Fujian Septwolves Industry Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fujian Septwolves Industry Bundle

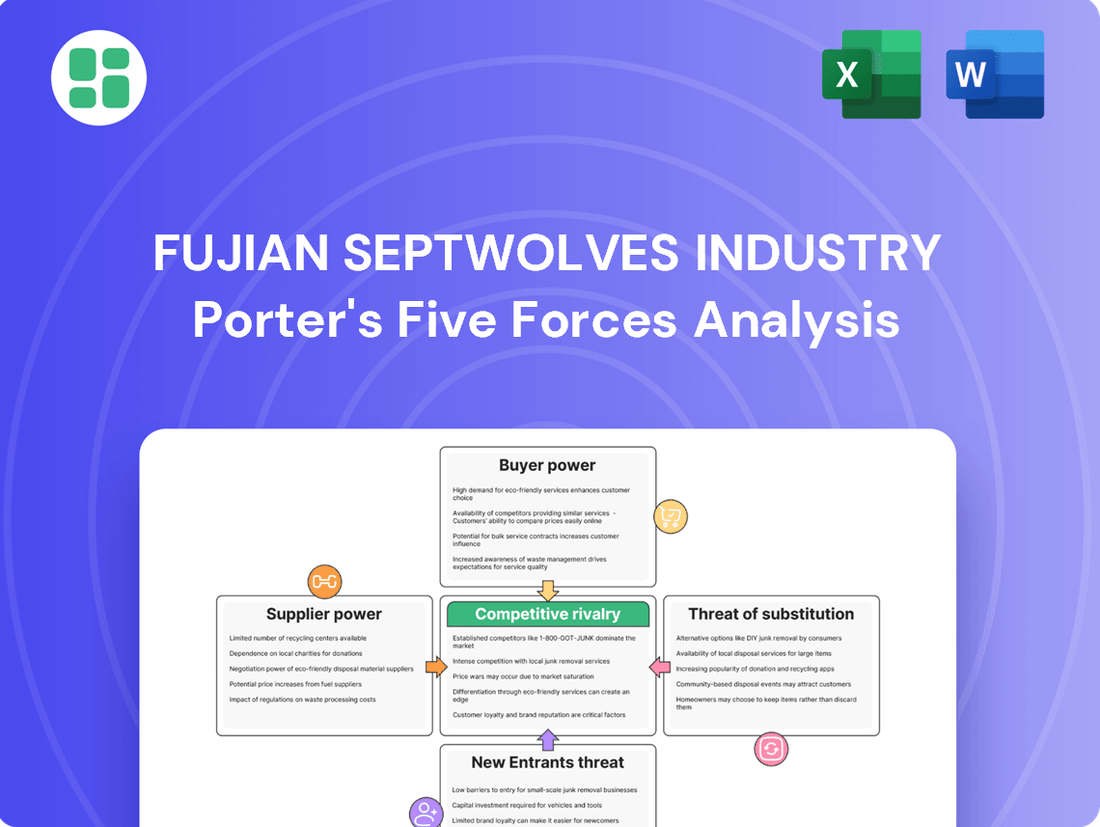

Fujian Septwolves Industry navigates a competitive landscape shaped by moderate buyer power and the persistent threat of substitutes within the apparel sector. Understanding the intensity of rivalry and the bargaining power of suppliers is crucial for strategic positioning.

The complete report reveals the real forces shaping Fujian Septwolves Industry’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for key raw materials, such as textiles and fabrics, significantly impacts their bargaining power over Fujian Septwolves Industry. If Septwolves relies on a limited number of suppliers for specialized fabrics essential to its menswear collections, these suppliers could leverage their position to command higher prices or impose less favorable payment terms. For instance, if a unique blend of sustainable cotton, critical for a new Septwolves line, is sourced from only two or three global producers, their collective power increases.

However, the vastness of China's textile industry generally suggests a more fragmented supplier base for many standard materials. In 2024, China remained the world's largest producer and exporter of textiles, with thousands of manufacturers catering to diverse needs. This broad availability of common fabrics and materials typically dilutes individual supplier leverage, allowing Septwolves to negotiate more competitive pricing and terms for these essential inputs, thereby mitigating some of the supplier bargaining power.

The costs Septwolves incurs to switch suppliers significantly influence supplier power. These costs can include retooling manufacturing equipment, redesigning garments to accommodate new material specifications, and the time and resources spent on requalifying new vendors. For instance, if Septwolves relies on specialized fabric treatments or unique dyeing processes that only a few suppliers can provide, the expense and effort to find and onboard alternatives would be substantial.

Suppliers offering unique or highly differentiated inputs, like proprietary fabric technologies or exclusive design collaborations, wield significant bargaining power. Fujian Septwolves Industry's focus on design and quality in its menswear offerings means it might rely on such specialized inputs, thereby enhancing the leverage of those particular suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into apparel manufacturing can significantly increase their bargaining power over Fujian Septwolves Industry. If suppliers can credibly threaten to produce the final garments themselves, they can exert more pressure on Septwolves regarding pricing and terms.

This risk is generally lower for suppliers of common textiles, but it becomes more relevant for manufacturers of specialized components or unique fabrics. Should these specialized suppliers identify a lucrative opportunity to capture greater value further down the supply chain, they might consider moving into direct apparel production.

For instance, if a supplier of advanced, proprietary performance fabrics were to develop the capability to design and manufacture finished activewear, they could potentially bypass brands like Septwolves. This would allow them to capture the full retail margin, thereby enhancing their leverage in negotiations with existing or potential clients.

While specific data on supplier forward integration threats for Fujian Septwolves in 2024 is not publicly detailed, the general trend in the apparel industry shows increased vertical integration by some raw material providers seeking to diversify revenue streams and gain market share.

Importance of Septwolves to Suppliers

The proportion of a supplier's total business that Fujian Septwolves represents is a critical factor in determining the supplier's bargaining power. If Septwolves constitutes a significant portion of a supplier's revenue, that supplier may be more accommodating to Septwolves' demands, thus reducing their own leverage. For instance, if a key fabric supplier for Septwolves derives over 30% of its annual sales from the company, it's less likely to push for unfavorable terms.

Conversely, if Septwolves is a minor client for a supplier, the supplier might prioritize larger, more lucrative customers. This could lead to Septwolves having less influence in negotiations, potentially facing higher prices or less favorable delivery schedules. For example, a supplier of specialized buttons that only sells 5% of its output to Septwolves might be less sensitive to Septwolves' pricing requests compared to a supplier where Septwolves is a primary customer.

This dynamic can be observed in the broader apparel industry. Suppliers who cater to a wide range of clients, with no single client dominating their sales, often hold stronger bargaining positions. In 2023, the average textile supplier in China reported that their top client accounted for approximately 15-20% of their total revenue, indicating that many suppliers have diversified customer bases, which can enhance their bargaining power when dealing with individual brands like Septwolves.

- Supplier Dependence: A supplier's reliance on Septwolves for a substantial percentage of their sales weakens their bargaining power.

- Septwolves' Market Share: If Septwolves is a major buyer for a specific input, suppliers may offer better terms to retain this significant business.

- Supplier Diversification: Suppliers with a broad customer base, where Septwolves is a smaller client, tend to have greater leverage.

- Industry Benchmarks: In 2023, top clients typically represented 15-20% of revenue for Chinese textile suppliers, suggesting a general trend of supplier diversification.

The bargaining power of suppliers for Fujian Septwolves Industry is influenced by several factors, including supplier concentration, switching costs, differentiation of inputs, threat of forward integration, and the proportion of a supplier's business that Septwolves represents. A concentrated supplier market or highly differentiated inputs can increase supplier leverage.

In 2024, China's vast textile industry generally offers a fragmented supplier base for common materials, which helps Septwolves negotiate favorable terms. However, reliance on niche suppliers for unique fabrics or treatments can elevate their bargaining power due to high switching costs for Septwolves.

Suppliers who are heavily dependent on Septwolves for a significant portion of their sales have less bargaining power. Conversely, suppliers with diversified customer bases, where Septwolves is a minor client, typically hold stronger positions. For instance, in 2023, Chinese textile suppliers' top clients represented an average of 15-20% of their revenue, indicating a general trend of diversification that can empower suppliers.

| Factor | Impact on Supplier Bargaining Power | Example for Septwolves |

|---|---|---|

| Supplier Concentration | High if few suppliers for key inputs | Reliance on a few producers for unique sustainable cotton |

| Switching Costs | High if specialized equipment or processes are needed | Retooling for new fabric treatments or dyeing methods |

| Input Differentiation | High for unique or proprietary materials | Proprietary performance fabrics or exclusive design collaborations |

| Threat of Forward Integration | High if suppliers can produce finished garments | Specialized fabric suppliers entering apparel manufacturing |

| Septwolves' Share of Supplier Business | Low if Septwolves is a small client | Supplier prioritizing larger, more lucrative customers |

What is included in the product

This analysis delves into Fujian Septwolves Industry's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the apparel sector.

Understand competitive pressures on Fujian Septwolves Industry with a clear, actionable breakdown of each Porter's Five Force, simplifying complex market dynamics.

Customers Bargaining Power

Chinese consumers, particularly in the mid-range apparel sector where Fujian Septwolves operates, exhibit significant price sensitivity. This heightened awareness of pricing is driven by economic factors and a persistent search for value. For instance, in 2023, the average retail price increase for apparel in China remained relatively contained, reflecting this consumer focus on affordability.

When consumers perceive prices as exceeding their perceived value, they readily explore alternative brands. This willingness to switch brands directly amplifies their bargaining power against companies like Septwolves. The competitive landscape in Chinese apparel ensures that brands must carefully balance quality and price to retain customer loyalty.

The Chinese menswear market is incredibly crowded, with a vast number of domestic and international brands vying for consumer attention. This intense competition means customers have plenty of options if Septwolves doesn't quite hit the mark on price, style, or quality. For instance, in 2023, the Chinese apparel market was valued at over $300 billion, showcasing the sheer scale and number of players involved.

The burgeoning e-commerce and social commerce landscape in China significantly amplifies customer bargaining power. Consumers can effortlessly access vast amounts of product information, compare prices across numerous retailers, and scrutinize peer reviews, fostering a highly transparent market environment. This readily available data empowers shoppers to make well-informed purchasing decisions, directly influencing brand strategies.

For a company like Fujian Septwolves Industry, this means heightened pressure to maintain competitive pricing and superior product quality. In 2024, China's e-commerce market continued its robust growth, with online retail sales reaching trillions of yuan, underscoring the critical role these platforms play in consumer purchasing behavior. Brands must actively engage with online communities and leverage digital channels to build trust and loyalty amidst this empowered consumer base.

Low Switching Costs for Consumers

For consumers, switching between apparel brands like those offered by Fujian Septwolves Industry is typically effortless and inexpensive. There are no substantial contracts or fees to deter them, meaning shoppers can easily move to a competitor based on style, price, or a special offer. This ease of transition significantly amplifies their influence.

The low switching costs in the apparel sector mean consumers have considerable leverage. For instance, in 2024, online fashion retailers often reported customer acquisition costs that were a fraction of customer lifetime value, underscoring the ease with which consumers can move between platforms and brands. This dynamic directly impacts brands’ pricing power and marketing strategies.

- Minimal Financial Barriers: Consumers face no significant financial penalties when changing apparel brands.

- Ease of Information Access: Online platforms and social media make it simple for consumers to compare products and prices across numerous brands.

- Trend-Driven Purchases: Apparel choices are often driven by fleeting trends, encouraging consumers to explore new brands frequently.

Customer Segmentation and Brand Loyalty

While the apparel market generally sees high price sensitivity, Fujian Septwolves Industry can leverage customer segmentation to its advantage. For instance, in 2024, brands embracing 'Guochao' or 'New Chinese Style' aesthetics have seen significant traction, particularly among younger demographics. Septwolves' focus on these trends can foster deeper brand loyalty within these specific segments, thereby reducing their overall bargaining power.

Cultivating this loyalty is key. By consistently delivering products that resonate with cultural identity and lifestyle preferences, Septwolves can create a customer base less inclined to switch based solely on price. This strategic approach allows the company to buffer the inherent power of consumers in a competitive market.

- Brand Loyalty Mitigation: Septwolves can reduce customer bargaining power by fostering loyalty among segments that value cultural identity and specific lifestyle aesthetics, such as 'Guochao' or 'New Chinese Style'.

- Segmented Price Sensitivity: While overall price sensitivity is high, specific customer groups may prioritize brand alignment over minor price differences.

- 2024 Trend Alignment: The success of 'Guochao' and 'New Chinese Style' in the 2024 apparel market demonstrates the potential for brands to build strong connections with consumers through cultural resonance.

The bargaining power of customers is a significant force for Fujian Septwolves Industry, particularly within China's vast and competitive apparel market. Consumers, armed with readily available information and low switching costs, can easily compare prices and quality across numerous brands. This transparency, amplified by robust e-commerce platforms, empowers shoppers to demand value. For instance, in 2024, China's online retail sales continued their upward trajectory, reaching trillions of yuan, highlighting the critical role of digital channels in shaping consumer decisions and brand accountability.

The ease with which consumers can move between apparel brands, often driven by fleeting trends, further strengthens their position. Without substantial financial barriers or contractual obligations, brand loyalty can be fragile. This dynamic pressures companies like Septwolves to maintain competitive pricing and continuously innovate to retain market share. In 2024, the average customer acquisition cost for online fashion retailers remained relatively low, underscoring the ease of consumer transition and its impact on brand pricing strategies.

| Factor | Impact on Septwolves | Evidence (2023-2024) |

|---|---|---|

| Price Sensitivity | High, demanding value for money. | Contained average retail price increases in apparel. |

| Switching Costs | Low, enabling easy brand changes. | Low customer acquisition costs for online fashion retailers. |

| Information Access | High, facilitating price and quality comparisons. | Continued robust growth in China's e-commerce market (trillions of yuan in sales). |

| Brand Loyalty Potential | Can be cultivated through cultural resonance (e.g., 'Guochao'). | 'Guochao' and 'New Chinese Style' gaining traction among younger demographics. |

Full Version Awaits

Fujian Septwolves Industry Porter's Five Forces Analysis

This preview showcases the comprehensive Fujian Septwolves Industry Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into the industry's dynamics.

Rivalry Among Competitors

Fujian Septwolves operates in a highly fragmented Chinese menswear market, characterized by a substantial number of domestic and international competitors. This includes a wide spectrum of brands, from fast-fashion retailers to luxury and premium labels, all vying for consumer attention.

The sheer volume and diversity of these players significantly amplify competitive rivalry. In 2024, the Chinese apparel market is projected to reach over $270 billion, highlighting the immense scale but also the intense competition for a share of this lucrative market.

While China's apparel market is substantial, its growth has moderated. For instance, the China apparel market's growth rate, which was robust in prior years, has seen a slowdown, especially in the mid-range and value segments, indicating a more mature market dynamic. This deceleration means companies like Fujian Septwolves face a more challenging environment.

The less dynamic growth in China's domestic apparel market amplifies the competitive rivalry. As the overall market expands at a slower pace, companies are compelled to compete more fiercely for market share. This intensified competition can lead to price wars and increased marketing expenditures, impacting profitability for all players, including established brands.

Fujian Septwolves Industry competes in a market where brand differentiation is paramount. They achieve this through a focus on design, quality, and compelling brand storytelling, ensuring their menswear stands out. For instance, in 2023, the company continued to invest in its brand image, aiming to connect with consumers through evolving fashion narratives.

Adapting to emerging trends is also key. Septwolves actively incorporates styles like athleisure and the 'quiet luxury' aesthetic, alongside traditional Chinese elements, into their collections. This agility in responding to consumer preferences, such as the growing demand for comfortable yet stylish apparel, allows them to maintain relevance.

Innovation in product development and marketing is vital for Septwolves to carve out its niche. Their ability to consistently introduce fresh designs and communicate a unique brand identity is what helps them gain an edge against competitors in the highly saturated menswear sector.

High Fixed Costs and Exit Barriers

The apparel manufacturing sector, including companies like Fujian Septwolves Industry, is characterized by substantial fixed costs. These investments span production machinery, extensive inventory management, and the establishment of broad retail distribution networks. For instance, in 2024, major apparel manufacturers continued to invest heavily in automated production lines and sophisticated supply chain technologies, with capital expenditures often running into tens of millions of dollars annually.

High exit barriers further intensify competitive rivalry. These can include specialized, non-transferable manufacturing equipment, significant lease obligations for retail spaces, and substantial severance packages for a large workforce. Such barriers make it financially punitive for companies to withdraw from the market, forcing them to remain active and compete fiercely even when industry profitability is low, as observed during periods of reduced consumer spending in late 2023 and early 2024.

- Significant Capital Outlay: Apparel manufacturing requires substantial upfront investment in factories and machinery, often exceeding $50 million for large-scale operations.

- Inventory Holding Costs: Maintaining diverse seasonal collections and managing stock levels across numerous SKUs incurs significant carrying costs, impacting liquidity.

- Retail Network Investment: Establishing and maintaining a physical retail presence, as Septwolves does, demands considerable expenditure on store leases, fit-outs, and staffing.

- Workforce Commitments: Large manufacturing bases involve significant human capital, with high potential costs associated with layoffs or plant closures.

Intensity of Marketing and Pricing Strategies

The apparel industry, where Fujian Septwolves operates, is characterized by intense competition, leading to aggressive marketing, promotional activities, and price wars, particularly amplified by the growth of e-commerce. Septwolves must continually invest in its brand image and digital presence to stand out. In 2024, the Chinese apparel market saw significant shifts, with brands leveraging social media and influencer marketing to drive sales, often resorting to frequent discounts to capture market share.

This competitive landscape forces Septwolves to allocate substantial resources towards advertising and sales promotions to maintain its market position. For instance, during major online shopping festivals in 2024, many apparel brands, including those competing with Septwolves, offered discounts exceeding 50% to attract price-sensitive consumers. The pressure to maintain market share necessitates continuous innovation in marketing strategies and product offerings.

- Aggressive Marketing: Competitors frequently launch extensive advertising campaigns across various platforms, including digital, television, and print media.

- Promotional Activities: Frequent sales, discounts, and bundled offers are common tactics used to stimulate demand and clear inventory.

- E-commerce Dominance: Online channels are crucial battlegrounds, with brands competing fiercely on price and promotional events like Double 11 (Singles' Day) and 618.

- Brand Building Investment: Septwolves needs to invest heavily in brand equity and digital marketing to differentiate itself and build customer loyalty amidst the price competition.

The competitive rivalry within China's menswear market is intense, driven by a vast number of domestic and international brands vying for consumer attention. This saturation is exacerbated by a maturing market with moderating growth rates, compelling companies like Fujian Septwolves to compete more aggressively for market share.

High fixed costs in manufacturing and distribution, coupled with significant exit barriers, further entrench existing players, intensifying the rivalry. For example, in 2024, the Chinese apparel market, projected to exceed $270 billion, sees brands like Septwolves investing heavily in brand differentiation and digital marketing to stand out amidst frequent discounting, with promotions often exceeding 50% during major online sales events.

Brands must continually innovate in product design and marketing to maintain relevance and customer loyalty. Septwolves' strategy of incorporating emerging trends like athleisure and quiet luxury, alongside traditional Chinese elements, demonstrates this need for agility in a market where brand storytelling and unique aesthetics are crucial differentiators.

The fierce competition necessitates substantial investment in advertising and sales promotions, as brands frequently engage in price wars and aggressive marketing campaigns, particularly through dominant e-commerce channels. This environment demands continuous adaptation to consumer preferences and a strong digital presence to navigate the crowded landscape effectively.

SSubstitutes Threaten

The casualization of dress codes, driven by the rise of athleisure and comfortable clothing, presents a substantial threat of substitutes for traditional menswear. This trend, amplified by widespread remote work policies, means consumers increasingly favor versatile, relaxed attire over formal wear for many occasions. For instance, by 2024, the global activewear market was projected to reach over $500 billion, indicating a strong consumer preference for comfort and casual styles.

The burgeoning circular economy presents a significant threat of substitutes for traditional apparel sales. Apparel rental services are gaining traction, offering consumers access to clothing without ownership, especially for event-specific needs. In 2023, the global online resale market for fashion was valued at approximately $177 billion, demonstrating a strong consumer preference for pre-owned items.

The rise of DIY and customization trends presents a significant threat of substitutes for mass-produced menswear. A growing interest in personalization, from bespoke tailoring to DIY fashion projects, caters to consumers seeking unique styles. This shift can divert demand away from standard, off-the-rack offerings, particularly impacting brands like Fujian Septwolves Industry that rely on broad appeal. For instance, the global custom clothing market is projected to reach $100.9 billion by 2027, indicating a substantial and growing alternative to conventional retail.

Shift to Non-Apparel Spending

Consumers, especially younger demographics, are increasingly channeling their disposable income towards experiences like travel, dining, and entertainment rather than solely focusing on acquiring physical goods. This trend represents a significant threat of substitutes for apparel companies like Fujian Septwolves Industry. For instance, in 2024, global spending on experiences saw a notable uptick, with travel and leisure sectors recovering strongly.

This reallocation of consumer budgets means that money that might have previously gone towards new clothing is now being directed towards activities and cultural pursuits. This broadens the competitive landscape beyond traditional apparel brands, as consumers weigh clothing purchases against other desirable spending options.

- Growing demand for experiential consumption: Younger consumers, in particular, are valuing memories and personal growth derived from experiences over material possessions.

- Diversion of disposable income: A larger portion of discretionary spending is being allocated to non-apparel categories such as travel, entertainment, and dining.

- Impact on apparel market share: This shift can lead to reduced demand for clothing as consumers prioritize alternative spending opportunities.

- Competitive pressure from other industries: The apparel sector now competes not just with other clothing brands but with the entire experiential economy for consumer attention and wallet share.

Generic or Unbranded Apparel

The rise of highly cost-effective, generic, or white-label apparel, particularly through major e-commerce platforms, poses a significant substitute threat to brands like Fujian Septwolves. These unbranded options cater to consumers prioritizing minimal cost and basic functionality, diverting potential buyers away from established brands.

For instance, in 2024, the global online apparel market continued its robust growth, with a significant portion of sales attributed to fast fashion and private label brands offering substantial price advantages. Consumers seeking value over brand recognition are increasingly drawn to these alternatives, especially when purchasing everyday wear or basics.

- Availability of Low-Cost Alternatives: E-commerce giants frequently feature a vast selection of unbranded apparel at prices considerably lower than those of established brands.

- Consumer Price Sensitivity: A segment of consumers prioritizes affordability and utility above all else, making generic options a compelling substitute.

- Market Share Erosion: The increasing accessibility and appeal of these substitutes can lead to a gradual erosion of market share for branded apparel manufacturers.

The increasing popularity of rental and resale platforms directly substitutes for new apparel purchases, offering consumers access to fashion at a lower cost or with greater variety. This trend, particularly strong among environmentally conscious and budget-savvy shoppers, diverts spending from traditional retail models. By 2024, the global online resale market was projected to exceed $200 billion, highlighting a significant shift in consumer behavior away from outright ownership.

The rise of athleisure and the casualization of wardrobes present a substantial substitute threat, as consumers increasingly opt for comfortable, versatile clothing over more formal attire. This shift is driven by evolving lifestyle preferences and remote work trends, making relaxed styles a viable alternative for a wider range of occasions. The global activewear market's continued expansion, projected to surpass $500 billion by 2024, underscores this preference for comfort.

Consumers are increasingly prioritizing spending on experiences, such as travel and dining, over material goods like clothing. This reallocation of disposable income means that apparel brands, including Fujian Septwolves Industry, face competition from an entire spectrum of leisure activities for consumer wallet share. In 2024, sectors like travel and entertainment saw a robust recovery, indicating a strong consumer demand for experiential consumption.

| Substitute Category | Impact on Apparel Demand | Market Data (2024 Projections/Estimates) |

|---|---|---|

| Rental & Resale Platforms | Reduces demand for new clothing purchases | Resale Market: >$200 billion globally |

| Athleisure & Casualwear | Replaces formal and traditional wear | Activewear Market: >$500 billion globally |

| Experiential Consumption (Travel, Dining) | Diverts discretionary spending from apparel | Strong recovery in travel and leisure sectors |

Entrants Threaten

Establishing a comprehensive apparel business, from design to distribution, demands significant financial investment. Think about the costs for factories, stocking products, and setting up stores. For instance, in 2024, the average cost to set up a small to medium-sized manufacturing facility in China could range from several million to tens of millions of USD, depending on scale and technology.

However, the landscape is shifting. New businesses can now operate with less capital by adopting asset-light strategies. This means outsourcing manufacturing to contract factories and relying heavily on online sales platforms. This approach significantly reduces the upfront financial burden, making it easier for new players to enter the market.

Established brands like Fujian Septwolves Industry have cultivated strong brand recognition and deep customer loyalty over many years in the competitive apparel market. This existing trust makes it difficult for newcomers to capture market share. For instance, in 2023, Septwolves reported a revenue of ¥7.11 billion, showcasing its significant market presence built on years of brand investment.

New entrants must overcome the substantial hurdle of building brand awareness and establishing credibility in China's crowded and dynamic fashion landscape. The cost associated with marketing, advertising, and creating a compelling brand narrative can be prohibitive for startups aiming to compete with established players like Septwolves, which has a well-recognized logo and extensive distribution network.

Septwolves benefits from a well-established distribution network, encompassing both a significant physical retail footprint and robust online e-commerce channels. This existing infrastructure presents a substantial hurdle for newcomers aiming to reach their target customers effectively.

New entrants face the considerable challenge of securing access to effective distribution channels, a task made more difficult by the entrenched market power of established players and the substantial investment required to build a comparable physical presence. For instance, in 2023, the apparel market saw continued consolidation, with major online retailers like Tmall and JD.com dominating a significant share of online sales, making it harder for new brands to gain visibility without substantial marketing spend or strategic partnerships.

Supply Chain Integration and Supplier Relationships

New companies entering the apparel market face significant hurdles in establishing integrated supply chains, a critical factor for cost competitiveness and operational efficiency. Fujian Septwolves Industry, for instance, has cultivated decades-long relationships with suppliers, ensuring consistent access to quality materials and favorable pricing. This deep integration makes it difficult for newcomers to replicate the same level of cost control and reliability.

Established brands like Septwolves benefit from economies of scale in sourcing and manufacturing, which new entrants cannot immediately match. For example, in 2023, Septwolves reported significant production volumes, allowing them to negotiate better terms with raw material providers and logistics partners. This scale advantage directly impacts the cost structure, creating a barrier for smaller, less established competitors.

Securing reliable and cost-effective manufacturing partners is another challenge. Septwolves likely has established contracts and quality control processes with its manufacturing base, built over years of collaboration. New entrants must invest considerable time and resources to identify, vet, and build trust with suitable manufacturing facilities, often at less advantageous terms initially.

- Supply Chain Complexity: New entrants struggle to build the intricate, multi-stage supply chains that established players like Septwolves have perfected.

- Supplier Relationships: Long-standing partnerships provide Septwolves with preferential pricing and guaranteed supply, a difficult advantage for newcomers to overcome.

- Economies of Scale: Septwolves' large-scale operations in 2023, which supported their extensive product lines, translate to lower per-unit costs, a barrier to entry for smaller competitors.

- Manufacturing Access: Gaining access to efficient and quality-controlled manufacturing facilities at competitive rates requires time and significant investment, posing a challenge for new entrants.

Government Regulations and Trade Policies

Government regulations and trade policies significantly shape the threat of new entrants for companies like Fujian Septwolves Industry. The Chinese government's strategic initiatives, such as promoting domestic brands through the 'Guochao' movement, create a more favorable environment for local players, thereby increasing the barrier for international competitors seeking to enter the market. For instance, in 2024, policies aimed at bolstering domestic consumption and manufacturing continue to be a key focus in China's economic planning.

Navigating the complex web of local regulations, including product standards, licensing, and environmental compliance, presents a substantial hurdle for any new entrant. Furthermore, evolving trade policies and geopolitical tensions can introduce unpredictability and impose additional costs. In 2023, China's apparel and textile sector, a key market for Septwolves, faced ongoing scrutiny regarding international trade practices, impacting import and export dynamics.

- Regulatory Compliance Costs: New entrants must invest heavily to meet China's stringent product safety and environmental regulations, which can deter smaller or less capitalized businesses.

- Trade Barriers and Tariffs: Import tariffs and non-tariff barriers can increase the cost of goods for foreign companies, making it harder to compete on price with established domestic brands.

- Government Support for Domestic Brands: Initiatives like 'Guochao' directly favor local companies, potentially limiting market share gains for new international entrants.

The threat of new entrants for Fujian Septwolves Industry is moderate, primarily due to significant capital requirements and established brand loyalty. However, the rise of asset-light strategies and online platforms is lowering some entry barriers, making it easier for agile newcomers to gain a foothold.

New companies face substantial costs in building brand recognition and distribution networks, especially when competing against established players like Septwolves, which reported ¥7.11 billion in revenue in 2023. Overcoming these challenges requires considerable investment in marketing and logistics.

Economies of scale in sourcing and manufacturing, a key advantage for Septwolves in 2023, create a cost barrier. New entrants struggle to match the preferential pricing and guaranteed supply that decades-long supplier relationships provide.

| Barrier to Entry | Impact on New Entrants | Septwolves' Advantage (2023 Data) |

|---|---|---|

| Capital Requirements | High (factories, inventory) | Established infrastructure |

| Brand Loyalty | Difficult to build | Strong customer trust |

| Distribution Networks | Costly to replicate | Extensive physical and online presence |

| Economies of Scale | Limited initial purchasing power | Lower per-unit costs from high volume |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fujian Septwolves Industry is built upon a foundation of reliable data, including the company's annual reports, industry-specific market research, and relevant trade publications to capture the competitive landscape.