Porsche Automobil Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Porsche Automobil Holding Bundle

Navigate the complex external landscape impacting Porsche Automobil Holding with our expert PESTEL analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the future of luxury automotive. Gain a competitive edge by leveraging these crucial insights to refine your strategy and investment decisions. Download the full version now for actionable intelligence.

Political factors

Government policies and evolving regulations, especially those targeting CO2 emissions and the eventual phasing out of gasoline and diesel engines, directly affect Porsche Automobil Holding SE through its major stake in Volkswagen AG. These stringent environmental mandates are compelling the entire VW Group to accelerate its transition towards electric mobility, requiring substantial capital infusion into EV development and manufacturing.

Global geopolitical tensions and evolving trade policies, such as potential tariffs between major economic blocs like the EU, US, and China, can significantly impact Volkswagen AG's international sales and its intricate global supply chains. For Porsche SE, as a holding company, its valuation is intrinsically linked to the market access and operational efficiency of its core investment, Volkswagen AG.

For instance, in 2024, the automotive sector continues to navigate complex trade relationships, with ongoing discussions around electric vehicle (EV) tariffs and local content requirements in various regions. These factors directly influence the cost of production and the competitiveness of vehicles manufactured by Volkswagen, thereby affecting Porsche SE's overall investment performance.

Government subsidies and incentives for electric vehicle (EV) purchases are a significant driver for EV adoption. For instance, in 2024, many countries continued to offer tax credits and rebates, such as the €9,000 incentive in Germany for new EVs, directly impacting consumer purchasing decisions and, by extension, the sales figures for Volkswagen Group's electric offerings, which include Porsche's Taycan and upcoming electric models.

The development of charging infrastructure is equally critical, with governments investing heavily in expanding charging networks. By mid-2024, the European Union aimed to have at least 3.5 million charging points installed, a move that directly supports the viability and convenience of owning EVs, thereby bolstering the market for Porsche SE's electrified vehicles and influencing its long-term investment strategy in this sector.

Political Influence on Corporate Governance

The political landscape significantly shapes corporate governance, particularly evident in Volkswagen AG's unique shareholder structure. The State of Lower Saxony holds a substantial voting stake, alongside considerable influence from labor representatives, directly impacting strategic decisions and corporate direction. This political dynamic necessitates careful navigation by major shareholders like Porsche Automobil Holding SE.

Porsche Automobil Holding SE, as Volkswagen's largest shareholder, must strategically engage with these political stakeholders to safeguard and enhance its long-term value. For instance, the German government's "Volkswagen Law," though amended, still grants the State of Lower Saxony special voting rights, underscoring the political influence in corporate governance. This requires Porsche SE to factor in political considerations when formulating its investment strategies and advocating for its interests within the Volkswagen group.

- Shareholder Influence: The State of Lower Saxony's approximately 20% voting share in Volkswagen AG, coupled with the significant representation of labor unions on the supervisory board, creates a complex political governance environment.

- Strategic Alignment: Porsche Automobil Holding SE's role as the controlling shareholder means it must align its strategic objectives with the interests and political realities influenced by these key stakeholders to ensure stability and growth.

- Regulatory Environment: Political decisions regarding automotive industry regulations, emissions standards, and labor laws in Germany and the EU directly impact Volkswagen's operations and, by extension, Porsche SE's investment performance.

Regulatory Stability and Investment Climate

Regulatory stability is a cornerstone for capital-intensive industries like automotive manufacturing, directly influencing Porsche SE's investment decisions. Predictable political landscapes and consistent regulatory frameworks in major markets like Germany, China, and the United States are crucial for long-term strategic planning and risk assessment. For instance, the European Union's ongoing efforts to finalize its 2035 CO2 emission standards for new cars, with potential adjustments debated into 2024 and 2025, highlight the dynamic nature of regulations that require careful monitoring by Porsche SE.

Sudden or unexpected policy changes can significantly alter Volkswagen AG's operational environment, which in turn affects Porsche SE's investment strategy and valuation. For example, shifts in government incentives for electric vehicles or changes in trade tariffs, such as those discussed between the EU and China in late 2023 and early 2024, can directly impact sales volumes and profitability, necessitating agile responses from Porsche SE's investment portfolio.

- Regulatory Predictability: The automotive sector thrives on predictable policy, with upcoming EU emissions targets for 2030 and beyond shaping investment in new technologies.

- Geopolitical Risk: Trade tensions and evolving international relations, exemplified by ongoing US-China trade discussions impacting supply chains in 2024, create investment uncertainty.

- Investment Climate: Government support for electric vehicle infrastructure and manufacturing, as seen in various national budgets through 2025, can significantly boost or hinder market growth.

Government policies directly influence Porsche SE via its stake in Volkswagen AG, particularly through stringent emissions regulations. These mandates are accelerating VW's shift to electric vehicles, requiring significant investment in EV technology and production. For instance, by 2024, the EU's CO2 standards continued to push manufacturers towards electrification, impacting the entire group's product development and capital allocation strategies.

Geopolitical shifts and trade policies, such as potential tariffs between major economic blocs, directly affect Volkswagen's global sales and supply chains. Porsche SE's valuation is therefore tied to Volkswagen's market access and operational efficiency. In 2024, ongoing trade discussions, particularly concerning EV tariffs between the EU and China, highlighted the sensitivity of the automotive sector to these political dynamics.

Government incentives for electric vehicles, like tax credits and rebates, are crucial for driving consumer adoption. Many nations, including Germany with its continued EV subsidies in 2024, offer financial support that directly impacts sales of electric models, including Porsche's Taycan and other upcoming EVs from the Volkswagen Group. This governmental support is a key factor in the market penetration of electric mobility.

Political influence is also evident in Volkswagen AG's corporate governance, with significant stakes held by the State of Lower Saxony and labor representatives. Porsche Automobil Holding SE, as the largest shareholder, must navigate these relationships to protect its investment. The German government's "Volkswagen Law," granting special voting rights to Lower Saxony, underscores the political considerations inherent in managing this investment.

| Political Factor | Impact on Porsche SE (via VW AG) | 2024/2025 Data/Trend |

| Emissions Regulations | Drives investment in EV technology and phasing out ICE vehicles. | EU CO2 targets for 2030 and beyond are shaping product roadmaps. |

| Trade Policies & Tariffs | Affects international sales, supply chain costs, and market access. | Ongoing EU-China trade discussions impacting EV tariffs and local content rules. |

| EV Subsidies & Incentives | Boosts consumer demand for electric vehicles. | Continued government tax credits and rebates in key markets like Germany support EV sales. |

| Corporate Governance | Requires navigation of state and labor stakeholder influence in VW AG. | The State of Lower Saxony's voting rights and labor union representation remain significant governance factors. |

What is included in the product

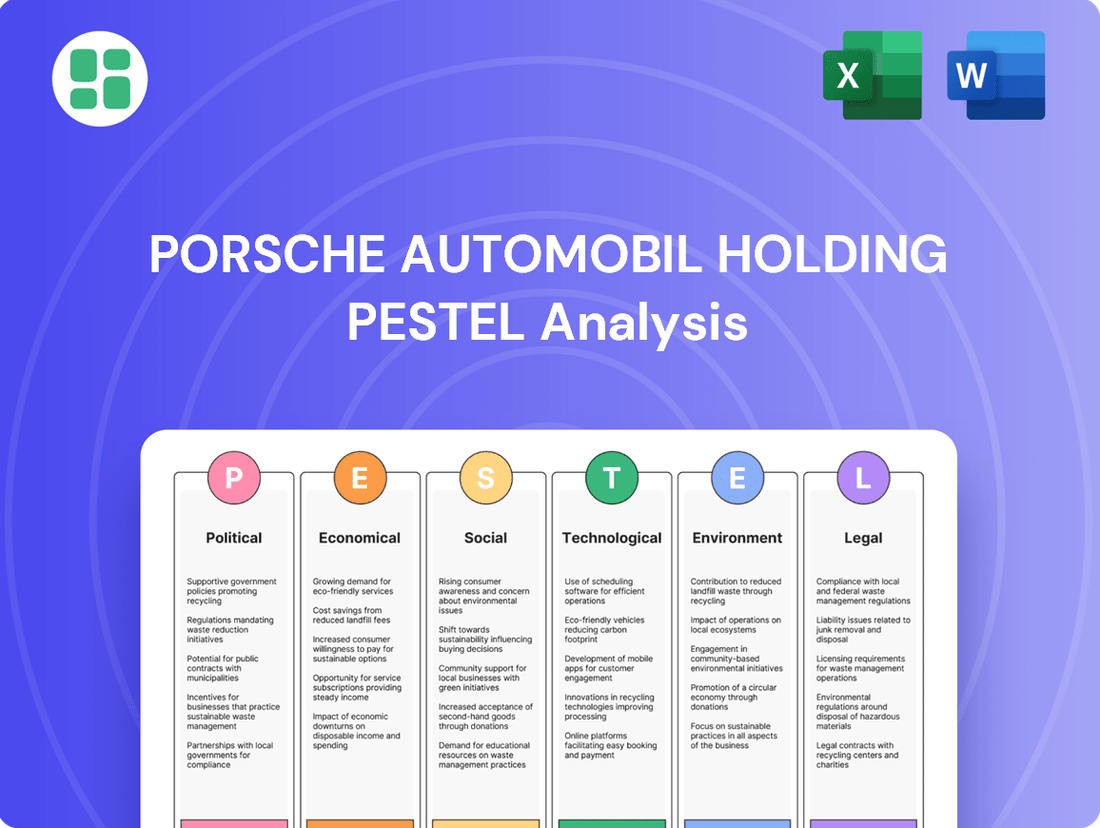

This PESTLE analysis of Porsche Automobil Holding examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its global operations and strategic planning.

It provides a comprehensive understanding of the external forces shaping the luxury automotive market, enabling informed decision-making and risk mitigation.

A concise, actionable summary of the Porsche PESTLE analysis, highlighting key external factors that can be leveraged to mitigate risks and unlock growth opportunities.

This PESTLE analysis for Porsche provides a clear framework to identify and address potential challenges, thereby streamlining strategic decision-making and improving market responsiveness.

Economic factors

Global economic growth is a critical driver for Porsche SE, as consumer purchasing power directly correlates with demand for its premium and luxury vehicles. A robust global economy generally translates to higher discretionary spending, benefiting brands like Porsche. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, but still indicating a generally positive economic environment.

However, economic downturns or persistent inflationary pressures can significantly dampen consumer confidence and reduce spending on high-value items. High inflation rates, like those experienced globally in recent years, erode purchasing power and can lead consumers to postpone or cancel purchases of new cars. This directly impacts sales volumes and profitability for Volkswagen Group's brands, which are core investments for Porsche SE.

The automotive sector, particularly the luxury segment, is sensitive to economic fluctuations. A slowdown in economic activity, coupled with rising interest rates and cost of living pressures, can lead to a contraction in demand for new vehicles. This was evident in some markets during 2023, where rising inflation and economic uncertainty led to a more cautious consumer approach, a trend that analysts expect to continue monitoring closely in 2024 and 2025.

Rising inflation in 2024 and projected into 2025 is a significant concern for Porsche Automobil Holding SE, impacting its parent company Volkswagen AG. Increased costs for essential inputs like steel, aluminum, and semiconductors directly translate to higher production expenses, potentially squeezing profit margins on vehicle manufacturing.

The prevailing interest rate environment, with central banks signaling a cautious approach to rate cuts through mid-2025, presents a dual challenge. Higher borrowing costs for consumers can reduce demand for new vehicles, particularly luxury and premium segments where Porsche operates. Simultaneously, increased interest expenses on Volkswagen AG's corporate debt will add to operational overhead, affecting overall financial performance.

Global supply chain disruptions, particularly for semiconductors and crucial EV battery materials like lithium and cobalt, present substantial economic hurdles for the automotive sector. These ongoing challenges directly influence production schedules and the availability of key components, impacting manufacturers across the board.

For Volkswagen AG, Porsche SE's primary investment, the volatility in raw material prices directly affects its bottom line. For instance, lithium prices saw significant swings in 2023, with hydroxide prices fluctuating considerably, impacting the cost of battery production for electric vehicles, a key growth area for the group.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for global automotive manufacturers like Volkswagen AG, the parent company of Porsche. As a major exporter and importer, Volkswagen's financial performance is directly tied to the strength and weakness of various currencies. For instance, a stronger Euro can make German-made vehicles more expensive for buyers in the United States, potentially dampening export sales and impacting revenue. Conversely, a weaker Euro could boost export competitiveness but increase the cost of imported components. This volatility directly influences the profitability of Volkswagen Group, which in turn affects the valuation and investment returns for Porsche Automobil Holding SE.

The impact of currency movements on Volkswagen's bottom line is substantial. In 2023, for example, the Group reported that adverse currency effects negatively impacted its operating result. While specific figures for the 2024/2025 period are still emerging, historical trends indicate that currency headwinds can shave hundreds of millions of Euros off profits. This makes managing currency exposure a critical aspect of financial strategy for the entire group.

- Impact on Revenue: Unfavorable exchange rates can reduce the Euro value of sales made in foreign currencies, directly impacting top-line revenue.

- Cost of Imports: A weaker domestic currency increases the cost of imported parts and raw materials, squeezing profit margins.

- Translation of Earnings: Profits earned in foreign subsidiaries are translated back into Euros, and currency fluctuations can significantly alter the reported value of these earnings.

- Investment Valuation: Volatile currency markets can create uncertainty in the valuation of overseas assets and investments held by Porsche Automobil Holding SE.

Competitive Landscape and Market Share

The automotive sector, especially the electric vehicle (EV) market, is incredibly competitive. This intense rivalry directly impacts pricing power and how much market share companies like the Volkswagen Group, which includes Porsche, can secure. Porsche SE's financial health is closely linked to Volkswagen's capacity for innovation, its ability to offer competitive pricing, and its success in gaining ground against formidable competitors.

Key players are heavily investing in EV technology, leading to a rapid pace of development and frequent product launches. For instance, by the end of 2023, Volkswagen Group had delivered over 771,100 battery-electric vehicles (BEVs), representing a significant increase from previous years. However, this growth occurs within a market where established automakers and new entrants are aggressively vying for consumer attention and loyalty. This dynamic necessitates continuous investment in research and development to stay ahead.

- Intensified EV Competition: Established automakers and new EV startups are fiercely competing, driving innovation and influencing pricing strategies.

- Market Share Dynamics: Volkswagen Group's ability to capture and maintain market share, particularly in premium and EV segments, is crucial for Porsche SE's economic outlook.

- Innovation as a Differentiator: Continuous investment in battery technology, charging infrastructure, and autonomous driving features is essential for competitive advantage.

- Pricing Power Constraints: Aggressive pricing from competitors can limit the pricing power of premium brands like Porsche, requiring careful balancing of brand value and market demand.

Economic growth directly influences demand for Porsche's luxury vehicles, with global growth projected at 3.2% for 2024 by the IMF. However, persistent inflation and rising interest rates, with central banks signaling caution on cuts through mid-2025, pose significant challenges by eroding purchasing power and increasing borrowing costs for consumers and Volkswagen AG, Porsche SE's parent company.

Volatility in raw material prices, such as lithium, directly impacts EV battery production costs for Volkswagen AG, affecting overall profitability. Currency exchange rate fluctuations also present a substantial risk, with adverse currency effects having negatively impacted Volkswagen's operating result in 2023, a trend that requires careful management to mitigate impacts on revenue and investment valuation for Porsche SE.

| Economic Factor | Impact on Porsche SE / Volkswagen AG | Relevant Data/Projection (2024-2025) |

|---|---|---|

| Global Economic Growth | Drives demand for luxury vehicles; slowdowns reduce discretionary spending. | IMF projects 3.2% global growth in 2024. |

| Inflation | Increases production costs (materials) and erodes consumer purchasing power. | Persistent inflationary pressures remain a concern. |

| Interest Rates | Higher borrowing costs reduce consumer demand and increase corporate debt expenses. | Central banks signaling cautious rate cuts through mid-2025. |

| Raw Material Prices | Affects EV battery production costs and overall manufacturing expenses. | Lithium price volatility noted in 2023, impacting battery costs. |

| Currency Exchange Rates | Impacts revenue from foreign sales and cost of imported components. | Adverse currency effects negatively impacted VW's 2023 operating result. |

What You See Is What You Get

Porsche Automobil Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Porsche Automobil Holding SE delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping Porsche's operations and future growth opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element, offering a robust framework for understanding Porsche's competitive environment.

Sociological factors

Societal values are increasingly prioritizing sustainability, driving a significant global trend towards eco-friendly transportation and electric vehicles. This shift directly impacts consumer choices, creating a growing market for e-mobility solutions.

Porsche SE's strategic alignment with Volkswagen AG's extensive e-mobility initiatives is a key advantage. Volkswagen's broad range of electric models, from compact cars to luxury SUVs, caters to diverse consumer preferences and reinforces Porsche's position in this evolving market.

By 2024, Volkswagen Group aims to have over 30 fully electric models available across its brands, with plans to invest significantly in battery production and charging infrastructure, further solidifying its commitment to e-mobility and supporting Porsche SE's long-term investment strategy.

The increasing trend of urbanization is reshaping how people move, with more individuals living in cities and often seeking alternatives to owning a personal vehicle. This shift is fueling a greater demand for flexible mobility options like car-sharing and subscription models. For instance, by the end of 2023, the global car-sharing market was valued at over $6 billion and is projected to grow significantly, indicating a strong consumer appetite for these services.

Porsche SE, as a major stakeholder in the Volkswagen Group, must recognize how these evolving urban lifestyles impact the automotive industry. The group's capacity to innovate its vehicle offerings and create compelling new mobility services is paramount. Successfully adapting to these changing commuting patterns and urban living preferences will be key to ensuring the sustained value of Porsche SE's investments in the long run.

Consumer trust and brand perception are paramount in the automotive sector, directly influencing purchasing decisions and long-term loyalty. Porsche SE's investment value is significantly tied to the reputation of the Volkswagen Group, its primary holding.

The Volkswagen Group's experience with the 'Dieselgate' scandal in 2015, which resulted in billions in fines and reputational damage, underscored the critical need for ethical operations and transparent communication. Rebuilding and maintaining consumer confidence remains a key focus for the group.

As of early 2024, the Volkswagen Group continues to invest heavily in brand recovery and sustainable practices, aiming to solidify its image as a responsible and innovative automotive manufacturer. This ongoing effort directly impacts the perceived stability and future growth potential of Porsche SE.

Demographic Shifts and Emerging Markets

Demographic trends significantly shape automotive demand. While developed markets like Europe and North America are experiencing an aging population, leading to potential shifts towards more comfortable and accessible vehicles, emerging economies, particularly in Asia, are witnessing a robust expansion of the middle class. This growing segment is increasingly seeking premium and performance-oriented vehicles, a key area for Porsche.

Volkswagen AG's extensive global footprint, which includes Porsche SE, allows for strategic adaptation to these diverse demographic landscapes. By understanding regional income levels, age distributions, and lifestyle preferences, the group can effectively tailor its product offerings. For instance, in 2023, emerging markets accounted for a substantial portion of global automotive sales growth, with China alone representing a significant driver.

- Aging Population Impact: In markets like Germany, where the average age is around 45.7 years (as of 2023), there's a growing demand for advanced driver-assistance systems and easier ingress/egress features.

- Emerging Market Growth: The global middle class is projected to reach 5.4 billion people by 2030, with a significant concentration in Asia, creating a substantial customer base for luxury and performance brands.

- Regional Demand Tailoring: Porsche's ability to adjust its model mix, such as offering more compact SUVs in densely populated urban areas of Asia, directly addresses the needs of a rising middle class with evolving mobility requirements.

- Global Sales Contribution: In 2023, Porsche reported a 3% increase in deliveries to 320,221 vehicles globally, with strong performance noted in regions experiencing significant middle-class expansion.

Workforce Dynamics and Skills Gap

The automotive industry's shift towards electric vehicles (EVs) and digital integration presents a significant challenge in workforce skills. Porsche SE, via its stake in Volkswagen AG, faces the imperative to cultivate a workforce proficient in areas such as battery chemistry, advanced software engineering, and automated manufacturing processes. For instance, by the end of 2024, the automotive sector globally will continue to see a demand for specialized EV engineers, with estimates suggesting a shortage of tens of thousands in key regions.

This evolving landscape necessitates a proactive approach to talent acquisition and development. Porsche SE's indirect exposure means it must support initiatives within Volkswagen to attract and retain individuals with expertise in:

- Software Development: Crucial for autonomous driving systems, in-car infotainment, and vehicle connectivity.

- Battery Technology: Essential for optimizing EV performance, charging infrastructure, and battery management systems.

- EV Manufacturing: Requiring new skills in assembly line automation, quality control for new components, and sustainable production methods.

Societal values increasingly favor sustainability, driving demand for electric vehicles and eco-friendly transportation. Porsche SE benefits from Volkswagen Group's extensive EV model range and significant investment in battery production and charging infrastructure, with over 30 fully electric models planned by 2024.

Urbanization trends are shifting mobility preferences towards car-sharing and subscription services, with the global car-sharing market valued at over $6 billion by the end of 2023. Porsche SE must adapt its offerings and develop new mobility services to align with these evolving urban lifestyles.

Consumer trust and brand perception are critical, with Volkswagen Group's past 'Dieselgate' scandal highlighting the need for ethical operations. Ongoing investments in brand recovery and sustainable practices by the group aim to bolster consumer confidence, directly impacting Porsche SE's investment value.

Demographic shifts, including aging populations in developed markets and a growing middle class in emerging economies, influence automotive demand. Porsche SE, through Volkswagen AG, can tailor its product mix, such as offering more compact SUVs in Asia, to meet the needs of these diverse consumer groups. Porsche reported a 3% increase in global deliveries to 320,221 vehicles in 2023.

The automotive industry's transition to EVs and digital integration requires a workforce skilled in battery chemistry and software engineering. By the end of 2024, the sector faces a shortage of tens of thousands of specialized EV engineers globally, necessitating proactive talent development within Volkswagen Group to support Porsche SE's long-term strategy.

Technological factors

Rapid advancements in electric vehicle (EV) technology are fundamentally reshaping the automotive landscape, directly impacting Volkswagen AG's (VW) competitiveness, a key holding for Porsche SE. Innovations in battery technology are crucial, with significant progress expected in energy density and lifespan, aiming to extend driving ranges and reduce the total cost of ownership.

Charging infrastructure development is another critical factor. By 2025, the expansion of high-speed charging networks is projected to significantly alleviate range anxiety, a major barrier to EV adoption. Porsche SE's strategic investments are closely tied to VW's substantial R&D spending and collaborations, which are focused on enhancing electric powertrain efficiency and accelerating the transition to sustainable mobility.

The relentless advancement of autonomous driving technology is fundamentally reshaping the automotive landscape. Porsche SE, through its significant stake in Volkswagen AG, is directly impacted by these developments. Volkswagen's substantial investments, reportedly in the billions of euros, into software and sensor development for self-driving systems are crucial. This push is expected to unlock new revenue opportunities, from ride-sharing services to advanced driver-assistance systems (ADAS), while simultaneously improving vehicle safety and passenger experience.

The automotive industry is rapidly embracing digitalization, with vehicles increasingly featuring sophisticated infotainment systems and the capability for over-the-air updates. This trend is significantly influencing what consumers expect from their driving experience, pushing manufacturers to integrate advanced digital features. Porsche SE's strategic focus on Volkswagen AG centers on exploiting the data generated by these connected vehicles to enhance the in-car digital environment and develop new revenue streams through subscription services, thereby strengthening customer relationships.

Manufacturing Process Innovation

Innovations in manufacturing are a significant technological driver, with increased automation and artificial intelligence (AI) in production becoming central. These advancements are geared towards boosting efficiency and cutting costs. For instance, Volkswagen AG, Porsche's parent company, has been actively integrating advanced production technologies. In 2023, VW Group invested €18.9 billion in digitalization and automation across its brands, aiming to streamline operations and enhance competitiveness. This focus on cutting-edge manufacturing indirectly benefits Porsche SE by improving overall group operational performance and access to shared technological advancements.

Sustainable manufacturing techniques are also gaining traction, driven by environmental regulations and consumer demand. These methods, such as reducing waste and energy consumption, are becoming integral to modern production. Porsche itself is investing heavily in this area, with its Leipzig plant aiming for carbon-neutral production. The company is also exploring new materials and processes to minimize its environmental footprint throughout the vehicle lifecycle.

- Increased Automation: Volkswagen Group's investment in advanced production technologies, including robotics and AI, aims to enhance manufacturing efficiency and quality.

- AI in Production: The integration of AI for predictive maintenance and quality control is expected to reduce downtime and improve output consistency.

- Sustainable Manufacturing: Porsche's commitment to carbon-neutral production and the use of sustainable materials in its vehicles reflects a broader industry trend towards eco-friendly manufacturing processes.

Cybersecurity and Data Privacy in Vehicles

As vehicles increasingly rely on software and connectivity, cybersecurity and data privacy are critical. Porsche SE, through its stake in Volkswagen AG, faces significant risks from cyber threats and data breaches. This necessitates ongoing investment in secure software development and stringent data privacy compliance to safeguard vehicle systems and customer information. For instance, the automotive industry saw a 20% increase in reported cyber incidents in 2024 compared to the previous year, highlighting the growing threat landscape.

The increasing complexity of vehicle electronics and the vast amounts of data generated mean robust protection is essential. Porsche SE must ensure Volkswagen AG's connected car technologies are protected against unauthorized access and manipulation. Failure to do so could lead to severe reputational damage and financial penalties, especially with regulations like the GDPR and similar data protection laws globally becoming more stringent. The cost of a single data breach for an automotive manufacturer can run into millions of dollars.

Key considerations for Porsche SE and Volkswagen AG include:

- Implementing end-to-end encryption for all vehicle communications.

- Conducting regular penetration testing and vulnerability assessments.

- Ensuring compliance with evolving global data privacy regulations.

- Developing incident response plans for potential cyber-attacks.

Technological advancements are fundamentally altering the automotive sector, impacting Porsche SE through its substantial investment in Volkswagen AG. The ongoing evolution of electric vehicle (EV) technology, particularly in battery performance and charging infrastructure, is a prime example. By 2025, significant improvements in battery energy density are anticipated, aiming to extend EV driving ranges and reduce overall ownership costs, which directly influences VW's competitive positioning.

The rapid development of autonomous driving systems represents another key technological shift. VW's substantial investments, reportedly in the billions of euros, into software and sensor development for self-driving capabilities are crucial for unlocking new revenue streams and enhancing vehicle safety. Furthermore, the increasing digitalization of vehicles, with advanced infotainment systems and over-the-air updates, allows for enhanced digital experiences and new revenue models through subscription services.

Innovations in manufacturing, such as increased automation and the integration of artificial intelligence (AI) in production, are boosting efficiency and reducing costs. For instance, VW Group invested €18.9 billion in digitalization and automation in 2023. Concurrently, a growing emphasis on sustainable manufacturing techniques, including carbon-neutral production and the use of eco-friendly materials, is becoming integral to the industry's future.

Cybersecurity and data privacy are critical concerns as vehicles become more software-dependent and connected. The automotive industry experienced a 20% rise in cyber incidents in 2024, underscoring the need for robust protection against threats and data breaches to maintain customer trust and comply with stringent global data privacy regulations.

Legal factors

Porsche Automobil Holding SE, along with its major investment in Volkswagen AG, navigates a complex global landscape governed by stringent antitrust and competition laws. These regulations are designed to prevent monopolies and ensure fair market practices across the automotive sector.

Failure to comply with these laws can result in substantial financial penalties; for instance, the European Commission has imposed significant fines on automotive manufacturers for anti-competitive practices, such as cartel agreements. In 2023, regulatory scrutiny continued to focus on pricing and supply chain agreements within the industry, underscoring the ongoing importance of adherence.

Adherence to these legal frameworks is paramount for the financial health of the Volkswagen Group, directly influencing the returns generated for Porsche SE. The potential for legal challenges and hefty fines necessitates continuous monitoring and proactive compliance strategies to mitigate risks and safeguard investment value.

The automotive sector is heavily regulated, with product liability laws and safety standards constantly being updated globally. For Porsche SE, through its significant stake in Volkswagen AG, this means a continuous need to adapt and comply. Failure to meet these stringent requirements can lead to substantial financial penalties, such as the €2.5 billion in fines Volkswagen AG paid in Germany by the end of 2023 related to the diesel emissions scandal, and significant damage to brand reputation.

Environmental and emissions legislation significantly impacts Porsche Automobil Holding SE. Beyond political targets, specific legal frameworks govern vehicle emissions, fuel economy, and overall environmental impact, necessitating ongoing technological adaptation and strict compliance. For instance, the EU's CO2 emission standards for new passenger cars, targeting an average of 95 g CO2/km for 2020, have been further tightened, with a proposed 2030 target of a 55% reduction compared to 2021 levels. Non-compliance with these stringent regulations can result in substantial penalties and legal action, posing a direct financial risk to Volkswagen AG, Porsche's primary asset.

Data Protection and Privacy Laws

The increasing prevalence of connected vehicles and digital services means that data protection laws, such as the General Data Protection Regulation (GDPR), are becoming critically important for companies like Volkswagen AG, which includes Porsche SE in its portfolio. Adherence to these regulations is essential for how customer data is gathered, stored, and utilized, directly influencing the development and rollout of new connected car features and digital offerings. Failure to comply can result in significant fines, as demonstrated by the €50 million fine levied against Google by France's CNIL in January 2019 for inadequate consent mechanisms, highlighting the financial risks associated with data privacy breaches.

Porsche SE, as part of the Volkswagen Group, must navigate a complex web of global data privacy legislation. This includes ensuring customer consent for data collection, implementing robust security measures to protect sensitive information, and managing data subject rights, such as the right to access and erasure. The company's strategy for developing and deploying new digital services, from infotainment systems to advanced driver-assistance features, must be designed with data privacy at its core to avoid legal challenges and maintain customer trust. For instance, the ongoing evolution of automotive cybersecurity standards, often intertwined with data protection, requires continuous investment and adaptation to meet evolving regulatory expectations.

- GDPR Fines: Non-compliance with GDPR can lead to penalties of up to 4% of annual global turnover or €20 million, whichever is higher.

- Connected Car Data: By 2025, it's projected that connected cars will generate over 400 exabytes of data annually, underscoring the scale of data management challenges.

- Privacy by Design: Automotive manufacturers are increasingly adopting 'privacy by design' principles, integrating data protection considerations from the initial stages of product development.

- Global Regulations: Beyond GDPR, Porsche SE must also consider data protection laws in other key markets like California's CCPA/CPRA and similar regulations emerging in Asia and South America.

Corporate Governance and Shareholder Rights

Porsche Automobil Holding SE, as a holding company, navigates a complex web of corporate governance and shareholder rights regulations. These legal frameworks are critical in Germany, its primary base, and in any other jurisdiction where it holds significant investments or conducts business. Adherence ensures that the company operates with transparency, safeguarding the interests of its shareholders and bolstering investor confidence in Porsche SE itself.

Key legal factors influencing Porsche SE include the German Stock Corporation Act (Aktiengesetz) and the rules of the Frankfurt Stock Exchange. These dictate requirements for board structure, executive compensation, disclosure obligations, and the rights afforded to shareholders, such as voting power and access to company information. For instance, in 2023, Porsche SE's Annual General Meeting (AGM) saw participation from shareholders representing a significant portion of its voting capital, underscoring the importance of these established shareholder rights.

- German Corporate Governance Code: Porsche SE must comply with the recommendations and suggestions outlined in this code, which promotes best practices in corporate management and oversight.

- Shareholder Rights: German law grants shareholders rights including the ability to propose agenda items for AGMs, request information, and challenge corporate decisions they deem unlawful.

- Disclosure Requirements: Porsche SE is obligated to publicly disclose material information that could affect its share price, ensuring a level playing field for all investors.

- Board Responsibilities: The supervisory and management boards have distinct legal duties to act in the best interests of the company and its shareholders, with specific liabilities for breaches.

Porsche SE, through its substantial investment in Volkswagen AG, is deeply impacted by evolving labor laws and worker representation standards. These legal stipulations govern employment conditions, collective bargaining, and employee rights, influencing operational costs and management strategies across the group.

Compliance with labor regulations is crucial, with significant implications for workforce relations and productivity. For example, co-determination laws in Germany, which grant employees representation on supervisory boards, are a cornerstone of corporate governance within Volkswagen AG, affecting strategic decision-making. In 2024, discussions around fair wages and working conditions continue to be prominent in the automotive sector, highlighting the ongoing relevance of these legal frameworks.

The automotive industry faces a growing number of product liability claims and recalls, directly impacting Porsche SE via its Volkswagen stake. Strict product safety regulations and consumer protection laws necessitate rigorous quality control and transparent communication. The sheer volume of vehicles produced by the Volkswagen Group means that even minor non-compliance can lead to substantial legal liabilities and reputational damage, as seen in past recalls affecting millions of vehicles globally.

The legal landscape for automotive manufacturers is increasingly shaped by intellectual property (IP) rights, particularly concerning new technologies like autonomous driving and electric powertrains. Protecting innovations through patents and managing licensing agreements are critical for maintaining competitive advantage. Volkswagen AG, and by extension Porsche SE, must navigate complex IP laws globally to safeguard its technological investments and avoid infringement disputes, which can incur significant financial penalties and hinder market access.

Environmental factors

Global pressure for carbon neutrality is intensifying, with governments worldwide setting increasingly stringent emission reduction targets. For the automotive sector, this translates to a significant shift towards electrification and sustainable manufacturing practices.

Volkswagen AG, Porsche SE's majority owner, is making substantial investments to meet these environmental mandates. By 2030, VW aims for over 50% of its global vehicle sales to be purely electric. This commitment to electrification directly influences Porsche SE's strategic outlook and its valuation of its stake in VW.

Porsche SE's investment strategy must account for these environmental factors. The company's long-term performance is intrinsically linked to Volkswagen's ability to navigate the transition to a low-carbon economy, including its progress in reducing CO2 emissions across its production and product portfolio.

The increasing demand for electric vehicles (EVs) puts pressure on the availability of key battery components like lithium and cobalt. For instance, the global lithium market was valued at approximately $25.1 billion in 2023 and is projected to reach $50.5 billion by 2028, indicating significant growth and potential scarcity. Porsche SE, through its stake in Volkswagen AG, is keenly interested in Volkswagen's initiatives to secure sustainable sourcing for these materials, aiming to reduce supply chain vulnerabilities and investigate alternative battery chemistries.

The automotive sector, including Porsche, is under growing pressure to embrace circular economy models, emphasizing waste reduction and efficient end-of-life vehicle handling. This includes a significant push for increased recycling rates for materials like aluminum and plastics.

Volkswagen AG, a major stakeholder in Porsche SE, has been actively investing in battery recycling technologies, aiming to recover valuable materials from electric vehicle batteries. For instance, their Salzgitter plant processed approximately 1,200 battery cells in its pilot phase in 2023, demonstrating tangible progress in this area.

These efforts by Volkswagen directly influence Porsche's sustainability profile, as the group’s commitment to reducing manufacturing waste and improving material reuse, such as through advanced recycling of high-voltage batteries, sets a precedent for its luxury automotive brand.

Impact of Climate Change on Operations

Extreme weather events, a growing consequence of climate change, pose a significant threat to Volkswagen AG's manufacturing and supply chain continuity. For instance, the severe flooding in parts of Europe during early 2024 led to temporary production halts at several automotive plants, impacting delivery schedules and increasing operational costs. Porsche SE actively assesses the vulnerability of its substantial investment in Volkswagen to these climate-related disruptions, focusing on how infrastructure integrity, transportation logistics, and the availability of critical raw materials might be compromised.

Porsche SE's approach to environmental risk management, as detailed in their 2024 sustainability report, explicitly addresses the physical impacts of climate change. They are investing in climate risk modeling to better understand potential disruptions.

- Supply Chain Vulnerability: Porsche SE acknowledges that extreme weather events like floods and heatwaves can directly impact its suppliers' manufacturing facilities and transportation networks, leading to shortages of components.

- Infrastructure Resilience: The company is evaluating the resilience of its own production sites and key logistics hubs against rising sea levels and more frequent extreme weather, aiming to implement protective measures.

- Resource Availability: Climate change can affect the availability and cost of essential resources, such as water needed for manufacturing processes and raw materials sourced from climate-sensitive regions.

- Operational Disruptions: In 2024, Volkswagen AG reported an estimated €50 million in losses due to weather-related disruptions affecting its European production facilities.

Corporate Social Responsibility (CSR) and ESG Reporting

Investor and public scrutiny of Environmental, Social, and Governance (ESG) factors is intensifying, directly impacting corporate reputation and the ability to secure capital. Companies demonstrating strong ESG performance and transparent reporting are increasingly favored.

Porsche SE's significant investment in Volkswagen AG is positively influenced by Volkswagen's commitment to ESG principles. This alignment with responsible investment practices bolsters stakeholder confidence and supports Porsche SE's overall investment strategy.

- Growing ESG Focus: By the end of 2023, over $37.7 trillion in assets under management globally were committed to ESG principles, highlighting a significant shift in investment priorities.

- Volkswagen's ESG Efforts: Volkswagen Group aims to achieve a 30% reduction in its Scope 1 and 2 CO2 emissions by 2030 compared to 2018 levels, demonstrating tangible environmental commitments.

- Stakeholder Trust: Transparency in ESG reporting, such as detailed sustainability reports, directly correlates with higher levels of trust from investors, customers, and employees.

The automotive industry faces increasing regulatory pressure to reduce emissions, driving a significant shift towards electric vehicles and sustainable manufacturing. Porsche SE's valuation is directly tied to Volkswagen AG's ability to meet these environmental mandates, including its ambitious goal for over 50% of global sales to be electric by 2030.

The demand for EV battery components like lithium presents supply chain challenges, with the global lithium market projected to grow substantially. Volkswagen's efforts to secure sustainable sourcing and explore alternative battery chemistries are crucial for mitigating these risks.

Climate change poses physical risks to manufacturing and supply chains, as evidenced by weather-related disruptions impacting production. Porsche SE is actively assessing these vulnerabilities to ensure the resilience of its investment in Volkswagen.

Growing investor and public focus on ESG factors means companies with strong environmental performance and transparent reporting are increasingly favored. Volkswagen's commitment to ESG principles and emission reduction targets positively influences stakeholder confidence in Porsche SE.

PESTLE Analysis Data Sources

Our Porsche Automobil Holding PESTLE analysis is built upon a robust foundation of data sourced from official automotive industry associations, global economic reports from institutions like the IMF and World Bank, and up-to-date government policy documents concerning environmental and trade regulations.