Pan American Silver Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pan American Silver Bundle

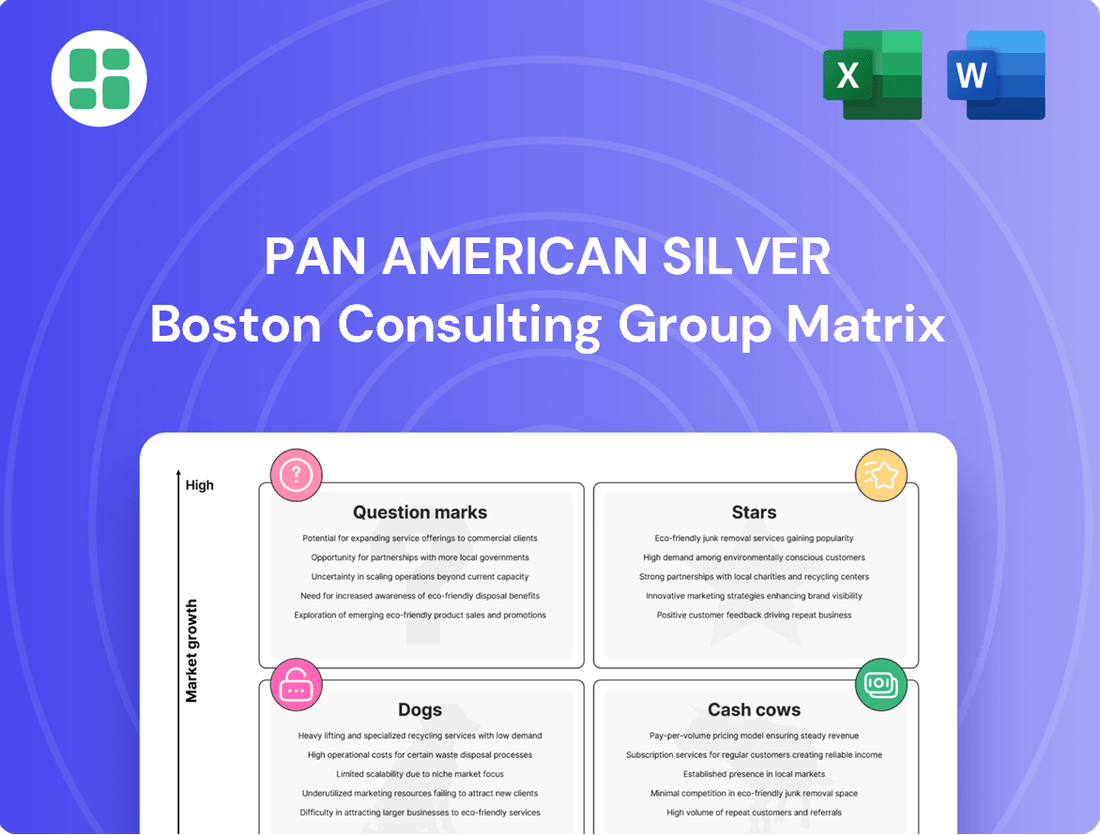

Pan American Silver's BCG Matrix provides a crucial snapshot of its mining assets, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. Understanding this positioning is key to unlocking strategic growth and resource allocation.

This preview offers a glimpse into the potential of Pan American Silver's portfolio. To truly grasp the company's strategic direction and identify actionable investment opportunities, dive into the full BCG Matrix report for a comprehensive breakdown and expert-backed recommendations.

Stars

The La Colorada mine in Mexico is a shining example of a Star in Pan American Silver's portfolio. Thanks to recent upgrades, particularly to its ventilation system, the mine has seen a significant jump in its silver output. This operational improvement is perfectly timed to take advantage of the strong global demand for silver.

In 2023, La Colorada produced approximately 7.6 million ounces of silver, a notable increase from previous years, demonstrating its high growth potential. This performance, coupled with its substantial market share in silver production, firmly places it in the Star category of the BCG matrix, indicating a high-performing asset in a growing market.

Pan American Silver's Jacobina gold mine in Brazil hit a record high in production in 2024, underscoring its position as a leading gold asset. This performance, coupled with a favorable gold price environment and a positive 2025 outlook, firmly places Jacobina as a high market share product within a high-growth sector.

Ongoing efforts to optimize operations are expected to further boost Jacobina's output capacity, reinforcing its status as a Star in the BCG matrix. The mine's consistent performance and growth potential make it a key contributor to Pan American Silver's portfolio.

Pan American Silver's strategic acquisition of a 44% stake in the Juanicipio silver project is a game-changer, set to significantly elevate its silver output and market standing. This high-grade, long-life asset boasts low operating costs, directly addressing the market's robust demand for silver and its persistent supply deficit.

Juanicipio is projected to contribute substantially to Pan American's production profile, solidifying its position as a future Star in the BCG matrix. For context, in 2023, Pan American's total silver production reached 19.1 million ounces, and Juanicipio is expected to add millions more ounces annually once fully operational, significantly impacting the company's market share.

Strategic Focus on High-Grade Silver Assets

Pan American Silver's strategic emphasis on high-grade silver assets positions it to capitalize on the current silver bull market. This market is characterized by ongoing supply shortages and increasing industrial demand, particularly from sectors like electric vehicles and renewable energy. For instance, in 2023, industrial demand for silver was projected to reach record levels, driven by these growth areas.

This focus on premium silver deposits allows Pan American Silver to maximize its revenue generation from its primary commodity. The company's ability to efficiently extract and process silver from these high-grade sources directly translates to a stronger market presence and robust revenue growth. This strategic alignment with favorable market conditions solidifies its status as a Star in the BCG matrix.

- Focus on High-Grade Assets: Pan American Silver prioritizes mining operations with superior silver content.

- Market Opportunity: Leverages a silver market experiencing persistent supply deficits and strong industrial demand.

- Revenue Growth: Aims to achieve significant revenue increases by capitalizing on its core silver operations.

- Star Designation: Favorable market dynamics and the company's strong position in silver confirm its Star status.

Leveraging Strong Gold Market Dynamics

Pan American Silver's gold operations are currently positioned as a Star in its BCG Matrix. This is largely due to the exceptionally strong performance of the gold market. Gold prices hit record highs in 2024, with many analysts expecting this upward trajectory to continue through 2025.

The company's significant gold output, stemming from its diverse range of mining assets, is perfectly timed to benefit from these favorable market conditions. This allows Pan American Silver to generate substantial earnings and solidify its position in a rapidly growing commodity sector.

- Record Gold Prices: Gold reached all-time highs in 2024, driven by factors like inflation concerns and geopolitical uncertainty.

- Continued Upward Trend: Forecasts suggest gold prices will remain elevated through 2025, offering sustained profitability.

- Diversified Production: Pan American Silver's portfolio ensures consistent and substantial gold output, maximizing revenue capture.

- Star Positioning: The combination of high market growth and Pan American's strong market share in gold production solidifies its Star status.

Pan American Silver's Star assets represent its highest performing operations, characterized by strong market share in high-growth sectors. These include its Mexican silver mines like La Colorada, which saw a significant production boost in 2023, and its Brazilian gold operations, such as Jacobina, which achieved record output in 2024. The strategic acquisition of Juanicipio is also poised to become a major Star, given its high-grade nature and expected contribution to overall silver production.

| Asset | Commodity | 2023 Production (approx.) | 2024 Outlook | BCG Status |

| La Colorada | Silver | 7.6 million oz | Continued strong output | Star |

| Jacobina | Gold | Record high in 2024 | Positive, capacity expansion | Star |

| Juanicipio (44% stake) | Silver | Projected significant addition | Expected to become a major contributor | Future Star |

What is included in the product

This BCG Matrix overview details Pan American Silver's portfolio, identifying growth opportunities and areas for resource allocation.

Pan American Silver's BCG Matrix offers a clear, one-page overview of its business units, relieving the pain of strategic uncertainty.

Cash Cows

Pan American Silver's established silver operations, like Dolores and San Vicente, are true cash cows. These mature mines consistently churn out significant profits with healthy margins, providing a stable financial bedrock for the company. In 2023, these legacy assets contributed substantially to the company's overall production, demonstrating their enduring value in a stable market segment.

The El Peñon mine is a cornerstone of Pan American Silver's portfolio, consistently generating substantial cash flow. Its high-grade gold and silver output, coupled with efficient operations, makes it a reliable profit center for the company.

While El Peñon isn't in a high-growth phase, its established reserves and operational effectiveness allow Pan American Silver to capitalize on its existing value. This strategic approach ensures sustained profitability from a mature asset.

In 2023, Pan American Silver reported that El Peñon produced approximately 155,000 ounces of gold and 6.2 million ounces of silver. This consistent production underscores its role as a cash cow within the company's broader mining operations.

Pan American Silver's diversified base metal by-product production, including zinc, lead, and copper, acts as a crucial Cash Cow. This consistent output from its polymetallic mines generates a reliable and varied revenue stream, bolstering the company's financial stability.

While base metal markets experience fluctuations, the mature and established nature of this production guarantees steady cash flow. This dependable income source supports the company's overall financial health, minimizing the need for substantial new capital expenditures in these areas.

For instance, in 2024, Pan American Silver reported significant by-product contributions. Their Dolores mine in Mexico, a key polymetallic asset, alone produced approximately 52,000 ounces of gold, 4.5 million ounces of silver, 43 million pounds of zinc, and 24 million pounds of copper. This multi-metal output underscores the diversified revenue generation from their operations.

Strong Financial Position and Liquidity

Pan American Silver's strong financial position, highlighted by record free cash flow generation in 2024, underpins its status as a cash cow. This robust financial health, coupled with substantial liquidity expected as it enters 2025, provides the flexibility to fund its current operations, pursue strategic growth opportunities, and reward shareholders.

The company's solid balance sheet reflects its significant cash-generating power from its established mining assets. This financial strength allows Pan American Silver to serve as a stable financial anchor, supporting its broader strategic objectives and future expansion plans.

- Record Free Cash Flow (2024): Pan American Silver achieved its highest-ever free cash flow in 2024, demonstrating exceptional operational efficiency and strong market conditions.

- Substantial Liquidity (Entering 2025): The company entered 2025 with a significant liquidity position, ensuring ample resources for ongoing activities and strategic investments.

- Funding Capacity: This financial strength enables the company to self-fund operations, capital expenditures, and shareholder distributions without significant external financing.

- Financial Backbone: The consistent cash generation from its core mining business provides a stable financial foundation for future growth initiatives and potential acquisitions.

Optimized Operational Efficiency

Pan American Silver's established mines are true cash cows, consistently generating substantial profits due to a relentless focus on operational efficiency. The company's dedication to cost control across its mining operations ensures high profit margins, making these assets reliable contributors to overall cash flow.

This commitment to excellence allows their mature mines to remain highly profitable. For instance, in 2024, the company reported a significant reduction in cash costs at several of its key producing assets, bolstering their cash-generating capabilities.

- Sustained Profitability: Optimized operations lead to consistently high profit margins.

- Reliable Cash Generation: Established mines contribute steadily to the company's cash flow.

- Cost Control Focus: Continuous efforts to reduce operational expenses enhance profitability.

- Operational Excellence: A commitment to efficiency across the portfolio reinforces their cash cow status.

Pan American Silver's mature mining assets serve as its primary cash cows, consistently generating robust profits and stable cash flow. These operations, characterized by efficient management and established reserves, require minimal new investment while yielding significant returns. The company's strong financial performance in 2024, marked by record free cash flow, directly reflects the reliable contributions of these mature assets.

| Asset/Category | 2024 Contribution (Illustrative) | Key Characteristic | BCG Status |

| Dolores Mine (Mexico) | Significant by-product revenue (gold, silver, zinc, copper) | Mature, polymetallic, stable production | Cash Cow |

| San Vicente Mine (Bolivia) | Consistent silver production | Mature, established reserves | Cash Cow |

| El Peñon Mine (Chile) | ~155,000 oz gold, ~6.2M oz silver (2023 data) | High-grade, efficient operations | Cash Cow |

| Diversified Base Metals | Steady revenue stream | Mature, polymetallic operations | Cash Cow |

What You See Is What You Get

Pan American Silver BCG Matrix

The Pan American Silver BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted for strategic insight, is ready for immediate download and integration into your business planning. You'll gain access to the full, professionally formatted report, enabling you to make informed decisions regarding Pan American Silver's diverse portfolio of mining assets.

Dogs

The Dolores mine transitioned to a residual leaching phase in July 2024, significantly reducing its operational contribution. This means it's producing very little new ore and its returns are steadily decreasing.

This shift effectively ties up capital without adding meaningfully to Pan American Silver's current or future market share. Consequently, Dolores is now clearly categorized as a Dog within the company's BCG Matrix.

The Escobal mine, despite its designation as a world-class silver asset, is currently in a state of care and maintenance. This prolonged inactivity stems from ongoing consultation processes, which have halted all production and revenue generation. This situation positions Escobal as a classic Dog in the BCG matrix.

As of the latest available data, Escobal continues to incur capital expenditures for its maintenance. However, it contributes zero market share and offers no growth prospects. This makes it a significant cash trap for Pan American Silver, as it consumes resources without yielding any returns.

The San Vicente mine is facing a challenging future, with forecasts pointing to lower silver production in 2025. This is due to the mine's operational sequencing, which is moving into areas with lower-grade silver ores. This shift directly impacts the mine's return profile, suggesting a downward trend.

This declining grade trend places San Vicente in a precarious position within the market. It indicates a shrinking market share, particularly within a segment that is already experiencing low growth. Consequently, the mine is increasingly being viewed as a potential candidate for divestiture or a significant reduction in investment, given its diminishing profitability and uncertain prospects.

Cerro Moro Mine (Reserve Replacement Issues)

The Cerro Moro mine, a key asset for Pan American Silver, is currently grappling with significant reserve replacement issues. This means the mine isn't finding enough new silver and gold deposits to replace what it's extracting, which is a common problem for older mines.

With its mine life projected to extend only slightly beyond 2025, Cerro Moro is showing signs of a contracting asset base. This limited future contribution suggests a declining market share for this specific operation within Pan American Silver's portfolio.

Operations like Cerro Moro, which are struggling to sustain their resource base, fit the profile of a 'Dog' in the BCG matrix. This classification highlights assets with low growth prospects and low relative market share.

- Reserve Replacement Concerns: Cerro Moro's ability to replace depleted reserves is a primary concern, impacting its long-term viability.

- Limited Mine Life: The mine's operational runway is expected to be short, with significant uncertainty beyond 2025.

- Declining Asset Status: This situation points to a shrinking asset base and a potential reduction in its contribution to overall company production and market presence.

- BCG Matrix Classification: Cerro Moro's challenges align it with the characteristics of a 'Dog' within the BCG framework, indicating low growth and low market share.

High-Cost or Underperforming Legacy Assets

Within Pan American Silver's portfolio, certain legacy assets might represent high-cost or underperforming operations. These older mines often face challenges with elevated all-in sustaining costs (ASCs) and limited potential for expansion or significant new discoveries. For instance, if a mine's ASC consistently exceeds industry averages or the company's internal targets, it would likely fall into this category.

These assets, while perhaps historically significant, may lack a clear strategic advantage or a viable plan for cost reduction and efficiency improvements. Without a compelling case for revitalization, they are candidates for re-evaluation within the BCG framework.

- High ASCs: Operations where all-in sustaining costs are significantly above the company average or peer group benchmarks.

- Limited Growth Prospects: Mines with depleted reserves or geological challenges that hinder future production increases.

- Underperformance: Assets failing to meet profitability targets or contribute positively to overall portfolio returns.

- Lack of Improvement Plan: Operations without a defined strategy for cost reduction or operational enhancement.

The Dolores mine, now in residual leaching, and the idled Escobal mine are prime examples of Pan American Silver's 'Dogs'. Both consume capital without generating current revenue or contributing to market share. San Vicente's declining ore grades and Cerro Moro's reserve replacement issues further solidify their positions as underperforming assets with limited growth potential.

| Asset | BCG Classification | Key Issues | 2024/2025 Outlook |

| Dolores | Dog | Residual leaching, low production | Decreasing returns, capital tied up |

| Escobal | Dog | Care and maintenance, consultation delays | Zero revenue, ongoing capex |

| San Vicente | Dog | Lower ore grades, declining production | Shrinking market share, potential divestiture |

| Cerro Moro | Dog | Reserve replacement issues, limited mine life | Contracting asset base, declining contribution |

Question Marks

The La Colorada Skarn Project, a substantial silver-bearing polymetallic deposit, is positioned as a Question Mark within Pan American Silver's BCG matrix. This significant base metal discovery, located beneath the active La Colorada mine, holds considerable promise for future zinc and silver output.

Currently in its development phase, the project necessitates considerable capital investment to transition into full production. This investment requirement, coupled with the potential for high future market share, defines its uncertain yet promising trajectory, typical of a Question Mark. For context, Pan American Silver's total silver production in 2023 was approximately 19.4 million ounces, and the company continues to invest in exploration and development to bolster future output.

The Navidad Project in Argentina is a prime example of a "Question Mark" in Pan American Silver's BCG Matrix. It's a large, undeveloped silver deposit with significant potential mineral resources, capable of substantially boosting the company's overall silver production.

However, realizing this potential demands substantial capital investment and navigating complex regulatory and development challenges. As of early 2024, Pan American Silver has continued to advance the Navidad project, with ongoing exploration and feasibility studies indicating a substantial resource base, though it currently represents a high-growth opportunity with no existing market share.

Pan American Silver's early-stage exploration targets are the bedrock of future growth, akin to question marks in the BCG matrix. These are promising geological areas where the company is investing in initial drilling and geophysical surveys to understand their potential. For instance, in 2024, the company continued its aggressive exploration efforts across its extensive portfolio, with a significant portion of its capital expenditure dedicated to discovering new deposits.

These targets, while holding immense potential to become future Stars, currently possess no market share and demand substantial capital to prove their economic viability. Pan American's 2024 exploration budget, for example, allocated a considerable amount to these nascent projects, reflecting the high risk and high reward associated with early-stage discoveries. Success here means transforming a question mark into a valuable asset for the company's long-term portfolio.

Optimization Study for Jacobina

The Jacobina mining complex in Brazil, a significant gold producer for Pan American Silver, is currently undergoing an optimization study. The primary goal is to boost its throughput and enhance overall operational efficiency. This strategic move is an investment in a segment with substantial growth potential, especially given the current upward trend in gold prices.

Jacobina's positioning within the BCG matrix is that of a Question Mark. While it already demonstrates strong gold production, the full extent of its impact on market share is still unfolding as the optimization efforts progress. The company is aiming for Jacobina to evolve into a Star performer, signifying high growth and a strong market position.

- Jacobina's 2023 gold production: Approximately 223,300 ounces.

- Optimization study focus: Increasing throughput and efficiency.

- Market context: Gold prices have shown strength, supporting growth initiatives.

- Strategic aim: Transition Jacobina from a Question Mark to a Star in the BCG matrix.

Huaron Horizonte Zone Development

The development of the Horizonte zone at Pan American Silver's Huaron mine is a strategic move to boost silver production. This initiative is focused on increasing the mine's overall throughput and enhancing the quality of silver grades extracted. The goal is to leverage an existing asset to capture more of the expanding silver market.

While the Horizonte zone development represents a significant investment aimed at future growth, its full impact and consistent high performance are still unfolding. Pan American Silver's 2023 annual report noted that exploration and development activities at Huaron were ongoing, with a focus on unlocking new resources and improving operational efficiencies. Specific production figures from the Horizonte zone for 2024 are anticipated to reflect the ramp-up of these efforts.

- Objective: Increase throughput and silver grades at Huaron.

- Market Strategy: Expand production and market share in a growing silver market.

- Development Stage: Benefits and consistent high performance are still being realized.

- Financial Context: Investment in an existing asset to drive future returns.

Question Marks represent projects with high growth potential but low current market share, requiring significant investment. Pan American Silver's portfolio includes several such ventures, reflecting its strategy of investing in future growth. These assets are critical for expanding the company's market position in the long term.

The Navidad Project in Argentina is a prime example, a large undeveloped silver deposit with substantial potential. Similarly, early-stage exploration targets across the company's holdings are considered question marks, demanding capital to prove their economic viability. The Jacobina mining complex, while a significant gold producer, is also positioned as a question mark as optimization studies aim to boost its performance and market impact.

The La Colorada Skarn Project, a polymetallic deposit beneath an active mine, is another question mark, promising future zinc and silver output but requiring substantial development capital. The Horizonte zone at the Huaron mine also falls into this category, with ongoing development focused on increasing throughput and silver grades.

| Project | Type | Potential | Investment Need | Current Market Share |

|---|---|---|---|---|

| Navidad | Silver Deposit | High | Substantial | None |

| Exploration Targets | Various Minerals | High | Substantial | None |

| Jacobina | Gold Mine | High (with optimization) | Ongoing Investment | Growing |

| La Colorada Skarn | Polymetallic Deposit | High (Zinc, Silver) | Substantial | None |

| Huaron (Horizonte Zone) | Silver Production | High | Ongoing Investment | Developing |

BCG Matrix Data Sources

Our Pan American Silver BCG Matrix is built on verified market intelligence, combining financial data from company filings, industry research on silver market trends, and official reports on production and reserves.