Rede D’Or São Luiz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rede D’Or São Luiz Bundle

Rede D'Or São Luiz faces a dynamic healthcare landscape, with significant bargaining power from suppliers of medical equipment and pharmaceuticals. The threat of new entrants, while somewhat mitigated by high capital requirements, remains a factor to consider in this growing market.

The complete report reveals the real forces shaping Rede D’Or São Luiz’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Rede D'Or São Luiz's reliance on specialized medical equipment and pharmaceuticals grants suppliers considerable leverage. The highly technical nature and often proprietary status of these products mean few, if any, direct substitutes exist, particularly for advanced diagnostic and surgical technologies crucial to maintaining a competitive edge in the healthcare sector.

The availability of highly specialized medical professionals significantly impacts supplier power for healthcare providers like Rede D’Or São Luiz. When there's a scarcity of doctors, nurses, or technicians with niche expertise, their ability to negotiate higher salaries and better working conditions increases substantially.

For instance, in 2024, Brazil, like many countries, continued to face a shortage of certain medical specialists. This dynamic directly translates to increased bargaining power for these in-demand professionals within the healthcare sector. Rede D'Or's strategic advantage hinges on its capacity to attract and retain this top-tier talent, as their skills are fundamental to delivering high-quality patient care and maintaining the company's competitive standing.

The bargaining power of technology and digital health solutions providers for Rede D'Or São Luiz is significant and growing. As Brazil's healthcare sector embraces innovation, companies offering AI, telemedicine, and advanced digital platforms are becoming increasingly crucial. Rede D'Or's own strategic investments, such as their focus on ERP systems, AI integration, and Revenue Cycle Management (RCM) solutions, underscore this dependence. These technology partners are essential for enhancing operational efficiency and improving patient care outcomes.

Rede D'Or's commitment to digital transformation means they rely heavily on these specialized suppliers. For instance, the adoption of AI in diagnostics or RCM software to streamline billing processes directly impacts the company's bottom line and service delivery. In 2023, the global digital health market was valued at over $200 billion, and it continues to expand rapidly, indicating strong demand and pricing power for innovative solutions providers in this space.

Consolidated Supply Chains

While Rede D'Or São Luiz's substantial size provides some negotiation leverage, the growing consolidation within the medical supply industry, both globally and within Brazil, presents a significant challenge. This consolidation means fewer suppliers are available, naturally increasing their bargaining power. For instance, in 2024, major medical equipment manufacturers continued to consolidate, reducing the number of key players for specialized devices.

This shift can directly impact Rede D'Or by potentially driving up prices and dictating terms for essential medical supplies and services. The ability to secure favorable pricing and payment terms becomes more difficult when dealing with a smaller pool of dominant suppliers. This trend underscores the critical importance of robust supply chain management strategies to navigate these pressures effectively.

- Consolidation Trend: Global and Brazilian medical supply markets are experiencing increased mergers and acquisitions, leading to fewer, larger suppliers.

- Impact on Pricing: Reduced competition among suppliers can result in higher costs for essential medical goods and services for healthcare providers like Rede D'Or.

- Strategic Importance: Effective supply chain management is crucial for Rede D'Or to mitigate the increased bargaining power of consolidated suppliers and maintain cost efficiency.

Infrastructure and Construction Services

Rede D’Or São Luiz’s expansion and modernization efforts mean suppliers of specialized infrastructure and construction services hold significant bargaining power. The demand for advanced healthcare facilities, adhering to stringent safety and hygiene regulations, allows these specialized firms to command higher prices.

For instance, in 2024, the Brazilian construction sector saw increased activity driven by infrastructure projects, which can translate to higher material costs and labor expenses for healthcare providers like Rede D’Or. Specialized contractors experienced in healthcare construction are particularly well-positioned to leverage this demand.

- Specialized Expertise: Firms with proven track records in building and renovating healthcare facilities possess unique knowledge that is difficult for Rede D’Or to replicate internally or source from general contractors.

- Regulatory Compliance: The complex web of healthcare building codes and certifications requires specialized suppliers who can ensure projects meet all necessary standards, adding to their leverage.

- Material Costs: Fluctuations in the prices of construction materials, such as steel and concrete, directly impact project costs and can be influenced by global supply chain dynamics and local demand.

- Project Timelines: Delays in construction can be costly for hospitals, giving suppliers who can consistently deliver on time and within budget a stronger negotiating position.

Suppliers of specialized medical equipment and pharmaceuticals wield significant power over Rede D’Or São Luiz due to the lack of substitutes and the proprietary nature of many high-tech offerings. This leverage is amplified by the ongoing consolidation within the medical supply industry, reducing the number of available providers and potentially increasing costs for essential goods. The growing dependence on advanced digital health solutions and AI further enhances the bargaining power of technology providers, as these innovations are critical for operational efficiency and patient care.

| Supplier Type | Factors Influencing Bargaining Power | Impact on Rede D'Or São Luiz | Example/Data Point (2023-2024) |

|---|---|---|---|

| Medical Equipment & Pharmaceuticals | Proprietary technology, lack of substitutes, supplier consolidation | Higher costs, potential supply chain disruptions | Global medical equipment manufacturers continued consolidation in 2024. |

| Specialized Medical Professionals | Scarcity of niche expertise, high demand | Increased labor costs, challenges in talent retention | Shortage of certain medical specialists persisted in Brazil in 2024. |

| Technology & Digital Health | Rapid innovation, critical for efficiency and patient care | Dependence on providers, pricing power for solutions | Global digital health market exceeded $200 billion in 2023. |

| Infrastructure & Construction | Need for specialized healthcare facility expertise, regulatory compliance | Higher project costs, reliance on specialized contractors | Increased activity in Brazil's construction sector in 2024 led to higher material costs. |

What is included in the product

This analysis delves into the competitive forces shaping Rede D'Or São Luiz's market, examining the intensity of rivalry, buyer and supplier power, the threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces for Rede D'Or São Luiz, providing immediate clarity on strategic vulnerabilities.

Customers Bargaining Power

For Rede D'Or São Luiz, large health insurance companies and corporate health plans are crucial customer segments. Their substantial bargaining power stems from the sheer volume of patients they direct to hospitals and their ability to negotiate reimbursement rates and contract terms. For instance, in 2023, Brazil's private health insurance sector covered approximately 50 million people, giving these payers significant leverage over providers.

Rede D'Or's strategic move to integrate its own insurance arm, SulAmérica, directly addresses this customer bargaining power. By internalizing a portion of the payer relationship, Rede D'Or can better manage contract negotiations and potentially improve its reimbursement structures, thereby mitigating the external pressure from large insurance providers.

Individual patients, especially those paying directly, generally possess limited bargaining power. This is particularly true for emergency or highly specialized medical needs where treatment options are scarce. However, for elective procedures or routine outpatient services, patients can exercise more influence by comparing prices, quality of care, and the overall patient experience. Rede D'Or São Luiz's strategy to emphasize humanized care and superior technical quality directly addresses this by building patient loyalty and attracting those seeking value beyond just the immediate medical necessity.

Patients increasingly have access to detailed hospital quality metrics and patient experience data. For instance, platforms like Newsweek's World's Best Hospitals 2024 highlight top-performing institutions, allowing patients to compare services more effectively. This transparency directly empowers patients, enabling them to make more informed choices about their healthcare providers.

This enhanced information access translates into greater patient bargaining power. As patients become more aware of quality differences and patient satisfaction scores, they can demand better services and pricing. This competitive pressure encourages hospitals, including those within networks like Rede D’Or São Luiz, to focus on improving both the quality of care and operational efficiency to attract and retain patients.

Corporate Clients and Employee Health Plans

Corporate clients, by purchasing health plans for their employees, form a substantial customer bloc with considerable bargaining power. These organizations typically prioritize comprehensive benefits, cost efficiency, and top-tier medical services. Rede D'Or São Luiz's integrated approach, leveraging its extensive hospital network and insurance capabilities, positions it favorably to meet these demands and secure large corporate contracts.

The bargaining power of these corporate clients is amplified by several factors:

- Volume Purchasing: Large companies can negotiate better rates due to the sheer volume of employees covered.

- Demand for Value: They actively seek healthcare providers that offer a strong return on investment through quality care and cost containment.

- Provider Choice: Corporate clients often have the flexibility to switch providers if their needs are not met, increasing pressure on healthcare systems to offer competitive packages.

- Focus on Wellness: Many corporations are increasingly interested in preventative care and wellness programs, influencing the types of services they demand from health plan providers.

Geographic Concentration and Local Alternatives

In regions where Rede D'Or São Luiz holds a significant market share with few direct private competitors, the bargaining power of local customers tends to be reduced. This is because fewer alternatives mean less leverage for patients to negotiate pricing or demand specific services.

Conversely, in areas where Rede D'Or faces competition from other private hospital groups or where public healthcare facilities are readily accessible, customers gain more options. This increased choice directly translates to higher bargaining power, as patients can opt for providers offering better value or more convenient care.

Rede D'Or's expansive operational footprint across numerous Brazilian states, encompassing 13.8 million consultations in 2023, allows it to strategically manage its presence and influence in various local markets. This broad network can dilute the impact of localized customer bargaining power by offering a consistent service level across different geographies.

- Geographic Concentration: Rede D'Or's presence in 15 states as of 2023 means customer choice varies significantly by region.

- Local Alternatives: In areas with multiple private hospitals, like São Paulo, customer bargaining power is higher than in more consolidated markets.

- Public Healthcare Access: The availability and quality of public healthcare also influence private sector customer leverage.

- Network Consolidation: Rede D'Or's 2023 revenue of R$23.3 billion reflects its scale, which can sometimes offset individual customer bargaining power.

The bargaining power of customers for Rede D'Or São Luiz is a multifaceted issue, influenced by the type of customer and market dynamics. Large health insurance companies and corporate clients wield significant power due to their volume and negotiation capabilities. For instance, in 2023, Rede D'Or São Luiz reported 13.8 million consultations, highlighting the substantial patient flow these payers represent. Individual patients, particularly for non-emergency services, are gaining more leverage due to increased transparency in quality and pricing, with platforms like Newsweek's World's Best Hospitals 2024 providing comparative data.

| Customer Segment | Bargaining Power Level | Factors Influencing Power | Rede D'Or São Luiz's Strategy |

|---|---|---|---|

| Health Insurance Companies | High | Volume of patients, reimbursement rate negotiation | Integration with SulAmérica |

| Corporate Clients | High | Volume purchasing, demand for value, provider choice | Leveraging extensive network and insurance capabilities |

| Individual Patients (non-emergency) | Moderate to High | Price comparison, quality metrics, patient experience | Focus on humanized care and technical quality |

| Individual Patients (emergency/specialized) | Low | Limited treatment options, urgent need | Emphasis on superior technical quality |

What You See Is What You Get

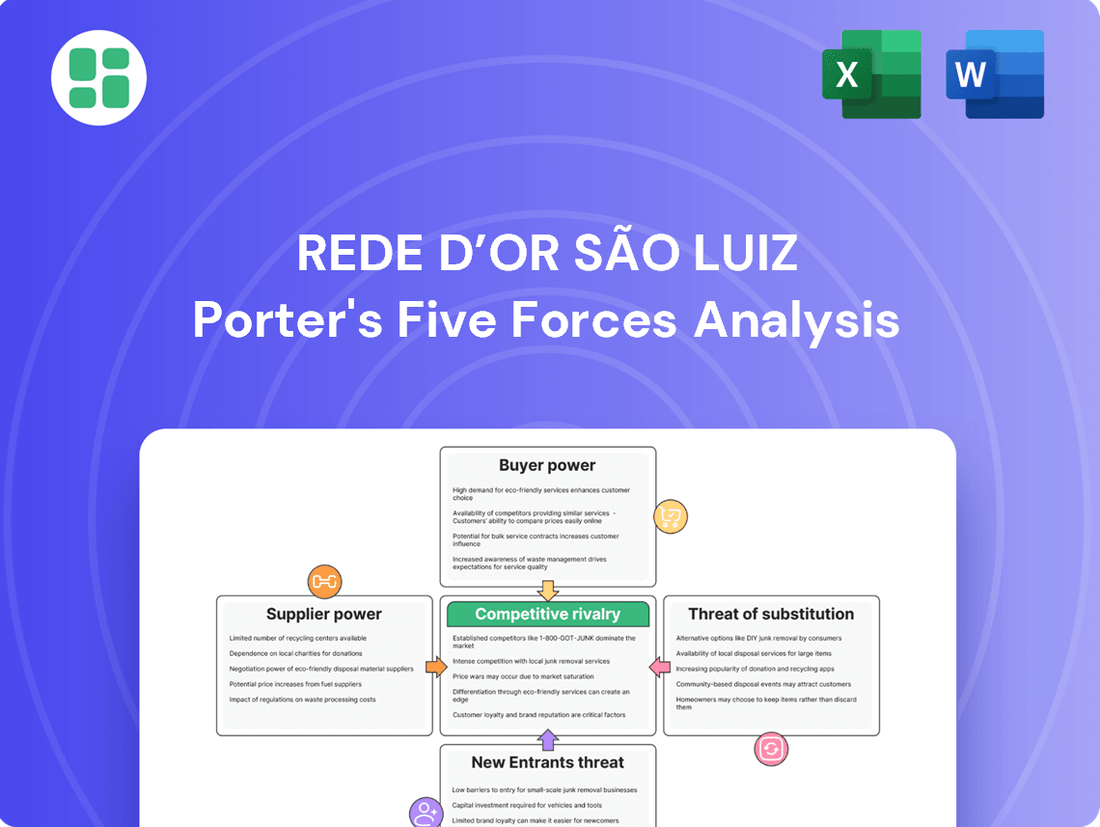

Rede D’Or São Luiz Porter's Five Forces Analysis

This preview showcases the exact Rede D’Or São Luiz Porter's Five Forces Analysis you will receive immediately after purchase, providing a comprehensive understanding of the competitive landscape. You're looking at the actual document, meticulously detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within Brazil's healthcare sector. Once your purchase is complete, you’ll gain instant access to this professionally formatted and ready-to-use analysis, enabling informed strategic decision-making.

Rivalry Among Competitors

Rede D'Or São Luiz operates within a highly competitive Brazilian private healthcare landscape. Major hospital groups such as Amil and Hapvida are significant rivals, actively expanding their operational footprints and broadening their service portfolios. This dynamic environment necessitates constant innovation in service quality, investment in advanced medical technologies, and strategic mergers and acquisitions to maintain market share.

Competitive rivalry is intensified by consistent merger and acquisition (M&A) activity. Companies are actively consolidating fragmented parts of the market and aiming to increase their share. Rede D'Or São Luiz has participated in this trend, notably acquiring Hospital São Luiz Campinas, a move that bolsters its strategic growth and competitive standing.

Major healthcare providers, including Rede D'Or São Luiz, are locked in a fierce competition driven by significant investments in technology and digital transformation. This includes the widespread adoption of telemedicine platforms, artificial intelligence for diagnostics and patient management, and advanced data analytics to streamline operations and personalize care.

For instance, in 2024, the global digital health market was projected to reach hundreds of billions of dollars, with a substantial portion allocated to AI and data analytics within healthcare systems. This technological arms race compels all significant players, Rede D'Or included, to consistently innovate and enhance their digital infrastructure to maintain a competitive edge and offer cutting-edge services to patients.

Differentiation in Service Quality and Specialization

Competitive rivalry for Rede D'Or São Luiz intensifies as rivals increasingly differentiate through superior service quality and specialized medical offerings. This competition isn't just about size; it's about the patient's overall experience and the availability of cutting-edge treatments. Hospitals are vying for patients by investing in advanced medical technology, such as robotic surgery systems, and developing centers of excellence for critical areas like oncology. Furthermore, a focus on humanized care, emphasizing empathy and patient comfort, is becoming a key differentiator, compelling Rede D'Or to consistently uphold its reputation for technical excellence and a full spectrum of medical services.

In 2024, the Brazilian healthcare market saw significant investment in specialized medical infrastructure. For instance, leading private hospital groups reported increased capital expenditure on advanced diagnostic equipment and the expansion of specialized treatment units. This strategic move by competitors directly challenges Rede D'Or's market position, forcing it to continuously innovate and enhance its service delivery to maintain patient loyalty and attract new clientele.

- Focus on Advanced Technology: Competitors are investing heavily in areas like AI-driven diagnostics and minimally invasive surgical techniques.

- Specialized Treatment Centers: The development of dedicated centers for cardiology, neurology, and oncology is a key strategy for differentiation.

- Patient Experience Enhancement: Hospitals are prioritizing patient comfort, personalized care plans, and improved digital interaction.

- Humanized Care Initiatives: Emphasis on staff training for empathetic communication and patient support is a growing competitive factor.

Geographic Reach and Network Density

Rede D'Or São Luiz's extensive geographic reach and dense network across Brazil are significant competitive advantages. As the largest private hospital operator, its comprehensive network acts as a formidable barrier to entry for new competitors. This widespread presence allows Rede D'Or to offer integrated care solutions and ensures broad patient access, solidifying its market position.

In 2023, Rede D'Or operated over 70 hospitals and more than 14,000 beds nationwide, demonstrating its substantial geographic footprint. This density facilitates economies of scale in procurement and operations, further enhancing its competitive edge. The ability to provide seamless patient transfers and specialized care across its network is a key differentiator.

- Network Size: Rede D'Or is Brazil's largest private hospital network, operating in all five regions of the country.

- Market Share: The company holds a significant market share in key metropolitan areas, leveraging its network density.

- Integrated Care: Its broad geographic presence enables the provision of end-to-end healthcare services, from primary care to complex procedures.

- Barriers to Entry: The capital investment and regulatory hurdles required to replicate Rede D'Or's network create substantial barriers for potential new entrants.

The competitive rivalry in Brazil's private healthcare sector is intense, with major players like Rede D'Or São Luiz, Amil, and Hapvida constantly vying for market share through expansion, technological investment, and service enhancement. This dynamic landscape, characterized by ongoing mergers and acquisitions, forces all participants to innovate continually to maintain their edge.

In 2024, the Brazilian healthcare market continued to see substantial investments in digital transformation, with companies adopting AI and telemedicine to improve patient care and operational efficiency. Rede D'Or São Luiz, as the largest private hospital operator in Brazil, leverages its extensive network and scale to compete effectively, though rivals are also investing heavily in specialized medical infrastructure and patient experience initiatives.

Rede D'Or São Luiz's competitive advantage is further solidified by its vast network, encompassing over 70 hospitals and more than 14,000 beds as of 2023. This significant geographic reach and operational density allow for economies of scale and integrated care solutions, creating substantial barriers to entry for new competitors in the Brazilian market.

| Competitor | Key Strategies | 2023/2024 Focus |

|---|---|---|

| Rede D'Or São Luiz | Network expansion, technology investment, specialized centers, patient experience | Consolidation, digital health integration, humanized care |

| Amil | Service portfolio expansion, geographic growth | Technological adoption, AI in diagnostics |

| Hapvida | Market consolidation, integrated care models | Digital transformation, specialized treatment units |

SSubstitutes Threaten

The Unified Health System (SUS) represents a substantial substitute for private healthcare providers like Rede D'Or São Luiz. SUS offers universal access to healthcare services across Brazil, acting as a critical safety net, particularly for the lower-income population.

While private healthcare often boasts superior amenities and shorter wait times, SUS provides a no-cost alternative that fundamentally limits the pricing power of private institutions. For instance, in 2024, SUS continued to serve the vast majority of Brazilians, with its budget allocated to providing essential medical services, thereby setting a benchmark for affordability that private entities must consider.

The increasing popularity of telemedicine and digital health platforms in Brazil presents a significant threat of substitutes for traditional healthcare services. These digital solutions, which saw accelerated adoption due to the pandemic, offer accessible and often cost-effective alternatives for various medical needs, including consultations and remote patient monitoring. For instance, by mid-2024, many Brazilian digital health startups reported substantial user growth, with some platforms handling millions of virtual consultations annually, indicating a tangible shift in patient behavior away from in-person visits for routine care.

The growing preference for home care services, especially for managing chronic illnesses, recovering from surgery, and providing elderly care, acts as a significant substitute for extended hospitalizations. This trend is particularly noticeable in Brazil, where home care offers a more personalized and often more economical option for patients who no longer require intensive hospital-level treatment.

The Brazilian home care market has seen robust expansion, with projections indicating continued growth. For instance, reports from 2023 and early 2024 suggest a substantial increase in the number of patients opting for in-home medical assistance, driven by factors like patient comfort, reduced risk of hospital-acquired infections, and the desire for familiar surroundings. This shift directly impacts hospital occupancy rates and revenue streams for providers like Rede D’Or São Luiz.

Preventive Care and Wellness Programs

The growing emphasis on preventive care and wellness programs presents a significant threat of substitution for hospital services like those offered by Rede D’Or São Luiz. As individuals increasingly adopt healthier lifestyles and utilize proactive health management strategies, the need for intensive medical interventions, including hospitalizations, may diminish.

This shift towards self-care and preventative measures means that conditions historically treated in hospitals could be managed or avoided altogether. For instance, the rise of personalized wellness plans and accessible health monitoring technologies could reduce reliance on traditional healthcare providers for managing chronic conditions.

In 2024, global spending on wellness programs saw a substantial increase, reflecting this trend. Companies are investing more in employee well-being, with estimates suggesting a market value exceeding $500 billion. This investment directly impacts the demand for services that address acute health issues, potentially diverting patients from hospital settings.

Consider these key aspects of the threat:

- Reduced Demand for Inpatient Services: Proactive health management can lead to fewer hospital admissions for preventable or manageable conditions.

- Shift in Healthcare Spending: Consumers and employers are allocating more resources to wellness and preventive services, rather than solely reactive medical care.

- Technological Advancements: Wearable devices and telehealth platforms empower individuals to monitor their health, potentially substituting the need for some in-person consultations and treatments.

Specialized Outpatient Clinics and Diagnostic Centers

Independent specialized outpatient clinics and diagnostic centers present a significant threat of substitution for Rede D’Or São Luiz. These facilities often focus on specific services, such as cardiology or radiology, and can offer competitive pricing due to lower overhead compared to large, integrated hospital systems.

Patients seeking routine check-ups, specialized diagnostic tests, or minor outpatient procedures may find these independent centers a more convenient and cost-effective alternative. For instance, a patient needing an MRI might choose a standalone imaging center if it offers faster appointment availability and a lower out-of-pocket expense than a hospital-affiliated facility.

This trend is particularly relevant as healthcare consumers become more price-sensitive and seek greater convenience. In 2024, the growth of outpatient surgery centers and specialized diagnostic clinics continued to outpace hospital-based services in many regions, indicating a clear shift in patient preference.

- Cost Advantage: Specialized centers often have lower operating costs, allowing them to offer services at a reduced price point.

- Convenience and Focus: Patients may prefer the focused expertise and potentially quicker service at specialized clinics for specific needs.

- Patient Choice: Increasing consumer awareness and a desire for value drive patients towards alternatives that meet their specific requirements efficiently.

- Market Trend: The expansion of independent diagnostic centers and outpatient clinics in 2024 highlights their growing appeal as substitutes for broader hospital services.

The Unified Health System (SUS) remains a powerful substitute, offering universal access that caps pricing for private providers like Rede D’Or. Telemedicine and digital health platforms are also gaining traction, providing accessible and cost-effective alternatives for consultations and monitoring, with many platforms handling millions of virtual consultations annually by mid-2024. Furthermore, the increasing preference for home care and a growing emphasis on preventive wellness programs are diverting patients from traditional hospital services, impacting occupancy and revenue streams.

| Substitute Type | Impact on Rede D'Or | Key Data/Trend (2023-2024) |

|---|---|---|

| Unified Health System (SUS) | Limits pricing power, provides a no-cost alternative | Serves the vast majority of Brazilians; budget allocated to essential services. |

| Telemedicine/Digital Health | Offers accessible, cost-effective alternatives for consultations | Substantial user growth reported by startups; millions of virtual consultations annually. |

| Home Care Services | Reduces demand for extended hospitalizations | Robust market expansion; patients opting for in-home assistance for comfort and cost. |

| Preventive Care/Wellness | Diminishes need for intensive medical interventions | Global wellness spending exceeding $500 billion; focus on self-care and health monitoring. |

| Independent Clinics/Diagnostic Centers | Offers competitive pricing and convenience for specific services | Outpatient surgery centers and diagnostic clinics outpace hospital-based services in growth. |

Entrants Threaten

Establishing a comprehensive hospital network like Rede D'Or São Luiz demands immense capital. Think about building state-of-the-art facilities, acquiring cutting-edge medical technology, and investing heavily in skilled personnel. These upfront costs create a significant financial hurdle for any potential new competitor looking to enter the Brazilian private healthcare sector.

For instance, the construction and equipping of a single advanced hospital can easily run into tens or even hundreds of millions of dollars. Rede D'Or itself has demonstrated this through its continuous expansion and acquisitions, which involve substantial financial commitments. This high capital requirement effectively limits the number of new entrants capable of competing at a similar scale and quality level.

The Brazilian healthcare sector is a labyrinth of intricate regulations, demanding specific licenses and accreditations for operation. This complex environment significantly raises the barrier to entry for new companies looking to establish a presence.

Navigating these regulatory requirements, such as obtaining authorizations from ANVISA for medical devices and pharmaceuticals, is not only time-consuming but also incurs substantial costs. For instance, in 2024, the average time for ANVISA approval for new medical devices saw an increase, making the initial investment for newcomers even more substantial.

The healthcare sector, particularly for hospital networks like Rede D'Or São Luiz, is inherently trust-based. New entrants must overcome the significant hurdle of establishing a strong brand reputation and cultivating patient trust, a process that takes considerable time and consistent quality of care. Building relationships with physicians and other medical professionals is also crucial, and this takes years to solidify.

Rede D'Or São Luiz, with its long-standing presence in the Brazilian market, already possesses this vital established reputation. This existing trust factor acts as a significant barrier to entry for new players, as they cannot easily replicate the goodwill and confidence that Rede D'Or has cultivated over decades. For instance, in 2024, Rede D'Or continued its focus on quality accreditations, with a significant portion of its hospitals holding international certifications, underscoring its commitment to established standards that new entrants would need to meet and surpass to gain similar recognition.

Access to Skilled Medical Professionals

The threat of new entrants in the hospital sector, particularly concerning access to skilled medical professionals, is significant. Rede D'Or São Luiz, like other major healthcare providers, relies heavily on a robust and specialized workforce to deliver quality care. New entrants would immediately face intense competition to recruit and retain these essential professionals.

Established players already possess strong employer branding and established relationships with medical schools and professional associations, making it challenging for newcomers to attract top talent. For instance, in 2024, Brazil faced a shortage of specialized doctors in certain fields, a trend expected to persist, intensifying competition for experienced professionals.

- High Demand for Specialists: The need for specialized medical expertise, such as oncologists, cardiologists, and neurosurgeons, is consistently high across the healthcare industry.

- Recruitment Costs: Attracting and retaining skilled medical staff often involves competitive salaries, benefits, and opportunities for professional development, driving up operational costs for new entrants.

- Existing Talent Pool Competition: Rede D'Or São Luiz and its established competitors actively recruit from the same limited pool of highly qualified medical professionals, creating a barrier for new hospitals seeking to build their teams.

- Geographic Concentration: In major urban centers where demand is highest, the concentration of skilled professionals is also higher, but so is the competition from existing, well-resourced institutions.

Economies of Scale and Network Effects

Rede D'Or São Luiz benefits immensely from its vast network, encompassing numerous hospitals, oncology clinics, and diagnostic centers spread across multiple Brazilian states. This extensive reach creates substantial economies of scale, allowing for more efficient operations and lower per-unit costs. In 2024, Rede D'Or continued to solidify its position as a dominant player, operating over 70 hospitals and more than 100 clinics, demonstrating a significant competitive advantage over smaller, emerging entities.

Furthermore, the network effects generated by Rede D'Or's integrated care model are a formidable barrier to entry. Patients benefit from seamless transitions between different levels of care within the same network, fostering loyalty and making it challenging for new entrants to replicate this comprehensive offering. This integrated approach, coupled with optimized resource allocation, enhances negotiation power with suppliers and insurers, further squeezing margins for potential new competitors.

- Economies of Scale: Rede D'Or's large operational footprint allows for bulk purchasing and standardized processes, reducing costs.

- Network Effects: An interconnected system of healthcare facilities enhances patient experience and operational efficiency, creating a virtuous cycle.

- Integrated Care: Offering a continuum of services from diagnostics to specialized treatments within a single network attracts and retains patients.

- Negotiation Power: A larger scale provides greater leverage in negotiating prices with suppliers and service providers.

The significant capital investment required to establish and equip modern healthcare facilities acts as a substantial barrier. Rede D'Or's ongoing expansion and acquisitions, which involve considerable financial outlays, highlight this. For instance, building and outfitting a single advanced hospital can cost tens to hundreds of millions of dollars, a prohibitive sum for many prospective entrants. This high cost of entry effectively limits the number of new players capable of competing at a comparable scale and quality.

Navigating Brazil's complex regulatory landscape, including obtaining necessary licenses and accreditations from bodies like ANVISA, is both time-consuming and costly. In 2024, the average approval time for new medical devices from ANVISA saw an increase, further escalating the initial investment burden for newcomers. This intricate web of regulations significantly raises the barrier for new companies seeking to enter the market.

Building patient trust and a strong brand reputation is paramount in the healthcare sector, a process that takes years of consistent, high-quality care. Rede D'Or São Luiz benefits from its established reputation, a key factor that new entrants struggle to replicate. In 2024, Rede D'Or continued to emphasize quality accreditations, with many of its facilities holding international certifications, setting a high standard for new competitors to meet.

The intense competition for skilled medical professionals further deters new entrants. Rede D'Or, along with other established providers, actively recruits from a limited pool of specialized talent. In 2024, Brazil experienced a shortage of certain medical specialists, a trend expected to continue, intensifying recruitment challenges for new hospitals aiming to build their teams.

| Factor | Impact on New Entrants | Rede D'Or São Luiz Advantage |

|---|---|---|

| Capital Requirements | Extremely High | Established financial capacity for expansion and acquisition |

| Regulatory Hurdles | Significant (time & cost) | Experience in navigating complex compliance |

| Brand Reputation & Trust | Difficult to build | Long-standing presence and established patient confidence |

| Talent Acquisition | Challenging (specialist shortages) | Strong employer branding and existing relationships with medical professionals |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Rede D'Or São Luiz leverages data from the company's official investor relations website, including annual reports and financial statements. We also incorporate insights from reputable healthcare industry research firms and relevant government health agency publications to provide a comprehensive view of the competitive landscape.