NorthWestern Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NorthWestern Energy Bundle

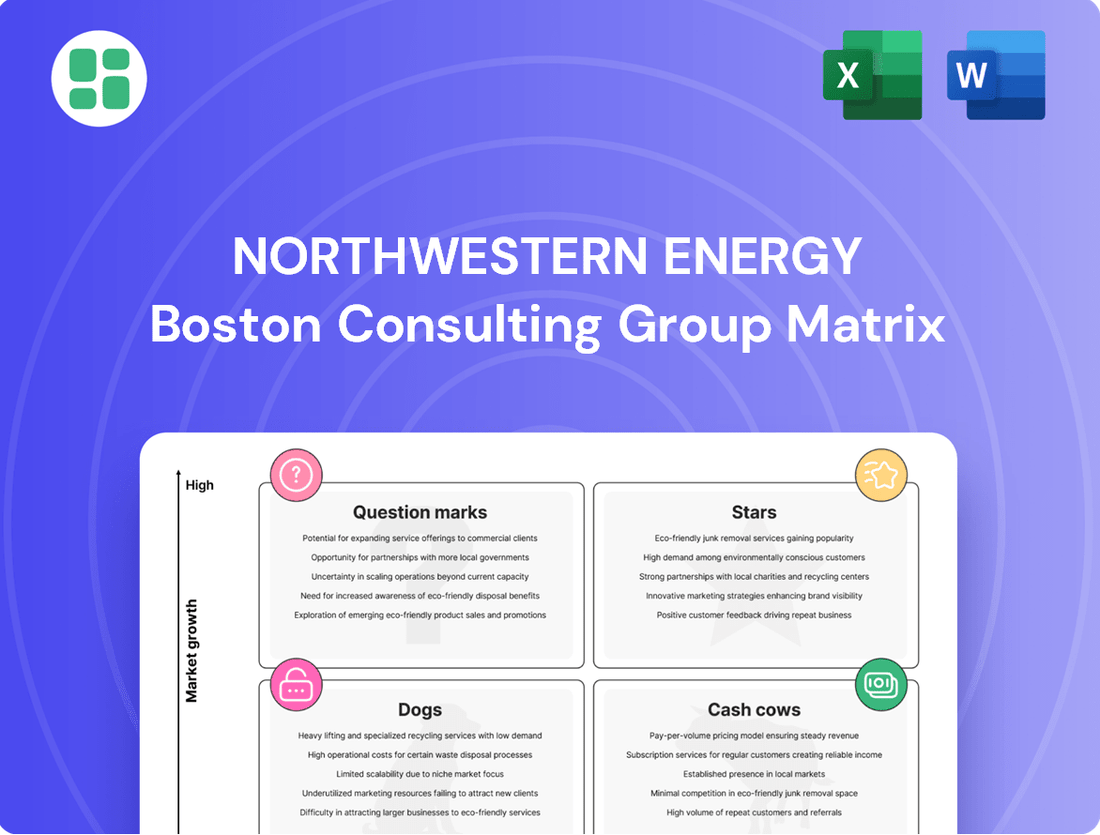

Curious about NorthWestern Energy's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their market dynamics and unlock actionable growth strategies, dive into the full report.

Gain a comprehensive understanding of NorthWestern Energy's portfolio by purchasing the complete BCG Matrix. This detailed analysis provides the critical insights needed to make informed investment decisions and optimize resource allocation for maximum impact.

Stars

NorthWestern Energy is aggressively pursuing renewable energy development, particularly in wind and solar. These are considered Stars in the BCG matrix due to their high growth potential, driven by the industry-wide transition to sustainable energy and rising consumer demand for cleaner power. For instance, in 2024, the company continued significant investments in projects like the Yellowstone Wind Project, aiming to bolster its clean energy capacity.

NorthWestern Energy is heavily investing in modernizing its grid and expanding transmission capabilities, recognizing it as a high-growth area. For instance, their 2023 capital expenditures included significant outlays for transmission and distribution upgrades, a trend expected to continue through 2024 and beyond to support increased demand and renewable integration.

Projects like the North Plains Connector highlight this commitment, aiming to enhance regional energy delivery and reliability. These infrastructure developments are crucial for integrating diverse energy sources and ensuring the grid can handle future energy needs, positioning the company as a key player in the evolving energy landscape.

NorthWestern Energy is experiencing a surge in demand from data centers, a high-growth segment fueled by the expanding digital economy. The company has secured agreements to power new large-load data centers in Montana, with projected energy service loads expected to climb substantially by 2029.

This burgeoning demand positions data centers as a potential star in NorthWestern Energy's portfolio. The company's ability to leverage its existing clean energy assets makes it an attractive partner for this industrial expansion, potentially driving significant revenue growth in the coming years.

Strategic Acquisition of Natural Gas Distribution Assets

NorthWestern Energy's strategic acquisition of Energy West's natural gas distribution assets, serving around 33,000 customers in Montana, positions these assets as a potential Star in the BCG Matrix. This move significantly expands NorthWestern's footprint in a growing natural gas market, enhancing its competitive standing.

The integration, slated for mid-2025, is anticipated to boost future revenue streams and market share. This expansion aligns with a strategy to solidify presence in key service territories.

- Acquisition Details: Energy West natural gas distribution system.

- Customer Impact: Approximately 33,000 new customers in Montana.

- Strategic Significance: Expansion into a growing natural gas market, increasing market share.

- Completion Timeline: Expected mid-2025, contributing to future growth.

Service Territory Population and Economic Growth

NorthWestern Energy's service territories in Montana, South Dakota, and Nebraska are experiencing robust economic development and population increases. This organic growth directly fuels higher demand for electricity and natural gas, positioning these regions as Stars in the BCG matrix for the company.

These growing areas represent significant opportunities for NorthWestern Energy, as they often hold a high, and in many cases, monopolistic market share for essential utility services. The increasing customer base and economic activity translate into predictable revenue streams and expansion potential.

- Montana's population grew by an estimated 1.5% between 2022 and 2023, reaching over 1.15 million residents.

- Nebraska's economy saw a GDP growth of 2.1% in 2023, indicating a healthy business environment.

- South Dakota's unemployment rate remained low at 2.3% as of early 2024, suggesting strong labor market conditions.

NorthWestern Energy's investments in renewable energy projects, such as wind and solar farms, are classified as Stars due to their high growth potential and industry-wide demand for cleaner power. The company's continued commitment to these initiatives, exemplified by ongoing developments in 2024, solidifies their position as key growth drivers.

The modernization and expansion of NorthWestern Energy's transmission and distribution infrastructure are also considered Stars. These upgrades are vital for integrating new renewable sources and meeting increasing energy demands, with substantial capital expenditures allocated to these areas throughout 2023 and anticipated for 2024.

The burgeoning demand from data centers represents another Star opportunity for NorthWestern Energy. Agreements to power new large data centers in Montana are expected to significantly increase energy service loads by 2029, leveraging the company's clean energy assets.

| Business Unit | Market Growth | Company Strength | BCG Classification |

| Renewable Energy Development (Wind & Solar) | High | High | Star |

| Grid Modernization & Transmission Expansion | High | High | Star |

| Data Center Energy Services | High | High | Star |

What is included in the product

This BCG Matrix overview for NorthWestern Energy details strategic recommendations for investing in Stars, holding Cash Cows, developing Question Marks, and divesting Dogs.

A clear visual of NorthWestern Energy's BCG Matrix, categorized by Stars, Cash Cows, Question Marks, and Dogs, alleviates the pain of strategic uncertainty.

Cash Cows

NorthWestern Energy's regulated electricity transmission and distribution business in Montana, South Dakota, and Nebraska is a prime example of a cash cow. This segment enjoys a dominant market position within its service areas, a direct result of its regulated monopoly status.

The stability and predictability of revenue streams from these essential services are a key characteristic. While growth in these mature markets is typically modest, the consistent profitability generated allows NorthWestern Energy to fund other ventures and return value to shareholders. For instance, in 2023, the regulated utility segment represented a significant portion of NorthWestern's overall operating income, underscoring its role as a reliable profit generator.

NorthWestern Energy's established natural gas distribution networks are prime examples of Cash Cows. These mature assets, serving residential, commercial, and industrial customers, consistently generate substantial and dependable cash flow for the company.

The ongoing investment required for growth in these established systems is relatively low. This allows them to be a stable source of funds, contributing significantly to NorthWestern Energy's overall financial health and supporting investments in other business areas.

In 2024, NorthWestern Energy reported that its natural gas distribution segment remained a core contributor to its earnings, highlighting the enduring strength of these mature infrastructure assets.

NorthWestern Energy's hydroelectric generation assets, primarily located in Montana, represent a core component of their business, functioning as significant cash cows. These facilities are a vital source of clean energy, contributing a substantial 28% to the company's total electric generation in 2024.

These hydro assets are characterized by their maturity, reliability, and cost-efficiency. They provide a consistent and stable baseload power supply, generating predictable cash flows with relatively low ongoing investment needs for growth.

Existing Baseload Thermal Generation (Colstrip)

NorthWestern Energy's ownership in the Colstrip coal-fired power plant, a significant asset for its Montana operations, positions it as a cash cow within its business portfolio. Despite environmental concerns, Colstrip offers reliable, 24/7 power generation crucial for meeting customer demand. In 2024, NorthWestern Energy's stake in Colstrip was approximately 40% of Unit 3 and 4, providing a substantial portion of its baseload power.

Colstrip's contribution to NorthWestern Energy's cash flow is significant, even in a market with limited growth prospects for coal generation. The plant's ability to generate power on demand, irrespective of weather conditions, underscores its value in ensuring grid stability. For instance, in 2023, Colstrip units generated a considerable amount of electricity, supporting the energy needs of thousands of homes and businesses across Montana.

- Colstrip's Role: Provides essential, on-demand baseload power for NorthWestern Energy's Montana customers.

- Financial Contribution: Generates substantial, albeit controversial, cash flow despite the low-growth market for coal.

- Ownership Stake: NorthWestern Energy holds a significant ownership percentage in the Colstrip plant, ensuring a consistent supply.

- Reliability Factor: Offers critical grid reliability, operating 24/7 regardless of external environmental factors.

Predictable Regulated Rate Base

NorthWestern Energy's regulated rate base acts as a significant cash cow, leveraging its position as a utility to generate consistent earnings. The company's substantial property, plant, and equipment are the foundation for this predictable revenue stream.

Regular rate reviews by regulatory bodies ensure that NorthWestern Energy can earn an approved return on its investments. This regulatory framework provides a stable and high-market-share segment, allowing for consistent cash generation.

- Predictable Revenue: The regulated nature of its operations allows for a stable and predictable income, a hallmark of a cash cow.

- Strong Market Share: As a utility provider, NorthWestern Energy typically holds a dominant market share in its service territories.

- Asset-Heavy Business: The vast property, plant, and equipment are essential for its operations and form the basis of its regulated rate base.

- Consistent Cash Flow: Approved returns on equity translate into reliable and consistent cash flow for the company.

NorthWestern Energy's regulated electricity transmission and distribution business in Montana, South Dakota, and Nebraska, along with its established natural gas distribution networks, are prime examples of cash cows. These mature segments benefit from regulated monopoly status, ensuring dominant market positions and predictable, stable revenue streams with relatively low investment needs for growth. In 2024, these regulated utility operations continued to be core contributors to the company's earnings, underscoring their role as reliable profit generators.

The hydroelectric generation assets, contributing approximately 28% to the company's total electric generation in 2024, also function as significant cash cows. Their maturity, reliability, and cost-efficiency provide a consistent and stable baseload power supply, generating predictable cash flows with minimal ongoing investment for expansion.

NorthWestern Energy's ownership in the Colstrip coal-fired power plant, representing about 40% of Units 3 and 4 in 2024, also acts as a cash cow. Despite market challenges for coal, Colstrip offers reliable, 24/7 power generation crucial for grid stability and customer demand, contributing significantly to cash flow.

| Business Segment | BCG Category | Key Characteristics | 2024 Data/Relevance |

|---|---|---|---|

| Regulated Electricity Transmission & Distribution (MT, SD, NE) | Cash Cow | Dominant market position, stable/predictable revenue, low growth, low investment needs. | Significant portion of operating income, core earnings contributor. |

| Natural Gas Distribution | Cash Cow | Mature assets, consistent and dependable cash flow, low growth, low investment needs. | Core contributor to earnings, enduring strength of mature infrastructure. |

| Hydroelectric Generation | Cash Cow | Maturity, reliability, cost-efficiency, stable baseload power, predictable cash flow, low investment needs. | Contributed 28% to total electric generation in 2024. |

| Colstrip Power Plant (Ownership Stake) | Cash Cow | Reliable 24/7 power, grid stability, significant cash flow despite low-growth market. | Approx. 40% ownership of Units 3 & 4 in 2024, substantial baseload power. |

What You’re Viewing Is Included

NorthWestern Energy BCG Matrix

The NorthWestern Energy BCG Matrix you are currently previewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive analysis, devoid of watermarks or demo content, is ready for your strategic planning needs. It provides actionable insights into NorthWestern Energy's business units, categorized by market share and growth rate, enabling informed decision-making. You can confidently use this document for internal presentations, competitive analysis, or investment strategies.

Dogs

NorthWestern Energy's older, less efficient thermal generation units, like the Aberdeen 1 diesel plant, are positioned in the Dogs quadrant of the BCG Matrix. These assets saw minimal operational use, with Aberdeen 1 last running in 2022, reflecting their high operating costs and declining reliability.

Their low utilization translates to minimal returns and a shrinking share of the company's energy portfolio. For instance, in 2023, the contribution of such older thermal units to NorthWestern Energy's total generation capacity was notably low, underscoring their diminishing economic viability.

NorthWestern Energy's high-cost or underutilized legacy infrastructure falls into the 'Dogs' category of the BCG Matrix. These are assets like aging power plants or transmission lines that are expensive to maintain and offer little to no growth potential. For instance, in 2024, the company continued to face significant capital expenditures for maintaining older generation facilities, some of which are nearing the end of their operational life and are not strategically aligned with future energy demands.

NorthWestern Energy's underperforming or obsolete technologies, falling into the 'Dogs' category of the BCG Matrix, represent past investments that haven't met expectations. These could include legacy IT systems or specialized equipment that now have a very small market share and little to no growth potential. For instance, if NorthWestern Energy invested heavily in a specific type of renewable energy technology that proved inefficient or was quickly surpassed by newer, more cost-effective options, it would likely be classified here.

These 'Dog' assets, while potentially requiring ongoing maintenance, offer limited future benefit and consume resources that could be better allocated. Consider a scenario where a particular grid modernization technology, initially promising, failed to gain widespread adoption due to integration challenges or high operational costs. By 2024, such a technology might only serve a tiny fraction of the customer base, generating minimal revenue and hindering innovation elsewhere.

Small, Declining Service Areas (if any)

Within NorthWestern Energy's extensive service footprint, there might be a few very small, isolated regions facing persistent population shrinkage or a downturn in local industry. These pockets, if they exist, would represent areas where the cost of maintaining essential infrastructure like power lines and gas pipes is becoming disproportionately high compared to the declining revenue generated from a shrinking customer base. Such segments would inherently possess a low market share and negligible growth prospects, fitting the description of a 'Dog' in a BCG matrix analysis.

Consider a hypothetical scenario where a small, rural town within NorthWestern Energy's territory sees its primary employer, a manufacturing plant, close down. By 2024, this could lead to a significant out-migration, reducing the customer count by, say, 15% year-over-year. If the remaining customer base is too small to justify ongoing capital investments in grid upgrades, these specific service areas would likely be categorized as 'Dogs'.

- Low Market Share: These areas would represent a minimal portion of NorthWestern Energy's overall customer base, likely less than 1% of total customers.

- No Growth: Projections for these specific zones would show negative population growth and stagnant or declining economic activity, indicating no future expansion potential.

- High Maintenance Costs: The expense of maintaining aging infrastructure in these sparsely populated or declining areas could exceed the revenue generated, leading to operational losses.

- Potential Divestment Consideration: While not always the case, such areas might, in the long term, be considered for divestment or consolidation if the costs of continued service become unsustainable.

Unsuccessful Pilot Programs or Non-Core Ventures

Unsuccessful pilot programs or non-core ventures within NorthWestern Energy's portfolio would likely be categorized as Dogs in the BCG Matrix. These are initiatives that have failed to capture significant market share and operate within markets that are not growing, or are even shrinking. For instance, any experimental ventures into unregulated energy markets that did not achieve profitability or scale by 2024 would fit this description.

These ventures represent past strategic bets that did not materialize into sustainable revenue streams. Their low market share and lack of growth potential indicate they are not contributing positively to the company's overall performance. Such projects often require significant capital investment without generating commensurate returns, draining resources that could be allocated to more promising areas.

- Low Market Share: These ventures typically hold a negligible percentage of their respective market.

- Stagnant or Declining Markets: They operate in sectors with little to no growth prospects.

- Resource Drain: Continued investment without a clear path to profitability can hinder growth in core business areas.

- Strategic Review: Such initiatives are often candidates for divestiture or discontinuation to reallocate capital.

NorthWestern Energy's older, less efficient thermal generation units, like the Aberdeen 1 diesel plant, are positioned in the Dogs quadrant of the BCG Matrix. These assets saw minimal operational use, with Aberdeen 1 last running in 2022, reflecting their high operating costs and declining reliability.

Their low utilization translates to minimal returns and a shrinking share of the company's energy portfolio. For instance, in 2023, the contribution of such older thermal units to NorthWestern Energy's total generation capacity was notably low, underscoring their diminishing economic viability.

NorthWestern Energy's high-cost or underutilized legacy infrastructure falls into the 'Dogs' category of the BCG Matrix. These are assets like aging power plants or transmission lines that are expensive to maintain and offer little to no growth potential. For instance, in 2024, the company continued to face significant capital expenditures for maintaining older generation facilities, some of which are nearing the end of their operational life and are not strategically aligned with future energy demands.

These 'Dog' assets, while potentially requiring ongoing maintenance, offer limited future benefit and consume resources that could be better allocated. Consider a scenario where a particular grid modernization technology, initially promising, failed to gain widespread adoption due to integration challenges or high operational costs. By 2024, such a technology might only serve a tiny fraction of the customer base, generating minimal revenue and hindering innovation elsewhere.

| Asset Type | BCG Category | Market Share | Growth Potential | Example |

| Older Thermal Generation | Dog | Very Low | None | Aberdeen 1 Diesel Plant |

| Legacy Infrastructure (Specific Regions) | Dog | Negligible | Negative | Service areas with declining populations |

| Unsuccessful Pilot Programs | Dog | Negligible | None | Non-profitable unregulated market ventures |

Question Marks

Early-stage renewable energy projects, such as the development of new, large-scale solar or wind farms, would be classified as Question Marks in NorthWestern Energy's BCG Matrix. These ventures are in nascent phases, demanding significant upfront capital for land acquisition, permitting, and construction, with their future profitability yet to be solidified.

While the overall renewable energy sector is experiencing robust growth, these individual projects, by definition, have not yet captured substantial market share. For instance, NorthWestern Energy's 2024 Integrated Resource Plan highlights ongoing investments in new renewable capacity, but these projects are still in the construction or pre-construction phases, indicating their early-stage status.

NorthWestern Energy is actively investing in advanced energy storage, particularly large-scale battery systems. While this sector is experiencing rapid technological growth, these solutions currently make up a minor fraction of the company's total energy capacity.

These forward-looking projects demand substantial research, development, and capital investment for scaling. Given the current uncertainties regarding immediate returns, they are positioned as question marks in the BCG matrix, holding the potential to evolve into stars as the technology matures and adoption increases.

If NorthWestern Energy were to heavily invest in carbon capture and storage (CCS) technologies for its thermal plants, these would be considered Stars in a BCG Matrix. The CCS market is emerging with high growth potential, driven by increasing environmental regulations and corporate sustainability goals. For instance, the U.S. Department of Energy has set ambitious targets for CCS deployment, with significant funding allocated through initiatives like the Bipartisan Infrastructure Law, aiming to reduce CO2 emissions by 50% by 2030.

Smart Grid and Advanced Metering Infrastructure (AMI) Rollouts in New Areas

NorthWestern Energy's smart grid and Advanced Metering Infrastructure (AMI) initiatives in new areas, particularly its Montana rollout, are currently positioned as Question Marks within a BCG Matrix framework. The company is striving for 92% completion of its AMI deployment in Montana by the close of 2024. This significant investment in technology is designed to enhance operational efficiency and customer interaction, but its ultimate market penetration and the full realization of its return on investment are still in the nascent stages. The ongoing integration of new functionalities and the gradual customer adoption curve mean that the long-term success and market share dominance of this venture are yet to be definitively established.

The strategic implications of these Question Mark projects are substantial. While the potential for high growth and market leadership exists, there's also a degree of uncertainty regarding the pace of adoption and the competitive landscape that will ultimately shape the success of these smart grid technologies. NorthWestern Energy's commitment to this rollout, with substantial capital expenditure, underscores the belief in its future value, but careful management and strategic adjustments will be crucial to transition these from Question Marks to Stars.

- Montana AMI Rollout Target: 92% completion by end of 2024.

- Strategic Classification: 'Question Mark' due to developing market impact and ROI.

- Key Drivers: Improved efficiency, enhanced customer engagement, integration of new functionalities.

- Future Outlook: Potential for high growth, contingent on adoption rates and technological evolution.

Strategic Acquisitions for Future Growth

NorthWestern Energy's strategic acquisitions for future growth would likely focus on emerging energy sectors with high growth prospects, even if they are currently small in scale. These ventures, akin to 'question marks' in the BCG matrix, demand substantial upfront investment and dedicated strategic execution to capture market share and achieve profitability.

Consider NorthWestern Energy's potential expansion into distributed solar and battery storage solutions. While the current market share might be nascent, the projected growth in renewable energy adoption, driven by favorable policy environments and declining technology costs, presents a significant opportunity. For instance, the U.S. solar market alone saw a record 37 GW of installations in 2023, a trend expected to continue.

These strategic moves necessitate careful market analysis and risk assessment. The company might explore acquiring smaller, innovative companies in these nascent fields or forming strategic partnerships to leverage existing expertise and infrastructure. By investing in these high-potential areas, NorthWestern Energy can position itself for long-term expansion and diversification.

- Acquisition of distributed solar developers: Targeting companies with existing project pipelines and operational expertise in residential and commercial solar installations.

- Partnerships in energy storage technology: Collaborating with or investing in firms developing advanced battery storage solutions to complement renewable generation.

- Geographic expansion into new utility markets: Identifying smaller, underserved regions with a clear need for modernized energy infrastructure and a supportive regulatory framework.

- Investment in grid modernization technologies: Acquiring or partnering with companies specializing in smart grid technologies, demand response, and advanced metering infrastructure.

NorthWestern Energy's investments in emerging technologies, such as its smart grid and Advanced Metering Infrastructure (AMI) rollout in Montana, are currently categorized as Question Marks. While the company aims for 92% completion of its Montana AMI deployment by the end of 2024, the long-term market impact and return on investment are still developing.

These projects represent significant capital outlays with uncertain future market share, making them classic Question Marks. The success hinges on customer adoption and the integration of new functionalities, which are still in their early stages.

The strategic importance lies in the potential for these ventures to become Stars if they gain significant market traction and prove highly profitable. However, the current phase is marked by investment and development rather than established market dominance.

NorthWestern Energy's expansion into distributed solar and battery storage also fits the Question Mark profile, with the U.S. solar market alone installing a record 37 GW in 2023, indicating strong growth potential for these nascent areas.

BCG Matrix Data Sources

Our NorthWestern Energy BCG Matrix is built on comprehensive data, including financial disclosures, market research reports, and industry growth forecasts to provide strategic insights.