Sany Heavy Industry Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sany Heavy Industry Bundle

Sany Heavy Industry faces intense competition, with powerful buyers and a moderate threat from new entrants shaping its market. Understanding these dynamics is crucial for any player in the heavy equipment sector.

The complete report reveals the real forces shaping Sany Heavy Industry’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The heavy equipment sector, including companies like Sany Heavy Industry, depends on a global network for critical parts such as engines, hydraulic systems, and sophisticated electronics. When these essential components come from a limited number of major suppliers, or if they are uniquely designed for Sany's specific needs, the suppliers gain more leverage.

In 2024, the automotive and industrial sectors, which heavily influence heavy equipment supply chains, saw continued consolidation among component manufacturers. For instance, major engine suppliers often serve multiple heavy equipment brands, but the proprietary nature of certain advanced hydraulic or electronic systems can create significant dependence for Sany on those specific providers.

Switching suppliers for Sany Heavy Industry can be a significant undertaking, involving substantial costs. These expenses often stem from the need to re-tool production lines, redesign existing components to fit new specifications, and undergo rigorous re-certification processes for newly sourced parts. For instance, in 2024, the heavy machinery sector continued to see complex supply chains where even minor component changes can necessitate extensive validation.

These substantial switching costs directly bolster the bargaining power of Sany's suppliers. When it is expensive and time-consuming for Sany to find and integrate an alternative supplier, existing suppliers can leverage this situation to negotiate more favorable terms, potentially leading to higher prices or less flexible contract conditions for Sany.

The threat of suppliers integrating forward into manufacturing heavy equipment themselves is a critical consideration for Sany Heavy Industry. If a key supplier, particularly one providing specialized components or integrated technology solutions, possesses the capability and incentive to enter Sany's market, it could significantly disrupt supply chains and introduce new competition.

While this threat is generally less pronounced for suppliers of highly standardized components, it becomes more relevant for those offering proprietary technologies or integrated systems. For instance, a major engine manufacturer or a sophisticated hydraulics provider might explore backward integration into assembling complete heavy equipment units if they perceive a substantial market opportunity and possess the necessary expertise.

Importance of Components to Sany's Product Quality and Performance

The bargaining power of suppliers for Sany Heavy Industry is significantly influenced by the criticality of the components they provide. For instance, specialized engine components, advanced hydraulic systems, and sophisticated electronic control units are vital for the performance, reliability, and technological edge of Sany's excavators, cranes, and other heavy machinery. Suppliers of these high-value, proprietary parts can command greater leverage.

Sany's strategic emphasis on innovation and decarbonization further amplifies supplier power, particularly for those offering advanced green technologies. As Sany invests in electric and hybrid powertrains, and components that reduce emissions and improve energy efficiency, it becomes more dependent on suppliers with cutting-edge expertise in these areas. This reliance can translate into stronger negotiating positions for these specialized suppliers.

- Critical Components: Suppliers of essential parts like high-performance engines, advanced hydraulic pumps, and sophisticated control systems hold considerable sway due to their direct impact on Sany's product quality and operational capabilities.

- Technological Dependence: Sany's commitment to innovation, especially in areas like electric powertrains and emission-reducing technologies, increases its reliance on suppliers who possess specialized, advanced green technologies, thereby strengthening their bargaining power.

- Supplier Concentration: In certain niche component markets, a limited number of suppliers may dominate, giving them increased leverage over Sany due to a lack of readily available alternatives.

- Input Cost Sensitivity: Fluctuations in the cost of raw materials or specialized manufacturing processes for critical components can directly impact Sany's production costs and profitability, giving suppliers a degree of control over pricing.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails the bargaining power of Sany Heavy Industry's suppliers. If Sany can readily source comparable raw materials or components, even with minor modifications, suppliers face pressure to offer competitive pricing and terms. This is crucial in the heavy machinery sector where material costs are substantial.

For instance, if a primary steel supplier were to significantly increase prices, Sany's ability to switch to an alternative steel producer or even a slightly different grade of steel with comparable properties would limit the original supplier's leverage. This dynamic is particularly relevant for commodity materials used in large volumes.

However, the situation changes for highly specialized or proprietary components. For technologies that are patented or unique, the availability of substitutes is often scarce, thereby granting those specific suppliers greater bargaining power. Sany's reliance on such specialized parts can therefore increase supplier leverage.

In 2024, Sany, like many in the manufacturing sector, navigated supply chain complexities. While global commodity prices saw fluctuations, the availability of alternative suppliers for many standard components remained a key factor in managing input costs. For example, reports from early 2024 indicated that while certain advanced electronic components for sophisticated machinery experienced lead time challenges, the market for more common structural steel and hydraulic parts offered greater flexibility due to a wider supplier base.

- Limited Substitute Availability for Specialized Components: Sany's dependence on unique, patented technologies or highly specialized parts from a few providers can grant those suppliers significant leverage.

- Impact of Commodity Substitutes: For more standard raw materials and components, the existence of multiple suppliers and interchangeable options reduces the bargaining power of any single supplier.

- Cost Management through Substitution: The ability to switch to alternative inputs, even with some adaptation costs, allows Sany to negotiate better terms and manage its cost of goods sold effectively.

- 2024 Supply Chain Dynamics: While general component availability improved in parts of 2024, specialized inputs continued to present challenges, highlighting the varying impact of substitute availability across Sany's supply chain.

Sany Heavy Industry's suppliers hold significant bargaining power when they provide critical, specialized components essential for Sany's machinery, especially those with advanced technologies. This power is amplified by high switching costs for Sany, which can involve re-tooling and extensive validation processes, as seen in the complex supply chains of 2024. The threat of suppliers integrating forward into manufacturing heavy equipment also adds pressure, particularly for those offering proprietary systems.

| Factor | Impact on Sany's Supplier Bargaining Power | 2024 Relevance |

| Criticality of Components | High for specialized engines, hydraulics, electronics | Key for advanced machinery performance |

| Switching Costs | High due to re-tooling and certification needs | Continues to be a major barrier to supplier changes |

| Supplier Concentration | Significant in niche technology markets | Limited alternatives increase supplier leverage |

| Forward Integration Threat | Relevant for tech-focused suppliers | Potential for new competitive dynamics |

What is included in the product

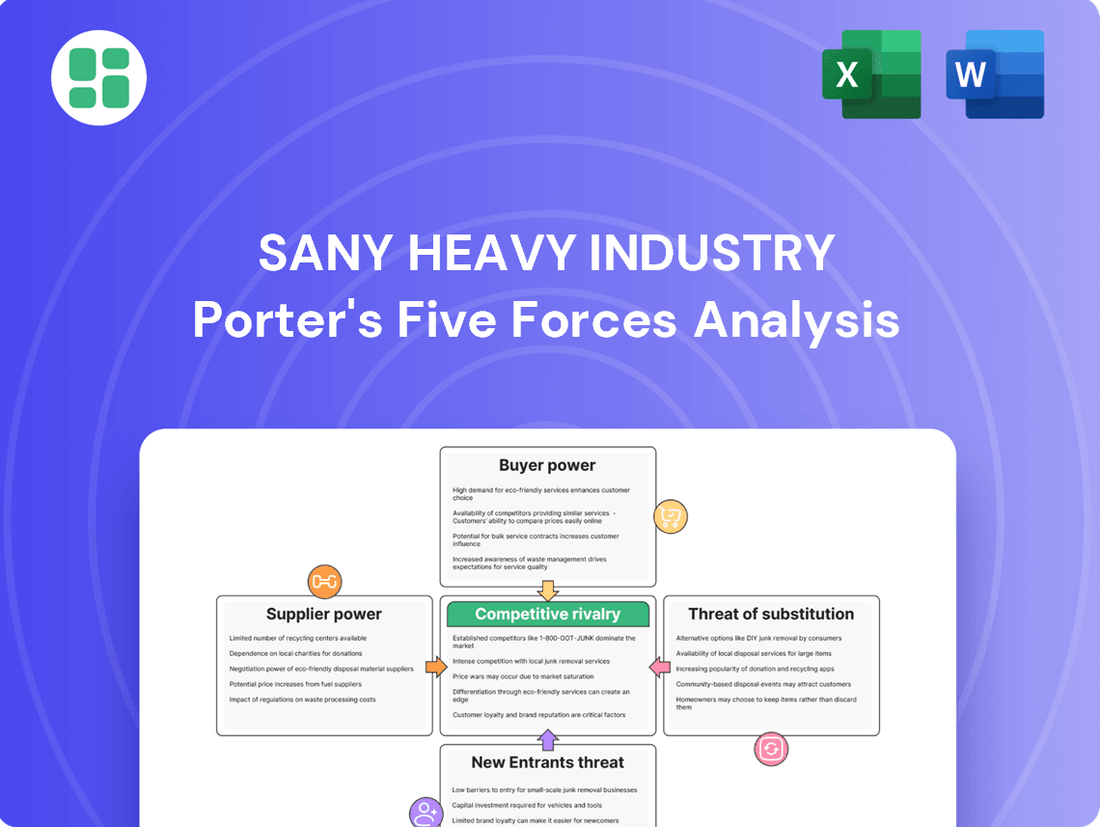

This Porter's Five Forces analysis for Sany Heavy Industry dissects the competitive intensity, buyer and supplier power, threat of new entrants and substitutes, ultimately revealing the strategic levers for sustained profitability.

Instantly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Sany Heavy Industry.

Customers Bargaining Power

Sany Heavy Industry's customer base is notably concentrated, featuring large construction firms, mining operations, and government bodies involved in significant infrastructure development. These major clients, particularly those procuring substantial quantities of equipment, wield considerable influence in price and contract negotiations.

Customer switching costs for heavy equipment like that produced by Sany Heavy Industry are significant. Beyond the initial purchase price, which can run into millions for large machinery, customers incur substantial expenses when changing suppliers. These include retraining operators on new equipment interfaces and maintenance procedures, setting up specialized maintenance facilities, and ensuring compatibility with existing fleet management software and spare parts inventories. For instance, a construction company heavily invested in a specific hydraulic system or telematics platform will face considerable disruption and cost to transition to a competitor’s offerings.

Customer price sensitivity is a significant factor for Sany Heavy Industry. In highly competitive markets, particularly for standardized equipment or during economic slowdowns, customers tend to be very focused on price. This means that even small price changes can influence purchasing decisions.

Sany's global presence is a key advantage here. With revenue diversified across many international markets, the company can better absorb localized price pressures. For instance, if one region experiences an economic downturn leading to increased price sensitivity, Sany's sales in more robust markets can help offset this. However, the overarching price trends across the entire heavy machinery industry still play a crucial role in overall profitability and market share.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Sany Heavy Industry is generally low. Manufacturing heavy equipment demands immense capital, estimated in the billions of dollars for a new facility, and highly specialized technical know-how. This creates a significant barrier to entry for most of Sany's diverse customer base, which ranges from individual contractors to large construction firms.

While unlikely for the majority, exceptionally large and diversified conglomerates with specific, high-volume needs might explore backward integration. However, the complexity and scale involved in producing sophisticated machinery like excavators or cranes, which often incorporate advanced hydraulics and electronics, make this a rare consideration. For instance, a major global infrastructure developer might assess the feasibility of producing certain components if their scale of operations justifies the investment and they possess the necessary engineering capabilities.

Sany's extensive product portfolio and ongoing innovation in areas like electric construction machinery further complicate potential customer integration. Customers would not only need to replicate Sany's existing manufacturing capabilities but also keep pace with technological advancements. In 2024, the ongoing global push for sustainability and smart manufacturing in the heavy equipment sector means that any customer considering backward integration would face substantial R&D costs to remain competitive.

- Low Likelihood of Backward Integration: The substantial capital outlay and specialized expertise required to manufacture heavy equipment make it an improbable strategy for most of Sany's customers.

- Niche Possibility for Large Conglomerates: Exceptionally large, diversified companies with very specific, high-volume equipment needs might consider backward integration, though it remains an uncommon scenario.

- Technological and Innovation Barriers: Sany's continuous investment in advanced technologies, including electric and intelligent machinery, presents a moving target that further deters potential customer integration efforts.

Product Differentiation and Information Asymmetry

Sany Heavy Industry's ability to differentiate its products significantly impacts customer bargaining power. When Sany offers highly specialized equipment, perhaps featuring advanced electric powertrains or integrated smart operational systems, customers find fewer direct substitutes, thereby reducing their leverage. For instance, Sany's investment in electric excavators and intelligent construction solutions aims to create a distinct market position.

The availability of detailed information also plays a crucial role. If customers have easy access to comprehensive data on Sany's product performance, reliability, and total cost of ownership compared to competitors, their ability to negotiate favorable terms increases. Conversely, information asymmetry, where Sany possesses superior knowledge about its product's value, can diminish customer power.

- Product Differentiation: Sany's focus on technological advancements, such as its electric and intelligent machinery, serves to reduce the substitutability of its offerings.

- Information Availability: Transparency regarding product lifecycle costs and performance metrics empowers customers, while a lack of such information strengthens Sany's position.

- Customer Leverage: Highly differentiated products and limited customer information access collectively decrease the bargaining power of customers.

Sany Heavy Industry faces moderate customer bargaining power due to significant switching costs and price sensitivity among its large-scale clients, although backward integration is largely improbable. The company's global diversification helps mitigate localized price pressures, but industry-wide pricing trends remain influential.

In 2023, Sany Heavy Industry reported total revenue of approximately RMB 105.3 billion (around $14.5 billion USD), showcasing the scale of its operations and the potential impact of customer negotiations on its financial performance. The heavy machinery sector, while experiencing growth driven by infrastructure projects, also sees intense competition, particularly from domestic rivals, which can amplify customer leverage on pricing.

| Factor | Impact on Sany's Customer Bargaining Power | Supporting Data/Observation (as of 2024) |

|---|---|---|

| Switching Costs | Moderate to High | Significant investment in training, maintenance infrastructure, and fleet compatibility creates high costs for customers to change suppliers. |

| Price Sensitivity | Moderate | Customers, especially large ones, are price-conscious, particularly in competitive segments or during economic downturns. |

| Backward Integration Threat | Low | The immense capital and technical expertise required for manufacturing heavy equipment makes this an unlikely strategy for most customers. |

| Product Differentiation | Low to Moderate | Sany's innovation in electric and intelligent machinery can reduce customer leverage, but standardization in some equipment types maintains some customer power. |

Preview Before You Purchase

Sany Heavy Industry Porter's Five Forces Analysis

This preview showcases the complete Sany Heavy Industry Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the heavy machinery sector. You're looking at the actual document, which will be available for instant download and use immediately after your purchase, ensuring you receive the full, professionally formatted report without any alterations.

Rivalry Among Competitors

The heavy equipment sector is a crowded arena with formidable global contenders such as Caterpillar, Komatsu, Volvo, and Liebherr. Sany Heavy Industry itself is a major force, frequently listed among the top worldwide manufacturers.

This intense competition is further amplified by significant regional players like XCMG and Zoomlion, all vying for market share. In 2023, Sany Heavy Industry reported revenue of approximately $12.1 billion, underscoring its substantial presence against these giants.

When the industry growth rate slows, such as with global construction equipment sales anticipated to see a dip in 2025, competitive rivalry tends to heat up. Companies then battle more fiercely for a shrinking pool of customers, potentially leading to price wars or increased marketing spend.

However, robust infrastructure development projects and ongoing urbanization trends can significantly boost demand for heavy machinery. For instance, China's ongoing infrastructure push, a key market for Sany, provides a counteracting force, potentially mitigating the impact of a general slowdown by creating pockets of strong demand and thus easing competitive pressures.

While heavy equipment might seem like a standard commodity, Sany distinguishes itself through significant investments in technological advancements, including electrification, automation, and the integration of the Internet of Things (IoT). This innovation, coupled with a focus on product quality and robust after-sales support, builds strong brand loyalty. For instance, Sany's commitment to R&D, which saw them invest billions in developing smarter, more efficient machinery, directly contributes to this differentiation.

Exit Barriers

High exit barriers can trap companies in an industry, fueling ongoing intense competition. For Sany Heavy Industry, its vast global footprint, encompassing numerous production facilities and research and development centers, represents substantial sunk costs. These investments make it economically challenging to simply shut down operations or divest assets without incurring significant losses.

Consider these factors contributing to Sany's exit barriers:

- Specialized Assets: Sany's manufacturing plants are equipped with highly specialized machinery for producing heavy construction equipment, which has limited resale value outside the industry.

- Long-Term Contracts: The company is likely bound by long-term supply agreements and customer contracts, making an immediate exit difficult without penalty.

- Significant Employee Bases: Sany employs a large, skilled workforce across its global operations. Disbanding these teams and managing associated severance costs would be a considerable financial undertaking.

- Global Network Investments: Sany's extensive network of production bases and R&D facilities, built over years, represents significant capital expenditure that is not easily recouped.

Strategic Commitments of Competitors

Competitors in the heavy machinery sector are making significant long-term strategic commitments that intensify rivalry. These include substantial investments in research and development for emerging technologies like electric-powered equipment, artificial intelligence for predictive maintenance, and advanced telematics for fleet management. For instance, Caterpillar announced a $1.9 billion investment in its Illinois facilities through 2026, focusing on advanced manufacturing and new product development, including electrification. Komatsu, another major player, has committed to increasing its investment in digital solutions and automation, aiming for a significant portion of its revenue to come from these areas by 2030.

Sany Heavy Industry itself is actively engaged in global expansion, digital transformation, and decarbonization initiatives, mirroring the strategic thrusts of its rivals. The company's commitment to R&D is evident in its 2023 financial reports, which showed a 15% increase in R&D spending, particularly directed towards intelligent manufacturing and new energy products. This pursuit of innovation and market reach means that competitive pressures are likely to remain high as companies vie for market share through technological advancement and geographic presence.

- R&D Investments: Competitors are channeling billions into electric, AI, and telematics technologies.

- Geographic Expansion: Companies are pushing into new international markets to broaden their customer base.

- Digitalization Focus: A strong emphasis is placed on integrating digital solutions for enhanced operational efficiency.

- Decarbonization Efforts: Significant resources are allocated to developing environmentally friendly machinery.

The competitive rivalry within the heavy equipment sector is intense, driven by a few dominant global players and numerous strong regional competitors. Sany Heavy Industry, a significant global manufacturer, faces constant pressure from giants like Caterpillar and Komatsu, as well as regional powerhouses such as XCMG and Zoomlion. This fierce competition is exacerbated by high exit barriers, including specialized assets and substantial global network investments, which lock companies into the market, forcing them to compete vigorously.

Companies are making substantial long-term strategic investments in areas like electrification, AI, and digitalization, intensifying the rivalry. For instance, Caterpillar's $1.9 billion investment in advanced manufacturing through 2026 highlights this trend. Sany Heavy Industry is actively mirroring these strategies, increasing its R&D spending by 15% in 2023 to focus on intelligent manufacturing and new energy products, ensuring that competitive pressures remain elevated as firms vie for market share through innovation and global reach.

| Competitor | 2023 Revenue (Approx.) | Key Strategic Focus |

|---|---|---|

| Sany Heavy Industry | $12.1 billion | Intelligent manufacturing, new energy products, global expansion |

| Caterpillar | $67.1 billion | Electrification, advanced manufacturing, digital solutions |

| Komatsu | $21.7 billion | Digital solutions, automation, sustainability |

SSubstitutes Threaten

While direct substitutes for heavy equipment like those produced by Sany are scarce, the threat of substitutes can emerge from alternative construction methodologies. For instance, the growing adoption of modular construction and prefabrication techniques can lessen the reliance on large-scale on-site heavy machinery, impacting demand for traditional equipment.

Furthermore, advancements in robotics and automation are increasingly reducing the necessity for certain types of heavy equipment on construction sites. This technological shift, which gained significant traction in 2024 with increased investment in construction automation, presents a potential long-term threat by fundamentally altering the labor and equipment requirements of the industry.

The threat of substitutes for Sany Heavy Industry's products is significantly influenced by the price-performance trade-off offered by alternative solutions. If other methods or technologies can achieve similar results at a lower cost or with better efficiency, they become more appealing to customers. For instance, advancements in drone technology for surveying construction sites or sophisticated project management software that optimizes resource allocation could lessen the demand for certain traditional heavy equipment.

In 2024, the construction and infrastructure sectors are increasingly exploring digital solutions that can streamline operations and reduce the need for extensive physical machinery. Companies are looking for ways to improve project timelines and cost-effectiveness. This trend means that while Sany's heavy machinery remains crucial for core construction tasks, the appeal of substitute technologies that offer a compelling price-performance advantage for specific functions poses a notable threat.

Customer willingness to switch to alternative solutions for heavy machinery is influenced by perceived risk, upfront costs, and potential long-term savings. For instance, while a new, more efficient telehandler might offer long-term cost benefits, the initial purchase price and the learning curve for operators can be significant deterrents. In 2024, the global construction equipment market saw continued demand for rental options, suggesting that outright purchase of new, potentially substituting technologies faces a hurdle of capital expenditure for many customers.

Technological Advancements Enabling Substitution

The threat of substitutes for Sany Heavy Industry is amplified by rapid technological advancements. Innovations in areas such as artificial intelligence, advanced robotics, and novel sustainable materials are paving the way for entirely new types of equipment and construction methods that could replace traditional heavy machinery. For instance, advancements in modular construction powered by robotics could reduce the reliance on large-scale earthmoving equipment in certain projects.

Sany itself is actively investing in these transformative technologies to mitigate this threat and remain competitive. Their significant investments in electrification and digital solutions, including autonomous driving for construction vehicles, are designed to preemptively address the emergence of these disruptive substitutes. By embracing these trends, Sany aims to offer more efficient, sustainable, and technologically advanced alternatives that are less susceptible to being replaced by external innovations.

The pace of change means that companies relying on established heavy machinery must continuously innovate. For example, the development of advanced drone technology for surveying and even light construction tasks presents a potential substitute for some traditional equipment roles. Sany’s strategic focus on R&D, which saw them allocate approximately 5.5% of their revenue to research and development in 2023, underscores their commitment to staying at the forefront of these technological shifts.

- Technological Disruption: AI, robotics, and new materials create potential substitutes for traditional heavy machinery.

- Sany's Response: Investments in electrification and digital technologies aim to counter substitution threats.

- R&D Investment: Sany's commitment to innovation, with significant R&D spending, is crucial for staying ahead.

- Emerging Alternatives: Technologies like advanced drone applications could replace certain functions of heavy equipment.

Rental Market Growth as a Substitute for Ownership

The increasing adoption of heavy equipment rental services poses a significant threat of substitution for Sany Heavy Industry. Many businesses, particularly those with fluctuating project demands or a desire to control capital expenditure, find renting a more attractive option than purchasing new machinery. This is especially true when considering the substantial upfront costs and ongoing maintenance associated with owning heavy equipment.

This rental trend can directly affect Sany's sales volumes. For instance, in 2024, the global construction equipment rental market was valued at approximately $110 billion, with projections indicating continued growth. This suggests that a substantial portion of potential Sany customers might opt for rental solutions instead of direct purchases, thereby limiting Sany's market penetration and revenue generation from new equipment sales.

The appeal of rentals is amplified by:

- Cost Efficiency: Renting avoids large capital outlays and reduces expenses related to depreciation, insurance, and storage.

- Flexibility: Businesses can access the specific equipment they need for the duration of a project, without long-term commitments.

- Access to Latest Technology: Rental companies often maintain modern fleets, allowing users to benefit from the newest innovations without the burden of rapid obsolescence.

The threat of substitutes for Sany Heavy Industry primarily stems from evolving construction methodologies and technological advancements that offer alternative ways to achieve project goals. While direct equipment replacements are few, shifts towards modular construction and automation in 2024 are reducing reliance on traditional heavy machinery. This trend, fueled by a desire for efficiency and cost savings, means that Sany must continuously innovate to remain competitive against these emerging solutions.

The price-performance ratio of these substitutes is a critical factor. If alternative methods or technologies can deliver comparable results more affordably or efficiently, they become more attractive to customers. For example, advancements in drone technology for site analysis or sophisticated project management software that optimizes resource allocation can lessen the demand for certain types of heavy equipment, impacting Sany's market share.

Furthermore, the increasing popularity of equipment rental services presents a significant substitution threat. In 2024, the global construction equipment rental market was valued at approximately $110 billion, indicating a substantial segment of the market that bypasses new equipment purchases. This rental trend allows businesses to access necessary machinery without the large capital expenditure and ongoing maintenance costs associated with ownership, directly impacting Sany's new equipment sales.

| Substitute Type | Key Drivers | Impact on Sany | 2024 Market Data/Trend |

| Alternative Construction Methods (e.g., Modular, Prefab) | Efficiency, Cost Reduction, Project Speed | Reduced demand for certain heavy machinery | Growing adoption in residential and commercial projects |

| Automation & Robotics | Labor Savings, Precision, Safety | Potential displacement of some equipment functions | Increased investment in construction automation technologies |

| Digital Solutions (e.g., Drones, Software) | Optimized Planning, Site Analysis, Resource Management | Reduced need for specific equipment for certain tasks | Growing integration into project workflows |

| Equipment Rental Services | Capital Expenditure Control, Flexibility, Access to Latest Tech | Direct competition with new equipment sales | Global rental market valued at ~$110 billion in 2024 |

Entrants Threaten

The heavy equipment manufacturing sector, including players like Sany Heavy Industry, demands substantial upfront capital. Establishing state-of-the-art research and development facilities, expansive manufacturing plants, and robust global distribution and service networks requires billions of dollars. For instance, building a new, fully integrated heavy machinery production facility can easily cost upwards of $500 million to $1 billion, making it a formidable hurdle for newcomers.

Established players like Sany Heavy Industry enjoy substantial economies of scale in manufacturing, purchasing, and research and development. This allows them to significantly lower their per-unit production costs, giving them a competitive edge.

New entrants would find it incredibly difficult to match these cost efficiencies. Without Sany's massive production volumes, a new company would likely face higher input costs and less bargaining power with suppliers, making it challenging to compete on price.

Existing strong brands like Sany have cultivated deep customer loyalty through consistent product quality, reliability, and extensive service networks. For instance, Sany's commitment to innovation and customer support has solidified its market position. New entrants must overcome this established trust, which is a significant barrier to entry, requiring substantial investment in marketing and service infrastructure to even approach comparable customer retention rates.

Access to Distribution Channels and Supply Chains

New entrants face significant hurdles in establishing the extensive global distribution and service networks that Sany Heavy Industry has cultivated over decades. Building this infrastructure, from dealerships to maintenance depots, requires substantial capital investment and intricate logistical planning, making it difficult for newcomers to compete effectively.

Securing reliable and specialized component supply chains also presents a formidable barrier. Sany Heavy Industry benefits from established relationships with key suppliers, often with long-term contracts and volume discounts. New entrants must invest heavily in sourcing and qualifying suppliers, often at less favorable terms, which can impact cost competitiveness and production reliability.

- Global Reach: Sany Heavy Industry operates in over 100 countries, showcasing the breadth of its distribution network.

- Supply Chain Investment: The company continuously invests in its supply chain to ensure efficiency and access to critical components.

- Barriers to Entry: The sheer scale and complexity of Sany's established network represent a significant deterrent for potential new competitors.

Government Policy and Regulation

Government policy and regulation significantly impact the threat of new entrants in the heavy equipment sector. Stringent environmental standards, such as emissions regulations for construction machinery, and rigorous safety requirements demand substantial upfront investment in compliance and research and development. This creates a high barrier to entry for potential new players who may lack the capital or technological expertise to meet these demands. For instance, by mid-2024, many regions are enforcing stricter emission standards, pushing manufacturers towards cleaner technologies.

Sany Heavy Industry proactively addresses these regulatory hurdles. The company's strategic emphasis on developing low-carbon technologies and expanding its portfolio of electric-powered equipment directly aligns with evolving environmental mandates. This forward-thinking approach not only ensures compliance but also positions Sany favorably against competitors who may struggle to adapt to new regulations.

- High Capital Investment: New entrants face significant costs to meet evolving environmental and safety standards.

- Technological Barriers: Compliance often requires advanced R&D, creating a technological hurdle for newcomers.

- Sany's Strategy: Sany's investment in low-carbon patents and electric products mitigates regulatory risks and enhances competitive positioning.

The threat of new entrants for Sany Heavy Industry remains relatively low due to the immense capital requirements for establishing manufacturing facilities, R&D, and global distribution networks, often exceeding hundreds of millions to billions of dollars. Established economies of scale, strong brand loyalty, and complex supply chain relationships further solidify Sany's competitive position, making it exceptionally difficult for newcomers to gain traction. Additionally, stringent government regulations, particularly concerning environmental standards, necessitate significant investment in compliant technologies, acting as a substantial barrier.

| Barrier Type | Description | Sany's Advantage |

|---|---|---|

| Capital Requirements | Establishing integrated manufacturing and R&D facilities can cost $500M - $1B+. | Sany's existing infrastructure and scale provide significant cost efficiencies. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | New entrants struggle to match Sany's purchasing power and production efficiency. |

| Brand Loyalty & Network | Decades of building trust and extensive service networks. | Sany's global reach (100+ countries) and established customer relationships are hard to replicate. |

| Supply Chain Access | Securing specialized components and favorable supplier terms. | Sany benefits from long-term contracts and volume discounts with key suppliers. |

| Regulatory Compliance | Meeting evolving environmental (e.g., emissions) and safety standards. | Sany's investment in low-carbon and electric technologies positions it favorably against regulatory changes. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Sany Heavy Industry is built upon a foundation of publicly available financial reports, including annual and quarterly filings, alongside comprehensive industry research from reputable market intelligence firms and trade publications.