Siemens Gamesa Renewable Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Siemens Gamesa Renewable Energy Bundle

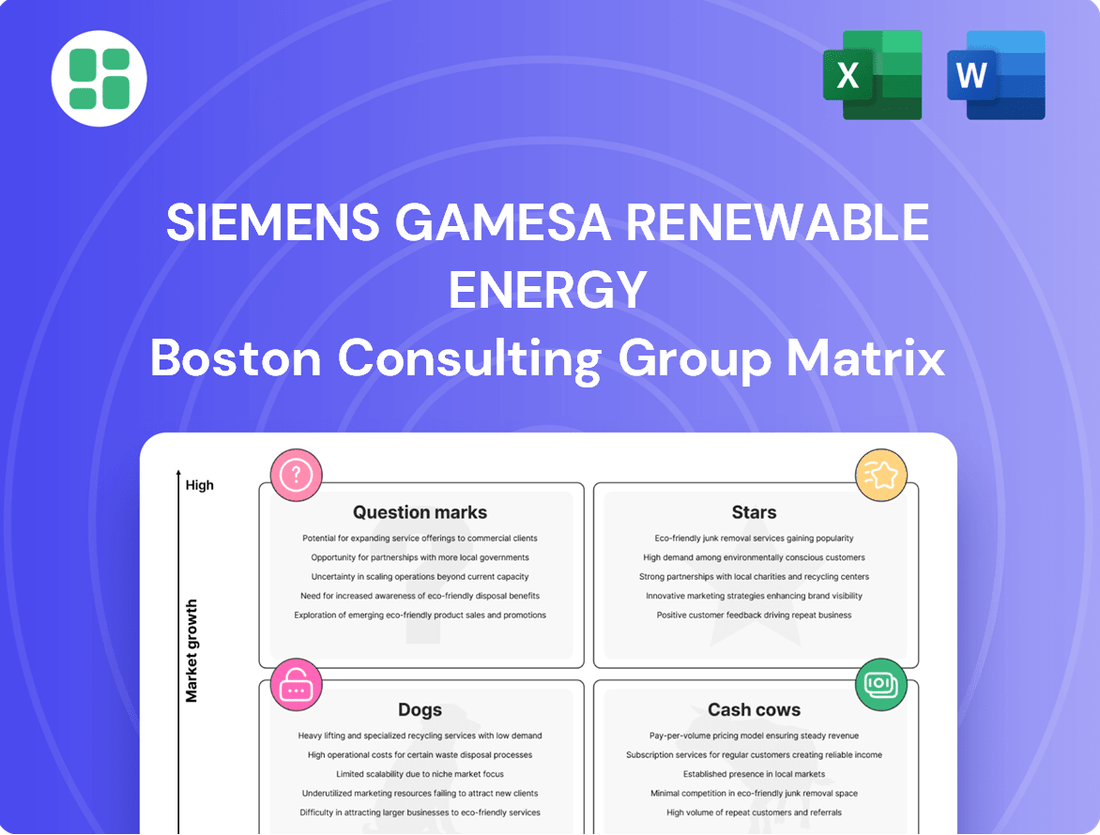

Curious about Siemens Gamesa Renewable Energy's strategic positioning? Our BCG Matrix analysis reveals which of their innovative wind turbine technologies are market leaders (Stars), consistent revenue generators (Cash Cows), underperforming assets (Dogs), or potential growth opportunities (Question Marks).

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of their product portfolio's market share and growth rate, enabling you to make informed investment and resource allocation decisions for a competitive edge.

Don't miss out on critical strategic insights; invest in the full BCG Matrix today for a clear roadmap to optimizing Siemens Gamesa's renewable energy future.

Stars

The SG 14-236 DD offshore wind turbine from Siemens Gamesa is a star performer in the booming offshore wind sector. With a capacity reaching up to 15 MW, this turbine is engineered for maximum energy generation, making it ideal for massive offshore projects. The global offshore wind market is expanding rapidly, with projections indicating it could reach USD 114.33 billion by 2032, highlighting the significant potential for this technology.

This turbine's cutting-edge design and impressive power output solidify its position as a market leader. It has already secured substantial orders, such as the commitment for 63 turbines for the Gennaker offshore wind farm in Germany. This demonstrates strong market confidence and the turbine's critical role in advancing large-scale renewable energy infrastructure.

Siemens Gamesa is a leader in offshore wind project development and installation, a segment that is experiencing significant expansion. In 2024, the company installed 294 turbines globally, excluding China, underscoring its strong market presence.

The offshore wind sector is projected to grow at a compound annual growth rate of 15.8% between 2025 and 2032. To capitalize on this, Siemens Gamesa is increasing production at its Cuxhaven, Aalborg, and Le Havre facilities.

This strategic focus is driven by robust government backing and ambitious renewable energy goals worldwide, positioning offshore wind as a high-growth, high-share area for Siemens Gamesa.

Long-term service agreements for offshore wind farms are a bedrock of Siemens Gamesa's business, providing a steady income that shores up their turbine sales. This segment is critical as the installed base of massive offshore turbines continues to expand, driving consistent demand for their specialized maintenance and service expertise.

The growth in offshore wind capacity directly fuels the need for these service contracts, allowing Siemens Gamesa to maintain a strong market position in this vital and growing sector. For example, in 2023, Siemens Gamesa reported its service business revenue grew by 12% year-over-year, reaching €1.8 billion, highlighting the increasing importance of these agreements.

These agreements are essential for ensuring that offshore wind farms operate at peak efficiency, directly impacting client profitability and solidifying Siemens Gamesa's reputation as a market leader. The company's focus on maximizing turbine uptime through these contracts is a key differentiator in the competitive offshore wind market.

RecyclableBlade Technology

Siemens Gamesa's RecyclableBlade technology represents a significant advancement, being the first commercially viable recyclable wind turbine blade for both onshore and offshore use. This addresses a key environmental challenge within the wind sector, marking Siemens Gamesa as a frontrunner in sustainable innovation.

The RecyclableBlade, while still in its early market stages, benefits from a distinct advantage in a market increasingly prioritizing circular economy principles. This positions it for substantial growth and a powerful competitive standing.

- Market Entry: Launched commercially in 2021, with initial installations beginning in 2022.

- Environmental Impact: Aims to reduce landfill waste by enabling the recovery of 99% of materials from decommissioned blades.

- Growth Potential: Forecasted to capture a significant share of the growing demand for sustainable wind energy solutions.

- Competitive Edge: Differentiates Siemens Gamesa in a market where environmental, social, and governance (ESG) factors are increasingly influential in purchasing decisions.

Next-Generation Offshore Turbine Prototypes (e.g., 21.5 MW)

Siemens Gamesa is actively developing and testing next-generation offshore wind turbine prototypes, exemplified by their 21.5 MW model installed in April 2025. This significant investment in cutting-edge research and development underscores their strategy to maintain market leadership in the rapidly expanding offshore wind sector. The company is participating in an industry-wide drive for larger, more efficient turbines, aiming to secure a substantial market share as these advanced models transition to commercial production.

The pursuit of ultra-large capacity turbines like the 21.5 MW prototype is crucial for Siemens Gamesa's competitive positioning. This technological advancement is designed to enhance energy capture and reduce the levelized cost of energy (LCOE), making offshore wind more competitive. By staying at the forefront of turbine innovation, Siemens Gamesa is preparing for future market demands and solidifying its role in the global energy transition.

- Technological Advancement: Installation of 21.5 MW prototype in April 2025 showcases commitment to pushing offshore wind turbine capacity limits.

- Market Leadership Strategy: Cutting-edge R&D in ultra-large turbines is key to securing future market share in a high-growth sector.

- Competitive Positioning: Investment in advanced models supports Siemens Gamesa's participation in the industry's 'arms race' for greater efficiency and capacity.

- Economic Impact: Larger turbines are expected to drive down LCOE, making offshore wind a more economically viable energy source.

Siemens Gamesa's SG 14-236 DD offshore wind turbine is a clear star in the rapidly expanding offshore wind market. Its impressive 15 MW capacity positions it as a leader for large-scale projects, with global offshore wind market value projected to reach USD 114.33 billion by 2032. The company's installation of 294 turbines globally (excluding China) in 2024 highlights its strong market presence and the success of its star products.

The company's investment in next-generation turbines, like the 21.5 MW prototype installed in April 2025, further solidifies its star status. This commitment to technological advancement is crucial for maintaining market leadership and driving down the levelized cost of energy (LCOE) in offshore wind.

| Product | Capacity | Market Position | Key Differentiator |

|---|---|---|---|

| SG 14-236 DD | Up to 15 MW | Star Performer | High energy generation for large projects |

| 21.5 MW Prototype | 21.5 MW | Emerging Star | Pushing capacity limits, R&D focus |

| RecyclableBlade | N/A | Potential Star | Environmental sustainability, circular economy |

What is included in the product

Siemens Gamesa's BCG Matrix identifies growth opportunities and areas for divestment within its renewable energy portfolio.

The Siemens Gamesa Renewable Energy BCG Matrix provides a one-page overview, clarifying which business units are stars, cash cows, question marks, or dogs, thus relieving the pain of strategic uncertainty.

Cash Cows

Siemens Gamesa's established onshore turbine models, exemplified by the SG 5.0-145, form a bedrock of its installed capacity, especially in mature markets like Europe and the United States. These workhorse turbines, despite operating in a segment with a projected compound annual growth rate of 5.6% to 5.9% for the onshore wind market, have secured a competitive edge. Their longevity and reliability translate into predictable, robust cash flows derived from both initial sales and ongoing service agreements.

Siemens Gamesa's Global Aftermarket Services and Spares segment is a prime example of a cash cow. This division offers a full spectrum of services, from providing essential spare parts to conducting complex repairs and advanced diagnostics for its extensive installed base of wind turbines globally. The long operational lifespan of these turbines, often spanning decades, coupled with the critical need for ongoing maintenance, ensures a consistent and predictable revenue stream.

This segment is characterized by its high-margin nature. The specialized knowledge and global infrastructure required to support these sophisticated machines create a significant barrier to entry for competitors. Siemens Gamesa effectively leverages its established market presence and deep operational expertise to generate reliable cash flow, essentially capitalizing on its substantial customer base and the ongoing demand for turbine upkeep.

In 2023, Siemens Gamesa reported a significant contribution from its Service division, which includes aftermarket services and spares. While exact figures for the "cash cow" segment are consolidated, the overall Service business unit demonstrated resilience, contributing positively to the company's financial performance amidst broader industry challenges. The company's commitment to expanding its service offerings and digital solutions further solidifies this segment's role as a stable cash generator.

Siemens Gamesa's expertise in project development and construction for mature markets, especially onshore wind, acts as a significant cash cow. This segment generates steady, reliable cash flow due to established market presence and repeat business, often with long-term clients. For instance, in 2023, Siemens Gamesa reported a strong order intake in its onshore division, contributing significantly to its revenue stability.

Existing Onshore Wind Farm Service Contracts

Existing onshore wind farm service contracts represent a significant cash cow for Siemens Gamesa. These long-term agreements provide a stable and predictable revenue stream, as they involve recurring maintenance and support for an established fleet of operational wind turbines. The consistent income generated from these contracts requires minimal additional investment, allowing them to contribute substantially to the company's overall cash flow.

- Stable Revenue: Long-term service agreements for existing onshore wind turbines offer a reliable and predictable income source.

- Recurring Nature: Maintenance and support services are performed regularly, ensuring consistent cash inflow.

- Low Investment Needs: These contracts generally require limited new capital expenditure compared to growth-oriented ventures.

- Global Fleet Contribution: The widespread installation base of onshore turbines globally amplifies the collective cash flow contribution from these service agreements.

Proven Onshore Turbine Technologies (e.g., SG 7.0-170)

The SG 7.0-170 turbine, a new generation model for medium wind speeds, is designed for established onshore markets where consistent performance and reliability are paramount. Its application in a mature market segment, coupled with proven geared + DFIG technology, suggests it can rapidly become a cash cow for Siemens Gamesa. This turbine is key to maintaining market share in areas prioritizing efficiency and robust design.

Siemens Gamesa's SG 7.0-170 is positioned to capitalize on the continued demand for dependable wind energy solutions in developed onshore markets. In 2024, the onshore wind sector experienced significant growth, with new installations reaching record levels in many regions. For instance, Europe saw substantial additions to its onshore wind capacity, driven by supportive policies and the urgent need for energy independence.

- Market Maturity: The SG 7.0-170 targets established onshore markets with proven demand for reliable wind power.

- Technological Foundation: It leverages proven geared and Doubly Fed Induction Generator (DFIG) technology, ensuring a high degree of reliability and performance.

- Cash Cow Potential: Its suitability for mature markets and dependable technology position it to generate consistent revenue and become a significant cash cow.

- Competitive Advantage: The turbine's focus on efficiency and robust design offers a strong competitive edge against more experimental technologies in these segments.

Siemens Gamesa's established onshore wind turbine models, such as the SG 5.0-145 and the newer SG 7.0-170, are key cash cows. These turbines are deployed in mature markets like Europe and the US, where demand for reliable, efficient wind energy is consistent. Their proven technology and long operational lifespans generate predictable revenue through sales and ongoing service agreements.

The Global Aftermarket Services and Spares division is another significant cash cow. This segment benefits from the large installed base of Siemens Gamesa turbines worldwide. The critical need for maintenance, repairs, and spare parts ensures a steady, high-margin revenue stream with minimal new investment required.

In 2023, Siemens Gamesa's Service business unit demonstrated resilience, contributing positively to the company's financial performance. This highlights the stable cash-generating capability of its aftermarket services, which are essential for maintaining the operational efficiency of its extensive turbine fleet.

Existing onshore wind farm service contracts are a prime example of a cash cow, providing stable, recurring revenue with low investment needs. The company's global fleet amplifies the collective cash flow from these long-term agreements, solidifying their role as reliable income generators.

| Segment | Description | Key Characteristics | 2023 Relevance |

|---|---|---|---|

| Onshore Turbine Models (e.g., SG 5.0-145, SG 7.0-170) | Workhorse turbines in mature markets | Proven reliability, predictable sales, and service revenue | Strong contribution to revenue stability in mature markets |

| Global Aftermarket Services and Spares | Maintenance, repairs, and spare parts for installed base | High-margin, recurring revenue, low investment needs | Resilient performance contributing positively to financials |

| Existing Onshore Wind Farm Service Contracts | Long-term maintenance agreements | Stable, predictable income, minimal new capital expenditure | Consistent cash inflow from established fleet |

Delivered as Shown

Siemens Gamesa Renewable Energy BCG Matrix

The Siemens Gamesa Renewable Energy BCG Matrix you are previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, showcasing Siemens Gamesa's product portfolio within the BCG framework, is ready for immediate strategic application without any watermarks or demo content. You can confidently use this preview as a direct representation of the valuable, actionable insights you'll gain, enabling informed decision-making for your renewable energy ventures.

Dogs

Certain older, less efficient onshore turbine models from Siemens Gamesa, especially those no longer in the company's strategic spotlight or incurring higher maintenance expenses, would likely be categorized as Dogs in the BCG Matrix. These legacy products often face declining market share within the increasingly competitive and mature onshore wind sector.

The continued investment in these older turbine designs yields minimal financial returns for Siemens Gamesa. Furthermore, it ties up valuable capital that could be more effectively allocated to newer, more efficient technologies or research and development, hindering overall growth and profitability.

Siemens Gamesa's 4.X and 5.X onshore turbine platforms are currently struggling, facing significant quality issues. These problems, particularly with rotor blades and main bearings, have resulted in high repair expenses and a pause in sales for these models. For instance, the company incurred substantial costs in 2023 and early 2024 addressing these reliability concerns, impacting project timelines and customer confidence.

These underperforming platforms hold a low market share within their segments, largely due to these persistent reliability problems. They are considered cash traps, demanding considerable investment for necessary upgrades and fixes. Without a clear path to profitability in the near term, these models represent a drain on resources, hindering the company's ability to focus on more promising growth areas.

Siemens Gamesa's strategic pivot away from onshore wind projects in markets with unstable regulatory environments signifies a clear move towards de-risking its operations. This focus on regions like Europe and the USA, which offer more predictable policy landscapes, is a logical step to safeguard profitability and investment. For instance, in 2024, the company's European onshore business has shown resilience, supported by robust renewable energy targets and stable auction mechanisms.

Markets characterized by regulatory uncertainty and low growth potential for Siemens Gamesa's onshore wind segment are now being evaluated for divestiture. These are essentially the 'Dogs' in the BCG matrix, representing areas where the company's investment is unlikely to yield significant returns due to external factors. The company's market share in many such emerging markets remained below 5% in the first half of 2024, underscoring the rationale for this strategic realignment.

Sub-scale or Non-strategic Regional Onshore Operations

Siemens Gamesa Renewable Energy's sub-scale or non-strategic regional onshore operations would likely be categorized as Dogs in a BCG Matrix analysis. These are operations in specific regional onshore markets where the company hasn't built substantial scale or faces intense competition, leading to low market share and minimal contributions to overall growth or profitability. For instance, in 2023, Siemens Gamesa reported a significant operating loss, partly due to challenges in its onshore wind business, which would encompass these less dominant regional segments.

The company's strategic reviews and restructuring efforts, which have been ongoing, often target these underperforming areas. This could involve consolidating resources, seeking partnerships, or even divesting from these non-strategic regional presences to focus on more promising markets. Such a move aligns with the typical strategy for managing Dog business units, aiming to free up capital and management attention for higher-potential ventures.

- Low Market Share: Operations in regions where Siemens Gamesa holds a minor position, struggling against established local or global competitors.

- Minimal Profitability: These segments often operate with thin or negative margins, failing to generate substantial returns.

- Strategic Divestment Potential: Siemens Gamesa may consider exiting or reducing its footprint in these non-core markets as part of its broader efficiency drives.

Discontinued Product Lines or Components

Discontinued product lines or components at Siemens Gamesa Renewable Energy (SGRE) are firmly placed in the Dogs quadrant of the BCG Matrix. These are offerings that have either become technologically outdated, experienced a significant drop in customer demand, or were phased out as part of a strategic shift by the company. For instance, older wind turbine models that are no longer competitive or parts no longer manufactured due to supply chain issues would fit here.

These discontinued items typically represent minimal market share and offer no discernible future growth potential. While they may still necessitate some level of ongoing support or maintenance, the resources allocated are generally kept to a minimum. SGRE's forward-looking strategy, such as their goal for 100% recyclable turbines by 2040, further reinforces the classification of older, less sustainable components as Dogs, as they will eventually need to be managed for end-of-life disposal.

- Technological Obsolescence: Older turbine models, like some variants of the G114, may be discontinued as newer, more efficient technologies emerge.

- Low Demand: Specific components or older turbine generations that are no longer specified in new projects due to market preference for newer models.

- Strategic Refocusing: As SGRE streamlines its portfolio to concentrate on advanced, sustainable solutions, certain legacy product lines are naturally phased out.

- End-of-Life Management: The company's commitment to sustainability necessitates phasing out older components that do not meet current recyclability standards.

Certain older, less efficient onshore turbine models from Siemens Gamesa, especially those no longer in the company's strategic spotlight or incurring higher maintenance expenses, would likely be categorized as Dogs in the BCG Matrix. These legacy products often face declining market share within the increasingly competitive and mature onshore wind sector.

The continued investment in these older turbine designs yields minimal financial returns for Siemens Gamesa. Furthermore, it ties up valuable capital that could be more effectively allocated to newer, more efficient technologies or research and development, hindering overall growth and profitability.

Siemens Gamesa's 4.X and 5.X onshore turbine platforms are currently struggling, facing significant quality issues. These problems, particularly with rotor blades and main bearings, have resulted in high repair expenses and a pause in sales for these models. For instance, the company incurred substantial costs in 2023 and early 2024 addressing these reliability concerns, impacting project timelines and customer confidence.

These underperforming platforms hold a low market share within their segments, largely due to these persistent reliability problems. They are considered cash traps, demanding considerable investment for necessary upgrades and fixes. Without a clear path to profitability in the near term, these models represent a drain on resources, hindering the company's ability to focus on more promising growth areas.

Siemens Gamesa's strategic pivot away from onshore wind projects in markets with unstable regulatory environments signifies a clear move towards de-risking its operations. This focus on regions like Europe and the USA, which offer more predictable policy landscapes, is a logical step to safeguard profitability and investment. For instance, in 2024, the company's European onshore business has shown resilience, supported by robust renewable energy targets and stable auction mechanisms.

Markets characterized by regulatory uncertainty and low growth potential for Siemens Gamesa's onshore wind segment are now being evaluated for divestiture. These are essentially the 'Dogs' in the BCG matrix, representing areas where the company's investment is unlikely to yield significant returns due to external factors. The company's market share in many such emerging markets remained below 5% in the first half of 2024, underscoring the rationale for this strategic realignment.

Siemens Gamesa Renewable Energy's sub-scale or non-strategic regional onshore operations would likely be categorized as Dogs in a BCG Matrix analysis. These are operations in specific regional onshore markets where the company hasn't built substantial scale or faces intense competition, leading to low market share and minimal contributions to overall growth or profitability. For instance, in 2023, Siemens Gamesa reported a significant operating loss, partly due to challenges in its onshore wind business, which would encompass these less dominant regional segments.

The company's strategic reviews and restructuring efforts, which have been ongoing, often target these underperforming areas. This could involve consolidating resources, seeking partnerships, or even divesting from these non-strategic regional presences to focus on more promising markets. Such a move aligns with the typical strategy for managing Dog business units, aiming to free up capital and management attention for higher-potential ventures.

Discontinued product lines or components at Siemens Gamesa Renewable Energy (SGRE) are firmly placed in the Dogs quadrant of the BCG Matrix. These are offerings that have either become technologically outdated, experienced a significant drop in customer demand, or were phased out as part of a strategic shift by the company. For instance, older wind turbine models that are no longer competitive or parts no longer manufactured due to supply chain issues would fit here.

These discontinued items typically represent minimal market share and offer no discernible future growth potential. While they may still necessitate some level of ongoing support or maintenance, the resources allocated are generally kept to a minimum. SGRE's forward-looking strategy, such as their goal for 100% recyclable turbines by 2040, further reinforces the classification of older, less sustainable components as Dogs, as they will eventually need to be managed for end-of-life disposal.

| Category | Characteristics | Example within SGRE | Strategic Implication |

| Dogs | Low Market Share, Low Growth Potential, Low Profitability | Older, less efficient onshore turbine models; sub-scale regional onshore operations; discontinued product lines/components. | Divestment, consolidation, or minimal resource allocation to free up capital for Stars and Cash Cows. |

Question Marks

Floating offshore wind technology represents a significant growth frontier, opening up deep-water locations previously inaccessible to wind farms. This innovative segment is still in its early development phase, demanding substantial capital for research, development, and early-stage project deployment.

While Siemens Gamesa is a key player in the broader offshore wind market, its position within the specialized floating wind sub-segment is likely still being established. The company's market share here is expected to be lower compared to its established presence in fixed-bottom offshore wind installations, reflecting the technology's immaturity.

Achieving a leadership position in this high-potential, high-risk area will necessitate considerable ongoing investment. For instance, the global floating offshore wind market is projected to reach over $50 billion by 2030, indicating the scale of opportunity and the investment required to capture it.

Siemens Gamesa's expansion into emerging offshore wind markets, such as those developing in parts of Southeast Asia or South America, would likely be classified as a Question Mark. These regions are characterized by significant untapped potential and rapidly growing demand for renewable energy infrastructure.

The challenge lies in the high investment required to establish a foothold, build supply chains, and navigate local regulatory landscapes against potentially entrenched competitors. For instance, while specific data for emerging offshore markets in 2024 is still solidifying, the global offshore wind market is projected to see substantial growth, with some analysts estimating capacity additions in the tens of gigawatts annually in the coming years.

Success in these nascent markets is not guaranteed, demanding strategic partnerships, aggressive market penetration strategies, and a willingness to adapt to unique regional dynamics. The company must carefully assess the return on investment and the long-term viability of its presence in these developing offshore territories.

Siemens Gamesa is heavily investing in digitalizing its wind farm operations, focusing on advanced diagnostics and AI-driven predictive maintenance through digital twin technology. This strategic push aims to enhance turbine reliability and optimize performance.

The market for smart wind farm solutions is experiencing robust growth, with projections indicating continued expansion in the coming years. However, Siemens Gamesa's current market share in these niche software and AI services might still be developing, given the specialized nature of these offerings.

Significant research and development expenditure is crucial for Siemens Gamesa to effectively differentiate its advanced digitalization and AI solutions. This investment is key to capturing a larger share of the burgeoning smart wind farm market and establishing a competitive edge.

Hydrogen-integrated Wind Solutions

Hydrogen-integrated wind solutions represent a burgeoning sector within the renewable energy landscape, fueled by the global push for decarbonization. Siemens Gamesa, as a key player within Siemens Energy, is actively participating in this evolution through hybrid power plant concepts that incorporate hydrogen.

While the broader energy transition solutions are a strategic focus, Siemens Gamesa's direct market share in dedicated wind-to-hydrogen applications is currently nascent. This emerging market, projected for significant growth, necessitates substantial strategic investment to establish a strong competitive position.

- Market Growth: The global green hydrogen market is anticipated to reach approximately $50 billion by 2030, with wind power playing a crucial role in its production.

- Siemens Gamesa's Role: The company's involvement in hybrid power plants signifies a commitment to integrated renewable solutions, leveraging its wind turbine expertise.

- Strategic Investment: Capturing a significant share in this nascent market will require focused R&D and strategic partnerships to develop and scale wind-to-hydrogen technologies.

- Competitive Landscape: While direct competition in integrated solutions is still developing, established players in both wind and electrolysis technology are positioning themselves for this future market.

Strategic Partnerships for Niche Technologies

Siemens Gamesa Renewable Energy's strategic partnerships for niche technologies, such as their involvement in the FOD4Wind project exploring drone innovation for offshore wind farm servicing, clearly position these ventures as Question Marks within the BCG matrix.

These are areas of high potential growth and technological advancement, but currently represent a small market share for Siemens Gamesa. The success of these niche technologies hinges on substantial investment and market adoption. For instance, the drone market for industrial applications, including wind turbine inspection and maintenance, is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 20% in the coming years, reaching billions of dollars by the late 2020s.

- FOD4Wind Project: Focuses on developing autonomous drone solutions for inspection and repair in offshore wind farms, aiming to cut operational costs and improve safety.

- High-Growth Potential: The market for specialized drone services in the energy sector is expanding rapidly, driven by the need for efficiency and reduced human intervention in hazardous environments.

- Investment Dependency: These initiatives require significant R&D funding and strategic alliances to mature and achieve commercial viability, reflecting their Question Mark status.

- Low Current Market Share: While promising, Siemens Gamesa's current market penetration in these highly specialized drone applications is minimal, necessitating further development and market acceptance.

Siemens Gamesa's ventures into emerging offshore wind markets, such as those in Southeast Asia or South America, represent Question Marks. These regions offer substantial untapped potential but demand significant upfront investment to establish infrastructure and navigate local complexities.

The company's investment in digitalizing operations, including AI-driven predictive maintenance, also falls into the Question Mark category. While the smart wind farm market is growing rapidly, Siemens Gamesa's market share in these specialized services is still developing, requiring considerable R&D to gain a competitive edge.

Hydrogen-integrated wind solutions, where Siemens Gamesa is exploring hybrid power plants, are another key Question Mark. The green hydrogen market is projected for substantial growth, but Siemens Gamesa's direct market share in wind-to-hydrogen applications is nascent, necessitating focused investment and strategic partnerships to scale.

Niche technology partnerships, like the FOD4Wind project for drone innovation in offshore wind servicing, are also Question Marks. These areas have high growth potential, but currently represent a small market share for Siemens Gamesa, dependent on significant investment and market adoption.

| Area | Market Potential | Current Market Share | Investment Needs | Strategic Focus |

|---|---|---|---|---|

| Emerging Offshore Markets | High (e.g., Asia-Pacific offshore wind market projected to grow significantly) | Low | High (infrastructure, supply chain) | Market penetration, local partnerships |

| Digitalization & AI Solutions | Growing (smart wind farm market expanding) | Developing | High (R&D, differentiation) | Enhancing reliability, optimizing performance |

| Hydrogen-Integrated Solutions | Very High (green hydrogen market to reach ~$50B by 2030) | Nascent | High (technology development, scaling) | Hybrid power plant concepts |

| Niche Technology Partnerships (e.g., Drones) | High (industrial drone market CAGR >20%) | Minimal | High (R&D, commercialization) | Cost reduction, safety improvement |

BCG Matrix Data Sources

Our Siemens Gamesa BCG Matrix is built on verified market intelligence, combining financial data from company reports, industry research on market share, and expert commentary on future growth trends.