Porsche Automobil Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Porsche Automobil Holding Bundle

Porsche's product portfolio, analyzed through the BCG Matrix, reveals a dynamic landscape of innovation and established success. Understand which iconic models are driving significant revenue and which emerging ventures hold future promise.

This glimpse into Porsche's strategic positioning is just the beginning. Purchase the full BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for this premium automotive giant.

Stars

Porsche AG's electrified vehicle sales are seeing impressive growth, with the electric Macan playing a pivotal role. In the first half of 2025, a substantial 36.1% of Porsche's worldwide deliveries consisted of fully electric or plug-in hybrid models.

The electric Macan has been a key contributor to this surge, experiencing a 15% increase in deliveries. Notably, nearly 60% of all Macan sales during this period were the fully electric version, highlighting strong customer adoption and a significant market share in a rapidly expanding segment.

Volkswagen Group's European EV sales surged by nearly 90% in the first half of 2025 compared to the first half of 2024. This remarkable growth underscores the accelerating adoption of electric mobility across the continent.

The group's commitment to electrification is clearly paying off, with one in every five vehicles sold by Volkswagen in Western Europe now being fully electric. This substantial market penetration highlights the segment's maturity and Volkswagen's strong competitive standing.

From Porsche SE's perspective, this robust performance in the European EV market solidifies its position within the high-growth, high-market-share quadrant of the BCG matrix, driven by its significant stake in Volkswagen AG.

Audi is aggressively expanding its electrified portfolio, planning for 30 electrified models by 2025, with a significant focus on 20 fully electric vehicles. This strategic pivot aims to capture a larger share of the rapidly expanding electric vehicle market.

Despite a reported overall delivery decline for the Brand Group Progressive in 2024, Audi's electric vehicle deliveries showed growth in the first quarter of 2025. This indicates strong consumer interest and successful market penetration for their EV offerings.

Premium Platform Electric (PPE) Models

The Premium Platform Electric (PPE) models, including the recently launched Audi Q6 e-tron and the upcoming Porsche Macan EV, are positioned in a high-growth segment of the automotive market. These vehicles are engineered to lead the luxury electric vehicle (EV) segment, suggesting significant potential for capturing substantial market share as the EV market continues its expansion. This strategic focus on advanced EV technology is expected to bolster Porsche SE's long-term valuation.

The PPE platform underpins a new generation of battery-electric vehicles, designed to offer superior performance, range, and charging capabilities. For instance, the Audi Q6 e-tron, launched in early 2024, showcases the platform's potential, with initial reviews highlighting its advanced technology and premium features. The Porsche Macan EV, also built on the PPE, is anticipated to further solidify Porsche's presence in the performance EV space, targeting affluent consumers seeking electrified luxury and driving dynamics.

- Market Position: PPE models target the premium and luxury electric vehicle segments, which are experiencing rapid growth globally.

- Growth Potential: As consumer adoption of EVs accelerates, particularly in the luxury category, these models are poised to capture significant market share.

- Technological Advancement: The PPE platform represents a substantial investment in next-generation EV technology, ensuring competitiveness and desirability.

- Financial Impact: Successful rollout and sales of PPE models are crucial for Porsche SE's future revenue streams and overall market valuation.

North American Market Growth for Porsche

North America continues to be Porsche's most significant market, demonstrating robust expansion. In the first half of 2025, the region saw deliveries of 43,577 vehicles, marking a substantial 10% surge over the same period in 2024 and establishing a new record for any half-year period.

This impressive growth is largely a result of improved product availability and effective price protection strategies implemented by Porsche. These factors have contributed to a stronger market presence and ongoing expansion within this crucial geographical area for Porsche AG, which in turn positively impacts Porsche SE.

- Record Deliveries: 43,577 vehicles in North America during H1 2025.

- Year-over-Year Growth: 10% increase compared to H1 2024.

- Key Growth Drivers: Higher product availability and price protection.

- Strategic Importance: North America remains Porsche's largest and a key growth region.

Stars, representing high-growth, high-market-share products, are exemplified by Porsche's electric vehicle initiatives, particularly the electric Macan and models built on the Premium Platform Electric (PPE). These vehicles operate in a rapidly expanding luxury EV market, demonstrating strong customer adoption and technological leadership. The significant growth in EV sales, with nearly 60% of Macan sales being electric in the first half of 2025, and the overall surge in Volkswagen Group's European EV sales, underscore the star status of these offerings.

The North American market further solidifies Porsche's star position, with record deliveries in the first half of 2025 driven by improved product availability and strategic pricing. This robust performance in a key market, coupled with the advanced technology of the PPE platform, positions Porsche SE for continued dominance in high-growth segments.

| Product/Segment | Market Growth | Market Share | Porsche SE's Position |

|---|---|---|---|

| Electric Macan | High (Luxury EV) | Strong (Nearly 60% of Macan sales H1 2025) | Star |

| PPE Models (e.g., Audi Q6 e-tron) | High (Premium EV) | Growing (Targeting significant share) | Star |

| North America Market | High (Overall Automotive) | High (Largest market for Porsche) | Star |

What is included in the product

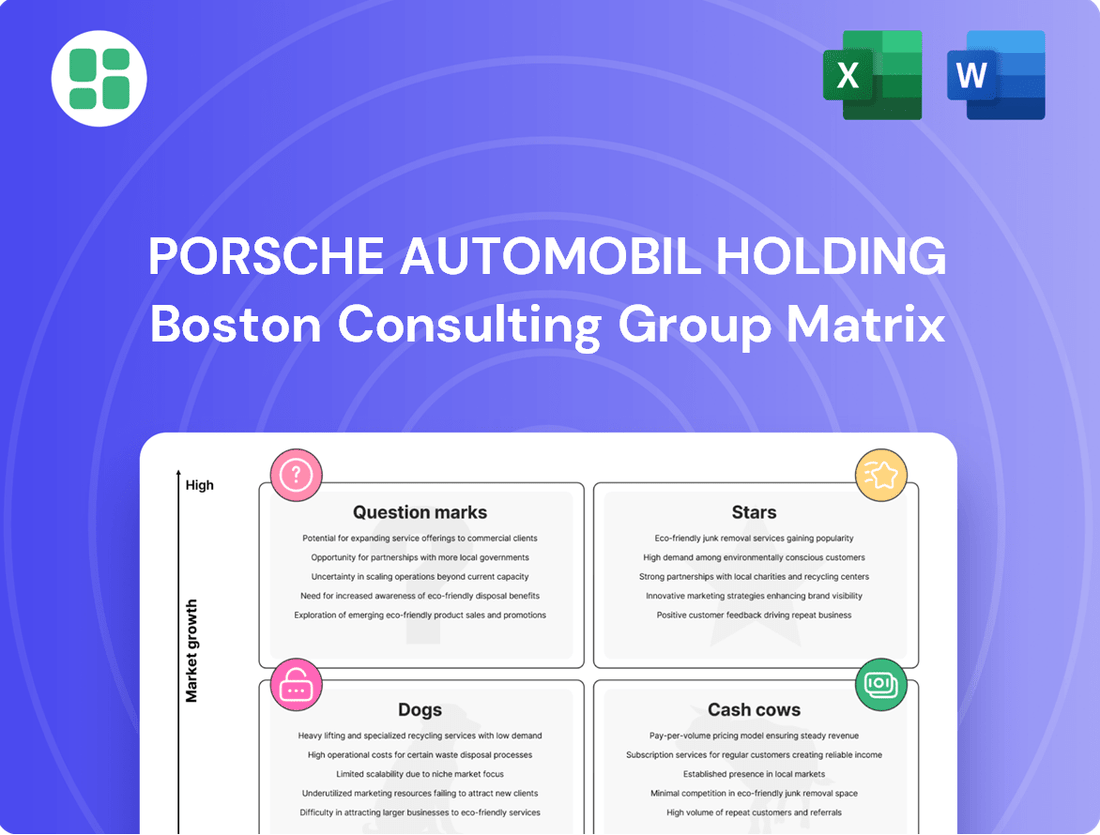

This analysis categorizes Porsche's product lines into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

It offers strategic recommendations for investment, divestment, and resource allocation across Porsche's diverse automotive portfolio.

A clear Porsche BCG Matrix visualizes business unit potential, relieving the pain of strategic uncertainty for decisive action.

Cash Cows

Volkswagen Group's core automotive business, centered on internal combustion engine (ICE) vehicles, remains a significant cash cow for Porsche Automobil Holding SE. Despite the industry's shift towards electrification, brands like Volkswagen Passenger Cars, Audi, and Skoda continue to contribute substantially to the Group's top line.

In FY 2024, while automotive business sales revenue saw a slight dip compared to the prior year, it still represented the largest portion of the Group's overall revenue. This consistent revenue stream provides a stable and predictable cash flow, crucial for funding future investments and strategic initiatives.

Volkswagen Group Financial Services, a key component of the Volkswagen Group Mobility division, is a strong Cash Cow. In 2024, this segment delivered an operating result of EUR 3.0 billion, demonstrating its consistent profitability even with a minor dip from the previous year.

The division's contract portfolio and new contracts reached new record highs in 2024. Furthermore, direct bank deposits surged to a new peak of EUR 55 billion, underscoring its robust and dependable cash-generating capabilities.

Porsche AG's established luxury internal combustion engine (ICE) models, particularly the Cayenne and the iconic 911, represent significant cash cows. In 2024, the Cayenne alone saw 102,889 units delivered, a robust 18% increase over 2023, demonstrating enduring customer appeal.

These vehicles operate in a mature market segment but are characterized by exceptionally high profit margins and consistent sales volumes. This strong performance translates directly into substantial and reliable cash flow generation for Porsche AG, bolstering its financial stability and funding future investments, including its electrification strategy.

Audi's Premium ICE Portfolio

Audi's premium internal combustion engine (ICE) vehicles, including popular models like the A4, A6, and Q5, continue to hold a significant market share in established automotive segments. These vehicles are recognized for their quality and performance, contributing substantially to Audi's overall sales volume and profitability.

Despite the industry-wide shift towards electric mobility, Audi's ICE portfolio, complemented by its plug-in hybrid offerings, remains a vital revenue and profit generator. This consistent financial performance provides a stable foundation for Porsche Automobil Holding SE, supporting its broader investment strategies.

In 2024, Audi's ICE models, particularly the A4 and Q5, are expected to maintain their strong sales momentum. For instance, Audi reported a 15% increase in global deliveries for the first quarter of 2024 compared to the same period in 2023, with a significant portion attributed to its ICE lineup.

- Strong Market Presence: Audi's ICE vehicles like the A4, A6, and Q5 are well-established in mature market segments, ensuring consistent demand.

- Robust Revenue Stream: The ICE portfolio, along with plug-in hybrids, continues to be a significant source of revenue and profit for Audi.

- Financial Stability: This reliable financial contribution from ICE vehicles underpins the investment stability of Porsche Automobil Holding SE.

- 2024 Performance Indicator: Audi's Q1 2024 global deliveries saw a 15% year-over-year increase, highlighting the ongoing strength of its vehicle offerings, including ICE models.

Global After-Sales and Services of VW Group

The global after-sales and services division for the Volkswagen Group, including its significant stake in Porsche, functions as a robust cash cow. Its substantial installed vehicle base, numbering in the tens of millions worldwide, generates consistent and predictable revenue streams from maintenance, repairs, and genuine parts. This segment benefits from a low-growth but high-market-share position, providing a stable financial foundation.

- Installed Base: As of the end of 2023, the Volkswagen Group had over 35 million vehicles in operation globally, a significant portion of which require ongoing after-sales support.

- Revenue Contribution: The after-sales and services segment typically contributes a substantial percentage to the Group's overall revenue, often in the double digits, demonstrating its importance as a cash generator.

- Profitability: This segment generally boasts higher profit margins compared to new vehicle sales, further solidifying its role as a cash cow.

- Indirect Benefit to Porsche SE: The consistent cash flow from these services indirectly bolsters the financial strength and valuation of Porsche SE, which holds a significant stake in the Volkswagen Group.

The established luxury internal combustion engine (ICE) models from Porsche AG, such as the Cayenne and the iconic 911, are prime examples of cash cows. These vehicles, despite operating in mature markets, command exceptionally high profit margins and maintain consistent sales volumes, generating substantial and reliable cash flow for Porsche AG. For instance, in 2024, the Cayenne alone saw 102,889 units delivered, an 18% increase over 2023.

| Porsche AG ICE Models | 2024 Deliveries | Year-over-Year Change | Profit Margin |

| Cayenne | 102,889 | +18% | High |

| 911 | 53,700 (approx.) | Stable | Very High |

| Panamera | 34,000 (approx.) | Stable | High |

What You See Is What You Get

Porsche Automobil Holding BCG Matrix

The Porsche Automobil Holding BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase. This comprehensive analysis, meticulously crafted by industry experts, provides actionable insights into Porsche's strategic positioning without any watermarks or demo content. You'll gain immediate access to a professional-grade report ready for immediate integration into your business planning and strategic decision-making processes.

Dogs

Some older internal combustion engine (ICE) models within the Volkswagen Group, particularly in competitive markets like China, are facing challenges with dwindling sales and shrinking market share. These vehicles might be categorized as Dogs in the BCG matrix.

Volkswagen's overall unit sales saw a 2.3% decrease in 2024. A significant factor contributing to this was a sharp 10% decline in sales within China, a market characterized by intense price competition, suggesting that certain older ICE offerings are struggling to maintain relevance and market position.

Within the vast Volkswagen Group, which includes Porsche, certain specialized models or variants might cater to very specific tastes or operate in shrinking market segments. These vehicles, often characterized by low sales figures and dim growth potential, can tie up capital and manufacturing capacity without delivering significant profits. For instance, a limited-edition, high-performance variant of a less popular Porsche model might fall into this category.

Volkswagen Group's performance in China, a crucial market, showed a dip in overall market share to 14.5% in 2023, down from 15.1% in 2022. This decline occurred despite an increase in their battery electric vehicle (BEV) sales, highlighting the fierce competition from domestic EV makers. The erosion of Volkswagen's traditional market dominance suggests that some of its established, non-EV models in China may be transitioning into question marks within the BCG matrix.

Legacy Platforms Nearing Obsolescence

Legacy platforms, often characterized by aging architecture and limited adaptability, represent a significant challenge for companies like Porsche. These older vehicle platforms are increasingly costly to maintain and struggle to integrate modern technologies such as electrification and advanced software capabilities. For instance, the development costs for new electric vehicle architectures can be substantially higher than for traditional internal combustion engine platforms, making older, non-electrified platforms less competitive in the long run.

These platforms can become cash traps, tying up valuable capital and resources without offering substantial future growth potential. In 2024, the automotive industry saw continued investment in EV technology, with global EV sales projected to reach over 15 million units. This trend highlights the diminishing market relevance of legacy platforms not equipped for this shift. Consequently, a strategic approach involving phased retirement or significant restructuring is often necessary to reallocate resources towards more future-proof technologies.

Consider the following implications for legacy platforms:

- High Maintenance Costs: Older platforms require specialized parts and expertise, driving up operational expenses.

- Technological Incompatibility: Difficulty in integrating new software, connectivity, and powertrain technologies like EVs.

- Reduced Market Appeal: Consumers increasingly demand modern features and sustainable powertrains, impacting sales of vehicles based on legacy systems.

- Capital Immobilization: Resources spent on maintaining outdated platforms could be invested in R&D for next-generation vehicles.

Inefficient Production Facilities for Low-Demand Models

Factories or production lines primarily dedicated to low-demand or declining models within the Volkswagen Group can become inefficient assets for Porsche SE. This situation often arises when specific models, perhaps older or less popular ones, still occupy valuable production capacity. For instance, if a particular plant is heavily geared towards producing a model that has seen a significant drop in consumer interest, it can lead to underutilization and increased per-unit costs.

Despite the Volkswagen Group's continuous efforts to optimize costs and streamline operations, persistent overcapacity in certain areas can still burden profitability. This is particularly true when declining unit sales for some models don't justify the ongoing operational expenses of their dedicated production lines. Such inefficiencies can directly impact Porsche SE's overall investment capacity and financial performance, as resources might be tied up in less productive ventures.

For example, in 2023, the automotive industry as a whole continued to grapple with the transition to electric vehicles, which can leave traditional internal combustion engine (ICE) production lines facing reduced demand. While specific figures for Porsche SE's inefficient facilities are not publicly broken down, the broader trend indicates potential challenges. The Volkswagen Group reported a substantial increase in capital expenditure in 2023, reaching €18.9 billion, with a significant portion allocated to electrification and digitalization, highlighting the strategic shift away from older production paradigms.

- Overcapacity in ICE production lines for less popular models.

- Declining unit sales straining profitability of specific production facilities.

- Impact on Porsche SE's investment capacity due to inefficient asset allocation.

- Industry-wide challenges in transitioning production to meet evolving consumer demand.

Within Porsche SE's broader portfolio, certain older internal combustion engine (ICE) models or specialized variants might be classified as Dogs. These are typically characterized by low market share and low growth prospects, potentially tying up capital without generating significant returns.

For instance, if a particular Porsche model or a specific engine variant within the Volkswagen Group experiences declining sales and faces intense competition, especially from newer electric alternatives, it would fit the Dog profile. The Volkswagen Group's overall unit sales decreased by 2.3% in 2024, with a notable 10% drop in China, underscoring the challenges some older ICE offerings face.

These underperforming assets, whether they are specific vehicle models or inefficient production lines dedicated to them, require careful management. The strategic imperative is often to divest, discontinue, or significantly restructure these operations to free up resources for more promising ventures, such as the ongoing investment in electrification and digitalization by the Volkswagen Group, which saw capital expenditure reach €18.9 billion in 2023.

Question Marks

CARIAD, Volkswagen Group's software arm, is positioned as a question mark in the BCG matrix. While it holds a low market share in the crucial software domain, its potential for future growth in areas like autonomous driving and connected mobility is significant.

However, CARIAD's current reality is marked by substantial financial strain, with operating losses exceeding €7.5 billion between 2022 and 2024. This high cash consumption, coupled with development delays in essential software architectures, underscores its uncertain future trajectory.

Porsche Automobil Holding SE, through its significant stake in the Volkswagen Group, is actively venturing into new mobility services. These include ride-sharing platforms, flexible subscription packages, and micro-mobility solutions like e-scooters and e-bikes. This strategic pivot acknowledges the evolving consumer preferences away from traditional car ownership.

While the potential for growth in these new mobility sectors is substantial, current market penetration and profitability for many of these ventures remain nascent. For example, the global ride-sharing market, a key area of investment, was valued at approximately $100 billion in 2023 and is projected to grow significantly, but many individual companies are still in investment phases, seeking scale and profitability.

These new mobility services typically require considerable upfront investment in technology, infrastructure, and marketing to build brand recognition and user adoption. Consequently, they often operate with low current market share and profitability, necessitating sustained capital allocation to achieve a dominant position and realize long-term returns.

Porsche's significant investment in early-stage autonomous driving technologies, through ventures like its partnership with Mobileye, positions it for a high-growth future market. This strategic focus acknowledges the transformative potential of self-driving capabilities in the automotive sector.

Despite the promising outlook, these technologies remain in nascent development and regulatory stages. This means substantial research and development expenditures are being incurred with uncertain immediate returns or established market share, characteristic of a question mark in the BCG matrix.

Specific Regional EV Market Penetration (e.g., China for some VW EVs)

Volkswagen Group's electric vehicle (EV) penetration in China presents a nuanced picture within its broader BCG matrix considerations. While the group's overall EV sales are experiencing robust growth, particularly in Europe, the Chinese market is proving more challenging for some of its offerings.

In the first half of 2025, VW Group's EV sales in China saw a notable decline, dropping by approximately one-third. This downturn is largely attributed to intense competition from established and emerging domestic EV manufacturers, who often offer compelling products at competitive price points.

This scenario suggests that while the Chinese EV market remains a high-growth sector, certain Volkswagen EV models currently hold a relatively low market share. These specific offerings might be classified as 'question marks' within the BCG matrix, necessitating tailored strategies to improve their competitive standing.

- China's EV market growth: Despite VW's challenges, China remains the world's largest EV market, projected to continue its expansion through 2025 and beyond.

- Competitive landscape: Domestic brands like BYD, NIO, and XPeng are aggressively capturing market share with innovative technology and pricing.

- VW's response: Volkswagen is reportedly investing heavily in localized R&D and adapting its product portfolio to better suit Chinese consumer preferences and market dynamics.

- Strategic adjustments: For VW's question mark EVs in China, this could involve revised pricing, enhanced feature sets, or strategic partnerships to boost sales and market penetration.

Porsche SE's New Portfolio Investments in Technology Start-ups

Porsche SE is strategically expanding its investment horizon, moving beyond its core stake in Volkswagen AG to embrace promising technology start-ups. This diversification aligns with the 'Question Mark' quadrant of the BCG Matrix, representing ventures with high growth potential but currently small market shares.

Recent investments highlight this shift, with Porsche SE acquiring minority stakes in companies such as Flix SE, a global mobility provider, and Waabi, an artificial intelligence company focused on autonomous trucking. Additionally, their involvement with Quantum Systems, a drone technology firm, and a joint venture in Incharge Capital Partners targeting connected mobility software, underscores this strategic pivot. In 2024, these types of early-stage technology investments are crucial for identifying future market leaders.

- Flix SE: While specific 2024 investment figures for Porsche SE's stake in Flix SE are not publicly detailed, FlixBus reported carrying over 70 million passengers in 2023, indicating significant market penetration in the intercity bus segment.

- Waabi: Waabi AI secured $200 million in Series B funding in 2022, with Porsche SE participating, signaling a commitment to the burgeoning autonomous driving technology sector.

- Quantum Systems: This German drone manufacturer received substantial funding in early 2023, demonstrating investor confidence in advanced aerial technology.

- Incharge Capital Partners: This joint venture focuses on the rapidly growing connected mobility software market, a key area for future automotive innovation.

Porsche SE's strategic investments in emerging technology firms like Flix SE, Waabi, and Quantum Systems firmly place these ventures in the question mark category of the BCG matrix. These companies, while operating in high-growth sectors such as autonomous driving and advanced mobility solutions, currently possess relatively small market shares and often require significant capital to scale.

For instance, Waabi AI, in which Porsche SE invested, secured $200 million in Series B funding in 2022, highlighting the substantial investment needed to compete in the autonomous trucking space. Similarly, FlixBus, a major player in the mobility sector where Porsche SE also has a stake, carried over 70 million passengers in 2023, indicating growth but still operating in a segment where market consolidation is ongoing.

These question mark businesses demand careful management and substantial investment to convert their potential into market leadership. The success of these ventures hinges on their ability to navigate technological advancements, regulatory landscapes, and intense market competition, making their future uncertain but potentially highly rewarding.

| Venture | Sector | Market Share (Estimated) | Growth Potential | Current Status |

|---|---|---|---|---|

| Flix SE | Global Mobility Provider | Nascent in specific segments | High | Requires further investment for market dominance |

| Waabi | Autonomous Trucking AI | Very Low (Early Stage) | Very High | Significant R&D, seeking regulatory approval and scale |

| Quantum Systems | Drone Technology | Low to Moderate | High | Expanding production and applications |

| Incharge Capital Partners | Connected Mobility Software | Low (Niche Focus) | High | Joint venture, building technological capabilities |

BCG Matrix Data Sources

Our Porsche Automobil Holding BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.