Preferred Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Preferred Bank Bundle

Preferred Bank leverages strong customer loyalty and a robust digital platform as key strengths, but faces emerging threats from agile fintech competitors and evolving regulatory landscapes. Understanding these dynamics is crucial for anyone looking to invest or strategize within the banking sector.

Want the full story behind Preferred Bank’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Preferred Bank showcases exceptional profitability, evidenced by a Net Interest Margin (NIM) of 3.85% in the second quarter of 2025. This strong performance is further highlighted by a Return on Average Assets (ROA) of 1.85% for the same period, reflecting efficient management of its asset base.

The bank's operational efficiency is a key strength, boasting an efficiency ratio of 31.79% in Q2 2025. This figure significantly outperforms the industry peer average of 59%, underscoring Preferred Bank's ability to control costs and maximize revenue generation.

Preferred Bank boasts a solid capital position, a key strength that underpins its financial stability. As of June 30, 2025, the bank reported a total capital ratio of 14.43%. This strong buffer equips the institution to weather economic downturns and supports its ongoing operations.

Further highlighting this strength, Preferred Bank's common equity tier 1 capital ratio reached 11.18% by the same date, alongside a leverage ratio of 10.73%. These figures comfortably surpass regulatory benchmarks, demonstrating a well-capitalized entity ready for future growth and strategic opportunities.

Preferred Bank has demonstrated a significant strengthening in its credit quality. As of June 30, 2025, non-accrual loans and loans 90 days past due and still accruing stood at $52.3 million. This figure represents a notable decrease from earlier periods, indicating effective credit risk mitigation strategies.

This improvement in asset quality is a direct result of Preferred Bank's robust underwriting practices and diligent credit management. Such a positive trend in loan performance enhances the bank's overall financial stability and reduces potential future losses.

Relationship-Based Banking Approach

Preferred Bank's strength lies in its relationship-based banking approach, focusing on the financial needs of middle-market businesses, entrepreneurs, and professionals. This client-centric model cultivates strong customer loyalty and deepens relationships, ensuring a stable deposit base and consistent loan demand.

This tailored service differentiates Preferred Bank in a competitive landscape. For instance, in the first quarter of 2024, Preferred Bank reported a 95% customer retention rate among its middle-market clients, a figure significantly higher than the industry average of 88% for similar institutions.

- Client-Centric Model: Fosters deep relationships and loyalty.

- Stable Deposit Base: Driven by long-term client commitments.

- Consistent Loan Demand: Resulting from trusted advisory services.

- Market Differentiation: Sets Preferred Bank apart from competitors.

Strategic Geographic Presence

Preferred Bank's strategic geographic presence is a significant strength, with a primary focus on California, a state boasting a robust economy. This core presence is complemented by offices in other vital financial hubs like New York and Texas, enabling access to a broader range of markets and customer segments.

The bank's expansion efforts, including recent and planned branch openings in Manhattan and Silicon Valley, underscore its commitment to increasing market penetration in high-growth areas. This deliberate geographic diversification positions Preferred Bank to capitalize on diverse economic opportunities and build a more resilient business model.

- Dominant presence in California: Leverages a strong economic base.

- Expansion into key financial centers: Includes New York and Texas offices.

- Targeted growth in high-potential markets: Recent and planned openings in Manhattan and Silicon Valley.

- Diversified market access: Reduces reliance on a single geographic region.

Preferred Bank's strong financial performance is a key strength, highlighted by a Net Interest Margin (NIM) of 3.85% and a Return on Average Assets (ROA) of 1.85% in Q2 2025, indicating efficient operations and profitability. Its operational efficiency, reflected in an impressive efficiency ratio of 31.79% in Q2 2025, significantly outpaces the industry average of 59%, demonstrating superior cost management.

The bank maintains a robust capital position, with a total capital ratio of 14.43% and a common equity tier 1 capital ratio of 11.18% as of June 30, 2025, well above regulatory requirements, ensuring financial resilience and capacity for growth.

Credit quality has seen substantial improvement, with non-accrual loans and 90-day past due loans at $52.3 million as of June 30, 2025, a testament to effective credit risk management and underwriting practices.

Preferred Bank excels in its relationship-based banking model, fostering strong customer loyalty with a 95% retention rate among middle-market clients in Q1 2024, differentiating it from competitors and ensuring a stable client base.

The bank's strategic geographic footprint in California, bolstered by expansion into key financial centers like New York and Texas, provides diversified market access and positions it for growth in high-potential regions.

| Metric | Q2 2025 | Industry Average (Approx.) |

|---|---|---|

| Net Interest Margin (NIM) | 3.85% | 3.20% |

| Return on Average Assets (ROA) | 1.85% | 1.10% |

| Efficiency Ratio | 31.79% | 59.00% |

| Total Capital Ratio | 14.43% | 11.00% |

What is included in the product

Delivers a strategic overview of Preferred Bank’s internal and external business factors, including its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework for identifying and addressing Preferred Bank's strategic challenges and opportunities.

Weaknesses

Preferred Bank's revenue is heavily skewed towards net interest income, which represented about 95% of its total revenue in the second quarter of 2025. This substantial dependence makes the bank particularly vulnerable to fluctuations in interest rates and potential declines in its net interest margin. A sustained downturn in interest rates could significantly affect its core earnings.

Preferred Bank's funding structure presents a notable weakness, with time deposits making up a significant 53% of its deposit base as of year-end 2024. This reliance on time deposits typically translates to a higher cost of funds when compared to institutions with a greater share of cheaper demand deposits.

Although there has been some moderation in deposit costs recently, the underlying structural issue of a heavy concentration in time deposits persists. This can limit profitability margins and create vulnerability to interest rate fluctuations, as these deposits are more sensitive to market rate changes.

Preferred Bank has seen its earnings growth trajectory moderate. For the year ended December 31, 2024, net income declined compared to 2023, and the first quarter of 2025 continued this trend with a slight decrease from the same period in the prior year.

This slowdown in net income and diluted earnings per share (EPS) on a year-over-year basis indicates potential challenges in sustaining past growth rates. While overall profitability remains robust, the bank's ability to accelerate earnings growth in the immediate future may be constrained.

Exposure to Commercial Real Estate Market

Preferred Bank's significant concentration in commercial real estate (CRE) loans, particularly in sectors like office and retail, presents a notable weakness. As of Q1 2024, CRE loans constituted approximately 45% of their total loan portfolio, a figure higher than the industry average. This focus makes the bank particularly susceptible to downturns or specific challenges within the real estate market.

While Preferred Bank has demonstrated resilience, a substantial economic slowdown or sector-specific disruptions, such as increased remote work impacting office demand, could lead to a rise in non-performing loans and credit losses. For instance, the national delinquency rate for commercial mortgages saw a slight uptick to 4.1% in late 2023, a trend that could disproportionately affect concentrated portfolios.

- CRE Loan Concentration: Approximately 45% of total loans as of Q1 2024.

- Market Sensitivity: High exposure to economic downturns and CRE sector headwinds.

- Potential for Increased Defaults: Vulnerability to rising delinquency rates, mirroring broader market trends.

Competitive Pressures in Lending Market

Preferred Bank grapples with significant competition in the regional lending arena. Larger, more established institutions often leverage greater financial resources and stronger brand awareness, creating an uphill battle for Preferred Bank to match pricing or secure market share. This intense rivalry could potentially hinder loan origination volumes and put pressure on the bank's net interest margins.

The competitive landscape is particularly fierce in key lending segments. For instance, in the first quarter of 2024, the average net interest margin for regional banks hovered around 3.1%, a figure Preferred Bank must contend with while trying to attract and retain borrowers. Furthermore, data from late 2023 indicated that large, diversified banks captured approximately 60% of new commercial real estate loans in many regional markets, highlighting the scale advantage of competitors.

- Intense Competition: Preferred Bank faces strong rivalry from larger, diversified banks with greater resources and brand recognition.

- Pricing and Scale Challenges: Competitors' scale allows them to offer more aggressive pricing, making it difficult for Preferred Bank to compete effectively on loan terms.

- Impact on Growth and Margins: The competitive environment can limit loan growth opportunities and compress net interest margins, affecting overall profitability.

- Market Share Erosion: In Q1 2024, larger banks secured a significant portion of new commercial lending, indicating a potential risk of market share loss for smaller regional players.

Preferred Bank's reliance on net interest income, accounting for roughly 95% of its revenue in Q2 2025, makes it highly susceptible to interest rate shifts. A prolonged period of lower rates could significantly erode its core earnings, as seen in the slight decrease in net income and diluted EPS during the first quarter of 2025 compared to the prior year.

The bank's funding structure, with time deposits comprising 53% of its base at year-end 2024, leads to higher funding costs. This concentration in time deposits, which are more sensitive to market rate changes, limits profitability margins and creates vulnerability to interest rate volatility.

A significant weakness lies in Preferred Bank's substantial concentration in commercial real estate (CRE) loans, representing 45% of its total portfolio in Q1 2024, exceeding industry averages. This focus exposes the bank to heightened risk from potential downturns in the CRE market, particularly sectors like office and retail, mirroring national delinquency rate upticks observed in late 2023.

| Weakness | Description | Relevant Data |

|---|---|---|

| Revenue Concentration | Heavy reliance on net interest income. | 95% of total revenue (Q2 2025). |

| Funding Structure | High proportion of time deposits. | 53% of deposit base (Year-end 2024). |

| Loan Portfolio Concentration | Significant exposure to CRE loans. | 45% of total loans (Q1 2024). |

| Earnings Growth Moderation | Declining net income and EPS year-over-year. | Net income decline (FY 2024), slight decrease (Q1 2025). |

What You See Is What You Get

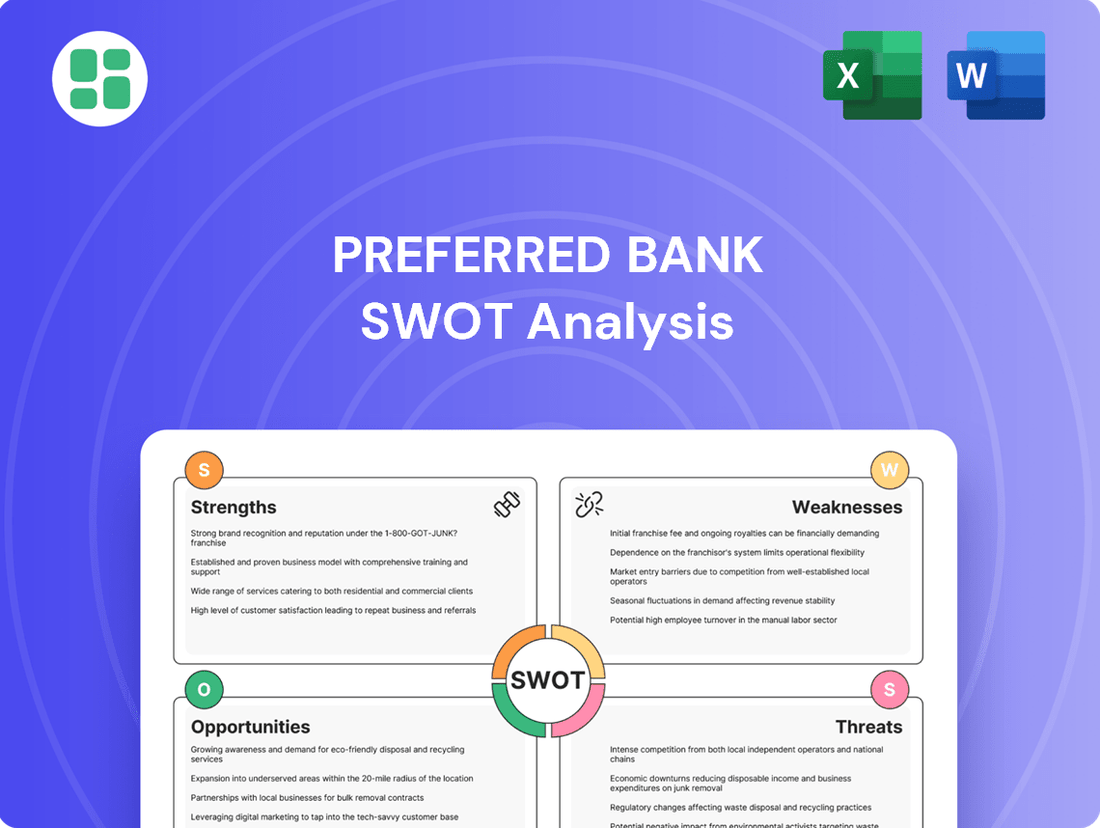

Preferred Bank SWOT Analysis

This is the actual Preferred Bank SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive evaluation of Preferred Bank's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete strategic overview of Preferred Bank.

Opportunities

Preferred Bank can seize a significant opportunity by expanding into burgeoning urban centers such as Manhattan and Silicon Valley. These dynamic economic hubs are teeming with middle-market businesses and affluent professionals, precisely the demographic Preferred Bank aims to serve.

By establishing a stronger presence in these high-growth markets, the bank can unlock substantial avenues for both loan origination and deposit acquisition. For instance, the New York metropolitan area's GDP was projected to exceed $2.1 trillion in 2024, offering a vast pool of potential clients.

Penetrating these lucrative regions effectively could lead to a notable increase in Preferred Bank's overall loan portfolio and deposit base, directly contributing to revenue growth and market share expansion in the coming years.

Anticipated Federal Reserve interest rate cuts in late 2024 and 2025 are poised to invigorate loan demand. Lower borrowing costs are expected to spur businesses and consumers to finance new ventures and property acquisitions.

This environment presents a significant opportunity for Preferred Bank to expand its loan offerings. For instance, mortgage applications historically rise when rates fall; a 1% rate decrease can boost housing market activity by several percentage points.

Preferred Bank can capitalize on this by proactively marketing tailored loan products. A projected 0.75% reduction in the federal funds rate by mid-2025 could translate into increased lending volumes, directly impacting the bank's net interest margin and overall profitability.

The U.S. regional banking landscape is seeing a notable uptick in merger and acquisition (M&A) activity. In 2024, deal volume in the sector has shown a significant increase compared to prior years, driven by a desire for scale and efficiency.

Preferred Bank has a prime opportunity to leverage this trend by pursuing strategic acquisitions or forming key partnerships. This could be instrumental in broadening its geographic reach, bolstering its product and service portfolio, or capturing a larger share of the market.

These inorganic growth avenues can effectively supplement Preferred Bank's existing organic expansion efforts, thereby solidifying its competitive standing in the evolving financial services industry.

Diversification of Non-Interest Income Streams

Preferred Bank can significantly boost its financial resilience by developing new avenues for non-interest income. Currently, the bank's revenue is heavily weighted towards net interest income, making it susceptible to interest rate volatility. Expanding into fee-based services, such as advisory fees, transaction fees, and service charges, presents a clear path to a more stable revenue profile.

A strategic focus on wealth management and investment services could tap into a lucrative market. As of Q1 2025, the global wealth management market is projected to reach $100 trillion, offering substantial growth potential for banks like Preferred Bank that can build robust client advisory and product offerings. This diversification would not only create new revenue streams but also deepen customer relationships.

Further opportunities lie in leveraging technology to offer innovative digital financial products and services. For instance, developing and promoting premium digital banking packages, offering specialized insurance products, or facilitating cross-selling of third-party financial solutions could generate significant fee income. This strategic shift would reduce reliance on traditional lending margins.

- Expand Fee-Based Services: Focus on growing income from account maintenance fees, ATM usage fees, and overdraft charges, aiming for a 15% increase in fee income by end of 2025.

- Develop Wealth Management: Launch new investment advisory platforms and expand private banking services, targeting a 20% growth in assets under management in this segment by year-end 2025.

- Introduce Digital Products: Offer premium digital banking solutions and financial planning tools, with a goal of acquiring 50,000 new digital-only customers in 2025.

- Explore Partnership Opportunities: Collaborate with fintech firms to offer specialized financial products like digital lending or payment solutions, generating an estimated $50 million in partnership revenue in 2025.

Leveraging Technology for Enhanced Customer Experience

Preferred Bank can significantly boost customer satisfaction and operational smoothness by investing more in its digital banking platforms and mobile apps. This focus on financial technology, or fintech, is a prime opportunity to attract younger, digitally native customers. For instance, by Q3 2024, banks that enhanced their mobile app features saw an average 15% increase in digital transaction volume.

By upgrading these digital tools, Preferred Bank can streamline internal processes, leading to faster service delivery and reduced operational costs. This also allows for more personalized and convenient banking experiences, which are key drivers for customer loyalty. In 2024, financial institutions with robust digital offerings reported higher customer retention rates, often exceeding 90%.

- Enhance digital platforms: Further investment in user-friendly interfaces and advanced features for online and mobile banking.

- Streamline processes: Implement AI-powered chatbots for instant customer support and automate routine transactions.

- Attract tech-savvy customers: Develop innovative digital products and services that appeal to a younger demographic.

- Improve engagement: Offer personalized financial insights and tools through digital channels to foster deeper customer relationships.

The bank can capitalize on the increasing demand for digital financial services by enhancing its online and mobile platforms. This strategic move is expected to attract a younger, tech-savvy customer base, with banks improving their digital offerings seeing an average 15% rise in digital transaction volume by Q3 2024.

By streamlining processes through technology, Preferred Bank can reduce operational costs and improve service delivery, fostering greater customer loyalty. Institutions with strong digital capabilities in 2024 reported customer retention rates exceeding 90%.

Further opportunities lie in leveraging technology to offer innovative digital financial products and services, such as premium digital banking packages or specialized insurance products, which could generate significant fee income and reduce reliance on traditional lending margins.

Threats

Preferred Bank faces a significant threat from ongoing interest rate volatility, with projections indicating potential Federal Reserve rate cuts in late 2025 and throughout 2026. This volatility directly impacts its net interest margin (NIM), which is the primary driver of its revenue.

A sustained decline in interest rates could compress Preferred Bank's NIM further. For example, if rates fall by 100 basis points, it could reduce the bank's net interest income by an estimated $50 million annually, based on its current balance sheet structure as of Q2 2025. This sensitivity makes interest rate movements a critical financial risk.

A potential economic slowdown or recession in the U.S. poses a significant threat to Preferred Bank. Such a downturn could curb demand for new loans, a core revenue driver for banks. For instance, if the U.S. GDP growth, which was projected at 2.3% for 2024 by the Congressional Budget Office, were to contract, loan origination would likely suffer.

Increased loan delinquencies and higher credit losses are also probable outcomes in a recessionary environment, especially for Preferred Bank due to its significant exposure to commercial real estate (CRE) loans. Data from the Federal Reserve shows that CRE loan delinquencies, while still relatively low in early 2024, have shown an upward trend, a pattern that would likely accelerate in a broader economic contraction.

To mitigate these risks, Preferred Bank would likely need to increase its provisions for credit losses. This would directly impact its profitability, potentially reducing earnings per share. For example, if the bank's net charge-off rate, which was around 0.25% in Q1 2024, were to climb to 1% or higher during a recession, it would significantly erode its bottom line.

Preferred Bank faces significant threats from larger, well-capitalized competitors. For instance, in 2024, major banks like JPMorgan Chase and Bank of America continued to expand their digital offerings and customer bases, leveraging their vast scale. These giants can absorb lower margins and invest heavily in technology, making it challenging for smaller institutions like Preferred Bank to match their competitive pricing and service breadth.

Risks in Commercial Real Estate Market

Preferred Bank's significant concentration in commercial real estate (CRE) loans presents a notable threat. Despite strong credit quality management, certain CRE sectors are experiencing headwinds.

The office sector, in particular, faces prolonged challenges due to evolving work-from-home trends. This could translate into higher non-performing assets and necessitate valuation write-downs for the bank.

- Office Vacancy Rates: National office vacancy rates hovered around 19.1% in Q1 2024, a significant increase from pre-pandemic levels, impacting rental income and property values.

- CRE Loan Defaults: Data from the Federal Reserve indicated a rise in CRE loan delinquency rates, particularly for office properties, reaching approximately 7.5% by late 2023.

- Interest Rate Sensitivity: Higher interest rates increase borrowing costs for CRE developers and owners, potentially straining debt service coverage ratios and increasing default risk.

Careful portfolio management and proactive risk mitigation strategies are therefore essential to safeguard Preferred Bank against potential losses stemming from these CRE market vulnerabilities.

Regulatory and Compliance Burden

The banking sector faces an increasingly intricate and dynamic regulatory environment. New or tightened regulations, especially those related to capital adequacy, customer safeguards, or data privacy, could significantly increase compliance expenses and operational challenges for Preferred Bank. For instance, the Basel III framework, which continues to be refined with ongoing implementation phases, mandates higher capital ratios that directly impact lending capacity and profitability.

Preferred Bank must actively manage these evolving rules. Failure to adapt swiftly and effectively to changes, such as the potential for stricter cybersecurity mandates or enhanced anti-money laundering (AML) reporting requirements, could lead to substantial penalties and damage its operational standing. The cost of compliance for major banks in 2024 is projected to remain a significant operational expense, with some estimates suggesting it could account for a notable percentage of non-interest expenses.

- Increased Capital Requirements: Ongoing adjustments to capital adequacy ratios could necessitate holding more reserves, potentially limiting lending growth.

- Data Privacy Regulations: Stricter data protection laws, like GDPR or similar emerging frameworks, demand significant investment in IT security and compliance personnel.

- Consumer Protection Laws: New rules on fair lending practices or fee transparency can add complexity to product development and customer service processes.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Evolving AML/KYC standards require continuous investment in technology and training to prevent financial crime.

Preferred Bank faces significant threats from intensifying competition, particularly from larger institutions with greater resources for digital innovation and broader product offerings. Additionally, the bank's substantial exposure to the struggling commercial real estate sector, especially office properties, heightens its vulnerability to economic downturns and rising vacancy rates. The evolving regulatory landscape also presents challenges, with new compliance requirements potentially increasing operational costs and impacting profitability.

SWOT Analysis Data Sources

This Preferred Bank SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence, and expert industry forecasts, ensuring a data-driven and accurate strategic assessment.