Siemens Gamesa Renewable Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Siemens Gamesa Renewable Energy Bundle

Navigate the complex external landscape impacting Siemens Gamesa Renewable Energy with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and social trends are shaping the renewable energy sector and influencing Siemens Gamesa's strategic direction. Gain a competitive edge by leveraging these critical insights to inform your own business planning and investment decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government policies are a major driver for Siemens Gamesa. Renewable energy targets, like the European Union's aim for 111 GW of offshore wind capacity by 2030 and 320 GW by 2050, directly create demand for their turbines. These ambitious goals translate into significant market opportunities.

Incentive schemes also play a crucial role. The US Inflation Reduction Act (IRA), for example, provides substantial tax credits for clean energy projects, encouraging investment and driving down the overall cost of wind energy. This makes wind power more competitive and boosts adoption, benefiting manufacturers like Siemens Gamesa.

The global wind sector grapples with trade barriers and market fragmentation, creating ripples through international supply chains. This can make it harder for companies like Siemens Gamesa to source components and distribute their products efficiently across borders.

Geopolitical tensions, notably between China and Western nations, are fueling protectionist policies. These include higher tariffs aimed at shielding domestic industries, directly affecting Siemens Gamesa's worldwide operations and how it plans its supply chains. For instance, Siemens Energy, the parent company, anticipates only a minor financial hit from new US tariffs, suggesting a degree of resilience and ongoing adjustments to these trade challenges.

Permitting hurdles continue to slow down new wind farm development globally, with complex processes delaying crucial project timelines. This is a major concern for companies like Siemens Gamesa, aiming to scale up renewable energy solutions.

Inadequate grid infrastructure and the pace of new grid connection approvals are also significant roadblocks, preventing the necessary rapid expansion of wind power capacity. For instance, the European Union's target to install 320 GW of wind power by 2030 relies heavily on overcoming these integration challenges.

Governments are being urged to fully implement new EU permitting rules and the Wind Power Package to speed up deployment. In 2023, the EU reported that permitting times for offshore wind projects could still take an average of 4.5 years, highlighting the urgency for reform.

International Climate Commitments

Global climate commitments, including the Paris Agreement and the widespread pursuit of net-zero emissions targets, are significant drivers for renewable energy solutions, particularly wind power. Siemens Gamesa Renewable Energy actively participates in this transition, aiming for net-zero CO2 emissions across its value chain by 2040, demonstrating its alignment with international environmental goals.

The urgency for expanding wind energy capacity is underscored by the fact that current global progress is insufficient to meet the targets required to limit global warming to 1.5°C. For instance, the International Energy Agency (IEA) reported in 2023 that while wind power capacity is growing, it needs to accelerate substantially to align with climate objectives.

- Paris Agreement: Aims to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

- Net-Zero Targets: Over 130 countries have set or are considering net-zero emission targets, creating a strong policy push for renewables.

- Siemens Gamesa's Commitment: Targeting net-zero CO2 emissions by 2040 across its entire value chain.

- Capacity Gap: The Global Wind Energy Council (GWEC) highlights that the world needs to install approximately 390 GW of wind power annually by 2030 to stay on track for 1.5°C, a significant increase from the 86 GW installed in 2023.

Geopolitical Stability and Energy Security

Geopolitical shifts, particularly those impacting energy markets, directly influence investment in renewables. For instance, the ongoing conflicts in Eastern Europe have underscored the fragility of traditional energy supplies, driving a greater push for energy independence. This trend, evident in many European nations, has accelerated investments in wind power, a core area for Siemens Gamesa.

The strategic importance of companies like Siemens Gamesa is amplified by this global focus on energy security. As nations aim to diversify their energy portfolios away from volatile fossil fuel markets, wind energy emerges as a key component. This diversification strategy is crucial for long-term economic stability and national security, making Siemens Gamesa's offerings increasingly vital.

However, geopolitical instability also presents significant challenges. Supply chain disruptions, a persistent issue since 2021, can impact the availability and cost of raw materials essential for wind turbine manufacturing, such as rare earth metals. For example, the price of neodymium, a key component in magnets for direct-drive turbines, saw significant volatility in 2023 due to supply chain concerns. This unpredictability can affect project timelines and profitability for Siemens Gamesa and its clients.

Government policies remain a primary driver, with ambitious renewable energy targets like the EU's goal of 320 GW of offshore wind by 2050 directly shaping demand for Siemens Gamesa's turbines. Incentive programs, such as the US Inflation Reduction Act, further bolster the market by providing tax credits that enhance the competitiveness of wind power. However, permitting delays and inadequate grid infrastructure continue to hinder the rapid expansion of wind energy projects globally, with EU offshore wind projects averaging 4.5 years for permitting in 2023.

Geopolitical shifts, particularly concerning energy security, are accelerating investments in wind power as nations seek to reduce reliance on volatile fossil fuel markets. This trend enhances the strategic importance of companies like Siemens Gamesa, though geopolitical instability also introduces supply chain risks, impacting the cost and availability of critical components like rare earth metals, as seen with neodymium price volatility in 2023.

| Factor | Impact on Siemens Gamesa | Data/Example (2023-2025) |

| Government Targets | Drives demand for wind turbines. | EU aims for 320 GW offshore wind by 2050. |

| Incentive Schemes | Increases investment and competitiveness. | US IRA tax credits for clean energy. |

| Permitting & Grid Infrastructure | Slows project development and deployment. | EU offshore wind permitting averaged 4.5 years in 2023. |

| Geopolitical Shifts | Increases demand for energy independence; creates supply chain risks. | Neodymium price volatility due to supply chain concerns in 2023. |

What is included in the product

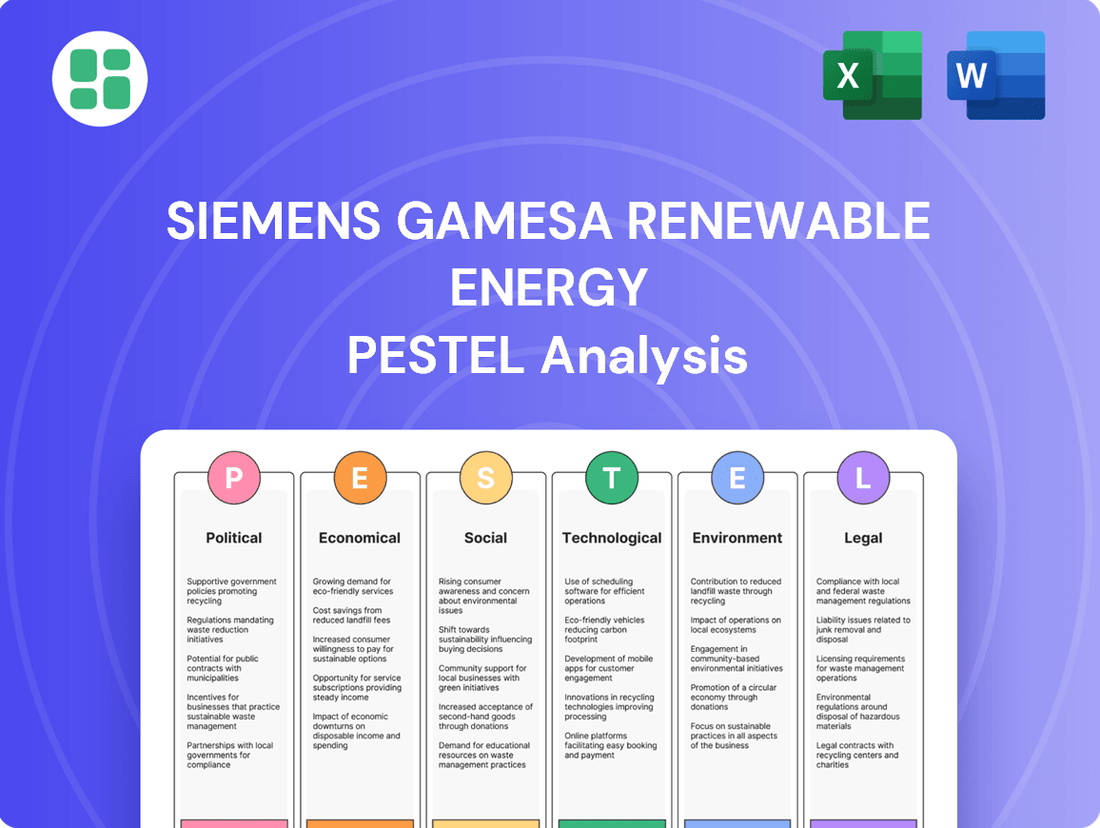

This PESTLE analysis of Siemens Gamesa Renewable Energy examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors, providing a comprehensive understanding of the external forces shaping the renewable energy sector.

It identifies key opportunities and threats arising from global trends, policy shifts, and market dynamics, offering strategic insights for navigating the complex landscape of renewable energy development.

A concise PESTLE analysis of Siemens Gamesa Renewable Energy provides a clear, actionable framework to navigate complex external factors, alleviating the pain of uncertainty in strategic decision-making.

Economic factors

The global economic outlook significantly shapes Siemens Gamesa's prospects. While the broader economic environment faced headwinds in early 2024, the renewable energy sector demonstrated resilience. The wind industry, a core market for Siemens Gamesa, achieved record installations in 2024, underscoring sustained global investment in clean energy solutions.

Despite this overall growth, investment in new wind farm projects saw a dip in the first half of 2024 compared to the same period in 2023. This indicates that while demand remains strong, the pace of new project financing and development faced some temporary challenges, potentially influencing order pipelines for turbine manufacturers like Siemens Gamesa.

High interest rates and persistent inflation have significantly impacted the offshore wind sector, including companies like Siemens Gamesa. These economic headwinds have driven up the costs of essential materials and the capital needed to fund massive projects. For instance, many offshore wind projects experienced cost overruns in 2023 and early 2024 due to these inflationary pressures.

While there's an expectation for interest rates to gradually decline through 2025, the current elevated levels continue to pose a challenge. This environment makes it difficult for developers to commit to new offshore wind farm investments, particularly for the large-scale developments that are crucial for renewable energy targets.

Fluctuating energy prices directly impact the competitiveness of wind power against traditional sources. Siemens Gamesa is actively working to reduce the Levelized Cost of Energy (LCoE) for offshore wind, targeting below eight euro cents per kilowatt-hour by 2025, a figure that encompasses grid connection expenses.

This strategic push towards cost reduction is fundamental for wind energy to achieve grid parity, meaning its cost becomes comparable to or lower than conventional power generation, thereby accelerating its market adoption.

Supply Chain Costs and Disruptions

The wind energy sector's supply chain is grappling with significant hurdles, including extended lead times, escalating costs, and insufficient manufacturing capacity, especially in regions beyond primary markets. These issues were exacerbated in 2023 and early 2024 by global events, such as the ongoing geopolitical instability and persistent high commodity prices, revealing vulnerabilities that have affected the financial performance and operational steadiness of companies like Siemens Gamesa.

Siemens Gamesa is actively working to mitigate these supply chain challenges. For instance, in their 2023/2024 fiscal year, the company reported efforts to secure critical components and increase local production to reduce reliance on distant suppliers. This strategic focus aims to enhance efficiency and bolster the company's resilience against future disruptions.

- Extended Lead Times: Components for wind turbines can have lead times of over a year, impacting project timelines and deployment schedules.

- Rising Material Costs: Prices for key materials like steel, copper, and rare earth elements saw significant volatility in 2023, directly impacting manufacturing costs.

- Manufacturing Capacity Gaps: A lack of specialized manufacturing facilities globally creates bottlenecks, particularly for larger components like turbine blades and towers.

- Geopolitical Impact: Events such as the war in Ukraine have disrupted logistics and increased energy costs, further straining supply chains.

Siemens Gamesa's Financial Performance and Turnaround

Siemens Gamesa is in the midst of a major overhaul, aiming for break-even by fiscal year 2026 and a return to profitable expansion. The company's financial results for the fourth quarter of fiscal year 2024 showed a reduction in losses, a positive sign stemming from operational stabilization efforts. This progress is being made even as the company navigates persistent quality concerns with some of its onshore turbine models and initial production hurdles in the offshore wind market.

Siemens Energy, the parent company, has indicated that sales for Siemens Gamesa's 5.X onshore turbine are anticipated to restart in fiscal year 2025. This resumption is crucial for the company's revenue generation and market position.

- Fiscal Year 2026 Target: Break-even point.

- Q4 FY2024 Performance: Narrowing losses achieved through operational stabilization.

- FY2025 Outlook: Resumption of sales for the 5.X onshore turbine platform expected.

- Ongoing Challenges: Quality issues with certain onshore turbines and offshore ramp-up difficulties persist.

The global economic landscape in 2024 presented mixed signals for Siemens Gamesa. While the renewable energy sector showed resilience with record wind installations globally, new project financing experienced a slowdown in early 2024. High inflation and interest rates continued to impact offshore wind projects, leading to cost overruns and making new investments challenging, although a gradual decline in rates is anticipated through 2025.

Siemens Gamesa's strategy focuses on reducing the Levelized Cost of Energy (LCoE) for offshore wind to below eight euro cents per kilowatt-hour by 2025, aiming for grid parity. However, supply chain disruptions, including extended lead times for components and rising material costs, persisted through early 2024, affecting manufacturing capacity and logistics.

The company is undergoing a significant restructuring with a target to achieve break-even by fiscal year 2026, showing progress with narrowed losses in Q4 FY2024. Sales of its 5.X onshore turbine are expected to resume in fiscal year 2025, crucial for revenue, though quality issues and offshore ramp-up challenges remain.

| Key Economic Factors Impacting Siemens Gamesa | Data Point / Trend | Implication for Siemens Gamesa |

| Global Wind Installations (2024) | Record installations | Sustained demand for wind turbines |

| New Project Financing (H1 2024 vs H1 2023) | Dip in financing | Potential impact on future order pipelines |

| Offshore Wind Project Costs | Cost overruns (2023-early 2024) | Increased capital expenditure, pressure on margins |

| Interest Rate Outlook | Gradual decline expected through 2025 | Potential easing of financing costs for projects |

| Target LCoE (Offshore Wind) | Below 8 euro cents/kWh by 2025 | Strategic focus on cost competitiveness |

| Supply Chain Lead Times | Over a year for some components | Project delays, operational challenges |

| Material Costs (Steel, Copper, Rare Earths) | Volatile in 2023 | Increased manufacturing costs |

| Break-even Target | Fiscal Year 2026 | Focus on financial recovery and profitability |

| 5.X Onshore Turbine Sales Resumption | Expected FY2025 | Key for revenue generation |

Preview Before You Purchase

Siemens Gamesa Renewable Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis of Siemens Gamesa Renewable Energy. This detailed breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to the full PESTLE analysis, offering critical insights into the external forces shaping Siemens Gamesa's renewable energy market position.

The content and structure shown in the preview is the same document you’ll download after payment. This includes an in-depth examination of how global trends and regulatory landscapes influence Siemens Gamesa's growth and innovation in the renewable sector.

Sociological factors

Public perception and community acceptance are absolutely vital for getting wind energy projects off the ground. While most people view wind power as a good thing for the environment, some can object due to how turbines look, the noise they make, or worries about local wildlife.

For Siemens Gamesa, building good relationships with communities is key. They work on being sustainable and talking with people to build trust and reduce any pushback. This approach is important because, for instance, in 2024, projects in Europe have faced delays due to local opposition, highlighting the need for strong community buy-in.

The burgeoning wind energy sector, crucial for meeting global decarbonization goals, faces a critical constraint: a shortage of skilled labor. As the industry expands, the demand for specialized technicians, engineers, and manufacturing personnel outstrips supply. For instance, the Global Wind Energy Council projected in late 2023 that the sector could employ over 3 million people by 2030, highlighting the immense need for workforce development.

Siemens Gamesa, a key player in this expansion, is navigating these labor challenges. While the company underwent restructuring in 2023, impacting some roles, its strategy involves internal reallocation to bolster its offshore wind business. This approach aims to maintain a stable overall workforce by shifting employees to areas of growth, such as the expanding offshore manufacturing and installation segments, which require distinct skill sets.

Growing environmental consciousness is a significant driver, pushing companies like Siemens Gamesa to prioritize sustainability. This trend translates directly into increased demand for renewable energy solutions, with consumers and businesses alike seeking to reduce their carbon footprint.

The push for decarbonization is accelerating, with many nations setting ambitious net-zero targets. For instance, by the end of 2023, the global installed capacity of wind power reached over 1,000 gigawatts, demonstrating a clear market shift towards cleaner energy sources.

Furthermore, the principles of a circular economy are gaining traction, influencing product design and end-of-life management in the renewable energy sector. Siemens Gamesa is actively investing in recycling technologies for wind turbine blades, reflecting this evolving industry standard.

Corporate Social Responsibility (CSR)

Siemens Gamesa Renewable Energy places a strong emphasis on Corporate Social Responsibility (CSR), integrating the UN Sustainable Development Goals (SDGs) into its core operations. This commitment is particularly evident in their focus on SDG 7 (Affordable and Clean Energy), SDG 13 (Climate Action), SDG 5 (Gender Equality), SDG 8 (Decent Work and Economic Growth), and SDG 16 (Peace, Justice, and Strong Institutions).

The company champions ethical conduct and transparency throughout its business dealings, extending this to its support for local communities. In 2023, Siemens Gamesa reported investing €25.9 million in social initiatives and community engagement programs, demonstrating a tangible commitment to the areas where it operates.

Furthermore, Siemens Gamesa actively manages its value chain to ensure responsible supplier conduct and uphold human rights. This proactive approach is crucial for building trust and ensuring long-term sustainability, as evidenced by their supplier code of conduct which covers environmental, social, and governance (ESG) aspects.

- Alignment with UN SDGs: Siemens Gamesa prioritizes SDGs related to clean energy, climate action, gender equality, decent work, and strong institutions.

- Community Investment: In 2023, the company invested €25.9 million in social initiatives and community engagement.

- Ethical Business Practices: Emphasis on transparency and ethical conduct across all operations.

- Value Chain Responsibility: Focus on supplier conduct and human rights within the entire value chain.

Stakeholder Engagement and Community Impact

Siemens Gamesa recognizes that strong relationships with local communities are crucial for the successful deployment of wind energy projects. Their commitment to social responsibility extends to actively engaging with stakeholders to ensure projects benefit the areas where they operate, fostering a social license to operate. This engagement is key to overcoming potential local opposition and securing project approvals.

The company's social initiatives are designed to create tangible positive impacts. For instance, in 2023, Siemens Gamesa aimed to reach over 10,000 beneficiaries through its technological education programs, a significant increase from previous years. Their annual social investment also saw a notable rise, with a focus on community development and skills training in regions where they have a presence.

- Community Investment: Siemens Gamesa's social investments in 2023 totaled €3.5 million, supporting over 50 community projects globally.

- Education Outreach: The company's STEM education programs engaged 12,500 students in 2023, exceeding their target of 10,000 beneficiaries.

- Stakeholder Dialogue: In 2024, Siemens Gamesa plans to conduct over 150 community consultation meetings for new wind farm developments across Europe and North America.

Public acceptance remains a critical factor for wind energy projects, with local communities often voicing concerns about visual impact and noise, despite the overall positive environmental perception. Siemens Gamesa actively engages with communities to build trust and mitigate opposition, a strategy underscored by the fact that in 2024, several European wind projects experienced delays due to local pushback, emphasizing the need for robust community buy-in.

The industry is also grappling with a significant shortage of skilled labor, a challenge Siemens Gamesa is addressing through internal reallocation. While the company saw some role restructuring in 2023, its focus is on bolstering its offshore wind business by shifting employees to areas requiring specialized skills, such as advanced manufacturing and installation, to meet the projected growth where the Global Wind Energy Council anticipated over 3 million jobs by 2030.

Siemens Gamesa's commitment to Corporate Social Responsibility is evident in its alignment with UN Sustainable Development Goals, particularly those concerning clean energy and climate action. The company invested €25.9 million in social initiatives and community engagement in 2023, demonstrating a tangible dedication to the regions where it operates and ensuring ethical practices throughout its value chain.

| Sociological Factor | Siemens Gamesa's Approach | 2023/2024 Data Point |

| Community Acceptance | Proactive engagement and dialogue | European projects faced delays due to local opposition in 2024 |

| Skilled Workforce | Internal reallocation and skills development | Focus on bolstering offshore wind business with specialized roles |

| Corporate Social Responsibility | Alignment with UN SDGs and community investment | €25.9 million invested in social initiatives and community engagement |

Technological factors

Siemens Gamesa is pushing the boundaries of wind turbine efficiency, notably with the testing of a 21.5MW offshore prototype in Denmark. This initiative aims to significantly boost energy generation capacity.

The company's commitment to direct drive technology is evident in the ongoing serial production of its SG 14-222 and SG 14-236 DD offshore models. These turbines are designed to optimize performance and lower the overall cost of wind energy.

The growing integration of renewable energy sources like wind power demands sophisticated grid integration and smart grid solutions to maintain grid stability and reliability. Siemens Gamesa, as a key player, is actively involved in developing technologies that facilitate this transition. For instance, the company's efforts in offshore wind, a significant growth area, directly contribute to the need for robust grid infrastructure.

Grid bottlenecks remain a significant hurdle, but ongoing advancements in grid connection technologies are crucial for accommodating the increasing capacity of wind power. Siemens Energy, the parent company, is investing heavily in grid modernization, aiming to strengthen electrical grids as a core component of its energy transition strategy, which directly benefits Siemens Gamesa's market expansion.

Siemens Gamesa is leveraging digitalization, artificial intelligence (AI), and machine learning (ML) to revolutionize its wind turbine operations and maintenance (O&M). These advanced technologies are key to optimizing performance and minimizing costs.

By applying AI and ML to O&M, Siemens Gamesa can enhance predictive maintenance, anticipate potential failures before they occur, and significantly improve turbine uptime. This proactive approach leads to higher energy yields and a reduction in overall operational expenses.

The company's strategy focuses on delivering best-in-class repair services, aiming to lower both turbine maintenance costs and associated CO2 equivalent emissions. This integrated approach to portfolio and strategy management underscores their commitment to efficiency and sustainability.

Development of Recyclable Materials and Circular Economy

Siemens Gamesa is actively pioneering the use of recyclable materials in wind turbine technology, exemplified by its RecyclableBlade, now available for both offshore and onshore installations. This innovation directly supports the growing global demand for sustainable energy solutions and aligns with the principles of a circular economy.

The company has set a clear objective to achieve 100% recyclable turbines by 2040, underscoring its dedication to minimizing environmental impact across the entire product lifecycle. This ambitious goal positions Siemens Gamesa at the forefront of the industry’s transition towards more sustainable manufacturing and waste reduction practices.

Technological advancements in material science are crucial for Siemens Gamesa's circular economy strategy. Key developments include:

- Development of advanced composite materials that are easier to separate and recycle at the end of a turbine's life.

- Investment in research and development focused on creating biodegradable or reusable components for wind turbine blades and nacelles.

- Collaboration with industry partners and research institutions to establish robust recycling infrastructure and processes for wind turbine components.

Green Hydrogen Production Integration

Siemens Gamesa, in partnership with Siemens Energy, is making substantial investments in a groundbreaking approach: integrating electrolyzers directly into offshore wind turbines. This initiative is a key technological factor, aiming to directly produce green hydrogen at the source of wind power generation.

This integration is designed to tackle the decarbonization challenge in sectors that are difficult to abate, such as heavy industry and transportation. By producing hydrogen offshore, the energy generated by wind turbines can be converted into a storable and transportable fuel, effectively unlocking new markets for renewable energy and offering a solution for energy storage and grid flexibility.

The strategic importance of this technology is underscored by the growing global demand for green hydrogen. For instance, the European Union's Hydrogen Strategy, updated in 2023, targets 40 GW of electrolyzer capacity by 2030, with a significant portion expected to be powered by renewable energy. Siemens Gamesa's direct integration strategy positions them to capitalize on this burgeoning market.

- Direct Integration: Electrolyzers are being co-located with offshore wind turbines, a novel approach to hydrogen production.

- Decarbonization Focus: The produced green hydrogen targets hard-to-abate sectors, expanding the utility of wind energy.

- Market Expansion: This technology opens new revenue streams by enabling hydrogen as a fuel and energy carrier.

- Energy Storage Solution: Green hydrogen offers a method to store intermittent wind power for later use or transport.

Siemens Gamesa is pushing technological boundaries with its 21.5MW offshore prototype, aiming to significantly increase energy generation. Their direct drive technology, seen in the SG 14-222 and SG 14-236 DD models, is designed to boost performance and reduce wind energy costs.

The company is also at the forefront of integrating digitalization, AI, and machine learning into turbine operations for optimized performance and predictive maintenance, enhancing turbine uptime and reducing operational expenses. Furthermore, Siemens Gamesa is pioneering the use of recyclable materials, with its RecyclableBlade technology, aiming for 100% recyclable turbines by 2040.

A key technological advancement is the direct integration of electrolyzers with offshore wind turbines to produce green hydrogen, a strategy supported by the EU's target of 40 GW electrolyzer capacity by 2030. This initiative addresses decarbonization in hard-to-abate sectors and provides a solution for energy storage and grid flexibility.

| Technology Area | Key Development | Impact | Target/Goal |

|---|---|---|---|

| Turbine Technology | 21.5MW Offshore Prototype | Increased energy generation capacity | Testing phase |

| Drive Technology | SG 14-222 & SG 14-236 DD | Optimized performance, lower cost of energy | Serial production |

| Digitalization & AI | AI/ML for O&M | Enhanced predictive maintenance, improved uptime | Reduced operational expenses |

| Sustainability | RecyclableBlade | Reduced environmental impact, circular economy | 100% recyclable turbines by 2040 |

| Hydrogen Production | Offshore Electrolyzer Integration | Green hydrogen production, energy storage | Support EU 2030 targets |

Legal factors

Siemens Gamesa navigates a complex web of environmental laws covering everything from emissions and waste disposal to how efficiently it uses resources across its manufacturing and the entire lifespan of its wind turbines. This includes adhering to international standards and country-specific mandates.

The company demonstrates its commitment by publishing annual Greenhouse Gas Emissions reports, which are independently verified against ISO 14064-1:2018, and has publicly committed to achieving net-zero emissions by 2040. This proactive approach is crucial for maintaining its social license to operate and ensuring continued access to global markets.

Siemens Gamesa Renewable Energy faces significant hurdles with permitting and licensing laws, which are intricate and differ greatly by location. These varying regulations, encompassing land use and environmental impact studies, frequently cause project development delays. For instance, in 2024, the average wind energy project in the US experienced delays of 18-24 months due to permitting complexities.

Siemens Gamesa Renewable Energy operates under stringent health and safety regulations, a critical aspect given the complex nature of manufacturing, installing, and maintaining wind turbines. These rules are designed to mitigate the significant risks inherent in the industry, ensuring the well-being of workers involved in every stage of the process.

The company places a high priority on its role as a socially responsible employer, actively fostering a safe work environment. A key metric for this commitment is the Total Recordable Injury Rate (TRIR), and Siemens Gamesa consistently aims to keep this figure exceptionally low, reflecting their dedication to operational integrity and employee welfare.

For instance, in its 2023 sustainability report, Siemens Gamesa highlighted a TRIR of 0.64 per 200,000 working hours, a testament to their robust safety protocols. Adherence to these rigorous standards is not merely a compliance issue; it is fundamental to protecting their workforce and maintaining the seamless operation of their global projects.

Intellectual Property Rights and Patents

In the fast-paced wind energy sector, safeguarding intellectual property rights (IPR) is crucial. Siemens Gamesa heavily relies on patents for its innovative turbine designs, advanced components, and efficient manufacturing methods. This legal shield is vital for maintaining their competitive advantage and deterring unauthorized use of their technology. In 2023, Siemens Gamesa reported significant investment in research and development, with a substantial portion allocated to securing and defending its patent portfolio, aiming to protect its market position and encourage continued innovation.

The legal framework surrounding patents directly impacts Siemens Gamesa's ability to innovate and commercialize new technologies. By securing patents, the company can prevent competitors from replicating its proprietary advancements, ensuring a return on its substantial R&D expenditures. This legal protection is a cornerstone of their strategy to lead in the evolving renewable energy landscape.

Siemens Gamesa's patent strategy is designed to:

- Protect proprietary turbine designs and technologies.

- Prevent competitors from infringing on their innovations.

- Safeguard market share and profitability.

- Stimulate further investment in research and development.

International Trade Laws and Tariffs

Siemens Gamesa Renewable Energy navigates a complex web of international trade laws and tariffs due to its global operations. These regulations, including import and export restrictions, directly influence the cost of components and the feasibility of market entry. For instance, tariffs imposed by countries like the United States on materials or finished goods can significantly affect Siemens Gamesa's profitability and necessitate adjustments to its global supply chain strategy. The company's robust compliance framework is crucial for ensuring adherence to export controls and customs regulations, particularly concerning dual-use goods, which are vital for maintaining operational integrity and avoiding penalties.

The evolving trade landscape presents both opportunities and challenges. For example, in 2023, the European Union continued to explore measures to counter unfair trade practices and protect its burgeoning renewable energy sector, which could impact companies like Siemens Gamesa. Conversely, trade agreements that reduce tariffs and streamline customs procedures can bolster the company's competitive position. Siemens Gamesa's ability to adapt its sourcing and manufacturing strategies in response to these dynamic trade policies is paramount to its sustained success in the global renewable energy market.

Key considerations for Siemens Gamesa regarding international trade laws and tariffs include:

- Tariff Impact: Fluctuations in tariffs, such as potential US tariffs on wind turbine components, can increase production costs and affect pricing strategies, potentially impacting market share.

- Supply Chain Resilience: The company must maintain agile supply chains capable of adapting to trade disputes and regulatory changes to ensure timely delivery of projects.

- Compliance Burden: Adhering to diverse international trade regulations, including export controls on sensitive technologies, requires significant investment in compliance infrastructure and expertise.

- Trade Agreements: Leveraging favorable trade agreements can reduce costs and open new markets, but requires careful monitoring of evolving trade policies.

Siemens Gamesa Renewable Energy is subject to a range of legal factors impacting its operations, from environmental compliance and worker safety to intellectual property protection and international trade regulations. Navigating these legal landscapes is critical for maintaining operational integrity, fostering innovation, and ensuring global market access.

The company's commitment to safety is underscored by its Total Recordable Injury Rate (TRIR), which stood at 0.64 per 200,000 working hours in 2023, reflecting robust safety protocols. Furthermore, Siemens Gamesa's investment in research and development in 2023 was substantial, with a significant portion dedicated to securing its extensive patent portfolio, which is vital for protecting its technological advancements and competitive edge in the rapidly evolving renewable energy sector.

International trade laws and tariffs present ongoing challenges; for example, in 2023, the EU continued to explore measures to protect its renewable energy sector, potentially affecting global supply chains and market entry strategies for companies like Siemens Gamesa.

Environmental factors

Siemens Gamesa is a leader in climate action, aiming for net-zero CO2 emissions by 2040 across its entire operations. This commitment is underscored by its achievement of carbon neutrality in 2019 and its use of 100% renewable energy, validated by the Science Based Targets initiative (SBTi).

The company's core business directly supports global decarbonization efforts, as its wind turbines and offshore wind solutions are key enablers of clean energy generation. In 2023, Siemens Gamesa's installed capacity prevented approximately 15 million tonnes of CO2 emissions, showcasing its tangible impact on reducing greenhouse gases.

Siemens Gamesa is deeply committed to resource efficiency, actively working to minimize waste, energy, and water usage across its operations. This includes a strategic focus on substituting materials, particularly chemicals, with more sustainable alternatives.

The company is a pioneer in the wind energy sector, driving the development of fully recyclable wind turbines. Their ambitious goal is to achieve 100% recyclability by 2040, a significant leap forward from current industry standards. The RecyclableBlade is already a commercially available testament to this commitment, demonstrating that wind power can be clean not only in operation but also at the end of its lifecycle.

Siemens Gamesa acknowledges that while wind power is a crucial tool for decarbonization, wind farm development can pose localized threats to biodiversity. Concerns include potential impacts on bird and bat populations, as well as marine ecosystems for offshore installations. For instance, studies published in 2024 continue to examine the specific mortality rates of avian species at various wind farm sites globally, with mitigation strategies like turbine shutdown during peak migration periods being a key focus.

To address these environmental considerations, Siemens Gamesa integrates comprehensive environmental impact assessments into its project planning and execution phases. The company actively pursues responsible siting practices and employs technological solutions designed to minimize harm to local wildlife. Their commitment extends to a life cycle perspective, aiming to improve the environmental footprint of their products from manufacturing through decommissioning, aligning with growing regulatory pressures and stakeholder expectations for sustainable energy infrastructure in 2024 and beyond.

Waste Management and End-of-Life Solutions

The growing concern over the end-of-life management of wind turbine components, particularly blades, presents a significant environmental challenge for Siemens Gamesa Renewable Energy. By 2025, it's estimated that tens of thousands of tons of composite wind turbine blades will reach their end-of-life annually in Europe alone, a figure projected to rise sharply in the coming years.

Siemens Gamesa is proactively tackling this issue by developing innovative solutions for blade recycling and enhancing the recyclability of its products. Their goal is to achieve a 100% reuse, recycling, or recovery rate for all waste generated from their operations. This commitment is vital for ensuring the long-term environmental viability and public acceptance of wind energy.

- Blade Recycling Initiatives: Siemens Gamesa has partnered with various companies to establish dedicated blade recycling facilities, aiming to process composite materials effectively.

- Material Innovation: The company is investing in research and development to create more easily recyclable blade materials, reducing reliance on non-recyclable composites.

- Circular Economy Focus: Siemens Gamesa is integrating circular economy principles into its business model, viewing end-of-life components not as waste but as potential resources for new products.

- Industry Collaboration: Working with industry associations and other manufacturers, Siemens Gamesa aims to set new standards for waste management and recyclability across the entire wind energy sector.

Noise and Visual Impact

Wind farms, especially those on land, can encounter local resistance stemming from concerns about noise pollution and the visual alteration of landscapes and communities. Siemens Gamesa actively works on design and site selection to reduce these effects, striving to balance the imperative for energy generation with local environmental and social considerations.

While specific recent data on Siemens Gamesa's noise and visual impact mitigation efforts isn't readily available, the industry consistently addresses these challenges. For instance, advancements in turbine blade design and operational adjustments, such as curtailment during specific wind conditions, are common strategies employed by manufacturers like Siemens Gamesa to lessen audible noise.

The visual impact, a subjective but significant factor, is often managed through careful placement away from sensitive viewpoints and the use of muted color schemes for turbines.

- Noise Reduction: Turbine designs often incorporate features to minimize aerodynamic noise, a crucial aspect for community acceptance.

- Visual Aesthetics: Siting and design choices aim to integrate wind farms more harmoniously into the surrounding environment.

- Community Engagement: Addressing local concerns proactively is a key part of project development for renewable energy companies.

Siemens Gamesa is actively addressing the environmental challenge of wind turbine blade end-of-life management, with tens of thousands of tons of blades expected to reach disposal annually in Europe by 2025. The company is investing in blade recycling facilities and material innovation to achieve a 100% reuse, recycling, or recovery rate for its operational waste.

These initiatives are crucial for the long-term sustainability and public acceptance of wind energy. For example, their RecyclableBlade technology, commercially available, demonstrates a commitment to cleaner lifecycles. The company also integrates environmental impact assessments, responsible siting, and technological solutions to minimize harm to wildlife, acknowledging potential localized threats to biodiversity in their project planning.

Siemens Gamesa's commitment to environmental stewardship extends to resource efficiency, aiming to minimize waste, energy, and water usage. They are also focused on replacing materials, particularly chemicals, with more sustainable alternatives, reflecting a broader industry trend towards greener practices in renewable energy generation.

PESTLE Analysis Data Sources

Our Siemens Gamesa Renewable Energy PESTLE analysis is grounded in comprehensive data from international energy agencies, governmental policy databases, and leading market research firms. We synthesize information on regulatory landscapes, economic forecasts, technological advancements, and socio-environmental trends to provide a holistic view.