Pan American Silver Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pan American Silver Bundle

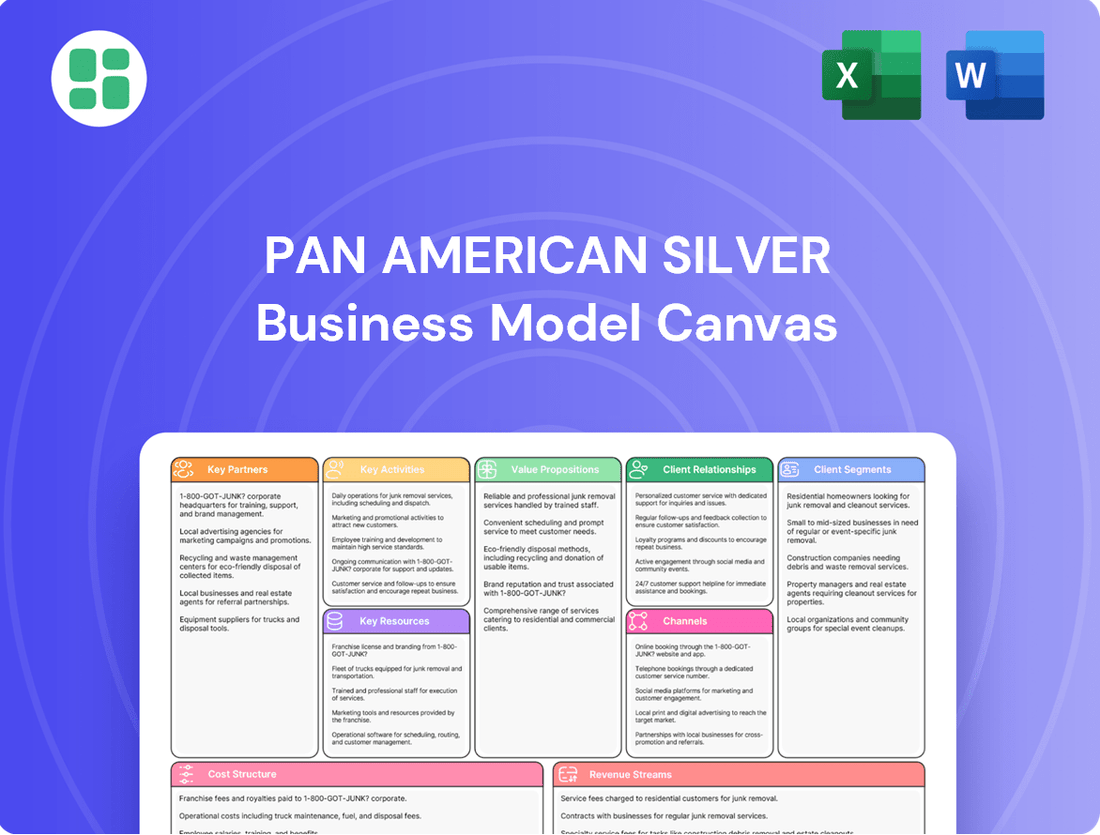

Discover the strategic framework behind Pan American Silver's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how they leverage key resources and partnerships to deliver value and generate revenue in the competitive mining sector.

Unlock the full potential of this analysis by downloading the complete Business Model Canvas. It's an essential tool for anyone looking to understand or replicate Pan American Silver's operational excellence and market position.

Partnerships

Pan American Silver actively collaborates with government agencies and regulators in its operating countries, including Mexico, Peru, Canada, Argentina, and Bolivia. These partnerships are essential for navigating mining laws, environmental standards, and permitting processes, ensuring legal and operational continuity.

In 2024, the company's ability to secure and maintain operating licenses, vital for projects like the Dolores mine in Mexico or the Huaron mine in Peru, hinges on these crucial governmental relationships. This engagement is fundamental for the successful development and ongoing operation of its silver and gold assets.

Pan American Silver prioritizes building and maintaining strong relationships with local communities and Indigenous groups, recognizing this as crucial for its social license to operate. This commitment is demonstrated through ongoing dialogue and targeted community development programs. For instance, in 2024, the company continued its investments in education and infrastructure projects, aiming to foster mutual respect and ensure shared benefits from its mining operations.

Pan American Silver's success hinges on strategic alliances with leading equipment and technology suppliers. These partnerships provide access to cutting-edge mining machinery, advanced processing equipment, and innovative technological solutions crucial for operational excellence. For instance, in 2024, the company continued its focus on modernizing its fleet and processing capabilities, seeking suppliers offering energy-efficient and automated systems to boost productivity and reduce environmental impact.

Financial Institutions and Investors

Pan American Silver relies heavily on financial institutions and investors for its operational and strategic needs. These partnerships are crucial for securing capital for exploration, development, and acquisitions, as well as for managing financial risks.

The company engages with a diverse range of financial partners, including commercial banks for credit facilities and investment funds for equity and debt financing. For instance, in 2024, Pan American Silver continued to leverage its existing credit facilities and explore new avenues for funding its ongoing projects and potential growth opportunities. Strong relationships with institutional investors, such as mutual funds and pension funds, are vital for maintaining market confidence and share liquidity.

Effective investor relations are paramount. Pan American Silver prioritizes transparent communication through its quarterly and annual financial reports, investor presentations, and regular engagement at shareholder meetings. This open dialogue fosters trust and provides the market with the necessary information to assess the company's performance and outlook. In 2023, the company reported a revenue of $1.14 billion, underscoring the financial scale of its operations and the importance of investor backing.

- Capital Funding: Access to credit facilities and equity markets for project financing and corporate initiatives.

- Risk Management: Partnerships for hedging strategies to mitigate the impact of fluctuating silver and gold prices.

- Investor Confidence: Maintaining robust investor relations through transparent reporting and communication to ensure market support.

Joint Venture Partners and Exploration Companies

Pan American Silver strategically engages with other mining and exploration entities through joint ventures. This approach allows for shared risk, pooled expertise, and broadened access to mineral resources. A prime example is the May 2025 agreement to acquire MAG Silver Corp., which includes its 44% stake in the Juanicipio mine. These collaborations are crucial for expediting exploration, improving resource development efficiency, and strengthening the company's market standing.

These partnerships are vital for several reasons:

- Risk Mitigation: Sharing the financial and operational burdens of large-scale mining projects.

- Expertise Leverage: Accessing specialized knowledge and technological capabilities from partners.

- Portfolio Expansion: Gaining access to new exploration targets and mineral reserves.

- Accelerated Development: Speeding up the exploration and production phases through combined resources.

Pan American Silver's key partnerships extend to financial institutions and investors, crucial for securing capital. In 2024, the company continued to utilize its credit facilities and explore new funding avenues for projects. Strong relationships with entities like mutual funds and pension funds are vital for market confidence and share liquidity, as evidenced by their 2023 revenue of $1.14 billion which requires significant financial backing.

| Partnership Type | Key Role | 2024 Focus/Example |

|---|---|---|

| Financial Institutions | Capital Funding, Risk Management | Leveraging credit facilities, exploring new financing for projects. |

| Investors (Institutional) | Investor Confidence, Market Support | Maintaining transparent reporting, engaging at shareholder meetings. |

| Other Mining Entities (Joint Ventures) | Risk Mitigation, Expertise Leverage | Acquisition of MAG Silver Corp.'s stake in Juanicipio mine (May 2025). |

What is included in the product

Pan American Silver's business model focuses on the exploration, development, and mining of silver and gold deposits, serving global industrial and investment customers with a reliable supply of precious metals.

This model is built on strategic mine operations, efficient resource management, and a commitment to sustainable practices, aiming for profitable growth and shareholder value.

Pan American Silver's Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap that simplifies complex operational and financial challenges in the mining sector.

It offers a structured approach to identify and address key issues, making it easier to manage risks and optimize resource allocation.

Activities

Pan American Silver's core activities revolve around discovering and advancing new silver and gold deposits. This involves significant investment in geological exploration, utilizing advanced techniques to pinpoint promising areas. For instance, in 2023, the company reported significant exploration expenditures, focusing on expanding existing resources and identifying new targets across its portfolio.

The company systematically conducts geological surveys and drilling programs to assess the potential of identified mineral deposits. These efforts are crucial for understanding the grade and tonnage of ore bodies. Following successful exploration, Pan American Silver moves into the development phase, which encompasses detailed mine planning, engineering, and the construction of necessary infrastructure to bring a project into production.

Pan American Silver's primary activity is the extraction of silver and gold, along with other base metals like zinc and lead, from its diverse portfolio of mines. These operations are spread across key regions in the Americas, including Mexico, Peru, Canada, Argentina, and Bolivia, showcasing a broad geographical reach.

The company employs both underground and open-pit mining methods, prioritizing efficiency and safety in the removal of valuable ore. For instance, in 2023, Pan American Silver produced approximately 22.7 million ounces of silver and 193,500 ounces of gold, highlighting the scale of their extraction efforts.

Focusing on operational excellence in these extraction processes is crucial for maintaining consistent production levels and upholding rigorous safety standards. This commitment ensures the reliable supply of metals to their processing facilities and ultimately to the market.

Pan American Silver's ore processing and refining is a crucial step, transforming raw ore into valuable commodities. This involves crushing and grinding the ore to liberate the metals, followed by flotation or leaching techniques to concentrate them. In 2023, the company processed approximately 27.6 million tonnes of ore across its operations.

The company's sophisticated processing plants are designed to refine multiple metals, including silver, gold, zinc, lead, and copper. These refined metals are then prepared for sale in global markets, ensuring they meet specific quality standards. For instance, their Dolores mine in Mexico is a significant producer of both silver and gold.

This activity is fundamental to Pan American Silver's ability to generate revenue. The efficiency and effectiveness of their processing and refining operations directly impact the quality and marketability of their final metal products. In the first quarter of 2024, the company reported an average silver price of $22.28 per ounce.

Metal Sales and Marketing

Pan American Silver actively manages the sale and marketing of its diverse metal output, engaging with a global network of industrial consumers, specialized refiners, and commodity traders. This crucial activity underpins the company's revenue generation and its ability to penetrate various markets effectively.

The company's sales and marketing efforts are deeply intertwined with global commodity market dynamics. This includes the strategic management of sales contracts, the complex logistics of metal transportation, and the implementation of pricing strategies that respond to fluctuating market conditions.

In 2024, Pan American Silver's financial performance highlights the importance of these activities. For the first quarter of 2024, the company reported total revenue of $336.7 million, a significant portion of which is directly attributable to its successful sales and marketing operations for silver, gold, zinc, and lead. This demonstrates the direct link between robust sales strategies and financial outcomes.

- Global Buyer Engagement: Pan American Silver cultivates relationships with a broad spectrum of international buyers, ensuring consistent demand for its metals.

- Contract and Logistics Management: Efficient handling of sales contracts and the intricate logistics of metal delivery are paramount to customer satisfaction and operational efficiency.

- Market-Responsive Pricing: The company employs dynamic pricing strategies, closely monitoring and reacting to global commodity market trends to maximize revenue.

- Revenue Generation and Market Penetration: Effective sales and marketing are the primary drivers for generating revenue and expanding the company's market reach for its varied metal portfolio.

Environmental, Social, and Governance (ESG) Management

Pan American Silver's key activities in ESG management focus on environmental stewardship, social impact, and strong governance. This includes implementing advanced water management systems to minimize usage and discharge, alongside efforts to reduce greenhouse gas emissions across its operations. The company actively cultivates positive relationships with local communities, investing in social programs and ensuring fair labor practices.

Ethical supply chain management is another crucial activity, ensuring that all partners adhere to high ESG standards. Pan American Silver's commitment is underscored by its 2024 Sustainability Report, released in May 2025. This report detailed significant progress, such as a 15% reduction in water intensity across its mines compared to 2023 levels and a 5% decrease in Scope 1 and 2 greenhouse gas emissions.

- Sustainable Water Management: Implementing closed-loop systems and advanced treatment technologies to reduce freshwater consumption and discharge.

- Greenhouse Gas Emission Reduction: Investing in renewable energy sources and improving energy efficiency to lower its carbon footprint.

- Community Engagement and Development: Supporting local employment, education, and infrastructure projects to foster mutually beneficial relationships.

- Ethical Supply Chain: Conducting due diligence to ensure suppliers meet stringent environmental, social, and human rights standards.

Pan American Silver's key activities are centered on the entire lifecycle of mineral resource management. This begins with exploration and development, moving through efficient extraction and processing, and culminating in the strategic sale and marketing of its metal products. Integral to these operations is a strong commitment to environmental, social, and governance (ESG) principles, ensuring sustainable and responsible mining practices.

| Key Activity | Description | 2023/2024 Data/Facts |

| Exploration & Development | Discovering and advancing silver and gold deposits. | Significant exploration expenditures in 2023; focus on expanding resources and identifying new targets. |

| Extraction | Mining silver, gold, and base metals. | Produced ~22.7 million oz silver and ~193,500 oz gold in 2023. |

| Processing & Refining | Transforming ore into marketable commodities. | Processed ~27.6 million tonnes of ore in 2023; Dolores mine is a significant producer. |

| Sales & Marketing | Selling refined metals globally. | Q1 2024 revenue of $336.7 million, driven by metal sales. Average silver price in Q1 2024 was $22.28/oz. |

| ESG Management | Ensuring environmental, social, and governance standards. | Reported 15% reduction in water intensity and 5% decrease in Scope 1 & 2 GHG emissions (vs. 2023) in May 2025 report. |

What You See Is What You Get

Business Model Canvas

The Pan American Silver Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or mockup; it represents the complete, ready-to-use analysis of their business strategy. Once your order is processed, you will gain full access to this identical, professionally structured document, allowing you to explore every facet of their operational framework without any alterations or omissions.

Resources

Pan American Silver's most vital asset is its extensive mineral reserves, encompassing silver, gold, zinc, lead, and copper, spread across its mining sites in the Americas. These reserves are the bedrock of the company's current production and its capacity for future expansion.

As of June 30, 2024, the company reported proven and probable silver reserves totaling approximately 468.0 million ounces, underscoring the significant geological wealth that underpins its operations and strategic planning.

Pan American Silver's mining infrastructure encompasses its operational mines, processing plants, and tailings facilities, alongside essential support systems like roads and power. In 2024, the company continued its focus on maintaining and enhancing these physical assets to ensure efficient ore extraction and processing.

The company's commitment to state-of-the-art equipment and processing technology is crucial for optimizing recovery rates and operational efficiency. Investments in these areas directly impact the cost-effectiveness of its mining activities, supporting its production targets.

Pan American Silver relies heavily on its highly skilled workforce, encompassing geologists, mining engineers, metallurgists, and operational experts. This human capital is fundamental to successful exploration, efficient operations, and upholding stringent safety and environmental protocols. For instance, in 2023, the company continued its focus on talent development, with significant investment in training programs for its employees across its various mining sites.

Financial Capital and Liquidity

Pan American Silver's financial capital and liquidity are critical for its business model. Access to substantial financial resources, encompassing cash, credit lines, and equity, underpins the company's ability to fund its day-to-day operations, invest in new exploration, and advance development projects. This robust financial foundation is a key enabler for growth and stability in the mining sector.

As of March 31, 2025, Pan American Silver demonstrated a healthy financial standing, reporting $923.0 million in cash and short-term investments. This significant liquidity provides the flexibility to pursue strategic opportunities, manage market fluctuations, and deliver value to shareholders through various means, including dividends and buybacks.

- Access to Capital: Essential for operations, exploration, and development.

- Liquidity Position: $923.0 million in cash and short-term investments as of March 31, 2025.

- Strategic Flexibility: Supports initiatives and shareholder returns.

Proprietary Technology and Operational Expertise

Pan American Silver's proprietary technology and operational expertise are cornerstones of its business model, enabling efficient and cost-effective mining. This includes specialized techniques for extracting and processing silver and gold, honed over years of experience in diverse geological settings.

Their operational know-how translates into a significant competitive advantage, particularly in managing costs and maximizing resource value. For instance, in 2023, the company achieved an all-in sustaining cost of $13.04 per silver ounce, demonstrating strong operational efficiency.

- Proprietary Extraction Techniques Developed and refined methods for efficient ore recovery.

- Advanced Processing Capabilities Expertise in optimizing metal recovery rates.

- Cost Management Systems Proven strategies for controlling operational expenditures.

- Knowledge Transfer Frameworks Facilitating best practices across all mine sites.

Pan American Silver's key resources include its substantial mineral reserves, advanced mining infrastructure, a skilled workforce, and significant financial capital. The company's proven and probable silver reserves were approximately 468.0 million ounces as of June 30, 2024. These assets are crucial for ongoing production and future growth, supported by continuous investment in technology and operational efficiency.

| Resource Category | Key Assets/Attributes | Data Point (as of latest available) |

|---|---|---|

| Mineral Reserves | Silver, Gold, Zinc, Lead, Copper | 468.0 million ounces silver (proven & probable, as of June 30, 2024) |

| Infrastructure | Operational Mines, Processing Plants, Tailings Facilities | Continued maintenance and enhancement in 2024 |

| Human Capital | Geologists, Engineers, Metallurgists, Operational Experts | Focus on talent development and training in 2023 |

| Financial Capital | Cash, Short-term Investments, Credit Lines | $923.0 million in cash and short-term investments (as of March 31, 2025) |

Value Propositions

Pan American Silver offers a dependable stream of various metals, including silver, gold, zinc, lead, and copper, to customers worldwide. This variety helps stabilize their supply chain, as they aren't overly dependent on just one metal. In 2024, the company continued to leverage its operations across several countries in the Americas to maintain this consistent output.

Pan American Silver's commitment to responsible and sustainable mining is a core value proposition. The company actively works to minimize its environmental footprint and foster positive relationships with the communities where it operates, adhering to stringent ethical standards. This dedication is evident in their 2024 Sustainability Report, which details achievements in reducing water consumption and lowering greenhouse gas emissions, resonating with investors and customers who prioritize environmental, social, and governance (ESG) principles.

Pan American Silver is committed to operational excellence, driving efficient production and maintaining competitive costs for its silver and gold products. This focus directly translates into favorable operating margins, as seen in their consistent efforts to optimize mining processes and control expenditures.

In 2024, the company continued to emphasize cost management, aiming to keep its all-in sustaining costs (AISC) within industry-leading ranges. For instance, their guidance often targets AISC in the low to mid-teens per silver ounce equivalent, a testament to their efficiency.

Proven Track Record and Financial Strength

Pan American Silver boasts over 30 years of operational experience across the Americas, demonstrating a consistent history of successful production and financial management. This extensive track record instills confidence in its stability and future growth potential.

The company's robust financial standing is a key value proposition. As of the first quarter of 2024, Pan American Silver reported approximately $395 million in cash and cash equivalents, alongside substantial undrawn credit facilities, highlighting its liquidity and capacity for strategic investments and operational expansion.

- Proven Operational Excellence: Over three decades of experience in silver mining across the Americas.

- Strong Financial Health: Significant cash reserves and liquidity, evidenced by $395 million in cash and cash equivalents as of Q1 2024.

- Prudent Management: A history of stable financial performance and effective resource management.

- Capacity for Growth: A solid financial foundation that supports continued investment and expansion initiatives.

Strategic Growth through Exploration and Acquisitions

Pan American Silver aims to deliver future value by actively exploring for new mineral deposits, a crucial component of its growth strategy. This proactive exploration is designed to replenish its resource base and identify high-potential opportunities. The company's commitment to expansion is further underscored by its strategic acquisition pipeline.

A prime example of this strategic growth is the planned acquisition of MAG Silver Corp. in 2025. This transaction is projected to significantly boost Pan American Silver's overall silver production. It will also integrate valuable, high-grade, and low-cost assets into its portfolio, reinforcing its long-term value creation objective.

- Exploration Programs: Ongoing exploration efforts are key to discovering new silver deposits and expanding existing ones.

- Acquisition Strategy: Strategic acquisitions are utilized to enhance production, acquire quality assets, and drive growth.

- MAG Silver Acquisition (2025): This planned acquisition is expected to substantially increase silver output and add high-grade, low-cost mineral resources.

- Long-Term Value Creation: Both exploration and acquisitions are integral to Pan American Silver's commitment to building sustainable long-term shareholder value.

Pan American Silver offers a diverse portfolio of precious and base metals, ensuring a stable supply chain for its global customers. This diversification, evident in their 2024 operations across multiple countries in the Americas, mitigates risks associated with single-commodity dependence.

The company prioritizes responsible mining, focusing on minimizing environmental impact and building strong community ties. Their 2024 sustainability efforts, including reduced water usage and lower emissions, align with growing ESG investor demands.

Operational efficiency and cost management are central to Pan American Silver's value. They consistently aim for competitive all-in sustaining costs, often targeting the low to mid-teens per silver ounce equivalent, as indicated in their 2024 guidance.

With over 30 years of experience, Pan American Silver demonstrates a strong track record of successful production and financial management. This deep-rooted expertise provides a foundation of trust and reliability.

Pan American Silver maintains a robust financial position, highlighted by approximately $395 million in cash and cash equivalents as of Q1 2024. This liquidity, coupled with available credit facilities, supports strategic growth and operational continuity.

The company actively pursues growth through exploration and strategic acquisitions. The planned 2025 acquisition of MAG Silver Corp. is a key initiative expected to significantly increase silver production and enhance the quality of its asset base.

| Value Proposition | Description | Supporting Data (2024/2025 Focus) |

|---|---|---|

| Diversified Metal Production | Provides a stable supply of silver, gold, zinc, lead, and copper globally. | Operations across multiple countries in the Americas ensure consistent output. |

| Commitment to Sustainability | Minimizes environmental footprint and fosters positive community relations. | 2024 Sustainability Report details achievements in water reduction and emissions control. |

| Operational Excellence & Cost Management | Drives efficient production and maintains competitive costs. | Targeting all-in sustaining costs in the low to mid-teens per silver ounce equivalent. |

| Proven Track Record | Over 30 years of successful mining operations and financial management in the Americas. | Demonstrated history of stability and growth potential. |

| Strong Financial Health | Maintains high liquidity for strategic investments and operations. | Approximately $395 million in cash and cash equivalents as of Q1 2024. |

| Growth Through Exploration & Acquisition | Actively seeks new deposits and strategic acquisitions to expand its portfolio. | Planned acquisition of MAG Silver Corp. in 2025 to boost silver production and asset quality. |

Customer Relationships

Pan American Silver primarily engages in transactional relationships with its metal buyers, focusing on the straightforward sale of refined silver and gold. These interactions are typically with industrial users, other refiners, and commodity traders who purchase on a spot basis or through short-term contracts. The emphasis is on efficiently fulfilling orders and ensuring the reliable delivery of quality metals at competitive prices.

Pan American Silver actively manages its investor relations by engaging with institutional investors, individual shareholders, and financial analysts. This commitment to transparency is demonstrated through regular quarterly earnings calls and comprehensive annual reports, ensuring stakeholders receive timely financial and operational updates. The company prioritizes building trust and fostering long-term commitment by addressing investor queries and clearly communicating its strategic vision.

Pan American Silver prioritizes strong ties with communities surrounding its mines, recognizing this as vital for its ongoing operations. This commitment is demonstrated through active community engagement and significant investment in social programs designed to foster local well-being and development.

In 2024 alone, the company invested US$20.3 million in various initiatives. These funds directly supported critical areas such as healthcare, education, and economic development, aiming to create lasting positive impacts and address community needs and concerns, particularly regarding environmental stewardship and local progress.

Regulatory Compliance and Government Dialogue

Pan American Silver prioritizes robust relationships with government bodies and regulatory agencies, built on a foundation of strict compliance, transparency, and continuous dialogue. This commitment is crucial for maintaining operational licenses and permits across its diverse mining portfolio.

The company actively engages with these stakeholders to ensure adherence to environmental standards and mining regulations. For instance, in 2024, Pan American Silver reported significant progress in its sustainability initiatives, which directly impacts its regulatory standing and its ability to secure approvals for new projects or expansions.

- Regulatory Adherence: Pan American Silver consistently works to meet or exceed environmental and operational regulations in all jurisdictions where it operates, fostering trust with government entities.

- Proactive Engagement: The company maintains open communication channels with regulators, facilitating smoother project development and mitigating potential operational disruptions.

- Risk Management: By proactively addressing regulatory requirements and engaging in transparent dialogue, Pan American Silver effectively manages regulatory risks, ensuring business continuity.

- Permitting Success: This approach has historically supported the company's success in obtaining and maintaining necessary permits and licenses, vital for its mining operations.

Supply Chain Partnerships and Due Diligence

Pan American Silver cultivates strong relationships with its vast network of suppliers and service providers, crucial for efficient procurement and responsible sourcing. The company actively vets these partners to ensure they meet environmental, social, and governance (ESG) standards.

In 2024, a significant step was taken as Pan American evaluated 264 suppliers utilizing a new, robust due diligence platform. This initiative underscores a commitment to operational continuity and ethical business practices throughout its supply chain.

- Supplier Network: Extensive base of suppliers and service providers.

- Due Diligence: Evaluation against ESG standards.

- 2024 Performance: 264 suppliers assessed via new platform.

- Importance: Essential for operational continuity and responsible business.

Pan American Silver's customer relationships are primarily transactional with metal buyers, focusing on efficient delivery of refined silver and gold. The company also prioritizes robust investor relations, maintaining transparency through regular communications to build trust. Additionally, strong community ties are fostered through significant investments in social programs, as seen with US$20.3 million allocated in 2024 for healthcare, education, and economic development.

| Relationship Type | Key Interactions | 2024 Data/Focus |

|---|---|---|

| Metal Buyers | Transactional sales, spot basis, short-term contracts | Efficient order fulfillment, competitive pricing |

| Investors | Quarterly earnings calls, annual reports, addressing queries | Transparency, building long-term commitment |

| Local Communities | Community engagement, social programs, local development | US$20.3 million invested in healthcare, education, economic development |

Channels

Pan American Silver primarily utilizes direct sales channels to reach its core customer base: large industrial buyers, metal refiners, and specialized traders across the globe. This direct approach is crucial for managing the complexities of selling precious and base metals.

Through these direct relationships, the company can negotiate customized contracts, arrange for bulk deliveries, and directly discuss terms and pricing. This level of direct engagement is vital for ensuring that the specific needs of industrial consumers are met efficiently.

In 2023, Pan American Silver reported total silver sales of 17.5 million ounces, with a significant portion of this volume likely moving through these direct channels to industrial and refining partners.

Pan American Silver leverages major global metal exchanges and commodity markets, such as the London Bullion Market Association (LBMA), for pricing benchmarks and liquidity. These platforms are crucial for ensuring transparent trading and accessing a broad base of buyers for their silver and gold. For instance, the LBMA sets daily fixings that influence global pricing.

While Pan American Silver often engages in direct sales agreements with customers, the pricing and market dynamics for their metals are heavily influenced by the activity on these exchanges. This provides a foundation for fair value discovery, even in customized transactions. The global silver market, for example, saw significant trading volumes in 2024, reflecting the importance of these exchange-driven price discovery mechanisms.

Pan American Silver's official website acts as a crucial hub, delivering essential corporate updates, financial statements, and sustainability reports directly to investors, media, and the general public. It offers a deep dive into their operational footprint, core values, and easy access to contact details.

Digital platforms are key to ensuring that information reaches a broad audience swiftly and efficiently, providing real-time updates on company performance and news. This digital presence is vital for maintaining transparency and broad stakeholder engagement.

Investor Presentations and Financial Reports

Pan American Silver actively engages the financial community through investor presentations and detailed financial reports. These channels are crucial for communicating financial performance, strategic direction, and operational achievements to stakeholders.

Key platforms for this engagement include quarterly earnings calls, which offer real-time updates and Q&A sessions, and comprehensive financial reports filed with regulatory bodies like the SEC. For instance, in their Q1 2024 earnings report, Pan American Silver highlighted a strong operational performance with increased silver production.

- Investor Presentations: These events showcase company strategy, financial results, and growth prospects to a wide audience of investors and analysts.

- Quarterly Earnings Calls: Regular calls provide updates on financial and operational performance, allowing for direct interaction with the investment community.

- Financial Reports: Publicly filed reports (e.g., 10-Q, 10-K) offer detailed financial statements, risk factors, and management discussion, ensuring transparency.

- Accessibility: All these materials are regularly updated and made publicly available on the company's investor relations website, facilitating informed decision-making for current and potential investors.

Industry Conferences and Trade Shows

Pan American Silver actively participates in key industry conferences and trade shows, such as PDAC (Prospectors & Developers Association of Canada) and the Denver Gold Show. This engagement is crucial for showcasing their operational advancements, fostering relationships with industry peers, and attracting potential strategic partners and investors. In 2024, these events served as vital platforms for Pan American Silver to disseminate crucial updates and engage in direct dialogue with the financial community.

These gatherings offer invaluable opportunities for Pan American Silver to gather critical market intelligence, understand emerging trends in the metals sector, and strengthen its brand visibility on a global scale. The company leverages these events for direct investor outreach, providing corporate presentations that highlight its strategic direction and financial performance. For instance, their presence at major 2024 events allowed them to connect with a broad spectrum of stakeholders, from institutional investors to industry analysts.

- Networking and Partnership Opportunities: Facilitates direct engagement with potential collaborators and service providers in the mining ecosystem.

- Market Intelligence Gathering: Provides insights into competitor activities, technological advancements, and evolving market demands.

- Investor Relations and Brand Promotion: Offers a platform for corporate presentations, investor meetings, and reinforcing brand reputation within the mining sector.

- Showcasing Operational Excellence: Allows for the display of technological innovations and operational efficiencies achieved by Pan American Silver.

Pan American Silver's channels are primarily direct sales to industrial buyers and refiners, supplemented by leveraging global metal exchanges for pricing and liquidity. Their investor relations efforts are robust, utilizing digital platforms, investor presentations, and earnings calls to communicate with financial stakeholders. Industry conferences also serve as key touchpoints for networking and market intelligence.

Customer Segments

Industrial manufacturers, including those in electronics, automotive, construction, and chemical sectors, represent a key customer segment for Pan American Silver. These businesses rely on silver, gold, zinc, lead, and copper as essential raw materials for their production lines. For instance, the electronics industry alone consumed approximately 150 million ounces of silver globally in 2023, a significant portion of which is used in components like semiconductors and circuit boards.

These customers have a critical need for a reliable and consistent supply of specific metal grades and predetermined volumes to maintain their operational efficiency. Fluctuations in supply or quality can directly impact their manufacturing output and product quality. The demand from these industrial users is closely tied to broader economic trends, with global GDP growth and advancements in technology, such as the increasing adoption of electric vehicles and renewable energy infrastructure, acting as primary drivers.

Jewelry and silverware producers represent a core customer segment for Pan American Silver. These businesses rely heavily on the consistent supply of high-purity silver and gold to craft their luxury goods. In 2024, the global jewelry market was projected to reach over $280 billion, with a significant portion of that demand directly translating into silver and gold consumption by these manufacturers.

The aesthetic appeal and perceived value of precious metals are paramount for this segment. Manufacturers prioritize metals with minimal impurities to ensure the quality and brilliance of their finished products. Consumer spending, particularly in emerging economies and during festive seasons, directly impacts their purchasing decisions and, consequently, their demand for raw materials from producers like Pan American Silver.

Investment funds, including mutual funds and pension funds, represent a significant customer segment for Pan American Silver. These institutional investors are primarily driven by the pursuit of financial returns, seeking capital appreciation and dividends. In 2024, their investment decisions are heavily influenced by Pan American Silver's demonstrated financial performance, its projected growth trajectory in silver production, and increasingly, its Environmental, Social, and Governance (ESG) credentials.

These large-scale investors play a vital role in supporting Pan American Silver's stock price stability and providing access to substantial capital. Their consistent buying or selling activity can significantly impact market sentiment and liquidity. For instance, a strong quarterly report showing increased production or improved cost efficiencies in 2024 would likely attract more interest from these funds, bolstering the company's market position.

Central Banks and Government Entities

Central banks and government entities are significant players in the precious metals market. They may purchase gold and silver to bolster their monetary reserves, aiming for currency stabilization or strategic stockpiling. For instance, in 2023, central banks globally continued their net purchases of gold, adding 1,037 tonnes, a slight decrease from the record 1,082 tonnes bought in 2022, according to the World Gold Council. While direct sales from these entities to companies like Pan American Silver might be infrequent, their market activities profoundly impact overall demand and price levels.

Their interest in precious metals is intrinsically linked to macroeconomic stability and geopolitical considerations. Fluctuations in global economic conditions and international relations can trigger increased demand from these official sector buyers. For example, heightened geopolitical tensions often lead central banks to increase their gold holdings as a safe-haven asset. This indirect influence means Pan American Silver must monitor global economic indicators and political events closely.

Key considerations for Pan American Silver regarding this customer segment include:

- Monetary Reserve Management: Central banks' decisions to increase or decrease gold and silver holdings directly affect market supply and demand dynamics.

- Currency Stabilization Efforts: The role of precious metals in maintaining currency value can drive purchasing, especially during periods of economic uncertainty.

- Strategic Stockpiling: Governments may acquire metals for national security or long-term economic planning, creating a baseline level of demand.

- Market Influence: Even without direct transactions, the collective actions of central banks significantly shape the price discovery process for silver and gold.

Commodity Traders and Refiners

Commodity traders and refiners are crucial intermediaries. They acquire Pan American Silver's raw or semi-refined metals, transforming them into higher-purity forms or facilitating their movement through commodity markets. These entities play a vital role in market liquidity and price discovery, ensuring efficient access to the broader market for Pan American Silver's products.

- Intermediary Role: Purchase raw materials for processing or trading.

- Value Addition: Refiners increase metal purity, enhancing marketability.

- Market Function: Traders provide liquidity and contribute to price discovery.

- Market Access: Essential for Pan American Silver to reach a wider customer base.

Pan American Silver serves diverse customer segments, including industrial manufacturers in electronics and automotive, jewelry and silverware producers, investment funds, central banks, and commodity traders. Each segment has unique needs, from consistent raw material supply for industrial applications to high-purity metals for luxury goods and financial returns for investors.

Cost Structure

Mining operations costs for Pan American Silver encompass the direct expenses of ore extraction. This includes wages for miners, energy for operations, explosives, and essential consumables such as tires and lubricants. These costs are closely tied to how much is produced, the specific ore body being mined, and the fluctuating prices of raw materials.

For instance, in 2023, Pan American Silver reported total cash costs per silver ounce sold at $12.07. This figure highlights the significant impact of operational expenses on profitability. The company's 2024 guidance anticipates these costs to remain a critical factor in their financial performance, influenced by global energy prices and supply chain dynamics.

Pan American Silver's exploration and development expenditures are significant costs. These cover geological surveys, drilling, and feasibility studies to find and evaluate new mineral deposits, essential for the company's long-term growth. For instance, in 2023, the company reported exploration and evaluation expenditures of $44.5 million, highlighting the ongoing investment in future resource discovery.

Development expenditures represent substantial capital investments. These funds are used to construct new mines, expand current operations, and build critical infrastructure like processing plants and transportation links. These investments are vital for future production capabilities and require considerable upfront and sustained financial commitment.

Pan American Silver dedicates significant resources to environmental compliance and remediation. In 2024, the company continued to invest in meeting stringent environmental regulations, securing necessary permits, and executing comprehensive environmental management strategies across its operations.

Key expenditures included robust tailings management systems and advanced water treatment facilities. These investments are crucial for responsible mining practices and minimizing environmental impact.

Furthermore, the company allocated funds for long-term mine closure planning and site remediation, ensuring a sustainable approach to the entire lifecycle of its mining activities. These costs are essential for maintaining its social license to operate and mitigating potential environmental liabilities.

Capital Expenditures (CapEx) for Projects

Capital expenditures, or CapEx, are crucial for maintaining and growing Pan American Silver's operations. These are investments in assets that will provide benefits for more than one year, like purchasing new mining equipment or upgrading processing facilities. In 2024, Pan American Silver reported total capital expenditures of $372.4 million. This significant investment covers both sustaining capital, which keeps existing operations running smoothly, and project capital, aimed at future growth and efficiency improvements.

These expenditures are vital for several reasons:

- Sustaining Production: CapEx ensures that current mining operations can continue efficiently by replacing worn-out equipment and maintaining infrastructure.

- Improving Efficiency: Investments in new technology or process upgrades can lower operating costs and increase the recovery rates of silver and gold.

- Expanding Capacity: CapEx is also directed towards developing new projects or expanding existing ones, which is key to increasing future production volumes and revenue.

Administrative and Overhead Costs

Administrative and overhead costs for Pan American Silver include essential functions like corporate salaries, office expenses, and legal fees, amounting to a significant portion of their operational budget. These G&A expenses are crucial for maintaining the corporate structure and ensuring compliance, even though they aren't directly linked to the physical mining process.

In 2023, Pan American Silver reported total selling, general and administrative expenses of $134.6 million. This figure highlights the substantial investment in corporate infrastructure and support services necessary to manage a global mining enterprise. Efficient management of these costs is paramount for maximizing overall profitability and shareholder value.

- Corporate Salaries and Benefits: Compensation for executive and administrative staff.

- Office Expenses: Costs associated with maintaining corporate headquarters and regional offices.

- Legal and Regulatory Compliance: Fees for legal counsel and ensuring adherence to mining and financial regulations.

- Investor Relations and CSR: Expenses related to communicating with shareholders and corporate social responsibility programs.

Pan American Silver's cost structure is heavily influenced by its mining operations, encompassing direct extraction expenses like labor, energy, and consumables, with 2023 total cash costs per silver ounce sold reported at $12.07. Significant investments are also made in exploration and development, totaling $44.5 million in 2023 for future resource discovery, alongside substantial capital expenditures of $372.4 million in 2024 for maintaining and expanding operations. Administrative and overhead costs, including $134.6 million in selling, general, and administrative expenses in 2023, are also critical for managing the company's global enterprise.

| Cost Category | 2023 Actuals / 2024 Guidance | Significance |

|---|---|---|

| Mining Operations (Cash Costs) | $12.07/oz (2023) | Direct costs of ore extraction, sensitive to production volume and commodity prices. |

| Exploration & Development | $44.5 million (2023) | Investment in future resource discovery and project evaluation. |

| Capital Expenditures (CapEx) | $372.4 million (2024) | Investments in assets for sustaining and growing production, including equipment and infrastructure. |

| Selling, General & Administrative (SG&A) | $134.6 million (2023) | Costs for corporate functions, management, and compliance. |

Revenue Streams

Pan American Silver's main income source is selling silver. As a major producer, the company earns money by selling the silver it mines. This revenue is calculated by multiplying the amount of silver sold by the current market price of silver.

In the first quarter of 2025, Pan American Silver produced 5.0 million ounces of silver. This production volume directly translates into revenue, underscoring the importance of efficient mining operations and favorable silver prices for the company's financial performance.

Pan American Silver's revenue stream from the sale of gold is significant, often stemming from its production as a co-product or by-product at its various mining operations. This revenue is directly tied to the quantity of gold ounces sold and the prevailing market price of gold, which can fluctuate. In the first quarter of 2025, the company reported gold production of 182.2 thousand ounces, contributing to this vital revenue segment.

Revenue is generated from the sale of zinc, a base metal often extracted alongside silver and gold at Pan American Silver's polymetallic mines. The quantity of zinc sold and its prevailing market price are key drivers of this revenue stream. For instance, the company successfully met its zinc production targets for 2024.

Sale of Lead

Pan American Silver also generates revenue through the sale of lead, a key base metal derived from its diverse mining activities. The income from lead sales is directly tied to production volumes and prevailing market prices, much like its zinc sales.

For 2024, the company successfully met its annual production targets for lead. This consistent output ensures a steady flow of revenue from this commodity, contributing to the overall financial health of the company.

- Lead Sales Contribution: Revenue is generated from the sale of lead, a base metal.

- Market Dependency: Income is influenced by production volume and market price fluctuations.

- 2024 Performance: Pan American Silver achieved its lead production guidance for the year 2024.

Sale of Copper

Sale of copper represents an important, albeit secondary, revenue stream for Pan American Silver. This income is generated from copper extracted as a by-product of its primary silver mining operations, contributing to a more diversified financial profile.

- Diversified Revenue: Copper sales add to the company's overall revenue base, reducing reliance solely on silver prices.

- By-product Contribution: Copper is not the main focus, but its sale still provides a valuable additional income source.

- 2024 Performance: Pan American Silver successfully met its copper production targets for 2024, underscoring the consistent generation of this revenue stream.

Pan American Silver's revenue streams are primarily driven by the sale of precious and base metals. The company's financial performance is closely tied to the market prices and production volumes of silver, gold, zinc, lead, and copper. In the first quarter of 2025, the company reported significant production figures, with 5.0 million ounces of silver and 182.2 thousand ounces of gold. Furthermore, Pan American Silver successfully met its production guidance for lead and copper in 2024, ensuring consistent contributions from these base metal segments.

| Metal | Q1 2025 Production | 2024 Guidance Met |

|---|---|---|

| Silver | 5.0 million ounces | N/A |

| Gold | 182.2 thousand ounces | N/A |

| Zinc | N/A | Yes |

| Lead | N/A | Yes |

| Copper | N/A | Yes |

Business Model Canvas Data Sources

The Pan American Silver Business Model Canvas is informed by a blend of financial disclosures, operational reports, and market intelligence. These sources provide a comprehensive view of the company's revenue streams, cost structures, and key activities.