New China Life Insurance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

New China Life Insurance Bundle

Navigate the complex external forces shaping New China Life Insurance's trajectory with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors impacting its operations and future growth. Gain a competitive advantage by leveraging these expert-curated insights to refine your strategy. Download the full PESTLE analysis now and unlock actionable intelligence for informed decision-making.

Political factors

The Chinese government, through entities like the National Financial Regulatory Administration (NFRA), significantly shapes the insurance landscape. New directives from the State Council, issued in September 2024, emphasize fostering high-quality growth, tightening market entry rules, and mitigating systemic risks within the financial sector.

This robust regulatory framework, while promoting stability, directly influences the operational strategies and compliance requirements for insurers such as New China Life Insurance. For instance, the NFRA's ongoing efforts to enhance solvency requirements and consumer protection measures are critical considerations for the company's strategic planning.

China's government is actively leveraging the insurance sector to bolster its national strategic priorities. This includes channeling insurance resources towards scientific and technological innovation and the development of advanced industrial systems. For instance, policies in 2024 and 2025 are expected to further integrate insurance products with these national goals.

Insurers are therefore encouraged to tailor their product offerings and investment portfolios to align with these broader state objectives, ensuring their business activities contribute to national development agendas. This strategic alignment is a key driver for the sector's evolution.

Furthermore, government initiatives are emphasizing the expansion of catastrophe insurance coverage, aiming to build more resilience against natural disasters. Simultaneously, there's a strong push to diversify and strengthen the private pension system, with insurance playing a crucial role in its growth and stability.

China's government is actively promoting the expansion of social welfare programs, with a particular focus on health and pension insurance. This policy push, highlighted by guidelines released in June 2024 for high-quality inclusive insurance development, directly targets underserved populations like the elderly, low-income individuals, and new citizens. These initiatives signal a significant market opportunity for insurers like New China Life to broaden their reach and cater to these growing needs.

Foreign Investment and Market Opening

China's commitment to opening its financial sector, particularly insurance, is a significant political factor. This high-level opening-up includes approving foreign-invested insurance companies, which directly impacts market dynamics. For instance, Prudential Insurance established an insurance asset management company in October 2024, showcasing this trend. Such moves are designed to boost competition and inject fresh expertise and innovation into China's insurance landscape, benefiting companies like New China Life Insurance.

The ongoing liberalization of the insurance market presents both opportunities and challenges. Increased foreign participation can lead to a more sophisticated market, with new products and investment strategies becoming available. However, it also intensifies competition, requiring domestic players to enhance their own capabilities and offerings to remain competitive. The government's policy direction in managing this opening is crucial for shaping the future operational environment.

- Increased Competition: Foreign insurers entering the market bring new capital and expertise, raising the competitive bar.

- Innovation and Expertise: Prudential's October 2024 asset management company establishment highlights the influx of advanced financial management practices.

- Regulatory Environment: Government policies on foreign investment approvals and operational guidelines will continue to shape market access and growth.

- Market Sophistication: The opening is expected to drive greater product diversity and service quality across the entire insurance sector.

Geopolitical Tensions and Trade Policies

Geopolitical tensions and evolving global trade policies can create ripples across financial markets, indirectly affecting insurers like New China Life Insurance. For instance, ongoing trade disputes, such as those between the United States and China, can lead to increased market volatility and impact investor sentiment. This volatility can influence the performance of the investment portfolios held by insurance companies, potentially affecting their profitability and ability to meet long-term obligations. As of late 2024, global trade uncertainty remains a significant factor, with ongoing discussions around tariffs and supply chain adjustments continuing to shape economic outlooks.

These broader economic shifts, driven by political factors, can influence capital market performance, which is crucial for insurers. New China Life Insurance, like its peers, relies on investment income to supplement premium revenue. Disruptions in global trade or heightened geopolitical risks can lead to fluctuations in equity and bond markets, impacting the value of these investments. For example, a slowdown in global economic growth, partly attributable to trade friction, could depress returns on equity investments for the insurer.

- Trade Policy Impact: US tariffs on Chinese goods and retaliatory measures can create economic headwinds, affecting consumer spending and business investment, indirectly influencing the demand for life insurance products.

- Market Volatility: Geopolitical events and trade disputes contribute to increased volatility in financial markets, impacting the investment returns that New China Life Insurance generates from its substantial asset base.

- Investor Confidence: Uncertainty stemming from trade tensions can erode investor confidence, potentially leading to capital outflows or reduced investment appetite, which can affect the insurer's investment income.

- Global Economic Outlook: Changes in global trade policies directly influence the overall economic outlook for China, impacting factors like GDP growth and interest rates, which are fundamental to the insurance industry's operating environment.

China's government is actively shaping the insurance sector through directives focused on high-quality growth and risk mitigation, as seen in September 2024 State Council guidance. This regulatory environment, managed by bodies like the NFRA, enforces stricter solvency and consumer protection rules, directly impacting insurers' strategic planning.

Government initiatives are also aligning insurance with national development goals, encouraging product and investment strategies that support technological innovation and advanced industrial systems, with policies in 2024-2025 expected to deepen this integration.

The liberalization of China's financial sector, including insurance, is a key political driver, with foreign investment approvals, such as Prudential's October 2024 asset management company establishment, fostering competition and introducing new expertise.

Geopolitical tensions and trade policies, like US-China trade disputes, contribute to market volatility, impacting insurers' investment returns and overall financial performance as of late 2024.

What is included in the product

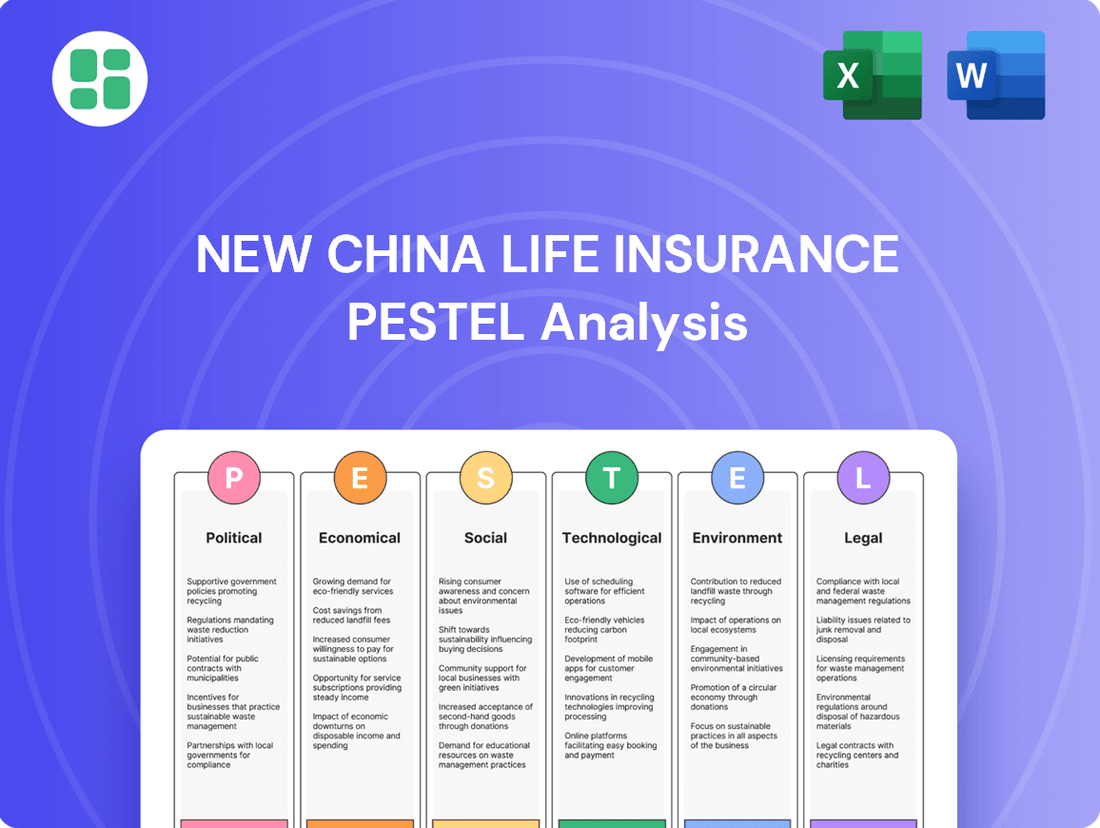

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting New China Life Insurance's strategic landscape.

It provides actionable insights for navigating market dynamics and identifying growth opportunities within the Chinese insurance sector.

A PESTLE analysis of New China Life Insurance provides a clear, summarized version of external factors, acting as a pain point reliever by offering actionable insights for strategic decision-making and risk mitigation.

Economic factors

China's economic trajectory remains a key factor for New China Life Insurance. Projections indicate a GDP growth of approximately 4.6% for 2025. While this represents a moderation from past growth rates, it signifies continued economic expansion that is strong when compared to many other nations.

This sustained economic growth directly fuels the insurance sector. As the economy expands and disposable incomes generally rise, consumers have more capacity to invest in financial products, including life insurance, creating a favorable environment for companies like New China Life.

The current low interest rate environment, with benchmark rates hovering near historic lows in many developed economies throughout 2024 and early 2025, directly impacts insurers like New China Life Insurance. This makes it harder for them to generate significant returns on their conservative fixed-income investments, a traditional cornerstone of their portfolios.

In response, life insurers are adjusting their product offerings and investment strategies. New China Life Insurance, for instance, has been observed increasing its allocation to equities. This shift, evident in their accelerated equity market investments in early 2025, aims to capture potentially higher yields in a market that, while volatile, offers greater upside than low-yielding bonds. They are also leaning more towards participating products, which typically have lower guaranteed returns but offer policyholders a share in the insurer's profits, thereby reducing the insurer's fixed liabilities.

China's burgeoning middle class is experiencing a significant uptick in disposable income. By 2024, the average disposable income per capita in China was projected to reach over 40,000 yuan, a substantial increase from previous years. This economic growth directly translates into greater capacity for families to invest in financial security and long-term planning.

Concurrently, there's a noticeable rise in financial literacy across China. More individuals are actively seeking knowledge about investment, savings, and insurance products, driven by a desire to safeguard their expanding wealth and secure their future. This heightened awareness is a powerful catalyst for the insurance sector, particularly for life insurance and wealth management services.

As a result, demand for financial protection and sophisticated wealth management solutions is on the rise. Families are increasingly prioritizing life insurance to shield their accumulated assets and provide for their dependents, directly benefiting companies like New China Life Insurance.

Inflation and Medical Cost Trends

Medical costs in China are projected to see continued double-digit growth through 2025. This surge is fueled by increased demand for healthcare services, rising pharmaceutical expenses, and the adoption of advanced medical technologies. For New China Life Insurance, this trend directly affects how health insurance products are priced and how claims are managed, impacting the overall profitability of their health insurance business.

The escalating medical inflation presents a significant challenge for insurers like New China Life. For instance, if medical inflation averages 12% annually, the cost of a specific medical procedure could increase substantially over a few years, necessitating adjustments in premium rates to maintain solvency and profitability.

- Projected Medical Cost Increase: Double-digit percentage growth expected in 2025.

- Driving Factors: Increased healthcare utilization, higher drug prices, and new medical tech.

- Impact on Insurers: Direct influence on health insurance pricing and claims costs.

- Profitability Concerns: Medical inflation can squeeze margins for health insurance products.

Capital Market Performance

The performance of China's capital markets is a crucial determinant of investment income for insurance companies like New China Life. A robust market translates directly into higher returns on the vast sums insurers invest on behalf of their policyholders.

In 2024, China's capital markets experienced a notable upswing, fueled by supportive national policies. This favorable environment allowed New China Life Insurance to achieve a significant year-on-year increase in its investment returns, bolstering its overall financial performance.

- Favorable Policy Environment: National policies enacted in 2024 created a more conducive atmosphere for capital market growth.

- Capital Market Boom: This supportive policy framework contributed to a significant expansion and improved performance within China's stock and bond markets.

- Impact on Insurers: The heightened market activity directly benefited New China Life Insurance by boosting its investment income.

- Increased Investment Returns: The company reported a substantial year-on-year rise in its investment returns, reflecting the positive capital market conditions.

China's economic outlook for 2025, with a projected GDP growth of 4.6%, continues to support the insurance sector by increasing disposable incomes and demand for financial products. The persistent low-interest-rate environment, a trend continuing into early 2025, forces insurers like New China Life to seek higher yields through increased equity investments and products like participating policies.

The rising middle class, with disposable incomes expected to exceed 40,000 yuan per capita in 2024, coupled with growing financial literacy, fuels demand for life insurance and wealth management. However, escalating medical costs, projected for double-digit growth through 2025 due to increased healthcare demand and advanced technologies, pose a challenge to health insurance profitability.

Positive capital market performance in 2024, driven by supportive national policies, significantly boosted New China Life's investment income. This trend is expected to continue, providing a crucial revenue stream for the company's operations.

| Economic Factor | 2024/2025 Data Point | Impact on New China Life |

|---|---|---|

| GDP Growth (Projected 2025) | 4.6% | Supports increased demand for insurance products. |

| Disposable Income Per Capita (2024) | > 40,000 yuan | Drives higher uptake of financial security products. |

| Interest Rates (Early 2025) | Historic lows | Pressures investment income, necessitates strategy shifts. |

| Medical Cost Inflation (Projected 2025) | Double-digit growth | Increases claims costs for health insurance. |

| Capital Market Performance (2024) | Notable upswing | Boosted investment returns for the insurer. |

What You See Is What You Get

New China Life Insurance PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of New China Life Insurance details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping New China Life Insurance's market landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It offers actionable insights for strategic planning and risk assessment.

Sociological factors

China's population is aging quickly. In 2023, there were over 203 million people aged 65 and older, a significant increase that signals a major demographic shift.

This growing elderly population directly fuels demand for senior care services and financial products tailored for retirement. Insurance companies like New China Life can expect increased interest in annuities, long-term care insurance, and private pension plans.

The government's focus on developing a multi-pillar pension system, with the third pillar (private pensions) gaining traction, further supports this trend. As more individuals seek to secure their financial future, the market for these specialized insurance products is set to expand considerably in the coming years.

Heightened health awareness, significantly amplified by the COVID-19 pandemic and the pervasive influence of online health information, has dramatically reshaped consumer demand in China. This growing consciousness has fueled a substantial increase in the uptake of medical and critical illness insurance products. For instance, by the end of 2023, the health insurance market in China saw robust growth, with premiums reaching over 1 trillion RMB, reflecting this heightened consumer focus.

Consumers are no longer solely focused on basic coverage; there's a clear trend towards seeking more comprehensive solutions. This includes a rising demand for supplementary health insurance that offers additional benefits beyond standard medical plans, as well as a growing interest in preventive care services and products. This shift indicates a proactive approach to personal well-being, moving from reactive treatment to proactive health management.

Chinese consumers are increasingly digital-first, with a growing comfort level in purchasing insurance policies online. This trend is evident in the surge of online insurance sales, which have become a significant channel for many providers. For instance, by the end of 2023, the penetration of online insurance sales in China continued its upward trajectory, reflecting a fundamental shift in how consumers engage with financial products.

Insurers like New China Life must respond by developing more personalized and inclusive product offerings. This means moving beyond one-size-fits-all solutions to cater to diverse needs, from gig economy workers to the aging population. The emphasis is on digital accessibility, ensuring seamless online experiences from product discovery to claims processing, aligning with the expectations of a tech-savvy consumer base.

Urbanization and Demographic Shifts

China's rapid urbanization continues to reshape its society, with a significant portion of its population now residing in cities. This trend directly impacts how people manage their finances and their need for security. As more individuals move to urban centers, their lifestyles and financial priorities evolve, creating new demands for insurance products.

These demographic shifts present a fertile ground for insurance companies like New China Life. The concentration of people in cities means a larger potential customer base with evolving needs, from health and life insurance to wealth management solutions tailored for urban living. For instance, by the end of 2023, China's urbanization rate reached 66.16%, a substantial increase that highlights the growing urban demographic.

- Urban Growth: China's urbanization rate was 66.16% at the end of 2023, indicating a significant shift towards city living.

- Evolving Needs: Urban dwellers often face different lifestyle risks and financial planning requirements compared to rural populations.

- New Market Segments: Tailored insurance products for urban professionals, families, and retirees are becoming increasingly important.

- Financial Protection: The demand for comprehensive financial protection and wealth accumulation tools is rising in these densely populated areas.

Social Security System Pressure

China's rapidly aging population is placing considerable strain on its public social security system. This demographic shift, with the number of elderly citizens growing substantially, is driving demand for private insurance solutions to supplement state pensions and long-term care coverage. For instance, by the end of 2023, China's population aged 60 and above reached 297 million, representing 21.1% of the total population, a figure projected to continue rising significantly in the coming years.

This societal need creates a substantial market opportunity for private insurers like New China Life. As the state system faces increasing pressure, consumers are actively seeking commercial alternatives to ensure adequate financial security in their later years. This trend is particularly evident in the growing interest in private pension plans and long-term care insurance products designed to fill the gaps left by public provisions.

The increasing reliance on commercial insurance is supported by government initiatives aimed at developing the private pension market. Policies encouraging the growth of the third pillar pension system, which includes commercial insurance products, are expected to further boost demand. By offering comprehensive and tailored solutions, private insurers can effectively address the evolving needs of an aging populace and capture significant market share.

China's aging demographic is a significant sociological factor influencing the insurance market. With over 203 million people aged 65 and older in 2023, there's a burgeoning demand for retirement-focused products like annuities and long-term care insurance. This trend is further bolstered by government efforts to expand the private pension system, creating a substantial opportunity for insurers to cater to individuals seeking financial security in their later years.

Technological factors

The Chinese insurance sector is rapidly embracing digital transformation, with companies like New China Life Insurance investing heavily in online platforms and mobile applications. This shift aims to improve customer experience and operational efficiency. By 2024, it's projected that over 70% of insurance customer interactions in China will occur through digital channels, a significant increase from previous years.

New China Life Insurance is actively utilizing these digital tools, including chatbots and online portals, to manage policies, process claims, and engage with policyholders. This digital push is crucial for staying competitive in a market where consumers increasingly expect seamless online service delivery. The company reported a substantial growth in its digital customer acquisition rates in early 2025, indicating the success of these initiatives.

New China Life Insurance is leveraging big data analytics to refine its risk assessment processes. This allows for more accurate pricing of insurance products and better identification of potential policyholder risks, moving beyond traditional actuarial methods.

The adoption of big data enables the company to develop highly personalized insurance products, catering to specific customer needs and behaviors. For instance, by analyzing vast datasets, they can offer tailored coverage options, increasing customer satisfaction and market competitiveness.

Furthermore, advanced analytics are crucial for enhanced fraud detection within the insurance sector. In 2023, the insurance industry globally saw significant losses attributed to fraudulent claims, making robust big data capabilities essential for New China Life Insurance to mitigate these financial exposures and protect its profitability.

Artificial intelligence and automation are revolutionizing China Life's operations. By 2024, AI is being integrated into underwriting and claims processing, significantly speeding up these crucial functions. This technological shift is also enhancing customer service, with AI-powered chatbots handling inquiries and improving response times.

The adoption of AI is particularly impactful in agent development and service accuracy. For instance, AI analytics can identify high-potential agents and provide personalized training, boosting sales performance. In 2023, China Life reported a notable increase in operational efficiency attributed to these automated processes, leading to cost savings and improved customer satisfaction.

Cybersecurity and Data Protection

The increasing reliance on digital platforms for customer interactions and claims processing by New China Life Insurance amplifies cybersecurity risks. Protecting sensitive customer data is paramount, especially with the implementation of China's Personal Information Protection Law (PIPL) and the Network Data Security Management Regulations, effective January 2025. These regulations mandate significant investments in data protection infrastructure and protocols, impacting operational costs and compliance strategies.

Insurers like New China Life are facing heightened threats from sophisticated cyberattacks, including ransomware and data breaches. A report from the China Academy of Information and Communications Technology (CAICT) indicated a 40% increase in reported cyber incidents targeting financial institutions in 2024. This necessitates continuous upgrades to security systems and employee training to mitigate potential financial and reputational damage.

- Increased Investment: New China Life must allocate substantial capital towards advanced cybersecurity solutions, potentially exceeding 15% of its IT budget in 2025.

- Regulatory Compliance: Adherence to PIPL and Network Data Security Management Regulations requires rigorous data handling policies and regular audits.

- Customer Trust: Demonstrating robust data protection is crucial for maintaining customer confidence and preventing churn in an increasingly digital market.

- Operational Resilience: Implementing comprehensive disaster recovery and business continuity plans is vital to ensure uninterrupted service in the event of a cyberattack.

Integration of FinTech and InsurTech

The convergence of FinTech and InsurTech is a major technological driver for New China Life Insurance. This integration fosters innovation in product design and customer service delivery. For instance, by the end of 2023, China's digital economy had reached an estimated 50 trillion yuan, with FinTech playing a significant role in this growth, impacting how insurance products are accessed and managed.

New China Life Insurance must actively incorporate advanced technologies to stay ahead. This includes leveraging AI for personalized underwriting and claims processing, which can significantly improve efficiency and customer satisfaction. In 2024, the global InsurTech market is projected to continue its upward trajectory, with significant investments flowing into AI and big data analytics within the insurance sector.

- AI-powered claims processing: Streamlining payouts and reducing fraud.

- Personalized product offerings: Tailoring insurance based on individual data analytics.

- Digital distribution channels: Expanding reach through online platforms and mobile apps.

- Blockchain for transparency: Enhancing security and trust in policy management.

New China Life Insurance is actively integrating advanced technologies like AI and big data to enhance its operations. By 2024, over 70% of insurance interactions in China are expected to be digital, a trend New China Life is capitalizing on with its online platforms and mobile apps, reporting strong digital customer acquisition growth in early 2025.

The company utilizes AI for more efficient underwriting and claims processing, speeding up these functions and improving customer service through AI-powered chatbots. Furthermore, big data analytics are employed for precise risk assessment and the development of personalized insurance products, with a notable increase in operational efficiency reported in 2023 due to these automated processes.

However, this digital push increases cybersecurity risks, necessitating significant investment in data protection to comply with China's PIPL and Network Data Security Management Regulations, effective January 2025. The company must also address a 40% increase in cyber incidents targeting financial institutions in 2024 by continuously upgrading security and training.

| Technology Area | Impact on New China Life | Key Data/Projections (2024-2025) |

|---|---|---|

| Digital Transformation | Enhanced customer experience, operational efficiency | >70% digital interactions by 2024; strong digital acquisition growth (early 2025) |

| Big Data Analytics | Improved risk assessment, personalized products, fraud detection | Enables tailored coverage, mitigates financial exposure from fraud |

| Artificial Intelligence (AI) | Streamlined underwriting & claims, improved customer service, agent development | Increased operational efficiency (2023); AI-powered chatbots for inquiries |

| Cybersecurity | Mitigating data breaches, ensuring regulatory compliance | 40% increase in cyber incidents (2024); PIPL compliance costs |

Legal factors

The insurance sector in China operates under the watchful eye of the National Financial Regulatory Administration (NFRA), which took over regulatory duties from the China Banking and Insurance Regulatory Commission (CBIRC) in 2023. This regulatory shift is significant for companies like New China Life Insurance as it signals potential changes in oversight and policy direction.

A crucial development for 2024 is the ongoing amendment of the Insurance Law. This legislative process is expected to further refine the legal framework governing insurance operations, impacting everything from product development to consumer protection, and will undoubtedly shape the strategic landscape for New China Life Insurance.

China's evolving legal landscape, particularly concerning data, presents significant considerations for New China Life Insurance. The Personal Information Protection Law (PIPL) and the Data Security Law (DSL), alongside the Network Data Security Management Regulations effective January 1, 2025, establish a robust data protection framework.

These regulations impose stringent obligations on how companies like New China Life Insurance collect, process, store, and transfer personal information. Strict adherence is crucial, especially regarding cross-border data flows, which directly impacts customer data management strategies and operational compliance.

Consumer protection regulations are paramount in China's insurance sector, particularly as New China Life Insurance (NCI) expands its digital presence and product range. These laws are designed to ensure policyholders receive fair treatment, clear information about policies, and access to effective complaint resolution. For instance, the China Banking and Insurance Regulatory Commission (CBIRC) has been actively refining rules around online sales and data privacy to safeguard consumers.

Anti-Monopoly and Fair Competition

China's anti-monopoly laws actively shape the insurance landscape, with the State Administration for Market Regulation (SAMR) overseeing competition. This ensures that dominant players do not stifle innovation or unfairly disadvantage smaller firms, impacting market entry strategies and M&A approvals. For instance, in 2023, SAMR continued its scrutiny of various sectors, and while specific insurance-related fines were not highlighted in broad public reports, the underlying principle of fair competition remains a key regulatory focus.

These regulations directly influence how companies like New China Life Insurance can expand through acquisitions or partnerships. The government's commitment to a level playing field means that any proposed mergers or market consolidation must demonstrate a clear benefit to consumers and not lead to undue market concentration. This regulatory environment is crucial for both domestic insurers and foreign entities seeking to establish or grow their presence in China's vast insurance market.

The emphasis on fair competition also extends to pricing and product offerings, preventing predatory practices. Regulatory bodies monitor market behavior to ensure that all participants adhere to fair competition principles, fostering a healthier and more dynamic insurance sector. This oversight is particularly important as the market evolves with new digital offerings and evolving consumer needs.

- Regulatory Oversight: The State Administration for Market Regulation (SAMR) actively monitors market competition to prevent monopolistic behavior.

- Market Entry & M&A Impact: Anti-monopoly laws influence decisions on market entry, mergers, and acquisitions, ensuring a balanced competitive environment.

- Fair Practices Enforcement: Regulations aim to ensure fair pricing and product offerings, preventing anti-competitive practices and promoting consumer welfare.

- Level Playing Field: The government's commitment to fair competition benefits both domestic and foreign insurance providers operating within China.

Solvency and Capital Requirements

New China Life Insurance, like all insurers in China, operates under stringent solvency regulations designed to safeguard policyholder interests and ensure market stability. The Administrative Provisions on the Solvency of Insurance Companies, updated in 2021, sets clear benchmarks for capital adequacy and risk management.

Compliance with these rules is paramount for New China Life. This involves maintaining a robust capital base and healthy solvency ratios, which are critical indicators of the company's ability to meet its long-term obligations.

- Solvency Ratios: Insurance companies must adhere to specific solvency ratios, often including a comprehensive solvency ratio and a core solvency ratio, to demonstrate their financial resilience.

- Registered Capital: Adequate registered capital is a foundational requirement, proving the insurer's initial financial commitment and capacity.

- Regulatory Oversight: The China Banking and Insurance Regulatory Commission (CBIRC) actively monitors these requirements, imposing penalties for non-compliance and ensuring the overall health of the insurance sector.

- Capital Buffers: Companies are encouraged to build capital buffers beyond minimum requirements to withstand market volatility and unexpected claims, a strategy New China Life likely employs to maintain its competitive edge.

The legal framework for insurance in China is dynamic, with the National Financial Regulatory Administration (NFRA) now overseeing the sector following its establishment in 2023, taking over from the CBIRC. This regulatory evolution, coupled with ongoing amendments to the Insurance Law in 2024, means companies like New China Life must remain agile in adapting to new compliance demands. Furthermore, stringent data protection laws, including the Personal Information Protection Law (PIPL) and the Data Security Law (DSL), alongside new regulations effective January 1, 2025, impose strict requirements on data handling and cross-border transfers, directly impacting customer data management strategies.

Environmental factors

Chinese insurers, including New China Life Insurance, are actively incorporating Environmental, Social, and Governance (ESG) principles into their investment mandates. This shift is significantly influenced by government directives promoting sustainable development and green finance initiatives. For instance, the China Banking and Insurance Regulatory Commission (CBIRC) has been encouraging insurers to invest in sectors aligned with low-carbon economic transformation, impacting asset allocation decisions.

This growing emphasis on ESG means New China Life Insurance must consider environmental impact and social responsibility when making investment choices. The company's asset allocation strategies are likely being reshaped to include more investments in green bonds and sustainable projects. By 2024, the sustainable finance market in China is projected to continue its robust growth, presenting both opportunities and challenges for insurers in aligning their portfolios with ESG mandates.

Climate change poses significant physical risks, with an increasing frequency and severity of extreme weather events like floods and typhoons directly impacting the insurance sector through higher claims. While New China Life Insurance's core business is life insurance, these broader climate-related events can indirectly affect its financial stability by impacting investment portfolios and the overall economic environment. For instance, the economic losses from natural disasters in China were estimated to be around 400 billion yuan in 2023, a figure that could rise with escalating climate impacts.

China's commitment to green finance is accelerating, with regulators encouraging insurers like New China Life to develop and offer green insurance products. This push aims to support the nation's transition to a low-carbon economy by providing financial protection for green industries. For instance, by the end of 2023, China's outstanding green loans had reached 15.78 trillion yuan, a significant increase that highlights the growing demand for green financial services.

Operational Environmental Footprint

Insurers are facing growing pressure to shrink their operational environmental impact. This includes actively working to lower greenhouse gas emissions and reduce overall energy usage across their facilities and operations. For instance, Ping An Insurance has been a leader in this space, implementing various sustainability initiatives that set a benchmark for other major players like New China Life Insurance.

New China Life Insurance, like its peers, is expected to align with these environmental expectations. The company's efforts in this domain will be crucial for maintaining its reputation and meeting evolving regulatory and investor demands. Key areas of focus for insurers typically include:

- Reducing carbon emissions from office buildings and data centers.

- Minimizing waste generation and promoting recycling programs.

- Increasing the use of renewable energy sources for operations.

- Enhancing energy efficiency in all business processes.

Public Awareness of Environmental Issues

Public awareness of environmental issues is significantly shaping consumer choices in the insurance sector. In China, a growing segment of the population is actively seeking out companies that demonstrate a commitment to sustainability. This trend is particularly evident in the younger demographic, with surveys indicating a higher propensity among Gen Z and Millennials to favor brands with strong environmental, social, and governance (ESG) credentials.

This societal shift directly impacts insurers like New China Life. Companies that integrate environmentally friendly practices into their operations and product development are likely to gain a competitive edge. For instance, offering green insurance products or highlighting investments in sustainable industries can resonate with a public increasingly concerned about climate change and resource depletion. By 2024, ESG investing in China saw a substantial increase, with assets under management in ESG-focused funds reaching new highs, signaling a clear market demand for responsible corporate behavior.

- Growing demand for sustainable insurance products.

- Consumer preference shifts towards environmentally conscious insurers.

- ESG investment trends in China show increasing investor focus on environmental factors.

- Insurers are encouraged to adopt greener operational practices and offerings.

Environmental factors significantly shape the operational landscape for New China Life Insurance, driven by China's ambitious green finance agenda and increasing awareness of climate risks. The company must navigate evolving regulations encouraging sustainable investments and the growing consumer demand for environmentally responsible products. By 2024, China's commitment to carbon neutrality by 2060 continues to fuel growth in green finance, impacting insurer asset allocation and product development.

| Environmental Factor | Impact on New China Life Insurance | Relevant Data/Trend (2023-2024) |

|---|---|---|

| Climate Change & Extreme Weather | Increased claims risk, potential impact on investment portfolios. | Estimated economic losses from natural disasters in China around 400 billion yuan in 2023. |

| Green Finance Initiatives | Opportunity to invest in sustainable projects, develop green insurance products. | China's outstanding green loans reached 15.78 trillion yuan by end of 2023; ESG investing assets under management in China saw substantial increase by 2024. |

| Operational Sustainability | Pressure to reduce carbon footprint, enhance energy efficiency. | Industry trend towards reducing greenhouse gas emissions from facilities and data centers. |

| Public Environmental Awareness | Growing consumer preference for ESG-conscious insurers, demand for green products. | Higher propensity among younger demographics (Gen Z, Millennials) to favor sustainable brands. |

PESTLE Analysis Data Sources

Our New China Life Insurance PESTLE analysis is grounded in data from official Chinese government ministries, international financial institutions like the IMF and World Bank, and reputable industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.