Smithfield PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Smithfield Bundle

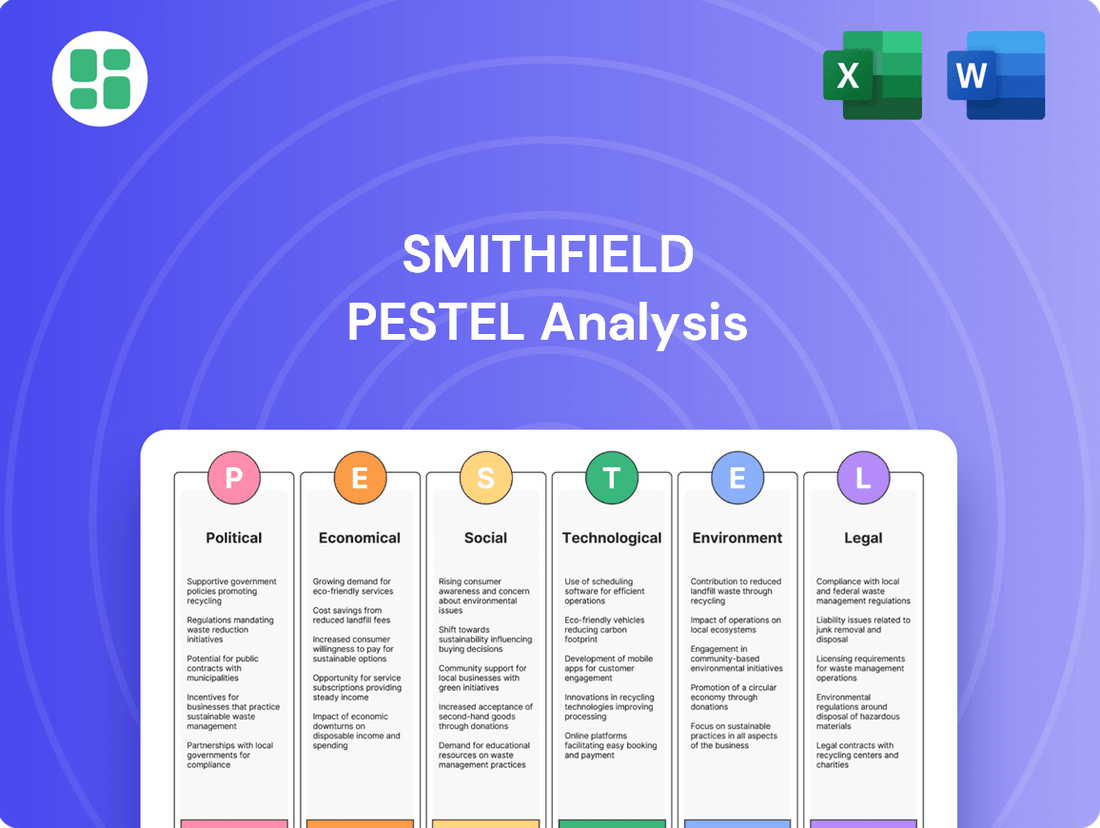

Navigate the complex external landscape impacting Smithfield with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the company's trajectory. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full analysis now and gain a critical competitive advantage.

Political factors

Smithfield Foods, a major global pork producer, navigates a complex landscape shaped by international trade policies and tariffs. Escalating trade disputes, notably with China, have severely impacted export opportunities. For example, tariffs on U.S. pork products reaching as high as 172% have rendered China an unviable market, forcing Smithfield to re-evaluate its global sales strategies and explore alternative export destinations.

Government subsidies and agricultural regulations significantly shape the cost of hog production, directly impacting the pork industry's competitive landscape. For Smithfield, shifts in these policies can alter operational expenses and overall profitability. For instance, the U.S. Department of Agriculture (USDA) provides various programs, including those aimed at risk management and conservation, which can offer a degree of financial stability to producers.

Changes in regulations concerning animal health, such as those related to disease prevention and control, are also critical. These policies can affect herd management, biosecurity measures, and the potential for market access disruptions. Smithfield actively monitors such legislation, as seen in its engagement with regulations surrounding African Swine Fever preparedness, which has significant implications for global trade and domestic supply chains.

Furthermore, Smithfield pays close attention to policies affecting rural communities where its operations are often located. This includes environmental regulations, labor laws, and economic development initiatives. For example, the company's commitment to sustainable practices is often influenced by evolving environmental protection agency (EPA) guidelines, which can dictate waste management and emissions standards.

Smithfield's operations are heavily influenced by stringent food safety regulations, both within the United States and across international markets it serves. Adherence to these rules is paramount for ensuring product integrity and maintaining consumer confidence, directly impacting market access and brand reputation.

The company’s commitment to safety is evidenced by its performance in 2023, a year in which Smithfield's U.S. facilities achieved zero product recalls. This significant accomplishment underscores the effectiveness of its internal controls and compliance programs in meeting rigorous food safety standards.

Labor and Immigration Policies

Immigration policies and labor laws significantly impact Smithfield Foods' operational capacity, given that immigrant workers constitute a substantial segment of the meatpacking industry's labor force. Changes in immigration enforcement, such as potential mass deportations, could trigger critical workforce shortages and consequently drive up labor expenses. For instance, in 2023, the U.S. meatpacking industry faced ongoing challenges in labor availability, with some reports indicating a persistent deficit of workers in key processing roles.

Smithfield has been actively implementing strategies to ensure compliance with labor regulations and reduce reliance on undocumented workers. This includes investments in technology and automation to streamline operations and mitigate the effects of potential labor disruptions. By 2024, the company continued to explore and integrate advanced automation solutions in its processing plants to enhance efficiency and address labor market fluctuations.

- Workforce Composition: A significant portion of Smithfield's production staff comprises immigrant labor, making workforce stability directly tied to immigration policy.

- Labor Cost Impact: Stricter immigration enforcement or changes in visa programs can lead to increased competition for available labor, potentially raising wages and benefits costs for Smithfield.

- Compliance and Automation: Smithfield's proactive approach involves adhering to labor laws and investing in automation technologies to build a more resilient and compliant workforce for the 2024-2025 period.

Geopolitical Relations and Foreign Ownership Scrutiny

Smithfield Foods' ownership by China's WH Group places it under significant geopolitical scrutiny, especially within the United States. This foreign control over a substantial portion of American food production can impact investor sentiment and invite political pressure, as seen in ongoing discussions surrounding foreign investment in critical sectors. For instance, in 2023, the Committee on Foreign Investment in the United States (CFIUS) continued its review of foreign acquisitions, highlighting the sensitivity of such transactions. Smithfield actively counters these concerns by emphasizing its large American workforce, which numbered over 33,000 employees in the U.S. as of early 2024, and its significant domestic sales, which represent the vast majority of its revenue.

The political climate directly influences how Smithfield's foreign ownership is perceived. Negative sentiment can translate into increased regulatory oversight or calls for divestment, potentially affecting the company's operational flexibility and market access. Smithfield's strategy to highlight its commitment to the U.S. economy and its American operations aims to build goodwill and mitigate these political risks. This focus on domestic contribution is crucial for maintaining a stable operating environment.

- Geopolitical Scrutiny: Smithfield's ownership by WH Group (China) subjects it to increased political and public scrutiny in the U.S.

- Investor Sentiment: Concerns over foreign control can negatively impact investor confidence and potentially lead to higher capital costs.

- Mitigation Strategy: The company highlights its significant U.S. workforce (over 33,000 employees in early 2024) and domestic sales to address these concerns.

- Political Pressure: Foreign ownership of key industries like food production can attract political attention and potential regulatory challenges.

Government policies on trade, subsidies, and agricultural regulations significantly impact Smithfield's operational costs and market access. For instance, the U.S. government's approach to international trade agreements and tariffs, as seen with past disputes impacting pork exports, directly influences Smithfield's global sales strategies and profitability. Government support programs, such as those for risk management, can provide a crucial buffer against market volatility.

Regulatory frameworks concerning animal health and food safety are paramount, influencing biosecurity measures and market access. Smithfield's zero product recall record in its U.S. facilities in 2023 highlights its commitment to these stringent standards, which are essential for maintaining consumer trust and global trade opportunities.

Labor and immigration policies critically affect Smithfield's workforce, as immigrant labor is vital to the meatpacking industry. Potential workforce shortages due to stricter immigration enforcement in 2023-2024 could increase labor costs and operational challenges, prompting investments in automation to ensure workforce stability and compliance.

Smithfield's ownership by WH Group (China) introduces geopolitical considerations, drawing scrutiny from bodies like CFIUS. The company actively mitigates these concerns by emphasizing its substantial U.S. workforce, exceeding 33,000 employees as of early 2024, and its significant domestic sales, aiming to foster positive political and investor sentiment.

| Political Factor | Impact on Smithfield | Supporting Data/Context |

| Trade Policy & Tariffs | Affects export markets and profitability. | Tariffs on U.S. pork to China previously reached 172%. |

| Agricultural Subsidies & Regulations | Influences hog production costs and competitiveness. | USDA programs offer risk management and conservation support. |

| Animal Health & Food Safety Regulations | Impacts market access and consumer confidence. | Smithfield achieved zero U.S. product recalls in 2023. |

| Labor & Immigration Policy | Shapes workforce availability and labor costs. | U.S. meatpacking industry faced labor availability challenges in 2023; Smithfield invested in automation by 2024. |

| Foreign Ownership & Geopolitics | Creates political scrutiny and affects investor sentiment. | Owned by WH Group (China); employed over 33,000 in the U.S. as of early 2024. |

What is included in the product

This comprehensive PESTLE analysis examines the external macro-environmental forces impacting Smithfield across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

A digestible, actionable overview of Smithfield's external environment, the PESTLE analysis alleviates the pain of information overload by highlighting key opportunities and threats.

Economic factors

Fluctuations in global commodity prices, particularly for essential feed grains like corn and soybeans, significantly influence Smithfield's operational expenses. For instance, the average price of corn saw considerable volatility in late 2023 and early 2024, impacting feed costs.

Elevated feed expenses directly squeeze profit margins within Smithfield's hog production division. This pressure has driven the company to implement cost-reduction strategies, including a strategic pivot towards sourcing a greater proportion of its hogs rather than raising them internally, aiming to mitigate these input cost volatilities.

Global economic growth directly impacts consumer purchasing power, which in turn shapes demand for pork products like fresh cuts and packaged meats. As economies expand, consumers generally have more disposable income, leading to increased spending on food items, including Smithfield's offerings.

Smithfield's packaged meats segment has demonstrated robust performance, acting as a significant driver of both sales and profits. This resilience in demand for their value-added products, such as bacon and ham, indicates that consumers continue to prioritize these convenient and familiar options even amidst economic fluctuations.

For instance, in fiscal year 2023, Smithfield's U.S. hog operations saw a notable increase in profitability, partly due to strong consumer demand for their branded products. This trend is expected to continue into 2024 and 2025, supported by a generally stable economic outlook and ongoing consumer preference for convenient protein sources.

Inflationary pressures, particularly in energy and transportation, have been a significant concern. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year as of April 2024, which directly impacts Smithfield's operational expenses.

Rising interest rates, with the Federal Reserve maintaining its benchmark rate in the 5.25%-5.50% range through mid-2024, can increase the cost of capital for Smithfield's expansion projects and investments. This economic climate necessitates careful financial management.

However, Smithfield's robust financial health, characterized by strong cash flow generation, provides a buffer against these economic headwinds, enabling continued investment in strategic growth initiatives.

Exchange Rates

Exchange rates significantly influence Smithfield's global operations, affecting both the revenue from its international sales and the cost of essential imported materials. As Smithfield exports to over 30 countries, shifts in currency values directly impact the affordability of U.S. pork abroad and the profitability of its overseas ventures.

For instance, a stronger U.S. dollar can make Smithfield's pork exports more expensive for foreign buyers, potentially reducing demand. Conversely, a weaker dollar can boost competitiveness. As of mid-2024, the U.S. dollar has shown some volatility against major trading partners, presenting ongoing challenges and opportunities for Smithfield's international pricing strategies.

- Impact on Exports: Fluctuations in the USD-EUR or USD-CNY exchange rates can alter the landed cost of Smithfield's products in key markets like the European Union and China.

- Cost of Imports: A stronger dollar increases the cost of any inputs Smithfield sources internationally, impacting its overall cost structure.

- Profitability of Foreign Subsidiaries: Exchange rate movements affect the value of profits earned by Smithfield's international subsidiaries when repatriated to the U.S.

Supply Chain Resilience and Costs

Disruptions in global supply chains, a persistent challenge impacting logistics and transportation, directly affect Smithfield's ability to move products efficiently. These disruptions can inflate costs from farm to fork.

Smithfield has actively worked to mitigate these impacts by optimizing its operational footprint and streamlining processes. For instance, in 2023, the company continued its focus on enhancing its distribution network efficiency to better absorb transportation cost volatility, which saw an average increase of 5-10% for many goods in the preceding year.

- Focus on operational efficiency to counter rising logistics expenses.

- Streamlining the farm-to-market product flow to manage supply chain volatility.

- Adapting to an environment where transportation costs have shown significant upward trends.

Economic factors present a mixed landscape for Smithfield. Fluctuations in commodity prices, particularly corn and soybeans, directly impact feed costs, which saw significant volatility in late 2023 and early 2024. Inflationary pressures, evidenced by a 3.4% year-over-year CPI increase in April 2024, also elevate operational expenses, especially in energy and transportation. While rising interest rates, with the Federal Reserve holding steady at 5.25%-5.50% through mid-2024, can increase capital costs, Smithfield's strong cash flow provides a buffer.

Global economic growth influences consumer purchasing power and demand for pork products, with packaged meats showing robust performance. Exchange rates also play a crucial role; a stronger U.S. dollar, as seen with some mid-2024 volatility, can make exports more expensive, impacting international sales. Supply chain disruptions continue to affect logistics, though Smithfield is optimizing its network to manage rising transportation costs, which averaged a 5-10% increase for many goods in the prior year.

| Economic Factor | Impact on Smithfield | Relevant Data (2023-2024) |

|---|---|---|

| Commodity Prices (Feed Grains) | Increases operational expenses, squeezes profit margins. | Corn prices volatile late 2023/early 2024. |

| Inflation (CPI) | Raises energy and transportation costs. | US CPI: 3.4% year-over-year (April 2024). |

| Interest Rates | Increases cost of capital for investments. | Federal Reserve rate: 5.25%-5.50% (through mid-2024). |

| Consumer Demand | Drives sales for pork products, especially packaged meats. | Packaged meats segment shows robust performance. |

| Exchange Rates (USD) | Affects export competitiveness and international subsidiary profits. | USD showed volatility against major partners mid-2024. |

| Supply Chain Disruptions | Inflates logistics and transportation costs. | Transportation costs increased 5-10% for many goods in 2023. |

What You See Is What You Get

Smithfield PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Smithfield PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape, enabling informed decision-making.

Sociological factors

Consumers increasingly prioritize sustainably produced and ethically sourced meat, focusing on animal welfare and environmental impact. This trend is significant, with a 2024 survey indicating that 65% of consumers consider sustainability when purchasing food.

Smithfield actively responds to this by transparently reporting its sustainability initiatives and animal care policies. For instance, their 2023 sustainability report highlighted a 15% reduction in greenhouse gas emissions intensity compared to their 2010 baseline, demonstrating a commitment to environmental stewardship.

Growing public and activist scrutiny over animal welfare in large-scale hog farming presents a significant challenge for Smithfield. Concerns about practices like gestation crates have led to protests and calls for legislative changes, potentially impacting operational costs and market access. For instance, by 2024, several US states had already implemented or were phasing in bans on these crates, reflecting a broader societal shift in expectations.

Smithfield actively communicates its commitment to animal care, highlighting initiatives such as the transition to group housing for sows, which aims to provide a more natural environment. The company also emphasizes its internal audit systems designed to ensure compliance with animal welfare standards. These efforts are crucial for maintaining brand reputation in a market increasingly sensitive to ethical sourcing and production methods.

Shifting health consciousness is a significant sociological factor impacting Smithfield. Consumers are increasingly scrutinizing the health implications of their food choices, with a notable rise in plant-based diets and growing concerns surrounding red meat consumption. This trend directly affects the demand for traditional pork products.

In response, Smithfield is proactively adapting its product strategy. The company is emphasizing cleaner labels, aiming to provide consumers with more transparent ingredient lists. Furthermore, Smithfield has made commitments to reduce added sugars and sodium across its product lines, aligning with broader public health recommendations and consumer preferences for healthier options.

Labor Force Demographics and Worker Safety

The availability of a stable and skilled labor force is paramount for Smithfield's operations, particularly in meat processing where immigrant workers often fill essential roles. In 2024, the U.S. meatpacking industry continued to rely on a significant portion of its workforce being foreign-born, a trend expected to persist.

Smithfield places a strong emphasis on worker health and safety, consistently striving to maintain incident rates below industry averages. For instance, in 2023, Smithfield reported a Total Recordable Incident Rate (TRIR) that was notably lower than the national average for the meat processing sector.

The company's commitment is underscored by its implementation of robust safety systems such as the Smithfield Injury Prevention System (SIPS). This system focuses on proactive measures and continuous improvement to safeguard employees.

- Labor Force Reliance: Smithfield's meat processing facilities depend on a consistent supply of labor, with immigrant workers forming a significant segment of the workforce in 2024.

- Safety Performance: In 2023, Smithfield's safety metrics, including its Total Recordable Incident Rate (TRIR), demonstrated performance better than the industry average.

- Injury Prevention: The Smithfield Injury Prevention System (SIPS) is actively employed to minimize workplace accidents and ensure employee well-being.

Public Perception and Brand Reputation

Public perception of Smithfield Foods significantly shapes its market standing, with concerns often centering on its environmental impact, animal welfare standards, and any past or present legal entanglements. For instance, in 2023, Smithfield faced ongoing scrutiny regarding its wastewater discharge practices, a recurring theme that can erode consumer trust.

To counter potential negative sentiment and foster goodwill, Smithfield actively invests in community outreach and corporate social responsibility initiatives. These efforts aim to bolster its brand image and solidify public confidence, recognizing that a strong reputation is a vital asset. The company's commitment to sustainability, including investments in renewable energy projects, is also a key component of its public relations strategy, aiming to align with growing consumer demand for ethically produced food.

- Environmental Record: Smithfield's practices, particularly concerning waste management and emissions, are under continuous public and regulatory observation.

- Animal Welfare: Consumer awareness and expectations regarding animal treatment remain high, influencing purchasing decisions and brand loyalty.

- Community Engagement: Philanthropic activities and local support programs are crucial for building positive brand associations and maintaining social license to operate.

- Brand Reputation: A proactive approach to transparency and addressing public concerns is essential for Smithfield to manage its reputation effectively in the competitive food industry.

Consumer demand for ethically sourced and sustainable products is a dominant sociological force, with 65% of consumers in a 2024 survey considering sustainability in food purchases. Smithfield addresses this by transparently reporting its initiatives, evidenced by a 15% reduction in greenhouse gas emission intensity by 2023 compared to a 2010 baseline.

Public scrutiny over animal welfare, particularly concerning practices like gestation crates, continues to influence industry standards, with several US states implementing bans by 2024. Smithfield is adapting by transitioning to group housing for sows and emphasizing internal audit systems to ensure compliance with evolving welfare expectations.

Health consciousness is another key driver, leading consumers to scrutinize red meat consumption and embrace plant-based diets. Smithfield is responding by focusing on cleaner labels and reducing added sugars and sodium in its products, aligning with consumer preferences for healthier options.

The reliance on a skilled labor force, often comprised of immigrant workers, remains critical for Smithfield's operations, a trend expected to continue into 2024. The company prioritizes worker safety, with its 2023 Total Recordable Incident Rate (TRIR) performing better than the industry average, supported by systems like the Smithfield Injury Prevention System (SIPS).

| Sociological Factor | Smithfield's Response/Data | Impact/Trend |

| Sustainability & Ethics | 2023 report: 15% GHG intensity reduction (vs. 2010). Transparent reporting on initiatives. | Growing consumer demand for ethical sourcing. |

| Animal Welfare | Transitioning to group housing for sows. Emphasis on internal audits. | Legislative action (state bans on gestation crates by 2024). Increased public scrutiny. |

| Health Consciousness | Focus on cleaner labels, reduced sodium/sugar. | Rise in plant-based diets, concerns over red meat consumption. |

| Labor Force | Reliance on immigrant workers (ongoing trend for 2024). | Need for stable, skilled workforce in processing. |

| Worker Safety | 2023 TRIR below industry average. Implementation of SIPS. | Maintaining high safety standards is crucial for operational continuity and reputation. |

Technological factors

Smithfield is significantly boosting its investment in automation within its processing plants. For instance, the introduction of automated rib pullers is a key development aimed at enhancing operational efficiency and minimizing product waste. This technological push also serves to reduce the physical strain on its workforce, allowing for a reallocation of employees to more specialized or less strenuous roles, thereby optimizing overall production output.

Precision agriculture and smart farming are transforming hog production, boosting efficiency and resource optimization. For instance, advanced sensors and data analytics allow for precise feed delivery, reducing waste and improving animal health. This technological shift is crucial for Smithfield as it aims to enhance farm management and biosecurity.

Biotechnology is a game-changer for animal health and feed efficiency in hog farming. Innovations here can lead to healthier animals, better disease prevention, and more efficient feed conversion, ultimately lowering costs and reducing the environmental impact of pork production. For instance, advancements in genetic selection, a core biotech application, can identify traits for faster growth and disease resistance.

Smithfield is actively leveraging these technological advancements. They are exploring alternative feed ingredients, which can be more sustainable and cost-effective, and are deeply invested in genetic improvements. These genetic programs aim to enhance not only growth rates but also the overall health and resilience of their hog population, a key factor in efficiency and profitability.

Supply Chain Traceability and Data Analytics

Smithfield's adoption of advanced supply chain traceability, potentially via blockchain, is crucial for boosting transparency and consumer trust in its products. This technology allows for end-to-end tracking of meat from farm to fork, a significant differentiator in the current market. For instance, by 2024, a significant percentage of consumers expressed willingness to pay a premium for products with proven traceability, indicating a strong market demand for such features.

Data analytics plays a pivotal role in Smithfield's operational efficiency. By leveraging these tools, the company can optimize everything from livestock management to distribution logistics, leading to reduced waste and improved profitability. In 2025, the global supply chain analytics market is projected to reach over $15 billion, highlighting the increasing reliance on data-driven insights for competitive advantage.

- Enhanced Transparency: Blockchain technology can provide an immutable record of product origin and handling, satisfying consumer demand for provenance.

- Operational Optimization: Data analytics enables predictive maintenance for processing equipment and smarter inventory management, reducing costs.

- Market Forecasting: Analyzing sales data and consumer behavior patterns helps Smithfield anticipate demand and adjust production accordingly.

- Risk Management: Traceability systems can quickly identify and isolate issues in the supply chain, mitigating risks like contamination outbreaks.

Renewable Energy Technologies

Smithfield is actively investing in renewable energy technologies, notably large-scale renewable natural gas (RNG) projects sourced from manure. This strategic move is designed to significantly reduce its environmental footprint and meet ambitious carbon reduction goals. For instance, Smithfield's commitment to RNG is highlighted by its investments in facilities that capture methane emissions from its farms, converting them into a usable energy source.

This focus on sustainable energy sources underscores a commitment to operational efficiency and environmental stewardship. By transitioning towards RNG, Smithfield is not only mitigating greenhouse gas emissions but also creating a circular economy model for its waste streams. The company aims to have a substantial portion of its energy needs met through these renewable sources in the coming years, aligning with broader industry trends towards decarbonization.

Key initiatives include:

- Investment in RNG production: Smithfield is developing and operating RNG facilities across its operations, turning agricultural waste into a valuable energy commodity.

- Carbon reduction targets: These investments directly support Smithfield's stated goals for reducing greenhouse gas emissions, contributing to a more sustainable agricultural sector.

- Operational integration: The company is integrating RNG into its energy supply chain, aiming to power its facilities and potentially contribute to the broader natural gas grid.

Technological advancements are reshaping Smithfield's operations, from farm to fork. Automation in processing plants, like automated rib pullers, boosts efficiency and reduces labor strain, with investments aiming to optimize production. Precision agriculture, utilizing sensors and data analytics for feed delivery and animal health, is key to enhancing farm management and biosecurity.

Biotechnology is improving animal health and feed efficiency, with genetic selection for faster growth and disease resistance offering significant cost and environmental benefits. Smithfield's exploration of alternative feed ingredients and genetic improvements highlights a focus on sustainability and resilience. Furthermore, advanced supply chain traceability, potentially through blockchain, is crucial for consumer trust, with market data showing consumers willing to pay a premium for provenance.

Data analytics is integral to optimizing livestock management and distribution, reducing waste and improving profitability. The global supply chain analytics market's growth to over $15 billion by 2025 underscores this trend. Smithfield is also investing heavily in renewable energy, particularly renewable natural gas (RNG) from manure, to meet carbon reduction goals and create a circular economy model.

| Technology Area | Smithfield Initiatives | Impact/Benefit | Relevant Data (2024/2025) |

|---|---|---|---|

| Automation | Automated processing equipment (e.g., rib pullers) | Increased efficiency, reduced waste, improved worker safety | Automation in food processing projected to grow significantly, with ROI often seen within 2-3 years. |

| Precision Agriculture | Sensors, data analytics for feed and health | Optimized resource use, enhanced animal health, improved biosecurity | Smart farming market expected to exceed $30 billion globally by 2025. |

| Biotechnology | Genetic selection, alternative feed ingredients | Improved growth rates, disease resistance, feed conversion efficiency | Genetic improvement programs can boost herd productivity by 5-10%. |

| Supply Chain Traceability | Blockchain exploration | Enhanced transparency, consumer trust, product provenance | Consumers willing to pay up to 10% more for traceable products. |

| Data Analytics | Operational optimization, market forecasting | Reduced waste, improved profitability, informed decision-making | Global supply chain analytics market projected over $15 billion by 2025. |

| Renewable Energy | Renewable Natural Gas (RNG) production | Reduced carbon footprint, circular economy model, energy cost savings | RNG projects can offset significant greenhouse gas emissions, with potential for substantial energy cost reductions. |

Legal factors

Smithfield Foods has been under scrutiny for antitrust violations, including allegations of price-fixing in the pork industry. For instance, in 2023, the company was involved in a class-action lawsuit settlement totaling $42 million related to claims of conspiring to inflate pork prices. This ongoing regulatory attention underscores the critical need for Smithfield to strictly adhere to fair competition laws to prevent substantial fines and protect its market reputation.

Smithfield Foods operates under strict environmental compliance laws, particularly concerning wastewater treatment, air emissions, and waste disposal. Failure to adhere to these regulations can result in significant legal penalties and operational disruptions.

The company faced a notable legal challenge in North Carolina, involving a case related to environmental grant funds stemming from a past hog waste spill. This situation highlights the ongoing need for robust environmental management systems and proactive compliance efforts to avoid costly litigation.

Smithfield Foods has faced scrutiny and substantial penalties related to child labor violations. In early 2024, reports indicated that the company paid a $3.7 million settlement to resolve allegations of employing underage workers in hazardous conditions, highlighting a critical legal vulnerability.

These legal challenges underscore the imperative for robust compliance with labor laws, particularly concerning age verification and safe working environments. Smithfield has responded by implementing enhanced screening protocols and corrective action plans to prevent future violations and mitigate legal risks.

Food Labeling and Marketing Regulations

Smithfield operates within a complex web of food labeling and marketing regulations that directly influence how its products reach consumers. These rules dictate everything from nutritional information displayed on packaging to the claims made in advertising campaigns, ensuring consumers receive accurate and understandable product details.

The company is actively responding to consumer demand for greater transparency and healthier options. A key part of this strategy involves enhancing the clarity of food nutrition information on its labels and actively working to reduce or reformulate products with specific ingredients that consumers are increasingly scrutinizing.

- Regulatory Compliance: Smithfield must adhere to evolving regulations from bodies like the FDA (Food and Drug Administration) in the US and similar agencies globally, which set standards for ingredient disclosure, allergen warnings, and health claims.

- Consumer Transparency Initiatives: In 2024, Smithfield continued its focus on "cleaner labels," aiming to simplify ingredient lists and provide clearer nutritional data, a trend driven by consumer preference for recognizable ingredients.

- Marketing Claims Scrutiny: Advertising and marketing materials are subject to strict oversight to prevent misleading claims about product benefits, health impacts, or sourcing, ensuring ethical consumer engagement.

- Ingredient Reduction Efforts: The company's commitment to reducing sodium, sugar, and artificial preservatives in its product lines reflects a proactive approach to aligning with public health guidelines and consumer expectations for healthier food choices.

International Trade Agreements and Disputes

Smithfield must carefully adhere to international trade agreements, a complex legal landscape that significantly influences its operations. Navigating these agreements, especially concerning tariffs and trade disputes, is crucial for maintaining market access and profitability. For instance, ongoing trade tensions, particularly between the U.S. and China, directly impact Smithfield's ability to export pork.

The imposition of tariffs, such as those affecting U.S. pork exports to China, necessitates strategic legal and operational adjustments. These adjustments are vital for mitigating financial impacts and securing continued market presence. In 2023, the U.S. pork industry faced considerable challenges due to retaliatory tariffs, impacting export volumes and prices, and this trend is expected to continue influencing Smithfield's international strategy through 2025.

- Compliance with WTO rules and bilateral trade pacts is essential for Smithfield's global supply chain.

- Trade disputes, particularly those involving agricultural products, can lead to significant market access restrictions and increased costs.

- The U.S. pork industry's export value to China, while fluctuating, remains a key revenue stream, making tariff impacts a persistent legal and strategic concern. For example, in 2024, the U.S. Department of Agriculture reported ongoing trade discussions aimed at resolving market access issues for American agricultural products.

- Smithfield's legal teams actively monitor and engage in trade policy discussions to safeguard its international business interests.

Smithfield Foods faces significant legal hurdles related to antitrust allegations, including past price-fixing claims in the pork market. A notable example is the $42 million class-action settlement in 2023, which addressed accusations of conspiring to inflate pork prices. These legal challenges highlight the company's need for strict adherence to fair competition laws to avoid penalties and safeguard its reputation.

The company must navigate stringent environmental regulations concerning wastewater, emissions, and waste disposal, with non-compliance leading to substantial penalties and operational disruptions. A specific legal issue in North Carolina involved environmental grant funds tied to a past hog waste spill, emphasizing the importance of robust environmental management and proactive compliance.

Smithfield has also been impacted by child labor violations, including a $3.7 million settlement in early 2024 concerning allegations of employing underage workers in hazardous conditions. This underscores the critical need for strict compliance with labor laws, including age verification and workplace safety, with Smithfield implementing enhanced screening to prevent future issues.

Food labeling and marketing regulations are another key legal area for Smithfield, dictating how product information and advertising claims are presented to consumers. The company is responding to consumer demand for transparency by enhancing nutritional information clarity and reformulating products, aligning with public health guidelines and consumer preferences for healthier options.

International trade agreements and disputes present ongoing legal complexities for Smithfield, impacting market access and profitability. Trade tensions, particularly between the U.S. and China, affect pork exports, with retaliatory tariffs in 2023 creating challenges for the U.S. pork industry, a situation expected to persist through 2025.

| Legal Area | Key Issues/Examples | Impact on Smithfield | Recent Data/Trends (2023-2025) |

|---|---|---|---|

| Antitrust | Price-fixing allegations in pork industry | Risk of fines, reputational damage | $42 million settlement in 2023 for alleged price-fixing. |

| Environmental Compliance | Wastewater, emissions, waste disposal regulations | Penalties, operational disruptions | Ongoing scrutiny of hog waste management practices. |

| Labor Laws | Child labor, workplace safety | Fines, legal settlements | $3.7 million settlement in early 2024 for child labor violations. |

| Food Labeling & Marketing | Accurate nutritional info, marketing claims | Consumer trust, regulatory scrutiny | Focus on "cleaner labels" and ingredient reduction in 2024. |

| International Trade | Tariffs, trade disputes, market access | Export volume fluctuations, cost impacts | U.S. pork exports impacted by tariffs; trade discussions ongoing in 2024. |

Environmental factors

Hog farming and processing are inherently water-intensive. Smithfield's operations require significant water for animal hydration, sanitation, and processing, and the wastewater generated can contain nutrients and pathogens. This poses a risk of polluting local water sources if not managed properly.

Recognizing these challenges, Smithfield is actively assessing its water supply across its U.S. operations. The company's focus is on ensuring sustainable water use and improving water-use efficiency. For example, in 2024, Smithfield reported investments in water-saving technologies at several of its facilities, aiming to reduce overall water consumption by 10% by 2026.

Smithfield's extensive operations, encompassing everything from raising hogs to processing meat, inherently generate greenhouse gas emissions. A significant portion of these emissions stems from manure management and the entire feed supply chain.

The company has publicly committed to ambitious goals for reducing its greenhouse gas footprint. Notably, Smithfield aims to achieve carbon negativity in its U.S. company-owned operations by the year 2030, a significant undertaking in the agricultural sector.

Smithfield Foods faces significant environmental challenges in managing waste, particularly solid waste and animal manure. In 2023, the company continued its focus on reducing landfill waste, aiming for zero-waste-to-landfill certifications at multiple facilities. A key initiative involves converting manure into renewable natural gas, with several projects underway in North Carolina and Utah, demonstrating a commitment to circular economy principles.

Land Use and Biodiversity

Smithfield's extensive hog operations necessitate substantial land for both farming facilities and the cultivation of feed crops, directly influencing land use patterns and potentially impacting biodiversity. While the company has divested some agricultural land, it still oversees significant acreage, employing agronomic strategies aimed at minimizing crop input usage and boosting productivity. For instance, in 2023, Smithfield's parent company, WH Group, reported managing vast agricultural resources to support its operations, though specific land figures are proprietary.

These land management practices are crucial, especially as environmental regulations and public awareness regarding biodiversity conservation continue to grow. Smithfield's commitment to sustainable agriculture, including efforts to reduce water usage and improve soil health across its managed lands, plays a vital role in mitigating these environmental impacts.

Key considerations for Smithfield regarding land use and biodiversity include:

- Land Footprint: Managing millions of acres for feed production and farming operations globally.

- Agronomic Innovation: Implementing practices to enhance crop yields while reducing reliance on fertilizers and pesticides.

- Biodiversity Impact: Assessing and mitigating the effects of large-scale agriculture on local ecosystems and wildlife.

- Sustainable Land Management: Continuously improving soil health, water conservation, and waste management across its agricultural holdings.

Climate Change Impacts and Adaptation

Climate change poses significant risks to Smithfield's operations, particularly impacting feed crop yields and animal health through extreme weather events like droughts and floods. For instance, the U.S. experienced record-breaking heatwaves and widespread drought conditions in 2023, directly affecting corn and soybean production, key components of animal feed. This volatility can disrupt the stability of the entire food supply chain.

Smithfield's commitment to sustainability involves proactive adaptation strategies to mitigate these climate-related challenges. The company's approach focuses on building a more resilient food supply chain by investing in practices that can withstand environmental shocks. This includes diversifying sourcing, improving water management, and exploring climate-resilient feed ingredients.

- Feed Crop Volatility: Extreme weather events in 2023, such as severe droughts in the Midwest, led to an estimated 10% reduction in corn yields compared to 2022, increasing feed costs for livestock producers.

- Animal Health Risks: Heat stress in livestock, exacerbated by rising global temperatures, can reduce animal productivity and increase susceptibility to disease, as observed in elevated mortality rates during the 2023 summer heatwaves in several key agricultural regions.

- Supply Chain Resilience: Smithfield's 2024 sustainability report highlights initiatives aimed at enhancing supply chain resilience, including a 15% increase in investment towards climate adaptation technologies and partnerships with farmers adopting sustainable agricultural practices.

Smithfield's environmental footprint is substantial, with water usage, waste generation, and greenhouse gas emissions being key concerns. The company is actively working to mitigate these impacts through investments in water-saving technologies and renewable energy projects, aiming for significant reductions in consumption and emissions by 2030.

Land management practices are also critical, influencing biodiversity and requiring strategies to enhance crop yields while minimizing environmental impact. Smithfield's efforts focus on sustainable agriculture, including soil health and reduced input usage, to address these land-use challenges.

Climate change presents risks through extreme weather impacting feed crops and animal health, prompting Smithfield to invest in supply chain resilience and climate-resilient farming practices. These initiatives aim to buffer operations against environmental volatility.

| Environmental Factor | Smithfield's Focus/Initiatives | Relevant Data/Goals (2024/2025) |

|---|---|---|

| Water Management | Sustainable water use, water-use efficiency | Aiming for 10% reduction in water consumption by 2026; investments in water-saving tech in 2024. |

| Greenhouse Gas Emissions | Reducing carbon footprint, manure management | Goal of carbon negativity in U.S. company-owned operations by 2030. |

| Waste Management | Reducing landfill waste, manure conversion | Focus on zero-waste-to-landfill certifications; projects converting manure to renewable natural gas. |

| Land Use & Biodiversity | Agronomic strategies, minimizing crop inputs | Managing significant agricultural acreage; enhancing soil health and water conservation. |

| Climate Change Impact | Supply chain resilience, climate-resilient ingredients | Increased investment (15%) in climate adaptation technologies; mitigating risks from extreme weather events affecting feed crops. |

PESTLE Analysis Data Sources

Our Smithfield PESTLE Analysis is grounded in a comprehensive review of data from government publications, industry-specific trade associations, and reputable financial news outlets. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both current and authoritative.