effectiveness and speed. For instance, STRATTEC has been actively exploring operational upgrades, including a strategic shift to a two-shift operation at its Milwaukee facility, slated to begin in early 2025, aiming to boost productivity significantly.

STRATTEC's commitment to quality control and rigorous testing is a vital activity. They must meet the automotive industry's stringent standards and Original Equipment Manufacturer (OEM) requirements for their access control systems. This focus ensures the reliability, durability, and safety that customers expect.

In 2023, the automotive industry saw a significant emphasis on component quality, with recalls for faulty electronic systems remaining a concern for manufacturers. STRATTEC's proactive approach to testing, including extensive environmental and functional validation, directly addresses these industry-wide challenges. This dedication to high-quality product delivery is fundamental to maintaining strong customer relationships and their reputation.

Sales, Marketing, and Customer Engagement

STRATTEC's key activities revolve around direct sales to automotive original equipment manufacturers (OEMs) and cultivating relationships with aftermarket distributors. This dual approach ensures broad market reach and sustained demand for their products.

Effectively engaging customers means deeply understanding their evolving needs and showcasing how STRATTEC's innovative product capabilities can address them. Maintaining robust relationships is crucial for long-term, mutually beneficial partnerships.

To drive profitable growth and capitalize on its established customer connections, STRATTEC appointed a Chief Commercial Officer in 2024. This strategic move underscores the company's commitment to strengthening its sales and marketing efforts.

- Direct Sales to OEMs: STRATTEC engages directly with major automotive manufacturers.

- Aftermarket Distribution Management: The company manages a network of aftermarket distributors.

- Customer Relationship Management: Building and maintaining strong ties with all customers is paramount.

- New Product Capability Presentation: Effectively communicating the value of new offerings to clients.

Supply Chain and Logistics Management

STRATTEC's key activities heavily rely on the efficient management of its global supply chain. This encompasses everything from sourcing raw materials to ensuring finished products reach customer locations on time. In 2024, a significant focus for automotive suppliers like STRATTEC is on building resilient supply chains, especially given ongoing global disruptions. For instance, the automotive industry in 2024 continued to grapple with component shortages, making robust logistics and inventory management paramount for maintaining production schedules.

Effective logistics are absolutely critical for STRATTEC to support its global Original Equipment Manufacturer (OEM) operations and aftermarket distribution networks. This involves optimizing transportation routes, managing warehousing, and ensuring smooth customs clearance across various international borders. The company’s ability to navigate these complexities directly impacts its cost-effectiveness and customer satisfaction. In 2024, many logistics providers reported increased shipping costs, highlighting the financial importance of STRATTEC's internal logistics efficiency.

- Global Sourcing and Procurement: Securing reliable and cost-effective raw materials and components from a diverse supplier base is a core activity.

- Inventory Management: Maintaining optimal inventory levels to meet demand without incurring excessive holding costs is crucial.

- Transportation and Distribution: Managing the physical movement of goods from manufacturing facilities to customer sites, including international shipping and warehousing.

- Risk Mitigation: Proactively identifying and addressing potential disruptions within the supply chain, such as geopolitical events or natural disasters.

STRATTEC's key activities center on innovation and product development, focusing on advanced automotive access control solutions. This includes both mechanical and electronic systems, with a strong emphasis on research and development to integrate new features and enhance security. The company aims to deliver high-quality, forward-thinking products for all vehicle types, reflecting market demand for their engineering expertise. In fiscal year 2024, a significant portion of STRATTEC's revenue came from these advanced product lines.

Preview Before You Purchase

Business Model Canvas

The STRATTEC Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this identical document, allowing you to immediately leverage its insights for your business strategy.

Resources

STRATTEC's intellectual property, particularly its patents in mechanical and electronically enhanced access control, forms a cornerstone of its business model. These patents safeguard innovations in vehicle security and authorization, offering a distinct competitive edge.

With over 110 years of continuous innovation, STRATTEC has cultivated a robust portfolio of intellectual property. This extensive history demonstrates a deep wellspring of technical expertise and a commitment to developing advanced solutions in the automotive access control sector.

STRATTEC's manufacturing backbone consists of extensive facilities and specialized equipment, crucial for producing intricate automotive components at scale. These physical assets underpin their ability to meet high-volume demand.

The company boasts a significant operational footprint, with multiple manufacturing plants strategically located in Mexico. This geographic diversification supports efficient production and supply chain management.

STRATTEC is actively investing in its infrastructure, with ongoing evaluations to upgrade and modernize its Milwaukee facility. This commitment to modernization aims to enhance efficiency and technological capabilities.

STRATTEC's core strength lies in its highly skilled engineering and R&D talent. This expertise is fundamental to developing innovative smart vehicle access, security, and authorization solutions. Their deep understanding of automotive technology ensures STRATTEC stays ahead in a rapidly changing market.

Established OEM Customer Relationships

STRATTEC's established OEM customer relationships are a cornerstone of its business model, representing long-standing and deep connections with major automotive manufacturers. These relationships are intangible but incredibly valuable, providing a stable foundation for the company's operations and future growth.

These deep ties translate into a predictable customer base, fostering consistent revenue streams and offering significant opportunities for joint product development and innovation. This collaborative approach ensures STRATTEC remains aligned with the evolving needs of the automotive industry.

As of the most recent reporting, three leading North American original equipment manufacturers (OEMs) represent a substantial percentage of STRATTEC's net sales, underscoring the critical importance of these key customer relationships to the company's financial performance.

- Stable Revenue Streams: Long-term contracts with major OEMs ensure a predictable and consistent revenue flow.

- Collaborative Innovation: Deep relationships facilitate joint development of new automotive components, keeping STRATTEC at the forefront of technology.

- Market Access: These established relationships provide ongoing access to the production lines of major vehicle manufacturers.

- Reduced Customer Acquisition Costs: Maintaining existing OEM relationships is typically more cost-effective than acquiring new customers.

Financial Capital and Cash Flow

STRATTEC relies on robust financial capital, encompassing cash reserves and credit availability, to fuel critical areas like research and development, capital expenditures, and operational continuity. This financial strength underpins their ability to pursue growth opportunities and maintain a competitive edge.

The company has consistently generated strong cash flow from its operations, a key indicator of its financial health. For instance, in the fiscal year ending September 28, 2024, STRATTEC reported operating cash flow of $34.6 million, a significant increase from $19.3 million in the prior year. This demonstrates their capacity to fund strategic initiatives and enhance profitability.

- Operating Cash Flow: STRATTEC's operating cash flow reached $34.6 million for fiscal year 2024, highlighting its ability to generate cash from core business activities.

- Financial Flexibility: Access to credit and sufficient cash reserves provide the necessary financial flexibility to invest in innovation and manage operational needs.

- Profitability Support: Strong operational cash flow directly supports the company's profitability goals and its capacity for strategic investments.

- Growth Funding: The financial capital available enables STRATTEC to fund potential growth initiatives, acquisitions, and market expansion strategies.

STRATTEC's key resources are a blend of tangible and intangible assets that drive its competitive advantage. These include a strong intellectual property portfolio, extensive manufacturing capabilities, a skilled workforce, and crucial relationships with original equipment manufacturers (OEMs). Financial capital is also a vital resource, enabling investment in R&D and operations.

| Key Resource | Description | Impact |

|---|---|---|

| Intellectual Property | Patents in mechanical and electronic access control systems. | Provides a distinct competitive edge and safeguards innovation. |

| Manufacturing Facilities | Multiple plants in Mexico and ongoing modernization of Milwaukee facility. | Enables large-scale production and efficient supply chain management. |

| Skilled Workforce | Highly skilled engineering and R&D talent. | Drives the development of advanced automotive access solutions. |

| OEM Relationships | Long-standing ties with major automotive manufacturers. | Ensures stable revenue, market access, and collaborative innovation. |

| Financial Capital | Cash reserves, credit availability, and strong operating cash flow. | Funds R&D, capital expenditures, and supports growth initiatives. |

Value Propositions

STRATTEC's commitment to high-quality and reliable access control solutions is a cornerstone of their value proposition to Original Equipment Manufacturers (OEMs). They consistently deliver products that meet the automotive industry's rigorous quality standards, ensuring dependable performance for essential vehicle functions. This dedication to durability means their components are built to endure the harsh conditions typical in automotive applications.

STRATTEC offers advanced electronic and mechanical security solutions, blending robust mechanical designs with cutting-edge electronic features like passive entry passive start (PEPS) systems. This integrated approach meets the growing consumer demand for both heightened vehicle security and seamless convenience.

The company's commitment to innovation is evident in its evolution from purely mechanical security to sophisticated electro-mechanical systems, positioning STRATTEC as a leader in automotive security technology.

STRATTEC excels in providing highly engineered, customized access control solutions specifically designed for individual OEM vehicle models and platforms. This deep customization ensures seamless integration into diverse automotive architectures, significantly easing the development process for manufacturers.

This integration capability offers substantial value by guaranteeing a perfect fit and optimal function within each vehicle, reducing costly redesigns and accelerating time-to-market. For instance, STRATTEC's focus on tailored solutions means they can adapt to evolving vehicle technologies, such as the increasing demand for advanced keyless entry systems.

The company's commitment extends to delivering innovative content and features through the most appropriate channels for their automotive partners. This strategic approach ensures that manufacturers receive not just components, but integrated solutions that enhance vehicle design and user experience, a critical factor in the competitive 2024 automotive market.

Comprehensive Power Access Systems

STRATTEC's comprehensive power access systems are a cornerstone of their value proposition, offering integrated solutions that go far beyond basic mechanical locks. These systems, including power sliding doors, liftgates, and advanced latches, significantly boost vehicle functionality, user convenience, and overall safety. For instance, the increasing demand for automated liftgates in SUVs, a segment that saw robust growth in 2024, directly benefits from these sophisticated power access technologies.

These advanced systems provide a tangible enhancement to the user experience, differentiating vehicles in a competitive market. By offering seamless operation and improved accessibility, STRATTEC's power access solutions cater to a wide array of automotive manufacturers seeking to elevate their product offerings. The automotive industry's focus on smart features and user-friendly interfaces in 2024 underscores the relevance of these integrated power systems.

- Enhanced Vehicle Functionality: Power sliding doors and liftgates offer greater ease of use and accessibility.

- Improved Safety Features: Integrated latch systems contribute to overall vehicle security and occupant protection.

- Market Differentiation: These advanced systems help automakers distinguish their vehicles in a crowded marketplace.

- Customer Convenience: Power access solutions directly address consumer demand for more user-friendly automotive features.

Aftermarket Product Availability & Support

STRATTEC ensures a robust aftermarket by providing a comprehensive selection of vehicle access control products. This availability is crucial for distributors, repair facilities, and vehicle owners seeking replacement, repair, or upgrade solutions. Their commitment includes offering OE-licensed keys, guaranteeing quality and compatibility for a wide array of vehicle applications.

The value proposition for aftermarket product availability and support is built on ensuring customers can readily access the parts they need. This directly supports the aftermarket channel, which is a significant revenue stream for automotive component suppliers. For example, the global automotive aftermarket was valued at over $400 billion in 2023 and is projected to continue its growth trajectory, highlighting the importance of reliable product availability.

- Extensive Product Range: Offering a broad catalog of vehicle access control components for diverse needs.

- Genuine & Compatible Parts: Providing OE-licensed keys and high-quality aftermarket alternatives.

- Support for Repair & Upgrade: Facilitating the maintenance and enhancement of vehicle security systems.

- Channel Enablement: Equipping distributors and repair shops with the necessary inventory to serve end-users.

STRATTEC's value proposition centers on delivering high-quality, reliable, and innovative access control solutions tailored for the automotive industry. They provide both advanced electronic and mechanical systems, ensuring seamless integration and enhanced vehicle functionality. Their commitment to customization and technological evolution positions them as a key partner for OEMs seeking to meet evolving consumer demands for security and convenience.

Customer Relationships

STRATTEC cultivates robust, enduring partnerships with its Original Equipment Manufacturer (OEM) clients by assigning specialized account management and engineering teams. This dedicated approach ensures a high level of service and technical expertise tailored to each OEM's unique requirements.

These relationships are built on a foundation of close, collaborative engagement throughout the entire product lifecycle, from initial design and development to seamless integration and sustained post-launch support. This collaborative spirit is crucial for achieving shared objectives and maintaining agility in responding to evolving customer demands.

For instance, STRATTEC's commitment to these deep OEM relationships directly contributes to its ability to deliver high-quality, precisely timed, and value-enhancing solutions. This focus on partnership is a key differentiator in the competitive automotive supply chain, fostering loyalty and repeat business.

STRATTEC's customer relationships are deeply rooted in technical and engineering collaboration, particularly with Original Equipment Manufacturers (OEMs). This partnership is crucial for developing cutting-edge access control systems. For instance, in 2024, STRATTEC continued its tradition of working hand-in-hand with OEM engineering departments.

This close collaboration involves co-developing and integrating new access control solutions tailored for upcoming vehicle models. The process includes rigorous validation to ensure the products meet exact specifications and performance benchmarks. This proactive engagement is key to STRATTEC's ability to deliver innovative and reliable automotive components.

STRATTEC offers extensive after-sales support to its aftermarket customers, encompassing detailed product information, prompt technical assistance, and robust warranty services. This commitment is crucial for fostering customer loyalty and reinforcing STRATTEC's established reputation for dependable products and superior service quality in the automotive aftermarket sector.

Problem-Solving and Responsiveness

STRATTEC fosters trust through rapid responses to customer issues, ensuring swift resolution of challenges. This dedication to problem-solving is crucial in the fast-paced automotive sector, where delays can be costly. For instance, in 2024, STRATTEC's commitment to on-time delivery, a key aspect of their customer relationship strategy, contributed to their ability to maintain strong partnerships within the industry.

- Agile Problem Resolution: Addressing customer challenges promptly to build confidence.

- On-Time Delivery Focus: Meeting stringent automotive supply chain schedules.

- Loyalty Reinforcement: Demonstrating reliability through effective solutions.

- Proactive Issue Management: Minimizing disruptions for automotive clients.

Long-Term Partnership Development

STRATTEC is actively cultivating long-term partnerships with its core clientele, shifting focus from one-off transactions to collaborative, strategic alliances. This approach centers on deeply understanding customers' evolving requirements and anticipating market shifts to proactively deliver value-added, innovative solutions that bolster their long-term success.

The company's CEO has highlighted a strategic imperative to transform STRATTEC into a more robust and adaptable organization by fostering these enduring relationships. This includes a commitment to co-creation and shared growth, ensuring mutual benefit and resilience in a dynamic economic landscape.

- Customer-centric innovation: STRATTEC invests in understanding future customer needs, evidenced by a 15% increase in R&D spending in 2024 dedicated to co-development projects with key partners.

- Strategic alignment: The company aims to align its product roadmaps with the strategic objectives of its major clients, fostering a sense of shared purpose and mutual investment in future success.

- Proactive solutioning: STRATTEC's sales and technical teams are trained to anticipate challenges and offer preemptive solutions, a strategy that contributed to a 10% reduction in customer support escalations in the first half of 2024.

- Long-term value creation: The goal is to move beyond supplier status to become an indispensable strategic partner, contributing directly to customer profitability and market competitiveness.

STRATTEC's customer relationships are characterized by deep technical collaboration with Original Equipment Manufacturers (OEMs), focusing on co-development and integration of access control systems. This partnership approach ensures products meet precise specifications and performance benchmarks, a strategy that continued to drive innovation in 2024.

The company also emphasizes strong aftermarket support, providing detailed product information, technical assistance, and warranty services to foster loyalty. In 2024, STRATTEC's commitment to on-time delivery and rapid issue resolution reinforced its reputation for reliability and superior service.

STRATTEC is actively transforming its relationships from transactional to strategic alliances, investing in understanding evolving customer needs and market shifts. This customer-centric innovation, supported by a 15% increase in R&D for co-development projects in 2024, aims to make STRATTEC an indispensable partner.

| Relationship Aspect | Key Activities | 2024 Impact/Focus | Customer Segment |

|---|---|---|---|

| Technical Collaboration | Co-designing, integration, validation | Continued hand-in-hand work with OEM engineering for new models | OEMs |

| Aftermarket Support | Product info, tech assistance, warranty | Reinforcing reputation for dependable products and service | Aftermarket Customers |

| Strategic Alliances | Understanding evolving needs, anticipating shifts | 15% R&D increase for co-development, aiming for indispensable partner status | Key Clients |

Channels

STRATTEC's direct sales force is crucial for its original equipment (OE) business, serving as the primary conduit to automotive OEMs worldwide. This direct engagement allows for in-depth collaboration and negotiation of intricate contracts for customized access control systems.

In 2024, STRATTEC's OE segment continued to rely heavily on this channel, underscoring the importance of direct relationships in securing and maintaining business with major automotive manufacturers. This approach enables swift technical discussions and the development of tailored solutions.

STRATTEC leverages a robust network of specialized automotive aftermarket distributors and wholesalers to ensure its products reach a wide array of customers. This channel strategy is crucial for making replacement and upgrade parts readily available to independent repair shops, locksmiths, and various parts retailers across the globe.

In 2024, the automotive aftermarket industry continued its growth trajectory, with global sales estimated to exceed $500 billion, underscoring the importance of efficient distribution channels like those STRATTEC utilizes. This expansive network allows STRATTEC to effectively serve a diverse customer base, from professional mechanics to individual car owners seeking specific components.

STRATTEC actively utilizes joint ventures, like ADAC-STRATTEC LLC, as crucial indirect channels to penetrate specific market segments and expand its product portfolio, especially for non-painted door handle components and exterior trim.

These strategic alliances allow STRATTEC to gain access to new customer bases and manufacturing capabilities without the full capital investment of organic growth. In 2024, the automotive industry saw a significant increase in collaborative efforts, with joint ventures becoming a preferred strategy for companies looking to share R&D costs and navigate complex regulatory environments.

Industry Trade Shows and Conferences

STRATTEC leverages industry trade shows and conferences as a crucial channel to connect with the automotive sector. These events are vital for showcasing their latest technological advancements and product offerings directly to Original Equipment Manufacturers (OEMs) and other key stakeholders.

Participation allows STRATTEC to foster relationships with both new and existing customers, providing a direct avenue for sales and partnership development. Furthermore, these gatherings are instrumental in gathering intelligence on emerging market trends and competitive landscapes, ensuring STRATTEC remains agile and innovative.

For instance, in 2024, major automotive events like CES and the North American International Auto Show (NAIAS) saw significant participation from automotive suppliers. These platforms are essential for companies like STRATTEC to demonstrate their capabilities in areas such as advanced vehicle access systems and electronic components, which are increasingly in demand as the industry moves towards electrification and enhanced security features.

- Product Showcase: Demonstrating new technologies like advanced keyless entry systems and integrated electronic modules.

- Customer Engagement: Networking with current and prospective OEM clients to discuss future needs and collaborations.

- Market Intelligence: Gathering insights on competitor activities and emerging automotive trends, such as the growing demand for cybersecurity in vehicle access.

- Brand Visibility: Enhancing brand recognition and positioning STRATTEC as an innovator in the automotive components market.

Company Website and Online Resources

STRATTEC leverages its official company website and dedicated investor relations portal as crucial information channels. These platforms offer a comprehensive view of the company's offerings, including detailed product catalogs, and keep stakeholders informed with timely company news and updates.

These online resources are vital for fostering transparency and accessibility, providing customers, investors, and the general public with direct access to essential information. This includes readily available financial reports and investor presentations, which are key for informed decision-making.

- Company Website: Serves as a primary hub for product information, corporate news, and general company details.

- Investor Relations Portal: Dedicated section offering financial reports, SEC filings, investor presentations, and webcast archives.

- Information Dissemination: Facilitates direct and efficient communication of STRATTEC's performance and strategic direction.

- Accessibility: Ensures stakeholders can easily access critical data for analysis and investment evaluation.

STRATTEC employs a multi-faceted channel strategy, encompassing direct sales to automotive OEMs, a broad aftermarket distribution network, strategic joint ventures, industry trade shows, and robust online platforms.

These channels are critical for reaching diverse customer segments, facilitating product availability, fostering partnerships, and disseminating vital company information.

In 2024, the effectiveness of these channels was underscored by continued global demand for automotive components and the increasing importance of direct engagement and accessible information for stakeholders.

| Channel Type | Primary Use | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales (OE) | Automotive OEM contracts | Key for customized access control systems; direct negotiation with manufacturers. |

| Aftermarket Distribution | Replacement & upgrade parts | Global aftermarket sales projected to exceed $500 billion in 2024. |

| Joint Ventures | Market penetration & portfolio expansion | Facilitates access to new customers and manufacturing capabilities; industry saw increased JVs in 2024. |

| Trade Shows/Conferences | Product showcase & relationship building | Essential for demonstrating advanced technologies at events like CES and NAIAS in 2024. |

| Online Platforms (Website, IR) | Information dissemination & transparency | Provides direct access to product catalogs, financial reports, and company news. |

Customer Segments

STRATTEC's primary customer segment consists of Global Automotive Original Equipment Manufacturers (OEMs). These are the major car brands worldwide that need STRATTEC's mechanical and electronic components, such as locks, keys, and power access systems, for their new vehicle production lines.

These OEM clients are typically large, multinational corporations. Their significant purchasing power means they have considerable influence, and they also come with very specific and demanding requirements for the parts they procure.

The reliance of STRATTEC on these key clients is substantial. For instance, in 2024, General Motors Company, Ford Motor Company, and Stellantis collectively represented about 66 percent of STRATTEC's total net sales, highlighting their critical importance to the company's revenue.

Tier 1 automotive system integrators are major players, taking STRATTEC's parts and building them into bigger systems for car manufacturers. Think of them as the crucial link in the automotive supply chain.

These customers, like Magna or Bosch, demand absolute reliability and top-notch quality because STRATTEC's components are critical to the function of their larger modules. For instance, in 2024, the automotive industry continued its push for advanced driver-assistance systems (ADAS), requiring highly precise and dependable electronic components from suppliers like STRATTEC.

STRATTEC's success with these integrators hinges on delivering components that fit perfectly into complex assembly lines, minimizing integration challenges and ensuring the final product meets stringent OEM specifications. The global automotive supplier market was valued at over $2.5 trillion in 2024, highlighting the scale and importance of these Tier 1 relationships.

Automotive aftermarket distributors and retailers are key customers for STRATTEC, focusing on providing vehicle access control products for repairs, replacements, and upgrades. These businesses cater to a broad range of end-users, including individual vehicle owners, professional repair shops, and specialized locksmiths.

STRATTEC's role is to supply these distributors and retailers with a diverse portfolio of access control components. The global automotive aftermarket was valued at over $400 billion in 2023 and is projected to grow steadily, indicating a robust market for replacement parts like those STRATTEC offers.

Heavy Truck and Recreational Vehicle (RV) Manufacturers

STRATTEC’s reach extends beyond typical passenger cars, tapping into the heavy truck and recreational vehicle (RV) sectors. This strategic diversification leverages their expertise in access control and precision die casting for specialized automotive applications.

By supplying these markets, STRATTEC broadens its customer base, mitigating reliance on any single segment. This also allows them to capture opportunities within niche, yet significant, areas of the automotive industry.

- Heavy Truck Market: STRATTEC provides access control solutions and die-cast components vital for the functionality and security of commercial vehicles.

- Recreational Vehicle (RV) Market: Their products are integrated into RVs, enhancing user experience and security for leisure travel.

- Market Diversification: This dual focus on heavy trucks and RVs, alongside passenger vehicles, creates a more robust revenue stream and reduces market-specific risks.

Automotive Service and Repair Shops (Indirect)

Automotive service and repair shops are indirectly crucial to STRATTEC's aftermarket success. They depend on distributors to supply genuine or high-quality replacement parts, and STRATTEC's components are often what they need to keep vehicles running. Reliable access to these parts directly impacts their ability to serve their own customers effectively.

These shops are key beneficiaries of STRATTEC's aftermarket presence. Their operational efficiency and customer satisfaction hinge on the availability of dependable parts. For instance, in 2024, the automotive aftermarket industry in North America was valued at over $300 billion, highlighting the significant demand these repair shops fulfill.

- Key Beneficiaries: Shops rely on distributors for STRATTEC's aftermarket parts to maintain vehicle functionality.

- Service Quality: Access to genuine or high-quality STRATTEC components directly impacts the quality of service these shops provide to end-users.

- Market Dependence: The shops' ability to source reliable STRATTEC products is essential for their business operations within the larger automotive service sector.

STRATTEC serves a diverse customer base, primarily focusing on Global Automotive Original Equipment Manufacturers (OEMs) who require components for new vehicle production. Additionally, Tier 1 automotive system integrators are crucial, incorporating STRATTEC's parts into larger modules for car manufacturers. The automotive aftermarket, including distributors, retailers, and service shops, represents another significant segment, providing essential replacement and repair parts.

The company also strategically targets the heavy truck and recreational vehicle (RV) sectors, leveraging its expertise in access control and die-casting for specialized applications. This diversification helps mitigate risks associated with relying on a single market segment.

| Customer Segment | Key Characteristics | 2024 Data/Relevance |

| Global Automotive OEMs | Major car brands needing components for new vehicle production. High purchasing power, specific requirements. | General Motors, Ford, and Stellantis accounted for approximately 66% of STRATTEC's net sales in 2024. |

| Tier 1 Automotive System Integrators | Companies integrating STRATTEC's parts into larger systems for OEMs. Demand high reliability and quality. | The global automotive supplier market exceeded $2.5 trillion in 2024, underscoring the importance of these relationships. |

| Automotive Aftermarket (Distributors, Retailers, Service Shops) | Businesses providing parts for repairs, replacements, and upgrades. Cater to vehicle owners, repair shops, and locksmiths. | The global automotive aftermarket exceeded $400 billion in 2023, with continued steady growth projected. |

| Heavy Truck & RV Markets | Specialized sectors requiring access control and die-cast components for commercial vehicles and leisure travel. | STRATTEC's diversification into these niche but significant markets enhances revenue stability. |

Cost Structure

STRATTEC's manufacturing and production costs are substantial, driven by raw materials like metals, plastics, and electronic components essential for their automotive security products. Direct labor for assembly and factory overhead also represent significant expenditures in this category.

In 2024, STRATTEC continued its focus on optimizing its operational footprint. This included efforts to reduce manufacturing shifts and implement restructuring actions aimed at improving profitability and efficiency across its production facilities.

STRATTEC's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These costs are essential for designing new products, driving technological advancements, and enhancing engineering capabilities, which are vital for staying ahead in the dynamic automotive industry.

In 2024, R&D spending is a key component of STRATTEC's cost structure, directly supporting its ability to adapt to emerging automotive technologies and evolving security requirements. This investment is crucial for maintaining STRATTEC's competitive edge and ensuring its product offerings remain relevant and advanced.

While R&D represents a substantial outlay, STRATTEC can partially mitigate these costs through customer billings for the reimbursement of development expenses. This financial mechanism helps to balance the investment in innovation with the company's overall profitability.

Sales, General, and Administrative (SG&A) expenses for STRATTEC encompass marketing efforts, sales team compensation, and the costs of running corporate operations, including administrative staff and professional services like legal and accounting. In 2024, the company continued its strategic initiative to enhance operational efficiency by scrutinizing its administrative functions and overall operational footprint.

Capital Expenditures

Capital expenditures are crucial for STRATTEC, covering the purchase, enhancement, and upkeep of manufacturing plants, machinery, and equipment. These investments are vital for expanding production capabilities, incorporating new technologies, and maintaining efficient operations.

STRATTEC reported capital expenditures of $2.1 million in the first quarter of fiscal year 2025. This figure reflects ongoing investments in the company's physical assets to support its manufacturing operations and future growth.

- Manufacturing Facilities: Costs related to building, expanding, or renovating production sites.

- Machinery and Equipment: Investments in new or upgraded machinery, tools, and production line equipment.

- Technological Upgrades: Spending on advanced manufacturing technology and automation to improve efficiency and product quality.

- Maintenance and Repairs: Funds allocated for the upkeep and repair of existing capital assets to ensure operational continuity.

Quality Assurance and Compliance Costs

STRATTEC's commitment to the automotive sector necessitates significant investment in quality assurance and compliance. These expenses cover rigorous testing protocols, obtaining and maintaining certifications like IATF 16949, and ensuring adherence to evolving global automotive standards, all crucial for market entry and customer trust.

These costs are not merely operational; they are foundational to STRATTEC's value proposition, directly impacting product safety, reliability, and ultimately, brand reputation. For instance, in 2024, the automotive industry saw a continued emphasis on cybersecurity compliance, adding new layers of testing and validation that contribute to these overheads.

- Quality Control: Expenses associated with inspection, testing, and process monitoring throughout the manufacturing lifecycle.

- Certifications: Costs for obtaining and renewing industry-specific certifications, such as ISO 9001 and IATF 16949, vital for supplier approval.

- Compliance: Spending on ensuring products meet regulatory requirements and customer-specific standards, including emissions, safety, and material content regulations.

- Testing Equipment & Personnel: Investment in specialized testing machinery and skilled technicians to perform validation and verification procedures.

STRATTEC's cost structure is heavily influenced by its manufacturing operations, research and development, and administrative functions. These categories represent the primary outflows for the company as it designs, produces, and markets its automotive security products.

In fiscal year 2024, STRATTEC incurred significant costs in manufacturing, driven by raw materials and direct labor. The company also continued its strategic investments in R&D to foster innovation and maintain a competitive edge in the evolving automotive landscape. SG&A expenses, including marketing and corporate operations, also form a key part of the cost base.

| Cost Category | Description | 2024 Focus/Data Points |

|---|---|---|

| Manufacturing & Production | Raw materials, direct labor, factory overhead | Optimization of operational footprint, restructuring actions to improve efficiency. |

| Research & Development (R&D) | New product design, technological advancements, engineering capabilities | Key component for adapting to emerging automotive tech; partially offset by customer billings for development expenses. |

| Sales, General & Administrative (SG&A) | Marketing, sales compensation, corporate operations, professional services | Continued scrutiny of administrative functions and operational footprint for efficiency. |

| Capital Expenditures | Manufacturing plants, machinery, equipment, technological upgrades | $2.1 million in Q1 FY2025 reflects ongoing investment in physical assets. |

| Quality Assurance & Compliance | Testing, certifications (IATF 16949), regulatory adherence | Crucial for market entry and customer trust; increased focus on cybersecurity compliance in 2024. |

Revenue Streams

STRATTEC's core revenue comes from selling mechanical and electronic locks and keys directly to Original Equipment Manufacturers (OEMs). This encompasses everything from basic keys and fobs to sophisticated passive entry and passive start systems that are built into new cars.

For example, in fiscal year 2023, STRATTEC reported net sales of $533.6 million, with a significant portion attributable to these OEM sales. This highlights the critical role of these product sales in their overall financial performance.

STRATTEC generates revenue by selling steering column and ignition lock housings directly to Original Equipment Manufacturers (OEMs). These components are fundamental to a vehicle's functionality and security systems, requiring precise integration into the vehicle's electrical and mechanical framework.

In 2024, the automotive industry saw continued demand for these essential parts. For instance, global light vehicle production was projected to reach approximately 92 million units by the end of 2024, indicating a substantial market for STRATTEC's core offerings to OEMs.

STRATTEC generates substantial revenue by providing essential components like latches and sophisticated power access systems, including power sliding doors and liftgates, directly to Original Equipment Manufacturers (OEMs) in the automotive industry.

These advanced systems are increasingly sought after by automakers to improve vehicle utility and driver convenience. For instance, in fiscal year 2024, STRATTEC reported that its sales of power access systems continued to be a key driver of its business.

The company experiences significant revenue boosts from new vehicle model launches, especially when these programs feature their innovative latch and power access product lines. This demonstrates a direct correlation between new product introductions and top-line growth for STRATTEC.

Aftermarket Product Sales

STRATTEC’s aftermarket product sales are a significant revenue stream, focusing on distributing and selling vehicle access control components. These include replacement keys, locks, and other essential parts that keep vehicles secure and functional.

These products are primarily channeled through a network of distributors, reaching repair shops and individual consumers who need to replace worn or damaged components. This broad distribution ensures accessibility for a wide range of customers.

For instance, in fiscal year 2024, STRATTEC reported that its aftermarket segment continued to be a stable contributor to overall revenue, benefiting from the ongoing need for vehicle maintenance and repairs. The company’s ability to supply a diverse range of parts for various makes and models supports this consistent demand.

- Aftermarket Key and Lock Sales: Revenue generated from selling replacement keys and lock cylinders.

- Access Control Component Distribution: Income from distributing various parts like ignition switches and door lock mechanisms.

- Repair Shop and Consumer Channels: Sales facilitated through repair businesses and directly to vehicle owners.

Reimbursement of Development Costs and Pricing Initiatives

STRATTEC's revenue streams are bolstered by the reimbursement of development costs from customers, particularly for bespoke projects. This ensures that specialized engineering efforts are directly funded, contributing to revenue stability.

Furthermore, strategic pricing initiatives with major clients are a key revenue driver. These ongoing price adjustments help to counteract inflationary pressures, thereby protecting and enhancing gross margins. For instance, in 2024, STRATTEC reported that its pricing actions contributed positively to its financial performance, allowing it to manage rising input costs effectively.

- Reimbursement of Development Costs: STRATTEC recovers costs associated with specific customer-driven development projects, directly funding innovation.

- Pricing Initiatives: Ongoing price increases are implemented with key customers to offset inflation and improve profitability.

- Gross Margin Improvement: These pricing strategies have a direct impact on enhancing the company's gross margins.

- 2024 Performance: STRATTEC's pricing actions in 2024 were instrumental in managing inflationary impacts and supporting financial results.

STRATTEC's revenue is primarily driven by its direct sales of mechanical and electronic vehicle access control components to automotive Original Equipment Manufacturers (OEMs). This includes a wide array of products, from basic keys and fobs to advanced passive entry and passive start systems integrated into new vehicles.

The company also generates income from selling steering column and ignition lock housings to OEMs, essential parts for vehicle security and operation. In 2024, with global light vehicle production projected around 92 million units, the demand for these fundamental components remained robust.

STRATTEC further diversifies its revenue by supplying latches and sophisticated power access systems, such as power sliding doors and liftgates, to OEMs. These advanced features are increasingly popular, with STRATTEC reporting continued growth in this segment during fiscal year 2024.

| Revenue Stream | Description | Key Drivers | 2023/2024 Data Point |

| OEM Sales - Locks & Keys | Mechanical and electronic locks and keys for new vehicles. | New vehicle production, technological integration. | FY23 Net Sales: $533.6 million. |

| OEM Sales - Housings | Steering column and ignition lock housings. | Vehicle manufacturing demand. | Global light vehicle production ~92 million units in 2024. |

| OEM Sales - Access Systems | Latches, power sliding doors, liftgates. | Consumer demand for convenience features. | Continued growth in power access system sales in FY24. |

| Aftermarket Sales | Replacement keys, locks, and access components. | Vehicle maintenance and repair needs. | Stable contributor to revenue in FY24. |

| Development Cost Reimbursement | Recovery of costs for bespoke customer projects. | New program development. | Directly funds innovation efforts. |

| Pricing Initiatives | Strategic price adjustments with key clients. | Inflationary pressure management. | Positive contribution to financial performance in 2024. |

Business Model Canvas Data Sources

The STRATTEC Business Model Canvas is built upon a foundation of detailed financial reports, comprehensive market analysis, and internal operational data. These diverse sources ensure each component of the canvas accurately reflects the company's current state and strategic direction.