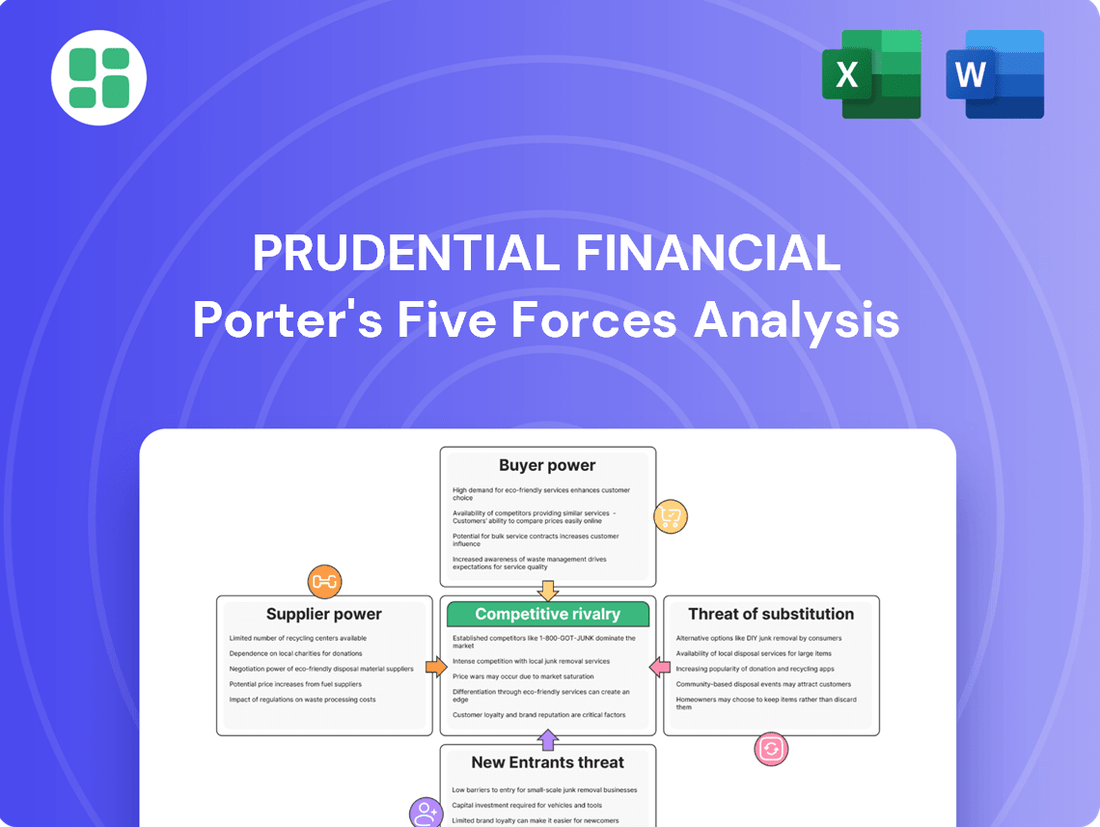

Prudential Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prudential Financial Bundle

Prudential Financial navigates a complex landscape shaped by intense competition and evolving customer demands. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for its strategic positioning.

The complete report reveals the real forces shaping Prudential Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Prudential Financial's operations are deeply intertwined with technology and data providers, encompassing everything from advanced analytics to critical cybersecurity and core processing systems. The bargaining power of these suppliers can range from moderate to significant, particularly when they offer highly specialized software or proprietary data crucial for maintaining a competitive advantage.

However, the landscape is evolving. The proliferation of scalable cloud-based solutions and the expansion of the vendor ecosystem are gradually tempering the influence of individual tech and data suppliers. For instance, in 2024, the global cloud computing market was projected to reach over $600 billion, indicating a robust and competitive environment for infrastructure and software providers.

The financial services sector, and a major player like Prudential, heavily relies on specialized expertise. Think actuaries, investment wizards, data gurus, and sharp financial advisors. These aren't just any employees; they're the skilled professionals who drive Prudential's success.

When certain skills are in short supply, especially in hot areas like AI and big data analysis, those professionals become powerful. They can command higher salaries and better benefits, directly impacting Prudential's operational costs. This scarcity gives them significant bargaining power.

Prudential's recent workforce adjustments, which have included layoffs, highlight a strategic shift in how they view and manage their human capital. This suggests a need to adapt to evolving market demands and perhaps a re-evaluation of where their talent needs are most critical, potentially increasing the leverage of those in high-demand specialized roles.

Reinsurance companies are vital partners for life insurers like Prudential, absorbing portions of their risk and helping meet capital needs. The reinsurance market, particularly for specialized risks, can be concentrated, giving powerful reinsurers leverage. For instance, in 2024, the global reinsurance market continued to see strong demand for property catastrophe coverage, with reinsurers able to command higher pricing due to increased modeling sophistication and a desire for greater returns.

Financial Market Infrastructure Providers

Financial market infrastructure providers, like exchanges and clearinghouses, are critical for Prudential's operations. While these services are highly regulated, Prudential's substantial scale and the presence of alternative providers can offer some bargaining power.

The bargaining power of these suppliers is influenced by several factors:

- Concentration of Providers: The number of viable exchanges or clearinghouses Prudential can utilize impacts their leverage. A market with fewer dominant players typically grants suppliers more power.

- Switching Costs: The expense and complexity involved in moving from one infrastructure provider to another for Prudential can be significant, potentially limiting their ability to negotiate favorable terms.

- Technological Advancements: The rise of new payment technologies and distributed ledger technologies could introduce new competitors or alter the value proposition of existing providers, shifting the balance of power. For instance, by the end of 2024, the global fintech market is projected to reach over $1.1 trillion, indicating significant innovation and potential disruption in payment systems.

Regulatory and Compliance Services

Regulatory bodies and compliance service providers act as powerful, albeit non-traditional, suppliers for Prudential Financial. Their influence stems from the mandatory nature of adhering to stringent financial regulations, which directly impacts operational costs and strategic direction. For instance, in 2024, the financial services industry continued to grapple with increasing compliance burdens, with many firms reporting significant investments in technology and personnel to meet evolving requirements around data privacy and anti-money laundering.

The indirect power of these entities is substantial. Prudential must invest heavily in systems and expertise to ensure compliance with rules governing areas like capital adequacy, consumer protection, and cybersecurity. Failure to comply can result in hefty fines and reputational damage, effectively giving regulators leverage over the company's operational framework and cost structure. For example, a 2024 report indicated that compliance costs for large financial institutions could represent a substantial percentage of their operating expenses.

- Mandatory Adherence: Prudential must comply with a complex web of financial regulations, impacting its operational model.

- Cost Implications: Investments in compliance technology and personnel are significant, directly affecting profitability.

- Indirect Power: Regulators wield substantial influence through the threat of penalties for non-compliance.

- Evolving Landscape: The constant evolution of regulations necessitates ongoing adaptation and resource allocation.

The bargaining power of suppliers for Prudential Financial is generally moderate, influenced by the availability of alternatives and switching costs. While specialized tech providers can hold sway, the growing cloud market in 2024, projected to exceed $600 billion, offers Prudential more options and reduces the leverage of any single vendor.

What is included in the product

This analysis of Prudential Financial's competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, offering strategic insights into its market position.

Understand competitive intensity with a visual representation of each force, allowing for targeted strategy adjustments.

Customers Bargaining Power

Individual clients seeking life insurance, annuities, and mutual funds possess moderate bargaining power. This stems from the sheer number of competing financial institutions and the growing accessibility of product information, allowing consumers to compare offerings more easily. For instance, in 2024, the U.S. life insurance industry continued to be highly competitive, with hundreds of providers vying for market share.

The rise of online comparison tools and direct-to-consumer sales channels further amplifies this power, enabling individuals to actively seek more favorable terms and pricing. While brand loyalty and the inherent complexity of certain financial products can somewhat temper this influence, the trend toward greater transparency empowers informed decision-making.

Annuity sales, a key area for firms like Prudential, reached record levels in recent years, indicating strong demand. However, the bargaining power of individual clients is also subtly shaped by macroeconomic factors like interest rate fluctuations, which can significantly impact the attractiveness and pricing of annuity products in 2024 and beyond.

Institutional clients, like major corporations seeking retirement and investment management, wield considerable bargaining power. Their sophisticated financial understanding and the sheer volume of assets they manage allow them to negotiate favorable terms and demand highly customized services.

For Prudential's PGIM, which handles substantial institutional assets, this means a constant need to prove superior performance and competitive pricing to retain these valuable relationships.

For many of Prudential's offerings, like basic mutual funds or standard brokerage accounts, customers can switch providers with relative ease. This low barrier to entry means customers have more sway, pushing Prudential to remain competitive on fees and service quality to keep them. For instance, in 2024, the average expense ratio for actively managed equity mutual funds remained around 0.69%, a figure customers readily compare across firms.

Price Sensitivity and Product Commoditization

In mature financial services sectors, products often become indistinguishable, making customers highly sensitive to price. This commoditization compels firms like Prudential to engage in intense price competition, which can negatively impact profitability. For instance, in 2024, the annuity market saw significant shifts in demand directly correlated with fluctuating interest rates, altering the attractiveness of certain products.

This price sensitivity is a critical factor in Prudential's competitive landscape. When financial products are perceived as similar, buyers naturally gravitate towards the lowest cost option. This dynamic is particularly evident in segments where innovation is slow or easily replicated.

- Price Sensitivity: Customers in mature financial markets are increasingly comparing offerings based on cost rather than unique features.

- Product Commoditization: In areas like basic life insurance or certain investment vehicles, products can become so standardized that differentiation is minimal.

- Margin Erosion: Aggressive price competition to attract customers in commoditized markets can lead to reduced profit margins for companies like Prudential.

- Market Dynamics: For example, as of mid-2024, the demand for fixed annuities was heavily influenced by the Federal Reserve's interest rate policies, demonstrating how external factors amplify price sensitivity.

Information Availability and Financial Literacy

The increasing availability of financial information and a growing level of financial literacy among consumers significantly boosts their bargaining power. Customers can now easily research financial products, compare different providers, and understand intricate contract details, forcing companies like Prudential Financial to be more transparent with pricing and demonstrate clear value.

Digital tools and accessible financial education platforms are key drivers behind this shift, empowering clients to make more informed decisions. For instance, by mid-2024, a significant portion of retail investors actively utilized online comparison tools before selecting financial services, a trend that has been steadily growing over the past few years.

- Informed Consumers: Customers can readily access product details and pricing, enabling direct comparisons between financial institutions.

- Digital Empowerment: Online platforms and educational resources equip individuals with the knowledge to scrutinize offerings and negotiate better terms.

- Price Sensitivity: Increased transparency and ease of comparison lead to greater price sensitivity, pressuring providers to offer competitive rates and fees.

- Demand for Value: Consumers are more likely to seek out providers that offer superior value, including better service, clearer communication, and more favorable product features.

Customers, especially those engaging with standardized financial products or seeking basic services, possess moderate to high bargaining power. This is driven by the ease of comparing offerings across numerous providers and the increasing availability of transparent pricing information, a trend particularly evident in 2024. For instance, the U.S. life insurance market, a key segment for Prudential, remained highly competitive with hundreds of insurers, making it easier for consumers to shop around.

The ability for customers to switch providers with minimal friction, coupled with the commoditization of certain financial products, compels companies like Prudential to focus on competitive pricing and service quality. In 2024, the average expense ratio for actively managed equity mutual funds hovered around 0.69%, a metric readily scrutinized by investors.

This customer leverage is further amplified by digital comparison tools and a general increase in financial literacy, empowering individuals to demand more value and transparency. As of mid-2024, a significant portion of retail investors actively used online comparison tools, highlighting their influence in shaping provider strategies.

| Factor | Impact on Prudential | 2024 Data Point |

| Ease of Switching | Lowers customer loyalty, increases price sensitivity | Low switching costs for basic brokerage accounts. |

| Information Availability | Empowers customers to compare and negotiate | High usage of online financial comparison tools by retail investors. |

| Product Standardization | Reduces differentiation, intensifies price competition | Average expense ratio for equity mutual funds around 0.69%. |

| Provider Competition | Forces competitive pricing and service offerings | Hundreds of life insurance providers in the U.S. market. |

Preview the Actual Deliverable

Prudential Financial Porter's Five Forces Analysis

This preview shows the exact Prudential Financial Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the financial services industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This detailed analysis is professionally formatted and ready for your immediate use, ensuring no surprises or placeholders.

Rivalry Among Competitors

Prudential Financial navigates a fiercely competitive market, facing off against established insurance giants, broad-based financial services conglomerates, specialized asset managers, and innovative fintech startups. This diverse competitive set actively challenges Prudential across its core offerings, including life insurance, retirement solutions, and investment management, all vying for customer attention and capital. The company’s Q1 2025 performance, which showed varied outcomes across its business lines, underscores the persistent impact of this intense rivalry on market positioning and profitability.

The financial services and insurance sectors are largely mature, meaning much of the growth achieved by companies like Prudential Financial is often a direct result of taking market share from rivals. This dynamic intensifies competitive rivalry, pushing firms towards more aggressive pricing, higher marketing investments, and a relentless pursuit of product innovation to stand out.

While specific areas such as annuities saw record sales in recent periods, the broader industry's maturity suggests that gains are hard-won. For instance, life insurance premiums are projected for continued growth into 2025, but this growth is expected to be accompanied by significant shifts in the types of products being sold, requiring adaptability.

Competitive rivalry in the financial services sector, including for Prudential, is significantly fueled by product differentiation and ongoing innovation. Companies strive to offer unique features in products like annuities, create personalized investment solutions tailored to individual needs, or develop advanced digital platforms that enhance customer experience. For instance, Prudential's focus on areas like responsible AI and evolving leadership frameworks demonstrates a commitment to innovation as a means to stand out in a crowded market and prevent its offerings from becoming mere commodities.

The demand for annuities, a key product for many financial institutions, is directly influenced by the industry's capacity for product innovation. Companies that can introduce novel features or more attractive structures within their annuity products are better positioned to capture market share. This drive for innovation is crucial for Prudential to maintain its competitive edge, especially as the financial landscape continues to evolve with technological advancements and changing customer expectations.

Mergers, Acquisitions, and Consolidation

Mergers and acquisitions are a constant force in financial services, significantly altering the competitive arena. For instance, in 2023, the global M&A market saw a notable uptick in financial services deals, with significant consolidation occurring in areas like wealth management and insurance. These transactions can forge larger, more powerful entities, directly intensifying rivalry among established firms.

This consolidation trend can elevate market concentration, making it tougher for new entrants to gain a foothold. Prudential Financial, in its strategic maneuvering, has actively participated in this dynamic. The company has undertaken de-risking initiatives and pursued diversification, which has included strategic divestitures to optimize its portfolio. For example, in recent years, Prudential has divested certain international operations to focus on core growth markets, a move that reflects the broader industry's drive for efficiency and competitive positioning.

- Increased Market Concentration: Consolidation leads to fewer, larger players.

- Heightened Rivalry: Larger firms often engage in more aggressive competition.

- Barriers to Entry: Mergers can create economies of scale, making it harder for new companies to compete.

- Prudential's Strategy: Prudential has engaged in divestitures as part of its strategic response to market consolidation and to enhance its competitive stance.

Regulatory Environment and Compliance Costs

The financial services sector is heavily regulated, and staying compliant with evolving rules presents a significant hurdle. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to emphasize robust cybersecurity measures and enhanced investor protection rules, requiring substantial technology and personnel investments. These compliance costs can deter new entrants, but for established players like Prudential Financial, they also intensify competition as firms vie to meet and exceed these standards efficiently.

Adherence to new regulations, especially those concerning data privacy and digital asset management, demands considerable financial and strategic resources. Prudential Financial, like its peers, must allocate significant capital to upgrade systems and train staff to ensure compliance. This ongoing investment influences how companies compete, pushing for innovation in risk management and operational efficiency to absorb these costs, thereby shaping the competitive landscape.

- Increased Compliance Burden: Financial institutions face mounting costs from regulations like the SEC's proposed climate disclosure rules and ongoing cybersecurity mandates, impacting operational budgets.

- Investment in Technology: Companies are investing heavily in data analytics and security infrastructure to meet compliance requirements, with cybersecurity spending in the financial sector projected to reach over $100 billion globally by 2025.

- Competitive Differentiator: Firms that effectively manage compliance costs and integrate regulatory adherence into their strategy can gain a competitive edge by demonstrating reliability and trustworthiness to customers and investors.

- Barrier to Entry: The sheer expense and complexity of navigating the regulatory environment serve as a significant barrier for smaller, less-resourced firms looking to enter the market.

Prudential Financial faces intense rivalry from a broad spectrum of competitors, including large insurers, diversified financial services firms, specialized asset managers, and agile fintech startups, all vying for market share and customer capital. This competition is amplified by the maturity of the insurance and financial services sectors, where growth is often achieved by taking share from rivals, leading to aggressive pricing and innovation efforts. For instance, while Prudential reported strong annuity sales in early 2024, the overall industry growth into 2025 is expected to be hard-won, with significant product shifts requiring constant adaptation.

Product differentiation and innovation are key battlegrounds, with companies like Prudential investing in unique features for annuities and personalized investment solutions to stand out. The company's focus on areas like responsible AI and evolving leadership frameworks highlights this commitment. Furthermore, industry consolidation, evidenced by a robust M&A market in financial services throughout 2023, creates larger entities that intensify rivalry and raise barriers to entry for new players. Prudential's strategic divestitures of certain international operations in recent years reflect this dynamic, aiming to optimize its portfolio and enhance competitive positioning in core markets.

| Key Competitor Actions | Impact on Prudential | Example (2023-2025) |

| Product Innovation (e.g., new annuity features) | Drives market share gains, necessitates matching innovation | Competitors launching enhanced variable annuities with guaranteed lifetime income options. |

| Aggressive Pricing Strategies | Pressures profit margins, requires cost efficiency | Price wars on term life insurance policies or lower management fees on ETFs. |

| Mergers & Acquisitions | Increases competitor scale and market power | Consolidation in wealth management, creating larger advisory firms with broader client bases. |

| Digital Transformation & Fintech Partnerships | Challenges traditional models, demands improved customer experience | Fintechs offering streamlined digital onboarding for investment accounts or AI-driven financial advice. |

SSubstitutes Threaten

Self-insurance and personal savings present a direct substitute for traditional insurance products like life insurance and annuities. Individuals, particularly those with a strong financial acumen, may opt to manage their financial security through personal investments in stocks, bonds, or real estate, bypassing insurance premiums altogether. This approach offers greater control over assets, a key draw for many.

The attractiveness of personal savings as a substitute is heavily influenced by prevailing economic conditions and interest rate environments. For instance, in periods of high interest rates, the returns on personal savings and investments can become more competitive, making them a more appealing alternative to insurance products. As of early 2024, the Federal Reserve maintained interest rates at elevated levels, which could have encouraged some individuals to lean more on personal savings for their long-term financial planning.

Government social security and pension programs present a significant threat of substitutes for Prudential's retirement offerings. These public programs, like Social Security in the U.S., provide a foundational income stream for many retirees, directly competing with private annuities and retirement savings plans. For instance, in 2024, the Social Security Administration estimated that over 67 million Americans were receiving benefits, highlighting the vast reach of this substitute.

The perceived adequacy and long-term sustainability of these government programs heavily influence individuals' willingness to invest in private retirement solutions. As many countries grapple with aging populations and the fiscal pressures on public pension systems, concerns about future payouts can actually drive demand for private alternatives. For example, projections for the U.S. Social Security system indicate potential funding shortfalls in the coming decades, encouraging more people to consider supplementary private retirement accounts.

The proliferation of direct investment platforms and robo-advisors presents a significant threat of substitutes for Prudential's traditional investment management services. These digital platforms, offering low-cost exchange-traded funds (ETFs) and automated portfolio management, directly compete with offerings from Prudential's asset management arm, PGIM. For instance, the assets under management in robo-advisors grew substantially, reaching an estimated $1.5 trillion globally by the end of 2024, a stark increase from previous years, highlighting their growing appeal to investors seeking accessible and affordable wealth accumulation solutions.

Alternative Lending and Decentralized Finance (DeFi)

Emerging financial technologies present a growing threat of substitution for traditional financial services. Buy Now, Pay Later (BNPL) services, for instance, offer consumers immediate purchasing power, potentially reducing reliance on credit cards or personal loans for short-term financing needs. In 2023, the global BNPL market was valued at over $150 billion and is projected to grow significantly, indicating a substantial shift in consumer payment behavior.

Decentralized Finance (DeFi) platforms, built on blockchain technology, are also creating alternative avenues for lending, borrowing, and investing, bypassing traditional intermediaries like banks and insurance companies. While still in its early stages for widespread adoption in insurance and retirement planning, DeFi's ability to offer potentially higher yields and more accessible financial products poses a long-term substitution risk. The total value locked in DeFi protocols reached over $100 billion in early 2024, demonstrating its increasing traction.

These innovations challenge established models by offering different value propositions, such as greater user control, lower fees, or novel investment opportunities. For Prudential, this translates to a need to monitor and potentially integrate these technologies to remain competitive, as they can siphon off customers seeking alternative financial solutions.

- BNPL Market Growth: The global BNPL market was valued at over $150 billion in 2023 and is expected to see continued expansion.

- DeFi Total Value Locked: DeFi protocols held over $100 billion in total value locked as of early 2024, signaling significant user engagement.

- Consumer Behavior Shift: These technologies cater to a growing demand for faster, more accessible, and potentially more rewarding financial transactions.

- Competitive Landscape: The rise of fintech alternatives necessitates adaptation and innovation within the traditional financial services sector.

Non-Traditional Wealth Management Services

Fintech startups are increasingly offering specialized financial planning and budgeting tools, directly competing with Prudential's core services. These platforms often attract younger demographics with streamlined digital experiences and lower fees, posing a significant threat. For instance, robo-advisors, a prominent segment of this trend, saw substantial growth in assets under management, with estimates suggesting over $2 trillion globally by the end of 2024.

Consumers are also exploring alternative investment vehicles and platforms that bypass traditional wealth management structures. This includes direct access to venture capital, private equity, and even fractional ownership of assets, often facilitated by blockchain technology. Such options cater to a desire for greater control and potentially higher returns, diverting capital that might otherwise flow to established players like Prudential.

- Fintech's Growing Market Share: Fintech platforms are capturing a larger share of the wealth management market, particularly among younger investors.

- Digital-First Experience: Many non-traditional services offer a more intuitive and accessible digital interface compared to legacy systems.

- Cost-Effectiveness: Lower overheads allow fintechs to offer services at a reduced cost, making them attractive to price-sensitive consumers.

- Niche Specialization: Some startups focus on specific financial needs, such as student loan management or early-stage investing, creating tailored solutions that Prudential may not directly replicate.

The threat of substitutes for Prudential is multifaceted, stemming from both traditional and innovative financial solutions. Individuals can self-insure or utilize personal savings, especially when interest rates make these options more attractive, as seen with elevated rates in early 2024. Government programs like Social Security also serve as direct substitutes for retirement offerings, with the U.S. Social Security system alone providing benefits to over 67 million Americans in 2024.

Furthermore, the rise of fintech, including robo-advisors and direct investment platforms, offers lower-cost alternatives to Prudential's asset management services. The global robo-advisor market, for instance, was estimated to manage over $1.5 trillion by the end of 2024. Emerging technologies like Buy Now, Pay Later (BNPL) and Decentralized Finance (DeFi) also present substitution risks by offering alternative payment and investment avenues, with the BNPL market exceeding $150 billion in 2023 and DeFi protocols locking in over $100 billion by early 2024.

| Substitute Category | Example Offering | 2024 Relevance/Data Point | Impact on Prudential |

|---|---|---|---|

| Personal Finance | Self-insurance, personal savings | Elevated interest rates in early 2024 made savings more competitive. | Reduces demand for insurance premiums. |

| Government Programs | Social Security, public pensions | Over 67 million Americans received Social Security benefits in 2024. | Directly competes with retirement products. |

| Fintech Platforms | Robo-advisors, direct investment platforms | Global robo-advisor AUM estimated over $1.5 trillion by end of 2024. | Siphons off customers seeking lower-cost investment management. |

| Emerging Technologies | BNPL, DeFi | BNPL market >$150 billion (2023); DeFi TVL >$100 billion (early 2024). | Offers alternative payment and investment methods, bypassing traditional channels. |

Entrants Threaten

The financial services sector, particularly in areas like insurance and annuities, necessitates considerable capital investment to satisfy stringent regulatory mandates, cover extensive operational expenses, and maintain the capacity to absorb unforeseen losses. This creates a formidable barrier for potential new competitors.

For instance, as of the first quarter of 2024, major insurance companies like Prudential Financial often maintain risk-based capital ratios well above regulatory minimums, demonstrating the sheer scale of financial resources required to operate credibly and absorb market volatility. These high capital demands make it exceptionally challenging for new entities to establish the necessary reserves and robust infrastructure.

New entrants into the financial services sector, like Prudential Financial, encounter substantial regulatory barriers. Obtaining necessary licenses and adhering to evolving compliance frameworks across multiple jurisdictions and product types demands significant investment and specialized expertise. For instance, the U.S. financial industry alone involves a complex web of federal and state regulations, such as those from the Securities and Exchange Commission (SEC) and FINRA, which require extensive documentation and capital reserves.

In the financial services sector, especially for offerings like life insurance and retirement plans, a solid brand reputation and customer trust are absolutely critical. Newcomers face a significant hurdle in replicating the deep-seated confidence that consumers place in established entities.

Prudential, with its extensive history exceeding 150 years, has cultivated strong brand recognition and a high level of customer assurance. This established trust is a formidable barrier for any new company attempting to enter the market and gain market share.

Further underscoring its strong market standing, Prudential was recognized as the top company in the life and health insurance industry by Fortune in its 2024 World's Most Admired Companies list. This accolade highlights the significant advantage Prudential holds in terms of reputation and customer perception.

Distribution Network and Scale

Developing a robust distribution network, encompassing agents, financial advisors, and digital platforms, demands considerable upfront investment and a lengthy establishment period. For instance, building a comparable agent force to Prudential’s would involve substantial costs in recruitment, training, and ongoing support, potentially running into hundreds of millions of dollars globally.

Prudential's established global scale and deeply entrenched distribution channels present a significant hurdle for newcomers. Replicating this reach and operational efficiency would require immense capital and strategic alliances, making it difficult for new entrants to compete effectively on scale alone.

- Significant Capital Investment: New entrants face substantial costs in establishing a widespread distribution network, mirroring Prudential's global presence.

- Time and Resource Intensive: Building trust and reach through agents and advisors takes years, a luxury many new companies lack.

- Competitive Disadvantage: Without a comparable network, new firms struggle to achieve the same market penetration and cost efficiencies as established players like Prudential.

Technological Advancements and AI Integration

Technological advancements, particularly in AI, present a dual-edged sword for new entrants. While fintech startups can leverage new tech to disrupt, established firms like Prudential are also making significant investments. For instance, Prudential has been actively integrating AI to streamline operations and improve customer engagement, a trend mirrored across the financial services industry. This means new players must not only innovate but also contend with the scale and data advantages of incumbents who are also embracing these powerful tools.

The threat of new entrants is amplified by the rapid pace of technological change. Companies that can effectively harness AI and digital platforms can significantly lower operational costs and offer more personalized services, potentially undercutting traditional models. However, the substantial capital required for robust AI development and deployment, coupled with stringent regulatory hurdles in financial services, can still act as a barrier. In 2024, venture capital funding for AI in finance remained strong, but the focus increasingly shifted towards scalable, compliant solutions.

- AI-driven efficiency gains: Incumbents like Prudential are using AI to automate tasks, reducing overhead and improving service speed.

- Data analytics advantage: Established players possess vast datasets, enabling more sophisticated AI models for risk assessment and customer insights.

- High entry costs for cutting-edge tech: Developing and deploying advanced AI requires significant investment, posing a challenge for smaller startups.

- Regulatory compliance: Navigating financial regulations adds another layer of complexity and cost for any new entrant.

The threat of new entrants in the financial services sector, particularly for a company like Prudential, is significantly mitigated by high capital requirements and extensive regulatory hurdles. These factors demand substantial financial resources and specialized expertise, making it difficult for newcomers to establish themselves. For instance, in early 2024, the average capital needed to launch a new insurance company in the US could easily run into hundreds of millions of dollars to meet solvency and operational demands.

Furthermore, the need for a strong brand reputation and a well-established distribution network presents another major barrier. Prudential's long history, exceeding 150 years, has fostered deep customer trust, a valuable asset that new entrants cannot quickly replicate. As of Q1 2024, Prudential maintained a strong brand equity score, reflecting this ingrained customer loyalty.

While technological advancements, especially in AI, offer potential avenues for disruption, incumbents are also investing heavily. Prudential's ongoing commitment to AI integration for operational efficiency and customer experience means new players must compete not only on innovation but also against the scale and data advantages of established firms. The cost of developing and deploying compliant AI solutions in finance remains a significant barrier for many startups.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Meeting regulatory capital, operational expenses, and loss absorption capacity. | High; requires substantial upfront investment. |

| Regulatory Compliance | Navigating complex licensing, evolving frameworks, and documentation. | Significant; demands specialized expertise and ongoing investment. |

| Brand Reputation & Trust | Building customer confidence and loyalty over time. | Challenging; incumbents like Prudential have decades of established trust. |

| Distribution Networks | Establishing agent forces, advisor relationships, and digital platforms. | Costly and time-consuming; requires extensive recruitment and training. |

| Technological Investment | Developing and deploying advanced technologies like AI. | High; requires significant R&D and infrastructure investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Prudential Financial is built upon a foundation of comprehensive data, including publicly available financial statements, annual reports, and investor relations materials. We also leverage industry-specific research from reputable market analysis firms and economic data from global institutions.