Strategic Education Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Strategic Education Bundle

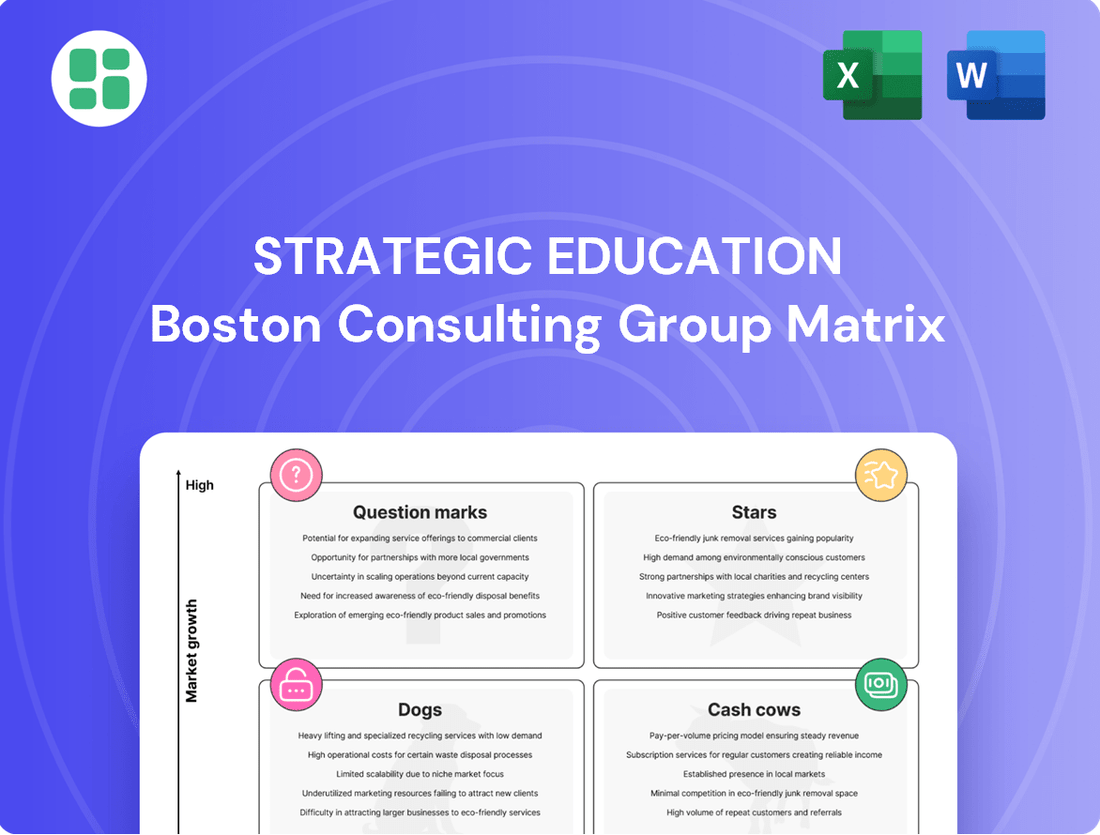

Uncover the hidden potential and critical challenges within this company's product portfolio using the Strategic Education BCG Matrix. This powerful framework categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual of market position and growth prospects.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Education Technology Services (ETS) segment is experiencing robust expansion, primarily fueled by the increasing adoption of Sophia Learning subscriptions and the growth of Workforce Edge employer partnerships. This segment's revenue surged by 45.2% in the first quarter of 2025, following a strong 39.3% increase in the fourth quarter of 2024.

These impressive growth figures highlight a dynamic market where SEI is effectively capturing market share through its strategic focus on employer collaborations. The rising number of Sophia Learning subscribers and the continuous addition of new employer agreements solidify ETS's position as a forward-thinking provider of accessible and industry-aligned training solutions.

Sophia Learning, a direct-to-consumer platform providing college-level courses for credit, is a significant driver of Strategic Education Inc.'s (SEI) ETS segment. Its impressive 37% growth in average total subscribers during Q1 2025 highlights its strong performance in the expanding online education market.

This direct-to-consumer platform is increasingly integrated into SEI's corporate partnerships, showing its growing importance. The demand for flexible and affordable online learning options continues to surge, a trend Sophia Learning is well-positioned to capitalize on.

Given its high growth trajectory and the expanding market it serves, Sophia Learning fits the profile of a Star in the BCG Matrix. Continued investment is crucial to maintain its momentum and secure a larger share of this dynamic market.

Workforce Edge, SEI's comprehensive education benefits administration solution, is demonstrating significant growth. By the close of 2024, it secured 76 corporate agreements, covering a workforce of approximately 3.82 million individuals. This expansion highlights the platform's success in connecting employees with valuable, affordable training and degree programs.

The platform's focus on the high-growth corporate training and upskilling market is clearly paying off. The substantial number of large corporate partnerships indicates strong market penetration and considerable potential for future expansion. This positions Workforce Edge as a Star within the Strategic Education BCG Matrix, warranting ongoing strategic investment to maintain its momentum.

AI-Powered Learning Initiatives

Strategic Education's (SEI) foray into AI-powered learning initiatives positions them within a rapidly expanding sector of educational technology. This focus likely involves leveraging AI for personalized learning pathways, adapting content and pace to individual student needs. Such advancements are crucial in a market where technological integration is a key differentiator.

The AI in education market is experiencing robust growth. For instance, the global AI in education market size was valued at approximately $2.2 billion in 2023 and is projected to reach over $20 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 37%. This indicates a significant opportunity for early adopters like SEI to capture substantial market share.

- AI-driven personalized learning platforms

- Adaptive learning and student support systems

- Focus on high-growth, nascent EdTech market

- Potential to establish leadership in future educational trends

Specialized Micro-credentialing Programs

Specialized micro-credentialing programs are rapidly gaining traction as individuals seek to acquire specific, in-demand skills quickly. This trend is particularly evident in sectors like technology and healthcare, where rapid advancements necessitate continuous learning and upskilling. The market for these short-term, career-focused credentials is experiencing significant growth, offering a lucrative opportunity for educational providers.

Strategic Education Inc. (SEI) is well-positioned to capitalize on this demand through its existing non-degree programs, such as Hackbright Academy and DevMountain. These programs, which focus on practical skills in web and mobile application development, directly address the need for job-ready talent in the tech industry. For instance, in 2023, SEI's career services reported strong placement rates for graduates of these intensive bootcamps.

- Market Growth: The global market for online education, including micro-credentials, was projected to reach over $370 billion by 2026, with a significant portion attributed to skills-based training.

- SEI's Strengths: SEI's established bootcamps offer specialized curricula designed for immediate employability in high-demand tech roles.

- Expansion Potential: By further promoting and potentially expanding these focused programs, SEI can capture a larger share of the growing micro-credential market, transforming them into significant revenue generators.

Sophia Learning and Workforce Edge are prime examples of Stars within SEI's portfolio, exhibiting high growth in expanding markets. Their success in direct-to-consumer subscriptions and corporate partnerships, respectively, demonstrates SEI's strategic alignment with current educational trends. Continued investment in these areas is essential to maintain their market leadership and capitalize on future growth opportunities.

| Business Unit | Market Growth | SEI's Market Share | BCG Classification | Strategic Recommendation |

|---|---|---|---|---|

| Sophia Learning | High (Online Education) | Growing | Star | Invest for continued growth |

| Workforce Edge | High (Corporate Upskilling) | Growing | Star | Invest for continued growth |

| AI in Education Initiatives | Very High (Emerging) | Nascent | Potential Star | Invest to establish leadership |

| Micro-credentialing Programs | High (Skills-based) | Growing | Potential Star | Expand and promote |

What is included in the product

This BCG Matrix overview details educational offerings by market share and growth, guiding investment decisions.

A clear, actionable roadmap for resource allocation, transforming complex strategic education portfolios into manageable growth opportunities.

Cash Cows

Strategic Education Inc.'s (SEI) core U.S. higher education programs, primarily Capella University and Strayer University, are firmly positioned as Cash Cows in the BCG matrix. These institutions operate within a mature market, yet SEI commands a substantial market share, catering predominantly to adult learners seeking flexible educational pathways.

Despite modest overall U.S. Higher Education revenue growth, projected at 1% for Q1 2025, Capella and Strayer consistently deliver robust operating income and predictable cash flow. Their established brand recognition and extensive student enrollment reduce the need for significant marketing expenditures, allowing them to efficiently convert revenue into profit.

Established online degree programs, such as those offered by Capella and Strayer Universities in business, nursing, and IT, represent significant cash cows. These programs boast strong brand recognition and a history of successful student outcomes, attracting a consistent flow of adult learners seeking flexible education options.

With low market growth but high market share, these established offerings are dependable revenue generators for Strategic Education. For instance, in 2023, Strayer University reported a net revenue of $551.7 million, demonstrating the financial stability these mature programs provide.

Capella and Strayer Universities’ extensive student support services are vital for keeping their large existing student populations engaged and on track. These services, though not directly generating income, are a cornerstone of the universities' appeal, fostering high student satisfaction and encouraging ongoing enrollment.

This established operational strength ensures a consistent, predictable revenue stream without requiring significant new capital outlays. For instance, in 2023, Capella University reported a student retention rate of approximately 79%, a testament to the effectiveness of its support systems in nurturing student success and loyalty.

Jack Welch Management Institute (JWMI) MBA

The Jack Welch Management Institute (JWMI) MBA program, delivered via Strayer University, functions as a prime example of a Cash Cow within the Strategic Education BCG Matrix. Its established brand recognition and solid reputation in the executive education sphere enable it to command a significant market share, reducing the need for extensive new market penetration strategies.

This program consistently draws a dedicated segment of working professionals, thereby creating dependable and recurring revenue streams for its parent organization, SEI. In 2024, JWMI continued to leverage its strong brand equity, maintaining its position as a leading online MBA for experienced professionals seeking practical business acumen.

- Established Brand: JWMI benefits from the legacy and association with Jack Welch, a renowned business leader, which fosters strong brand loyalty and recognition.

- High Market Share: The program consistently holds a substantial portion of the online executive MBA market, indicating a mature but highly profitable segment.

- Reliable Revenue: Its appeal to a specific demographic of seasoned professionals ensures a steady influx of tuition revenue, contributing significantly to financial stability.

- Low Investment Needs: As a mature offering, JWMI requires minimal incremental investment for growth, allowing for substantial cash generation.

Australia/New Zealand Segment (Torrens University, Think Education, Media Design School)

The Australia/New Zealand segment, encompassing Torrens University, Think Education, and Media Design School, stands as a cornerstone of the organization's financial stability. These institutions consistently deliver robust revenue and operating income, underscoring their maturity and established market positions.

While the growth trajectory for this segment may not match the rapid expansion seen in emerging markets, its contribution to the overall cash flow is substantial and reliable. Torrens University, in particular, is recognized for its high standards in teaching quality and student satisfaction, reinforcing its status as a dependable cash generator.

- Established Market Presence: Torrens University, Think Education, and Media Design School benefit from long-standing reputations in Australia and New Zealand.

- Consistent Revenue Contribution: This segment reliably generates significant revenue and operating income, acting as a stable financial anchor.

- High Student Satisfaction: Torrens University's strong performance in teaching quality and student satisfaction directly translates to sustained enrollment and cash flow.

- Mature Market Dynamics: Although growth rates might be moderate, the segment's stability provides a predictable and valuable cash flow stream.

Cash Cows, like SEI's established online universities, are mature businesses with high market share but low growth potential. They generate more cash than they consume, providing stable, predictable income for the company. These operations require minimal investment to maintain their position, allowing SEI to reinvest profits elsewhere.

For example, Strayer University's 2023 net revenue of $551.7 million highlights its significant contribution as a cash cow. Similarly, Capella University's strong student retention rates, around 79% in 2023, demonstrate the stability and ongoing profitability of these mature educational offerings.

The JWMI MBA program and the Australia/New Zealand segment further exemplify SEI's cash cows. These businesses benefit from established brands and loyal student bases, ensuring consistent revenue generation with limited need for further capital investment.

These segments are vital for SEI's financial health, providing the necessary funds to support other ventures within the company's portfolio.

| Business Unit | BCG Category | 2023 Revenue (Millions USD) | Key Characteristic |

|---|---|---|---|

| Strayer University | Cash Cow | 551.7 | High market share, mature market, stable revenue |

| Capella University | Cash Cow | N/A (part of consolidated results) | High retention, strong brand, predictable cash flow |

| JWMI MBA Program | Cash Cow | N/A (part of Strayer University) | Established brand, loyal customer base, minimal investment needs |

| Australia/New Zealand Segment | Cash Cow | N/A (part of consolidated results) | Strong reputation, high student satisfaction, consistent income |

What You See Is What You Get

Strategic Education BCG Matrix

The preview you see is the identical, fully realized Strategic Education BCG Matrix report you will receive upon purchase. This comprehensive document is meticulously designed for strategic clarity, offering actionable insights into educational program positioning without any watermarks or demo content. You can be confident that the professional formatting and expert analysis presented here will be directly transferable to your planning and decision-making processes.

Dogs

Within the Strategic Education framework, outdated or niche campus-based programs represent the 'Dogs' quadrant. These are offerings that have low enrollment and minimal market share, often in segments of traditional education that are shrinking. For instance, a specialized, in-person degree program that once attracted a dedicated following but now sees fewer than 50 students annually, as reported by some universities in 2024, would fit this description.

These programs typically consume valuable resources, including faculty time and facilities, without generating substantial revenue or demonstrating growth potential. Their limited appeal means they are unlikely to attract new students, leading to a cycle of decline. Institutions might find these 'Dogs' are draining financial and operational capacity that could be better allocated to more promising online or hybrid educational models.

Generic online courses with high competition, like introductory programming or basic business principles, often land in the Dog quadrant of the BCG matrix. These are typically undifferentiated offerings facing a crowded marketplace. For instance, the global e-learning market, while growing, is also seeing an explosion of content, with platforms like Coursera and edX offering thousands of courses in similar subjects, making it difficult for any single provider to stand out without a unique selling proposition.

Underperforming non-core acquisitions, particularly those failing to integrate or gain market traction, can emerge as Dogs in the Strategic Education BCG Matrix. For instance, if a university acquired a niche online learning platform in 2023 that consistently shows low enrollment figures and a shrinking market share, it would clearly fit this category. These ventures often drain resources without yielding expected returns.

These underperforming acquisitions represent capital traps, especially when they consistently deliver low enrollment and market share despite initial investments. Consider a scenario where a major educational institution invested $5 million in a specialized vocational training center in 2022, but it has yet to break even or attract a significant student base. Such entities require careful evaluation.

SEI would need to critically assess these underperforming assets, determining whether to divest them to reallocate capital towards more promising strategic areas. For example, if a portfolio review in late 2024 reveals that a previously acquired language school is operating at a substantial loss, with no clear path to profitability, selling it might be the most prudent financial decision.

Programs with Declining Industry Relevance

Programs with declining industry relevance are those whose curricula are no longer aligned with current market demands, often due to technological advancements or shifts in consumer behavior. For instance, degrees focused on legacy software development or outdated manufacturing techniques might fall into this category. In 2024, the demand for skills in artificial intelligence and data science continues to surge, while traditional administrative roles are seeing automation impact job availability.

These educational offerings face a predictable downturn in student enrollment and graduate employability. A report from the Bureau of Labor Statistics in early 2024 indicated a projected decline in employment for certain clerical support occupations, underscoring the need for educational institutions to adapt their program offerings. Institutions continuing to heavily invest in these areas without strategic redirection risk significant financial strain and reputational damage.

- Obsolete Skill Sets: Programs teaching skills that are rapidly being replaced by automation or new technologies, such as manual data entry or certain types of print media design.

- Low Graduate Demand: Educational pathways that lead to professions with shrinking job markets or low starting salaries, reflecting diminished industry need. For example, in 2024, the median annual wage for some administrative assistant roles remained stagnant compared to rapidly growing tech-adjacent fields.

- Decreasing Enrollment: A clear trend of fewer students applying to or enrolling in these programs year-over-year, signaling a lack of perceived future value by prospective students.

- Resource Misallocation: Continued funding and faculty support for these programs divert resources that could be invested in developing high-demand, future-oriented educational opportunities.

Inefficient Legacy IT Infrastructure

Legacy IT infrastructure, if outdated and costly to maintain, can act as a Dog in the BCG Matrix for Strategic Education Inc. (SEI). These systems, while not products, drain resources due to high upkeep costs and offer little competitive advantage in terms of technological sophistication. For example, many companies in 2024 still grapple with maintaining systems that were built decades ago, leading to increased operational expenses and slower innovation cycles.

Such inefficient systems hinder SEI's ability to adapt and scale its online learning platforms, directly impacting its market position. The continued investment in these aging technologies can become a cash trap, diverting funds that could be used for growth initiatives or more modern, agile solutions. A report from Gartner in early 2024 indicated that organizations spending over 70% of their IT budget on maintenance of legacy systems are significantly lagging in digital transformation.

- High Maintenance Costs: Legacy systems often require specialized, scarce talent for support, driving up operational expenses.

- Limited Scalability: Outdated architecture struggles to accommodate increased user demand or new feature rollouts.

- Reduced Agility: Inflexibility of old systems slows down the pace of innovation and response to market changes.

- Security Vulnerabilities: Older platforms may lack modern security features, posing significant risks.

Dogs represent educational offerings with low market share and low growth potential, often characterized by declining enrollment and relevance. These programs typically consume resources without generating significant returns, hindering overall institutional growth. For instance, in 2024, many universities reported that specialized, in-person degree programs in humanities or niche sciences were struggling to attract sufficient student numbers, often enrolling fewer than 75 students annually.

These offerings can include outdated online courses in highly competitive fields or underperforming acquisitions that fail to gain traction. A 2024 analysis of the e-learning market revealed that generic courses in areas like basic accounting or introductory marketing had an oversupply of providers, making it difficult for any single program to achieve substantial market share without a unique value proposition.

Divesting or revamping these 'Dog' assets is crucial for reallocating capital to more promising ventures. For example, a university that in 2023 acquired a small online platform for vocational training might, by late 2024, find it more financially sound to sell the underperforming asset and invest in developing new programs in high-demand fields like cybersecurity or data analytics, where market growth projections remain robust.

Legacy IT systems also fall into the Dog category if they are costly to maintain and offer limited functionality. In 2024, many educational institutions are still burdened by outdated student information systems that require significant investment for upkeep, diverting funds from essential digital transformation initiatives. This drains resources, as organizations spending heavily on legacy system maintenance often see slower innovation cycles.

| Category | Characteristics | Example (2024 Context) | Financial Implication |

|---|---|---|---|

| Outdated Programs | Low enrollment, shrinking market, declining relevance | In-person liberal arts degrees with low job placement rates | Resource drain, opportunity cost |

| Generic Online Courses | High competition, undifferentiated offering | Introductory programming courses on multiple platforms | Low revenue potential, difficulty in market penetration |

| Underperforming Acquisitions | Low market traction, integration issues, consistent losses | Acquired niche online learning platform with minimal user growth | Capital trap, negative ROI |

| Legacy IT Infrastructure | High maintenance costs, limited scalability, security risks | Decades-old student management systems | Operational inefficiency, hinders digital innovation |

Question Marks

Strategic Education Inc. (SEI) is actively exploring international market entries beyond its core Australia/New Zealand operations. These new ventures target high-growth regions in online education where SEI currently has minimal presence. For instance, the global online education market was projected to reach $375 billion in 2024, with significant expansion anticipated in Asia and Latin America.

Entering these markets necessitates substantial investment in brand building, navigating diverse regulatory landscapes, and cultivating a student base. SEI's commitment to this strategy is reflected in its ongoing investments in global infrastructure and marketing. For example, in fiscal year 2023, SEI reported a 15% increase in international marketing spend, specifically targeting emerging online education hubs.

Developing advanced vocational training for emerging industries like green energy and AI applications places Strategic Education Inc. (SEI) squarely in the Question Mark quadrant of the BCG matrix. The market hunger for these skills is undeniable, with the global green energy jobs market projected to reach over 40 million by 2030, according to the International Renewable Energy Agency (IRENA).

However, SEI faces the challenge of rapidly building its reputation and capturing market share against established training providers. This necessitates significant upfront investment in cutting-edge curriculum, specialized equipment, and forging robust partnerships with industry leaders to ensure program relevance and graduate employability.

Expanding into new direct-to-consumer skill-based learning platforms beyond Sophia Learning represents a classic Question Mark in the BCG matrix for Strategic Education Inc. (SEI). This move targets the burgeoning lifelong learning market, which is projected to reach $370 billion globally by 2026, according to HolonIQ data. SEI would face intense competition from established players and new entrants alike.

The strategy involves developing diverse, short-form content or niche skill offerings for previously untapped learner segments. While the overall market is expanding, SEI's initial market share in these new ventures would likely be minimal. Significant investment in marketing, platform development, and content creation would be essential to gain traction and achieve widespread adoption.

AI-Integrated Adaptive Learning Pathways

Investing in AI-integrated adaptive learning pathways represents a significant Question Mark for educational institutions. This advanced technology aims to tailor learning experiences to individual student needs, potentially boosting engagement and academic success. For instance, platforms like Knewton, acquired by Wiley in 2017, have demonstrated the potential of adaptive learning to improve student outcomes, with some studies showing improvements of up to 15% in course completion rates.

The high growth potential stems from the promise of personalized education at scale, addressing diverse learning paces and styles. This could lead to greater efficiency in resource allocation and improved overall educational quality. The global AI in education market was valued at approximately $2.1 billion in 2023 and is projected to grow substantially, reaching over $25 billion by 2030, according to various market research reports.

However, the substantial R&D and pilot program costs present a considerable hurdle. Initial market penetration will likely be low until the technology's effectiveness and scalability are widely proven. Organizations must consider the significant upfront investment in developing and integrating these complex systems.

- High R&D Investment: Significant capital is required for AI algorithm development, content integration, and platform infrastructure.

- Pilot Program Costs: Initial testing and refinement phases demand resources for data collection, analysis, and iterative improvements.

- Uncertain Market Adoption: Widespread acceptance hinges on demonstrating tangible improvements in learning outcomes and user experience.

- Scalability Challenges: Ensuring the AI can effectively serve a large and diverse student population requires robust and flexible architecture.

Strategic Acquisitions in Emerging EdTech Niches

Strategic acquisitions in emerging EdTech niches represent a key growth avenue for Strategic Education (SEI), particularly in areas like virtual and augmented reality (VR/AR) for immersive learning or blockchain for secure academic credentialing. These moves target high-potential segments, acknowledging that acquired companies, while innovative, often possess smaller market shares and require substantial capital infusion and integration support to achieve scale.

The success of these acquisitions hinges on SEI's capacity to deploy its resources effectively, fostering the growth of these nascent businesses. For instance, in 2024, the global EdTech market was projected to reach over $300 billion, with specialized segments like AR/VR in education experiencing rapid expansion, demonstrating the potential for significant returns on strategic investments in these niche areas.

- Targeting Niche Growth: Focus on acquiring smaller, innovative EdTech firms in high-growth, specialized sectors like VR/AR learning or blockchain credentialing.

- Capital & Integration Needs: Recognize that these acquisitions will likely involve companies with lower current market share, requiring significant capital and integration efforts to scale.

- Resource Leverage: SEI's ability to leverage its existing resources, expertise, and capital will be critical to nurturing and growing these acquired nascent businesses.

- Market Potential: The global EdTech market's continued growth, with specialized segments showing particularly strong upward trends, underscores the strategic value of these acquisitions.

Question Marks in the BCG matrix represent business units or products with low relative market share in high-growth industries. These ventures require significant investment to increase market share, but their future success is uncertain. Strategic Education Inc. (SEI) is actively exploring these types of opportunities in the dynamic global education market.

For SEI, developing advanced vocational training for emerging industries like green energy and AI applications places them squarely in the Question Mark quadrant. The market hunger for these skills is undeniable, with the global green energy jobs market projected to reach over 40 million by 2030, according to the International Renewable Energy Agency (IRENA). However, SEI faces the challenge of rapidly building its reputation and capturing market share against established training providers.

Expanding into new direct-to-consumer skill-based learning platforms beyond Sophia Learning also represents a classic Question Mark. This targets the burgeoning lifelong learning market, projected to reach $370 billion globally by 2026, according to HolonIQ. SEI would face intense competition, necessitating significant investment in marketing, platform development, and content creation to gain traction.

Investing in AI-integrated adaptive learning pathways is another significant Question Mark. The global AI in education market was valued at approximately $2.1 billion in 2023 and is projected to grow substantially, reaching over $25 billion by 2030. However, the substantial R&D and pilot program costs present considerable hurdles, with uncertain market adoption being a key concern.

BCG Matrix Data Sources

Our Strategic Education BCG Matrix is built on robust data, integrating academic performance metrics, enrollment trends, and government educational statistics to provide a comprehensive view.