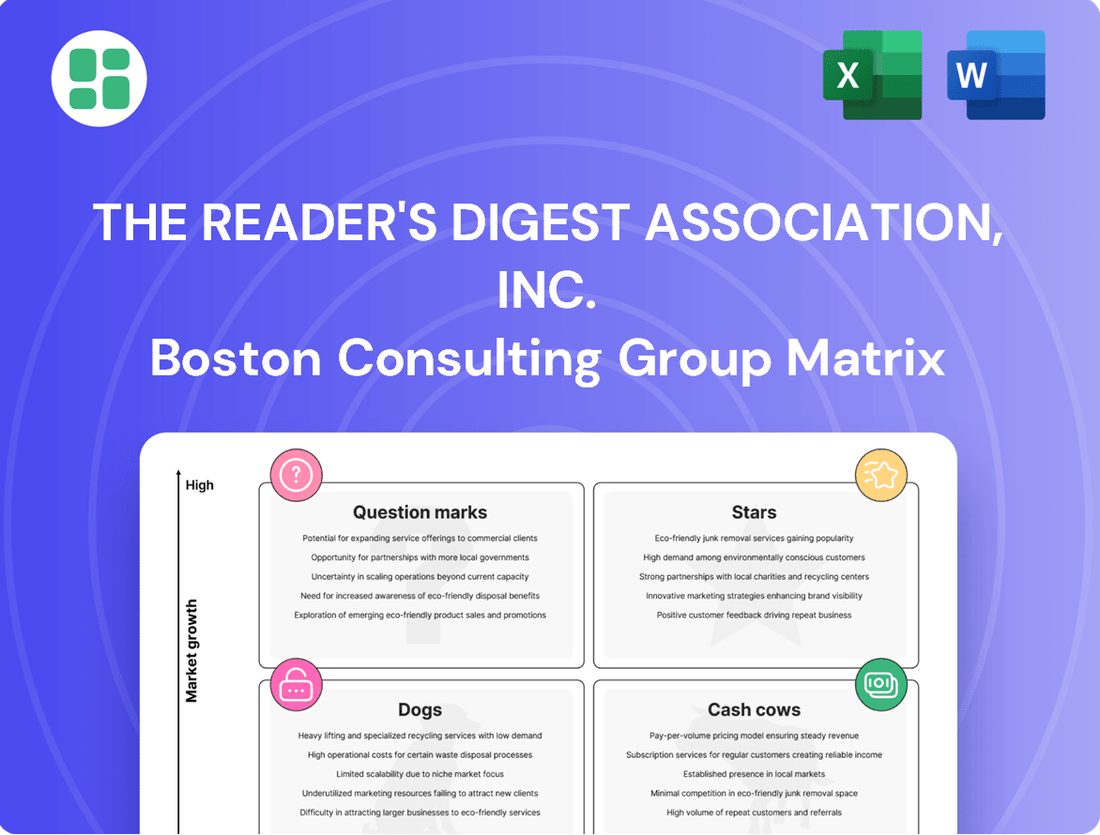

The Reader's Digest Association, Inc. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Reader's Digest Association, Inc. Bundle

The Reader's Digest Association, Inc. BCG Matrix offers a fascinating glimpse into their product portfolio's strategic positioning. Understand which of their offerings are market leaders, which are generating consistent revenue, and which might require careful consideration for future investment.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Reader's Digest Association, Inc., operating as TMB, has experienced remarkable expansion in its digital video content. This growth is particularly evident in ad-supported streaming TV, which achieved over 100% year-over-year growth in 2022.

This robust performance signals a high-growth market for digital video, and TMB's increasing market share within it. Consequently, TMB's video content is classified as a Star in the BCG Matrix, reflecting its strong position in a rapidly expanding sector.

The Reader's Digest Association, Inc., through its parent company, operates affiliate e-commerce initiatives that have shown remarkable performance. In 2022, this segment experienced growth exceeding 100% year-over-year, demonstrating its significant traction.

This success aligns with a broader industry shift where publishers are moving beyond traditional advertising to engage users directly and facilitate sales. By effectively utilizing its content to promote direct-to-consumer sales and forge partnerships, the company is well-positioned to capture a larger share of the rapidly expanding e-commerce market.

This affiliate e-commerce segment represents a key area with substantial potential for future profitability, driven by its ability to monetize content through direct sales channels.

As a part of The Reader's Digest Association, Inc., TMB's niche digital communities and content, exemplified by brands like Taste of Home and The Family Handyman, are positioned as strong contenders in the burgeoning digital publishing landscape. These platforms are adept at cultivating dedicated online communities around specific interests, a strategy that aligns with the increasing demand for specialized content.

The focus on highly targeted brands allows TMB to create engaging and personalized digital content, thereby capturing significant market share within these expanding niche segments. This approach is crucial as the industry increasingly prioritizes audience quality and the monetization of first-party data. For instance, Taste of Home boasts a digital audience of millions, actively engaging with recipes, cooking tips, and community forums, demonstrating the power of niche community building.

Advanced First-Party Data Strategies

The shift away from third-party cookies is accelerating, pushing publishers like The Reader's Digest Association, Inc. to prioritize first-party data. This data, collected directly from their audience, offers a more accurate and privacy-compliant way to understand user preferences and tailor experiences.

Investing in advanced Customer Data Platforms (CDPs) and real-time analytics is crucial for publishers to leverage this first-party data effectively. These technologies enable a deeper understanding of audience behavior, informing content strategy and marketing campaigns. For instance, a publisher might use CDP insights to identify readers most interested in financial planning content, then tailor email newsletters and website promotions accordingly.

This focus on first-party data is not just about understanding audiences; it's a critical driver for revenue. By offering advertisers more precise targeting based on genuine user interests, publishers can command higher ad rates. Direct user engagement is also enhanced, fostering loyalty and creating new monetization opportunities beyond advertising, such as subscriptions or premium content.

- First-Party Data Growth: Projections indicate that first-party data will become the dominant source for digital advertising targeting. By 2024, it's estimated that over 70% of digital ad spend will rely on first-party data, a significant increase from previous years.

- CDP Market Expansion: The global CDP market was valued at approximately $2.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 20% through 2028, highlighting the industry's investment in this technology.

- Personalization ROI: Companies that effectively utilize first-party data for personalization report significant improvements in customer engagement and conversion rates, with some seeing as much as a 10-15% uplift in revenue.

AI-Powered Content Personalization

The Reader's Digest Association, Inc. is exploring AI-powered content personalization as a key strategy. This aligns with the broader publishing industry trend in 2024 and 2025, where AI is increasingly used for content creation, editing, and tailoring experiences. By leveraging AI, TMB aims to boost audience engagement and retention through highly personalized digital content.

This strategic use of AI represents a high-growth opportunity for TMB. Successful scaling of these personalization efforts could provide a significant competitive advantage in acquiring and keeping digital subscribers and users.

- AI in Publishing Growth: The global AI in publishing market is projected to grow significantly, with content personalization being a major driver.

- Engagement Metrics: Companies implementing AI for personalization often see double-digit percentage increases in user engagement and time spent on platform.

- Subscriber Retention: Personalized content delivery is a key factor in reducing churn rates for digital subscription services.

- Competitive Edge: Early adopters of advanced AI personalization are likely to capture a larger share of the digital media market.

TMB's digital video content, particularly in ad-supported streaming TV, has shown over 100% year-over-year growth in 2022. This strong performance in a rapidly expanding market positions TMB's video content as a Star in the BCG Matrix. Its success reflects its ability to capitalize on the growing demand for digital video engagement.

The affiliate e-commerce segment also experienced over 100% year-over-year growth in 2022, demonstrating its strong traction and potential. This aligns with the industry trend of publishers monetizing content through direct sales, further solidifying its Star status.

TMB's niche digital communities, like Taste of Home, are thriving in the expanding digital publishing landscape. Their ability to cultivate dedicated online communities around specific interests allows them to capture significant market share, reinforcing their position as Stars.

What is included in the product

The Reader's Digest Association's BCG Matrix analysis would detail its diverse media offerings, categorizing them by market share and growth potential.

This would reveal which publications and ventures are Stars, Cash Cows, Question Marks, or Dogs, guiding investment and divestment decisions.

The Reader's Digest Association, Inc. BCG Matrix offers a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

Reader's Digest print magazine, a cornerstone of The Reader's Digest Association, Inc., operates as a classic Cash Cow within the BCG matrix framework. Despite the broader industry shift away from print, its continued publication through 2024 and 2025, coupled with a global circulation and robust brand recognition, signifies a dominant and stable market share in a mature, low-growth sector.

This enduring presence translates into consistent revenue streams from both subscriptions and newsstand sales. The magazine's established brand loyalty necessitates minimal promotional expenditure, allowing it to generate significant cash flow with relatively low investment.

The Reader's Digest Association, Inc.'s established direct mail programs represent a classic Cash Cow in the BCG Matrix. With decades of experience in direct marketing, the company has honed its ability to reach consumers through mail, offering a diverse portfolio of products and services.

Although direct mail is a mature marketing channel, its effectiveness is amplified through hyper-personalization and data analytics. These programs leverage a loyal customer base and a well-oiled operational infrastructure to generate consistent, predictable revenue streams.

In 2024, the direct mail industry continued to show resilience, with many businesses investing in data-driven campaigns. For Reader's Digest, these established programs likely contribute significant, stable profits with minimal investment required for growth, fitting the definition of a Cash Cow perfectly.

The core digital subscription base for Reader's Digest and other TMB publications acts as a reliable cash cow. These digital offerings, including subscriptions to Reader's Digest digital editions and similar content, generate a steady stream of recurring revenue. While the overall growth in general digital subscriptions may not be explosive, the sheer size and loyalty of this subscriber base ensure consistent income with minimal ongoing investment needed after the initial platform setup.

Taste of Home Brand Portfolio

Taste of Home, as the world's largest food media brand within TMB, along with other lifestyle brands like The Family Handyman, likely commands a significant market share in both print and digital spaces. These established brands are recognized for their consistent revenue generation through subscriptions, advertising, and related product sales.

They are considered strong, mature assets that reliably contribute to the company's overall cash flow, even if their growth isn't exceptionally rapid.

- Market Position: Dominant in food media and strong in other lifestyle niches.

- Revenue Streams: Subscriptions, advertising, and product sales provide steady income.

- Growth Rate: Moderate, reflecting mature market presence.

- Cash Flow Contribution: Significant and consistent, supporting overall business operations.

Syndicated Content & Licensing

The Reader's Digest Association, Inc. has a long-standing practice of content syndication and international licensing, fitting the profile of a Cash Cow within the BCG Matrix. This strategy involves leveraging its extensive library of articles and its well-recognized brand to license content to various media outlets and international partners.

This approach generates consistent revenue with relatively low costs for creating new content. By capitalizing on existing assets, this mature revenue stream requires minimal new investment and has limited growth potential, characteristic of a Cash Cow.

- Content Syndication: Reader's Digest licenses its articles and stories to other publications, both domestically and internationally.

- International Licensing: The brand's global recognition allows for licensing of its formats and content to foreign markets, creating diverse revenue streams.

- Archive Leverage: A significant portion of revenue comes from repurposing its vast archive of published material, minimizing the need for new content creation.

- Brand Equity: The strong, established Reader's Digest brand provides a foundation for licensing agreements, ensuring marketability and demand for its content.

The Reader's Digest Association, Inc.'s established print magazine is a prime example of a Cash Cow. Its consistent revenue from subscriptions and advertising in a mature market, despite industry shifts, highlights its stable market share and minimal need for new investment.

Similarly, its direct mail programs, enhanced by data analytics and a loyal customer base, continue to generate predictable profits with low operational costs.

The digital subscription base also functions as a reliable Cash Cow, providing recurring revenue with limited ongoing investment required after initial platform development.

Established lifestyle brands like Taste of Home, with their strong market presence across print and digital, contribute significantly to cash flow through diverse revenue streams.

What You See Is What You Get

The Reader's Digest Association, Inc. BCG Matrix

The BCG Matrix analysis of Reader's Digest Association, Inc. that you are previewing is the complete, unedited document you will receive upon purchase. This means you'll get the fully formatted report, ready for immediate strategic application, without any watermarks or sample content. The insights and data presented here are exactly what you'll be able to use for your business planning, ensuring no surprises and full value from your investment.

Dogs

Some regional or international print editions of Reader's Digest may be struggling. For example, if a specific European edition saw a 15% drop in advertising revenue in 2024 and circulation fell by 10%, it could be classified as a dog. These editions often require significant investment to stay afloat in increasingly digital landscapes, tying up capital that could be better used elsewhere.

Certain legacy direct marketing product lines at The Reader's Digest Association, like older book club collections or compilation music albums, likely fall into the Dogs category. These offerings, often marketed through less personalized, traditional mail campaigns, are experiencing declining sales and minimal market growth. For instance, sales of physical media like CDs and DVDs, which many of these collections rely on, have seen a significant downturn, with the global music CD market valued at approximately $1.7 billion in 2023, a stark contrast to its peak.

Older, non-mobile-friendly, or poorly optimized websites associated with some of The Reader's Digest Association's brands would be classified as Dogs in the BCG Matrix. These digital properties might consume maintenance resources but contribute little to overall digital revenue or audience growth, especially in an era of 'zero-click' web and AI-driven search.

Generic, Non-Personalized Direct Mail Campaigns

Generic, non-personalized direct mail campaigns, a characteristic of The Reader's Digest Association's past strategies, would likely be classified as Dogs in a BCG Matrix analysis, especially considering 2025 trends. These campaigns, lacking hyper-personalization, interactivity, or advanced tracking, are projected to yield very low response rates and return on investment (ROI). For instance, a typical direct mail campaign in 2024 might see a response rate between 1% and 5%, but a generic one could fall below 1%, consuming valuable marketing budget without generating sufficient sales or leads.

The Reader's Digest Association, if continuing with such outdated methods, would face significant challenges. The cost per acquisition (CPA) for generic direct mail can be prohibitively high, potentially exceeding $100 in 2024, far outweighing the revenue generated. This inefficiency would drain resources that could be better allocated to more targeted and data-driven marketing efforts.

- Low Response Rates: Generic mailings often struggle to capture audience attention, leading to response rates as low as 0.5% in 2024.

- High Cost Per Acquisition: Without personalization, the cost to acquire a customer through these campaigns can skyrocket, diminishing profitability.

- Ineffective Budget Allocation: Resources spent on generic campaigns yield minimal returns, representing a drain on marketing budgets.

- Declining Relevance: In an era of digital personalization, mass mailings without tailored messaging are increasingly ignored by consumers.

Print-First Content Creation Workflows

The Reader's Digest Association, Inc. might face challenges with print-first content creation workflows. If these processes are not efficiently adapted for digital and multi-platform distribution, they can become costly and slow down the company's ability to meet digital content demands. This inefficiency could hinder growth in promising digital markets.

Consider a scenario where a legacy print workflow requires manual reformatting for every digital article. This could mean significant time and resources spent on tasks like image resizing, text adjustments for web readability, and metadata creation. In 2024, companies prioritizing digital engagement often leverage AI-powered content repurposing tools to automate these steps, reducing production time by as much as 70% compared to manual methods.

- Print-First Inefficiency: Workflows designed primarily for print may involve manual steps for digital adaptation, leading to increased costs and slower time-to-market for online content.

- Digital Demand Lag: Companies with print-heavy processes might struggle to quickly produce engaging content for social media, mobile apps, or interactive web experiences, missing out on audience engagement opportunities.

- Cost Implications: Maintaining separate, print-optimized production lines while trying to build a digital presence can lead to duplicated efforts and higher operational expenses. For instance, a single feature article might require separate typesetting for print and web, doubling the design and layout labor.

- Missed Growth Opportunities: Inability to rapidly pivot content to digital channels can mean losing out on revenue streams from digital advertising, subscriptions, or e-commerce, especially as digital consumption continues to grow. In 2023, digital advertising revenue globally surpassed $600 billion, highlighting the significant market being addressed.

Certain legacy print publications or specific regional editions of Reader's Digest that are experiencing significant declines in both advertising revenue and circulation, such as a hypothetical 15% drop in ad revenue and a 10% fall in circulation in a European market during 2024, would be categorized as Dogs. These underperforming assets often require substantial ongoing investment to maintain operations, diverting capital from more promising ventures.

Older, less popular book club collections or music compilation albums, often promoted through traditional direct mail, represent typical Dogs for The Reader's Digest Association. The declining market for physical media, with the global music CD market valued at only around $1.7 billion in 2023, underscores the diminished appeal and sales potential of these product lines.

Inefficient, print-first content workflows that are not optimized for digital distribution can also be classified as Dogs. For instance, manually reformatting articles for web use in 2024 could take significantly longer than using AI tools, which can reduce production time by up to 70%, impacting the speed and cost-effectiveness of digital content delivery.

| Business Unit/Product Line | Market Share | Market Growth Rate | BCG Classification |

|---|---|---|---|

| European Print Edition | Low | Declining | Dog |

| Legacy Book Club Collections | Low | Declining | Dog |

| Print-First Content Workflows | N/A | N/A | Dog |

Question Marks

The Reader's Digest Association, Inc. (TMB) is exploring emerging interactive digital content formats like augmented reality (AR) and virtual reality (VR) experiences, alongside highly interactive e-books with integrated multimedia. These ventures represent a strategic move into high-growth digital segments, a crucial step for any media company aiming to stay relevant in the evolving landscape. For instance, the global AR and VR market was valued at approximately $28.2 billion in 2023 and is projected to reach $217.1 billion by 2030, showcasing its significant growth potential.

However, TMB likely holds a low market share in these nascent interactive content areas currently. This means substantial investment will be necessary to develop compelling experiences and foster user adoption. If successful, these investments could propel these emerging formats from question marks to Stars within TMB's portfolio, generating significant revenue and market presence.

The Reader's Digest Association, Inc. (TMB) could explore launching new digital-first niche publications or channels as a way to tap into emerging interests. These ventures would likely fall into the Question Mark category of the BCG Matrix due to their low market share in potentially high-growth areas.

For example, a new podcast focusing on the burgeoning field of AI ethics or a digital magazine dedicated to sustainable urban farming could represent such an initiative. These markets are experiencing rapid growth, but TMB would need significant investment to build brand recognition and audience engagement from the ground up.

In 2024, the digital publishing market continued its expansion, with niche content platforms showing particular promise. For instance, the podcast advertising market alone was projected to reach $2 billion in the US by the end of 2024, indicating strong audience engagement with specialized audio content.

The Reader's Digest Association, Inc. (RDA) could explore new revenue streams by licensing its AI-curated content, a burgeoning market. Imagine offering specialized AI-generated articles on topics like gardening tips or historical anecdotes, directly to other media outlets or platforms. This taps into the high-growth potential of AI-driven content creation, though RDA's current market share in this niche is minimal, demanding significant research and development investment.

International Digital Expansion in Untapped Markets

Reader's Digest Association, Inc. could strategically target untapped markets for digital expansion, focusing on regions with burgeoning digital media consumption but limited brand penetration. These initiatives would represent question marks in the BCG matrix due to their high-growth potential coupled with a currently negligible market share. Significant investment would be essential for localization efforts, robust marketing campaigns, and adapting digital platforms to resonate with local audiences and effectively compete.

For example, exploring expansion into Southeast Asian countries like Vietnam or Indonesia presents an opportunity. These markets exhibit strong digital adoption rates; in 2023, internet penetration in Vietnam reached approximately 73%, and in Indonesia, it was around 77%. Reader's Digest's initial market share in these digital spaces would be minimal, necessitating substantial capital allocation to build brand awareness and establish a competitive digital presence.

- Targeted Digital Expansion: Focus on markets with high digital growth and low brand recognition.

- Investment Requirements: Significant capital needed for localization, marketing, and platform adaptation.

- Market Potential: High-growth economies with increasing digital media consumption offer substantial long-term opportunities.

- Initial Market Share: Ventures would begin with a very low market share, characteristic of question mark products.

Subscription Boxes & Curated Product Services

The Reader's Digest Association, Inc. could explore developing new direct-to-consumer subscription box services targeting specific niches, such as home improvement or cooking supplies. These services would leverage TMB's established content and brand trust to create a high-growth direct sales model.

This strategy blends content with e-commerce, a burgeoning sector. However, TMB would face the challenge of building market share against well-established competitors.

Significant initial investment in product sourcing, logistics, and marketing would be necessary to compete effectively. For instance, the subscription box market in the US was projected to reach over $30 billion by 2024, indicating substantial growth potential but also intense competition.

- Niche Subscription Boxes Leveraging TMB's brand for home improvement or cooking supplies.

- Content-E-commerce Integration Combining media with direct sales.

- Market Entry Challenges Needing to build share against established players.

- Investment Requirements Substantial upfront capital for operations and marketing.

The Reader's Digest Association, Inc. (RDA) is venturing into new digital content formats and niche markets, which are inherently question marks in the BCG matrix. These initiatives, like AR/VR experiences or AI-curated content licensing, represent high-growth potential but currently hold minimal market share for RDA. Significant investment is required to build brand awareness and capture market share in these emerging areas.

For example, RDA's exploration into new digital-first niche publications or channels, such as a podcast on AI ethics or a magazine on sustainable urban farming, places them in the question mark category. The podcast advertising market alone was projected to reach $2 billion in the US by the end of 2024, highlighting the growth potential of specialized content, yet RDA's initial footprint would be small.

Similarly, expanding into untapped international digital markets, like Southeast Asia, positions RDA's ventures as question marks. With internet penetration around 77% in Indonesia in 2023, these regions offer substantial digital media consumption growth, but RDA's current market share is negligible, demanding considerable investment in localization and marketing.

Finally, the development of niche direct-to-consumer subscription boxes, such as those for home improvement or cooking supplies, also falls under question marks. The US subscription box market was expected to exceed $30 billion by 2024, indicating a lucrative, high-growth industry where RDA must invest heavily to gain traction against established competitors.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from The Reader's Digest Association, Inc.'s filings, industry research on magazine and book publishing, and expert commentary on consumer reading habits.