PSC Insurance Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PSC Insurance Group Bundle

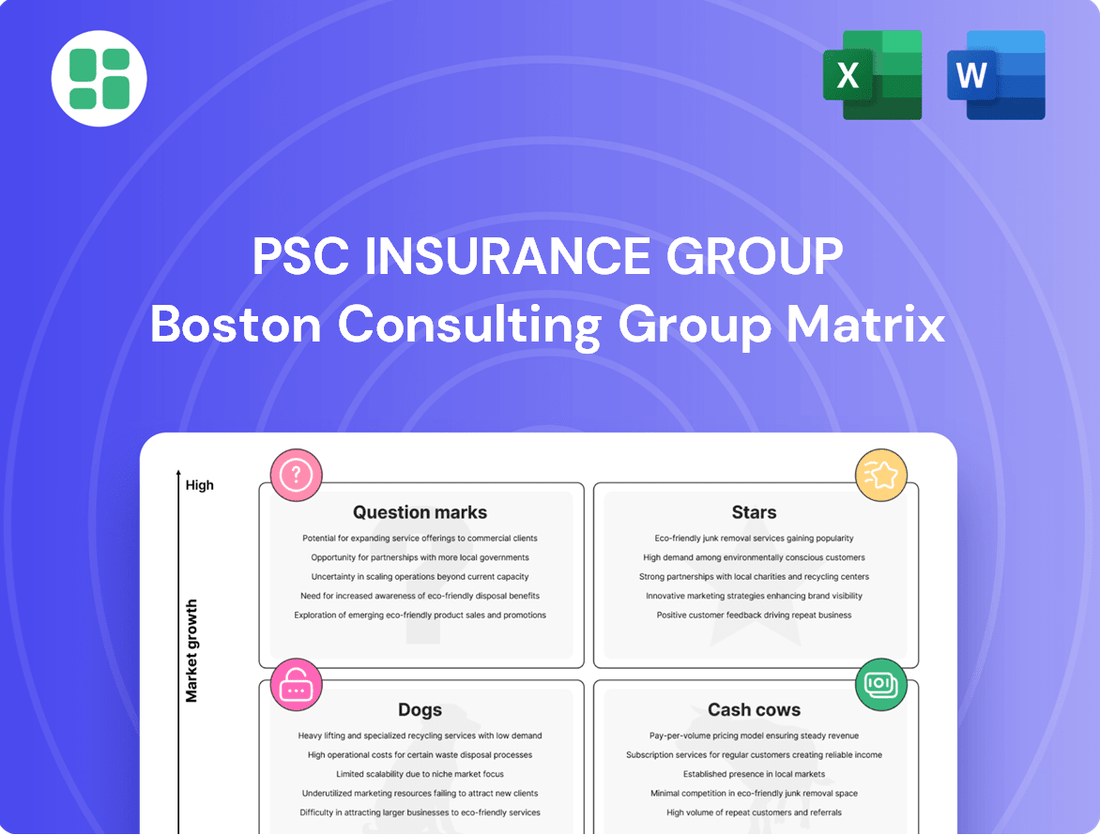

Curious about PSC Insurance Group's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio's potential, highlighting areas of growth and stability. Don't miss out on the complete picture; purchase the full BCG Matrix for a detailed analysis of their Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full strategic potential of PSC Insurance Group by diving into our comprehensive BCG Matrix. This detailed report provides a clear roadmap for resource allocation and future investment, moving beyond this introductory overview to actionable insights.

Gain a competitive edge by understanding PSC Insurance Group's market performance with our complete BCG Matrix. This essential tool will equip you with the knowledge to identify high-potential products and manage those requiring strategic adjustments, so you can make informed decisions today.

Stars

PSC's UK and international broking operations, including entities like Paragon and Carrolls, are showing impressive momentum. In FY24, these segments achieved an 18% revenue increase and a 21% rise in EBITDA. This strong performance is a result of successful organic expansion, strategic acquisitions, and beneficial currency movements.

These high-growth markets are key for PSC, where the group has solidified and expanded its market share. This positions them as stars in the BCG matrix, indicating they are ideal candidates for further investment and resource allocation to sustain and capitalize on their growth trajectory within the broader Ardonagh Group structure.

Specialty underwriting agencies, like Chase Professional Risks following its acquisition of Ensurance, are considered growth businesses within PSC Insurance Group's Agency segment. Despite a slight dip in the segment's EBITDA for FY24, these niche players are strategically positioned for future expansion.

These agencies concentrate on specialized, high-demand insurance sectors, tapping into markets with significant growth potential. Their focus allows them to capture increasing market share by offering tailored solutions to specific client needs.

PSC Insurance Group's approach to its Strategic Acquisitions Portfolio aligns perfectly with the 'Star' quadrant of the BCG matrix. In fiscal year 2024, the company demonstrated this by completing an impressive 14 acquisitions, deploying approximately $50 million. These were not large, transformative deals, but rather smaller, accretive acquisitions designed to enhance capabilities and broaden market presence.

This consistent pursuit of targeted acquisitions fuels PSC's growth by integrating new businesses that are expected to yield high returns and strengthen its competitive standing. By actively expanding its portfolio through these strategic moves, PSC is effectively investing in high-growth areas that are crucial for its continued market leadership and overall expansion.

Australian Commercial Broking in Niche Areas

PSC Insurance Group's Australian commercial broking operations in niche areas are positioned as stars within the BCG matrix. Despite the broader Australian broking market being mature, specific segments within commercial broking have demonstrated robust growth. PSC's continued strength in the Small to Medium Enterprise (SME) market highlights its ability to capture opportunities in an established yet expandable sector.

The company's strategic investments in leadership and infrastructure within these niche areas are designed to further capitalize on their growth potential. This focus on targeted expansion and operational enhancement solidifies their star status, suggesting they are high-growth, high-market-share businesses that require ongoing investment to maintain their momentum.

- Niche Growth: While the overall Australian broking market is mature, specific niche segments within commercial broking are experiencing strong growth.

- SME Dominance: PSC maintains a strong position in the SME market, a segment that, while established, offers significant opportunities for focused expansion.

- Investment in Potential: PSC's investments in leadership and infrastructure within these niche areas are aimed at amplifying their star potential and market share.

Integrated Risk Management Solutions

PSC Insurance Group's integrated risk management solutions are a key component of its business strategy, reflecting a growing market demand for comprehensive risk mitigation. As businesses navigate increasingly complex and interconnected risks, the need for expert guidance and tailored solutions is paramount.

PSC's offerings go beyond standard insurance broking, encompassing advisory services that help clients identify, assess, and manage a wide array of potential threats. This strategic expansion into risk management leverages their deep industry knowledge and established client relationships.

The market for risk management services is expanding significantly. For instance, the global risk management market was valued at approximately USD 30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 7% through 2030, driven by regulatory changes, cyber threats, and geopolitical instability.

- Growing Demand: Businesses are increasingly seeking integrated risk management to address evolving threats like cyber-attacks and supply chain disruptions.

- PSC's Expertise: PSC Insurance Group offers a broad spectrum of risk management services, building on its established broking foundation.

- Market Opportunity: The global risk management market is expanding, with projections indicating continued strong growth in the coming years.

- Strategic Advantage: PSC's focus on risk management positions it to capitalize on this expanding market by providing valuable, comprehensive solutions to its clients.

PSC Insurance Group's UK and international broking operations, along with strategic acquisitions, are prime examples of 'Stars' in the BCG matrix. These segments demonstrated robust growth in FY24, with revenue up 18% and EBITDA rising 21%. This strong performance is driven by organic expansion and strategic integration of acquired entities.

The group's proactive approach to acquiring smaller, accretive businesses, deploying approximately $50 million across 14 acquisitions in FY24, further solidifies its 'Star' status. These strategic moves are designed to enhance capabilities and broaden market presence, ensuring continued high growth and market share.

PSC's Australian commercial broking, particularly within niche SME markets, also exhibits 'Star' characteristics. Investments in leadership and infrastructure within these segments are aimed at capitalizing on their growth potential, reinforcing their position as high-growth, high-market-share businesses requiring ongoing investment.

PSC Insurance Group's integrated risk management solutions are another area demonstrating 'Star' potential. The global risk management market, valued at roughly USD 30 billion in 2023 and projected to grow at a 7% CAGR, presents a significant opportunity for PSC's expanding advisory services.

What is included in the product

The PSC Insurance Group BCG Matrix offers a tailored analysis of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This framework highlights which units to invest in, hold, or divest to optimize PSC's strategic resource allocation.

The PSC Insurance Group BCG Matrix offers a clear, one-page overview identifying strategic priorities, alleviating the pain of resource allocation uncertainty.

Cash Cows

PSC's established Australian broking network, encompassing its Distribution segment, stands as a prime example of a cash cow within the BCG matrix. In FY24, this core business demonstrated robust performance, achieving 15% revenue growth and a 12% increase in EBITDA, underscoring its consistent ability to generate substantial cash flow.

This segment operates in a mature market where PSC holds a significant market share, particularly within the Small to Medium Enterprise (SME) sector. Its strength lies in providing stable and predictable earnings, requiring relatively modest investment for ongoing operations and maintenance, thereby freeing up capital for other strategic initiatives.

The PSC Network business, encompassing entities like PSC Insurance Brokers NZ, demonstrated resilience by successfully implementing major system upgrades while achieving robust financial outcomes. This segment, built on a foundation of authorized representatives, is a significant contributor to PSC Insurance Group's total earnings.

Operating as a dependable cash cow, the PSC Network capitalizes on its well-established market presence and efficient operations. In 2024, this segment continued to generate consistent profits, benefiting from a relatively stable insurance market environment.

PSC Insurance Group's Workers Compensation Consulting business in Australia is a solid Cash Cow. In FY24, this division demonstrated enhanced performance, acting as a significant contributor to the overall growth of the Distribution segment.

This specialized consulting service thrives within Australia's mature workers' compensation market, a sector characterized by predictable and recurring client demands. The business benefits from its deep-seated expertise and strong, long-standing client relationships.

These established advantages enable the consulting arm to consistently generate substantial and stable cash flows. Consequently, it requires minimal additional investment in aggressive marketing efforts to maintain its strong market position and profitability.

Mature Underwriting Portfolios (e.g., Medisure Indemnity)

Within PSC Insurance Group's Agency segment, mature underwriting portfolios such as Medisure Indemnity Australia are likely classified as Cash Cows. These are established products with significant market share in their respective niches, generating stable and predictable premium income. They require minimal new investment, allowing them to serve as reliable sources of cash flow to support the group's other strategic initiatives.

These mature portfolios are crucial for maintaining the financial health of the group. Their consistent profitability helps to offset investments in newer, high-growth areas. For instance, in 2024, the general insurance market in Australia saw continued demand for health and indemnity products, underscoring the stability of such offerings.

- Stable Revenue Generation: Medisure Indemnity likely contributes consistent, high-margin revenue streams.

- Low Investment Needs: Mature portfolios typically require less capital expenditure for growth or innovation.

- Funding Growth Initiatives: Profits from these Cash Cows can be reinvested into Stars or Question Marks within the portfolio.

- Market Position: They represent dominant players in their specific, often niche, insurance markets.

Consolidated Group Investments and Income

The Group segment of PSC Insurance Group, responsible for consolidated income and investments from non-operating assets, is a significant contributor to the company's overall financial health. This segment leverages the collective financial strength of the entire organization, acting as a stable source of passive income.

This consistent income generation allows the Group segment to function as a cash cow. It provides crucial financial stability, enabling PSC to support its other operational segments and fund various strategic initiatives. For example, in fiscal year 2024, PSC Insurance Group reported a strong financial performance, with the Group segment's investment income playing a vital role in bolstering the company's bottom line.

- Consistent Profitability: The Group segment reliably contributes to PSC Insurance Group's overall profitability.

- Financial Strength Leverage: It benefits from the cumulative financial strength of the entire organization.

- Passive Income Generation: This segment acts as a cash cow by generating passive income.

- Strategic Support: It provides financial stability, supporting other operational segments and initiatives.

PSC's established Australian broking network, a core component of its Distribution segment, exemplifies a cash cow. In FY24, this segment achieved 15% revenue growth and a 12% EBITDA increase, showcasing its consistent ability to generate strong cash flows in a mature market where PSC holds significant market share, particularly in the SME sector.

The PSC Network business, including PSC Insurance Brokers NZ, demonstrated resilience and robust financial outcomes, implementing system upgrades while contributing significantly to PSC Insurance Group's earnings. This segment, built on authorized representatives, leverages its established market presence and efficient operations to generate consistent profits, benefiting from a stable insurance market environment in 2024.

PSC Insurance Group's Workers Compensation Consulting business in Australia is a well-defined cash cow, contributing significantly to the Distribution segment's FY24 performance. Operating in a mature market with predictable client needs, its deep expertise and strong client relationships generate substantial, stable cash flows with minimal need for aggressive investment.

Mature underwriting portfolios within PSC's Agency segment, such as Medisure Indemnity Australia, function as cash cows by generating stable premium income with minimal new investment. These products, holding significant market share in niche areas, are crucial for the group's financial health, helping to fund growth in other areas, a stability reflected in the general insurance market's demand for such products in 2024.

| Segment/Business Unit | BCG Category | FY24 Performance Highlight | Market Characteristics | Key Strength |

|---|---|---|---|---|

| Australian Broking Network (Distribution) | Cash Cow | 15% Revenue Growth, 12% EBITDA Increase | Mature, significant SME market share | Stable, predictable earnings |

| PSC Network (incl. NZ) | Cash Cow | System upgrades, robust financial outcomes | Established presence, authorized representatives | Consistent profit generation |

| Workers Compensation Consulting (Australia) | Cash Cow | Enhanced performance, Distribution segment contributor | Mature market, recurring client demands | Deep expertise, strong client relationships |

| Mature Underwriting Portfolios (e.g., Medisure Indemnity) | Cash Cow | Stable premium income generation | Niche markets, significant share | Reliable cash flow source |

What You See Is What You Get

PSC Insurance Group BCG Matrix

The PSC Insurance Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally crafted strategic analysis ready for your immediate use in business planning and decision-making.

Dogs

Underperforming legacy products and services within PSC Insurance Group's portfolio, while not explicitly named in recent public disclosures, represent offerings facing declining demand or low profitability. These could include older insurance policies in mature or shrinking market segments. For instance, if a particular type of life insurance policy, popular decades ago, now sees minimal new uptake and high administrative costs, it would fit this category. These products often tie up valuable capital and resources that could be better allocated to growth areas.

Following its acquisition by Ardonagh, PSC Insurance Group's business units that are no longer efficient or necessary within the new structure could be classified as Dogs. This often means these units are candidates for divestment or closure to streamline operations and focus resources on more profitable areas.

The winding up of PSC Connect, a network offering by Envest where PSC's ANZ operations are merging, exemplifies this. This strategic shift indicates a move away from business models that are not performing optimally, a common outcome for Dog units in a post-acquisition integration phase.

Within PSC Insurance Group's portfolio, certain micro-segments or smaller acquired entities experienced persistent negative organic EBITDA growth in FY24 and preceding periods. These segments, despite the company's overall positive organic growth trajectory, indicate a struggle to expand market share organically. For instance, if a specific niche brokerage, acquired in FY22, continued to report a decline in its own revenue generation beyond initial integration challenges, it would fall into this category.

Outdated Software Infrastructure

Before PSC Insurance Group's strategic shift towards developing its own key software infrastructure, its reliance on outdated or inefficient internal systems would have placed them in the Dogs quadrant of the BCG Matrix. These legacy systems often drain resources for ongoing maintenance and upgrades, significantly impeding operational efficiency and failing to provide any competitive edge or support future growth initiatives. The imperative to replace or significantly upgrade these systems represents a strategic divestment from outdated assets.

Such outdated software infrastructure would likely have been characterized by:

- High maintenance costs: Older systems often require specialized, expensive support and are prone to frequent breakdowns.

- Limited functionality: Inability to integrate with newer technologies or support advanced business processes, hindering agility.

- Security vulnerabilities: Outdated software is a prime target for cyber threats, posing significant risks to data and operations.

Businesses Hindered by Regulatory Burdens

Businesses hindered by regulatory burdens, particularly those in sectors with stringent compliance requirements and evolving legal frameworks, often find themselves in a challenging position within the BCG Matrix. These segments, where PSC Insurance Group might not hold a dominant market share, can be classified as Dogs. For instance, in 2024, the insurance industry globally faced increased scrutiny regarding data privacy and cybersecurity, with new regulations like the EU's Digital Operational Resilience Act (DORA) coming into full effect, imposing significant compliance costs.

The complexity and expense of navigating these regulatory landscapes, especially without a substantial competitive advantage, can transform these business areas into cash traps. This situation is exacerbated when the potential returns from these operations are diminished by the ongoing costs of compliance. For example, a smaller insurance broker dealing with multiple international regulatory bodies might spend a disproportionate amount of its revenue on legal and compliance staff, diverting resources from growth initiatives.

- High Compliance Costs: Segments facing significant regulatory hurdles, such as those in the financial services sector dealing with anti-money laundering (AML) and know-your-customer (KYC) regulations, often incur substantial operational expenses. In 2023, the global cost of financial crime compliance was estimated to be in the tens of billions of dollars annually.

- Lack of Market Dominance: When a company, like PSC Insurance Group, operates in a regulated market but does not possess a leading market share, the ability to absorb compliance costs and pass them on to customers is limited. This can lead to shrinking profit margins.

- Regulatory Uncertainty: Rapidly changing regulatory environments, common in areas like fintech or emerging insurance products, create ongoing uncertainty and necessitate continuous adaptation, which can be a drain on resources for businesses without a strong market position.

- Strategic Re-evaluation: The combination of high regulatory burdens and a weak market position often prompts a strategic decision to exit or significantly reduce exposure in these segments to reallocate capital to more promising areas.

Dogs within PSC Insurance Group's portfolio represent business units or products with low market share and low growth potential. These segments often consume resources without generating significant returns, making them candidates for divestment or restructuring. For example, niche insurance products with declining customer bases or underperforming acquired entities that haven't integrated well would fit this classification.

In 2024, PSC Insurance Group's focus on streamlining operations post-acquisition by Ardonagh means any remaining legacy systems or inefficient business units are likely categorized as Dogs. These are areas where investment is no longer justified due to poor performance and limited future prospects. The company's strategic pivot away from certain legacy IT infrastructure, for instance, highlights a move to shed these resource-draining assets.

Segments facing intense regulatory burdens, such as those in specific financial services niches without a dominant market position, can also be considered Dogs. The high cost of compliance, as seen globally with evolving data privacy laws impacting the insurance sector, can make these areas unprofitable. For example, a small brokerage struggling with international regulatory adherence in 2024 would likely fall into this category, requiring a strategic decision on its future.

The company's prior reliance on outdated internal software systems, which incurred high maintenance costs and offered limited functionality, exemplifies a Dog. These systems required significant capital to maintain and upgrade, offering no competitive advantage, and were a drain on resources that could be better used in growth-oriented areas.

Question Marks

PSC Insurance Group launched several new underwriting ventures in FY24, including Chase Plant & Equipment, Chase Credit, and Chase Accident & Health, all operating within its Agency segment. These ventures are positioned in high-growth potential, emerging, or underserved markets, reflecting a strategic move to diversify PSC's offerings.

While these new businesses, like Chase Plant & Equipment, currently hold low market share and have incurred initial losses, they represent significant growth opportunities. The company's investment in these areas is aimed at capturing market share and establishing their long-term viability, with the ultimate goal of them becoming future 'Stars' in the BCG matrix.

PSC Insurance Group's recent small-scale acquisitions in new markets, part of its FY24 strategy which saw 14 deals completed, represent a calculated move into emerging territories or specialized product areas. These smaller ventures, while operating in potentially high-growth sectors, currently hold minimal market share for PSC.

The focus for these new acquisitions is on intensive integration and strategic investment to assess their potential for future market leadership. PSC is actively evaluating whether these entities can scale effectively or if a strategic divestment is the more prudent course of action, a common consideration for businesses navigating nascent markets.

PSC Insurance Group's investments in start-up businesses in FY24, totaling a $1.4 million loss, position these ventures squarely in the 'Question Marks' category of the BCG Matrix. These are businesses with high growth potential but currently small market shares and negative cash flow, requiring significant capital to thrive.

The strategy for these 'Question Marks' involves careful nurturing and substantial investment to increase their market share and eventually achieve profitability. The $1.4 million loss highlights the inherent risk and the upfront costs associated with developing these nascent enterprises.

For PSC, the success of these start-ups hinges on their ability to evolve from their current low-market-share, high-cost phase into profitable entities. This transition is critical for their future contribution to the group's overall portfolio performance.

Digital Transformation and Software Infrastructure Initiatives

PSC Insurance Group's investment in digital transformation and software infrastructure, such as the development of its new customer portal launched in early 2024, positions it in a high-growth segment of the insurance market. This initiative aims to enhance digital service delivery, a key area where the company is actively building its competitive advantage.

These projects are currently demanding significant resources and their immediate financial returns are not yet fully established, placing them in a position that requires careful management and strategic execution. The success of these digital endeavors is directly tied to the speed of customer adoption and the ability to create meaningful differentiation from competitors in the evolving digital insurance landscape.

Key aspects of this strategy include:

- Focus on enhancing customer experience through digital channels.

- Investment in scalable and modern software architecture to support future growth.

- Development of data analytics capabilities to drive personalized insurance offerings.

Emerging Global Specialty Markets (Post-Ardonagh Merger)

Following its acquisition by The Ardonagh Group, PSC Insurance Group is poised for significant expansion, particularly within emerging global specialty markets. This strategic move positions PSC to leverage Ardonagh's extensive platform to enter or deepen its presence in high-growth niche sectors worldwide. While initial market share in these areas may be modest, the potential for rapid scaling is substantial.

These new ventures represent strategic opportunities for PSC, demanding focused investment to capitalize on their inherent growth trajectories. The combined entity's global reach facilitates entry into markets where PSC's independent presence was previously limited.

- Targeted Expansion: PSC is focusing on specialty insurance lines with projected global growth rates exceeding 10% annually, aiming to capture significant market share in these nascent areas.

- Ardonagh Synergy: The merger provides PSC access to Ardonagh's existing international distribution networks, estimated to cover over 100 countries, accelerating market penetration.

- Investment Focus: Significant capital allocation is directed towards technology and talent acquisition to support the rapid development and underwriting capabilities required for these specialty markets.

- Market Potential: For example, the global cyber insurance market, a key specialty area, is projected to reach $20 billion by 2025, offering substantial upside for PSC within the Ardonagh ecosystem.

PSC Insurance Group's new underwriting ventures and recent small acquisitions in FY24, such as Chase Plant & Equipment and ventures in new product areas, are classified as 'Question Marks' in the BCG matrix. These initiatives exhibit high growth potential but currently possess low market share and require substantial investment, as evidenced by the $1.4 million loss in start-up businesses during FY24.

The company's digital transformation efforts, including the launch of a new customer portal in early 2024, also fall into this category, demanding significant resources with unestablished immediate returns. PSC's strategy involves careful nurturing and investment to increase market share for these ventures, aiming to transform them into future 'Stars'.

These 'Question Marks' represent strategic bets on emerging markets and digital capabilities, with success contingent on scaling effectively and achieving profitability. The global cyber insurance market, a key specialty area targeted by PSC post-acquisition by The Ardonagh Group, is projected to reach $20 billion by 2025, highlighting the significant upside potential.

| Venture Type | FY24 Investment/Loss | Market Share | Growth Potential | BCG Category |

|---|---|---|---|---|

| New Underwriting Ventures (e.g., Chase Plant & Equipment) | Initial Losses Incurred | Low | High | Question Mark |

| Small-Scale Acquisitions in New Markets | Part of 14 Deals Completed in FY24 | Minimal | High | Question Mark |

| Digital Transformation (e.g., Customer Portal) | Significant Resource Demand | Developing | High | Question Mark |

| Emerging Global Specialty Markets (Post-Ardonagh Acquisition) | Capital Allocation for Tech & Talent | Modest | Substantial | Question Mark |

BCG Matrix Data Sources

Our PSC Insurance Group BCG Matrix is built on a foundation of robust data, incorporating financial disclosures, market share analysis, and industry growth projections to ensure strategic accuracy.