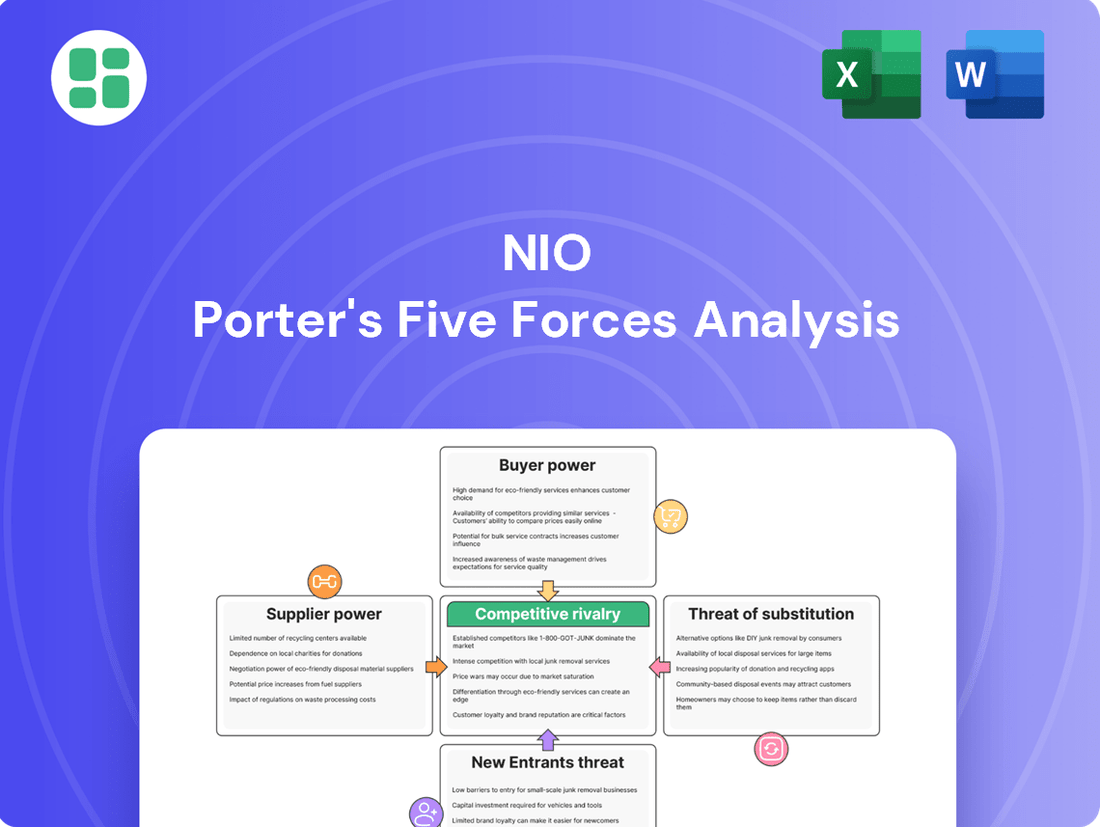

NIO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NIO Bundle

NIO faces intense competition, with significant threats from new entrants and powerful buyers in the burgeoning electric vehicle market. Understanding the bargaining power of suppliers and the constant threat of substitutes is crucial for navigating this dynamic landscape.

The complete report reveals the real forces shaping NIO’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

NIO's reliance on a concentrated group of battery and semiconductor suppliers, such as CATL for batteries, grants these suppliers substantial bargaining power. This concentration means NIO has limited alternatives, allowing suppliers to influence pricing and supply terms. For instance, the global semiconductor shortage in 2021-2022 significantly impacted automotive production, highlighting the leverage these chipmakers held.

The high switching costs associated with integrating new battery or semiconductor technology further solidify supplier power. NIO must invest heavily in R&D and re-tooling to adopt components from different manufacturers, making it difficult and expensive to change suppliers. This dependence can lead to increased component costs for NIO, impacting its overall profitability and competitive pricing strategy.

NIO's reliance on critical raw materials like lithium and nickel, crucial for its electric vehicle batteries, exposes it to significant supplier power. The availability and pricing of these materials are inherently volatile, often influenced by a concentrated group of mining companies and unpredictable geopolitical events. For instance, in early 2024, the price of lithium carbonate experienced fluctuations, impacting battery production costs across the EV sector.

Suppliers possessing proprietary technology, especially in critical areas such as advanced battery chemistries or sophisticated autonomous driving sensors, wield significant bargaining power. NIO's potential dependence on these suppliers for its innovative features can restrict its ability to negotiate favorable terms or explore alternative sourcing options. For instance, in 2023, the global automotive semiconductor market, a key area for advanced components, saw continued supply chain pressures, with lead times for certain chips extending significantly, impacting production costs for automakers.

Switching Costs for NIO

Switching from one major supplier to another presents significant hurdles for NIO. These include the substantial expenses associated with redesigning vehicle components, retooling complex manufacturing lines, and the rigorous process of re-certifying vehicles to meet safety and regulatory standards. These high switching costs inherently limit NIO's operational flexibility.

Consequently, the elevated switching costs empower NIO's current suppliers, bolstering their bargaining position. This situation means suppliers can potentially demand more favorable terms, impacting NIO's cost structure and profitability.

- High Redesign Costs: Modifying vehicle designs to accommodate components from new suppliers can be extremely costly and time-consuming.

- Manufacturing Retooling: Adapting production lines for different parts requires significant capital investment and potential downtime.

- Certification and Testing: Ensuring new components meet all regulatory and performance standards involves extensive and expensive testing phases.

- Supplier Dependence: For critical components like batteries or advanced driver-assistance systems, NIO may rely on a limited number of specialized suppliers, further concentrating power.

Limited Threat of Forward Integration by Suppliers

The threat of battery suppliers, a critical component for NIO, integrating forward into vehicle production is generally limited. The immense capital requirements and intricate manufacturing processes involved in creating electric vehicles present a substantial barrier to entry for most suppliers. This complexity means that widespread, direct competition from battery manufacturers entering the EV market is not an immediate concern for NIO.

While direct forward integration by suppliers is constrained, the landscape can shift. Strategic collaborations between battery manufacturers and NIO's competitors could indirectly bolster supplier leverage. For instance, if a major battery supplier forms an exclusive or preferential partnership with another EV maker, it could reduce the availability or increase the cost of critical battery technology for NIO, thereby enhancing the supplier's bargaining power.

- Limited Forward Integration: The high capital expenditure and complexity of EV manufacturing deter most battery suppliers from directly entering vehicle production, mitigating a direct competitive threat to NIO.

- Strategic Alliances: Partnerships between battery suppliers and rival EV manufacturers can indirectly increase supplier power by potentially limiting NIO's access to key technologies or favorable terms.

- Indirect Impact: While direct competition from suppliers is low, their ability to influence the market through strategic alliances with other automakers remains a factor in their overall bargaining power.

NIO faces significant bargaining power from its suppliers, particularly for essential components like batteries and semiconductors. This power stems from the concentrated nature of the supplier market and high switching costs for NIO. For example, in 2023, the automotive semiconductor market experienced continued supply chain pressures, with extended lead times for certain chips, impacting production costs for automakers like NIO.

The reliance on a few key battery manufacturers, such as CATL, means these suppliers can dictate terms. Switching to a new battery supplier involves substantial costs for redesign, retooling, and recertification, which can take years and millions of dollars. This makes it difficult for NIO to negotiate lower prices or secure more favorable supply agreements.

NIO's dependence on critical raw materials like lithium also plays a role. In early 2024, lithium carbonate prices saw volatility, directly affecting battery production expenses for EV makers. This price fluctuation, often driven by a small number of mining companies, further amplifies supplier leverage over NIO's cost structure.

| Supplier Type | Key Suppliers | Impact on NIO | Relevant Data (2023-2024) |

| Batteries | CATL, CALB | High pricing power, potential supply constraints | Lithium carbonate prices fluctuated significantly in early 2024. |

| Semiconductors | Various global chipmakers | Risk of production delays and increased component costs | Extended lead times for certain automotive chips persisted through 2023. |

| Raw Materials | Lithium, Nickel mining companies | Exposure to price volatility and supply chain disruptions | Global demand for battery metals remained strong, impacting raw material costs. |

What is included in the product

This analysis unpacks the competitive forces shaping NIO's market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the electric vehicle sector.

Quickly identify and address competitive threats with a visual breakdown of each Porter's Five Forces, making strategic adjustments effortless.

Customers Bargaining Power

The Chinese electric vehicle (EV) market is a battleground for pricing, with intense competition driving down costs. For instance, BYD, a major player, has been actively implementing significant price reductions across its model range. This aggressive pricing strategy by competitors directly impacts customer behavior, making them highly attuned to price differences.

This heightened price sensitivity forces companies like NIO, even those with a premium brand image, to consider more competitive pricing or offer attractive promotions. Such actions, while necessary to attract and retain customers in this environment, can put considerable pressure on NIO's profit margins. It's a delicate balancing act to maintain brand value while remaining price-competitive.

The sheer number of electric vehicle (EV) options available significantly boosts customer bargaining power. Consumers can readily compare and switch between brands like Tesla, BYD, XPeng, Li Auto, and even newcomers like Xiaomi, if NIO's pricing or product features don't meet their expectations.

For many electric vehicle (EV) features, the direct cost for a customer to switch from one brand to another is minimal after the initial purchase. This generally keeps customer bargaining power high.

However, NIO's innovative Battery as a Service (BaaS) model and its expansive network of power swap stations create a degree of customer loyalty. Customers invested in this ecosystem, which includes battery swapping and charging solutions, may find it less convenient to switch, thereby slightly mitigating their bargaining power.

Informed Customer Base

The bargaining power of customers is significantly amplified by an increasingly informed customer base, particularly within the electric vehicle (EV) market. Buyers, especially those considering premium models like those offered by NIO, are often highly educated on vehicle specifications, the latest technological innovations, and competitive pricing across various manufacturers. This deep understanding allows them to meticulously compare options, directly influencing their purchasing decisions and compelling NIO to maintain a high standard of innovation and deliver exceptional value to remain competitive.

This informed consumer segment actively leverages their knowledge to negotiate better terms and demand superior features. For instance, by early 2024, the global EV market saw a surge in new model introductions, providing consumers with a wider array of choices and increasing their leverage. NIO's ability to attract and retain customers hinges on its capacity to meet these sophisticated expectations, demonstrating clear technological advantages and competitive pricing structures. Failing to do so risks losing market share to rivals who better cater to these discerning buyers.

- Informed EV Buyers: Customers in the premium EV segment thoroughly research vehicle features, battery technology, charging infrastructure, and pricing, making them highly discerning.

- Comparative Purchasing: Buyers readily compare NIO's offerings against competitors like Tesla, BYD, and established luxury brands, using this information to drive their purchase decisions.

- Pressure for Innovation: The well-informed customer base pressures NIO to continuously invest in R&D to deliver cutting-edge technology, improved range, and enhanced user experience.

- Value Proposition Focus: NIO must articulate a strong value proposition that justifies its pricing, considering the readily available information on total cost of ownership and performance metrics.

Influence of Brand Community and Loyalty Programs

NIO has effectively leveraged its user-centric community and loyalty programs, such as NIO Houses and NIO Points, to cultivate strong brand advocacy and encourage referrals. This strategy aims to build emotional connections and perceived value that extend beyond the product itself.

While customers in the electric vehicle market typically possess significant bargaining power due to the availability of alternatives, NIO's approach to community building offers a partial counterbalance. By fostering a sense of belonging and shared experience, NIO seeks to reduce price sensitivity among its core customer base.

- Brand Community Engagement: NIO's approximately 300,000 active users as of early 2024 are integral to its brand identity, participating in events and providing feedback.

- Loyalty Program Impact: The NIO Points system, which rewards user engagement and purchases, incentivizes continued patronage and can mitigate the inclination to switch brands based solely on price.

- Mitigating Customer Power: The emotional attachment and community support generated by these initiatives can lessen the direct bargaining power of individual customers, as they perceive greater value in the NIO ecosystem.

The bargaining power of customers in the premium electric vehicle (EV) market, especially concerning brands like NIO, is substantial. This is driven by an increasingly informed consumer base that meticulously researches vehicle specifications, technological advancements, and pricing across a growing number of competitors. For instance, by early 2024, the global EV market saw a significant influx of new models, offering consumers an unprecedented array of choices and enhancing their leverage in negotiations and purchase decisions.

Customers readily compare NIO's offerings against rivals such as Tesla, BYD, and other luxury automotive manufacturers. This comparative purchasing behavior pressures NIO to maintain a strong value proposition, emphasizing innovation, superior features, and competitive pricing to justify its premium positioning. The ease with which consumers can access information about total cost of ownership and performance metrics further amplifies their ability to demand value.

While NIO's community engagement and loyalty programs, like NIO Houses and NIO Points, aim to foster brand advocacy and reduce price sensitivity among its user base, the fundamental bargaining power remains high. The approximately 300,000 active NIO users as of early 2024 are a testament to its community-building efforts, yet the competitive landscape necessitates continuous value delivery.

| Factor | Impact on NIO | Supporting Data/Observation (Early 2024) |

|---|---|---|

| Customer Information Level | High Bargaining Power | Consumers extensively research EV technology, battery life, charging infrastructure, and pricing. |

| Availability of Alternatives | High Bargaining Power | Proliferation of new EV models from numerous manufacturers (e.g., BYD price cuts, new entrants like Xiaomi). |

| Switching Costs (Post-Purchase) | Generally Low | Minimal direct costs for customers to switch brands after initial vehicle purchase, though ecosystem lock-in can exist. |

| NIO's Mitigation Strategies | Partial Counterbalance | NIO Houses, NIO Points, and BaaS model aim to build loyalty and ecosystem dependence, reducing price-driven switching. |

What You See Is What You Get

NIO Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive NIO Porter's Five Forces Analysis details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the electric vehicle market. You'll gain actionable insights into NIO's strategic positioning and potential challenges.

Rivalry Among Competitors

The Chinese electric vehicle market is a battleground of intense price competition, with numerous manufacturers vying for dominance. This dynamic is fueled by a significant oversupply of vehicles and a crowded field of domestic and international players, creating a challenging environment for all involved.

Companies like BYD have engaged in aggressive price reductions, a strategy that, while boosting sales volume, directly impacts profitability across the sector. This ongoing price war puts considerable pressure on NIO's profit margins and its ability to maintain market share, even though NIO primarily targets the premium segment.

NIO operates in a highly competitive environment, contending with global EV giants like Tesla. In 2024, BYD solidified its position as the world's largest EV manufacturer, presenting a significant challenge. Chinese competitors such as XPeng and Li Auto are also rapidly expanding their market share.

The competitive pressure is further amplified by traditional automotive manufacturers increasingly investing in and launching their own electric vehicle models. This broadens the competitive spectrum, demanding continuous innovation and strategic pricing from NIO to maintain its market position.

The electric vehicle market is a hotbed of innovation, with competitors like Tesla, BYD, and XPeng relentlessly pushing boundaries. They are constantly introducing new models, advancing battery technology for longer ranges and faster charging, and developing sophisticated autonomous driving capabilities. For instance, BYD's Blade Battery technology has been a significant differentiator.

NIO's unique selling propositions, such as its Battery-as-a-Service (BaaS) model and its extensive power swap station network, help it stand out. However, staying ahead in this rapidly evolving landscape demands substantial and ongoing investment in research and development. This is crucial to counter the formidable R&D budgets and established market presence of global automotive giants and well-funded EV startups.

High Fixed Costs and Pressure for Volume

The electric vehicle (EV) manufacturing sector is characterized by incredibly high fixed costs. Think about the massive investments needed for research and development, building state-of-the-art factories, and establishing charging infrastructure. These upfront expenses are enormous, creating a significant barrier to entry and putting immense pressure on companies like NIO to sell a lot of cars.

This need for high sales volume is a direct consequence of those fixed costs. To spread these costs out and become profitable, NIO, like its competitors, must achieve economies of scale. This often translates into aggressive sales tactics and a relentless pursuit of market share, intensifying the competition among EV makers.

- High Fixed Costs: NIO's substantial investments in R&D and manufacturing facilities necessitate high production volumes.

- Economies of Scale: Achieving profitability hinges on producing enough vehicles to lower per-unit costs.

- Sales Volume Pressure: Companies are driven to aggressively compete for customers to meet volume targets.

- Market Share Focus: The intense rivalry means a constant battle to capture and retain a larger portion of the EV market.

Market Share Dynamics and New Sub-brands

NIO's expansion into more competitive segments with its new sub-brands, ONVO and Firefly, intensifies the rivalry. These brands are designed to target a broader, more price-sensitive market, directly confronting established players and new entrants alike.

The automotive industry, particularly the electric vehicle sector, is characterized by a crowded field of manufacturers vying for market share. This intense competition makes achieving sustained growth and profitability a significant hurdle for all players, including NIO.

- Intensified Competition: NIO's entry into mass-market segments with ONVO and Firefly directly challenges brands like Tesla, BYD, and numerous other EV startups, increasing the number of direct competitors.

- Market Share Struggle: In 2024, the global EV market saw a proliferation of models, with established automakers and new players aggressively competing for consumer attention and sales, making market share gains difficult.

- Profitability Challenges: The high cost of R&D, manufacturing, and marketing in the EV sector, coupled with aggressive pricing strategies by competitors, puts pressure on profit margins for all automakers, including NIO.

- Brand Differentiation: Successfully differentiating ONVO and Firefly from a vast array of existing and upcoming electric vehicles will be crucial for NIO to capture and retain market share.

The competitive rivalry in the electric vehicle market is fierce, with numerous global and domestic players intensifying the battle for market share. NIO faces direct competition from established giants like Tesla and the rapidly growing BYD, which solidified its position as the world's largest EV manufacturer in 2024. Furthermore, domestic rivals such as XPeng and Li Auto are aggressively expanding, creating a highly dynamic and challenging landscape for NIO.

NIO's strategic move to launch sub-brands ONVO and Firefly for more accessible market segments directly escalates this rivalry. These new offerings will compete head-to-head with a growing array of affordable EVs from both legacy automakers and new EV startups, making market differentiation and customer acquisition increasingly difficult.

The pressure to achieve economies of scale due to high fixed costs in EV manufacturing, including R&D and production facilities, forces companies to pursue aggressive sales volumes. This often leads to price competition and a relentless focus on capturing market share, as seen with BYD's sales strategies impacting overall industry profitability.

| Competitor | 2024 EV Sales (Approx.) | Key Strategy |

|---|---|---|

| BYD | Over 3 million units | Aggressive pricing, broad model range, battery innovation |

| Tesla | ~1.8 million units | Brand loyalty, technology leadership, Supercharger network |

| XPeng | ~100,000 units | Advanced driver-assistance systems (ADAS), smart cockpit technology |

| Li Auto | ~300,000 units | Extended-range electric vehicles (EREVs), family-focused SUVs |

SSubstitutes Threaten

Despite the accelerating adoption of electric vehicles (EVs), traditional internal combustion engine (ICE) vehicles remain a potent substitute. This is particularly true for consumers who are more sensitive to price or harbor reservations about EV range and the accessibility of charging stations. In 2023, for instance, while EV sales surged, ICE vehicles still accounted for a considerable portion of the global automotive market.

Plug-in Hybrid Electric Vehicles (PHEVs) and Extended-Range Electric Vehicles (EREVs) present a significant threat to NIO's Battery Electric Vehicle (BEV) strategy. These vehicles offer a compelling alternative for consumers hesitant about pure EV range anxiety, providing the convenience of gasoline backup for longer journeys. In 2023, China's PHEV market experienced substantial growth, with sales increasing by over 70% year-over-year, reaching approximately 2.7 million units, according to China's Passenger Car Association.

For urban consumers, readily available public transportation and the growing popularity of ride-sharing services present a significant threat of substitution for private vehicle ownership, including electric vehicles like those offered by NIO. The convenience and often lower per-trip cost of these alternatives can directly impact the demand for new car purchases. In 2023, ride-sharing services saw continued growth in major metropolitan areas, with platforms like Didi and Meituan's ride-hailing services facilitating millions of trips daily.

Advancements in Fuel Efficiency and Alternative Fuels for ICE

Ongoing innovations in traditional internal combustion engine (ICE) vehicles, particularly in fuel efficiency, can act as a substitute threat. For instance, by 2024, many automakers are expected to continue improving gasoline engine efficiency, potentially reducing the cost advantage of EVs for some consumers.

While still nascent, advancements in alternative fuels for ICE vehicles, such as hydrogen fuel cell technology, could also emerge as a substitute. Although widespread adoption is not yet a reality, continued research and development in these areas might offer consumers more compelling non-battery electric options in the future.

- Increased ICE Fuel Efficiency: By 2024, average fuel economy standards in many regions continue to push for greater efficiency in gasoline and diesel engines, making them more competitive on a running cost basis.

- Hydrogen Fuel Cell Development: While limited, investments in hydrogen infrastructure and fuel cell technology for vehicles are ongoing, representing a potential long-term substitute for battery EVs.

- Hybrid Technology Advancements: Sophisticated hybrid powertrains, which combine ICE with electric motors, offer improved fuel economy and performance, serving as a strong intermediary substitute for pure EVs.

Cost-Performance Trade-offs

The higher upfront cost of premium electric vehicles (EVs), such as those offered by NIO, presents a significant threat from substitutes. While consumers may anticipate long-term savings on fuel and maintenance, the initial purchase price can deter many potential buyers. This makes NIO vulnerable to more affordable EV alternatives or even high-end internal combustion engine (ICE) vehicles that offer a lower entry barrier.

As the EV market continues to mature, the price premium associated with electric cars is expected to decline. In 2024, the average price difference between comparable EV and ICE models is narrowing, influencing consumer purchasing decisions. This trend could lead consumers to opt for ICE vehicles if the perceived value proposition of EVs diminishes due to cost alone.

- High Upfront Costs: Premium EVs like NIO's often carry a higher initial price tag compared to traditional gasoline cars, impacting affordability for a broader consumer base.

- Total Cost of Ownership (TCO) vs. Initial Price: While EVs can offer lower TCO due to fuel and maintenance savings, the upfront cost remains a primary consideration for many buyers.

- Market Maturation and Price Convergence: As EV technology advances and production scales up, the price gap between EVs and ICE vehicles is shrinking, increasing the substitutability of ICE alternatives.

- Availability of Affordable EV Substitutes: The growing number of lower-priced EV models entering the market from various manufacturers directly competes with premium offerings by providing a more accessible entry point into electric mobility.

The threat of substitutes for NIO is multifaceted, encompassing traditional internal combustion engine (ICE) vehicles, plug-in hybrids (PHEVs), and even alternative transportation methods. ICE vehicles, particularly those with improved fuel efficiency, remain a strong substitute, especially for price-sensitive consumers or those concerned about EV infrastructure. In 2024, ongoing advancements in ICE technology continue to narrow the cost-of-ownership gap.

Hybrid vehicles, including PHEVs, offer a compelling middle ground, mitigating range anxiety and providing flexibility that pure EVs currently lack. China's PHEV market, for example, saw substantial growth in 2023, indicating a strong consumer appetite for these transitional technologies. This segment directly siphons potential buyers from pure EV offerings.

Furthermore, the increasing viability and adoption of ride-sharing services and improved public transportation in urban areas present a substitution threat to private vehicle ownership altogether. For many city dwellers, these alternatives offer cost-effectiveness and convenience, reducing the necessity of purchasing a personal vehicle, whether electric or otherwise.

| Substitute Type | Key Characteristics | Impact on NIO | 2023/2024 Data Point |

| ICE Vehicles | Lower upfront cost, established refueling infrastructure, improving fuel efficiency | Direct competition, particularly for cost-conscious buyers. | Global ICE vehicle sales still significant, though EV market share is growing. |

| Plug-in Hybrids (PHEVs) | Combines electric and gasoline power, reduces range anxiety | Appeals to hesitant EV buyers, offering a transitional solution. | China's PHEV sales increased over 70% in 2023. |

| Ride-Sharing & Public Transport | Cost-effective per trip, convenient in urban areas, reduces need for ownership | Threatens overall private vehicle demand, especially in cities. | Major ride-sharing platforms facilitate millions of daily trips in urban centers. |

Entrants Threaten

Entering the premium electric vehicle (EV) market, like the one NIO operates in, demands substantial upfront investment. We're talking about billions of dollars for research and development, building state-of-the-art manufacturing facilities, and creating a robust sales and after-sales service infrastructure. For instance, in 2024, establishing a new EV production line can easily cost upwards of $1 billion, making it a significant hurdle.

This immense capital requirement acts as a strong deterrent for potential new competitors. Beyond the initial setup, the need for continuous innovation in battery technology, autonomous driving, and software development necessitates ongoing, significant R&D expenditure. This financial barrier, coupled with the long payback periods typical in the automotive industry, effectively limits the number of new players that can realistically challenge established brands like NIO.

The development of sophisticated electric vehicle (EV) technology, encompassing battery management, autonomous driving systems, and integrated vehicle intelligence, requires a deep well of specialized knowledge and substantial research and development investment. New players entering the EV market must navigate a steep learning curve, akin to mastering complex engineering and software development, and compete fiercely for highly sought-after technical talent.

Established players like NIO have cultivated significant brand loyalty and built robust ecosystems, including services like Battery-as-a-Service (BaaS) and NIO Houses. For instance, NIO's extensive network of service centers and charging stations, developed over years, creates a strong barrier. Newcomers face a considerable challenge in replicating this established brand equity and integrated service model, which demands substantial time and capital investment.

Regulatory Hurdles and Policy Support

The automotive sector, especially electric vehicles (EVs), faces significant regulatory challenges. New entrants must comply with stringent safety and environmental standards, which can be costly and time-consuming to meet. For instance, China, a key market for NIO, has evolving regulations regarding battery safety and charging infrastructure that newcomers must adeptly navigate.

While government support has historically boosted EV markets, the landscape is shifting. Policies that once offered substantial subsidies may be phasing out or changing, requiring new players to adapt their business models. In 2023, China's EV subsidies saw adjustments, signaling a move towards market-driven growth and increased competition for any new entrants aiming to establish a foothold.

- Stringent Safety and Environmental Standards: EV manufacturing necessitates adherence to complex regulations, increasing the barrier to entry.

- Evolving Government Policies: Historically supportive policies, such as subsidies, are being recalibrated, posing a challenge for new players.

- Navigating Regulatory Frameworks: New entrants must invest resources to understand and comply with diverse national and international automotive regulations.

- Diminishing Subsidies: A potential reduction in government incentives means new companies will need to rely more on inherent product competitiveness.

Access to Supply Chains and Distribution Channels

New electric vehicle (EV) manufacturers face significant hurdles in securing dependable and affordable supply chains for essential components like batteries and semiconductors. For instance, the global semiconductor shortage experienced in 2021-2022 significantly impacted automotive production worldwide, highlighting the vulnerability of new entrants lacking established supplier relationships.

Furthermore, building a widespread and efficient distribution and after-sales service network is a substantial undertaking. NIO, having launched its operations earlier, has already invested in developing its proprietary charging infrastructure and service centers. By the end of 2023, NIO had established over 2,500 battery swap stations and over 1,000 service centers across China.

- Supply Chain Dependence: New entrants are heavily reliant on existing suppliers for critical EV components, often at less favorable terms than established players.

- Distribution Network Costs: The capital expenditure required to build a comparable sales, service, and charging infrastructure to that of NIO is immense.

- Economies of Scale: Existing players like NIO benefit from economies of scale in procurement and manufacturing, which new entrants struggle to match initially.

The threat of new entrants in the premium electric vehicle (EV) market, where NIO operates, is significantly mitigated by the immense capital required for research, development, and manufacturing. For example, establishing a new EV production line in 2024 can cost well over $1 billion, a substantial financial barrier.

Furthermore, the need for continuous innovation in areas like battery technology and autonomous driving necessitates ongoing, high R&D spending, making it difficult for newcomers to keep pace with established players like NIO. This financial intensity, coupled with long payback periods, effectively limits the number of viable new competitors.

New entrants must also contend with the challenge of replicating established brand loyalty and integrated service models, such as NIO's Battery-as-a-Service (BaaS) and NIO Houses. By the end of 2023, NIO had built an extensive network with over 2,500 battery swap stations and 1,000 service centers in China, a feat requiring years of investment and effort.

Navigating stringent safety and environmental regulations, along with the potential recalibration of government policies and subsidies, adds further complexity for new EV manufacturers. For instance, adjustments to China's EV subsidies in 2023 signaled a shift towards market-driven growth, increasing the competitive pressure on any new entrants.

| Barrier to Entry | Estimated Cost/Challenge | Impact on New Entrants |

| Capital Investment (R&D, Manufacturing) | >$1 Billion for a new EV production line (2024) | Significant financial hurdle, limits number of new players |

| Technological Expertise & Innovation | High ongoing R&D for battery, autonomous driving | Requires continuous investment to compete with established brands |

| Brand Equity & Ecosystem Development | NIO's 2,500+ swap stations & 1,000+ service centers (end of 2023) | Difficult and costly for newcomers to replicate service and charging infrastructure |

| Regulatory Compliance | Adherence to safety/environmental standards, evolving policies | Adds cost and time to market entry, requires adaptation to policy shifts |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for NIO leverages data from NIO's annual and quarterly reports, investor presentations, and official press releases. We also incorporate insights from reputable automotive industry research firms, market intelligence platforms, and news outlets covering the electric vehicle sector.