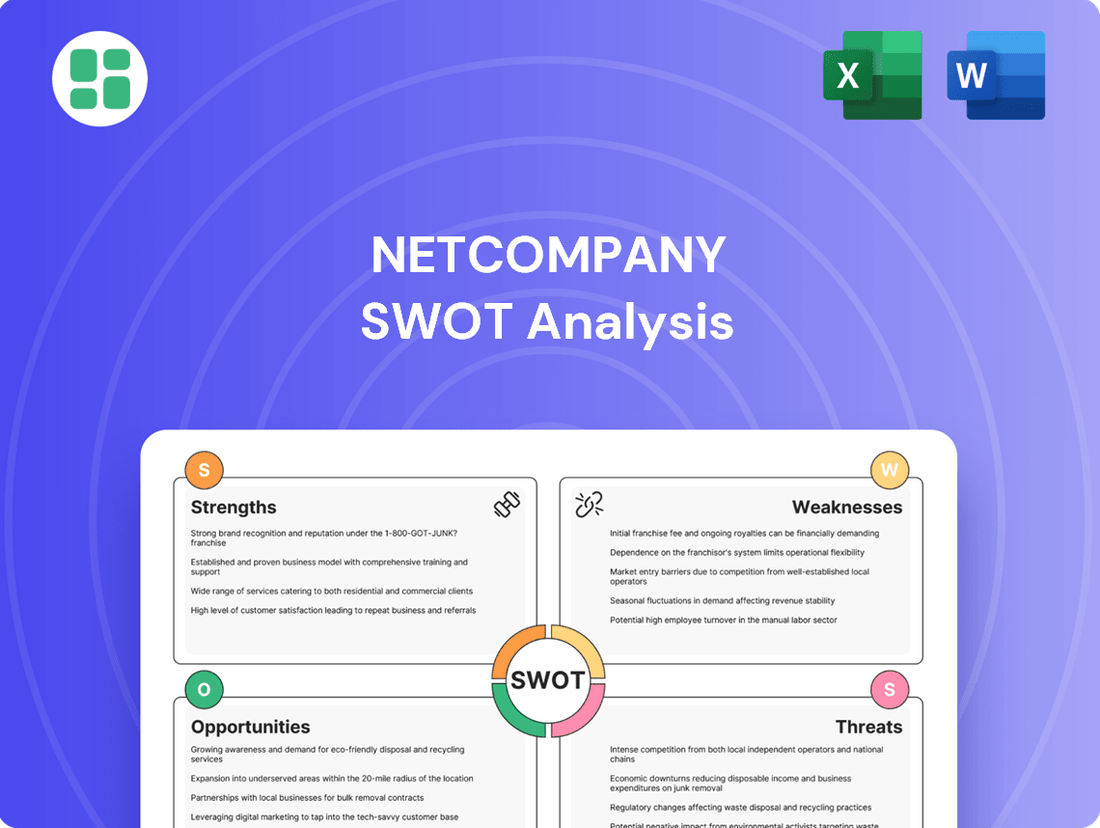

Netcompany SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Netcompany Bundle

Netcompany boasts strong technical expertise and a solid reputation for delivering complex IT solutions, but faces intense competition and potential reliance on key clients. Understanding these dynamics is crucial for any strategic decision-maker.

Want the full story behind Netcompany’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Netcompany's robust presence in the public sector is a significant strength, evidenced by its extensive work with governments across Northern Europe. For instance, in 2023, the company reported that a substantial portion of its revenue was derived from public sector contracts, highlighting the stability and predictability of this client base. This deep engagement translates into long-term partnerships and recurring revenue, offering a buffer against economic downturns.

Their specialized knowledge in digital transformation for government agencies makes them a go-to provider for critical national projects. This expertise is not just about technology; it's about understanding the unique regulatory and operational needs of public entities. This positions Netcompany as a trusted advisor, capable of delivering complex solutions that enhance public services and efficiency, as seen in their ongoing projects with municipalities and national agencies.

Netcompany's strength lies in its specialized focus on business-critical IT solutions. They excel at building and deploying custom software and digital platforms that are absolutely essential for their clients' day-to-day operations.

This dedication to core business systems demonstrates a profound understanding of various industries and fosters significant client reliance. For instance, in 2024, Netcompany reported a client retention rate of over 90%, highlighting the sticky nature of their tailored, complex solutions.

The intricate and bespoke nature of their offerings creates a substantial competitive advantage, making it difficult for rivals to replicate their success or easily displace them from client engagements.

Netcompany's strength lies in its comprehensive service portfolio, encompassing system integration, bespoke application development, and robust IT outsourcing. This wide array allows them to cater to a diverse client base, acting as a single point of contact for multifaceted IT requirements.

This all-encompassing approach fosters deeper client engagement and unlocks significant cross-selling potential, as evidenced by their ability to manage projects from initial strategy formulation through to successful implementation, a key differentiator in the competitive IT landscape.

Solid Financial Performance and Outlook

Netcompany's financial health is a significant strength, underscored by its robust performance in Q1 2025. The company reported a healthy 9.1% revenue increase, demonstrating its ability to expand its market presence. This growth was complemented by a notable rise in adjusted EBITDA, which, coupled with an improved margin, points to efficient operational management.

The company's confidence in its trajectory is further evidenced by its reiteration of full-year 2025 financial expectations. This includes maintaining its projected revenue growth and adjusted EBITDA margin, signaling a stable and predictable financial outlook. Such financial resilience creates a solid bedrock for Netcompany to pursue strategic investments and capitalize on future growth opportunities.

- Q1 2025 Revenue Growth: 9.1%

- Adjusted EBITDA: Significant increase reported

- Full-Year 2025 Outlook: Reiteration of financial expectations

Proven Track Record and Reputation for On-Time Delivery

Netcompany's established reputation for successfully delivering projects on time and within budget is a significant strength. This consistent performance has enabled them to secure a high win rate in public tenders, a critical factor in the competitive IT sector.

This proven track record not only attracts new clients but also fosters loyalty among existing ones. For instance, in 2023, Netcompany reported a revenue of DKK 10.1 billion, underscoring their capacity to manage and execute large-scale projects effectively.

Their expertise in fixed-price projects has historically translated into robust operating margins, demonstrating financial discipline and operational efficiency. This focus on predictable outcomes provides a stable foundation for continued growth.

- High Public Tender Win Rate: Demonstrates market confidence and competitive advantage.

- Consistent On-Time, On-Budget Delivery: Builds trust and reduces client risk.

- Strong Revenue Growth: 2023 revenue of DKK 10.1 billion highlights execution capability.

- Reputational Capital: A key differentiator in client acquisition and retention.

Netcompany's deep specialization in business-critical IT solutions, particularly for the public sector, is a core strength. Their ability to develop and implement bespoke software and digital platforms ensures essential operations for government entities, fostering long-term client relationships. This focus is reflected in a high client retention rate, exceeding 90% in 2024, a testament to the indispensable nature of their tailored solutions.

The company's comprehensive service offering, including system integration, custom development, and IT outsourcing, allows them to act as a single, capable partner for complex client needs. This integrated approach facilitates deeper client engagement and significant cross-selling opportunities, enhancing their value proposition.

Netcompany's financial stability is a key asset, with Q1 2025 revenue showing a 9.1% increase and a healthy rise in adjusted EBITDA. The reiteration of full-year 2025 financial expectations, including revenue growth and EBITDA margin targets, signals operational efficiency and a predictable financial trajectory, supporting strategic investments.

Their proven track record of delivering projects on time and within budget, especially in fixed-price public tenders, builds significant trust and contributes to a high win rate. This reliability, underscored by DKK 10.1 billion in revenue in 2023, demonstrates strong execution capabilities and operational discipline.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Public Sector Expertise | Dominant market position in Northern Europe | Substantial portion of revenue from public sector contracts (2023) |

| Specialized Solutions | Bespoke, business-critical IT development | Client retention rate > 90% (2024) |

| Financial Health | Consistent revenue growth and profitability | Q1 2025 revenue up 9.1%; Reiterated full-year 2025 financial expectations |

| Project Execution | On-time, on-budget delivery | 2023 Revenue: DKK 10.1 billion; High public tender win rate |

What is included in the product

Presents a comprehensive assessment of Netcompany's internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Uncovers critical market gaps and competitive threats, enabling proactive strategy adjustments.

Weaknesses

Netcompany's significant revenue concentration in Denmark and Sweden, particularly from public sector contracts, presents a notable weakness. This reliance makes the company susceptible to localized economic slowdowns or shifts in government policy and spending priorities. For example, a significant reduction in public sector IT spending in Denmark could disproportionately impact Netcompany's financial performance.

The company's strong performance in these core markets, while a strength, also highlights the potential risk of over-dependence. Should economic conditions deteriorate in these specific regions, or if key public sector clients face budget cuts, Netcompany's revenue streams could be severely affected. This underscores the strategic imperative for Netcompany to actively pursue greater diversification across a wider range of geographies and client sectors to build resilience.

The IT services sector is fiercely competitive, with a crowded field of global giants and agile local providers constantly bidding for projects. This intense rivalry often leads to downward pressure on pricing, impacting profit margins for companies like Netcompany. For instance, a report from Gartner in late 2024 highlighted that the average contract value in the mid-market IT consulting space saw a 3% year-over-year decline due to competitive bidding.

To stay ahead, Netcompany must consistently invest heavily in both cutting-edge technology and attracting top-tier talent, a significant ongoing expense. The need to continuously innovate and differentiate its service portfolio is paramount to avoid being commoditized and to maintain its market position against a backdrop of aggressive pricing strategies from competitors.

Netcompany faces significant hurdles in attracting and keeping top-tier IT talent, a crucial element for its continued success, especially given the intense global competition for skilled tech professionals. This scarcity of talent directly translates to higher recruitment expenses and upward pressure on wages, potentially squeezing profit margins.

The loss of essential employees poses a tangible risk to Netcompany's ability to successfully deliver projects and maintain strong relationships with its clients. For instance, in 2023, the IT sector globally experienced an average 15% increase in recruitment costs for specialized roles, a trend Netcompany likely navigated.

Integration Risks from Acquisitions

Netcompany's growth strategy through acquisitions, such as the recent SDC merger, introduces significant integration risks. Merging distinct company cultures, IT systems, and client bases can lead to operational disruptions and hinder the achievement of projected synergies.

These integration challenges can manifest as increased costs, reduced productivity, and a negative impact on customer retention. For instance, the SDC acquisition is projected to have a dilutive effect on Netcompany's Earnings Per Share (EPS) in 2025, primarily due to the expenses associated with this integration process.

- Cultural Clashes: Integrating different organizational cultures can create friction and reduce employee morale.

- System Incompatibilities: Merging disparate IT infrastructure and software can lead to technical glitches and operational inefficiencies.

- Client Portfolio Disruption: Poor integration can result in a decline in client satisfaction and potential loss of business.

- Synergy Realization Failure: The inability to effectively combine operations can prevent Netcompany from achieving the expected financial and strategic benefits from acquisitions.

Dependency on Economic Cycles

Netcompany's reliance on private sector IT spending makes it vulnerable to economic cycles. When the economy slows, businesses often cut back on discretionary IT investments. For instance, during a recessionary period, a company might postpone a major digital transformation project, directly affecting Netcompany's sales pipeline and revenue growth forecasts.

This sensitivity to macroeconomic trends can lead to unpredictable revenue streams, especially when compared to companies with more stable, long-term contracts. While the public sector offers a degree of resilience, a widespread economic downturn can still significantly dampen demand from private enterprises, posing a considerable threat to their financial performance.

- Economic Sensitivity: Private sector IT spending is directly tied to economic health, making Netcompany susceptible to downturns.

- Discretionary Spending Cuts: Companies often reduce non-essential IT projects during recessions, impacting Netcompany's revenue.

- Revenue Volatility: Macroeconomic fluctuations can lead to less predictable financial results for Netcompany.

Netcompany's significant revenue concentration in Denmark and Sweden, particularly from public sector contracts, presents a notable weakness. This reliance makes the company susceptible to localized economic slowdowns or shifts in government policy and spending priorities. For example, a significant reduction in public sector IT spending in Denmark could disproportionately impact Netcompany's financial performance.

The IT services sector is fiercely competitive, with a crowded field of global giants and agile local providers constantly bidding for projects. This intense rivalry often leads to downward pressure on pricing, impacting profit margins for companies like Netcompany. For instance, a report from Gartner in late 2024 highlighted that the average contract value in the mid-market IT consulting space saw a 3% year-over-year decline due to competitive bidding.

Netcompany faces significant hurdles in attracting and keeping top-tier IT talent, a crucial element for its continued success, especially given the intense global competition for skilled tech professionals. This scarcity of talent directly translates to higher recruitment expenses and upward pressure on wages, potentially squeezing profit margins. The loss of essential employees poses a tangible risk to Netcompany's ability to successfully deliver projects and maintain strong relationships with its clients. For instance, in 2023, the IT sector globally experienced an average 15% increase in recruitment costs for specialized roles, a trend Netcompany likely navigated.

Netcompany's growth strategy through acquisitions, such as the recent SDC merger, introduces significant integration risks. Merging distinct company cultures, IT systems, and client bases can lead to operational disruptions and hinder the achievement of projected synergies. These integration challenges can manifest as increased costs, reduced productivity, and a negative impact on customer retention. For instance, the SDC acquisition is projected to have a dilutive effect on Netcompany's Earnings Per Share (EPS) in 2025, primarily due to the expenses associated with this integration process.

What You See Is What You Get

Netcompany SWOT Analysis

The preview you see is the actual Netcompany SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report offers a comprehensive look at Netcompany's strategic position. Purchase unlocks the entire in-depth version, ready for your use.

Opportunities

The worldwide surge in digital transformation offers a significant avenue for Netcompany's expansion. Companies and public sector entities are channeling substantial investments into upgrading their IT systems and embracing digital technologies to boost operational effectiveness and market standing.

Netcompany's core strengths in bespoke software development and digital platform creation are perfectly aligned with this escalating market need. For instance, in 2024, the global IT spending on digital transformation was projected to reach over $2.3 trillion, highlighting the immense market potential.

Netcompany can leverage its proven business model and deep expertise to enter new international markets, replicating its success in regions where digital transformation is accelerating. This expansion could target countries with strong government or enterprise IT spending, mirroring its existing strongholds.

The recent merger with SDC significantly bolsters Netcompany's position within the financial services sector, a key growth area for IT services in Europe. This strategic move opens doors to a high-spending vertical, providing a robust platform for cross-selling and upselling its digital solutions to a broader financial client base.

Netcompany can capitalize on the booming adoption of Artificial Intelligence (AI), Machine Learning (ML), Cloud Computing, and the Internet of Things (IoT). These technologies are transforming how businesses operate, creating a significant demand for advanced digital solutions. For instance, the global AI market was valued at approximately $196.6 billion in 2023 and is projected to reach $1.81 trillion by 2030, demonstrating substantial growth potential.

By integrating these cutting-edge technologies into its service portfolio, Netcompany can develop innovative offerings that address evolving client needs. This strategic move enhances its value proposition, attracting businesses eager for enhanced digital capabilities and competitive advantages. Early 2024 saw continued investment in cloud infrastructure, with global spending expected to grow significantly, providing a fertile ground for Netcompany's cloud-based solutions.

To fully leverage these opportunities, Netcompany must prioritize investment in research and development (R&D) and cultivate talent in AI, ML, cloud, and IoT. This commitment ensures they remain at the forefront of technological innovation, capable of delivering sophisticated solutions that drive client success and solidify their market position in the rapidly digitizing landscape.

Increased Demand for Cybersecurity Solutions

The escalating frequency and sophistication of cyberattacks, coupled with stricter data protection regulations like GDPR, are driving a substantial surge in the need for advanced cybersecurity measures. This trend presents a significant opportunity for Netcompany to bolster its cybersecurity service portfolio, encompassing expert consulting, seamless implementation, and proactive managed security services. By addressing these critical client needs, Netcompany can tap into a rapidly expanding market segment characterized by strong recurring revenue streams.

For instance, the global cybersecurity market was projected to reach approximately $270 billion in 2024, with a compound annual growth rate (CAGR) of over 13% expected through 2028. This growth is fueled by enterprises across all sectors prioritizing digital transformation and cloud adoption, thereby increasing their attack surface and the demand for comprehensive security solutions.

- Growing Threat Landscape: Cybercrime costs are projected to hit $10.5 trillion annually by 2025, underscoring the urgency for robust defenses.

- Regulatory Compliance: Mandates such as the NIS2 directive in Europe are compelling organizations to invest heavily in cybersecurity infrastructure and services.

- Digital Transformation Acceleration: Increased reliance on cloud services and remote work models inherently expands the need for secure digital environments.

- Managed Services Demand: Businesses are increasingly outsourcing cybersecurity functions to specialized providers like Netcompany for cost-efficiency and expertise.

Strategic Partnerships and Collaborations

Netcompany's strategic partnerships are a key growth driver. By teaming up with technology vendors, other consultancies, or niche solution providers, the company can access larger projects and tap into new customer bases. These alliances also foster knowledge exchange, speed up innovation, and broaden Netcompany's market presence and service offerings.

A prime example of this strategy in action is the merger with SDC, which established Netcompany Banking Services. This move demonstrates Netcompany's commitment to leveraging collaborations to strengthen its position in specific sectors. Such strategic integrations are crucial for expanding capabilities and achieving greater market penetration.

- Enhanced Market Access: Partnerships allow Netcompany to reach previously inaccessible client segments and geographical markets.

- Accelerated Innovation: Collaborations with technology vendors and specialized firms can fast-track the development and deployment of new solutions.

- Expanded Service Portfolio: By integrating with complementary businesses, Netcompany can offer a more comprehensive suite of services to its clients.

- Synergistic Growth: The merger with SDC into Netcompany Banking Services exemplifies how strategic collaborations can create significant value and market leadership.

Netcompany is well-positioned to capitalize on the ongoing global digital transformation, with IT spending on this area projected to exceed $2.3 trillion in 2024. The company's expertise in bespoke software and digital platforms aligns perfectly with this demand, offering a significant opportunity for international expansion into markets with high IT investment. The recent merger with SDC further strengthens its foothold in the financial services sector, a key growth area for IT services in Europe.

The company can also leverage the rapid adoption of AI, ML, cloud computing, and IoT, technologies that are driving demand for advanced digital solutions. The global AI market alone was valued at approximately $196.6 billion in 2023 and is expected to grow substantially. By integrating these technologies, Netcompany can create innovative offerings that meet evolving client needs and enhance its competitive edge.

The increasing threat landscape and stringent data protection regulations are also creating a strong demand for cybersecurity services. The global cybersecurity market was projected to reach around $270 billion in 2024, with significant growth anticipated. Netcompany can expand its cybersecurity portfolio to include consulting, implementation, and managed security services, tapping into this lucrative market segment.

Strategic partnerships, such as the SDC merger creating Netcompany Banking Services, are crucial for accessing new markets and expanding service offerings. These collaborations enable Netcompany to tap into larger projects, gain knowledge exchange, and accelerate innovation, ultimately broadening its market presence and client base.

| Opportunity Area | Market Data Point | Netcompany Relevance |

|---|---|---|

| Digital Transformation | Global IT spending on digital transformation projected over $2.3 trillion in 2024. | Core strength in bespoke software and digital platforms aligns with market demand. |

| Emerging Technologies (AI, Cloud, IoT) | Global AI market valued at ~$196.6 billion in 2023, projected to reach $1.81 trillion by 2030. | Opportunity to integrate cutting-edge tech into service portfolio for innovative solutions. |

| Cybersecurity | Global cybersecurity market projected at ~$270 billion in 2024, with a CAGR of over 13% through 2028. | Expansion of cybersecurity services to meet rising demand driven by threats and regulations. |

| Strategic Partnerships | Merger with SDC into Netcompany Banking Services strengthens position in financial services. | Access to new client segments, accelerated innovation, and expanded service offerings through alliances. |

Threats

The IT services landscape is fiercely competitive, with global giants and specialized firms constantly battling for dominance. This rivalry often translates into aggressive pricing, which can squeeze Netcompany's profit margins. For instance, in 2024, reports indicated that the average IT services contract negotiation saw price reductions of up to 7% due to competitive bidding.

Netcompany must continually emphasize its unique value proposition and service quality to stand out. Failing to differentiate effectively in this crowded market makes it harder to command premium pricing and maintain healthy profitability against competitors who might offer lower-cost alternatives.

An economic slowdown presents a significant threat to Netcompany. A recession could force both public and private sector clients to slash their IT budgets, directly impacting the company's revenue streams. For instance, a widespread economic contraction, as seen in periods of high inflation or rising interest rates, often leads to delayed or cancelled IT investments by businesses seeking to conserve capital.

This macroeconomic sensitivity means Netcompany's project pipeline and revenue growth are vulnerable to broader economic downturns. While IT spending can be more resilient than other sectors, a severe recession can still trigger significant cutbacks, affecting Netcompany's ability to secure and complete large-scale projects. This was a concern noted by analysts in late 2023 and early 2024, as global economic uncertainty persisted.

The IT sector is in constant flux, with new technologies emerging at an unprecedented pace. This rapid obsolescence poses a significant threat, as Netcompany's current offerings could quickly become outdated if not proactively managed.

To counter this, Netcompany needs to maintain substantial investments in research and development, ensuring its solutions stay ahead of the curve. Furthermore, continuous upskilling of its workforce is crucial to adapt to evolving technological landscapes and maintain a competitive edge.

Failure to adapt swiftly to these technological shifts could result in a decline in market share and a loss of relevance among clients, impacting revenue streams and long-term growth prospects.

Cybersecurity Risks and Data Breaches

Netcompany, as a key player in business-critical IT solutions, faces significant cybersecurity risks. A successful cyberattack targeting their own infrastructure or the sensitive data they manage for clients could lead to severe reputational damage and substantial financial repercussions. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, a figure that could disproportionately impact a company like Netcompany, which handles extensive client data.

The potential for data breaches presents a major threat, potentially resulting in significant financial penalties and a critical erosion of client trust. Regulatory bodies are increasingly stringent; for example, GDPR fines can amount to 4% of annual global revenue. Maintaining robust internal cybersecurity measures is therefore not just a best practice but an existential necessity for Netcompany to mitigate these evolving threats.

- Reputational Damage: A major breach could lead to a loss of client confidence, impacting future business opportunities.

- Financial Penalties: Non-compliance with data protection regulations, such as GDPR, can result in substantial fines.

- Operational Disruption: Cyberattacks can disrupt Netcompany's own operations and those of its clients, leading to downtime and lost revenue.

- Client Loss: Clients entrusting Netcompany with their data may seek alternative providers if security concerns arise.

Talent Shortage and Wage Inflation

The ongoing global deficit in skilled IT professionals, especially in niche fields like cloud computing and cybersecurity, presents a substantial hurdle for Netcompany. This scarcity directly impacts the company's ability to scale operations and pursue new growth opportunities.

The intense competition for talent inevitably fuels wage inflation. For instance, in 2024, average IT salaries in key European markets saw increases of 7-10%, a trend expected to continue into 2025. This rise in compensation and recruitment expenses can erode Netcompany's profit margins and complicate project staffing.

To counter these challenges, Netcompany must prioritize robust talent retention strategies. Failing to keep its highly skilled workforce could hinder its capacity to deliver on client projects and maintain its competitive edge.

- Global IT Talent Shortage: A persistent issue affecting Netcompany's capacity.

- Wage Inflation: Expected salary increases of 7-10% in 2024 in European markets, impacting costs.

- Talent Retention: Critical for sustained operational success and project delivery.

Intense competition in the IT services sector can lead to price wars, potentially squeezing Netcompany's profit margins, with average IT contract negotiations seeing price reductions of up to 7% in 2024. Economic downturns pose a significant threat, as clients may cut IT budgets, impacting Netcompany's revenue. The rapid pace of technological change necessitates continuous investment in R&D and workforce upskilling to avoid obsolescence.

Cybersecurity risks are paramount, as a breach could result in substantial financial penalties, estimated at up to 4% of global revenue for GDPR violations, and severe reputational damage. Furthermore, a global shortage of skilled IT professionals, with average IT salaries in European markets rising 7-10% in 2024, increases recruitment costs and challenges talent retention.

| Threat Category | Specific Threat | Impact on Netcompany | Relevant Data/Trend |

|---|---|---|---|

| Competition | Aggressive Pricing | Reduced Profit Margins | Up to 7% price reduction in IT contracts (2024) |

| Economic Conditions | Budget Cuts during Downturns | Decreased Revenue, Project Delays | Sensitivity to economic contractions noted (late 2023/early 2024) |

| Technology | Rapid Obsolescence | Loss of Market Share, Reduced Relevance | Need for continuous R&D and upskilling |

| Cybersecurity | Data Breaches | Reputational Damage, Financial Penalties (e.g., 4% GDPR fine), Client Loss | Average data breach cost $4.45 million (2023) |

| Talent Market | Skilled IT Professional Shortage & Wage Inflation | Increased Operational Costs, Staffing Challenges | 7-10% IT salary increase in European markets (2024) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Netcompany's official financial reports, comprehensive market research, and insights from industry analysts. These diverse sources ensure a well-rounded and accurate understanding of the company's strategic position.