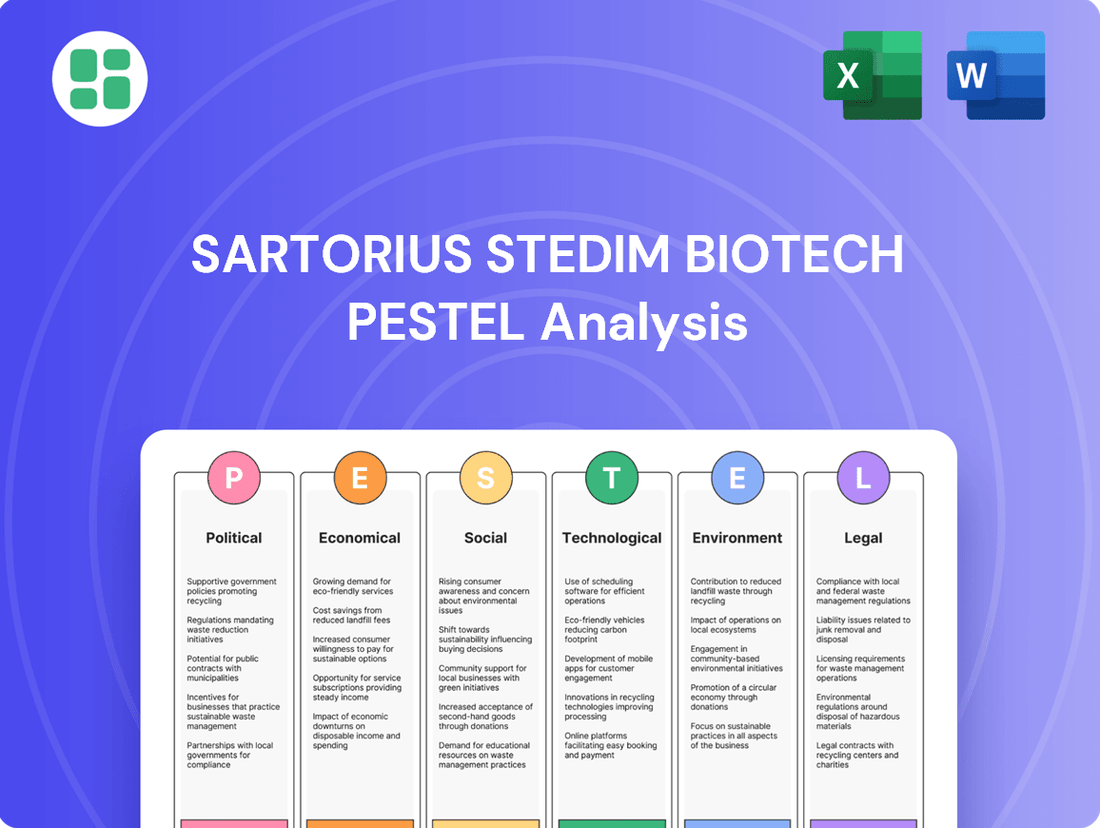

Sartorius Stedim Biotech PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sartorius Stedim Biotech Bundle

Navigate the complex external forces shaping Sartorius Stedim Biotech's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges. Download the full version to gain actionable intelligence and refine your strategic approach.

Political factors

Government funding for life sciences and R&D is a major driver for companies like Sartorius Stedim Biotech. In 2024, many governments globally continued to prioritize biopharmaceutical innovation through grants for drug discovery and clinical trials. For instance, the U.S. National Institutes of Health (NIH) allocated over $47 billion in funding for biomedical research in fiscal year 2023, a significant portion of which supports areas directly relevant to Sartorius Stedim Biotech's cell and gene therapy technologies.

These funding initiatives, including those seen in the European Union's Horizon Europe program, which aims to invest €95.5 billion through 2027, directly bolster the investment capacity of Sartorius Stedim Biotech's customer base. Policies encouraging public-private partnerships, such as the UK's Life Sciences Vision, further accelerate R&D, creating a more robust market for Sartorius Stedim Biotech's upstream and downstream processing solutions.

Global trade policies, tariffs, and international agreements significantly impact Sartorius Stedim Biotech's operational costs and the efficiency of its supply chain. For instance, changes in trade relations between major economies can directly affect the price and availability of critical raw materials and components used in their bioprocess solutions.

As a company with a global footprint, Sartorius Stedim Biotech is particularly vulnerable to shifts in international trade dynamics and geopolitical tensions. These factors can disrupt the stability of its worldwide supply networks and lead to increased operational expenses, impacting overall profitability and market access.

Evolving healthcare policies, especially those concerning drug pricing and reimbursement, directly influence the profitability of biopharmaceutical firms. This, in turn, shapes their willingness to invest in advanced manufacturing technologies and services like those offered by Sartorius Stedim Biotech. For instance, the Inflation Reduction Act (IRA) in the U.S. is designed to lower prescription drug costs, potentially impacting the financial strategies of drug developers and, consequently, the demand for Sartorius Stedim Biotech's solutions. In 2024, the IRA's negotiation process for Medicare drug prices is expected to continue impacting R&D budgets.

Geopolitical stability and supply chain resilience

Geopolitical shifts significantly impact the biopharmaceutical supply chain's robustness. For companies like Sartorius Stedim Biotech, events such as international conflicts or rising protectionism, which spurs supply chain localization, demand agile strategies to maintain uninterrupted product flow. For instance, the ongoing geopolitical tensions in Eastern Europe have highlighted the vulnerabilities in global logistics networks, leading many life science companies to re-evaluate their sourcing strategies. This has driven increased investment in diversifying manufacturing and distribution hubs, aiming to mitigate risks associated with single-region dependencies.

The push for supply chain resilience is a direct response to these geopolitical realities. Sartorius Stedim Biotech, as a key supplier of laboratory and bioprocess solutions, must navigate these complexities. In 2024, many companies in the sector reported increased costs associated with diversifying their supplier base and establishing regional manufacturing capabilities to counter potential disruptions. This strategic adaptation is crucial for ensuring the consistent availability of critical components and finished goods to their global customer base.

- Geopolitical Instability: Increased risk of supply chain disruptions due to international conflicts and trade disputes.

- Supply Chain Localization: Trend towards reshoring or near-shoring manufacturing to reduce reliance on distant suppliers.

- Strategic Adaptation: Companies like Sartorius Stedim Biotech must invest in diversified sourcing and regional production.

- Cost Implications: Diversification efforts may lead to higher operational costs in the short to medium term.

Regulatory harmonization efforts across regions

Efforts to align regulatory standards, such as those between the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA), are gaining momentum. This harmonization aims to simplify and expedite the journey of new therapies from lab to market, a process that can significantly reduce the time and expense involved in drug development and manufacturing.

For companies like Sartorius Stedim Biotech, which provides critical equipment and services for biopharmaceutical production, regulatory harmonization translates into a more predictable and efficient operating environment. This can lead to increased demand for their standardized solutions as more companies seek to navigate global markets with greater ease.

- Global Regulatory Alignment: Initiatives like the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) continue to drive convergence in guidelines, impacting areas like Good Manufacturing Practices (GMP).

- Reduced Market Entry Barriers: Harmonized regulations can lower the complexity and cost of obtaining approvals in multiple key markets, potentially accelerating the adoption of new bioprocessing technologies.

- Impact on Equipment Standards: As regulatory expectations become more consistent, there's a greater likelihood of biopharmaceutical manufacturers adopting globally recognized equipment and service standards, benefiting suppliers like Sartorius Stedim Biotech.

Governmental support for life sciences through R&D funding remains a critical factor for Sartorius Stedim Biotech, with many nations continuing to prioritize biopharmaceutical innovation. For example, the U.S. NIH's substantial budget, exceeding $47 billion for fiscal year 2023, directly fuels research in areas relevant to Sartorius Stedim Biotech's advanced therapies. Similarly, the EU's Horizon Europe program, with its €95.5 billion commitment through 2027, enhances the investment capacity of the company's client base, fostering demand for its bioprocessing solutions.

Evolving healthcare policies, particularly those focused on drug pricing and reimbursement, directly influence biopharmaceutical companies' investment in advanced manufacturing technologies. The U.S. Inflation Reduction Act (IRA), aiming to lower prescription drug costs, continues to shape R&D budgets and, consequently, the demand for Sartorius Stedim Biotech's offerings, with ongoing negotiations on Medicare drug prices in 2024 impacting these financial strategies.

Geopolitical shifts and the drive for supply chain resilience are compelling companies like Sartorius Stedim Biotech to adapt. The trend towards supply chain localization and the need to mitigate disruptions from international conflicts have led to increased investment in diversifying manufacturing and distribution hubs. This strategic adaptation, reported by many in the sector in 2024, is crucial for maintaining consistent product flow and managing operational costs associated with these changes.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Sartorius Stedim Biotech, offering a comprehensive overview of the external landscape.

It provides actionable insights for strategic decision-making, highlighting potential opportunities and threats within the biopharmaceutical industry.

The Sartorius Stedim Biotech PESTLE analysis acts as a pain point reliever by offering a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus simplifying complex external factors.

Economic factors

Global economic growth significantly influences healthcare spending, which in turn drives demand for Sartorius Stedim Biotech's products. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight pickup from 3.0% in 2023. This economic expansion generally translates to higher disposable incomes and increased government budgets allocated to healthcare, benefiting companies like Sartorius.

Increased healthcare spending directly fuels the biopharmaceutical sector, creating a robust market for bioprocessing solutions. As economies grow, there's a greater capacity for investment in research and development, new drug discovery, and the expansion of manufacturing capabilities. This trend is vital for Sartorius Stedim Biotech, as its equipment and services are integral to the production of life-saving therapies.

In 2023, global healthcare spending was estimated to reach $10 trillion, a figure expected to continue its upward trajectory. This substantial market underscores the direct correlation between economic health and the demand for advanced bioprocessing technologies that Sartorius Stedim Biotech provides, enabling the production of innovative medicines.

Inflationary pressures and fluctuating raw material costs directly affect Sartorius Stedim Biotech's production expenses. For instance, the global inflation rate, which saw significant increases in 2023 and is projected to remain elevated in 2024, can drive up the cost of essential materials for bioprocessing.

Managing these rising input costs is crucial for maintaining profitability. Sartorius Stedim Biotech's ability to implement efficiency gains in its manufacturing processes or strategically adjust pricing for its products will be key to preserving its robust EBITDA margins, which have historically been strong, demonstrating the company's operational resilience.

As a global player with significant operations and sales in Europe, North America, and Asia, Sartorius Stedim Biotech is inherently exposed to the volatility of currency exchange rates. These fluctuations can directly impact the company's reported financial performance.

When Sartorius Stedim Biotech converts earnings from foreign currencies back into its reporting currency, typically the Euro, fluctuations can alter the reported revenue, costs, and ultimately, its profitability. For instance, a stronger Euro against currencies like the US Dollar or Chinese Yuan could reduce the value of sales made in those regions when translated back.

In 2024, for example, the Euro experienced a period of strengthening against the US Dollar, which could have presented a headwind for companies like Sartorius Stedim Biotech with substantial North American sales. Conversely, a weaker Euro can boost reported earnings from overseas markets.

Access to capital for biopharma startups and established companies

The availability of capital is a critical determinant for biopharma companies, influencing their capacity to invest in crucial research, development, and manufacturing scale-ups. For startups, securing funding is often a make-or-break scenario, directly impacting their survival and innovation pipeline.

A tightening capital market, especially for early-stage biotechs, can translate into reduced spending on capital equipment and slower integration of novel technologies. This directly affects Sartorius Stedim Biotech's sales of its advanced filtration, purification, and single-use systems, as companies become more conservative with their investments.

For instance, venture capital funding for biotech startups saw a notable dip in early 2024 compared to the peak years, with global biotech VC funding reaching approximately $15 billion in the first half of 2024, down from over $20 billion in the same period of 2023. This trend underscores the increased pressure on startups to demonstrate clear commercial viability to attract investment, potentially slowing the adoption of Sartorius Stedim Biotech's cutting-edge solutions.

- Venture Capital Funding Trends: Global biotech VC funding experienced a slowdown in early 2024, impacting the capital available for startups.

- Impact on R&D and Expansion: Limited access to capital directly curtails biopharma companies' ability to fund research, development, and manufacturing expansions.

- Technology Adoption: A constrained funding environment can lead to cautious capital expenditure and a slower adoption rate of new technologies by biopharma firms.

- Sartorius Stedim Biotech's Sales: Reduced investment by biopharma companies in capital equipment and systems directly affects Sartorius Stedim Biotech's revenue streams.

R&D investment trends by pharmaceutical companies

Pharmaceutical companies are significantly increasing their R&D investments, particularly in novel therapeutic areas. For instance, global pharmaceutical R&D spending was projected to reach over $240 billion in 2024, a notable increase from previous years.

This surge in R&D is directly fueling demand for sophisticated bioprocessing solutions. As companies pivot towards advanced therapies such as cell and gene therapies, the need for specialized equipment and single-use technologies, areas where Sartorius Stedim Biotech excels, is growing rapidly.

- Increased R&D Spending: Global pharmaceutical R&D expenditure is on an upward trajectory, with significant investments anticipated in 2024 and 2025.

- Shift to New Modalities: A growing focus on cell and gene therapies and personalized medicine is reshaping R&D priorities.

- Demand for Specialized Solutions: These advanced therapeutic approaches necessitate advanced bioprocessing equipment and consumables.

- Sartorius Stedim Biotech's Position: The company is strategically aligned to capitalize on this trend with its expertise in single-use technologies and bioprocessing.

Global economic growth directly impacts healthcare spending, which in turn drives demand for Sartorius Stedim Biotech's products. The IMF projected global growth at 3.2% for 2024, a slight increase from 2023, fostering greater investment in healthcare and biopharmaceutical innovation.

Inflationary pressures and fluctuating raw material costs can impact Sartorius Stedim Biotech's production expenses. Global inflation, elevated in 2023 and expected to remain so in 2024, increases the cost of essential bioprocessing materials, necessitating efficient cost management.

Currency exchange rate volatility affects Sartorius Stedim Biotech's financial performance, especially with significant operations in Europe, North America, and Asia. Fluctuations can alter the reported value of sales and profits when converted into the company's reporting currency, the Euro.

The availability of capital is crucial for biopharma companies' R&D and expansion efforts. A tightening capital market, particularly for early-stage biotechs, can reduce spending on capital equipment, slowing the adoption of Sartorius Stedim Biotech's advanced solutions.

| Economic Factor | 2024 Projection/Data | Impact on Sartorius Stedim Biotech |

|---|---|---|

| Global Economic Growth | IMF projected 3.2% (2024) | Drives healthcare spending and biopharma investment. |

| Global Inflation Rate | Elevated in 2023, expected to remain high in 2024 | Increases production costs for raw materials. |

| Currency Exchange Rates | Euro strengthening against USD in early 2024 | Can reduce reported earnings from North American sales. |

| Biotech VC Funding | Approx. $15 billion (H1 2024) vs. >$20 billion (H1 2023) | Restricts capital for startups, potentially slowing technology adoption. |

Preview the Actual Deliverable

Sartorius Stedim Biotech PESTLE Analysis

The preview shown here is the exact Sartorius Stedim Biotech PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Sartorius Stedim Biotech, delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same Sartorius Stedim Biotech PESTLE Analysis document you’ll download after payment, providing comprehensive insights into its operating environment.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, nearly one in six people globally will be over the age of 65. This demographic shift, coupled with a concerning rise in chronic diseases—such as cardiovascular conditions, diabetes, and cancer—directly fuels the demand for innovative biopharmaceutical treatments. For instance, the global prevalence of diabetes alone was estimated to be around 537 million adults in 2021 and is projected to reach 783 million by 2045, according to the International Diabetes Federation.

This sustained and expanding need for advanced therapies translates into robust long-term growth opportunities for the biopharmaceutical sector. Companies like Sartorius Stedim Biotech, which provide essential tools and technologies for drug development and manufacturing, are well-positioned to benefit from this trend. The increasing burden of chronic illness necessitates continuous investment in research and development, driving the market for upstream and downstream processing solutions that Sartorius specializes in.

The biopharmaceutical industry's shift towards personalized medicine and the burgeoning market for biologics, particularly cell and gene therapies, present a significant tailwind for Sartorius Stedim Biotech. These advanced treatments, often tailored to individual patients, necessitate sophisticated, flexible manufacturing processes. For instance, the global cell and gene therapy market was projected to reach over $30 billion by 2025, highlighting the immense growth potential in this area.

Public trust in biotech and pharma significantly shapes how quickly new treatments are adopted. For instance, a 2023 Pew Research Center survey found that while a majority of Americans (57%) believe the benefits of medical research outweigh the risks, a notable portion remains cautious, highlighting the need for clear communication and demonstrable safety.

This public sentiment directly impacts regulatory bodies and market demand for Sartorius Stedim Biotech's products. Positive public perception can streamline approval processes and boost uptake of innovative therapies, as seen with the rapid global rollout of mRNA vaccines. Conversely, negative public perception, often fueled by concerns about pricing or side effects, can lead to stricter regulations and slower market penetration for new biotechnological advancements.

Workforce availability and skilled labor in life sciences

The life sciences and biomanufacturing sectors heavily rely on a skilled workforce for innovation and efficient production. A deficit in specialized professionals, such as bioprocess engineers and cell culture technicians, can significantly hinder drug development timelines and manufacturing capacity for Sartorius Stedim Biotech's clients. For instance, in 2024, reports indicated a growing demand for these roles, with some regions experiencing a shortage of over 15% for experienced biomanufacturing personnel.

This scarcity directly impacts the pace at which new therapies can be brought to market. Consequently, Sartorius Stedim Biotech, as a key supplier to these industries, faces potential operational constraints if its customers struggle to find qualified staff to operate and maintain advanced equipment. The global biopharmaceutical market, projected to reach over $700 billion by 2025, underscores the immense pressure on talent acquisition within this field.

- Growing demand for bioprocess engineers and cell culture specialists.

- Potential bottlenecks in drug development and manufacturing due to talent shortages.

- Impact on Sartorius Stedim Biotech's customer operations and its own service delivery.

- The biopharmaceutical market's expansion amplifies the need for skilled labor.

Ethical considerations in drug development and manufacturing

Societal and ethical considerations are increasingly shaping drug development, especially for cutting-edge treatments like gene therapies. Public perception and ethical debates around these advanced technologies can directly influence government policies and the regulations that companies like Sartorius Stedim Biotech must adhere to. For instance, by mid-2025, ongoing discussions about equitable access to gene therapies, which can cost hundreds of thousands of dollars per treatment, are expected to intensify, potentially leading to new pricing and reimbursement frameworks.

Navigating this evolving ethical terrain is crucial for Sartorius Stedim Biotech. Ensuring their technologies and services align with societal values, such as patient safety and responsible innovation, is paramount. The company’s commitment to ethical practices will be a key factor in maintaining public trust and securing its long-term social license to operate in a sector where public scrutiny is high.

- Public Scrutiny: Public opinion on genetic modifications and advanced therapies can lead to calls for stricter oversight, impacting market acceptance and regulatory pathways.

- Ethical Frameworks: Development of robust ethical guidelines for gene editing and cell therapy manufacturing is ongoing, with potential implications for quality control and data privacy.

- Access and Equity: Societal pressure for affordable and accessible advanced therapies may drive policy changes that affect manufacturing scale and cost-efficiency demands on suppliers like Sartorius Stedim Biotech.

Societal trends, such as an aging global population and the rise of chronic diseases, are a significant driver for Sartorius Stedim Biotech, increasing demand for advanced biopharmaceutical treatments. For example, by 2050, one in six people worldwide will be over 65, and the global diabetes prevalence was around 537 million adults in 2021, projected to hit 783 million by 2045.

Public trust and ethical considerations heavily influence the adoption of new biotech innovations, impacting regulatory pathways and market acceptance. Concerns about equitable access to high-cost therapies, like gene therapies, are expected to intensify by mid-2025, potentially leading to new pricing frameworks.

A shortage of skilled professionals in biomanufacturing, such as bioprocess engineers, poses a challenge, potentially hindering drug development timelines. Reports in 2024 indicated a shortage of over 15% for experienced biomanufacturing personnel in some regions, a trend that amplifies the need for efficient and scalable manufacturing solutions.

| Sociological Factor | 2024/2025 Data Point | Impact on Sartorius Stedim Biotech |

| Aging Population & Chronic Disease | 1 in 6 globally over 65 by 2050; Diabetes projected to reach 783M by 2045. | Increased demand for biopharmaceutical treatments and manufacturing solutions. |

| Public Trust & Ethics | Ongoing debate on gene therapy access and pricing by mid-2025. | Influences regulatory approval and market acceptance of advanced therapies. |

| Skilled Workforce Shortage | Over 15% shortage of experienced biomanufacturing personnel in some regions (2024). | Potential bottlenecks in client operations, increasing need for automation and support. |

Technological factors

Sartorius Stedim Biotech's core strategy heavily relies on the ongoing evolution of single-use technologies and automation. These advancements are critical for their customers in the biopharmaceutical sector.

These innovations directly translate into tangible benefits for biomanufacturers, offering greater production agility and significantly reducing the potential for cross-contamination. Furthermore, the reduced upfront capital expenditure associated with single-use systems makes them a compelling proposition, especially for emerging biotech firms.

The market for bioprocessing equipment, including single-use solutions, saw robust growth. For instance, the global single-use bioprocessing market was valued at approximately $7.5 billion in 2023 and is projected to reach over $16 billion by 2030, demonstrating a compound annual growth rate of over 11%, according to various market research reports from late 2024.

The burgeoning field of gene and cell therapies is rapidly expanding, with the U.S. Food and Drug Administration (FDA) approving an increasing number of these advanced treatments. For instance, by the end of 2023, the FDA had authorized over 30 cell and gene therapies, a number projected to climb significantly in 2024 and 2025. This growth directly fuels the need for specialized manufacturing capabilities.

These complex therapies, often produced in smaller, highly customized batches, demand flexible and sterile production environments. Sartorius Stedim Biotech's portfolio of single-use bioreactors and filtration systems is particularly well-positioned to meet these stringent requirements. The company's solutions offer the adaptability and contamination control essential for the successful and scalable production of these innovative treatments.

The biopharmaceutical industry is rapidly adopting digitalization and Industry 4.0 principles, integrating AI, machine learning, and digital twins into bioprocessing. This shift is crucial for Sartorius Stedim Biotech, as these technologies allow for real-time data analysis and predictive modeling, significantly improving process control and yield. For instance, the adoption of advanced analytics in biomanufacturing is projected to boost efficiency by up to 30% by 2025.

Development of novel filtration and purification techniques

Ongoing advancements in filtration and purification methods are crucial for enhancing biopharmaceutical production efficiency and product quality. Sartorius Stedim Biotech's commitment to research and development in these cutting-edge techniques directly translates into superior solutions for their clients, boosting product yield and purity.

This focus on innovation solidifies Sartorius Stedim Biotech's competitive edge. For instance, their development of single-use filtration systems, a key area of technological advancement, has been a significant driver of growth. In 2023, the company reported a substantial increase in sales for its bioprocess solutions, which heavily feature these advanced filtration technologies, demonstrating their market impact.

- Enhanced Product Purity: New techniques minimize impurities, leading to safer and more effective biopharmaceuticals.

- Increased Manufacturing Yield: Improved filtration processes capture more of the desired product, reducing waste.

- Streamlined Production: Novel methods often simplify complex purification steps, saving time and resources.

- Market Leadership: Sartorius Stedim Biotech's investment in R&D for these technologies underpins their position as a key supplier to the biopharma industry.

Data analytics and AI for process optimization and drug discovery

Data analytics and AI are revolutionizing bioprocessing and drug discovery for companies like Sartorius Stedim Biotech. These technologies offer powerful ways to fine-tune cell culture conditions, predict experimental results, and speed up the identification of promising drug targets. For instance, AI algorithms can analyze vast datasets from experiments to pinpoint optimal parameters, leading to higher yields and more consistent product quality.

The impact on efficiency is substantial. By accelerating drug target identification and streamlining clinical trial processes, AI and data analytics can significantly reduce the time and cost associated with bringing new therapies to market. This enhanced efficiency directly benefits the entire biopharmaceutical value chain, from initial research to final production. In 2024, investments in AI for drug discovery alone were projected to reach tens of billions of dollars globally, highlighting the sector's commitment to these advancements.

- Process Optimization: AI can analyze real-time bioprocessing data to adjust parameters like temperature, pH, and nutrient levels, improving cell growth and protein production.

- Drug Discovery Acceleration: Machine learning models are identifying potential drug candidates and predicting their efficacy and toxicity at speeds previously unimaginable.

- Predictive Maintenance: Data analytics can forecast equipment failures in manufacturing, reducing downtime and ensuring continuous production.

- Clinical Trial Efficiency: AI is being used to identify suitable patient populations and predict trial outcomes, potentially shortening development timelines.

Technological advancements are paramount for Sartorius Stedim Biotech, particularly in single-use systems and automation, which are vital for biopharmaceutical manufacturing agility and contamination control. The market for these solutions is expanding rapidly, with the global single-use bioprocessing market valued at around $7.5 billion in 2023 and expected to exceed $16 billion by 2030, reflecting an over 11% CAGR.

The growth in gene and cell therapies, with over 30 FDA-approved treatments by the end of 2023 and continued expansion anticipated in 2024-2025, directly drives demand for Sartorius Stedim Biotech's flexible and sterile production solutions.

Digitalization and Industry 4.0 principles, including AI and machine learning, are transforming bioprocessing, enabling real-time data analysis and predictive modeling. This adoption is projected to enhance manufacturing efficiency by up to 30% by 2025.

Sartorius Stedim Biotech's investment in R&D for advanced filtration and purification techniques enhances product purity and manufacturing yield, solidifying its market leadership. For instance, sales of their bioprocess solutions, featuring advanced filtration, saw substantial growth in 2023.

Legal factors

Compliance with stringent regulatory approvals and standards from bodies like the FDA and EMA is paramount in the biopharmaceutical industry. Sartorius Stedim Biotech's products and services must meet these evolving global requirements, and their ability to facilitate customer compliance is a key competitive advantage. For instance, in 2023, the FDA approved over 50 new molecular entities, highlighting the dynamic regulatory landscape that Sartorius Stedim Biotech actively supports through its advanced filtration and purification technologies.

Intellectual property rights and patent protection are cornerstones for Sartorius Stedim Biotech, particularly in the biopharmaceutical industry. Strong legal frameworks safeguard their innovative technologies, ensuring a competitive edge and encouraging continued investment in research and development. For instance, the company's focus on single-use technologies and advanced filtration systems relies heavily on patents to protect its unique designs and manufacturing processes.

The enforcement of these patents directly impacts R&D spending and market positioning. In 2023, Sartorius Stedim Biotech continued to invest significantly in innovation, with a substantial portion of its revenue allocated to R&D, underscoring the importance of IP protection in recouping these investments. The company actively monitors and defends its patent portfolio against infringements, a critical legal factor for maintaining its market leadership.

Strict regulations like Good Manufacturing Practices (GMP) are paramount in biomanufacturing, dictating every step of drug production. Sartorius Stedim Biotech's solutions are designed to help clients meet these stringent quality and safety standards, which is crucial for patient well-being and avoiding hefty penalties for non-compliance.

Data privacy regulations for patient data and research

Sartorius Stedim Biotech must navigate increasingly stringent data privacy regulations, such as the General Data Protection Regulation (GDPR), as the volume of patient and research data in biopharma continues to surge. These laws dictate how sensitive information is handled throughout the entire drug development lifecycle, from initial data collection and secure storage to its ultimate use in clinical trials and the advancement of personalized medicine. For instance, GDPR mandates strict consent protocols and data anonymization techniques, directly influencing research methodologies and the accessibility of data for analysis.

Compliance with these evolving legal frameworks is critical for Sartorius Stedim Biotech, impacting everything from their data management systems to their collaboration agreements with research institutions and pharmaceutical partners. Failure to adhere can result in substantial fines and reputational damage, underscoring the importance of robust data governance. The global nature of research means companies must often comply with multiple, sometimes conflicting, data protection laws, adding complexity to operations.

- GDPR Fines: Non-compliance with GDPR can lead to fines of up to €20 million or 4% of global annual revenue, whichever is higher.

- Data Breach Impact: A significant data breach involving patient data could cost companies millions in remediation, legal fees, and lost business, as seen in numerous healthcare incidents in recent years.

- Personalized Medicine: The growth of personalized medicine relies heavily on access to large, anonymized patient datasets, making data privacy compliance a foundational element for innovation in this area.

- Research Data Integrity: Regulations ensure the integrity and ethical use of research data, building trust among patients and contributing to the overall reliability of scientific findings.

Product liability laws and compliance

Product liability laws are a critical consideration for Sartorius Stedim Biotech, as they hold manufacturers responsible for any harm caused by their products. This is especially pertinent given their role in supplying equipment and consumables for drug production, where product safety and efficacy are paramount. Failure to meet these stringent standards can lead to significant legal repercussions and damage to the company's standing.

Sartorius Stedim Biotech must maintain rigorous quality control and adhere to all relevant regulations to ensure its products are safe and perform as expected. For instance, in 2023, the global product liability litigation market was valued at approximately USD 18 billion, highlighting the substantial financial risks involved. Staying compliant is key to mitigating these risks and preserving the trust of its biopharmaceutical clients.

Key aspects of product liability compliance for Sartorius Stedim Biotech include:

- Ensuring product design and manufacturing adhere to international safety standards.

- Providing clear and accurate instructions for product use and maintenance.

- Implementing robust post-market surveillance to identify and address potential issues promptly.

- Maintaining comprehensive documentation for all products and their development processes.

The biopharmaceutical sector operates under a complex web of legal and regulatory requirements, directly impacting Sartorius Stedim Biotech's operations and product development. Compliance with stringent approvals from bodies like the FDA and EMA is non-negotiable, as demonstrated by the over 50 new molecular entities approved by the FDA in 2023, a landscape Sartorius Stedim Biotech actively supports.

Intellectual property protection is a critical legal pillar, safeguarding Sartorius Stedim Biotech's innovations in areas like single-use technologies. The company's significant R&D investments in 2023 underscore the necessity of robust patent enforcement to secure market position and recoup innovation costs.

Navigating data privacy laws, such as GDPR, is increasingly vital, especially with the rise of personalized medicine. These regulations influence data handling throughout the drug development lifecycle, with potential fines for non-compliance reaching up to 4% of global annual revenue, impacting research methodologies and data accessibility.

Product liability laws hold Sartorius Stedim Biotech accountable for the safety and efficacy of its biomanufacturing solutions. The company's commitment to rigorous quality control and adherence to international safety standards, in a market where product liability litigation reached approximately USD 18 billion in 2023, is essential for mitigating risks and maintaining client trust.

Environmental factors

The growing global focus on sustainability is significantly boosting the demand for greener manufacturing within the biopharmaceutical sector. Sartorius Stedim Biotech is actively addressing this by innovating with more environmentally friendly products and processes. Examples include their development of biodegradable single-use components and energy-efficient systems, which directly meet evolving customer and regulatory demands.

The biopharmaceutical industry's reliance on single-use technologies, a core offering for Sartorius Stedim Biotech, creates substantial waste management hurdles. Growing global concern over plastic pollution, particularly from disposable medical products, puts pressure on manufacturers to develop more sustainable solutions. For instance, the European Union's Single-Use Plastics Directive, implemented in 2021, aims to reduce plastic waste, indirectly impacting companies like Sartorius Stedim Biotech by encouraging the adoption of reusable or more easily recyclable alternatives where feasible.

Sartorius Stedim Biotech is actively exploring innovations in material science to mitigate the environmental impact of its disposable product portfolio. This includes researching biodegradable or compostable materials and designing products for easier recycling or energy recovery. The company's commitment to sustainability is crucial as regulatory bodies and end-users increasingly demand environmentally responsible practices throughout the product lifecycle, aligning with broader circular economy principles.

Energy consumption in bioprocessing facilities is a significant environmental consideration, with the sector's growth amplifying this impact. Sartorius Stedim Biotech is positioned to address this by developing and promoting equipment designed for greater energy efficiency. For instance, their single-use bioreactors and filtration systems are engineered to minimize power draw compared to traditional stainless-steel setups, contributing to a lower carbon footprint for their clients.

Beyond product design, Sartorius Stedim Biotech can foster sustainable operational practices by educating customers on optimizing energy use within their bioprocessing workflows. This includes guidance on efficient sterilization cycles and process scheduling. Furthermore, the company is exploring the integration of renewable energy sources into its own manufacturing operations and encouraging similar adoption by its customer base to further reduce environmental strain.

Water usage and wastewater treatment regulations

Water scarcity and increasingly strict wastewater treatment regulations present significant environmental challenges for the biomanufacturing sector. Companies must navigate complex compliance requirements and minimize their ecological footprint. Sartorius Stedim Biotech offers technologies designed to help its clients manage water resources more efficiently and treat wastewater effectively, thereby supporting both environmental stewardship and regulatory adherence.

For instance, the global biopharmaceutical industry's water consumption is substantial, with some facilities using millions of liters daily for processes like purification and cleaning. In 2024, many regions are experiencing heightened water stress, intensifying the need for water optimization. Sartorius Stedim Biotech's filtration and single-use technologies can reduce water needed for cleaning-in-place (CIP) and sterilization-in-place (SIP) cycles, and their wastewater solutions aim to improve effluent quality to meet stringent discharge limits, which are projected to become even more rigorous by 2025.

- Water Scarcity: Many biomanufacturing hubs are in regions facing increased water stress, impacting operational continuity and costs.

- Regulatory Landscape: Wastewater discharge standards are tightening globally, requiring advanced treatment methods to remove biological contaminants and chemicals.

- Sartorius Stedim Biotech's Role: The company provides solutions that reduce water consumption in bioprocessing and enhance the efficiency of wastewater treatment, aiding compliance.

- Industry Impact: Optimizing water usage and wastewater management is crucial for sustainability and cost-effectiveness in biopharmaceutical production, with an estimated 10-15% reduction in water usage achievable through advanced process design by 2025.

Supply chain environmental footprint and carbon emissions targets

Companies are increasingly focused on their supply chains' environmental impact, with a growing emphasis on carbon emissions. Sartorius Stedim Biotech, like many in its sector, is under pressure to not only manage its own operational emissions but also to work with suppliers to lower the overall carbon footprint. This includes everything from raw material sourcing to product delivery.

In 2023, the European Union's emissions trading system saw carbon prices average around €95 per tonne of CO2, a significant increase that highlights the financial implications of emissions. For Sartorius Stedim Biotech, this means investing in greener logistics and encouraging sustainable practices among its partners. For instance, a 2024 report by the CDP (formerly the Carbon Disclosure Project) indicated that over 70% of companies now have some form of supply chain decarbonization strategy in place.

- Supply Chain Scrutiny: Businesses are actively assessing and reporting on the environmental performance of their entire value chain.

- Carbon Targets: Many companies, including those in the life sciences, are setting ambitious goals to reduce greenhouse gas emissions across their operations and supply networks.

- Collaboration is Key: Sartorius Stedim Biotech's success in reducing its environmental footprint is dependent on effective collaboration with its suppliers and logistics providers.

- Regulatory and Market Pressures: Increasing carbon pricing mechanisms and investor demand for sustainability are driving these changes.

Environmental regulations are becoming more stringent, pushing companies like Sartorius Stedim Biotech to invest in cleaner technologies and sustainable practices. The growing awareness of climate change and plastic pollution directly influences product development and operational strategies within the biopharmaceutical sector. For instance, by 2025, the European Environment Agency anticipates further tightening of waste management directives, impacting the lifecycle management of single-use technologies.

Sartorius Stedim Biotech's commitment to sustainability is evident in its pursuit of biodegradable materials and energy-efficient bioprocessing equipment. The company aims to reduce the environmental footprint associated with biopharmaceutical manufacturing, a sector that has historically been resource-intensive. Their focus on innovation in areas like water management and waste reduction is critical for meeting evolving customer expectations and regulatory demands.

The company's efforts to address environmental concerns are also reflected in its supply chain management, with a growing emphasis on reducing carbon emissions. By collaborating with suppliers and optimizing logistics, Sartorius Stedim Biotech is working to lower its overall environmental impact. This proactive approach is essential as industries worldwide face increasing pressure to adopt more sustainable business models, with many companies setting ambitious greenhouse gas reduction targets for 2025 and beyond.

PESTLE Analysis Data Sources

Our Sartorius Stedim Biotech PESTLE Analysis is informed by a comprehensive review of official government publications, leading economic databases, and reputable industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the biopharmaceutical and life sciences sectors.