NIO Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NIO Bundle

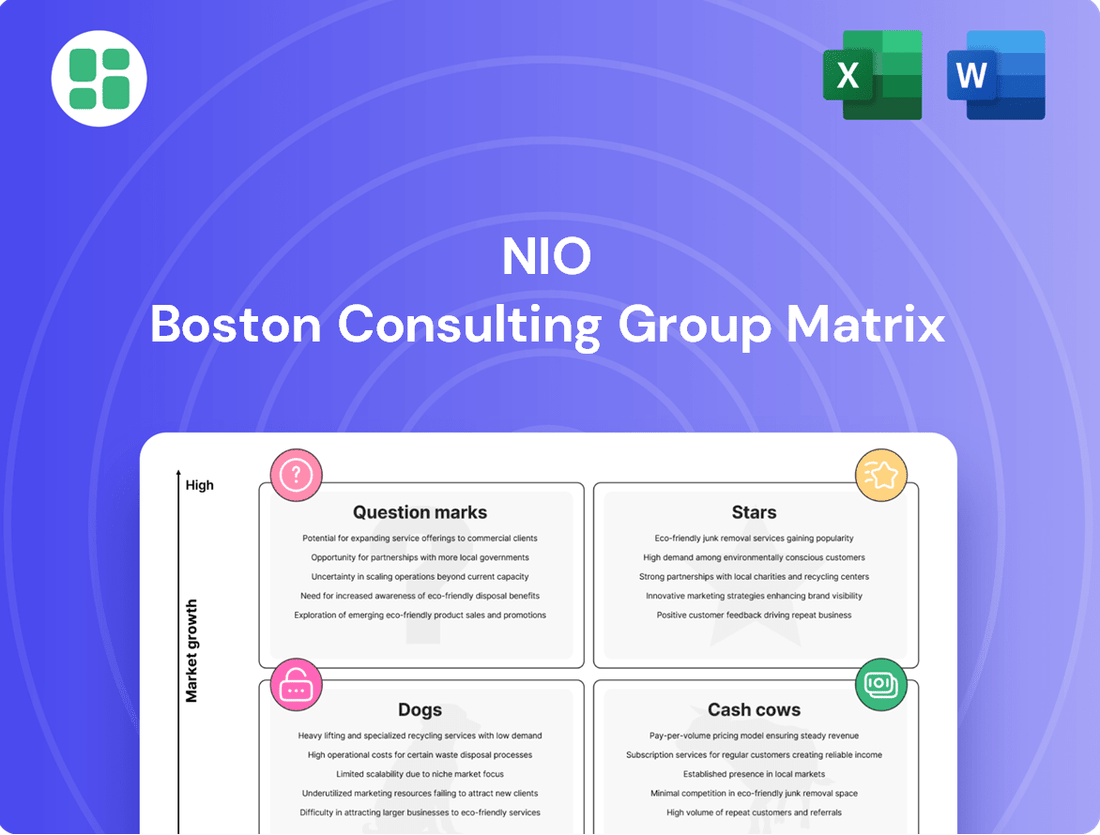

Understand the strategic positioning of a company's products with the BCG Matrix. This powerful tool categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks, guiding resource allocation and future investment. Gain a comprehensive understanding of your portfolio's health and potential.

Ready to move beyond a basic overview? Purchase the full BCG Matrix to unlock detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your product strategy. Make informed decisions that drive growth and profitability.

Stars

NIO's Battery as a Service (BaaS) is a game-changer, tackling range anxiety and lowering initial EV purchase prices. This model builds a predictable, recurring revenue stream through subscriptions. As of early 2024, NIO's expansive network of over 1,300 power swap stations across China is a key differentiator, boosting customer loyalty.

The NIO ET5 and ET5T models have shown robust market performance, solidifying their position in the competitive mid-size battery electric sedan market. Their consistent sales figures are a testament to their quality and appeal.

These models achieved top rankings in the China NEV-IQS study and received high marks in the 2025 J.D. Power studies, underscoring their excellent quality and customer satisfaction. This recognition is crucial for NIO's brand reputation.

The strong sales volume from the ET5 and ET5T directly contributes to NIO's overall delivery figures, acting as significant growth engines for the company, particularly within the premium electric vehicle segment.

NIO's core brand firmly occupies the premium smart electric vehicle space, attracting affluent buyers with its blend of luxury and cutting-edge technology.

Even with heightened competition, NIO's solid brand reputation and steady delivery increases, including 14,593 premium vehicles delivered in June 2025, highlight its dominant market standing.

This premium segment remains NIO's main profit driver and a cornerstone of its broader business approach.

Advanced Autonomous Driving Technologies

NIO's dedication to full-stack research and development, especially in autonomous driving, is a key differentiator. The company's investment in its proprietary Shenji NX9031 chip underscores its commitment to technological leadership in this rapidly evolving sector.

This focus is evident in advanced features like steer-by-wire and comprehensive sensor suites, as seen in models such as the ET9. These innovations not only elevate the user experience but also create a distinct competitive advantage, appealing to a discerning customer base.

- NIO's R&D Investment: The company consistently allocates significant resources to autonomous driving development.

- Proprietary Chip Technology: The Shenji NX9031 chip is central to NIO's autonomous driving capabilities.

- Advanced Vehicle Integration: Steer-by-wire and sophisticated sensor suites are being integrated into flagship models.

- Market Differentiation: These technologies are designed to attract tech-savvy consumers and set NIO apart.

User-Centric Community and Service Ecosystem

NIO's strategic focus on a user-centric community and service ecosystem is a cornerstone of its business model, particularly relevant when considering its position within a BCG Matrix. This approach fosters deep customer loyalty and brand advocacy, transforming owners into active participants in the NIO brand.

The company cultivates this loyalty through initiatives like NIO Houses, which serve as lifestyle centers, and a dedicated app that enhances user engagement. This ecosystem extends beyond the car itself, encompassing power solutions, comprehensive services, and data packages. By offering this holistic experience, NIO creates a sticky environment that encourages repeat business and organic growth.

This community-driven strategy translates into tangible benefits. For instance, NIO reported a significant increase in its user base, with over 400,000 cumulative vehicle deliveries by the end of 2023. The strong engagement within its ecosystem, including the utilization of its Battery Swap stations, which surpassed 20 million swaps by early 2024, directly contributes to higher customer lifetime value and a robust pipeline for future sales and services.

- Community Engagement: NIO Houses and the NIO App are central to fostering a strong user community, driving brand loyalty.

- Ecosystem Value: The integration of power solutions, services, and data packages creates a comprehensive user experience beyond vehicle ownership.

- Customer Retention: This holistic approach significantly boosts customer retention rates and encourages brand advocacy.

- Growth Driver: The sense of belonging and exclusivity cultivated within the NIO community acts as a key competitive advantage and a powerful growth engine.

NIO's premium brand positioning, exemplified by models like the ET5 and ET5T, firmly places it in the 'Stars' category of the BCG Matrix. These vehicles are market leaders, demonstrating strong sales growth and high customer satisfaction, as evidenced by their top rankings in quality studies.

The company's significant investments in autonomous driving technology and proprietary chip development, like the Shenji NX9031, further solidify its 'Star' status by creating a strong competitive advantage and appealing to a forward-thinking consumer base.

NIO's Battery as a Service (BaaS) model and its extensive power swap station network are also critical drivers, building recurring revenue and addressing key consumer pain points, reinforcing its position as a high-growth, high-market-share entity.

The strong community engagement and user-centric ecosystem further enhance NIO's 'Star' classification by fostering exceptional customer loyalty and brand advocacy, which are crucial for sustained growth in the premium EV market.

What is included in the product

Analysis of NIO's products as Stars, Cash Cows, Question Marks, and Dogs, guiding investment decisions.

Visually map your product portfolio to identify strategic resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

NIO's established premium SUV models, such as the ES6 and ES8, represent its Cash Cows. While their growth phase might be slowing, they continue to be reliable revenue generators for the company. The ES6, in particular, was a standout performer in 2024, accounting for a significant portion of NIO's total deliveries, underscoring its strong and stable market demand.

NIO's comprehensive service packages, encompassing power, maintenance, and data connectivity, are a significant driver of recurring revenue. These established offerings create a reliable cash flow, bolstering the company's financial stability and funding its expansion into new ventures.

A key component of this recurring income is NIO's Battery-as-a-Service (BaaS) subscription model. Analysts project that BaaS could achieve profitability by 2026, further solidifying its contribution to NIO's predictable revenue streams.

NIO's integrated charging and power network, extending beyond its well-known battery swap stations, functions as a mature cash cow. This ecosystem includes Power Home charging units, Power Charger public fast chargers, and Power Mobile charging vans, all supporting a growing EV user base and generating consistent operational revenue. By the end of 2023, NIO had deployed over 2,300 battery swap stations and over 4,000 charging points across China, demonstrating the scale and reliability of this infrastructure.

Brand Recognition and Market Leadership in Premium Segment

NIO has successfully carved out a strong brand identity and market leadership within China's premium electric vehicle segment. This is particularly evident in battery electric vehicles priced above RMB 300,000.

This established position, supported by consistent high marks in quality assessments, ensures a reliable sales base and consistent profitability in its specialized market. The company's premium positioning attracts a dedicated customer base, fostering steady demand.

- Brand Recognition: NIO is widely recognized as a premium EV brand in China.

- Market Leadership: It holds a leading position in the high-end BEV market (above RMB 300,000).

- Quality Perception: Consistent high ratings in quality studies reinforce its premium image.

- Customer Loyalty: A strong, loyal customer base contributes to stable sales volume.

Optimized Manufacturing and Supply Chain

NIO's strategic focus on optimizing its manufacturing and supply chain has been a key driver in strengthening its position as a Cash Cow. By implementing rigorous cost control measures and enhancing operational efficiency, the company has seen tangible improvements in its financial performance.

These efforts directly translate into better vehicle margins. For instance, NIO's vehicle margin reached 10.2% in the first quarter of 2025, a notable increase from 9.2% recorded in the first quarter of 2024. This upward trend highlights the success of their operational enhancements.

The efficiencies gained in production processes and logistics management are crucial for bolstering gross profit margins. These improvements allow NIO to generate healthier profits from its established, higher-volume vehicle sales, solidifying its Cash Cow status.

- Improved Vehicle Margin: Reached 10.2% in Q1 2025, up from 9.2% in Q1 2024.

- Operational Efficiency: Focus on cost control across manufacturing and supply chain.

- Enhanced Profitability: Efficiencies contribute to better gross profit margins on existing sales.

- Supply Chain Optimization: Streamlined logistics supporting higher-volume vehicle sales.

NIO's established premium SUV models, like the ES6 and ES8, are its cash cows, consistently generating revenue despite potentially slower growth. The ES6, in particular, was a major contributor to NIO's 2024 deliveries, proving its enduring market appeal.

These vehicles, coupled with NIO's comprehensive service packages and the growing Battery-as-a-Service (BaaS) model, create a stable, recurring revenue stream. BaaS is projected to reach profitability by 2026, further strengthening these predictable income sources.

NIO's market leadership in China's premium EV segment, especially for vehicles over RMB 300,000, is a testament to its strong brand and customer loyalty. This is supported by consistent high quality ratings, ensuring a solid sales base.

| Vehicle Model | Role | 2024 Performance Indicator |

|---|---|---|

| ES6 | Cash Cow | Significant contributor to total deliveries |

| ES8 | Cash Cow | Reliable revenue generator |

| BaaS Subscription | Recurring Revenue | Projected profitability by 2026 |

Preview = Final Product

NIO BCG Matrix

The NIO BCG Matrix preview you see is the identical, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis of NIO's product portfolio.

Dogs

Older, less competitive vehicle trims within NIO's lineup, perhaps those not receiving the latest technological upgrades, can become cash cows or question marks. These variants might still generate some revenue but struggle to gain market share against newer models. For instance, if a specific trim level saw a year-over-year sales decline of 15% in late 2023, it could indicate a shift towards newer, more appealing configurations.

NIO's smaller, early-stage international market entries that haven't yet gained significant momentum could be classified as 'dogs' if they continue to consume resources without a clear path to future growth. These ventures, often requiring substantial upfront investment, can become cash drains if sales volumes consistently lag behind expectations.

For instance, if NIO's initial foray into a specific European country, like Norway, which saw early adoption of EVs, didn't translate into the projected sales volumes by the end of 2024, it might be considered a dog. This scenario would involve underutilized charging infrastructure or sales teams in that region, highlighting a lack of traction despite the investment.

NIO's commitment to cutting-edge electric vehicle technology means significant spending on research and development. For instance, in the first quarter of 2024, NIO reported R&D expenses of RMB 1.9 billion (approximately $262 million USD), a substantial figure that underscores their drive for innovation.

However, these investments in unproven technologies carry inherent risks. If these R&D efforts don't quickly lead to successful products or capture significant market share, they can become a financial burden. The company's net loss for Q1 2024, standing at RMB 5.9 billion (approximately $814 million USD), highlights the considerable scale of these ongoing developmental expenditures.

Sub-optimal Early Generation Infrastructure

NIO's earlier generation power swap stations, particularly those in less populated regions, might be categorized as 'dogs' in a BCG matrix. These older facilities could be underutilized, leading to operational costs exceeding their revenue generation or strategic value, especially with the introduction of advanced technologies like Power Swap Station 4.0.

This situation can result in inefficient capital deployment. For instance, while NIO had over 1,300 swap stations by the end of 2023, a portion of these older units may not be meeting performance benchmarks compared to newer, more efficient models. The ongoing maintenance and energy consumption of these less productive assets can drain resources that could be better allocated to expanding the more advanced network or other growth areas.

- Underutilization: Older stations in low-density areas may experience significantly lower swap volumes compared to newer stations in high-demand urban centers.

- Higher Operating Costs: Older infrastructure might have higher maintenance needs and potentially lower energy efficiency than the latest generation.

- Strategic Obsolescence: As NIO rolls out Station 4.0, which offers faster swaps and greater capacity, older models can become strategically less relevant, impacting their long-term viability.

Less Adopted Supplementary Services

Within NIO's comprehensive service ecosystem, some supplementary offerings are currently underperforming, fitting the description of 'dogs' in a BCG matrix. These are services that, despite NIO's investment in personnel, technology, and marketing, are not gaining significant traction with users.

These underutilized services can become a financial drain if they continue to require operational expenditure without contributing meaningfully to revenue or driving core vehicle sales. For instance, if a particular charging network expansion or a niche in-car entertainment feature sees very low adoption, it represents a cost without a proportional return.

As of the latest available data, while NIO's core battery swapping and charging network are key strengths, specific value-added digital services or lifestyle memberships might be experiencing lower uptake. For example, while NIO's user community is strong, if a particular premium digital subscription service saw only a few thousand active users out of hundreds of thousands of NIO owners in 2024, it would highlight a 'dog' category.

- Low Adoption Rate: Certain supplementary services are not being utilized by a significant portion of NIO's user base, indicating a potential 'dog' status.

- Financial Burden: Continued investment in underperforming services without sufficient revenue generation or impact on core vehicle sales can strain financial resources.

- Resource Allocation: Identifying these 'dog' services allows NIO to re-evaluate resource allocation, potentially divesting or revamping offerings that are not resonating with customers.

NIO's older vehicle trims, especially those not updated with the latest tech, can become 'dogs' if they consistently lose market share. For example, a trim that saw a 15% sales drop in late 2023 might be a candidate if this trend continues into 2024, consuming resources without significant returns.

Early-stage international markets that fail to gain traction, despite investment, also fit the 'dog' profile. If NIO's entry into a market like Norway, known for EV adoption, didn't meet sales projections by the end of 2024, it could represent an underperforming asset.

Older power swap stations in less populated areas are another example of potential 'dogs.' With over 1,300 stations by end of 2023, a portion of these older units may have high operating costs and low utilization, especially as NIO rolls out advanced Station 4.0 technology.

Certain supplementary services within NIO's ecosystem may also be classified as 'dogs' if they have low adoption rates. For instance, a premium digital service with only a few thousand active users out of hundreds of thousands of NIO owners in 2024 would indicate a 'dog' category.

| Category | Example | Rationale |

|---|---|---|

| Vehicle Trims | Older, non-upgraded models | Declining sales, low market share despite investment. |

| International Markets | Early, underperforming market entries | Low sales volumes, high operational costs relative to revenue. |

| Infrastructure | Older Power Swap Stations in low-density areas | Low utilization, higher maintenance costs compared to newer models. |

| Services | Niche digital services with low user uptake | Financial drain due to operational expenditure without significant revenue or impact. |

Question Marks

NIO's Onvo brand, particularly the L60 and L90 models, firmly sits in the Question Mark quadrant of the BCG matrix. This positioning reflects its status as a new entrant in the high-growth electric vehicle market, specifically targeting the more price-sensitive mass market segment. While it holds significant potential, its current market share is still being established, requiring substantial investment to gain traction.

The Onvo L60 commenced deliveries in September 2024, with the L90 slated for a Q3 2025 launch, directly challenging established players like the Tesla Model Y. NIO's ambitious forecast of 240,000 units for the Onvo brand in 2025 underscores the company's strategic intent to rapidly scale this new venture and capture a meaningful share of the burgeoning mass-market EV segment.

The Firefly brand, NIO's newest venture, targets the subcompact EV segment, with its initial vehicle slated for delivery in April 2025. This brand exhibits strong growth potential, especially in European markets where smaller vehicles are favored, though its current market share in the broader EV sector remains minimal.

With anticipated monthly sales in the low thousands and 3,932 deliveries recorded in June 2025, Firefly clearly fits the profile of a Question Mark in the BCG matrix. It necessitates substantial investment to realize its ambitious sales objectives and climb the market share ladder.

The NIO ET9, positioned as an ultra-luxury executive sedan, debuted in December 2024 with deliveries commencing in March 2025. This vehicle represents NIO's commitment to high-end technology and premium design within a niche segment of the automotive market.

With an anticipated monthly sales volume of approximately 1,000 units, the ET9 is classified as a star in the BCG matrix. It targets significant growth in a specialized market, even though its overall market share remains modest.

The ET9's strategic importance lies in its role as a brand halo and a showcase for NIO's technological advancements. Its performance is crucial for reinforcing the company's image as an innovator in the premium electric vehicle space.

Global Expansion in New Markets (e.g., MENA, Azerbaijan)

NIO's strategic push into emerging international markets like Azerbaijan and the MENA region, beginning with the UAE, positions these ventures as Question Marks within the BCG matrix. These regions represent nascent markets for NIO, characterized by low current market share but substantial long-term growth potential.

The company's success in these areas hinges on its ability to tailor its offerings to local consumer preferences and regulatory environments, alongside significant investment in building brand awareness and establishing a robust sales and service network. For instance, by the end of 2024, NIO aims to have established a presence in key MENA markets, leveraging partnerships to navigate local complexities.

- Nascent Market Entry: NIO's presence in Azerbaijan and the MENA region is in its early stages, indicating low current market penetration.

- High Growth Potential: These markets are identified as having significant untapped demand for electric vehicles, offering substantial future revenue streams.

- Strategic Investment Required: Success necessitates considerable investment in localization, marketing, and infrastructure development to build brand recognition and customer trust.

- Adaptation is Key: Adapting product offerings and business models to meet the unique demands and cultural nuances of each new market is crucial for market share acquisition.

Next-Generation Battery Technologies and Platforms

NIO is actively investing in cutting-edge battery technologies and vehicle architectures, exemplified by its 900V high-voltage platform powering the ET9. These innovations hold substantial promise for transforming electric vehicle performance and charging speeds.

While these next-generation technologies offer significant future growth potential, their current market penetration is limited due to early adoption phases and the substantial capital required for broad deployment. For instance, the 900V platform, while a technological leap, is currently exclusive to a flagship model.

- High-Voltage Platforms: NIO's commitment to 900V architectures, as seen in the ET9, aims to drastically reduce charging times, potentially adding hundreds of kilometers of range in minutes.

- Early Adoption & Investment: These advanced technologies require significant R&D and manufacturing investment, leading to a current low market share as they are gradually introduced.

- Future Growth Potential: Despite current limitations, these next-generation platforms are positioned to drive future market share gains and establish NIO as a leader in EV performance.

Question Marks represent new products or ventures with low market share in a high-growth industry. NIO's Onvo brand, particularly the L60 and L90 models, and the Firefly brand are prime examples, requiring significant investment to capture market share against established competitors. These ventures aim to tap into the growing demand for EVs in different market segments, necessitating strategic resource allocation to achieve growth.

| Brand/Venture | Product Focus | Market Growth | Current Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|---|

| Onvo (L60, L90) | Mass-market EVs | High | Low (New Entrant) | Question Mark | Requires substantial investment for market penetration and scaling. |

| Firefly | Subcompact EVs | High | Minimal (New Entrant) | Question Mark | Needs investment to build brand awareness and sales volume, especially in international markets. |

| MENA/Azerbaijan Expansion | EV Market Entry | High | Low (Nascent) | Question Mark | Demands investment in localization, marketing, and infrastructure for market share acquisition. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.