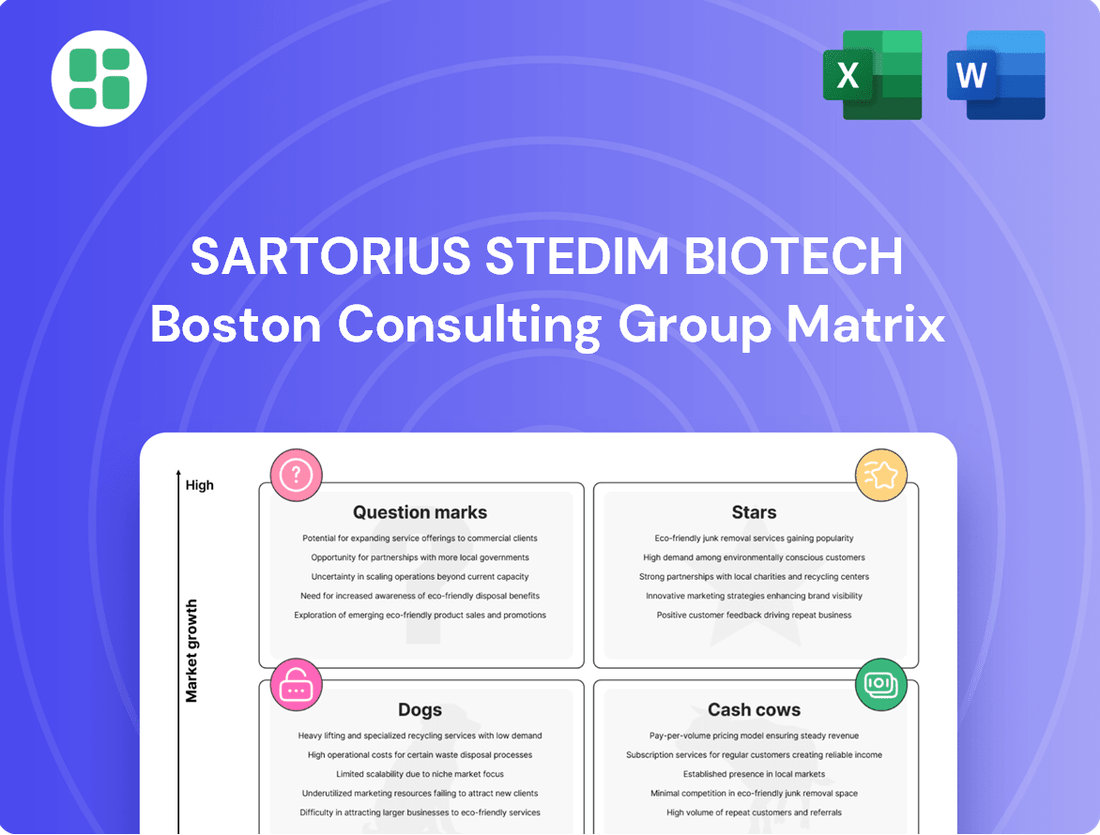

Sartorius Stedim Biotech Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sartorius Stedim Biotech Bundle

Uncover the strategic positioning of Sartorius Stedim Biotech's product portfolio with our comprehensive BCG Matrix analysis. See which innovations are poised for growth and which are generating consistent returns.

This preview offers a glimpse into the power of the BCG Matrix for Sartorius Stedim Biotech. For a complete understanding of their market share and growth potential, including actionable strategies for each quadrant, invest in the full report.

Don't miss out on the critical insights that will shape your investment decisions. Purchase the full BCG Matrix to gain a detailed roadmap for optimizing Sartorius Stedim Biotech's product strategy and securing future success.

Stars

Sartorius Stedim Biotech is making significant strides in the advanced cell and gene therapy bioprocessing market, a sector projected to grow at an impressive 20-30% annually. Their strategic investments and expanded product portfolio are designed to meet the escalating demand for these cutting-edge treatments.

The acquisition of Polyplus in 2023 was a pivotal move, equipping Sartorius with advanced transfection technologies essential for the development and large-scale manufacturing of cell and gene therapies. This integration bolsters their position in a high-growth market.

By focusing on enabling faster and more efficient production, Sartorius Stedim Biotech is capturing a substantial market share in the rapidly expanding cell and gene therapy space. Their commitment to innovation supports the commercialization of novel therapeutic approaches.

Sartorius Stedim Biotech stands out in the single-use bioreactor market, especially with its impressive 2,500-liter system, which currently faces no direct competition. This strong product offering places them firmly in the "star" category of the BCG matrix.

The market for single-use bioreactors is experiencing robust growth, with projections indicating a compound annual growth rate of 18% between 2025 and 2032. This rapid expansion, driven by the increasing demand for high-volume biologics, further solidifies the star status of Sartorius Stedim Biotech's high-capacity single-use bioreactors.

The biopharmaceutical sector's growth, particularly in mRNA vaccine production, fuels a strong demand for specialized manufacturing consumables. Sartorius Stedim Biotech offers a wide array of single-use products, such as fluid management and filtration systems, crucial for these advanced therapies.

Sartorius Stedim Biotech's significant revenue from recurring consumables highlights their substantial market presence in this dynamic and vital manufacturing segment. For instance, in 2023, consumables represented a significant portion of their overall sales, underscoring their established role in supporting high-volume bioprocessing.

Cutting-Edge Downstream Purification Technologies

Sartorius Stedim Biotech is a leader in downstream purification, offering advanced solutions for biologics. Their commitment to innovation in filtration and purification, like high-throughput filters, boosts efficiency and cuts waste in biopharma manufacturing.

The company's continuous expansion of its product portfolio for biologics process development and manufacturing, particularly in advanced purification, solidifies its position. For instance, their acquisition of Novasep’s chromatography division in 2022 significantly strengthened their downstream capabilities, including chromatography resins and systems.

- Innovation in Filtration: Sartorius Stedim Biotech is at the forefront of developing new filtration technologies, such as their Sartoclear® filters, designed for higher throughput and improved impurity removal.

- Market Growth: The global biopharmaceutical purification market is experiencing robust growth, projected to reach over $20 billion by 2027, driven by the increasing demand for biologics.

- Competitive Edge: By providing cutting-edge purification solutions, Sartorius Stedim Biotech maintains a significant competitive advantage and a high market share in this specialized sector.

- Efficiency Gains: Their technologies aim to reduce processing times and costs, a critical factor for biopharmaceutical companies looking to scale up production efficiently.

Integrated Bioprocess Platforms for Biologics

Sartorius Stedim Biotech's integrated bioprocess platforms are a cornerstone of their offering, covering the entire biopharmaceutical production lifecycle. These solutions, from cell cultivation to fluid management, are highly sought after by customers for simplifying complex drug development and manufacturing processes.

The biologics market is experiencing robust expansion, and Sartorius Stedim Biotech's provision of complete, validated workflows positions them as a leader with a significant market share. For instance, in 2024, the global biologics market was projected to reach over $600 billion, highlighting the substantial demand for efficient production solutions.

- End-to-End Solutions: Sartorius Stedim Biotech provides integrated platforms that manage all critical stages of biopharmaceutical production.

- Customer Value: These comprehensive systems streamline drug development and manufacturing, offering significant advantages to clients.

- Market Growth: The expanding biologics sector, expected to see continued strong growth through 2025 and beyond, benefits from these advanced production capabilities.

- Market Leadership: The company's ability to deliver validated, end-to-end workflows solidifies its leading position and high market share in this dynamic industry.

Sartorius Stedim Biotech's single-use bioreactors, particularly their 2,500-liter system, represent a significant innovation with no direct competitors, firmly placing them in the Star quadrant of the BCG matrix. The market for these bioreactors is expanding rapidly, with an estimated 18% compound annual growth rate anticipated between 2025 and 2032, driven by the increasing need for large-scale biologics production. This robust market growth, coupled with Sartorius Stedim Biotech's unique product offering, solidifies their status as a market leader with substantial revenue-generating potential.

| Product Category | BCG Quadrant | Market Growth | Sartorius Stedim Biotech's Position | Key Data Point |

| Single-Use Bioreactors (High Capacity) | Star | 18% CAGR (2025-2032) | Market Leader, No Direct Competition | 2,500-liter system |

| Cell and Gene Therapy Solutions | Star | 20-30% Annual Growth | Strong Market Share, Advanced Technologies | Acquisition of Polyplus (2023) |

| Downstream Purification | Star | Projected to exceed $20 billion by 2027 | Leading Provider, High Market Share | Acquisition of Novasep's chromatography division (2022) |

| Integrated Bioprocess Platforms | Star | Continued strong growth through 2025+ | Leader in End-to-End Solutions | Global biologics market projected over $600 billion (2024) |

What is included in the product

This BCG Matrix overview analyzes Sartorius Stedim Biotech's portfolio, categorizing products as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment.

The Sartorius Stedim Biotech BCG Matrix offers a clear, visual framework to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Sartorius Stedim Biotech's standard single-use fluid management systems, encompassing bags, tubing, and connectors, are a prime example of a cash cow within their portfolio. This segment generates substantial, high-margin recurring revenue, underscoring its stable and predictable cash-generating capabilities.

These critical components are indispensable in biopharmaceutical manufacturing, a sector that has widely embraced single-use technologies. The market for these fluid management systems is mature, meaning growth is steady rather than explosive, but the established customer base and high switching costs ensure a consistent and significant cash flow for Sartorius Stedim Biotech.

Sartorius Stedim Biotech's established filtration units for bioprocessing are clear Cash Cows. The company commands a top-three market position, signifying a significant market share in a mature but crucial bioprocessing area. These units are fundamental to numerous biopharmaceutical processes, ensuring a consistent and reliable revenue stream.

The mature nature of the filtration market, characterized by low growth, means these products require minimal reinvestment. This allows them to convert their substantial sales into significant free cash flow, a hallmark of a Cash Cow. For instance, in 2023, Sartorius reported strong performance in its filtration segment, contributing significantly to the company's overall profitability.

Traditional single-use bioreactors in standard sizes are Sartorius Stedim Biotech's cash cows. These systems, having achieved broad industry adoption, are deeply embedded in current manufacturing processes, generating a reliable and steady income. Their significant market share in the mature single-use technology sector guarantees ongoing demand and profitability.

Cell Culture Media and Consumables for Established Biologics

Sartorius Stedim Biotech offers a comprehensive range of cell culture media and consumables specifically designed for the manufacturing of well-established biologics, such as monoclonal antibodies. These products represent core offerings with consistent, high-volume demand from a broad and stable customer base within a mature market segment.

The recurring nature of purchasing these essential, high-margin consumables is a key driver of Sartorius Stedim Biotech's strong profitability and substantial cash flow generation. For instance, in 2024, the biologics market, driven by established therapies, continued to show steady growth, underpinning the demand for these foundational products.

- Established Biologics Focus: Products are tailored for the production of mature biologic therapies, ensuring broad applicability.

- Recurring Revenue Stream: High demand for consumables from a large, existing customer base creates predictable income.

- Profitability Driver: The high margins on these essential items significantly contribute to the company's financial health.

- Market Maturity: Operating in a stable, mature market provides a solid foundation for consistent cash generation.

Bioprocess Consulting and Services

Bioprocess Consulting and Services, within Sartorius Stedim Biotech's portfolio, represents a classic Cash Cow. These offerings, which include validation, training, and technical support, tap into the company's extensive knowledge base and strong existing ties with clients in a well-established biopharmaceutical manufacturing sector.

These services, while not tangible products, are crucial for generating consistent, high-margin revenue. They foster deep customer loyalty, ensuring a predictable and reliable contribution to the company's overall cash flow. For instance, Sartorius Stedim Biotech's commitment to supporting clients through complex regulatory landscapes and process optimization solidifies its position as a trusted partner, driving recurring revenue streams.

- High-Margin Revenue: Services like validation and technical support command strong margins due to specialized expertise.

- Recurring Revenue Streams: Ongoing support and training contracts create predictable income.

- Customer Loyalty: Deep engagement through services strengthens client relationships, reducing churn.

- Mature Market Leverage: Capitalizes on established demand in biopharmaceutical manufacturing.

Sartorius Stedim Biotech's cell culture media and consumables for established biologics, like monoclonal antibodies, are significant cash cows. These high-margin products benefit from consistent, high-volume demand in a mature market segment, ensuring a steady revenue stream.

The recurring purchase of these essential items drives profitability, as seen in 2024's stable biologics market growth, which directly supports demand for these foundational products. This segment requires minimal investment, allowing for strong cash flow generation.

The company's expertise in providing these solutions to a broad and stable customer base solidifies their position. This focus on mature therapies ensures ongoing demand and predictable financial contributions.

| Product Segment | BCG Matrix Category | Key Characteristics | 2024 Market Relevance |

|---|---|---|---|

| Cell Culture Media & Consumables (Established Biologics) | Cash Cow | High-margin, recurring revenue, mature market, broad customer base | Steady demand driven by established therapies, contributing significantly to profitability. |

Preview = Final Product

Sartorius Stedim Biotech BCG Matrix

The Sartorius Stedim Biotech BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises – just the comprehensive strategic analysis ready for your immediate use. You can be confident that the professional layout and data presented here are precisely what you will download, enabling you to seamlessly integrate this valuable business intelligence into your strategic planning and decision-making processes. This is your direct gateway to actionable insights for Sartorius Stedim Biotech's product portfolio.

Dogs

Legacy reusable stainless steel bioprocessing equipment, like that historically offered by Sartorius Stedim Biotech, falls squarely into the 'Dogs' category of the BCG Matrix. This is primarily due to the biopharmaceutical industry's significant shift towards single-use technologies. As of 2024, the demand for traditional reusable systems is demonstrably declining, with growth prospects in this segment being minimal.

Sartorius Stedim Biotech's strategic emphasis on single-use solutions means that any remaining reusable hardware likely occupies a small market share within a shrinking market. This segment may require ongoing investment for maintenance and support without yielding substantial returns, making it a prime candidate for resource reallocation or even divestment to improve overall portfolio efficiency.

Within Sartorius Stedim Biotech's Lab Products & Services division, basic, non-specialized laboratory consumables often find themselves in a highly competitive landscape with little room for differentiation. If Sartorius Stedim Biotech participates in this commoditized segment, especially with products not directly linked to their bioprocessing expertise, these offerings would likely exhibit a small market share and minimal growth. For instance, in 2024, the global market for general laboratory consumables, excluding specialized bioprocessing items, is characterized by numerous suppliers, leading to price-based competition.

Older analytical instruments for bioprocess monitoring, if any are still part of Sartorius Stedim Biotech's portfolio, would likely fall into the 'Cash Cow' or even 'Dog' category of the BCG Matrix. These instruments might have a stable, albeit declining, market share due to their established presence in some facilities. However, their growth potential would be severely limited as newer, more advanced technologies emerge.

The bioprocess analytical instrument market is rapidly evolving, emphasizing speed, accuracy, and seamless integration. Instruments that fail to keep pace with demands for high-throughput or real-time analysis, such as older spectrophotometers or basic chromatography systems, would face diminishing market share and negligible growth. For instance, the global bioprocess analytical instruments market was valued at approximately USD 2.5 billion in 2023 and is projected to grow, but older technologies are unlikely to capture this expansion.

These less competitive instruments could become cash traps. While they may still generate some revenue, the ongoing costs associated with maintenance, calibration, and spare parts for outdated technology, coupled with their inability to meet current industry performance standards, would offer limited upside. This scenario contrasts sharply with the company's focus on innovative solutions like advanced Raman spectroscopy or PAT (Process Analytical Technology) tools, which are driving growth.

Niche, Low-Demand Chromatography Resins (Older Generations)

Within Sartorius Stedim Biotech's portfolio, older generation or highly niche chromatography resins likely fall into the 'Dogs' category of the BCG Matrix. These products, while part of the essential purification process, face a market increasingly favoring advanced chemistries and formats. For instance, while the broader bioprocessing market continues to expand, specific segments relying on legacy resin technologies may see stagnant or declining demand as newer, more efficient alternatives emerge.

These niche, low-demand resins probably exhibit low growth rates and possess a small market share. Their profitability might be marginal, potentially only breaking even, or they could even require disproportionate sales and marketing efforts relative to the revenue they generate. This situation is common when a company holds onto products that have been superseded by technological advancements in the field.

- Low Market Share: Older resins struggle to compete with newer, higher-performance alternatives.

- Low Growth: Demand for these specific products is likely stagnant or declining as the bioprocessing industry evolves.

- Limited Profitability: These items may only break even or require significant effort to sell, impacting overall margins.

- Resource Drain: Maintaining and marketing outdated product lines can divert resources from more promising areas.

Non-Strategic, Low-Volume Contract Manufacturing Services

Non-strategic, low-volume contract manufacturing services at Sartorius Stedim Biotech could be classified as dogs in the BCG matrix. These might include highly specialized process development or manufacturing for niche biopharmaceutical clients that don't align with the company's core strengths or market focus. Such activities often yield low revenue and demand significant resources without promising substantial future growth or strategic benefits.

For instance, if Sartorius Stedim Biotech were to engage in contract manufacturing of a legacy or highly specialized cell culture media component that requires unique, non-scalable equipment and serves a very small patient population, this would fit the dog profile. Such services, while potentially profitable on a per-unit basis, might not contribute meaningfully to overall revenue growth or market share expansion for Sartorius Stedim Biotech, especially when compared to their high-volume, high-growth product lines.

- Low Revenue Contribution: These services typically generate minimal revenue compared to the company's core offerings, potentially representing less than 1% of total sales.

- High Resource Allocation: Despite low returns, these contracts might require dedicated personnel, specialized equipment, and process optimization efforts, diverting resources from more promising ventures.

- Limited Growth Potential: The niche nature and low volume of these services inherently restrict their scalability and future growth prospects, offering little competitive advantage.

- Strategic Misalignment: These activities may not leverage Sartorius Stedim Biotech's leading technologies or align with its long-term strategic goals in the biopharmaceutical manufacturing sector.

Products or services within Sartorius Stedim Biotech's portfolio that exhibit a low market share in a low-growth or declining market are classified as 'Dogs' in the BCG Matrix. This typically includes legacy equipment or older technologies that are being phased out by industry advancements.

For example, Sartorius Stedim Biotech's historical offerings in reusable stainless steel bioprocessing equipment, while once foundational, now represent a 'Dog' segment. The market's strong pivot to single-use technologies by 2024 has significantly diminished the demand and growth prospects for these reusable systems.

These 'Dog' products often require continued investment for maintenance and support without generating substantial returns, making them candidates for strategic review, such as divestment or reduced resource allocation to optimize the company's overall portfolio efficiency.

Within the Lab Products & Services division, basic, undifferentiated laboratory consumables that face intense price competition would also be considered 'Dogs'. In 2024, the general lab consumables market, excluding specialized bioprocessing items, is highly fragmented with numerous suppliers, leading to minimal growth for non-specialized offerings.

| BCG Category | Sartorius Stedim Biotech Example | Market Characteristics | Strategic Implication |

|---|---|---|---|

| Dogs | Legacy Reusable Bioprocessing Equipment | Low market share, declining market growth (post-2024 shift to single-use) | Consider divestment or minimal investment to free up resources. |

| Dogs | Basic, Non-Specialized Lab Consumables | Low market share, highly competitive, low growth (in general consumables market) | Focus on core competencies; potentially phase out or re-evaluate pricing strategy. |

| Dogs | Older Bioprocess Analytical Instruments | Low market share, negligible growth due to rapid technological advancement | High maintenance costs relative to revenue; potential cash drain. |

| Dogs | Niche, Older Chromatography Resins | Low market share, stagnant or declining demand due to superior alternatives | Marginal profitability, may require disproportionate sales effort. |

Question Marks

Sartorius Stedim Biotech is actively developing novel continuous bioprocessing platforms, collaborating with key clients to pioneer this high-growth sector. This innovative approach promises substantial gains in manufacturing efficiency and a notable reduction in resource utilization.

While the potential of continuous manufacturing is immense, it remains an emerging technology. Sartorius Stedim Biotech is therefore strategically positioned to build its market share in this nascent but promising field.

Significant capital investment is crucial to accelerate the adoption of these platforms and transition them from their current developmental stage into future market leaders. For instance, Sartorius Stedim Biotech's commitment to R&D, which represented approximately 10% of its revenue in 2023, underscores this strategic focus on innovation.

Sartorius Stedim Biotech is actively broadening its product range, with a significant focus on bioanalytical solutions. Emerging technologies like the iQue® 5 HTS Platform, designed for advanced confocal imaging, are key examples of this expansion. These tools are specifically developed to address rapidly expanding markets such as organoid analysis and complex 3D cell models, indicating a strategic move towards high-potential applications.

While these new bioanalytical and Process Analytical Technology (PAT) tools are currently in their early stages, representing a small portion of the company's overall market share, their future looks promising. The high growth prospects are contingent on increased market adoption, a trend that the company is actively pursuing through innovation and targeted development. For instance, the iQue® 5 platform offers enhanced throughput and detailed cellular insights, crucial for the advancement of these cutting-edge biological research areas.

Sartorius Stedim Biotech’s acquisition of Polyplus in 2022, a leader in transfection reagents for cell and gene therapies, exemplifies their strategy of integrating specialized innovations. These advanced components, crucial for delivering genetic material into cells, cater to the rapidly expanding biopharmaceutical market, particularly in areas like CAR-T therapy.

While Polyplus’s technologies address high-growth segments, their initial market share within Sartorius Stedim Biotech’s extensive portfolio might appear modest as integration and scaling efforts are underway. For instance, the cell and gene therapy market itself is projected to reach over $30 billion by 2030, indicating substantial future potential for these acquired assets.

Next-Generation Single-Use Technologies for Ultra-High Density Cultures

As bioprocessing aims for unprecedented cell densities and product yields, the demand for sophisticated single-use technologies that can handle these demanding environments is escalating. Sartorius Stedim Biotech is strategically positioned to address this burgeoning market, likely investing in and refining its next-generation single-use systems designed for ultra-high density cultures. These advanced solutions are crucial for enabling more efficient and scalable biomanufacturing.

These cutting-edge technologies hold substantial promise for the future of biopharmaceutical production, offering the potential to significantly improve process economics and throughput. However, capturing a leading position in this innovative space necessitates considerable investment to overcome technical hurdles and establish a strong foothold among early adopters. The market for these specialized single-use systems is expected to see robust growth as the biopharma industry continues to push the boundaries of cell culture performance.

- High-Density Culture Support: Next-generation single-use systems are being engineered to maintain cell viability and productivity at densities exceeding 100 million cells per milliliter, a significant leap from current standards.

- Increased Product Titer Potential: These advanced technologies are designed to facilitate higher product concentrations, potentially doubling or even tripling the titers achieved in traditional bioreactors, thereby improving downstream processing efficiency.

- Market Growth Anticipation: The global single-use bioprocessing market, which includes these advanced technologies, was valued at approximately USD 7.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, according to various industry analyses.

- Investment Focus: Companies like Sartorius Stedim Biotech are channeling R&D resources into developing robust, scalable, and contamination-resistant single-use solutions to meet the evolving needs of high-density cell culture applications.

Digital Solutions and Software for Bioprocess Optimization

The biopharmaceutical industry is rapidly embracing digital tools to enhance bioprocess development, real-time monitoring, and overall optimization. While Sartorius Stedim Biotech is traditionally known for its hardware and consumables, expanding into integrated software and digital platforms for bioprocessing represents a significant high-growth opportunity where they are strategically building market share.

These digital solutions, encompassing areas like advanced analytics, AI-driven process control, and cloud-based data management, are crucial for improving efficiency, reducing costs, and accelerating drug development timelines. For instance, the global bioprocessing software market was valued at approximately USD 2.5 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, indicating substantial demand.

- Market Growth: The bioprocessing software market is experiencing robust growth, driven by the increasing complexity of biomanufacturing and the need for greater process control and data integrity.

- Investment Needs: Developing and penetrating the market for these advanced digital solutions requires significant cash investment in research and development, software engineering, and sales and marketing efforts.

- Strategic Importance: Integrating digital capabilities allows Sartorius Stedim Biotech to offer more comprehensive, end-to-end solutions, thereby enhancing customer value and competitive positioning in a digitally transforming industry.

- Potential Impact: Successful implementation of these digital offerings can lead to recurring revenue streams and a stronger foothold in the high-margin software segment of the bioprocessing value chain.

Sartorius Stedim Biotech's investments in continuous bioprocessing, bioanalytical tools like the iQue® 5, transfection reagents via Polyplus acquisition, advanced single-use systems for high-density cultures, and bioprocessing software all represent areas with high growth potential but also significant investment needs and early-stage market penetration. These initiatives are characteristic of Question Marks in the BCG matrix, requiring careful nurturing and strategic resource allocation to transition into Stars.

| Area of Investment | Current Market Position | Growth Potential | Investment Requirement | Strategic Focus |

|---|---|---|---|---|

| Continuous Bioprocessing | Nascent, building market share | High | Significant capital investment for R&D and adoption | Pioneering high-growth sector |

| Bioanalytical Solutions (e.g., iQue® 5) | Early stage, small market share | High (organoid analysis, 3D cell models) | Continued R&D and market penetration efforts | Expanding product range in high-potential applications |

| Transfection Reagents (Polyplus) | Modest initial share, integration phase | Very High (cell and gene therapies) | Scaling and market integration | Acquisition of specialized innovations for expanding biopharma market |

| High-Density Single-Use Systems | Emerging, developing next-gen systems | High (improved process economics) | Considerable investment for technical hurdles and early adopters | Addressing escalating demand for demanding biomanufacturing environments |

| Bioprocessing Software & Digital Platforms | Expanding into new segment | High (over 15% CAGR projected) | Significant investment in R&D, software engineering, sales & marketing | Enhancing end-to-end solutions and customer value |

BCG Matrix Data Sources

Our Sartorius Stedim Biotech BCG Matrix is built on robust financial disclosures, comprehensive market research, and industry growth forecasts to provide strategic clarity.