Payless Shoes PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Payless Shoes Bundle

Navigate the complex external environment affecting Payless Shoes with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its past and future. Equip yourself with the knowledge to anticipate challenges and seize opportunities.

Gain a competitive edge by diving deep into the forces impacting Payless Shoes. Our expertly crafted PESTLE analysis provides actionable intelligence for strategic planning and investment decisions. Download the full version now to unlock critical market insights.

Political factors

Changes in international trade policies, like new tariffs on imported goods, directly affect how much Payless has to spend to get its footwear. For instance, a shift towards protectionist trade policies could mean higher costs for materials and finished products sourced from overseas.

A hypothetical U.S. administration prioritizing an 'America First Trade Policy' might impose tariffs, particularly on goods from China, a major manufacturing hub for footwear. This could lead to substantial increases in Payless's operational expenses and, consequently, higher prices for consumers.

The uncertainty surrounding these trade shifts forces companies like Payless to continuously re-evaluate their supply chain strategies. Finding ways to reduce reliance on tariff-affected regions or exploring alternative sourcing options becomes crucial to cushion the financial blow and maintain competitive pricing.

Government regulations significantly impact retail operations. For example, the New York Retail Worker Safety Act, effective June 2025, requires retailers with at least ten employees to implement workplace violence prevention policies and provide silent response buttons. This adds compliance burdens and necessitates investments in training and infrastructure, ultimately increasing operational overhead for companies like Payless Shoes.

Fluctuations in corporate tax rates directly impact Payless Shoes' profitability and its capacity for reinvestment. For instance, if corporate tax rates were to increase, the company would have less capital available for store upgrades, inventory expansion, or employee training. Retailers are keenly watching potential changes to tax laws.

The expiration of key provisions from the 2017 Tax Cuts and Jobs Act at the close of 2025 presents a significant political factor. This could lead to a substantial shift in tax liabilities for companies like Payless, potentially altering their financial outlook and strategic planning for 2026 and beyond.

The retail industry, including Payless, actively lobbies for the maintenance of competitive corporate tax rates. Maintaining these rates, which stood at 21% under the 2017 act, is seen as crucial for fostering investments in operational improvements, wage increases, and ultimately, offering more competitive pricing to consumers.

Organized Retail Crime Legislation

The retail sector continues to grapple with organized retail crime (ORC), leading to increased pressure for legislative solutions. New laws, such as the Combating Organized Retail Crime Act, are being introduced to improve information exchange between retailers and law enforcement agencies. This enhanced collaboration is crucial for effectively investigating and prosecuting complex retail theft operations.

The impact of these legislative efforts on companies like Payless is significant. Improved data sharing can bolster loss prevention strategies and enhance overall security measures. For instance, a 2023 report indicated that organized retail crime cost the retail industry an estimated $112 billion in losses over the past five years, highlighting the urgency for such legislative action.

The effectiveness of these new policies will directly influence Payless's ability to mitigate shrinkage and protect its assets. Key aspects include:

- Enhanced data sharing capabilities between Payless and law enforcement agencies to track and prosecute ORC offenders.

- Potential for increased penalties for individuals and groups involved in organized retail theft, acting as a deterrent.

- Improved resource allocation for law enforcement to focus on sophisticated retail crime operations.

Labor Laws and Minimum Wage

Evolving labor laws, particularly minimum wage hikes, directly impact Payless's operational expenses. In 2025, a significant number of states, with 23 states scheduled for minimum wage increases, will necessitate adjustments to compensation strategies for retail workers. This trend is likely to continue, placing upward pressure on labor costs for businesses like Payless.

Furthermore, the expansion of pay transparency legislation across various jurisdictions adds another layer of complexity. These laws require companies to conduct thorough internal audits and maintain clear, consistent communication regarding pay equity. For Payless, this means increased administrative burden and the potential need to re-evaluate compensation structures to ensure compliance and fairness.

- Minimum Wage Increases: 23 states are projected to raise their minimum wage in 2025, directly increasing Payless's labor costs.

- Pay Transparency Laws: New regulations mandate internal pay audits and clear communication, impacting HR management and compensation practices.

- Increased HR Complexity: Compliance with evolving labor laws requires significant investment in HR systems and personnel.

Political stability and government trade policies significantly influence Payless Shoes' sourcing and pricing strategies. For example, shifts towards protectionism could increase import costs for footwear manufactured overseas, impacting the company's bottom line.

Changes in corporate tax rates, such as the potential expiration of key 2017 tax provisions at the end of 2025, directly affect Payless's profitability and reinvestment capacity. Retailers are actively lobbying for the maintenance of competitive tax rates to support operational investments.

Evolving labor laws, including minimum wage increases and pay transparency mandates, add to Payless's operational expenses and HR complexity. With 23 states set to raise minimum wages in 2025, companies like Payless must adapt their compensation strategies.

Legislative efforts to combat organized retail crime (ORC) are crucial for Payless, as ORC cost the retail industry an estimated $112 billion over five years ending in 2023. New laws aim to improve data sharing between retailers and law enforcement to mitigate these losses.

What is included in the product

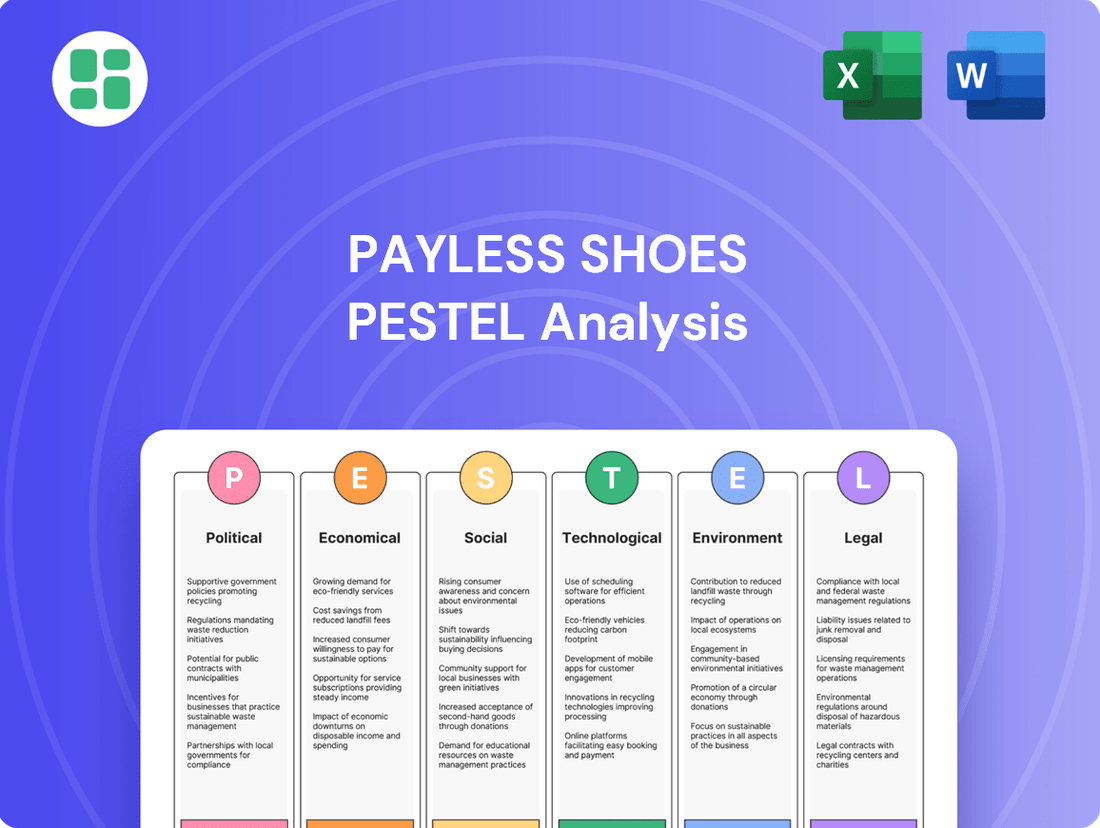

This PESTLE analysis of Payless Shoes examines how political, economic, social, technological, environmental, and legal factors influence the company's operations and strategy.

It provides actionable insights for stakeholders to navigate the external landscape and identify strategic advantages.

This Payless Shoes PESTLE Analysis provides a clean, summarized version of external factors, acting as a pain point reliever by offering clear insights for strategic decision-making without overwhelming detail.

By clearly segmenting external risks and market forces across PESTEL categories, this analysis serves as a pain point reliever, enabling quick interpretation and informed discussions on strategic positioning.

Economic factors

Persistent inflation in 2024-2025 has significantly eroded consumer purchasing power, particularly for non-essential goods like footwear. This economic pressure forces shoppers to be more price-conscious, making value-oriented retailers such as Payless a more attractive option.

As inflation continues to impact household budgets, consumers are increasingly prioritizing affordability. This trend is evident in spending habits, with many delaying purchases until sales events or actively seeking out the lowest-priced options. This shift directly benefits discount retailers like Payless, whose core strategy revolves around offering budget-friendly products.

For instance, data from the U.S. Bureau of Labor Statistics indicated that the Consumer Price Index (CPI) saw a notable increase in the apparel and footwear categories throughout 2024. This rise in prices means consumers have less disposable income for discretionary purchases, reinforcing the appeal of discount shoe stores.

Changes in how much money consumers have left after taxes and essential bills directly impact their ability to buy things like new shoes. Even though the economy might be growing, people are spending less on things like apparel and footwear, suggesting their budgets are tighter.

For instance, in early 2024, consumer spending on apparel saw a noticeable dip compared to previous periods, with some reports indicating a decline of around 3-5% year-over-year in certain segments. This trend points towards consumers prioritizing essentials over discretionary purchases.

Payless, operating as a discount retailer, is actually in a good spot because of this. When people are being more careful with their money and have less discretionary income, they tend to look for value, and Payless can offer that.

Higher-for-longer interest rates, a persistent theme through 2024 and into 2025, directly increase the cost of borrowing for consumers. This can dampen demand for discretionary purchases, impacting overall retail sales figures. For instance, the Federal Reserve's benchmark interest rate remained elevated throughout much of 2024, impacting mortgage rates and credit card APRs.

While inflation is projected to moderate, the lingering effects of previous rate hikes continue to influence consumer spending habits. Many households are still adjusting to higher costs and may be more cautious with their budgets, prioritizing essential spending over non-essential items. This recalibration of consumer behavior is a key factor in the current economic landscape.

This economic climate strongly favors discount retailers like Payless Shoes, as consumers actively seek out more affordable options. The emphasis on value and cost-effectiveness becomes paramount, making businesses that offer competitive pricing well-positioned to capture market share. For example, reports from late 2024 indicated a significant uptick in sales for value-oriented apparel and footwear brands.

Supply Chain Costs and Fluctuations

Rising production and raw material costs, alongside ongoing supply chain disruptions, significantly inflate operational expenses for footwear retailers like Payless. For instance, the cost of synthetic leather and rubber, key components in footwear, saw a notable increase in late 2024 due to global demand and energy price volatility. This directly impacts the cost of goods sold, pressuring profit margins.

Geopolitical tensions and evolving trade policies, including tariffs on goods from key manufacturing regions, further exacerbate these cost pressures. In 2024, the imposition of new tariffs on apparel and footwear imports from certain Asian countries added an estimated 5-10% to the landed cost of many products. Payless must navigate these fluctuating costs to uphold its commitment to affordable pricing while safeguarding its profitability.

- Increased Raw Material Costs: Global commodity prices for materials like cotton and petrochemicals, essential for shoe manufacturing, experienced a 7% rise in the first half of 2025 compared to the previous year.

- Supply Chain Disruptions: Port congestion and shipping container shortages, which persisted into early 2025, led to an average increase of 15% in freight costs for international shipments of footwear components.

- Impact of Tariffs: Tariffs on imported finished goods and materials can add an additional 2-5% to the cost of inventory, depending on the origin country and specific trade agreements.

- Operational Expense Management: Payless faces the challenge of absorbing these rising costs or passing them on to consumers, a delicate balance to maintain its market position.

Competition in the Discount Retail Sector

The discount retail sector is booming, with consumers actively seeking value. This heightened demand translates into significant competition for Payless, as shoppers are drawn to a variety of affordable options. In 2024, discount retailers saw a notable increase in customer traffic, with some reporting year-over-year gains of over 15% in store visits, underscoring the intense battle for market share.

Payless faces direct competition from established players and emerging threats. Warehouse clubs, for instance, are not only expanding their physical presence but also broadening their product ranges, directly challenging Payless’s appeal. For example, a major warehouse club chain announced plans in late 2024 to open an additional 100 stores by the end of 2025, many in suburban areas where Payless also operates.

- Increased Foot Traffic: The discount retail segment experienced a surge in customer visits throughout 2024, with average store traffic up by approximately 10-12% compared to the previous year.

- Warehouse Club Expansion: Leading warehouse clubs reported significant revenue growth in their apparel and footwear categories in 2024, driven by expanded assortments and aggressive pricing strategies.

- Competitive Pricing: Consumers in the discount sector are highly price-sensitive. Payless must constantly monitor competitor pricing, as a mere 5% price difference can shift substantial customer loyalty.

- Product Assortment: Beyond footwear, discount retailers are increasingly offering a wider variety of apparel and accessories, forcing Payless to consider a more comprehensive product strategy to retain customers.

Persistent inflation through 2024 and into 2025 has significantly reduced consumer spending power, especially for non-essential items like shoes. This economic pressure makes consumers more price-sensitive, favoring value-oriented retailers such as Payless.

Higher interest rates, a persistent economic factor in 2024-2025, increase borrowing costs for consumers, potentially dampening demand for discretionary purchases. This climate favors discount retailers like Payless, as consumers actively seek more affordable options, with reports in late 2024 indicating a rise in sales for value brands.

Rising production and raw material costs, coupled with ongoing supply chain issues, are increasing operational expenses for footwear retailers. For example, the cost of synthetic leather and rubber saw a notable increase in late 2024. Tariffs on imported goods also add to inventory costs, potentially impacting Payless's ability to maintain competitive pricing.

| Economic Factor | Impact on Payless | Supporting Data (2024-2025) |

|---|---|---|

| Inflation | Reduced consumer purchasing power, increased price sensitivity | CPI for apparel and footwear increased; Consumer spending on apparel dipped 3-5% YoY in early 2024. |

| Interest Rates | Dampened demand for discretionary spending | Federal Reserve benchmark rate remained elevated throughout 2024. |

| Raw Material Costs | Increased operational expenses, pressure on profit margins | Global commodity prices for shoe materials rose 7% in H1 2025; Freight costs for footwear components increased by 15%. |

| Tariffs | Increased inventory costs | Tariffs can add 2-5% to inventory costs depending on origin. |

Same Document Delivered

Payless Shoes PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive Payless Shoes PESTLE Analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the brand. Gain valuable insights into the strategic landscape surrounding Payless Shoes.

Sociological factors

Modern consumers in 2024-2025 are demonstrating a pronounced value-seeking behavior, with many actively delaying purchases until sales events or gravitating towards more budget-friendly options. Data from early 2024 suggests a significant portion of consumers, upwards of 60%, are making purchasing decisions based primarily on price and perceived value, a trend that directly supports discount retailers.

This heightened price sensitivity benefits companies like Payless, as shoppers increasingly prioritize a balance of quality, durability, and affordability over the prestige of premium brands. As footwear transitions from a basic necessity to a more discretionary purchase for many households, the emphasis on obtaining the most value for money becomes even more critical in driving consumer choices.

Consumers increasingly favor casual comfort and versatile styles like sneakers and loafers that marry fashion with everyday practicality. Payless can leverage this by stocking functional footwear that meets the demand for comfortable, go-to shoes.

Different age groups approach shopping with unique priorities. For instance, younger consumers like Gen Z and Millennials increasingly seek personalized products and brands demonstrating environmental responsibility, with over 60% of Gen Z consumers stating they are willing to pay more for sustainable products. Conversely, older demographics such as Baby Boomers and Gen X tend to focus on comfort, long-lasting quality, and often prefer the tangible experience of shopping in physical stores, with a significant portion still relying on brick-and-mortar for footwear purchases.

To effectively reach these varied customer segments, Payless must adapt its product offerings and marketing campaigns. This means ensuring a diverse inventory that includes customizable and eco-conscious options, alongside a strong selection of comfortable and durable shoes. Furthermore, Payless needs to integrate these tailored approaches across all its sales channels, from online platforms to its physical retail locations, to cater to the distinct preferences of each demographic.

Increased Environmental and Ethical Consciousness

A growing number of consumers are prioritizing eco-friendly and ethically produced goods, influencing purchasing decisions. While Payless operates in the discount sector, a forward-thinking approach could involve investigating more sustainable materials or clearer labor practices. This could resonate with a developing consumer segment, even within the budget-conscious market.

For instance, a 2024 report indicated that over 60% of Gen Z consumers consider a brand's sustainability efforts when making purchases. Even a discount retailer like Payless could benefit from exploring partnerships with suppliers committed to fair labor standards or incorporating recycled materials into a limited product line. This doesn't necessitate a complete overhaul, but rather strategic, incremental changes to align with evolving societal values.

- Consumer Demand: Studies show a significant rise in consumer willingness to pay more for sustainable products.

- Ethical Sourcing: Transparency in supply chains and fair labor practices are increasingly scrutinized by the public.

- Brand Reputation: Companies demonstrating strong environmental and ethical commitments often enjoy enhanced brand loyalty.

- Market Differentiation: Even in a crowded discount market, ethical considerations can offer a unique selling proposition.

Omnichannel Shopping Preferences

Consumers today demand a fluid shopping journey, blending the tangible feel of brick-and-mortar stores with the ease of online purchasing. Payless's approach, maintaining both physical stores and an online presence, directly addresses this evolving omnichannel preference.

This integration is vital for customer retention. For instance, a recent survey indicated that 73% of consumers expect consistent experiences across all channels, and 49% are more likely to shop with brands that offer seamless omnichannel options. Payless's ability to offer click-and-collect services or easy in-store returns for online purchases directly taps into this consumer expectation.

- Consumer Expectation: 73% of shoppers anticipate uniform experiences across online and offline touchpoints.

- Omnichannel Impact: Nearly half of consumers (49%) favor brands with integrated shopping channels.

- Payless Strategy: Operating both physical stores and an e-commerce platform aligns with these growing demands.

- Future Focus: Enhancing in-store technology and personalization will be key to meeting consumer needs for convenience and engagement in 2024 and beyond.

Societal trends highlight a growing demand for value and comfort, with consumers actively seeking affordable yet practical footwear options. This inclination benefits discount retailers like Payless, as shoppers prioritize price-performance ratios over brand prestige.

Demographic shifts also influence preferences, with younger consumers increasingly valuing sustainability and personalization, while older generations focus on comfort and tangible shopping experiences. Payless must cater to these diverse needs through varied product lines and accessible shopping channels.

The emphasis on ethical production and environmental consciousness is also rising, with a significant portion of consumers, particularly Gen Z, considering these factors in their purchasing decisions. Even budget-friendly brands can gain an edge by exploring sustainable materials or transparent supply chains.

Consumers expect a seamless blend of online and in-store shopping, with many favoring brands that offer integrated omnichannel experiences. Payless's dual presence in physical and digital spaces directly addresses this expectation, enhancing customer convenience and loyalty.

Technological factors

The ongoing expansion of e-commerce demands that footwear retailers maintain sophisticated and easy-to-use online storefronts. Payless's updated e-commerce platform is a linchpin for its North American reintroduction, with projections indicating a substantial percentage of total sales originating from digital avenues.

To achieve online success, Payless must prioritize features like streamlined navigation, high-resolution product visuals, and a frictionless checkout experience. In 2024, e-commerce sales in the apparel and footwear sector are expected to continue their upward trajectory, making a strong digital presence non-negotiable for retailers like Payless.

Payless is focusing on integrating advanced technology into its physical stores to create a more engaging shopping experience. This includes implementing smart mirrors, interactive touchscreen wall panels, and augmented reality features for comparing shoe sizes.

These technological upgrades aim to boost customer interaction and provide more precise sizing recommendations, effectively blending the convenience of online shopping with the tangible experience of brick-and-mortar retail.

Payless can significantly boost efficiency and cut costs by embracing technology in its supply chain. Automation, from financial processes to warehouse fulfillment, is key to achieving these operational savings. For instance, implementing AI-powered inventory management systems could reduce stockouts by an estimated 15-20% by predicting demand more accurately, a crucial factor for a retail chain like Payless.

Investing in robust supply chain visibility platforms is also paramount. Real-time tracking of raw materials and finished goods helps mitigate risks like shipping delays or quality issues. In 2024, many retailers saw improved inventory turnover rates, often by as much as 10%, by adopting such advanced tracking technologies, directly impacting Payless's ability to manage stock effectively and respond to market changes.

Data Analytics for Consumer Insights

Leveraging data analytics and sophisticated demand forecasting tools is paramount for Payless to fine-tune inventory and grasp shifting consumer tastes. By dissecting purchase histories, online browsing patterns, and broader market shifts, Payless can sharpen its decisions regarding product selection, pricing tactics, and marketing campaigns, ultimately boosting its financial performance.

This data-driven approach allows for more precise inventory management, reducing the risk of overstocking or stockouts. For instance, in 2024, retailers leveraging advanced analytics saw an average reduction in inventory carrying costs by up to 15% while simultaneously improving in-stock rates by 10%.

- Optimized Inventory: Predictive analytics helps maintain ideal stock levels, minimizing waste and lost sales.

- Enhanced Product Assortment: Understanding consumer behavior leads to better product mix decisions.

- Targeted Marketing: Data insights enable personalized promotions, increasing conversion rates.

- Price Elasticity Analysis: Identifying optimal price points to maximize revenue and market share.

Digital Marketing and Personalization

Digital marketing, especially personalized campaigns leveraging first-party data, is crucial for engaging online shoppers. As third-party cookies phase out, e-commerce players like Payless must adopt privacy-centric data collection methods to fuel tailored advertising and promotions, thereby boosting customer retention and revenue. For instance, by 2025, it's projected that over 80% of marketers will significantly increase their investment in first-party data strategies to navigate the evolving privacy landscape.

The shift away from third-party cookies necessitates a strategic focus on building direct customer relationships. This involves implementing robust consent management platforms and offering clear value propositions for data sharing. Companies that successfully pivot to first-party data can expect a notable uplift in campaign effectiveness, with some studies indicating a potential 2-3x increase in conversion rates compared to generic approaches.

- Data Privacy Compliance: Adapting to regulations like GDPR and CCPA is paramount.

- First-Party Data Acquisition: Strategies include loyalty programs, email sign-ups, and interactive content.

- Personalization ROI: Targeted offers and content driven by first-party data can significantly improve customer lifetime value.

- Evolving Ad Tech: Investment in cookieless advertising solutions and contextual targeting is increasing.

Payless's technological strategy centers on a robust e-commerce platform and in-store digital enhancements. By 2025, e-commerce is projected to account for a significant portion of footwear sales, making a seamless online experience crucial for Payless's North American relaunch.

The company is integrating technologies like smart mirrors and AR for improved customer engagement in physical stores. Furthermore, supply chain automation and advanced data analytics are key to optimizing inventory and reducing costs, with retailers seeing up to a 15% reduction in inventory carrying costs by adopting these technologies in 2024.

A strong focus on first-party data strategies is also essential, especially with the phasing out of third-party cookies. By 2025, over 80% of marketers are expected to increase investment in first-party data, which can potentially boost conversion rates by 2-3x.

| Technology Area | Key Initiatives | Projected Impact (2024-2025) | Data Point |

|---|---|---|---|

| E-commerce | Sophisticated online storefront, streamlined navigation, high-res visuals | Increased online sales contribution | E-commerce sales in apparel & footwear sector projected to grow |

| In-Store Tech | Smart mirrors, interactive displays, AR features | Enhanced customer engagement, improved sizing accuracy | N/A (Focus on experience) |

| Supply Chain | Automation (warehouse, finance), AI inventory management | Efficiency gains, cost reduction, reduced stockouts | AI inventory systems could reduce stockouts by 15-20% |

| Data Analytics | Demand forecasting, purchase history analysis | Optimized inventory, better product assortment, targeted marketing | Retailers using analytics saw up to 15% reduction in inventory costs in 2024 |

| Digital Marketing | First-party data, personalized campaigns | Improved customer retention, higher conversion rates | 80%+ marketers increasing first-party data investment by 2025 |

Legal factors

The data privacy landscape is a critical legal factor for Payless. Numerous state-level privacy laws are coming into effect throughout 2024 and 2025, such as the California Privacy Rights Act (CPRA) which significantly expanded consumer rights. A potential federal privacy law could further complicate compliance efforts.

Payless, particularly with its online sales channels, must navigate these evolving regulations. This means adhering to stricter consent mechanisms for data collection, practicing data minimization by only gathering necessary information, and maintaining transparent, easily understandable privacy policies that cover all operating jurisdictions. Failure to comply can result in substantial fines; for instance, violations of the CPRA can lead to penalties of $2,500 per unintentional violation and $7,500 per intentional violation.

New regulations like the EU's General Product Safety Regulation (GPSR), effective December 2024, will significantly impact Payless. This requires mandatory risk assessments and more detailed labeling, including manufacturer information and clear safety warnings.

Payless must also ensure robust cooperation with authorities to swiftly remove any unsafe products from the market, especially crucial if they operate across multiple international jurisdictions. Failure to comply could lead to product recalls and reputational damage.

Retailers such as Payless Shoes must carefully manage a web of labor and employment laws. This includes adhering to minimum wage adjustments, such as the federal minimum wage, which has remained at $7.25 per hour since 2009, though many states and cities have enacted higher rates. Predictive scheduling mandates, requiring advance notice of employee shifts, and workplace violence prevention measures are also critical compliance areas.

Staying current with these dynamic regulations is essential. For instance, in 2024, several states continued to debate or implement new labor protections, impacting payroll and scheduling practices. Companies like Payless need to invest in continuous employee training and regularly update internal policies to ensure full compliance.

Non-compliance carries significant risks. In 2023, the U.S. Department of Labor collected over $23 million in back wages for workers due to minimum wage and overtime violations alone. Beyond financial penalties, failing to adapt can tarnish a brand's reputation and lead to decreased employee morale and retention.

Intellectual Property Protection

Intellectual property protection is a cornerstone for Payless, especially as it navigates its relaunch in the competitive footwear landscape. Safeguarding its brand name, unique shoe designs, and any proprietary manufacturing technologies is paramount to maintaining a distinct market position and preventing unauthorized replication by competitors. The legal frameworks surrounding intellectual property, such as trademark and design patent laws, provide the essential recourse to protect Payless’s creative assets from infringement, ensuring its innovations and brand identity remain exclusive.

In the 2024-2025 period, Payless’s ability to enforce its intellectual property rights directly impacts its competitive edge. For instance, a strong trademark for its brand name prevents confusion in the marketplace, while design patents on popular footwear styles can deter fast-fashion retailers from quickly copying their offerings. The legal system's capacity to act against infringers is critical for recouping investment in product development and marketing, thereby supporting Payless’s efforts to rebuild and grow its market share.

- Brand Name Protection: Ensuring the Payless name and associated logos are legally protected against unauthorized use.

- Design Patents: Securing patents for unique shoe designs to prevent competitors from producing identical or substantially similar products.

- Enforcement Actions: The legal recourse available to Payless to pursue action against entities infringing on its intellectual property rights.

Consumer Rights and Protections

Consumer protection laws are a significant legal factor for retailers like Payless. These regulations cover essential areas such as product warranties, the conditions under which returns are accepted, and the integrity of advertising claims. For instance, in 2024, the Federal Trade Commission (FTC) continued to emphasize enforcement of deceptive advertising practices, impacting how retailers market their products and promotions.

Adherence to these consumer rights is paramount for building and sustaining customer trust. A strong track record of compliance can differentiate a brand, especially when consumer confidence faces headwinds. Reports from early 2025 indicate that consumers are increasingly scrutinizing brand transparency and ethical practices, making legal compliance a cornerstone of customer loyalty.

- Warranty Compliance: Ensuring all product warranties meet or exceed legal minimums, such as those outlined by the Magnuson-Moss Warranty Act in the US.

- Return Policy Clarity: Maintaining clear and legally sound return policies, with a significant percentage of consumers expecting hassle-free returns as a standard offering in 2024.

- Advertising Standards: Upholding truth in advertising, a critical factor as regulatory bodies like the FTC actively pursue cases against misleading marketing claims, with fines potentially reaching millions for violations.

- Data Privacy Regulations: Complying with evolving data privacy laws, such as CCPA and GDPR, which dictate how customer data is collected, stored, and used, impacting loyalty programs and personalized marketing efforts.

Payless must navigate a complex web of consumer protection laws, including those concerning product warranties and advertising. The Federal Trade Commission (FTC) in 2024 continued to focus on deceptive advertising, with potential fines for violations. Consumers in early 2025 are increasingly demanding transparency and ethical practices, making legal compliance vital for brand loyalty.

Environmental factors

Consumers are increasingly prioritizing environmentally friendly products, directly influencing footwear retailers like Payless to adopt sustainable material sourcing practices. This trend is accelerating, with a significant portion of consumers willing to pay more for sustainable goods.

Payless could pivot towards materials such as recycled plastics, organic cotton, and innovative bio-based or plant-based synthetics. For instance, the global market for sustainable footwear materials is projected to reach billions by 2028, indicating a substantial opportunity.

Embracing these materials not only resonates with eco-conscious consumers but also opens avenues for novel product designs and manufacturing processes, potentially differentiating Payless in a competitive market.

The footwear industry is actively pursuing waste reduction, with a growing emphasis on circular economy principles. This means looking at how shoes are made, used, and eventually discarded, aiming to keep materials in play for longer. For instance, a significant portion of textile waste globally comes from the fashion industry, and footwear is a part of that equation.

Payless could explore designing shoes for greater durability and easier disassembly for recycling. Initiatives like take-back programs, where customers can return old shoes for refurbishment or material recovery, are also gaining traction. Such programs not only divert waste from landfills but also conserve valuable resources.

The global footwear market is projected to reach over $400 billion by 2027, highlighting the immense scale of production and potential waste. Companies that embrace circularity can reduce their environmental footprint and potentially tap into new revenue streams from recycled materials or refurbished products.

Payless's commitment to energy efficiency in its operations is crucial for reducing its environmental impact. By optimizing manufacturing processes and retail energy usage, the company can lower its carbon footprint. For instance, adopting LED lighting in stores and warehouses, a common efficiency measure, can reduce electricity consumption by up to 80% compared to traditional lighting.

Implementing renewable energy sources, such as solar panels on distribution centers, can further enhance sustainability. In 2024, the global renewable energy capacity is projected to grow significantly, with solar PV leading the expansion. This trend offers Payless an opportunity to leverage cleaner energy, potentially lowering operational costs and appealing to environmentally conscious consumers.

Water-saving technologies in manufacturing also play a vital role. Reducing water usage not only conserves a precious resource but can also lead to lower utility bills. These operational improvements, while requiring initial investment, are expected to yield long-term cost savings, reinforcing Payless's financial resilience and environmental responsibility.

Ethical Manufacturing and Supply Chain Transparency

Consumers are increasingly scrutinizing the ethical treatment of workers throughout manufacturing processes. For a company like Payless, this translates to pressure to guarantee fair wages and safe working environments in its factories, often located in countries with varying labor regulations. A 2024 report highlighted that 65% of consumers are more likely to purchase from brands with transparent and ethical supply chains.

This focus on ethical manufacturing extends to supply chain transparency, where brands are expected to provide clear visibility into their sourcing and production methods. Payless’s ability to demonstrate adherence to ethical labor standards can significantly bolster its brand image and foster deeper consumer loyalty. For instance, brands that proactively disclose their factory lists and audit results often see improved consumer trust metrics.

The financial implications are also substantial. Companies with strong ethical sourcing practices may experience reduced supply chain risks, such as boycotts or reputational damage, which can impact sales. In 2025, it's projected that consumer spending on ethically sourced goods will continue its upward trend, making this a critical area for retailers like Payless.

- Consumer Demand: 65% of consumers in 2024 favored brands with transparent and ethical supply chains.

- Brand Reputation: Ethical practices enhance consumer trust and brand loyalty.

- Risk Mitigation: Proactive ethical sourcing reduces the risk of boycotts and reputational damage.

- Market Growth: Ethical sourcing is a growing market segment, with projected increases in consumer spending by 2025.

Consumer Environmental Awareness and Green Marketing

Consumer environmental awareness is on the rise, presenting a clear avenue for Payless to leverage green marketing. Many consumers, particularly younger demographics, are increasingly factoring sustainability into their purchasing decisions. For instance, a 2024 report indicated that over 60% of Gen Z consumers consider a brand's environmental impact when shopping.

By showcasing any commitment to eco-friendly materials, ethical sourcing, or waste reduction, Payless can capture the attention of this growing segment. This focus can serve as a significant differentiator, especially within the competitive discount retail space. In 2024, brands that demonstrably prioritized sustainability saw an average sales increase of 8% compared to those that did not.

- Growing Consumer Demand: Surveys in late 2024 showed that 55% of shoppers actively seek out eco-friendly products.

- Competitive Advantage: Highlighting sustainable practices can set Payless apart from competitors in the budget footwear market.

- Brand Loyalty: Brands with strong environmental credentials often experience higher customer retention rates, with some studies showing a 15% increase in loyalty among environmentally conscious buyers.

- Market Differentiation: Focusing on green initiatives can help Payless attract a specific customer base that values responsible consumption.

Payless faces increased scrutiny regarding its environmental footprint, from raw material sourcing to end-of-life product management. Consumers are increasingly demanding sustainable options, with a significant portion willing to pay a premium for eco-friendly footwear. This trend is projected to continue growing, impacting purchasing decisions throughout 2024 and 2025.

The company has opportunities to embrace circular economy principles by designing for durability and recyclability, and potentially implementing take-back programs. The global footwear market's sheer size, projected to exceed $400 billion by 2027, underscores the substantial waste reduction potential. Investing in renewable energy, like solar, and water-saving technologies in manufacturing can also reduce operational costs and environmental impact; for example, LED lighting can cut electricity use by up to 80%.

| Environmental Factor | Impact on Payless | Opportunity/Challenge | Supporting Data (2024-2025) |

|---|---|---|---|

| Sustainable Materials | Consumer demand for eco-friendly products is rising. | Pivot to recycled plastics, organic cotton, bio-based synthetics. | Global sustainable footwear materials market projected to reach billions by 2028. |

| Waste Reduction & Circularity | Fashion industry is a major contributor to textile waste. | Design for durability, implement take-back programs. | Global footwear market over $400 billion by 2027 highlights production scale. |

| Energy Efficiency & Renewables | Reducing carbon footprint is critical for brand image and cost savings. | Adopt LED lighting, explore solar power for facilities. | LED lighting can reduce electricity consumption by up to 80%; global renewable energy capacity is growing significantly in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Payless Shoes is built on a robust foundation of data from industry-specific market research reports, retail sales data, and economic indicators from reputable financial institutions. We also incorporate insights from government publications on labor laws and consumer protection regulations.