Prudential Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prudential Financial Bundle

Unlock the strategic advantages Prudential Financial is poised to gain or face. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors shaping its future. Equip yourself with actionable intelligence to navigate this complex landscape and make informed decisions. Download the full analysis now to gain a competitive edge.

Political factors

Government policy shifts, like tax reforms impacting retirement savings or changes to social security benefits, directly influence Prudential's life insurance and retirement product demand. For instance, the SECURE 2.0 Act of 2022, which expanded retirement savings options, presents opportunities for Prudential to offer new solutions.

The broader regulatory environment, including capital requirements and consumer protection laws, significantly shapes Prudential's operational costs and compliance burdens. In 2023, the U.S. financial services industry saw continued focus on cybersecurity regulations, requiring substantial investment in data protection measures.

Geopolitical shifts and trade relations significantly impact Prudential Financial's global strategy. For instance, ongoing trade disputes, such as those between major economic blocs, can disrupt investment flows and currency valuations in markets where Prudential operates, affecting its profitability. The company's exposure to regions with political instability requires careful risk management, as seen in the potential impact of conflicts on emerging market investments.

Prudential Financial's operations are sensitive to political stability, particularly in key markets like the United States and Asia. For instance, the 2024 US presidential election cycle could introduce policy shifts impacting financial regulations and market sentiment. Uncertainty surrounding geopolitical tensions, such as those in Eastern Europe, can also affect global investment flows and risk appetite, potentially influencing Prudential's asset valuations and insurance demand.

Fiscal and Monetary Policy Changes

Changes in fiscal and monetary policy significantly shape the economic landscape for Prudential Financial. Government spending and taxation decisions, reflected in budget deficits or surpluses, directly impact economic growth and consumer confidence. For instance, a fiscal stimulus package aimed at boosting infrastructure spending could lead to increased economic activity, potentially benefiting Prudential's investment portfolios. Conversely, rising government debt might necessitate future austerity measures, dampening economic prospects.

Monetary policy, primarily managed by central banks like the U.S. Federal Reserve, plays a crucial role through interest rate adjustments and quantitative easing or tightening. As of late 2024, the Federal Reserve has maintained a cautious approach to interest rate cuts, balancing inflation concerns with economic growth. Higher interest rates generally increase borrowing costs for consumers and businesses, potentially slowing demand for financial products, while lower rates can stimulate lending and investment. Prudential's profitability is thus sensitive to these policy shifts, influencing everything from mortgage demand to the returns on its fixed-income investments.

- Interest Rate Environment: The Federal Reserve's target federal funds rate, hovering around 5.25%-5.50% in late 2024, influences Prudential's net investment income and the cost of capital.

- Inflationary Pressures: Persistent inflation can erode the real value of assets and may prompt tighter monetary policy, impacting investment strategies.

- Government Debt Levels: High national debt can create uncertainty and potentially lead to higher long-term interest rates, affecting Prudential's bond holdings and market stability.

Industry-Specific Lobbying and Advocacy

Prudential Financial actively engages in industry lobbying and advocacy to influence financial services legislation and regulations. Through its participation in trade associations, the company works to shape policies that impact its operations and client base. For instance, in 2024, the financial services sector saw significant debate around capital requirements and consumer protection, areas where Prudential's advocacy efforts are crucial. This proactive stance helps mitigate potential adverse regulatory impacts and promotes conditions favorable to business growth.

The company's direct lobbying expenditures provide insight into its commitment to policy influence. In the first half of 2024, Prudential Financial reported spending approximately $1.5 million on federal lobbying efforts, focusing on issues such as retirement security and market stability. These efforts are vital for ensuring that regulatory frameworks align with the company's strategic objectives and the broader interests of the financial services industry.

- Advocacy Focus: Prudential prioritizes lobbying on issues like retirement savings reform and insurance market regulations, aiming to foster a stable and growth-oriented environment.

- Industry Collaboration: The company works with organizations like the American Council of Life Insurers (ACLI) to present a unified voice on key legislative matters.

- Regulatory Mitigation: Lobbying efforts are directed at preventing overly burdensome regulations that could increase operational costs or limit product innovation, thereby protecting profitability.

Government policy and regulatory shifts are paramount to Prudential Financial's business model, directly impacting its insurance, retirement, and investment offerings. For example, the SECURE 2.0 Act of 2022 continues to shape retirement savings products, with Prudential actively developing solutions to leverage its provisions. Furthermore, ongoing scrutiny of financial sector regulations, including capital adequacy and consumer protection, demands continuous adaptation and investment in compliance, as seen in the industry's focus on cybersecurity in 2023.

Political stability and geopolitical events significantly influence Prudential's global operations and investment strategies. The 2024 US presidential election cycle, for instance, carries the potential for policy changes affecting financial markets and consumer confidence. Similarly, international conflicts and trade tensions can disrupt investment flows and currency valuations, impacting Prudential's asset management and international business segments.

Prudential Financial actively engages in lobbying and advocacy to shape favorable legislation and regulatory environments. In the first half of 2024, the company reported approximately $1.5 million in federal lobbying expenditures, focusing on retirement security and market stability. This proactive approach, often in collaboration with industry groups like the ACLI, aims to mitigate regulatory burdens and foster growth opportunities.

| Policy Area | 2024/2025 Impact on Prudential | Example/Data Point |

|---|---|---|

| Retirement Savings Legislation | Increased demand for retirement solutions; opportunities for new product development. | SECURE 2.0 Act of 2022 continues to drive product innovation. |

| Financial Regulation | Higher compliance costs; need for robust data security measures. | Continued focus on cybersecurity regulations in 2023-2024. |

| Monetary Policy (Federal Reserve) | Impacts net investment income and cost of capital. | Federal funds rate target around 5.25%-5.50% in late 2024. |

| Lobbying Efforts | Influence on policy outcomes; mitigation of regulatory risks. | $1.5 million in federal lobbying expenditures in H1 2024. |

What is included in the product

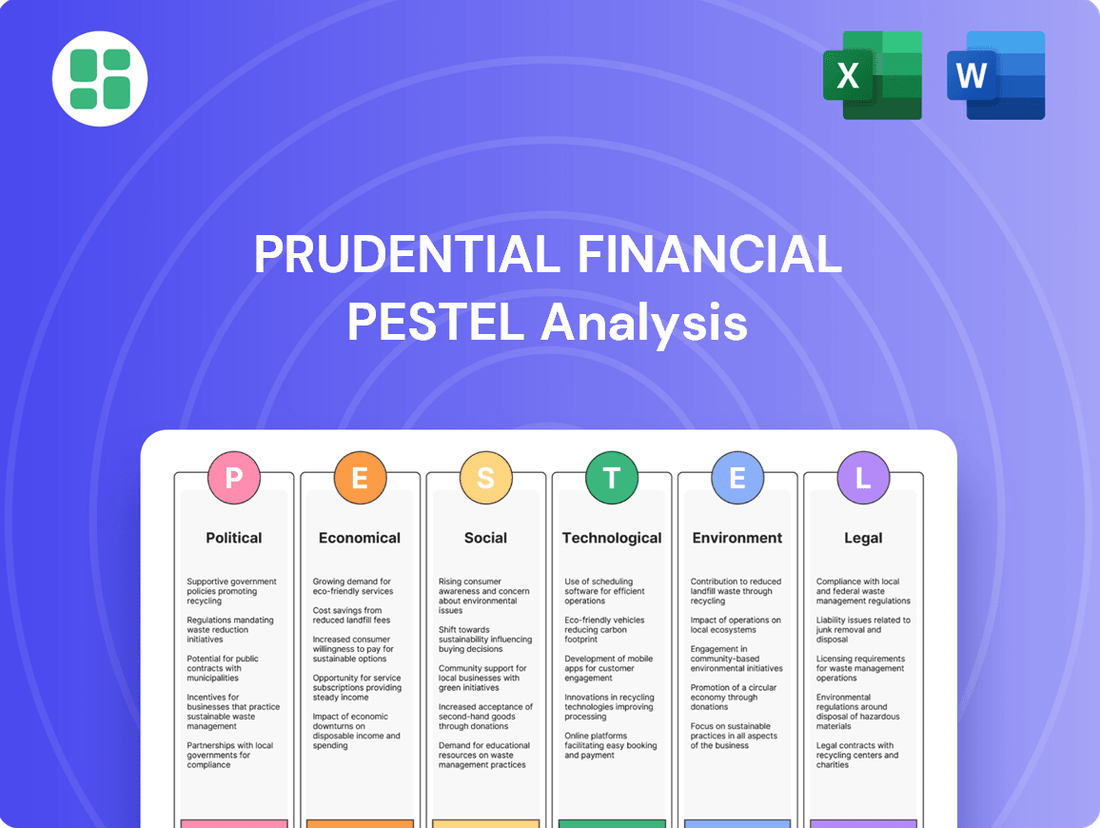

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Prudential Financial, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making by identifying emerging trends and potential challenges within these critical external dimensions.

A concise, actionable PESTLE analysis for Prudential Financial that highlights key external factors impacting strategy, thereby relieving the pain of navigating complex market dynamics.

Economic factors

The prevailing interest rate environment significantly impacts Prudential Financial's annuity and life insurance businesses. Low interest rates, as seen in recent years, can compress investment yields on Prudential's substantial asset base, potentially affecting the profitability of its long-duration products. Conversely, rising rates, such as the Federal Reserve's series of hikes in 2022-2023 aiming to combat inflation, can improve investment income but also increase the cost of capital and potentially impact the attractiveness of certain product offerings if not priced appropriately.

For instance, a sustained period of low rates can make it challenging for insurers like Prudential to generate sufficient returns to meet guaranteed minimum death benefits and cash values in their annuity products. As of late 2024, while rates have stabilized somewhat from their peaks, they remain elevated compared to the pre-2022 era, offering a more favorable backdrop for investment income. However, the sensitivity remains; even a modest shift in long-term bond yields can have a material effect on Prudential's net investment income and the valuation of its liabilities.

Inflationary pressures can significantly impact Prudential Financial by eroding the real value of its future payouts and the purchasing power of its investment returns. For instance, if inflation runs at 3% in 2024, a guaranteed payout of $10,000 in ten years will be worth considerably less in today's terms. This necessitates careful asset allocation to ensure investments outpace inflation, a challenge Prudential navigates by diversifying its portfolio across various asset classes.

Conversely, deflationary trends, though less common recently, could pose different challenges. A sustained period of falling prices might dampen premium growth as the nominal value of insurance policies and investment products could stagnate or decline. Furthermore, deflation can negatively affect the market value of assets held by Prudential, potentially impacting its capital reserves and profitability.

In the 2024-2025 period, global inflation rates have shown varied trends, with some regions experiencing persistent elevated levels while others see moderating inflation. For example, the US Consumer Price Index (CPI) saw a year-over-year increase of 3.3% in May 2024, indicating continued inflationary pressures that Prudential must manage in its investment and product pricing strategies.

The health of the global economy significantly influences Prudential Financial's performance. In 2024, the International Monetary Fund projected global GDP growth to be around 3.2%, a slight moderation from previous years but still indicating expansion. This growth fuels consumer spending, directly impacting demand for Prudential's diverse financial products, from life insurance to investment management.

Strong employment figures are a key indicator of economic well-being and a driver of consumer confidence. As of early 2025, many developed economies are experiencing relatively low unemployment rates, often below 4%. This translates to higher disposable incomes, enabling individuals to allocate more resources towards financial planning, retirement savings, and insurance solutions offered by Prudential.

Consumer confidence surveys, such as the Conference Board Consumer Confidence Index, provide a forward-looking view of spending intentions. A rising confidence index, often seen in periods of economic stability and job security, directly correlates with increased uptake of Prudential's services, as consumers feel more secure in making long-term financial commitments.

Global Market Volatility and Investment Performance

Global market volatility significantly impacts Prudential Financial's investment performance. Fluctuations in equity, bond, and real estate markets directly affect the value of assets under management, influencing fee income and overall profitability for its investment management and wealth accumulation segments. For instance, a sharp downturn in global equity markets, such as a 15% decline in the MSCI World Index in a given quarter, would reduce the total value of assets managed by Prudential, consequently impacting their revenue streams from management fees.

The performance of Prudential's investment products is intrinsically linked to these market movements. When markets are turbulent, the returns on mutual funds, annuities, and other investment vehicles can become unpredictable, potentially leading to lower client satisfaction and increased redemptions. For example, if Prudential's flagship balanced fund experienced a negative return of 5% in a quarter due to widespread market sell-offs, it would directly impact client wealth accumulation goals and could lead to outflows from the fund.

- Impact on Assets Under Management (AUM): Market downturns can lead to substantial decreases in AUM, directly reducing fee-based revenue for Prudential. For instance, a 10% drop in global stock markets could instantly reduce AUM by billions, impacting the company's top line.

- Investment Product Performance: Volatility affects the returns of various investment products, influencing client retention and acquisition. A period of high volatility leading to negative returns in key product categories can deter new investors and cause existing ones to withdraw funds.

- Risk Management Costs: Increased market volatility often necessitates more robust risk management strategies and potentially higher hedging costs, which can eat into profit margins for Prudential's investment divisions.

- Economic Uncertainty: Broader economic uncertainty, often a driver of market volatility, can also dampen investor sentiment, leading to reduced demand for investment products and services offered by Prudential.

Currency Exchange Rates and International Business

Fluctuations in currency exchange rates significantly impact Prudential Financial's international business. For instance, a strengthening US dollar can reduce the translated value of earnings from overseas operations, affecting overall reported profits. This volatility can also influence the cost of capital and the attractiveness of foreign investments.

In 2024, the US dollar experienced moderate strength against several major currencies, which would have presented a headwind for US-based companies with substantial foreign earnings, including Prudential. For example, if Prudential generated a significant portion of its revenue in Euros or Yen, a stronger dollar would mean those foreign earnings translate into fewer dollars.

- Impact on Revenue Translation: A stronger USD can decrease the dollar value of foreign revenues when converted, directly impacting reported earnings.

- Competitive Positioning: Currency shifts can alter the price competitiveness of Prudential's products and services in different international markets.

- Foreign Currency Exposure: Prudential manages exposure to currencies like the Euro, Yen, and Pound Sterling, which are key to its global operations.

- Hedging Strategies: The company employs financial instruments to mitigate the risks associated with adverse currency movements, aiming to stabilize earnings.

Interest rates remain a critical economic factor for Prudential. While the Federal Reserve's rate hikes in 2022-2023 offered a more favorable investment income environment, continued rate stability or potential future adjustments directly influence the profitability of Prudential's long-duration products like annuities and life insurance. For instance, a sustained interest rate at 4.5% in late 2024 provides a better yield compared to the near-zero rates of prior years, but any significant deviation impacts investment returns.

Inflationary pressures continue to challenge Prudential by eroding the real value of future payouts. With the US CPI at 3.3% year-over-year in May 2024, Prudential must ensure its investments outpace this inflation to maintain the value of its liabilities and policyholder benefits. This necessitates strategic asset allocation to counter the diminishing purchasing power of money over time.

Global economic growth, projected around 3.2% for 2024 by the IMF, underpins consumer spending and demand for Prudential's financial products. Coupled with low unemployment rates in many developed nations, often below 4% in early 2025, this economic backdrop supports increased disposable income and a greater propensity for individuals to engage in long-term financial planning and insurance solutions.

Market volatility remains a key concern, directly impacting Prudential's assets under management and fee-based revenue. A 10% dip in global equity markets, for example, could instantly reduce AUM by billions, affecting the company's top line. Furthermore, currency exchange rate fluctuations, such as the moderate strength of the US dollar in 2024, can decrease the translated value of overseas earnings, impacting overall reported profits.

What You See Is What You Get

Prudential Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Prudential Financial delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook. You'll gain valuable insights into the external forces shaping Prudential's business environment.

Sociological factors

The world's population is getting older. In 2024, the percentage of people aged 65 and over is projected to reach 10.7%, a significant increase from 9.3% in 2019. This trend, coupled with declining birth rates in many developed nations, means Prudential Financial faces a growing demand for retirement income solutions, annuities, and long-term care insurance. For instance, by 2050, over 1.5 billion people are expected to be 65 or older globally, presenting a substantial market for these specialized financial products.

This demographic shift also impacts traditional life insurance. As life expectancies continue to rise, actuaries must reassess mortality tables, potentially leading to adjustments in pricing and product design for life insurance policies. Prudential's ability to adapt its offerings to cater to an aging demographic, focusing on wealth preservation and income generation in retirement, will be crucial for sustained growth in the coming years.

Consumer attitudes are shifting, with a growing demand for personalized financial advice and seamless digital experiences. For instance, a 2024 survey indicated that over 60% of millennials and Gen Z prioritize digital channels for managing their finances, a significant increase from previous years.

Prudential must adapt its product development and outreach strategies to resonate with these evolving preferences. This includes offering flexible, digitally-native solutions and leveraging data analytics to provide tailored recommendations, particularly for younger demographics seeking guidance on wealth accumulation and retirement planning.

Wealth distribution and income inequality significantly shape the market for Prudential Financial's offerings. In 2024, the U.S. saw a widening gap, with the top 10% of households holding a disproportionate share of wealth, impacting the affordability of insurance and investment products for lower and middle-income segments.

This disparity necessitates Prudential to develop more tailored product strategies. For instance, the demand for basic life insurance and accessible savings plans may rise among lower-income groups, while higher-income individuals might seek more complex wealth management and retirement solutions, reflecting varying financial capacities.

Social Attitudes Towards Risk and Savings

Societal attitudes towards risk and savings significantly shape Prudential's market. In 2024, a noticeable trend shows a growing public interest in financial security, with many individuals actively seeking ways to protect their wealth. This increased awareness is partly driven by economic uncertainties and a greater understanding of the long-term benefits of diligent saving and insurance. For instance, a recent survey indicated that over 65% of adults in key markets are prioritizing building emergency funds, a direct reflection of this risk-averse sentiment.

Public awareness campaigns and cultural norms play a crucial role in influencing investment behavior. As of early 2025, financial literacy initiatives are gaining traction, encouraging more people to consider long-term financial products like annuities and life insurance. This shift is evident in the rising participation rates in retirement savings plans, with data from 2024 showing a 5% year-over-year increase in contributions to defined contribution plans in several developed economies where Prudential operates.

- Growing Risk Aversion: In 2024, a majority of individuals expressed a preference for lower-risk investments and greater emphasis on capital preservation.

- Increased Savings Focus: Public awareness campaigns have successfully highlighted the importance of savings, leading to higher personal savings rates in 2024 compared to previous years.

- Insurance as a Wealth Protector: There's a rising perception of insurance not just as a safety net but as a vital tool for wealth accumulation and intergenerational transfer.

- Demand for Financial Guidance: The complexity of financial markets is driving demand for professional advice, with a significant portion of the population seeking expert help in managing their finances.

Health and Wellness Trends

Shifting health and wellness trends significantly impact Prudential Financial's life and health insurance segments. Growing public awareness of preventative care and healthier lifestyles can lead to improved mortality rates, potentially reducing claims payouts for life insurance. For instance, a 2024 report indicated a continued rise in participation in wellness programs offered by employers, a trend Prudential can leverage.

Advancements in medical technology, while potentially increasing the cost of some treatments, also offer opportunities for new insurance products. Prudential can develop policies that cover innovative therapies or focus on chronic disease management, aligning with a proactive approach to health. The global digital health market, valued at over $300 billion in 2023, underscores the growing integration of technology into healthcare, a space Prudential is exploring.

- Increased Life Expectancy: Favorable health trends contribute to longer lifespans, influencing long-term life insurance liabilities.

- Demand for Wellness Programs: Growing interest in preventative health creates opportunities for Prudential to partner or offer related insurance products.

- Technological Integration: Telemedicine and wearable health trackers offer data that could personalize underwriting and pricing for health insurance.

- Focus on Mental Health: A societal shift towards prioritizing mental well-being opens avenues for specialized mental health coverage within Prudential's offerings.

Societal attitudes towards risk and savings are a key driver for Prudential Financial. In 2024, a significant majority of individuals showed a preference for capital preservation and lower-risk investments, influenced by economic uncertainties. This risk-averse sentiment is further evidenced by a trend of increasing personal savings rates, with many actively building emergency funds.

Public awareness campaigns are effectively promoting financial literacy, encouraging greater engagement with long-term products like annuities and life insurance. This is reflected in the rising contributions to retirement savings plans, with a notable 5% year-over-year increase observed in 2024 across several developed economies where Prudential operates.

There's a growing perception of insurance as a tool for wealth accumulation and intergenerational transfer, not just a safety net. This, combined with a strong demand for professional financial guidance due to market complexity, positions Prudential to offer comprehensive wealth management solutions.

| Societal Factor | 2024/2025 Trend | Impact on Prudential |

|---|---|---|

| Risk Aversion | Majority prefer lower-risk investments and capital preservation. | Increased demand for stable, secure products like annuities and fixed-income investments. |

| Savings Focus | Higher personal savings rates and increased emergency fund building. | Opportunity to offer savings-linked insurance products and financial planning services. |

| Financial Literacy | Growing public interest in long-term financial products. | Increased potential market for life insurance, retirement planning, and investment advisory services. |

| Wealth Protection Perception | Insurance viewed as a wealth accumulation and transfer tool. | Enhanced market for estate planning, wealth management, and legacy products. |

Technological factors

Prudential Financial is aggressively pursuing digital transformation to elevate its customer experience and operational efficiency. By investing in advanced data analytics and user-friendly mobile applications, the company aims to offer more personalized and accessible financial services. This digital push is crucial for attracting and retaining a modern client base, with digital channels becoming increasingly vital for engagement and transactions.

Prudential Financial is increasingly integrating Artificial Intelligence (AI) and Machine Learning (ML) across its operations. These technologies are being deployed to enhance underwriting processes, identify fraudulent activities more effectively, and deliver personalized financial advice to clients. For instance, AI-powered tools can analyze vast datasets to assess risk more accurately, potentially leading to more competitive pricing for insurance products.

The adoption of AI and ML is expected to drive significant efficiency gains and cost reductions for Prudential. By automating routine tasks, such as claims processing and customer inquiries through chatbots, the company can free up human resources for more complex and value-added activities. This shift allows for more data-driven decision-making, enabling Prudential to better understand customer needs and market trends.

In 2024, the global AI in financial services market was valued at approximately $15.8 billion and is projected to grow substantially. Prudential's strategic investment in these areas positions it to leverage these advancements for improved operational performance and a more competitive market offering, aiming to provide more tailored financial solutions and streamline customer interactions.

Cybersecurity and data privacy are paramount for Prudential Financial, given the constant threat of sophisticated cyberattacks. Protecting sensitive client information is not just a regulatory requirement but a fundamental aspect of maintaining trust and avoiding severe reputational and financial damage. A significant data breach could lead to substantial fines and loss of customer confidence, impacting future business operations.

In 2024, the global average cost of a data breach reached $4.45 million, a concerning figure for any financial institution. Prudential must invest heavily in advanced security protocols and employee training to safeguard its vast data assets against evolving threats. Adherence to regulations like GDPR and CCPA is crucial, with non-compliance carrying penalties that can significantly impact profitability.

Fintech Innovation and Competitive Landscape

Fintech innovation is rapidly reshaping the financial services landscape, presenting both challenges and opportunities for established players like Prudential Financial. Emerging fintech companies are introducing agile, customer-centric solutions in areas such as digital payments, wealth management, and insurtech, forcing traditional institutions to accelerate their own digital transformation efforts. For instance, the global fintech market size was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, highlighting the scale of this disruption.

To maintain its competitive edge, Prudential Financial must actively adapt to these evolving market dynamics. This includes exploring strategic partnerships with innovative fintech firms to leverage their technology and reach, as well as investing in internal capabilities to develop and integrate new digital solutions. The company's ability to embrace and integrate these technological advancements will be crucial for its future success in an increasingly competitive environment.

Key areas of fintech impact for Prudential include:

- Digital Onboarding and Customer Experience: Fintechs excel at seamless digital customer journeys, pushing Prudential to streamline its own processes.

- Insurtech Advancements: Innovations in data analytics, AI, and IoT are enabling personalized insurance products and more efficient claims processing.

- Robo-Advisory and Digital Wealth Management: The rise of automated investment platforms challenges traditional advisory models, requiring Prudential to offer competitive digital wealth solutions.

- Payment Modernization: Fintech-driven payment solutions are changing how consumers and businesses transact, impacting fee structures and customer loyalty.

Blockchain and Distributed Ledger Technologies

Prudential Financial is exploring blockchain and distributed ledger technologies (DLT) for enhanced security and efficiency. These technologies hold promise for revolutionizing insurance operations, particularly in areas like smart contracts for policy management and streamlined claims processing. By mid-2024, the global blockchain in insurance market was projected to reach $1.5 billion, indicating significant industry interest.

The potential applications are vast, ranging from immutable record-keeping to facilitating faster, more transparent transactions. Prudential's strategic interest aligns with broader industry trends where DLT is seen as a long-term disruptive force. By late 2024, many financial institutions were investing heavily in DLT pilot programs, with insurance being a key focus area for innovation.

- Secure Record-Keeping: Blockchain offers an unalterable ledger for policyholder data, reducing fraud and enhancing privacy.

- Smart Contracts: Automation of insurance policy clauses, such as automatic payouts upon verifiable events, can improve efficiency and customer experience.

- Claims Processing: DLT can expedite claims by providing a single, shared source of truth for all parties involved, reducing disputes and processing times.

Technological advancements are a core driver for Prudential Financial's strategy, with a significant focus on digital transformation and AI integration. By leveraging these tools, the company aims to enhance customer experience, streamline operations, and improve risk assessment. This commitment to innovation is essential for maintaining competitiveness in the rapidly evolving financial services sector.

Legal factors

Prudential Financial operates within a highly regulated environment, facing stringent rules from state insurance departments and federal agencies. These regulations cover crucial areas such as capital requirements, solvency standards, and product design, directly impacting operational costs and strategic flexibility. For instance, the National Association of Insurance Commissioners (NAIC) continually updates solvency frameworks, influencing how Prudential manages its reserves and investments.

Changes in these legal frameworks can significantly alter Prudential's compliance burden and the profitability of its product lines. For example, new consumer protection laws enacted in 2024 might necessitate adjustments to sales practices or product disclosures, adding to overhead. The ongoing evolution of financial services regulation, including potential shifts in interest rate oversight or data privacy mandates, requires constant vigilance and adaptation from Prudential.

Data protection and privacy laws are becoming increasingly strict worldwide. Regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) mandate robust security measures for client data. Prudential Financial must adhere to these stringent rules concerning data collection, storage, and usage to prevent significant fines and protect its reputation.

Consumer protection laws, like the SEC's Regulation Best Interest (Reg BI) implemented in 2020, mandate that financial professionals act in the best interest of their clients. This requires Prudential Financial to ensure its marketing and sales practices are transparent and free from deceptive or unfair conduct, impacting how they present investment products and services.

Anti-fraud measures and disclosure requirements are crucial. For instance, the Financial Industry Regulatory Authority (FINRA) actively enforces rules against misrepresentation and omission of material facts. Prudential Financial must adhere to these, ensuring clear communication about fees, risks, and product features to avoid regulatory penalties, which can include significant fines and reputational damage.

These regulations directly influence Prudential's customer service operations by demanding robust complaint handling procedures and clear communication channels. In 2023, FINRA reported over 1.3 million customer complaints, highlighting the importance of proactive compliance and customer satisfaction in the financial services sector.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Laws

Prudential Financial, like all financial institutions, operates under a strict legal framework designed to combat money laundering and terrorist financing. This means Prudential must have robust systems in place to monitor transactions, identify suspicious activities, and report them to the relevant authorities. Failure to comply can result in significant penalties.

The company's legal obligations extend to rigorous customer due diligence (CDD) and know your customer (KYC) procedures. This involves verifying the identity of clients and understanding the nature of their business to prevent the misuse of financial services for illicit purposes. These requirements are constantly evolving to keep pace with new criminal methodologies.

In 2024, regulatory bodies worldwide continued to emphasize the importance of effective AML/CTF programs. For instance, the Financial Action Task Force (FATF) recommendations, which serve as an international standard, are regularly updated. Prudential's compliance efforts are directly influenced by these global standards and national legislation, such as the Bank Secrecy Act in the United States.

- Transaction Monitoring: Prudential utilizes advanced analytics to flag unusual transaction patterns, aiming to detect potential money laundering or terrorist financing activities.

- Suspicious Activity Reporting (SAR): The company is legally mandated to file SARs with financial intelligence units when suspicious transactions are identified, a critical step in preventing financial crime.

- Customer Due Diligence (CDD): Comprehensive checks are performed on new and existing clients to understand their risk profile and ensure they are not involved in illicit activities.

- Regulatory Compliance: Adherence to national and international AML/CTF laws, including those set forth by FinCEN and FATF, is a continuous operational priority for Prudential.

Litigation Risks and Class Action Lawsuits

Prudential Financial faces ongoing litigation risks, including class action lawsuits stemming from allegations of product misrepresentation or contractual disputes. For instance, in 2023, the company was involved in a significant class-action settlement related to variable annuity products, highlighting the substantial financial impact such legal challenges can have. These legal battles necessitate robust risk management strategies and can lead to considerable financial liabilities, affecting the company's profitability and operational focus.

The company's exposure to litigation is influenced by evolving regulatory environments and consumer protection laws. Prudential's approach to managing these risks involves proactive compliance measures and a dedicated legal defense team. The potential for future claims, particularly concerning new financial products or market volatility, remains a key consideration in their strategic planning and financial forecasting.

- Class Action Exposure: Prudential, like many large financial institutions, is susceptible to class action lawsuits concerning product sales, fees, or advisory services.

- Settlement Impact: Significant settlements, such as those in prior years related to annuity or mutual fund practices, can result in multi-million dollar financial outlays, impacting earnings per share.

- Regulatory Scrutiny: Increased regulatory oversight, particularly from bodies like the SEC and FINRA, can lead to investigations and potential litigation if compliance failures are identified.

- Operational Risk Link: Litigation often arises from operational failures or perceived missteps in customer interactions, underscoring the need for strong internal controls and ethical conduct.

Prudential Financial navigates a complex legal landscape, with regulations from state insurance departments and federal agencies dictating capital requirements, solvency, and product design, directly impacting its operational costs and strategic flexibility. For instance, the NAIC's solvency frameworks influence reserve management, while evolving consumer protection laws, such as SEC's Regulation Best Interest, necessitate clear sales practices and product disclosures, adding to compliance overhead.

Environmental factors

Climate change presents significant risks and opportunities for Prudential Financial. The increasing frequency and severity of extreme weather events, such as hurricanes and wildfires, directly impact the company through higher insurance claims. For instance, in 2023, global insured losses from natural catastrophes were estimated to be around $110 billion, a substantial figure that affects insurers like Prudential.

Beyond direct claims, Prudential must also navigate climate-related risks within its vast investment portfolios. This involves assessing the potential for stranded assets in carbon-intensive industries and identifying opportunities in the rapidly growing green finance sector. The global sustainable investment market reached $37.7 trillion in 2022, demonstrating a clear trend towards environmentally conscious capital allocation.

Prudential can leverage these trends by expanding its offerings in sustainable investing and developing innovative insurance products that address climate resilience. The company's commitment to net-zero emissions by 2050 aligns with this strategic imperative, positioning it to capitalize on the transition to a low-carbon economy.

Environmental, Social, and Governance (ESG) investing is rapidly shaping financial markets, with a significant portion of global assets now incorporating these principles. In 2024, investor demand for sustainable options continues to surge, pushing companies like Prudential Financial to integrate ESG factors deeply into their asset management strategies.

Prudential Financial is responding to this trend by enhancing its commitment to sustainable practices and offering clients more socially responsible investment choices. This focus is driven by a growing awareness among investors that ESG performance can correlate with long-term financial resilience and value creation.

Prudential Financial, like many global institutions, faces growing regulatory pressure concerning sustainable finance. Governments and financial watchdogs are increasingly mandating climate-related financial disclosures, pushing companies to be more transparent about their environmental impact and how they manage climate risks.

This trend is evident in initiatives like the Task Force on Climate-related Financial Disclosures (TCFD), whose recommendations are being adopted by regulators worldwide. By late 2024, a significant number of major economies are expected to have implemented mandatory climate reporting frameworks, impacting how Prudential Financial assesses and reports on its portfolio's climate exposure.

Natural Disaster Impact on Insurance Claims

The increasing frequency and intensity of natural disasters, potentially exacerbated by climate change, pose a significant challenge to Prudential Financial's property and casualty insurance operations. This trend directly translates to higher claims payouts, straining profitability and requiring more sophisticated risk assessment models. For instance, the global insured losses from natural catastrophes in 2023 were estimated by Swiss Re to be around $110 billion, a notable increase from previous years, highlighting the growing exposure for insurers like Prudential.

These environmental shifts necessitate a proactive approach to risk management and pricing within Prudential's insurance products. The company must continually adapt its underwriting strategies and reinsurance arrangements to account for evolving climate-related risks. The impact is not just financial; it also involves the operational challenges of processing a surge in claims following major weather events.

Key considerations for Prudential include:

- Increased Reinsurance Costs: As natural disaster frequency rises, the cost of reinsurance, which insurers use to protect themselves from large losses, is also increasing. This directly impacts Prudential's cost of doing business.

- Pricing Adjustments: To maintain solvency and profitability, Prudential may need to adjust premiums for property and casualty insurance, particularly in regions more susceptible to extreme weather.

- Investment in Climate Resilience: Prudential, like other financial institutions, faces pressure to invest in climate resilience and potentially divest from industries contributing significantly to climate change, influencing its broader investment portfolio.

Corporate Social Responsibility and Reputation

Prudential Financial's dedication to environmental, social, and governance (ESG) principles significantly shapes its public image and the confidence stakeholders place in the company. A strong commitment to sustainability, for instance, can directly translate into a more favorable brand perception. In 2023, Prudential reported a 20% reduction in its operational carbon emissions compared to a 2019 baseline, a move that resonates with increasingly eco-conscious consumers and investors.

Transparent environmental policies and active community involvement are key to building this trust. Prudential's ongoing investments in renewable energy projects, totaling over $500 million by the end of 2024, not only contribute to environmental goals but also serve as tangible evidence of their corporate citizenship. This can attract talent and clients who prioritize working with or for socially responsible organizations.

- Brand Enhancement: Positive ESG performance can lead to a stronger brand reputation, attracting a wider customer base.

- Stakeholder Trust: Transparency in environmental and social initiatives fosters trust among investors, employees, and the public.

- Talent Acquisition: A commitment to CSR can make Prudential a more attractive employer for individuals seeking purpose-driven careers.

- Client Attraction: Environmentally and socially conscious clients are more likely to choose financial institutions that align with their values.

Prudential Financial is increasingly impacted by environmental factors, particularly the rise in natural catastrophes. Global insured losses from natural catastrophes in 2023 alone were approximately $110 billion, a figure that directly influences insurance claims and necessitates robust risk management. The company's investment strategies are also adapting, with the sustainable investment market reaching $37.7 trillion in 2022, signaling a significant shift towards environmentally conscious capital allocation.

Regulatory pressures are mounting, with global adoption of climate-related financial disclosure frameworks accelerating through 2024. Prudential must navigate these requirements, which demand greater transparency regarding its environmental impact and climate risk management. This evolving landscape requires proactive strategies in underwriting, pricing, and investment to align with a low-carbon economy.

| Environmental Factor | Impact on Prudential Financial | Supporting Data (2022-2024) |

|---|---|---|

| Extreme Weather Events | Increased insurance claims, higher reinsurance costs | Global insured losses from natural catastrophes: ~$110 billion (2023) |

| Climate Change Transition | Opportunities in green finance, risk of stranded assets | Global sustainable investment market: $37.7 trillion (2022) |

| Regulatory Disclosure | Mandatory climate reporting, increased transparency requirements | Growing adoption of TCFD recommendations globally by late 2024 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Prudential Financial draws upon a robust blend of data from reputable financial institutions, government regulatory bodies, and leading economic research firms. We integrate insights from global economic indicators, policy updates from key markets, and industry-specific trend reports to ensure a comprehensive understanding of the macro-environment.