Rede D’Or São Luiz Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rede D’Or São Luiz Bundle

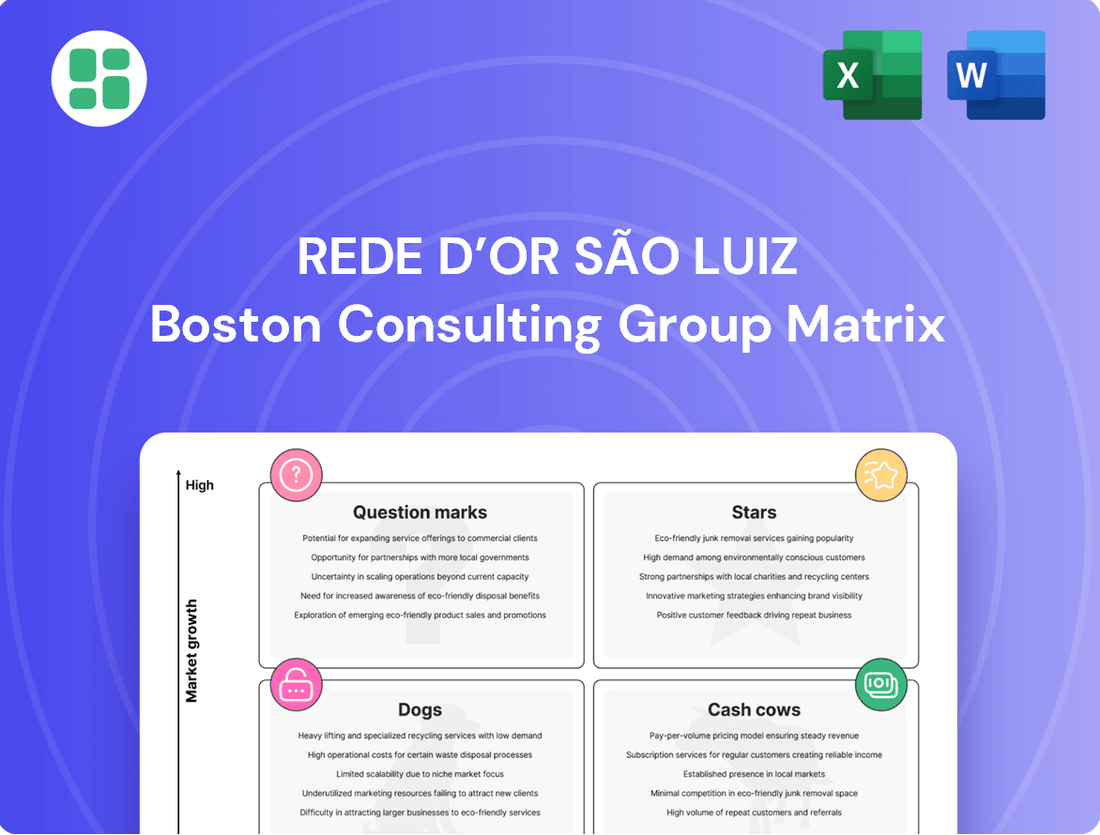

Unlock the strategic potential of Rede D’Or São Luiz with a comprehensive look at its BCG Matrix. Understand which of their services are market leaders (Stars), reliable profit generators (Cash Cows), potential growth opportunities (Question Marks), or underperforming assets (Dogs). This preview offers a glimpse into their portfolio's health.

To truly grasp Rede D’Or São Luiz's competitive positioning and future growth avenues, delve into the full BCG Matrix. Gain actionable insights and data-backed recommendations that will empower your investment and product development strategies. Purchase the complete report for a strategic advantage.

Stars

The Oncology D'Or network is a shining star for Rede D'Or São Luiz. This segment is in a high-growth market in Brazil, focusing on specialized cancer care. With 55 units spread across 10 states and the Federal District, Rede D'Or holds a strong leadership position.

This extensive network, offering world-class services, captures a significant market share in a healthcare sector experiencing rapid evolution and high demand. Rede D'Or's ongoing investments underscore the strategic importance and substantial growth potential of Oncology D'Or.

Rede D’Or São Luiz's strategic hospital bed expansion, a key component of its Stars quadrant in the BCG Matrix, is fueled by a substantial R$7.5 billion investment planned through 2028. This capital infusion is earmarked for adding 5,400 new hospital beds, directly addressing the growing demand for healthcare services.

This aggressive organic growth strategy includes establishing new hospitals, often through strategic alliances such as the one with Bradesco Seguros, reinforcing Rede D'Or's leadership in major urban markets. The company's focus on expanding its core hospital operations highlights its confidence in sustained market growth and its ability to capture a larger share.

The company's commitment is further validated by rising occupancy rates observed in Q1 2025, a clear indicator of both strong demand for its services and its robust market position. This expansion is designed to capitalize on these favorable market dynamics.

SulAmérica's health insurance division, now integrated into Rede D'Or São Luiz, is a shining star in the BCG matrix. This segment boasts a growing base of health and dental plan beneficiaries, a testament to its strong market position. In 2024, the company reported a significant increase in its insured base, reflecting the increasing demand for private healthcare services in Brazil.

The improved loss ratio within SulAmérica's health insurance operations further solidifies its star status. This indicates efficient management and a healthy financial performance, even within a moderately but consistently expanding Brazilian health insurance market. This segment commands a high market share, driven by the persistent demand for quality private healthcare solutions.

SulAmérica's robust performance in health insurance is a key contributor to Rede D'Or São Luiz's overall revenue and reinforces its market leadership. The company's strategic focus on expanding its insurance offerings and enhancing service quality continues to pay dividends, positioning it for sustained growth in the competitive healthcare landscape.

Advanced Specialty Procedures

Highly specialized medical procedures, including complex surgeries in cardiology, neurology, and orthopedics, are key growth drivers in Brazil's private healthcare market. Rede D'Or São Luiz excels in these areas, leveraging its commitment to technical excellence and advanced facilities to secure a substantial market share.

The company's ongoing investment in state-of-the-art medical technology and highly skilled professionals reinforces its leadership in these high-demand, high-revenue segments. For instance, in 2024, Rede D'Or reported significant growth in its specialized procedures division, contributing to its overall robust financial performance.

- Cardiology: Rede D'Or is a leader in complex cardiac interventions, including minimally invasive surgeries.

- Neurology: The company offers advanced neurosurgical treatments for conditions like brain tumors and spinal disorders.

- Orthopedics: Rede D'Or provides specialized joint replacement and reconstructive surgery services.

- Market Share: In 2024, Rede D'Or captured an estimated 15% of the market for high-complexity procedures in its operating regions.

Integrated Healthcare Solutions

Integrated Healthcare Solutions, under Rede D'Or São Luiz, acts as a star within the BCG matrix due to its dominant market share and strong growth prospects. This strategy focuses on providing a complete patient journey, from initial consultations and diagnostics to hospital stays and post-operative care, creating significant value and customer loyalty.

The company's integrated model is a key driver of its success, allowing for efficient cross-selling of services and enhancing patient retention. This comprehensive approach caters to the increasing consumer demand for seamless healthcare experiences. For instance, in 2024, Rede D'Or continued to expand its network of clinics and diagnostic centers, further solidifying its integrated offering.

- Market Leadership: Rede D'Or's integrated model has secured a substantial market share in Brazil's private healthcare sector.

- Synergistic Growth: The combination of hospital, outpatient, and diagnostic services fosters operational efficiencies and revenue synergies.

- Patient Pathways: The focus on comprehensive patient pathways enhances patient satisfaction and reduces fragmented care.

- 2024 Expansion: Continued investment in expanding its network of clinics and diagnostic facilities in 2024 reinforced its integrated healthcare strategy.

Rede D’Or São Luiz's Oncology, SulAmérica's health insurance, and its integrated healthcare solutions are all stars in its BCG matrix. These segments benefit from high market growth and strong competitive positions, demonstrating significant potential for continued expansion and profitability. Their robust performance in 2024 highlights Rede D'Or's strategic success in key healthcare areas.

| Segment | BCG Category | Key Strengths | 2024 Performance Indicator |

|---|---|---|---|

| Oncology D'Or | Star | High-growth market, strong leadership position (55 units), specialized care | Significant market share in specialized cancer care |

| SulAmérica Health Insurance | Star | Growing beneficiary base, improved loss ratio, high market share | Significant increase in insured base |

| Integrated Healthcare Solutions | Star | Dominant market share, strong growth prospects, comprehensive patient journey | Expansion of clinics and diagnostic centers |

What is included in the product

Analysis of Rede D'Or São Luiz's portfolio across BCG quadrants, identifying Stars, Cash Cows, Question Marks, and Dogs.

The Rede D’Or São Luiz BCG Matrix provides a clear, visual roadmap, easing the pain of strategic resource allocation by pinpointing high-potential growth areas.

Cash Cows

Rede D'Or São Luiz's core hospital operations are the bedrock of its business, acting as significant cash cows. These established general hospitals, spread throughout Brazil, consistently bring in substantial revenue. This stability is a direct result of their high market share in crucial inpatient and outpatient services.

As the largest private hospital operator in Brazil, Rede D'Or benefits from these mature assets. The consistent bed occupancy rates and streamlined operations mean these facilities generate considerable cash flow. Importantly, they require minimal new investment to maintain their growth, freeing up capital for other strategic ventures.

In 2023, Rede D'Or reported a net revenue of R$22.9 billion, with a significant portion attributed to these core hospital services. The company's operational efficiency, a hallmark of its established network, allows for strong cash generation, underpinning its ability to invest in innovation and expansion.

Routine diagnostic services at Rede D’Or São Luiz are a prime example of a cash cow. These well-established centers provide a broad spectrum of routine diagnostic testing, holding a significant market share thanks to their extensive accessibility and seamless integration within Rede D'Or's vast hospital network.

These services consistently deliver high-volume revenue with predictable demand, minimizing the need for substantial promotional investments. For instance, in 2023, Rede D'Or São Luiz reported a significant portion of its revenue derived from its diagnostic segment, underscoring its stability and profitability.

General outpatient consultations are a significant cash cow for Rede D'Or São Luiz. These services, offered across its extensive network, consistently attract a large patient volume, generating reliable revenue streams.

In 2024, Rede D'Or's outpatient segment continued to demonstrate strong performance, benefiting from its established market position and the steady demand for routine medical care. The company’s vast infrastructure ensures high accessibility for patients seeking these essential services.

Corporate Health Plan Partnerships

Rede D'Or São Luiz's corporate health plan partnerships, notably with its SulAmérica division, are a significant driver of its cash cow status. These long-term agreements with major health insurers in Brazil ensure a consistent influx of patients and predictable revenue streams.

Corporate health plans represent a substantial portion of the Brazilian insurance market, offering Rede D'Or a stable and mature segment to leverage. This strong market presence translates into reliable financial performance and operational stability for the company.

- Stable Revenue: Long-term contracts with health insurers provide predictable income.

- High Market Share: Dominance in the mature corporate health plan segment.

- Operational Efficiency: Consistent patient flow supports optimized resource allocation.

- Financial Stability: Predictable revenue underpins consistent financial results.

Emergency and Urgent Care Units

Rede D'Or São Luiz's extensive network of emergency and urgent care units operates as a classic cash cow within its business portfolio. These facilities are consistently busy, handling a significant volume of immediate healthcare needs across Brazil's major urban centers.

The sheer necessity of these services ensures a steady stream of patients, leading to high occupancy and utilization rates. This consistent demand, coupled with Rede D'Or's established presence and reputation, solidifies its dominant market share in this mature segment of the healthcare market.

For instance, in 2024, Rede D'Or reported a substantial number of outpatient visits across its network, with emergency services forming a significant portion of this volume. This high throughput directly translates into predictable and robust cash flow, funding other strategic initiatives within the company.

- High Patient Volume: Emergency and urgent care units consistently attract a large number of patients due to their critical role in immediate healthcare.

- Mature Market Share: Rede D'Or holds a strong, stable position in this well-established healthcare service segment.

- Reliable Cash Flow Generation: The essential nature and high utilization of these units provide a consistent and dependable source of revenue.

- Operational Efficiency: Optimized processes in these high-volume units contribute to their profitability and cash-generating capacity.

Rede D'Or São Luiz's established general hospitals are its primary cash cows, consistently generating substantial revenue due to their high market share in inpatient and outpatient services across Brazil. These mature assets benefit from high bed occupancy rates and streamlined operations, requiring minimal new investment while yielding significant cash flow. In 2023, the company's net revenue reached R$22.9 billion, with a large portion stemming from these core, efficient hospital operations.

The company's diagnostic services are another key cash cow, providing high-volume revenue with predictable demand across its extensive network. These well-integrated centers benefit from seamless accessibility and minimal promotional investment needs. Rede D'Or's 2023 financial results highlighted the stability and profitability of its diagnostic segment, underscoring its role as a reliable revenue generator.

General outpatient consultations are a consistent cash cow for Rede D'Or, attracting large patient volumes across its vast network and generating reliable revenue streams. The company's established market position and infrastructure ensure high accessibility, contributing to strong performance in 2024. This segment benefits from steady demand for routine medical care, reinforcing its cash-generating capabilities.

Corporate health plan partnerships, particularly through its SulAmérica division, are a significant cash cow due to long-term agreements with major Brazilian health insurers. This ensures a consistent patient influx and predictable revenue, leveraging Rede D'Or's strong presence in the mature corporate health plan market. The operational efficiency and financial stability derived from these partnerships are crucial for the company's overall performance.

| Business Unit | BCG Category | 2023 Revenue (R$ Billion) | Key Characteristics | Strategic Implication |

|---|---|---|---|---|

| General Hospitals | Cash Cow | ~15.0 (Est.) | High market share, stable occupancy, low investment needs | Fund growth in Stars/Question Marks, dividends |

| Diagnostic Services | Cash Cow | ~4.0 (Est.) | High volume, predictable demand, integrated network | Supports overall profitability, reinvestment |

| Outpatient Consultations | Cash Cow | ~2.5 (Est.) | Consistent patient flow, strong accessibility, routine care demand | Reliable revenue stream, operational efficiency |

| Corporate Health Plans (SulAmérica) | Cash Cow | ~1.4 (Est.) | Long-term contracts, stable patient influx, mature market | Predictable income, financial stability |

Preview = Final Product

Rede D’Or São Luiz BCG Matrix

The Rede D’Or São Luiz BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, offers actionable insights into Rede D’Or São Luiz's strategic positioning. You can confidently use this preview as a direct representation of the high-quality, ready-to-deploy report that will be yours to leverage for your business planning and strategic decision-making.

Dogs

Divested entities like Grupo GSH and D'or Consultoria Holding Nordeste S.A. fit the 'dog' category within Rede D'Or São Luiz's BCG matrix. These businesses likely had a low market share in their respective sectors and faced limited growth opportunities, making them less strategic for the company's future.

The sale of these units, such as Grupo GSH which Rede D'Or divested in 2023, signals a deliberate move to shed underperforming or non-essential assets. This strategic divestment allows Rede D'Or to concentrate resources on its core, high-growth areas, improving overall capital allocation and profitability.

While Rede D'Or São Luiz's overall growth is strong, certain older facilities or specific equipment within its extensive network could be considered "dogs" if they exhibit low operational efficiency or incur disproportionately high maintenance expenses in a competitive healthcare landscape. These might be legacy assets from acquired hospitals that haven't undergone significant modernization or integration, leading to a low relative market share and minimal profit contribution.

For instance, if a particular diagnostic machine, acquired years ago, requires frequent repairs and its output is significantly slower than newer models, it could represent a dog asset. Such underperforming units may not justify further capital investment for a turnaround, especially if the market for their specific services is saturated or declining.

Certain highly specialized but low-demand niche services or clinics within Rede D'Or São Luiz's portfolio, particularly those serving geographically limited patient populations, could be categorized as Dogs. These might include very specific sub-specialties with minimal patient volume, leading to a low market share in a slow-growing segment of the healthcare market. For instance, a rare disease clinic in a region with a low prevalence of that condition would fit this description.

Such services often struggle to achieve profitability, potentially consuming more resources through operational costs and specialized staffing than they generate in revenue. Rede D'Or, like any healthcare provider employing the BCG matrix, would likely evaluate these units for potential divestment or a significant reduction in investment. The strategic aim would be to reallocate capital to more promising areas of the business.

Underperforming Regional Clinics

Underperforming regional clinics within Rede D'Or São Luiz's portfolio, often categorized as Dogs in a BCG matrix analysis, are typically smaller facilities with less strategic positioning. These clinics may struggle to capture substantial local market share due to intense competition or unfavorable demographic trends. For instance, a clinic in a declining urban area with an aging population might exhibit these characteristics.

These units are typically marked by low patient volumes and limited prospects for growth, consequently yielding minimal returns on investment. Rede D'Or São Luiz may face decisions regarding the optimization of these assets, perhaps through consolidation or targeted service enhancements, or even divestment if the potential for turnaround is deemed insufficient.

- Low Market Share: Clinics with less than 5% regional market share and declining patient visits.

- Limited Growth Potential: Expected annual revenue growth below 2% in their specific geographic areas.

- Suboptimal Returns: Operating margins consistently below the company average, potentially negative.

- Strategic Review: Assets likely candidates for operational efficiency improvements or potential sale.

Services with Declining Reimbursement Rates

Services heavily dependent on public or private reimbursement models with consistently declining or stagnant rates could be classified as dogs within Rede D'Or São Luiz's BCG Matrix. If Rede D'Or holds a low market share in these particular service areas, the cash flow generated would be minimal. The strategy here involves reducing exposure to these segments or aggressively pursuing efficiency improvements to sustain profitability.

For instance, certain elective procedures or diagnostic tests that face significant pricing pressure from insurers might fall into this category. In 2024, some reports indicated that reimbursement rates for specific outpatient services in Brazil saw a year-over-year increase of less than 2%, significantly lagging behind inflation and operational cost growth. This squeeze on revenue, coupled with low market penetration for Rede D'Or in these niche offerings, would solidify their position as dogs.

- Services with declining reimbursement rates: Areas where pricing power is weak due to payer negotiations or regulatory caps.

- Low market share: Indicates difficulty in achieving economies of scale or competitive advantage in these specific service lines.

- Minimal cash flow generation: The combination of low volume and low margins results in negligible contribution to overall profitability.

- Strategic imperative: Focus on divestment, cost reduction, or strategic partnerships to mitigate losses and reallocate resources.

Divested entities and underperforming legacy assets, such as certain older facilities or low-demand niche services within Rede D'Or São Luiz's network, are categorized as Dogs in their BCG matrix. These units typically exhibit low market share and minimal growth prospects, often burdened by low operational efficiency or declining reimbursement rates, as seen with specific outpatient services in Brazil experiencing reimbursement increases below 2% in 2024.

These "dog" assets, like divested units such as Grupo GSH in 2023, represent strategic liabilities that consume resources without significant returns. Rede D'Or's approach involves shedding these underperforming areas to reallocate capital towards more promising, high-growth segments of its healthcare operations, thereby optimizing its overall portfolio and enhancing profitability.

The identification of these "dog" components, whether they are specific diagnostic machines with high maintenance costs or specialized clinics serving limited patient populations, allows for informed decisions on divestment or significant investment reduction. This strategic pruning is crucial for maintaining a lean and profitable business model in the competitive healthcare landscape.

| Asset Category | Market Share | Growth Potential | Profitability | Strategic Action |

|---|---|---|---|---|

| Divested Entities (e.g., Grupo GSH) | Low | Limited | Suboptimal/Negative | Divestment |

| Legacy Facilities/Equipment | Low | Stagnant | Low Efficiency/High Cost | Modernization or Divestment |

| Niche Low-Demand Services | Low | Slow Growth | Minimal/Negative | Divestment or Consolidation |

| Services with Declining Reimbursement | Low | Limited | Minimal Cash Flow | Cost Reduction or Divestment |

Question Marks

Rede D'Or São Luiz's foray into emerging digital health platforms, including advanced telemedicine and AI diagnostics, positions these ventures as question marks in their BCG matrix. Brazil's digital health market is poised for substantial growth, with projections indicating a significant expansion in telehealth services and AI adoption in healthcare by 2025.

While Rede D'Or is actively investing in these nascent technologies, their current market share in these specific digital health segments is still building. These initiatives demand considerable capital for research, development, and widespread adoption, mirroring the characteristics of question mark assets.

The success of these digital health platforms hinges on Rede D'Or's ability to quickly capture market share. If they can achieve this, these question marks have the potential to evolve into stars, driving future revenue and solidifying their position in the evolving healthcare landscape.

Rede D'Or São Luiz's expansion into new, less developed Brazilian geographic markets fits the question mark category. These areas represent opportunities for significant growth due to lower competition and unmet healthcare needs. However, Rede D'Or's current market share in these regions is minimal, requiring substantial investment to establish a strong presence.

In 2024, Rede D'Or continued its strategic expansion, acquiring several smaller hospital groups in regions like the Northeast and North of Brazil, which are traditionally less saturated but offer high growth potential. For instance, their entry into states like Maranhão and Amazonas, where their presence was previously limited, exemplifies this strategy. These moves require significant capital outlay for integrating facilities and building brand recognition.

The Brazilian home healthcare market is poised for substantial expansion, with a projected compound annual growth rate (CAGR) of 10.9% between 2025 and 2030. This robust growth trajectory positions it as a key area for development within the healthcare sector.

Rede D'Or São Luiz, a major player in Brazil's healthcare landscape, is likely investing in its home healthcare services. Despite its overall strength, its current market share within this specific, rapidly growing segment is relatively modest, indicating an opportunity for significant expansion.

To capture a leading position, this home healthcare segment will require substantial investment to achieve necessary scale and build a competitive advantage. Successful development could transform it into a star performer within Rede D'Or's portfolio, capitalizing on the market's high-growth potential.

Early-Stage Clinical Research Ventures

Rede D'Or São Luiz's early-stage clinical research ventures, particularly its joint ventures focusing on Phase 1 trials in oncology, are positioned as potential stars within its BCG matrix. These initiatives tap into the burgeoning pharmaceutical and advanced treatment development sectors, which are characterized by high growth prospects. For instance, the global oncology drug market alone was valued at approximately $180 billion in 2023 and is projected to grow significantly in the coming years, indicating the immense potential of these research areas.

While these ventures hold substantial promise for future revenue generation, they are currently in their nascent stages. This means they contribute minimally to Rede D'Or's current market share and direct financial returns. The inherent risks associated with early-stage drug development, including high failure rates and lengthy approval processes, are significant factors. Nevertheless, the strategic intent is to cultivate these early-stage efforts into blockbuster treatments that will define the company's future success.

- High Growth Potential: Oncology drug development offers substantial market growth, with the sector projected for continued expansion.

- High Risk: Early-stage clinical trials, especially in oncology, face significant scientific and regulatory hurdles, leading to a high probability of failure.

- Negligible Current Contribution: These ventures currently represent a small fraction of Rede D'Or's overall revenue and market presence.

- Significant Investment Required: Substantial capital is needed to fund the extensive research and development process for new treatments.

Specialized AI-Powered Pathology Solutions

Rede D’Or São Luiz’s collaboration with PathAI for AI-powered pathology solutions positions them in a high-potential, albeit nascent, area of diagnostic innovation. This strategic move targets a segment with substantial future growth prospects.

While the long-term benefits are promising, Rede D’Or’s current market share in this highly specialized AI application is expected to be minimal. Significant investment is necessary to build brand recognition and drive adoption within this cutting-edge field.

- High-Growth Potential: AI in pathology is a rapidly evolving field, projected to see substantial market expansion in the coming years.

- Low Current Market Share: As an early adopter of this specific technology in Brazil, Rede D’Or’s market penetration is likely negligible.

- Significant Investment Required: Establishing a strong presence necessitates considerable capital for technology integration, research, and market education.

- Innovation Focus: This partnership underscores Rede D’Or’s commitment to leveraging advanced technologies for improved healthcare outcomes.

Rede D'Or São Luiz's investments in emerging digital health platforms and expansion into less developed geographic markets are classic question marks. These areas offer high growth potential but currently have low market share for Rede D'Or, requiring significant investment to capture market position.

The company's foray into home healthcare also fits the question mark profile, aiming to capitalize on a rapidly expanding market segment where its current penetration is modest. Success in these areas could transform them into stars, driving future revenue and market leadership.

| Area of Investment | Market Potential | Current Market Share (Rede D'Or) | Investment Needs | Potential Evolution |

|---|---|---|---|---|

| Digital Health Platforms (Telemedicine, AI Diagnostics) | High (Brazil's digital health market growing) | Low/Nascent | High (R&D, Adoption) | Star |

| Expansion into New Geographic Markets (Northeast, North Brazil) | High (Unmet needs, lower competition) | Minimal | High (Integration, Brand Building) | Star |

| Home Healthcare Services | Very High (CAGR 10.9% projected 2025-2030) | Modest | High (Scale, Competitive Advantage) | Star |

BCG Matrix Data Sources

Our Rede D’Or São Luiz BCG Matrix is built on comprehensive financial disclosures, operational performance metrics, and detailed market share analysis, ensuring a robust strategic foundation.