Fujian Septwolves Industry SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fujian Septwolves Industry Bundle

Fujian Septwolves Industry faces a dynamic market, with its strong brand recognition and diversified product lines as key strengths. However, understanding the full scope of its competitive landscape and potential internal weaknesses is crucial for strategic advantage.

Don’t settle for a snapshot—unlock the full SWOT report to gain detailed strategic insights, editable tools, and a high-level summary in Excel. Perfect for smart, fast decision-making.

Strengths

Fujian Septwolves Industry has cultivated a powerful and highly recognizable brand, 'Septwolves,' in China's competitive menswear sector since its inception in 1990. This enduring brand equity fosters significant customer loyalty and secures a substantial market share, solidifying its position as a premier apparel enterprise.

The company's extensive history and specialized focus on jackets have earned it the esteemed moniker of the 'king of jackets' within China, a testament to its market leadership and product expertise. This strong brand recognition is a key driver of its sustained success and market dominance.

Fujian Septwolves Industry boasts a comprehensive distribution network, a significant strength that underpins its market presence. This network encompasses a vast array of physical retail stores strategically located throughout China, ensuring accessibility for a broad spectrum of consumers.

Complementing its brick-and-mortar presence, Septwolves has also established a robust online footprint across various e-commerce platforms. This dual approach, leveraging both offline and online channels, allows the company to effectively cater to diverse consumer preferences and adapt to the dynamic retail landscape. In 2023, online sales channels contributed significantly to the apparel sector's growth in China, with e-commerce penetration reaching new heights, a trend Septwolves is well-positioned to capitalize on.

Fujian Septwolves boasts an integrated business model, managing everything from design and production to marketing for its apparel, footwear, and accessories. This end-to-end approach grants significant control over product quality and supply chain operations, ensuring efficiency. For instance, in 2023, this integration contributed to a reported revenue of 8.18 billion RMB, demonstrating the operational strength derived from their cohesive value chain management.

Focus on Menswear Specialization

Fujian Septwolves' deliberate focus on menswear has cultivated significant expertise and a robust market presence within this niche. This strategic specialization enables the company to tailor product innovation, marketing campaigns, and brand messaging precisely for male consumers in China, enhancing its appeal and market penetration.

This concentrated approach allows for efficient resource allocation and a deeper understanding of evolving male fashion trends. For instance, in 2023, Septwolves reported that its menswear segment continued to be the primary revenue driver, underscoring the success of its specialization.

- Deep Expertise: Cultivated specialized knowledge in menswear design, production, and marketing.

- Targeted Marketing: Ability to craft campaigns that resonate directly with the male demographic.

- Brand Identity: Clear and consistent brand image focused on men's fashion needs.

- Market Share: Maintained a strong position in China's competitive menswear market, with menswear sales accounting for over 80% of its total revenue in recent reporting periods.

Innovation in Product Development

Septwolves Industry showcases a strong commitment to innovation, particularly evident in its recent SS25 collection presented at Milan Fashion Week. This collection highlighted functional and technologically integrated business travel wear, demonstrating the company's forward-thinking approach to product development. The focus on blending aesthetics with cutting-edge features positions Septwolves as a leader in incorporating advanced technology into apparel.

The SS25 collection featured a range of innovations designed for modern business travelers:

- Technical Fabrics: Utilization of advanced materials for enhanced performance and comfort.

- Modular Designs: Offering versatility and adaptability in clothing configurations.

- Integrated Support and Comfort: Inclusion of features like inflatable cushions for improved ergonomics.

- Intelligent Heating and Massage Systems: Incorporation of smart technology for personalized comfort and well-being.

Fujian Septwolves Industry benefits from a deeply ingrained brand recognition in China, particularly for its 'Septwolves' menswear label, established in 1990. This strong brand equity translates into significant customer loyalty and a commanding market share, reinforcing its status as a leading apparel company. The company's specialization in jackets has earned it the reputation of the 'king of jackets' in China, highlighting its product expertise and market leadership.

Septwolves operates an extensive distribution network, featuring numerous physical retail stores across China, ensuring broad consumer access. This is augmented by a robust online presence on major e-commerce platforms, enabling the company to cater to diverse shopping preferences. In 2023, the apparel sector saw substantial growth driven by e-commerce, a trend Septwolves is well-positioned to leverage.

The company's integrated business model, encompassing design, production, and marketing for apparel, footwear, and accessories, provides strong control over quality and supply chains. This holistic approach contributed to a reported revenue of 8.18 billion RMB in 2023, showcasing the efficiency of its value chain management.

Fujian Septwolves' strategic focus on menswear has fostered deep expertise and a strong market foothold. This specialization allows for tailored product innovation and marketing that resonates with Chinese male consumers, enhancing its market penetration. In 2023, menswear remained the primary revenue driver, confirming the success of this focused strategy.

Innovation is a key strength, demonstrated by the SS25 collection at Milan Fashion Week, which featured functional, tech-integrated business travel wear. This forward-thinking approach, blending aesthetics with advanced features, positions Septwolves as an innovator in incorporating technology into apparel.

| Key Strength | Description | Supporting Data/Fact |

|---|---|---|

| Brand Recognition | Highly recognizable 'Septwolves' brand in China's menswear market. | Established in 1990, leading to significant customer loyalty and market share. |

| Market Leadership | Known as the 'king of jackets' in China. | Testament to specialized product expertise and market dominance. |

| Distribution Network | Extensive offline and online retail presence. | Numerous physical stores across China and a robust e-commerce footprint. |

| Integrated Business Model | End-to-end control from design to marketing. | Contributed to 2023 revenue of 8.18 billion RMB. |

| Menswear Specialization | Deep expertise and market penetration in menswear. | Menswear segment was the primary revenue driver in 2023. |

| Innovation Focus | Development of technologically integrated apparel. | Showcased functional business travel wear in SS25 collection. |

What is included in the product

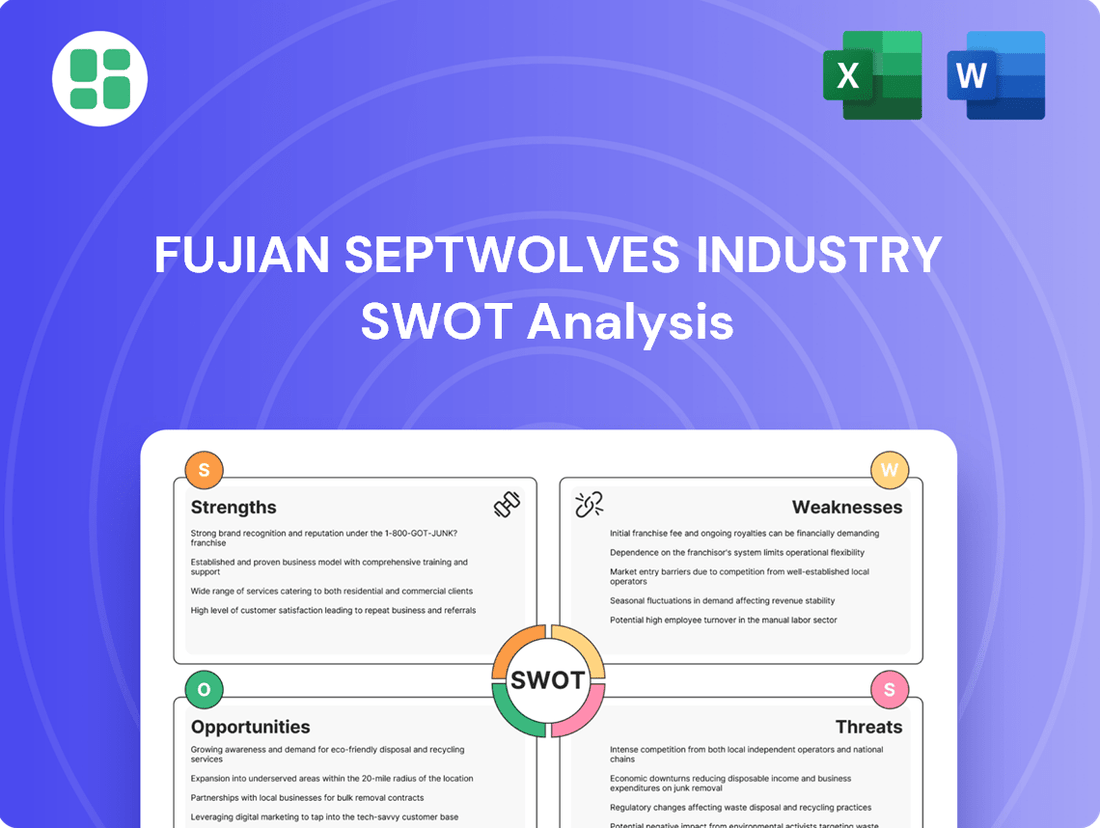

Delivers a strategic overview of Fujian Septwolves Industry’s internal and external business factors, highlighting its brand strength and market opportunities while acknowledging potential operational weaknesses and competitive threats.

Offers a clear, actionable roadmap by highlighting Fujian Septwolves' competitive advantages and areas for improvement, thereby simplifying strategic decision-making.

Weaknesses

Fujian Septwolves Industry's significant concentration on the domestic Chinese market, particularly in East and South China, presents a notable weakness. This heavy reliance means that any economic slowdown or adverse shift in Chinese consumer preferences could disproportionately impact the company's performance.

The limited international presence, primarily consisting of minimal cross-border e-commerce and sporadic overseas sales, further amplifies this vulnerability. For instance, while specific 2024-2025 international sales figures are not publicly detailed, the company's stated strategy indicates a minimal contribution from these channels, underscoring the domestic dependency.

Fujian Septwolves Industry, despite its established presence in traditional menswear, faces a significant weakness in its vulnerability to the rapid pace of fashion trends. The burgeoning influence of fast fashion and streetwear, in particular, creates a dynamic market that demands constant stylistic evolution.

While Septwolves has demonstrated a capacity for innovation, a potential lag in adapting to these swiftly changing styles and consumer desires could diminish its competitive edge against more agile, trend-focused fashion houses. For instance, in 2023, the global apparel market saw a notable surge in demand for athleisure and vintage-inspired streetwear, areas where Septwolves might not have been as quick to pivot compared to emerging brands.

Fujian Septwolves Industry's brand image, while established, may be perceived as somewhat traditional, potentially limiting its appeal to younger consumers who are increasingly drawn to domestic brands that creatively fuse heritage elements with contemporary fashion and evolving style preferences, including gender-neutral designs.

In 2023, while Septwolves reported a revenue of approximately ¥5.9 billion RMB, a slight increase from the previous year, the challenge remains in consistently innovating its brand perception to resonate with a rapidly shifting market dynamic, especially as competitors embrace bolder, trend-forward aesthetics.

Intense Competition in Chinese Apparel Market

The Chinese apparel market is incredibly crowded, with established domestic brands and global giants all vying for consumer attention. This fierce rivalry puts constant pressure on pricing strategies and market share, demanding significant ongoing investment in marketing and unique product development to stay ahead.

For Fujian Septwolves Industry, this intense competition translates into a need for continuous innovation and brand building. For instance, in 2024, the overall Chinese apparel market experienced a growth rate of approximately 5-7%, but for brands like Septwolves, maintaining or increasing their share within this expanding but highly contested space requires strategic differentiation and effective marketing campaigns to stand out from the crowd.

- Intense Rivalry: Both domestic and international brands compete aggressively in China's apparel sector.

- Pricing Pressures: High competition can lead to price wars, impacting profit margins.

- Market Share Challenges: Maintaining or growing market share requires constant effort and investment.

- Need for Differentiation: Continuous product innovation and strong branding are crucial for survival and success.

Slowing Growth in Mass Market Apparel

The mass market apparel sector in China has shown signs of slowing, with industry-wide growth moderating and consumer spending remaining subdued throughout 2024. This presents a challenge for Fujian Septwolves, as its core business is centered on this mainstream menswear category.

If this trend of weaker consumer demand persists, it could limit Septwolves' ability to achieve substantial expansion. For instance, reports indicated that retail sales of clothing in China saw a modest increase in early 2024, but the overall consumer sentiment remained cautious.

- Slowing Industry Growth: The overall Chinese apparel market, particularly the mass market segment, is experiencing a deceleration in its growth rate.

- Weak Consumer Demand: Consumer spending on apparel in 2024 has been characterized by weakness, impacting sales volumes for brands focused on the mainstream.

- Impact on Septwolves: As a company heavily invested in mass-market menswear, Septwolves is susceptible to these broader market headwinds, potentially hindering its growth trajectory.

Fujian Septwolves Industry's significant reliance on the domestic Chinese market, particularly in East and South China, is a key weakness. This concentration makes the company highly susceptible to any economic downturns or shifts in Chinese consumer preferences. For example, while specific international sales data for 2024-2025 isn't detailed, the company's limited global footprint means it misses out on diversification benefits, leaving it exposed to domestic market fluctuations.

Preview the Actual Deliverable

Fujian Septwolves Industry SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Fujian Septwolves Industry SWOT analysis, including all its strategic insights. Purchase unlocks the complete, in-depth report for your business planning.

Opportunities

The continued surge in e-commerce and social commerce in China offers a prime opportunity for Fujian Septwolves. With over 60% of apparel purchases now happening online, and platforms like Douyin and Xiaohongshu becoming major sales drivers, Septwolves can significantly expand its reach. Building on its already strong 36% online sales reported in 2024, the company can further capitalize on these digital channels for both increased revenue and deeper customer interaction.

The men's casual and athleisure wear market in China is experiencing robust expansion. Data from 2024 suggests a continued shift in consumer preference towards comfort and versatility, with athleisure projected to capture a larger share of the menswear market. This trend presents a significant opportunity for Septwolves to innovate and broaden its offerings.

Septwolves can strategically leverage this growth by introducing new collections that emphasize casual comfort and performance features. For instance, incorporating advanced fabric technologies into their designs could appeal to the growing demand for functional apparel. This proactive approach aligns with the evolving lifestyle of Chinese consumers, who increasingly value both style and practicality in their clothing choices.

The booming 'Guochao' trend, a significant shift where Chinese consumers increasingly favor domestic brands infused with traditional Chinese culture and aesthetics, presents a prime opportunity for Fujian Septwolves Industry. This movement reflects a growing national pride and a desire to connect with heritage.

Septwolves can capitalize on this by more deeply integrating cultural elements and local design sensibilities into its apparel collections and marketing campaigns. This approach will resonate strongly with the patriotic and culturally aware consumer base, driving brand loyalty and sales.

For instance, in 2023, the 'Guochao' market size was estimated to be over $100 billion, with continued robust growth projected. Septwolves' ability to authentically blend modern fashion with traditional Chinese motifs could significantly capture a larger share of this expanding market.

Targeting Lower-Tier Cities and Silver Generation

China's lower-tier cities represent a significant, yet often underserved, consumer base. As these markets develop, there's a growing demand for branded apparel, and Septwolves can leverage this by implementing localized marketing campaigns and product assortments that resonate with regional preferences. This strategy aims to capture new market share by directly addressing the evolving needs of these emerging consumers.

The silver generation, a rapidly expanding demographic in China, presents a distinct opportunity for Septwolves. This group prioritizes comfort, durability, and practicality in their clothing choices. By developing product lines specifically designed for this segment, such as easy-wear collections and functional outerwear, Septwolves can tap into a growing market driven by an aging population seeking quality and ease of use.

- Emerging Consumer Base: China's lower-tier cities are projected to contribute significantly to domestic consumption growth, with an increasing disposable income among their residents.

- Silver Generation Demand: By 2025, China's population aged 60 and above is expected to exceed 300 million, creating substantial demand for goods and services tailored to their needs, including apparel.

- Market Expansion Potential: Septwolves can introduce specialized product lines and targeted marketing efforts in these cities to build brand loyalty and increase market penetration.

Strategic Diversification and Acquisitions

Fujian Septwolves Industry has a history of strategic moves to elevate its market position, notably acquiring an 80% stake in Karl Lagerfeld China. This acquisition signaled a clear ambition to tap into the accessible luxury market, broadening its appeal and brand portfolio.

Looking ahead, the company has significant opportunities to further diversify its offerings and expand its market reach. Pursuing acquisitions of brands that resonate with current consumer trends or entering complementary business segments could unlock new revenue streams and strengthen its competitive standing.

- Brand Portfolio Expansion: Acquiring brands in adjacent lifestyle categories could create synergies and cross-promotional opportunities.

- Geographic Market Deepening: Further penetration into existing international markets or expansion into new, high-growth regions presents a clear path for revenue growth.

- Digital Transformation and E-commerce: Investing in advanced digital platforms and e-commerce capabilities can enhance customer engagement and sales, especially given the continued growth in online retail, which saw the global e-commerce market reach an estimated $5.7 trillion in 2023.

Fujian Septwolves can capitalize on the growing demand for athleisure and comfortable casual wear, a trend that saw significant momentum in 2024 and is projected to continue. By innovating with new collections featuring advanced fabrics and versatile designs, the company can appeal to evolving consumer lifestyles. This strategic focus aligns with the increasing value placed on both style and practicality by Chinese shoppers.

The company has a substantial opportunity to leverage the 'Guochao' trend, which favors domestic brands incorporating Chinese culture. By authentically blending modern fashion with traditional aesthetics, Septwolves can resonate with a growing nationalistic consumer base, potentially capturing a larger share of this market which was valued at over $100 billion in 2023.

Expanding into China's lower-tier cities offers a significant growth avenue, as these markets show increasing disposable income and a growing appetite for branded apparel. Targeted marketing and localized product assortments can drive brand loyalty and market penetration in these developing regions.

The rapidly expanding silver generation in China presents a distinct market segment. Developing specialized apparel lines focused on comfort, durability, and ease of use for this demographic, projected to exceed 300 million individuals aged 60+ by 2025, can unlock substantial demand.

Further diversification through strategic brand acquisitions, particularly in complementary lifestyle categories, could create synergies and expand Septwolves' market reach. The company's acquisition of an 80% stake in Karl Lagerfeld China in 2023 demonstrates its capability and ambition in this area, opening doors to the accessible luxury market.

Continued investment in digital transformation and e-commerce capabilities is crucial, given the global e-commerce market's estimated $5.7 trillion valuation in 2023. Enhancing online platforms will bolster customer engagement and sales, especially as social commerce continues its upward trajectory in China.

| Opportunity Area | Key Trend/Data Point | Septwolves' Strategic Leverage |

|---|---|---|

| Athleisure & Casual Wear | Continued growth in comfort-focused apparel, 2024 trends show strong consumer preference. | Innovate collections with advanced fabrics and versatile designs. |

| 'Guochao' Trend | Market size exceeded $100 billion in 2023, driven by national pride. | Integrate cultural elements and local aesthetics into designs and marketing. |

| Lower-Tier Cities | Increasing disposable income and demand for branded apparel in developing urban areas. | Implement localized marketing and product assortments. |

| Silver Generation | China's 60+ population to exceed 300 million by 2025. | Develop specialized product lines focusing on comfort and practicality. |

| Brand Portfolio Expansion | Acquisition of Karl Lagerfeld China (80% stake) signals ambition in accessible luxury. | Pursue acquisitions in adjacent lifestyle categories for synergies. |

| Digital Transformation | Global e-commerce market reached $5.7 trillion in 2023. | Invest in advanced digital platforms and e-commerce capabilities. |

Threats

The Chinese apparel sector is a crowded space, with a multitude of domestic and global players vying for consumer attention. This fragmentation means Septwolves faces constant pressure from both established brands and emerging companies.

The rapid ascent of ultra-fast fashion retailers such as Shein and Temu presents a significant challenge, offering trendy, low-cost options that can quickly capture market share. Furthermore, the increasing prominence of independent Chinese designers, who often cater to niche markets with unique styles, adds another layer of competitive intensity that could potentially dilute Septwolves' market standing.

Economic headwinds, including sluggish global growth and China's ongoing internal restructuring, are creating a challenging environment. This, coupled with a weak property market, has led to subdued consumer confidence and slower income growth across China, particularly affecting the mass market segment.

This economic climate directly translates to potentially decreased discretionary spending on apparel, which could negatively impact Fujian Septwolves Industry's sales volumes and overall profitability. For instance, in early 2024, retail sales growth in China showed signs of moderation, with apparel categories experiencing varied performance depending on consumer sentiment.

Global supply chain disruptions, particularly those originating from China, present a significant threat to Fujian Septwolves. The country's diminishing dominance in apparel manufacturing, coupled with rising production costs, could directly impact operational efficiency and profitability. For instance, the average manufacturing cost in China saw an increase of approximately 5% in 2024 compared to the previous year, according to industry reports.

Managing these escalating costs, potentially through diversification of sourcing strategies or absorbing higher labor expenses, poses a considerable challenge for the company. Failure to adapt could lead to reduced profit margins or necessitate price increases, affecting competitiveness in the market.

Rapidly Evolving E-commerce Landscape and Platform Dependence

The e-commerce environment is constantly changing, and this rapid evolution presents a significant threat. Fujian Septwolves Industry, like many apparel retailers, faces the challenge of adapting to shifting platform algorithms and increasing competition for online customer attention. For instance, in 2024, major e-commerce platforms frequently updated their search and recommendation algorithms, impacting organic visibility for brands that didn't adapt their content strategies quickly enough.

Over-dependence on a single e-commerce platform or a slow response to emerging trends can severely hamper online sales performance. The rise of live-streaming commerce, which saw substantial growth in 2024 with many brands leveraging it for direct sales and customer engagement, is a prime example. Similarly, the increasing adoption of Buy Now, Pay Later (BNPL) options by consumers in 2024 necessitates that businesses integrate these payment methods to remain competitive and capture a broader customer base.

- Platform Algorithm Volatility: Frequent changes to algorithms on platforms like Tmall and JD.com can disrupt sales if brands fail to optimize their product listings and marketing campaigns accordingly.

- Emergence of New Sales Channels: The growing popularity of social commerce and live-streaming sales in 2024 requires continuous investment in new marketing and sales strategies to maintain market share.

- Shifting Consumer Payment Preferences: The increasing demand for flexible payment options, such as BNPL services, means businesses must adapt their checkout processes to avoid losing potential customers.

Brand Loyalty Challenges and Price Sensitivity

Fujian Septwolves faces a significant threat from the fickle nature of Chinese consumer loyalty in the apparel sector. Many consumers are highly price-sensitive, readily switching brands based on cost, which directly impacts Septwolves' ability to retain customers and maintain pricing power. This is exacerbated by the growing influence of affordable, fast-fashion brands that quickly adapt to trends, offering a constant stream of new, low-cost options that draw consumers away from established players.

The market landscape is increasingly characterized by:

- Shifting Consumer Preferences: A notable 45% of Chinese Gen Z consumers indicated they would switch to a cheaper alternative if their preferred brand raised prices, according to a 2024 report by China Skinny.

- Fast Fashion Dominance: Brands like SHEIN and Temu have seen explosive growth, with SHEIN reportedly achieving over $22 billion in revenue in 2023, demonstrating the powerful appeal of rapid trend adoption and low price points.

- Erosion of Brand Equity: The constant influx of new, inexpensive styles challenges the perceived value and long-term appeal of brands like Septwolves, particularly in the non-luxury segment where price is a primary driver.

Fujian Septwolves faces intense competition from both domestic and global players, including the disruptive rise of ultra-fast fashion brands like Shein and Temu, which offer trend-driven, low-cost apparel. This dynamic, coupled with the growing influence of independent designers catering to niche markets, intensifies pressure on Septwolves' market position.

Economic challenges, such as moderating retail sales growth in China during early 2024 and subdued consumer confidence due to a weak property market, directly threaten discretionary spending on apparel. This environment could lead to reduced sales volumes and profitability for Septwolves, especially in the mass-market segment.

Escalating production costs in China, with manufacturing costs seeing an approximate 5% increase in 2024, pose a significant threat. This, combined with potential supply chain disruptions and the diminishing dominance of China in apparel manufacturing, could impact Septwolves' operational efficiency and profit margins.

The company must navigate a volatile e-commerce landscape, adapting to frequent algorithm changes on major platforms and the increasing importance of new sales channels like live-streaming commerce. Furthermore, evolving consumer payment preferences, such as the adoption of Buy Now, Pay Later services in 2024, require continuous strategic adjustments to maintain competitiveness.

SWOT Analysis Data Sources

This analysis is built upon comprehensive data from Fujian Septwolves' official financial reports, detailed market research on the apparel industry, and expert commentary from industry analysts to ensure a robust and insightful SWOT assessment.