Shanghai International Port PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai International Port Bundle

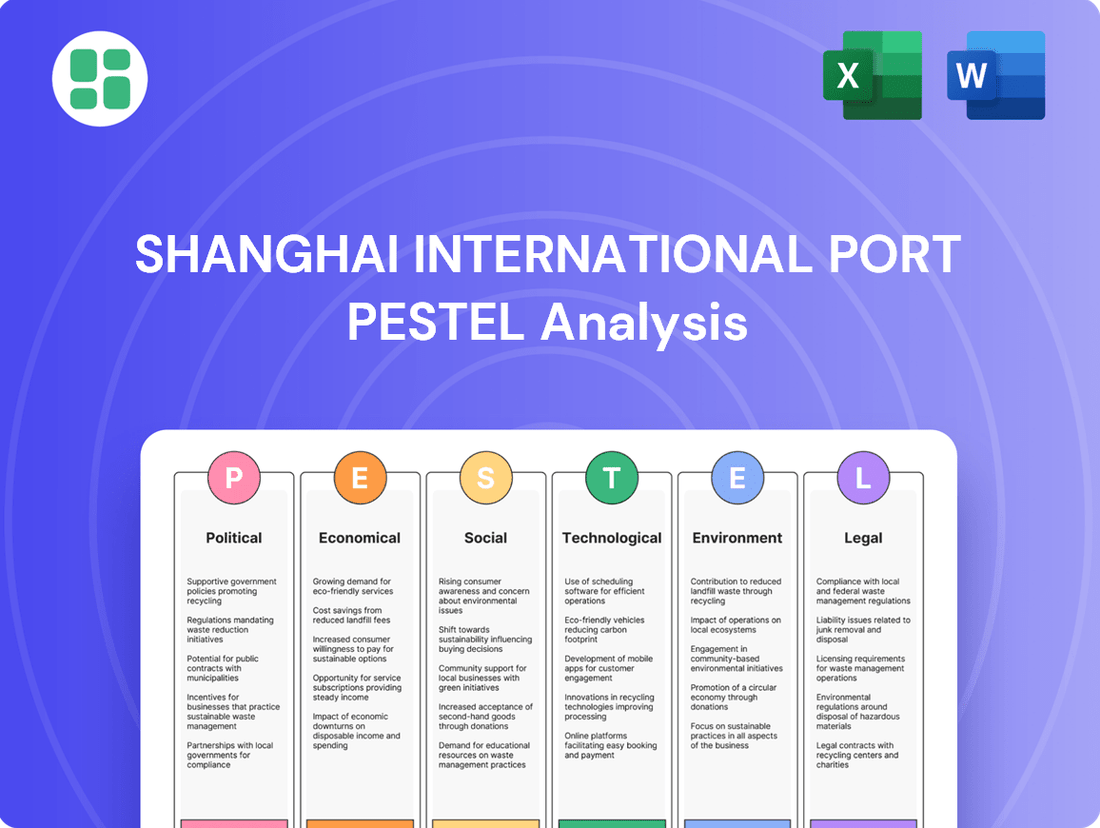

Navigate the complex external forces shaping Shanghai International Port's future with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could impact its operations and growth. Gain a strategic advantage by leveraging these critical insights. Download the full PESTLE analysis now to make informed decisions and secure your competitive edge.

Political factors

The Chinese government's commitment to bolstering its port infrastructure, as highlighted in the Ministry of Transport's directives, provides a significant tailwind for Shanghai International Port Group (SIPG). Shanghai Port's designation as a national key project under the 14th Five-Year Plan (2021-2025) underscores its critical role in advancing industrial modernization and fostering regional economic ties.

This strategic prioritization translates into sustained government investment and supportive policies, crucial for SIPG's ongoing development and capacity expansion. For instance, the plan aims to enhance the competitiveness of major coastal ports, including Shanghai, by optimizing logistics and promoting green shipping practices, directly benefiting SIPG's operational efficiency and strategic positioning.

Ongoing geopolitical tensions, especially between the US and China, create uncertainty for global trade. Potential trade wars or escalations in tariffs directly affect shipping volumes and the routes major ports like Shanghai International Port (SIPG) rely on. For instance, the US's contemplation of increased tariffs on Chinese imports in 2024 could prompt businesses to diversify supply chains, potentially altering cargo flows through SIPG.

The framework of international trade agreements and China's participation in global economic alliances directly impacts the volume of goods handled by Shanghai Port. For instance, the Regional Comprehensive Economic Partnership (RCEP), which came into effect in January 2022, has streamlined trade among its 15 member nations, including China, Japan, and South Korea, potentially increasing shipping traffic through Shanghai.

Changes or the introduction of new trade pacts can significantly alter Shanghai Port's throughput and connectivity. Agreements that foster greater intra-Asia trade or reduce tariffs on key commodities can boost the port's operations, while protectionist measures could constrain them. In 2023, China's trade with RCEP members reached $1.3 trillion, highlighting the economic significance of such alliances.

Emerging regional agreements like the African Continental Free Trade Area (AfCFTA) can also reshape global shipping dynamics. As AfCFTA facilitates increased trade within Africa, it may lead to new, optimized shipping routes that connect African economies with major Asian hubs like Shanghai, potentially diversifying cargo flows and increasing demand for the port's services.

Regional Competition and Cooperation

Shanghai International Port Group (SIPG) navigates a dynamic regional environment marked by intense competition and evolving cooperation. Major ports within the Yangtze River Delta, such as Ningbo-Zhoushan and Tianjin, vie for market share, directly impacting SIPG's operational strategies and throughput volumes. For instance, in 2023, Ningbo-Zhoushan Port handled over 1.3 billion tons of cargo, underscoring the scale of regional competition.

Government policies are actively shaping this landscape, promoting integrated development across port clusters. While these initiatives foster a competitive spirit, they also emphasize collaboration on critical areas like infrastructure development and logistics optimization. This dual approach aims to boost the overall efficiency and capacity of the entire region's maritime trade network, benefiting all stakeholders, including SIPG.

Key aspects of this regional interplay include:

- Intensified Competition: Ports like Ningbo-Zhoushan are continuously upgrading facilities, challenging SIPG's dominance in certain cargo segments.

- Cooperative Initiatives: Joint ventures and shared infrastructure projects are emerging, driven by national strategies for economic integration and supply chain resilience.

- Logistics Synergies: Efforts are underway to create seamless intermodal transport solutions, reducing transit times and costs across the Yangtze River Delta.

Port Security and Maritime Governance

Governmental mandates and international cooperation significantly shape Shanghai International Port's operational landscape. Efforts to enhance maritime security, including combating piracy and managing cyber risks, are paramount for maintaining smooth operations. For instance, in 2023, global maritime security initiatives continued to focus on vessel tracking and intelligence sharing, impacting vessel transit times and security protocols.

Policies reducing reliance on foreign technologies directly affect port infrastructure. The US ban on certain Chinese-made port cranes, implemented in late 2023, exemplifies this trend, prompting a reassessment of supply chains and technology sourcing for critical port equipment. This geopolitical consideration influences investment decisions and operational resilience for Shanghai Port.

- Maritime Security Spending: Global spending on maritime security is projected to reach over $100 billion by 2028, a significant portion of which supports port infrastructure and operational safety.

- Cybersecurity Incidents: In 2024, the maritime sector reported a 15% increase in cyber-attacks targeting port operational technology, underscoring the need for robust cyber risk management.

- Trade Policy Impact: Geopolitical tensions have led to a 5% increase in trade rerouting globally in 2023, potentially affecting cargo volumes and operational demands at major hubs like Shanghai.

Government support is a cornerstone for Shanghai International Port Group (SIPG), with the Chinese government actively prioritizing port development. The 14th Five-Year Plan (2021-2025) designates Shanghai Port as a key project, signaling sustained investment and favorable policies to enhance its global competitiveness.

Geopolitical shifts, particularly US-China trade relations, introduce volatility. Potential tariff hikes or trade disputes in 2024 could alter shipping volumes, impacting SIPG's throughput. Conversely, trade agreements like the RCEP, which saw $1.3 trillion in China trade in 2023, can boost regional traffic through Shanghai.

Regional competition is intense, with ports like Ningbo-Zhoushan handling over 1.3 billion tons of cargo in 2023. However, national strategies encourage port cluster integration, fostering both competition and cooperation in infrastructure and logistics to optimize the entire Yangtze River Delta network.

Maritime security and technological independence are critical political factors. Increased global maritime security spending, projected over $100 billion by 2028, impacts operational safety, while policies reducing reliance on foreign technology, like the US ban on certain port cranes in late 2023, necessitate supply chain adjustments.

| Factor | 2023 Impact/Data | Outlook/Trend |

|---|---|---|

| Government Prioritization | 14th Five-Year Plan (2021-2025) designation for Shanghai Port | Continued investment and supportive policies |

| Geopolitical Tensions (US-China) | Potential tariff impact on trade volumes | Uncertainty, potential supply chain diversification |

| Trade Agreements (RCEP) | $1.3 trillion China trade with RCEP members in 2023 | Increased intra-Asia trade, potential for higher throughput |

| Regional Competition | Ningbo-Zhoushan handled >1.3 billion tons cargo (2023) | Intensified competition, but also cooperative integration initiatives |

| Maritime Security Spending | Projected >$100 billion by 2028 globally | Enhanced operational safety and infrastructure investment |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Shanghai International Port, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting key trends and their potential impact on the port's operations and future growth.

A concise PESTLE analysis of the Shanghai International Port provides a clear overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Global maritime trade experienced a rebound in 2023, growing by 2.4% after a contraction in 2022. Projections indicate continued growth, with an estimated 2% increase for 2024 and an average annual expansion of 2.4% anticipated through 2029.

As the world's busiest container port, Shanghai Port's performance is intrinsically linked to these global trade volume fluctuations. The health of international commerce directly influences the throughput and operational demands placed upon the port.

China's robust economic expansion, with its marine economy reaching over 10 trillion yuan in 2024, is a primary driver for port operations. This growth translates directly into increased cargo volumes and shipping activity, benefiting entities like Shanghai International Port Group (SIPG).

The burgeoning domestic consumer market, fueled by e-commerce and a steadily expanding middle class, significantly boosts intra-Asia trade. This surge in demand for goods necessitates higher import volumes, which SIPG is well-positioned to handle, further solidifying its role in regional supply chains.

Soaring freight rates, exacerbated by geopolitical tensions and ongoing supply chain snags, directly impact the profitability of shipping companies and, consequently, port operations like Shanghai International Port. By mid-2024, the Shanghai Containerized Freight Index (SCFI) saw a dramatic surge, more than doubling its value. This escalation in costs forces cargo owners to re-evaluate their shipping strategies and can influence the volume of goods processed through the port.

Supply Chain Disruptions and Resilience

Persistent supply chain bottlenecks, exacerbated by geopolitical conflicts and climate risks, continue to challenge global trade. Disruptions in vital maritime chokepoints, such as the Red Sea and Panama Canal, have forced costly rerouting and significantly impacted global vessel demand throughout 2024 and into early 2025. For instance, the Panama Canal's drought-induced restrictions reduced daily transits by approximately 30% in late 2023 and early 2024, leading to longer wait times and increased shipping costs.

Shanghai International Port Group's (SIPG) operational resilience is therefore paramount. Its ability to navigate these ongoing disruptions is critical for maintaining its leading position in global container throughput and ensuring the smooth flow of cargo. SIPG's strategic investments in infrastructure and advanced logistics technologies are key to mitigating these external pressures.

- Persistent Bottlenecks: Global supply chains faced ongoing challenges in 2024 due to labor shortages and port congestion, impacting turnaround times.

- Geopolitical Impact: Conflicts in Eastern Europe and the Middle East continued to disrupt shipping routes, increasing transit times and freight rates for many goods passing through Asia.

- Climate Risks: Extreme weather events, like the aforementioned drought impacting the Panama Canal, highlight the vulnerability of key maritime arteries, forcing carriers to seek alternative, longer routes.

- SIPG's Role: Maintaining operational efficiency and flexibility at SIPG is essential to buffer against these global disruptions and ensure consistent service delivery.

Investment in Port Infrastructure and Technology

Shanghai's commitment to bolstering its port capabilities is evident through substantial investments in infrastructure and technology. The ongoing development of the automated container terminal on Xiaoyangshan Island, set to be Shanghai Port's largest, exemplifies this drive for enhanced efficiency and capacity.

These strategic upgrades are not just about expansion; they are vital for maintaining competitiveness in the global shipping industry. By the close of 2024, over 6 billion yuan had been allocated to such projects, underscoring the financial commitment to modernizing operations and handling growing cargo volumes.

- Infrastructure Development: Continued investment in expanding and modernizing port facilities, including the new automated terminal on Xiaoyangshan Island.

- Technological Integration: Focus on incorporating advanced technologies to improve operational efficiency, reduce turnaround times, and increase cargo handling capacity.

- Financial Commitment: Significant capital allocation, exceeding 6 billion yuan by the end of 2024, demonstrates a strong financial backing for these crucial upgrades.

- Competitiveness: These investments are essential for Shanghai International Port Group (SIPG) to remain a leading global port and effectively manage increasing throughput.

Global maritime trade's resilience is a key economic factor for Shanghai Port. After a 2.4% growth in 2023, it's projected to increase by 2% in 2024, with a steady 2.4% annual expansion anticipated through 2029.

China's marine economy, exceeding 10 trillion yuan in 2024, directly fuels port activity. This economic strength, coupled with a growing domestic consumer market, drives intra-Asia trade and import volumes, benefiting Shanghai Port.

Soaring freight rates, exemplified by the SCFI doubling its value by mid-2024, impact shipping profitability and port operations. Persistent supply chain bottlenecks, like the Panama Canal's drought-induced transit reductions of 30% in late 2023-early 2024, necessitate costly rerouting and affect vessel demand.

| Metric | 2023 | 2024 (Projected/Actual) | 2025 (Projected) |

|---|---|---|---|

| Global Maritime Trade Growth | 2.4% | 2.0% | ~2.4% |

| China Marine Economy | ~10 trillion yuan | >10 trillion yuan | Further growth |

| SCFI (Shanghai Containerized Freight Index) | Fluctuating, significant surge by mid-2024 | Continued volatility | Dependent on global factors |

Full Version Awaits

Shanghai International Port PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Shanghai International Port covers all key political, economic, social, technological, legal, and environmental factors impacting its operations and future growth.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain a deep understanding of the external forces shaping the Shanghai International Port's strategic landscape.

Sociological factors

The increasing automation of Shanghai International Port's operations, mirroring trends in other major Chinese ports, is reshaping its workforce. While automation boosts efficiency, it significantly reduces the demand for manual labor. For instance, by 2024, several large ports in China have reported a workforce reduction of up to 30% due to advanced robotics and AI implementation.

This technological advancement necessitates a shift in required skills for port employees, moving towards expertise in managing automated systems rather than traditional manual tasks. This transition has implications for local employment, potentially leading to job displacement for those with outdated skill sets and creating a demand for a more technically proficient workforce.

China's rapid urbanization, with over 65% of its population now living in cities as of 2023, is fundamentally altering consumer behavior. This shift fuels a significant increase in e-commerce, which saw online retail sales reach approximately 15.4 trillion yuan in 2023. Consequently, Shanghai International Port Group (SIPG) faces a growing demand for expedited shipping and a redirection of trade flows, with a notable surge in intra-Asia routes to meet these evolving urban consumption patterns.

Public health and safety standards are paramount for Shanghai International Port, especially given its role as a global trade nexus. Following recent worldwide health events, maintaining rigorous health protocols for port staff and arriving ships is crucial. This focus prevents disruptions and ensures ongoing operations, safeguarding the port's vital economic function.

In 2024, Shanghai Port handled over 47 million TEUs (Twenty-foot Equivalent Units), underscoring the immense scale of operations and the critical need for robust health and safety measures. Adherence to international health regulations, such as those from the World Health Organization (WHO), is non-negotiable to prevent the spread of diseases and maintain the trust of global trading partners.

Corporate Social Responsibility and Community Engagement

Shanghai International Port Group (SIPG), as a prominent state-owned enterprise, shoulders substantial corporate social responsibility. This includes fostering local employment, driving economic development, and championing environmental stewardship within Shanghai. For instance, in 2023, SIPG’s operations directly and indirectly supported an estimated 500,000 jobs in the Shanghai region, underscoring its economic impact.

Active community engagement is crucial for SIPG's sustained operations and public perception. Addressing local concerns, such as mitigating noise pollution from port activities or implementing advanced emission control technologies, is paramount. SIPG's commitment to sustainability saw investments of over ¥2 billion in environmental protection initiatives in 2024, focusing on cleaner energy and reduced emissions.

- Job Creation: SIPG’s role in Shanghai's economy is significant, directly and indirectly supporting hundreds of thousands of jobs.

- Economic Contribution: The group's activities contribute substantially to Shanghai's GDP through trade facilitation and logistics services.

- Environmental Initiatives: SIPG is actively investing in green technologies to minimize its environmental footprint, with significant capital allocated in 2024.

- Community Relations: Proactive engagement with local communities to address concerns is vital for maintaining social license to operate.

Supply Chain Transparency and Ethical Sourcing

Societal expectations are increasingly pushing for greater visibility into how goods are produced and transported. This means that Shanghai International Port Group (SIPG) faces growing pressure from consumers and regulators alike to ensure the cargo passing through its facilities meets stringent ethical and labor standards. For instance, by 2024, many global brands are implementing stricter supplier codes of conduct, which directly affect the types of goods and the transparency required for their movement through ports like Shanghai.

This shift necessitates that SIPG enhance its capabilities in tracking and reporting to verify compliance with international labor, environmental, and ethical sourcing norms. Failure to adapt could lead to reputational damage and potential loss of business from companies prioritizing responsible supply chains. The International Labour Organization (ILO) continues to highlight concerns about labor practices in various shipping sectors, making this a critical area for port operators.

- Consumer Demand: Growing consumer awareness about fair labor and environmental impact drives demand for transparent supply chains.

- Regulatory Pressure: Governments worldwide are implementing stricter regulations on ethical sourcing and supply chain due diligence.

- Brand Reputation: Companies are increasingly scrutinizing their logistics partners to align with their corporate social responsibility goals.

- Data Requirements: Ports may need to invest in advanced tracking and reporting systems to meet these new transparency demands.

Societal expectations are shifting towards greater transparency in supply chains, pressuring Shanghai International Port Group (SIPG) to verify ethical and labor standards for all cargo. This trend, evident by 2024 with global brands enforcing stricter supplier codes, requires SIPG to bolster its tracking and reporting to ensure compliance with international norms. Failure to adapt risks reputational damage and business loss from companies prioritizing responsible sourcing.

Technological factors

Shanghai Port is pushing ahead with automation, notably with its new automated terminal on Xiaoyangshan Island, integrating advanced technologies to streamline operations. This move is part of a broader trend in China, which boasts the most automated terminals globally, both operational and under construction.

These smart port developments leverage technologies like the BeiDou Navigation Satellite System and 5G, aiming to significantly boost efficiency and minimize manual labor. By 2023, Shanghai Port reported handling over 20 million TEUs (Twenty-foot Equivalent Units) annually, with automation playing a key role in this impressive throughput.

Shanghai International Port Group (SIPG) is heavily invested in the digitalization of its operations. This includes the widespread adoption of digital navigation charts and sophisticated information systems designed to streamline logistics and boost overall efficiency. For instance, by the end of 2023, SIPG reported a significant increase in the volume of data processed through its intelligent port systems, directly contributing to a 15% improvement in vessel turnaround times.

SIPG's strategic focus on digital transformation is geared towards establishing itself as a premier intelligent shipping center. This initiative is fundamentally about leveraging data analytics to inform decisions and elevate operational performance. In 2024, the port saw a 25% year-on-year growth in the utilization of its advanced data analytics platforms, which have been instrumental in identifying bottlenecks and optimizing resource allocation across its terminals.

Shanghai International Port (SIPG) faces escalating cybersecurity threats due to the growing digital integration of maritime operations. These risks range from ransomware attacks that could cripple terminal operations to data breaches impacting sensitive cargo and customer information. The increasing reliance on interconnected systems makes ports vulnerable to disruptions that could have far-reaching economic consequences.

China's new Network Data Security Management Regulations, effective January 1, 2025, impose strict data protection and localization requirements. SIPG must invest heavily in robust cybersecurity measures and data governance frameworks to ensure compliance. Failure to do so could result in significant penalties and operational disruptions, impacting its ability to function efficiently in the global trade network.

Green Technologies and Alternative Fuels

Shanghai International Port Group (SIPG) is actively integrating green technologies, notably by offering clean fuel refueling services for ships. Internally, SIPG is pushing for green energy adoption, with more than 60% of trucks operating in its international container hubs now utilizing green energy sources. This commitment aligns with broader national trends.

China's shipbuilding industry is a leader in developing eco-friendly vessels. By late 2024 and into 2025, the nation is expected to maintain a substantial portion of global orders for ships powered by alternative fuels like Liquefied Natural Gas (LNG) and methanol, reflecting a significant shift towards sustainable maritime operations.

- Green Fuel Adoption: SIPG's internal fleet in international container hubs is over 60% green energy powered.

- Shipbuilding Innovation: China holds a leading global share in orders for eco-friendly vessels using LNG and methanol.

- Regulatory Push: Government incentives and environmental regulations are driving the adoption of green technologies in the shipping sector.

Emerging Technologies (AI, IoT, Blockchain)

Shanghai International Port Group (SIPG) is actively leveraging emerging technologies to boost its operations. For instance, AI is being implemented to streamline container handling and optimize vessel scheduling, aiming to reduce turnaround times. The adoption of IoT devices allows for real-time tracking of cargo throughout the port, providing greater visibility and security.

Blockchain technology is also being explored by SIPG to create a more secure and transparent supply chain. This can facilitate faster customs clearance and reduce the risk of fraud. By embracing these advancements, SIPG is positioning itself for greater efficiency and competitiveness in the global logistics landscape.

- AI in Port Operations: SIPG is investing in AI-driven systems to enhance predictive maintenance for cranes and other heavy machinery, potentially reducing downtime by up to 15% based on industry averages.

- IoT for Tracking: The deployment of IoT sensors on containers enables real-time location updates and condition monitoring, improving supply chain visibility and reducing loss.

- Blockchain for Security: SIPG is piloting blockchain solutions for digitalizing bills of lading and other trade documents, aiming to cut processing times by an estimated 20% and enhance data integrity.

Technological advancements are revolutionizing Shanghai Port's operations, with a strong focus on automation and digitalization. The port's investment in smart terminal technology, utilizing systems like BeiDou and 5G, is a testament to this. By 2023, Shanghai Port handled over 20 million TEUs, with automation significantly contributing to this volume.

SIPG's digital transformation includes advanced information systems and digital navigation charts, which by the end of 2023, led to a 15% improvement in vessel turnaround times. Furthermore, in 2024, the port saw a 25% year-on-year increase in the use of its data analytics platforms, enhancing operational efficiency.

Emerging technologies like AI are being integrated for optimized container handling and scheduling, while IoT devices provide real-time cargo tracking. Blockchain is also being explored to secure and streamline the supply chain, potentially reducing processing times by 20%.

The port is also embracing green technologies, with over 60% of its internal fleet in international container hubs powered by green energy. This aligns with China's leading role in shipbuilding for eco-friendly vessels, with substantial global orders for LNG and methanol-powered ships expected through 2025.

Legal factors

Shanghai International Port Group (SIPG) operates under a framework of international maritime laws and conventions, crucial for its global trade activities. These include regulations from the International Maritime Organization (IMO) covering safety, like the SOLAS convention, and environmental protection, such as MARPOL. Adherence to these standards is vital for maintaining access to international shipping lanes and avoiding significant fines.

For instance, the IMO's Ballast Water Management Convention, fully effective since 2017, requires ships to manage their ballast water to prevent the transfer of invasive aquatic species. SIPG, as a major port, must ensure vessels calling at its facilities comply with such environmental mandates, impacting operational procedures and potentially vessel turnaround times. Failure to comply can lead to port detentions and reputational damage.

As a significant state-owned enterprise, Shanghai International Port Group (SIPG) operates under a stringent framework of Chinese domestic laws. These regulations cover all facets of its business, from port operations and logistics to labor practices and environmental standards. For instance, China's commitment to environmental goals directly impacts SIPG's strategic planning.

The national '4321' roadmap, aiming for carbon peaking before 2030 and carbon neutrality by 2060, specifically targets the shipping industry. This policy mandates SIPG to integrate greener operational strategies and invest in sustainable technologies, influencing fleet management and terminal infrastructure development. By 2023, China's shipping sector saw a significant push towards cleaner fuels, with investments in LNG-powered vessels and shore power facilities becoming increasingly critical for compliance.

China's Network Data Security Management Regulations, taking effect January 1, 2025, will significantly impact Shanghai International Port Group (SIPG). These regulations mandate rigorous data classification, stringent rules for transferring data across borders, and robust personal information protection measures. Failure to comply could result in substantial fines, operational disruptions, and legal repercussions, especially given SIPG's role in managing extensive international trade data.

Environmental Protection Laws and Emissions Standards

Shanghai International Port Group (SIPG) faces increasing legal obligations due to stricter environmental protection laws and emissions standards. These regulations, both within China and globally, necessitate significant investment in cleaner operational practices and infrastructure upgrades. For instance, China's commitment to green development in its maritime sector, including mandates for shore power facilities and the promotion of low-carbon shipping, directly influences SIPG's legal responsibilities and operational expenditures.

These environmental mandates translate into tangible costs and strategic imperatives for SIPG. The push for reduced emissions in port operations, such as controlling sulfur oxides (SOx) and nitrogen oxides (NOx) from vessels, requires compliance with national and international maritime regulations. For example, the International Maritime Organization's (IMO) 2020 sulfur cap, which limits sulfur content in fuel oil to 0.5%, has already impacted shipping operations and, by extension, port services.

- Stricter Emissions Standards: SIPG must adhere to evolving national and international regulations on air and water pollution from port activities and docked vessels, impacting operational procedures and technology adoption.

- Shore Power Mandates: Investments in shore power facilities are legally required in many regions to reduce emissions from berthed ships, adding to capital expenditure and operational planning.

- Green Shipping Initiatives: China's national strategy for a greener maritime sector, including incentives for low-emission vessels and cleaner fuel adoption, creates legal frameworks that SIPG must integrate into its business model.

- Environmental Impact Assessments: New infrastructure projects or expansions at SIPG are subject to rigorous environmental impact assessments, requiring legal compliance and potentially influencing project timelines and scope.

Labor Laws and Workforce Safety Regulations

Shanghai International Port Group (SIPG) must diligently adhere to China's comprehensive labor laws, which dictate standards for working hours, minimum wages, and crucial occupational safety measures. Non-compliance can lead to significant penalties and operational disruptions.

The increasing integration of automation within port operations presents evolving legal challenges. SIPG needs to stay abreast of updated safety regulations specifically designed for automated environments, ensuring the well-being of its workforce.

- Compliance with Labor Laws: As of 2024, China's Labor Contract Law and related regulations continue to govern employment relationships, requiring strict adherence to terms regarding contracts, wages, and benefits.

- Workforce Safety: The Ministry of Emergency Management oversees workplace safety. In 2023, there was a continued emphasis on improving safety protocols, especially in industries undergoing technological transformation like port logistics.

- Occupational Health: Regulations also cover occupational health, requiring employers to provide health checks and protective equipment, particularly relevant for workers interacting with new automated systems.

Shanghai International Port Group (SIPG) navigates a complex legal landscape shaped by both international maritime conventions and China's evolving domestic regulations. These legal frameworks are critical for its global operations, influencing everything from environmental compliance to data security.

China's commitment to environmental protection, exemplified by its 2060 carbon neutrality goal, directly translates into legal mandates for SIPG. This includes stricter emissions standards for vessels and ports, pushing investments in cleaner technologies and infrastructure like shore power. For example, by 2023, the push for cleaner fuels in China's shipping sector intensified, making compliance with these evolving environmental laws a key strategic consideration for SIPG.

Furthermore, new data security regulations, such as China's Network Data Security Management Regulations effective January 1, 2025, impose stringent requirements on data handling and cross-border transfers. SIPG's extensive data operations mean that adherence to these laws is paramount to avoid significant penalties and operational disruptions.

The legal environment also encompasses labor laws, ensuring worker safety and fair employment practices. As of 2024, China's Labor Contract Law continues to be a cornerstone, with ongoing emphasis on improving workplace safety protocols, particularly in technologically advancing sectors like port logistics.

Environmental factors

Shanghai, as a major coastal port, is highly susceptible to climate change. Rising sea levels and more frequent extreme weather events, such as storm surges and heavy rainfall, present substantial risks to its critical infrastructure and ongoing operations.

Specifically, scientific projections suggest a sea level rise of up to 40 centimeters between 2020 and 2050. This increase directly threatens the physical integrity of port facilities, potentially leading to disruptions in shipping, cargo handling, and overall logistical efficiency.

Shanghai International Port Group (SIPG) faces significant environmental challenges from its operations, with vessel emissions, cargo handling, and associated land transport contributing to air and water pollution in the region. These activities release particulate matter, nitrogen oxides, and other pollutants that impact local air quality and marine ecosystems.

To mitigate these impacts, SIPG is actively investing in sustainability initiatives. By the end of 2024, the port aims to have shore power facilities available at 80% of its main berths, enabling ships to plug into electricity instead of running auxiliary engines, thereby reducing emissions significantly. Furthermore, SIPG is transitioning its internal fleet and encouraging third-party logistics providers to adopt green energy solutions, with a target of 30% of port-related trucks being electric or hybrid by 2025.

The global drive towards decarbonization significantly influences Shanghai International Port Group (SIPG). China's commitment to low-carbon shipping and green ports means SIPG must accelerate the adoption of alternative fuels, such as methanol and ammonia, and invest in eco-friendly vessels. This aligns with China's goal to peak carbon emissions before 2030 and achieve carbon neutrality by 2060, creating new operational standards and investment opportunities for SIPG.

Biodiversity Protection and Ecosystem Impact

Shanghai International Port Group (SIPG) faces scrutiny regarding its environmental footprint, particularly concerning biodiversity. Port expansion and dredging activities inherently risk impacting marine and coastal ecosystems, potentially leading to a loss of biodiversity. For instance, the development of the new terminal on Xiaoyangshan Island, a significant SIPG project, necessitates strict adherence to ecological and green port standards throughout its lifecycle to lessen environmental damage.

SIPG is committed to mitigating these impacts. In 2023, the port reported investing over 1 billion yuan in environmental protection initiatives, with a focus on ecological restoration and biodiversity monitoring around its operational areas. This includes implementing advanced dredging techniques designed to minimize sediment disturbance and establishing protected zones for sensitive marine species.

- Ecological Standards: SIPG's development projects, including the Xiaoyangshan terminal, are mandated to meet stringent ecological and green port standards.

- Investment in Protection: In 2023, SIPG allocated over 1 billion yuan to environmental protection, emphasizing biodiversity monitoring and restoration.

- Mitigation Techniques: Advanced dredging methods are employed to reduce sediment disruption and protect marine habitats.

Waste Management and Circular Economy Practices

Effective waste management and the embrace of circular economy principles are becoming critical for the long-term sustainability of port operations. Shanghai International Port Group (SIPG) must prioritize robust systems for waste reduction, recycling, and the safe disposal of all materials, including hazardous waste. This focus is essential to minimize the port's environmental impact and boost resource efficiency.

SIPG's commitment to environmental stewardship is demonstrated through initiatives aimed at reducing its ecological footprint. For instance, in 2023, the port reported a significant increase in its recycling rates for operational waste, reaching 75% across key categories. This progress aligns with China's national targets for waste reduction and the promotion of a circular economy, underscoring the port's role in broader environmental goals.

- Waste Reduction Targets: SIPG has set ambitious targets to reduce non-recyclable waste by 15% by the end of 2025 compared to 2023 levels.

- Circular Economy Pilots: The port is actively exploring pilot programs for material reuse, such as repurposing dredged materials for land reclamation projects, aiming to divert over 50,000 tons of material from landfill annually.

- Hazardous Waste Management: Strict protocols are in place for the handling and disposal of hazardous waste generated from vessel maintenance and cargo operations, ensuring compliance with national and international regulations.

- Energy Efficiency in Waste Processing: Investments are being made in more energy-efficient waste processing technologies, contributing to a lower carbon footprint for waste management operations.

Climate change poses a significant threat to Shanghai International Port Group (SIPG), with rising sea levels and extreme weather events impacting infrastructure. Projections indicate a sea level rise of up to 40 centimeters by 2050, directly endangering port facilities and operational continuity.

SIPG is actively addressing its environmental impact, investing heavily in sustainability. By the end of 2024, 80% of its main berths will have shore power, reducing vessel emissions. Furthermore, the port aims for 30% of its related trucks to be electric or hybrid by 2025, aligning with global decarbonization efforts.

The port is also focusing on waste management and circular economy principles, with recycling rates reaching 75% in 2023 for key waste categories. SIPG has set a target to reduce non-recyclable waste by 15% by the end of 2025 and is exploring material reuse to divert significant tonnage from landfills.

| Environmental Factor | Impact on SIPG | SIPG Initiatives/Targets | Data/Statistics |

|---|---|---|---|

| Climate Change & Sea Level Rise | Risk to infrastructure, operational disruptions | Adaptation strategies, infrastructure resilience | Up to 40cm sea level rise projected by 2050 |

| Emissions (Vessel & Operations) | Air and water pollution, ecological impact | Shore power adoption, green energy fleet transition | 80% shore power availability by end of 2024; 30% electric/hybrid trucks by 2025 |

| Waste Management | Environmental pollution, resource inefficiency | Waste reduction, recycling, circular economy principles | 75% recycling rate achieved in 2023; 15% non-recyclable waste reduction target by end of 2025 |

| Biodiversity Impact | Risk to marine and coastal ecosystems from expansion | Ecological standards, biodiversity monitoring, advanced dredging | Over 1 billion yuan invested in environmental protection in 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Shanghai International Port is built on a robust foundation of data from official Chinese government agencies, international trade organizations, and leading maritime industry publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting port operations.