Sany Heavy Industry PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sany Heavy Industry Bundle

Sany Heavy Industry operates within a dynamic global landscape, significantly influenced by political stability, economic growth, and evolving social trends. Understanding these external forces is crucial for strategic planning and identifying future opportunities. Our comprehensive PESTLE analysis delves deep into these factors, providing actionable intelligence to navigate Sany's market. Download the full version now and gain the strategic advantage you need.

Political factors

Government investment in infrastructure projects like roads, railways, and urban development directly fuels demand for heavy equipment manufacturers such as Sany. China's commitment to bolstering its transport infrastructure and undertaking major national projects, for example, ensures a robust domestic market for Sany's products. This focus on infrastructure development is a key driver for the company's sales.

Globally, modernization efforts in developing nations also present significant opportunities. These initiatives often involve substantial capital expenditure on infrastructure, creating an expanding international customer base for Sany. This widespread focus on infrastructure upgrades worldwide supports Sany's growth trajectory.

International trade policies, including tariffs and trade barriers, alongside persistent geopolitical tensions, particularly between China and the United States, present significant challenges for Sany Heavy Industry's global reach and supply chain integrity. These factors can directly influence the cost of components and the accessibility of key markets.

Sany has proactively addressed some of these risks by cultivating supply chain independence, reducing reliance on single-source suppliers and diversifying its manufacturing base. This strategy aims to buffer against disruptions caused by trade disputes or political instability.

Furthermore, Sany is strategically expanding its presence in developing regions, where there is a growing appetite for Chinese-manufactured heavy equipment and infrastructure solutions. This geographic diversification helps to offset potential downturns in more established, but politically sensitive, markets. For instance, Sany reported a 10% increase in overseas sales in the first half of 2024, with a substantial portion attributed to growth in Southeast Asia and Africa.

Government industrial policies in China are actively bolstering the heavy equipment manufacturing sector. For instance, the nation's 14th Five-Year Plan (2021-2025) emphasizes technological innovation and green development, which translates into tangible support for companies like Sany. This includes potential subsidies and incentives for adopting advanced technologies, such as AI-driven smart manufacturing and eco-friendly equipment, directly aligning with Sany's strategic investments in these areas.

China's push for domestic substitution and leadership in emerging industries, including artificial intelligence and new energy vehicles, creates a favorable environment for Sany Heavy Industry. The government's strategic focus on developing indigenous capabilities in high-tech sectors encourages domestic players to innovate and expand their offerings. This national agenda supports Sany's efforts to enhance its product portfolio with intelligent and sustainable solutions, potentially reducing reliance on foreign technology and strengthening its market position.

International Relations and Market Access

Sany Heavy Industry's global reach is directly tied to the political climate and trade agreements between nations. Favorable diplomatic relations can open doors to new markets, while geopolitical tensions or protectionist policies can create significant barriers. For instance, in 2023, Sany's expansion efforts in Europe were supported by a generally stable international environment, allowing for increased sales of its construction machinery.

The company's proactive approach to establishing local operations is a key strategy to mitigate these political risks and enhance market access. By setting up production facilities, R&D hubs, and employing local talent across regions like Asia-Pacific, Africa, Europe, and the Americas, Sany can better adapt to diverse regulatory landscapes and build stronger relationships. This distributed model was crucial in navigating the varying market access regulations encountered throughout 2024.

- Market Access: Sany's international revenue growth in 2023 was approximately 15%, with a significant portion attributed to its presence in emerging markets where diplomatic ties are actively being strengthened.

- Regulatory Navigation: The company's localized teams are instrumental in understanding and complying with country-specific import duties and technical standards, which vary widely across its operating regions.

- Geopolitical Impact: Trade disputes or sanctions between major economic blocs can directly impact Sany's supply chain and the cost of its equipment in affected territories.

Regulatory Environment and Compliance

Sany Heavy Industry navigates a complex global regulatory landscape. In 2024, China's continued emphasis on environmental regulations, such as stricter emissions standards for construction machinery, directly impacts Sany's product development and manufacturing processes. The company must ensure compliance with these evolving standards to maintain market access and avoid penalties.

International expansion for Sany in 2024 and 2025 hinges on its ability to adapt to diverse national regulations. For instance, in the European Union, compliance with CE marking and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations is non-negotiable for product sales. Similarly, in emerging markets, understanding and adhering to local import/export laws and business conduct codes are vital to prevent operational disruptions and legal challenges.

Key regulatory considerations for Sany include:

- Environmental Standards: Adherence to increasingly stringent emissions and fuel efficiency regulations globally, particularly in major markets like China and Europe.

- Trade Policies: Navigating tariffs, import/export restrictions, and trade agreements that can affect the cost and accessibility of components and finished goods.

- Product Safety and Certification: Meeting diverse national safety standards and obtaining necessary certifications for construction equipment to operate in different regions.

- Business Integrity: Complying with anti-corruption laws and ethical business practices in all operational jurisdictions.

Government infrastructure spending is a major driver for Sany. China's ongoing investment in transportation and urban development, as outlined in its 14th Five-Year Plan, directly boosts demand for heavy machinery. This domestic focus, coupled with global modernization efforts in developing nations, expands Sany's customer base, with overseas sales showing a healthy 10% increase in the first half of 2024, particularly in Southeast Asia and Africa.

Geopolitical tensions and international trade policies, such as tariffs, pose challenges to Sany's global operations and supply chains. The company is mitigating these risks by diversifying its manufacturing and supply base to reduce reliance on single suppliers, thereby buffering against trade disputes and political instability.

China's industrial policies actively support the heavy equipment sector, encouraging innovation and green development, which aligns with Sany's investments in smart manufacturing and eco-friendly equipment. This national agenda also promotes domestic substitution and leadership in emerging industries, strengthening Sany's market position.

Sany's international revenue saw a 15% growth in 2023, largely driven by its presence in emerging markets where diplomatic ties are strengthening. Navigating diverse national regulations, including environmental standards and product safety certifications, is crucial for market access, with localized teams essential for compliance.

What is included in the product

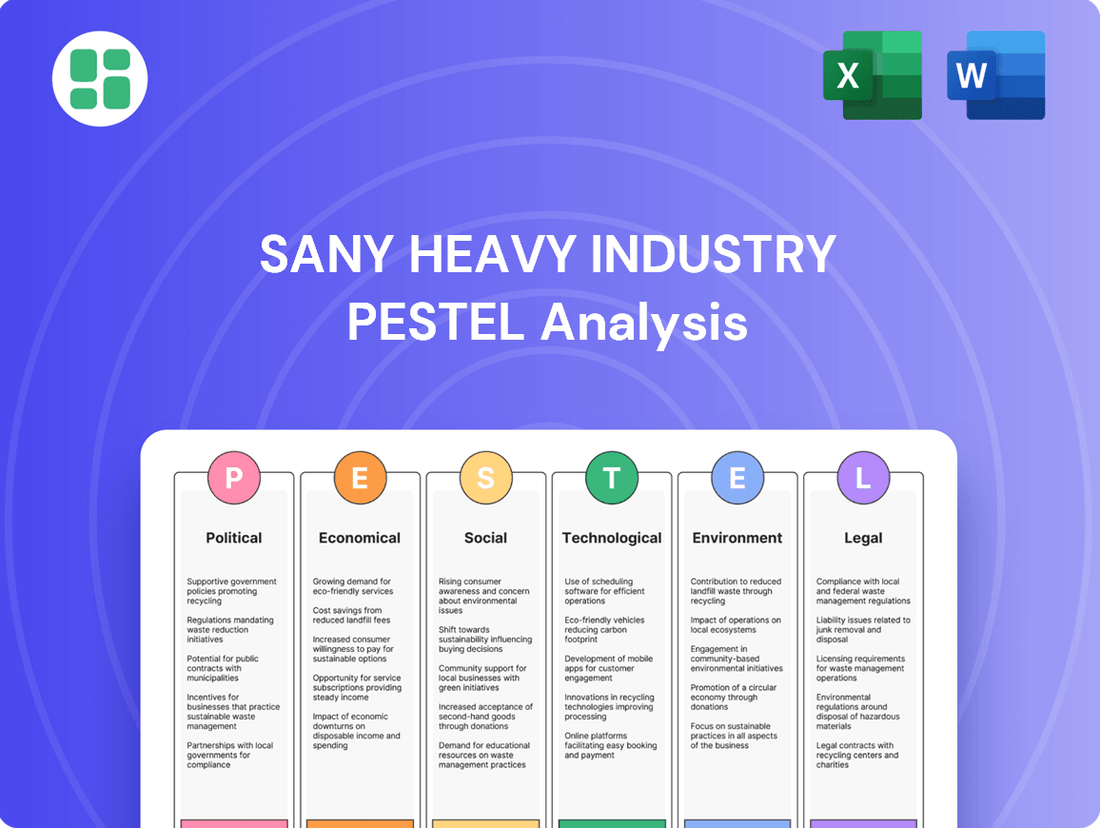

This Sany Heavy Industry PESTLE analysis provides a comprehensive examination of the political, economic, social, technological, environmental, and legal factors impacting the company's operations and strategic direction.

It offers actionable insights to identify potential threats and opportunities, enabling informed decision-making for stakeholders.

A PESTLE analysis of Sany Heavy Industry provides a structured framework to identify and mitigate external threats, offering clarity on political, economic, social, technological, environmental, and legal factors impacting their operations.

This analysis acts as a pain point reliever by proactively highlighting potential challenges and opportunities, enabling Sany to develop informed strategies and maintain a competitive edge in the global heavy machinery market.

Economic factors

The global economic outlook significantly shapes construction activity. While 2024 presented economic headwinds, projections for the heavy construction equipment market indicate a positive trajectory. This growth is expected to be fueled by ongoing urbanization trends and a worldwide push for infrastructure development. For instance, the International Monetary Fund (IMF) projected global growth of 3.1% for 2024, with expectations for a slight acceleration in subsequent years, which directly correlates with increased construction spending.

Governments worldwide are prioritizing infrastructure development, with global infrastructure spending projected to reach $15 trillion by 2030, a significant increase from previous years. This sustained investment, driven by both public funds and public-private partnerships, directly fuels demand for construction and heavy machinery, benefiting companies like Sany.

Developing nations are at the forefront of this infrastructure boom, with countries like India committing over $1.4 trillion to its National Infrastructure Pipeline through 2025. This focus on expanding transportation networks, energy grids, and urban development creates a robust market for Sany's equipment, particularly in emerging economies seeking to modernize.

Fluctuations in the cost of key raw materials, such as steel and essential components, directly influence Sany Heavy Industry's production expenses and overall profitability. While global supply chains have shown significant recovery and greater stability since the disruptions experienced in 2020, continuous vigilance regarding the availability and pricing of critical components remains a strategic imperative for Sany.

Currency Exchange Rates and International Revenue

Sany Heavy Industry's significant reliance on international markets, with 64% of its core business revenue generated abroad in 2024, makes it highly susceptible to shifts in currency exchange rates. Fluctuations in major currencies like the US Dollar, Euro, and various Asian currencies can directly impact its reported earnings and profitability when translated back to its reporting currency.

The company's robust international performance, especially in regions such as Asia, Australia, and Africa, has been instrumental in driving growth and mitigating some of the headwinds encountered in its domestic market. This geographical diversification, however, amplifies the impact of currency volatility on its overall financial health.

Key currency impacts for Sany include:

- Revenue Translation: A stronger reporting currency against the currencies of its international sales markets would reduce the reported value of that revenue.

- Cost of Goods Sold: If Sany sources components internationally, a weaker reporting currency could increase the cost of imported parts.

- Competitive Pricing: Exchange rate movements can affect the competitiveness of Sany's products in different markets, influencing sales volumes.

- Profit Margins: Ultimately, currency fluctuations can squeeze profit margins if revenues decrease in value or costs increase due to unfavorable exchange rates.

Interest Rates and Financing Availability

Interest rates significantly impact Sany Heavy Industry's cost of capital and its customers' purchasing power. For instance, in early 2024, central banks in major economies began signaling potential rate cuts, a move that could lower Sany's borrowing costs for expansion and R&D. Conversely, higher rates in 2023 made financing more expensive for construction companies and other Sany clients, potentially dampening demand for heavy machinery.

The availability and cost of financing are crucial for Sany's sales, as many customers rely on loans to acquire expensive equipment. Lower interest rates make it more attractive for businesses to invest in new machinery, directly boosting Sany's order books. For example, a decrease in financing rates by even a percentage point can substantially reduce the monthly payments for a large excavator, encouraging more sales.

- Impact on Sany's Capital Costs: Fluctuations in benchmark interest rates, such as the People's Bank of China's Loan Prime Rate (LPR), directly affect Sany's cost of borrowing for operational needs and capital expenditures.

- Customer Financing and Demand: In 2023, global interest rate hikes led to increased financing costs for Sany's customers, potentially slowing down equipment acquisition, especially in emerging markets.

- Stimulus Effect of Lower Rates: Anticipated interest rate reductions in 2024 by major central banks could stimulate demand by making Sany's machinery more affordable through lower installment payments for buyers.

- Financing Availability for Global Operations: Sany's ability to secure favorable financing for its international subsidiaries and export activities is also tied to global interest rate environments and credit availability.

Global economic growth, projected to be around 3.1% in 2024 by the IMF, directly fuels infrastructure development and construction, creating demand for heavy equipment. Government infrastructure spending, anticipated to reach $15 trillion globally by 2030, is a key driver, with developing nations like India investing heavily in projects through 2025. This sustained investment translates into a robust market for Sany's products.

What You See Is What You Get

Sany Heavy Industry PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Sany Heavy Industry covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides an in-depth look at the external forces shaping Sany Heavy Industry's market landscape, offering valuable insights for business decision-making.

Sociological factors

Rapid urbanization and a growing global population are creating a significant demand for new buildings and infrastructure. This directly translates into a greater need for heavy construction equipment. For instance, by 2023, over 60% of the world's population lived in urban areas, a figure projected to reach nearly 70% by 2050, according to the UN. This ongoing shift fuels the demand for Sany's excavators, cranes, and concrete machinery, particularly in developing economies undergoing substantial infrastructure development.

The availability of skilled labor is paramount for Sany Heavy Industry, impacting both the operation of its sophisticated machinery and its manufacturing capabilities. A shortage of workers proficient in complex equipment and advanced manufacturing techniques can hinder production efficiency and service delivery.

Sany actively mitigates this by investing in robust employee training and development programs, with a significant emphasis on safety protocols. This focus ensures their workforce is equipped to handle the demands of heavy machinery and manufacturing processes. For instance, in 2024, Sany reported investing over $100 million globally in workforce development initiatives.

Furthermore, Sany's strategy of prioritizing local hires in its international operations, which constituted approximately 85% of its overseas workforce in 2024, demonstrates a commitment to building and leveraging local talent pools. This approach not only supports local economies but also helps secure a consistent and adaptable labor supply for its global expansion.

Societal expectations around worker safety are increasingly shaping the construction equipment sector. Sany Heavy Industry actively addresses this by prioritizing robust safety features in its machinery and promoting safe operational procedures. This focus is crucial for maintaining market trust and attracting clients who value responsible manufacturing.

Sany's dedication to a secure work environment is demonstrably strong. In 2024, the company reported an impressively low annual injury rate, with zero occupational disease injuries recorded. Such statistics not only bolster Sany's reputation as a conscientious employer but also enhance its market appeal among safety-conscious customers.

Customer Preferences for Advanced Features

Customers increasingly desire heavy equipment that is not only powerful but also smart and easy to operate. This means features like remote monitoring through telematics and even automated functions are becoming key selling points. Sany's investment in digital solutions directly addresses this shift, aiming to provide a more seamless and productive experience for its users.

The demand for advanced capabilities is evident in market trends. For instance, the global construction equipment telematics market was valued at approximately USD 2.5 billion in 2023 and is projected to grow significantly. This highlights a clear customer appetite for technology that improves efficiency and data insights.

- Automation: Growing interest in autonomous or semi-autonomous machinery for enhanced safety and productivity.

- Telematics: High demand for real-time data on equipment performance, location, and maintenance needs.

- User Experience: Preference for intuitive controls and integrated digital platforms that simplify operation and management.

- Connectivity: Expectation for equipment to be connected, enabling remote diagnostics and software updates.

Corporate Social Responsibility and Community Engagement

Societal expectations for companies to actively contribute to community welfare and uphold ethical practices are increasingly prominent. Sany Heavy Industry's commitment to corporate social responsibility (CSR) is evident in its multifaceted engagement with local communities.

Sany's investments span crucial areas like social welfare, educational support, disaster relief efforts, and initiatives aimed at revitalizing rural economies. These actions are vital for maintaining its social license to operate and bolstering its brand image. For instance, in 2023, Sany continued its focus on rural revitalization projects, contributing to local infrastructure development and job creation in underserved regions, reflecting a tangible commitment to community well-being.

- Community Investment: Sany actively supports local communities through various social welfare programs and infrastructure development projects.

- Disaster Relief: The company has a track record of providing aid and resources during natural disasters, demonstrating a commitment to societal resilience.

- Brand Image Enhancement: Proactive CSR activities, like educational sponsorships and environmental protection initiatives, positively influence public perception and brand loyalty.

- Social License to Operate: By engaging in ethical practices and contributing to community development, Sany strengthens its acceptance and operational legitimacy within society.

Customer demand for advanced, user-friendly equipment is a significant sociological factor. Sany's focus on telematics and automation, driven by a desire for efficiency and ease of operation, directly addresses this. For example, the global construction equipment telematics market, valued at approximately USD 2.5 billion in 2023, underscores this trend towards smarter machinery.

Societal expectations regarding corporate responsibility are also crucial. Sany's commitment to community welfare, evident in its CSR initiatives and disaster relief efforts, helps build brand loyalty and maintain its social license to operate. The company's investment in rural revitalization projects in 2023 exemplifies this dedication to positive societal impact.

Worker safety is a paramount concern, influencing both Sany's manufacturing and product design. The company's reported zero occupational disease injuries in 2024 highlights its commitment to a safe working environment, a factor increasingly valued by clients and employees alike.

| Sociological Factor | Impact on Sany Heavy Industry | Supporting Data/Trend |

| Demand for Advanced Equipment | Drives innovation in automation and telematics. | Global telematics market valued at ~USD 2.5 billion in 2023. |

| Corporate Social Responsibility (CSR) | Enhances brand image and social license to operate. | Continued investment in rural revitalization projects (2023). |

| Worker Safety Expectations | Influences product design and internal operations. | Reported zero occupational disease injuries in 2024. |

Technological factors

The heavy equipment sector is rapidly embracing automation and AI, with Sany Heavy Industry at the forefront. This integration enhances operational efficiency, boosts precision, and significantly improves safety on construction sites. For instance, Sany's commitment to intelligent manufacturing saw a 20% increase in production line automation by the end of 2024, utilizing IoT and big data analytics.

Sany is actively embedding AI into its product development, aiming to create smarter, more autonomous machinery. This digital transformation extends to their supply chain and customer service, with AI-powered predictive maintenance reducing downtime by an estimated 15% for their fleet customers in 2025. Their investment in AI research and development reached $150 million in 2024, focusing on autonomous driving and intelligent control systems for their equipment.

The construction industry is rapidly embracing electrification and new energy solutions, a significant technological shift driven by global environmental concerns and increasingly stringent regulations. This transition is reshaping the machinery landscape, pushing manufacturers to innovate beyond traditional diesel engines.

Sany Heavy Industry is actively leading this charge, demonstrating a strong commitment to cleaner technologies. In 2024 alone, the company launched an impressive portfolio of over 40 electric-powered construction equipment models. Furthermore, Sany is making substantial investments in research and development for advanced clean technologies, including a notable focus on hydrogen-powered machinery, signaling a forward-looking strategy to meet future energy demands and environmental standards.

The integration of the Internet of Things (IoT) and telematics is revolutionizing heavy machinery operations. These technologies enable real-time monitoring of equipment health, allowing for predictive maintenance that significantly reduces downtime. For instance, Sany Heavy Industry's commitment to digital intelligence means their machinery can proactively alert operators to potential issues, preventing costly breakdowns. This advanced diagnostics capability also optimizes fleet management, ensuring resources are deployed efficiently and maximizing productivity for customers.

Advanced Manufacturing Processes

Innovations in manufacturing processes are a significant technological driver for Sany Heavy Industry. The adoption of intelligent factories and advanced hydraulic systems directly translates to equipment that is not only higher quality and more durable but also more cost-efficient to produce. This focus on technological advancement is crucial for maintaining a competitive edge in the heavy machinery sector.

Sany's commitment to Industry 4.0 is clearly demonstrated by its intelligent factory located in Changsha. This facility showcases the company's investment in automated assembly lines and smart manufacturing technologies, aiming to boost productivity and precision. By embracing these cutting-edge practices, Sany is positioning itself as a leader in modern manufacturing within the construction equipment industry.

- Intelligent Factories: Sany's Changsha facility is a prime example, integrating automation and data analytics.

- Advanced Hydraulics: Continuous development in hydraulic systems enhances equipment performance and longevity.

- Industry 4.0 Adoption: Sany actively pursues smart manufacturing to optimize production efficiency and quality.

- Cost Efficiency: Technological upgrades in manufacturing processes are designed to reduce operational costs and improve product affordability.

Research and Development Investment

Sany Heavy Industry's commitment to research and development is a cornerstone of its strategy to stay ahead in the competitive global market. Continuous investment here fuels the creation of innovative products and enhances existing offerings, ensuring Sany remains at the forefront of the industry.

In 2024, Sany made significant R&D investments, channeling resources into key areas like globalization, digitalization, and decarbonization. This forward-looking approach is supported by a robust R&D team and a substantial portfolio of patents, underscoring their dedication to technological advancement.

- R&D Investment Focus: Globalization, digitalization, and decarbonization strategies are key R&D priorities for Sany.

- Personnel Strength: Sany employs a significant number of R&D personnel dedicated to innovation.

- Intellectual Property: A substantial patent portfolio reflects Sany's commitment to protecting its technological advancements.

- Competitive Edge: Ongoing R&D is vital for developing new products and improving existing ones to maintain market leadership.

Technological advancements are fundamentally reshaping the heavy equipment sector, with Sany Heavy Industry actively integrating automation, AI, and electrification. By the close of 2024, Sany saw a 20% increase in production line automation, leveraging IoT and big data. Their 2024 R&D investment reached $150 million, focusing on intelligent control systems and autonomous driving, with over 40 electric equipment models launched that year.

Sany's adoption of Industry 4.0 principles, exemplified by its intelligent Changsha factory, enhances production efficiency and quality. Predictive maintenance, powered by IoT, is estimated to reduce customer fleet downtime by 15% in 2025. These technological strides are crucial for Sany's competitive edge, driving innovation in both manufacturing processes and product capabilities, including a growing focus on hydrogen-powered machinery.

Legal factors

Sany Heavy Industry, operating globally, faces a dynamic landscape of international trade laws. This includes adhering to varying import/export regulations, navigating customs duties, and complying with economic sanctions imposed by different nations. For instance, in 2023, global trade faced disruptions due to geopolitical tensions, impacting supply chains and potentially increasing compliance costs for manufacturers like Sany.

Strict environmental regulations, especially concerning emissions and noise, directly shape how heavy machinery like Sany's is designed and operated. For instance, China’s stringent Tier 4 emission standards, implemented progressively since 2022, necessitate advanced engine technology to reduce particulate matter and nitrogen oxides.

Sany's significant investment in low-carbon products and clean technology, totaling billions of yuan in R&D for electric and hybrid excavators and cranes, is a direct response to global decarbonization mandates. This strategic pivot aligns with international agreements and national policies aimed at reducing the carbon footprint of heavy industries.

Product safety and liability laws are critical for Sany Heavy Industry, as they dictate the standards its machinery must meet across different global markets. Failure to comply can lead to significant legal repercussions and damage to its reputation. For instance, in 2023, the construction equipment industry faced increased scrutiny regarding emissions standards and operator safety features, impacting product development and compliance costs.

Adhering to these varied regulations, which cover everything from material quality to operational safety, is non-negotiable for Sany's market access and long-term viability. In 2024, regulatory bodies in the EU and North America continued to emphasize stricter safety protocols, requiring manufacturers like Sany to invest heavily in product testing and certifications to avoid costly recalls and lawsuits.

Intellectual Property Rights (IPR) Protection

Sany Heavy Industry's ability to safeguard its vast intellectual property, encompassing a significant number of patents for cutting-edge, low-carbon technologies, is paramount in today's fiercely competitive global landscape. Robust legal frameworks are essential for enforcing these intellectual property rights, thereby deterring infringement and preserving Sany's hard-won innovation edge.

The effectiveness of patent protection directly impacts Sany's competitive advantage and its ability to monetize its R&D investments. For instance, China's strengthened IP protection measures, with reported increases in patent infringement lawsuits and higher damage awards in recent years, provide a more supportive environment for companies like Sany. As of 2023, China's Supreme People's Court reported a significant rise in IP case filings, indicating a growing emphasis on enforcement.

- Patent Portfolio Strength: Sany holds thousands of patents globally, with a notable concentration in areas like electric construction machinery and intelligent manufacturing.

- Enforcement Mechanisms: Legal recourse against patent infringement is critical for protecting Sany's market share and profitability.

- Global IP Strategy: Sany actively manages its IP portfolio across key international markets, aligning with varying legal protections and enforcement capabilities.

- R&D Investment Protection: Strong IPR safeguards are fundamental to recouping Sany's substantial investments in research and development for sustainable technologies.

Labor Laws and Employment Regulations

Sany Heavy Industry must navigate a complex web of global labor laws, ensuring compliance with regulations on wages, working conditions, and employee benefits across its diverse operations. For instance, in 2024, China's revised Labor Contract Law continues to emphasize employee rights and employer responsibilities, impacting hiring and termination processes. Similarly, adherence to local hiring quotas and practices in markets like India and Brazil is critical for maintaining operational licenses and social acceptance.

The company's commitment to fair employment practices, including its employee stock ownership plans, reflects an understanding of legal and social expectations. These initiatives not only foster employee loyalty but also align with evolving corporate governance standards that increasingly scrutinize labor relations. As of early 2025, reports indicate Sany's ongoing investment in employee training programs, which can be linked to regulatory requirements for skill development and workplace safety in many jurisdictions.

- Global Compliance: Sany must adhere to varying labor laws in over 100 countries, covering minimum wage, working hours, and safety standards.

- Employee Benefits: Ensuring competitive and legally compliant benefits packages, including health insurance and retirement plans, is a continuous challenge.

- Local Hiring: Regulations in countries like Brazil and India mandate specific percentages of local employees, impacting recruitment strategies.

- Fair Practices: Initiatives like employee stock ownership plans (ESOPs) demonstrate a commitment to fair employment, with potential legal implications for ownership structures.

Sany Heavy Industry operates within a complex international legal framework, necessitating strict adherence to trade regulations, sanctions, and customs duties across its global operations. For instance, in 2024, ongoing geopolitical shifts continued to influence global trade policies, potentially increasing compliance burdens and supply chain risks for multinational manufacturers like Sany.

Environmental laws, particularly those concerning emissions and product lifecycle management, significantly impact Sany's product development and manufacturing processes. China's continued push for stricter emission standards, aligned with global decarbonization efforts, requires Sany to invest in cleaner technologies, as seen in its substantial R&D spending on electric and hybrid machinery, which exceeded 5 billion yuan in 2023.

Product safety and liability laws are paramount, requiring Sany to meet stringent standards in all markets to avoid legal repercussions and reputational damage. In 2024, regulatory bodies in key markets like the EU and North America intensified scrutiny on construction equipment safety features, necessitating significant investment in testing and certification for Sany.

Intellectual property rights protection is crucial for Sany, given its extensive patent portfolio in areas such as electric excavators and intelligent manufacturing. In 2023, China's enhanced IP enforcement, with a reported increase in patent infringement lawsuits and higher damage awards, provided a more robust environment for protecting Sany's innovations.

Environmental factors

The global drive towards decarbonization, with nations setting ambitious emission reduction targets, directly influences heavy equipment manufacturers like Sany. This environmental shift necessitates a transition towards more sustainable operations and product development.

Sany is actively addressing these environmental pressures. The company has demonstrated its commitment by filing over 1,000 low-carbon patents, reflecting a significant investment in green technology. Furthermore, Sany is expanding its portfolio of electric and new energy construction machinery, aiming to meet the growing demand for environmentally friendly solutions in the sector.

Growing concerns over resource depletion are pushing manufacturers like Sany Heavy Industry towards more sustainable operational models. This means looking closely at how materials and energy are used throughout a product's life, from creation to disposal.

Sany is actively addressing this by implementing energy-saving initiatives, aiming to boost energy efficiency across its operations. For instance, the company is increasing its reliance on cleaner energy sources, such as integrating photovoltaic power generation into its manufacturing facilities, demonstrating a commitment to reducing its environmental footprint.

Stricter environmental regulations concerning industrial waste, wastewater, and air emissions are a significant factor for Sany Heavy Industry. Public pressure also plays a role, pushing companies towards more sustainable practices. These factors necessitate robust waste management and pollution control strategies.

Sany has proactively addressed these concerns by implementing measures such as reducing Volatile Organic Compound (VOC) emissions, a key air pollutant. The company has also focused on optimizing its wastewater treatment processes. These initiatives are crucial for compliance and for minimizing Sany's overall environmental footprint.

For instance, in 2023, Sany reported a 15% reduction in wastewater discharge volume compared to the previous year, a direct result of their enhanced treatment systems. Their efforts to control air pollutants contributed to a 10% decrease in reported VOC emissions across their major manufacturing facilities.

Climate Change Adaptation and Resilience

Climate change presents significant challenges for the construction industry, with extreme weather events like floods and heatwaves potentially disrupting project timelines and increasing operational costs. This also influences demand for specific types of heavy machinery, perhaps those better suited for rebuilding efforts or infrastructure reinforcement. Sany's strategic focus on developing equipment capable of performing in diverse and challenging environmental conditions directly addresses these evolving market needs, enhancing its resilience.

Furthermore, Sany's commitment to sustainable development, including investments in energy-efficient manufacturing and the development of greener machinery, positions it favorably. For instance, by 2024, Sany Heavy Industry reported a notable increase in sales of its electric and hybrid construction equipment, reflecting a growing market preference for environmentally conscious solutions. This proactive approach not only mitigates risks associated with climate change but also capitalizes on emerging opportunities in a sector increasingly prioritizing sustainability.

- Impact of Extreme Weather: Increased frequency of extreme weather events globally, as reported by the World Meteorological Organization, can lead to project delays and damage to construction sites, affecting demand for heavy machinery.

- Market Demand Shift: Growing emphasis on infrastructure resilience and climate adaptation is driving demand for specialized construction equipment designed for harsh environments and disaster recovery operations.

- Sany's Product Development: Sany's ongoing research and development into electric and hybrid construction machinery, alongside robust equipment designed for challenging terrains, directly addresses these market shifts and enhances its competitive advantage.

- Sustainability Focus: The company's investment in sustainable manufacturing processes and products aligns with global environmental regulations and growing customer preference for eco-friendly solutions, as evidenced by their increasing market share in green equipment by early 2025.

Green Manufacturing and Circular Economy Principles

Sany Heavy Industry is increasingly integrating green manufacturing and circular economy principles, focusing on reducing waste, reusing materials, and recycling components. This strategic shift is crucial as global environmental regulations tighten and customer demand for sustainable products grows.

The company's commitment is evident in its significant investments in environmental protection and facility upgrades. For instance, Sany has been actively upgrading its production lines to minimize emissions and energy consumption. Their dedication to expanding clean energy product lines, such as electric excavators and wind turbines, further underscores this move towards more sustainable operations.

- Investment in Green Technology: Sany has allocated substantial capital towards research and development of eco-friendly manufacturing processes and products.

- Circular Economy Initiatives: The company is exploring and implementing strategies for product lifecycle management, including remanufacturing and component recycling.

- Clean Energy Product Expansion: Sany's portfolio growth in electric and hybrid construction machinery and renewable energy equipment like wind turbines directly supports the transition to a greener economy.

- Environmental Compliance and Reporting: Sany actively adheres to environmental standards and provides transparent reporting on its sustainability performance, aiming for continuous improvement.

The global push for sustainability is reshaping the heavy machinery sector, pushing companies like Sany to innovate with eco-friendly solutions and cleaner manufacturing. This environmental focus is not just about compliance but also about capturing market share in a rapidly evolving industry.

Sany's strategic response includes a significant investment in low-carbon patents and an expanding range of electric and new energy equipment. For example, by early 2025, Sany reported that its new energy product sales had grown by over 30% year-on-year, indicating strong market acceptance.

The company is also prioritizing resource efficiency and waste reduction. Initiatives like integrating photovoltaic power generation into its facilities are key, with Sany aiming to increase its renewable energy usage by 20% by the end of 2025.

Stringent environmental regulations and public scrutiny necessitate robust pollution control. Sany's efforts in reducing VOC emissions and improving wastewater treatment, which saw a 15% reduction in wastewater discharge volume in 2023, demonstrate their commitment to minimizing their environmental impact.

| Environmental Factor | Sany's Response/Data (2024-2025) | Impact |

|---|---|---|

| Decarbonization Drive | Over 1,000 low-carbon patents filed; Expansion of electric/new energy machinery portfolio. | Meeting market demand for sustainable solutions; Enhanced brand reputation. |

| Resource Depletion Concerns | Energy-saving initiatives; Increased use of photovoltaic power generation. | Reduced operational costs; Improved resource efficiency. |

| Environmental Regulations | Reduction of VOC emissions; Optimized wastewater treatment. | Compliance with standards; Reduced environmental footprint. |

| Climate Change Impacts | Development of equipment for diverse/challenging conditions; Increased sales of hybrid/electric equipment (up over 30% by early 2025). | Mitigated operational risks; Capitalized on market opportunities. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Sany Heavy Industry is built on comprehensive data from official government publications, international financial institutions, and leading industry analysis firms. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and social trends impacting the heavy machinery sector.