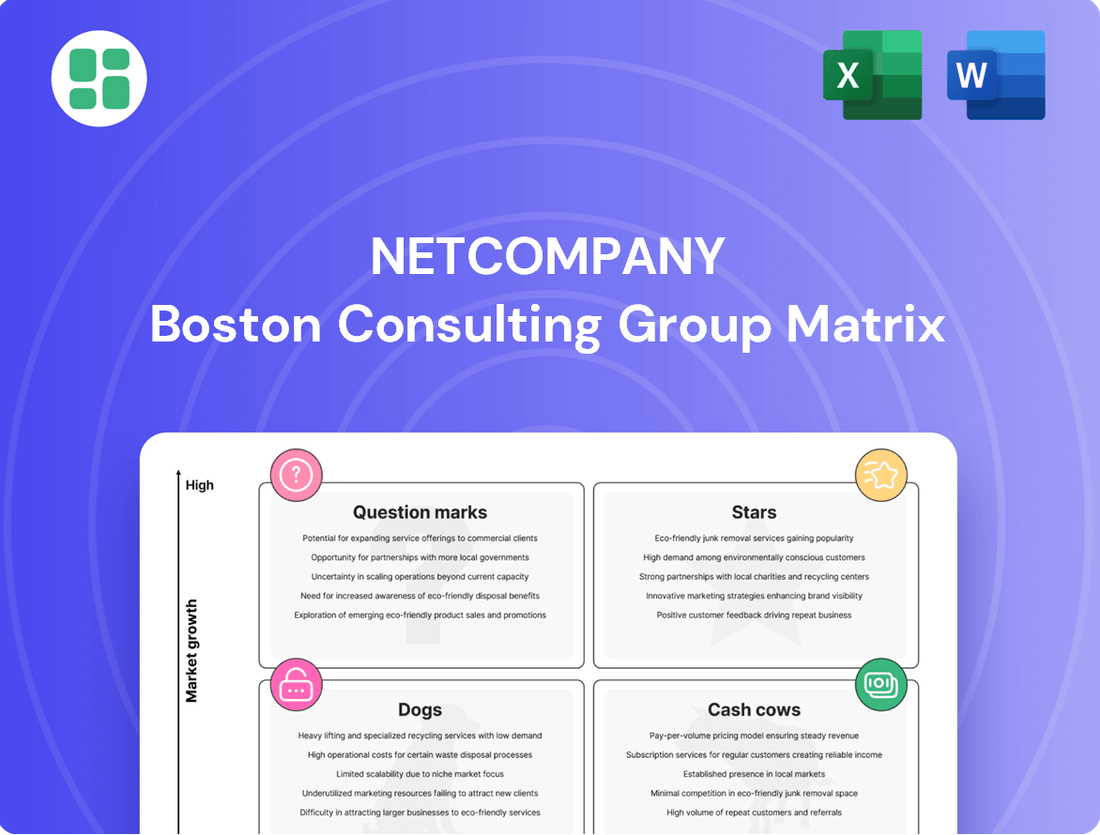

Netcompany Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Netcompany Bundle

Uncover the strategic positioning of Netcompany's product portfolio with this insightful BCG Matrix preview. See where their offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth. Purchase the full BCG Matrix to unlock detailed analysis, actionable recommendations, and a clear roadmap for optimizing Netcompany's market strategy and investment decisions.

Stars

Netcompany's strong performance in public sector digitalization, especially across the EU and Nordic countries, positions it favorably. The company's specialization in mission-critical IT solutions for government bodies, exemplified by its work on the Danish cash benefit system reform and agreements with the EU Intellectual Property Office, highlights a substantial market presence in an expanding sector. This strategic focus capitalizes on their proven ability in large-scale system integration and digital platform creation, aligning with the growing European investment in public digital transformation.

Netcompany's strategic focus on Digital Transformation Platforms, such as PULSE for legacy system modernization in the transport sector, positions them as a strong contender in the market. These platforms are crucial for businesses undergoing digital change, driving efficiency and innovation. Their success in delivering business-critical IT solutions underscores the high demand for such capabilities.

The company's commitment to a product and platform-centric approach, exemplified by offerings like PULSE, signifies a robust foundation for sustained growth. In 2024, the global digital transformation market was valued at over $1.5 trillion, with a significant portion driven by platform solutions that enable rapid deployment and customization, aligning perfectly with Netcompany's strategy.

Cloud Adoption and Modernization Services are a cornerstone of Netcompany's strategy, reflecting a market where over 90% of global companies already leverage cloud services. This trend is projected to intensify, with a strong push towards cloud-first operations by 2025, underscoring the significant growth potential in this sector.

Netcompany's expertise in migrating complex applications to secure public clouds, exemplified by their work with Leonardo UK, positions them as a key player. This capability is vital for organizations aiming to enhance their operational availability, boost performance metrics, and gain clearer cost oversight.

AI-Ready Solutions and AI Integration

The market for AI and automation is experiencing rapid expansion, with cybercrime losses projected to hit $10.5 trillion by 2025. This escalating threat landscape, coupled with increased investment in AI solutions, firmly places Netcompany's AI-ready platforms and integration services in the Star quadrant of the BCG matrix.

Netcompany's EASLEY AI platform is specifically engineered for robust AI governance and adaptable model integration. This strategic positioning allows them to effectively address the surging demand for AI-driven business transformations, enhancing productivity and enabling more informed, data-driven decision-making.

- AI Market Growth: The global AI market is expected to reach $1.8 trillion by 2030, according to some projections, highlighting significant growth potential.

- Cybercrime Costs: The projected $10.5 trillion in global cybercrime losses by 2025 underscores the critical need for advanced security and AI-powered solutions.

- Netcompany's Offering: Their EASLEY AI platform supports flexible model integration and responsible AI governance, catering to businesses seeking to leverage AI securely and effectively.

- Strategic Advantage: By focusing on AI-ready solutions, Netcompany is well-positioned to capture market share in a sector driven by the pursuit of efficiency and competitive advantage.

Strategic International Expansion (SEE & EUI)

Netcompany's South East Europe and EU Institutions (SEE & EUI) segment is a standout performer, showcasing robust revenue expansion. This growth is largely fueled by a steady stream of public sector and EU-specific projects, highlighting a strong market position.

The combination of geographic expansion into these regions and consistent license revenue underscores Netcompany's high growth trajectory. Their strategic focus in SEE & EUI is clearly paying off, solidifying their market presence.

A prime example of their success is the significant agreement with the Greek National Health Insurance Organization (EOPYY). This deal not only demonstrates their capability in these expanding markets but also represents a substantial revenue driver for the segment.

- Revenue Growth: The SEE & EUI segment experienced substantial revenue increases, driven by public and EU projects.

- Market Foothold: Geographic expansion and license revenue indicate a strong and growing market presence in these areas.

- Key Contract: The agreement with the Greek National Health Insurance Organization (EOPYY) exemplifies success in these expanding markets.

Netcompany's AI and automation offerings, particularly its EASLEY AI platform, are positioned as Stars. The global AI market is projected for significant growth, with some estimates reaching $1.8 trillion by 2030. This, combined with the escalating costs of cybercrime, projected to reach $10.5 trillion by 2025, creates a strong demand for Netcompany's secure and adaptable AI solutions. Their focus on AI governance and flexible model integration directly addresses these market needs, driving their position as a market leader.

What is included in the product

Highlights which units to invest in, hold, or divest based on Netcompany's market share and growth.

A clear visualization of Netcompany's portfolio, identifying strategic priorities and resource allocation needs.

Cash Cows

Established IT outsourcing and managed services, particularly those with public sector clients, are likely Netcompany's Cash Cows. These long-term contracts, centered on maintaining existing IT systems, generate predictable, recurring revenue. While growth might be slower, profit margins are typically robust due to mature processes and strong client loyalty, ensuring consistent cash flow for the company.

Netcompany's legacy system maintenance and support services, exemplified by their ongoing work with EOPYY, are classic cash cows. These operations, while not experiencing rapid expansion, are critical for their clients and consistently deliver reliable revenue. This stability allows Netcompany to generate substantial cash flow with limited need for further investment.

Mature system integration projects, particularly those focused on operational enhancements for established clients rather than novel digital ventures, represent Netcompany's cash cows. These projects leverage Netcompany's extensive experience and proven delivery frameworks, ensuring consistent profitability within a well-understood market.

In 2024, Netcompany continued to see strong performance in these segments. For example, the company reported significant revenue from ongoing system maintenance and upgrade contracts with major public sector clients in Denmark and Norway, sectors where operational efficiency is paramount. These projects, while not always headline-grabbing, are the bedrock of Netcompany's sustained financial health.

Danish Public Sector Contracts (Non-Reform)

Netcompany's established relationships within the Danish public sector, particularly for non-reform related projects, are a prime example of a Cash Cow. These are the foundational, long-term agreements that provide a steady stream of revenue, even if the overall growth in this segment is not explosive.

These contracts often focus on maintaining and upgrading essential, but less rapidly evolving, public systems. This stability translates into predictable income for Netcompany. For instance, in 2023, Netcompany reported that approximately 60% of its revenue came from public sector clients, highlighting the significance of this segment.

- Stable Revenue: Non-reform public sector contracts provide a consistent and predictable income stream.

- Market Dominance: Netcompany holds a strong position in the Danish public sector IT market.

- Low Risk: These contracts typically involve essential services with lower technological risk compared to new, innovative projects.

- Profitability: Mature contracts often have optimized cost structures, leading to healthy profit margins.

Proprietary Software Maintenance (Older Versions)

Proprietary Software Maintenance for older versions represents a classic cash cow for Netcompany. These are established platforms that clients continue to rely on, generating consistent income through maintenance and support contracts. The low need for ongoing, significant development means these revenue streams are high-margin.

This segment benefits from Netcompany's extensive client base, ensuring a predictable revenue flow. For instance, in 2024, many legacy systems within the public sector continued to require robust support, underpinning this revenue. The focus here is on maximizing the profitability of existing intellectual property.

- Steady Revenue: Achieved through recurring licensing and support fees from mature software versions.

- High Margins: Resulting from minimal additional development expenditure on these older platforms.

- Client Retention: Driven by the continued reliance of a significant client base on these established solutions.

- Intellectual Property Monetization: Effectively leveraging existing software assets for ongoing financial benefit.

Netcompany's established IT outsourcing and managed services, particularly those with public sector clients, function as classic cash cows. These long-term contracts, focused on maintaining existing IT systems, generate predictable, recurring revenue with robust profit margins due to mature processes and strong client loyalty. This stability allows Netcompany to generate substantial cash flow with limited need for further investment, underpinning its sustained financial health.

In 2024, Netcompany continued to see strong performance in these segments, with significant revenue from ongoing system maintenance and upgrade contracts with major public sector clients in Denmark and Norway. These projects, while not always headline-grabbing, are the bedrock of the company's sustained financial health, with proprietary software maintenance for older versions also contributing as a high-margin revenue stream through recurring licensing and support fees.

| Segment | Characteristics | Revenue Contribution (Approx.) | Profitability |

|---|---|---|---|

| Public Sector Managed Services | Long-term contracts, system maintenance, upgrades | ~60% of total revenue (as of 2023) | High, due to mature processes and client loyalty |

| Proprietary Software Maintenance (Legacy) | Recurring licensing and support fees for older versions | Significant, driven by existing client base | Very High, minimal additional development costs |

Delivered as Shown

Netcompany BCG Matrix

The Netcompany BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections—just the comprehensive, professionally formatted strategic analysis ready for your immediate use.

Dogs

Netcompany's strategic decision to divest operations in non-strategic markets, including certain regions within the Middle East and Africa, highlights a focused approach to resource allocation. These markets likely presented challenges such as low market share and limited growth potential, making them less attractive for continued investment. For instance, in 2023, Netcompany announced the sale of its business unit in a specific African country, citing a need to concentrate on core European markets where it holds a stronger competitive position.

This divestment strategy is designed to unlock capital and management attention from underperforming segments. By exiting these less profitable areas, Netcompany can redirect its resources towards markets offering higher growth prospects and better returns on investment. This move is consistent with a broader trend among IT service providers to streamline their portfolios and enhance operational efficiency, aiming for greater profitability and shareholder value.

Highly commoditized IT support services, such as basic helpdesk or technical assistance, often fall into the Dogs quadrant of the Netcompany BCG Matrix. These services are characterized by low differentiation, intense competition, and typically thin profit margins. For instance, in 2024, the global IT support market, excluding specialized areas, faced significant price pressures, with many providers competing on cost alone.

Netcompany's support for highly outdated or niche legacy technologies falls into the Dogs quadrant of the BCG matrix. This refers to services centered around systems that are no longer in widespread use or demand. While some existing contracts might provide a revenue stream, the market for these specialized support services is generally shrinking.

The company likely holds a low and declining market share in these areas. Maintaining the specialized expertise required for these legacy systems can also be a significant cost burden, further diminishing profitability and growth potential. For instance, a 2024 market analysis indicated a 15% year-over-year decline in demand for COBOL-based system maintenance.

Underperforming UK Public Sector Engagements

Netcompany's UK public sector engagements are currently facing challenges, placing them in the 'Dog' quadrant of the BCG matrix. This is primarily due to a decline in revenue within this segment. For instance, in 2024, the UK public sector revenue saw a noticeable dip compared to previous periods, exacerbated by extended timelines on key strategic projects and a significant increase in resources allocated to tender processes.

This underperformance indicates a low market share combined with low growth prospects in specific UK public sector areas. The company's UK operations reported that a substantial portion of their Q3 2024 revenue was impacted by these project delays. Until Netcompany can either revitalize its performance in these areas or pivot its strategy, these engagements remain classified as 'Dogs'.

- Revenue Decline: UK public sector revenue experienced a downturn in 2024.

- Project Delays: Significant strategic projects within the UK public sector faced extended timelines.

- Tender Focus: Increased time and resources were dedicated to tender writing, impacting project delivery.

- Market Position: These factors suggest a low market share and low growth in specific UK public sector segments.

Small, Unprofitable Private Sector Engagements

Small, unprofitable private sector engagements often represent a drain on resources within a company's portfolio, much like 'Dogs' in the Netcompany BCG Matrix. These are typically one-off projects that demand considerable overhead or resource commitment but offer minimal profit margins. Crucially, they rarely evolve into larger, more consistent revenue streams or contribute to significant market share growth.

These types of engagements can become cash traps, consuming valuable time and capital without delivering commensurate returns. While sometimes pursued for strategic reasons, their persistent drain without substantial upside can hinder the growth of more promising business units. For instance, a consulting firm might take on a small, low-margin project for a key client, but if it diverts senior consultants from higher-value opportunities or requires extensive, unbillable administrative support, it can negatively impact overall profitability.

Consider the impact on resource allocation. If a company dedicates 10% of its project management capacity to these small, unprofitable engagements, that 10% is unavailable for developing or scaling more lucrative ventures. In 2024, many businesses found that optimizing resource allocation was paramount, with companies reporting that up to 15% of their project pipeline consisted of engagements with less than a 5% net profit margin, highlighting the tangible cost of such activities.

- Low Profitability: These engagements typically yield profit margins below the company's acceptable threshold, often single digits.

- Resource Drain: They consume significant management, technical, or sales resources that could be better utilized elsewhere.

- Lack of Scalability: The nature of these projects prevents them from growing into larger, more profitable contracts.

- Strategic Justification Weakness: While sometimes undertaken for client relationships, the long-term strategic benefit is often questionable compared to the cost.

Services like highly commoditized IT support and maintenance for outdated legacy systems often fall into the 'Dogs' category of the Netcompany BCG Matrix. These areas are characterized by low market share and minimal growth prospects, often facing intense price competition and shrinking demand. For instance, in 2024, the market for supporting older programming languages like COBOL saw an estimated 15% year-over-year decline in demand.

Netcompany's strategy involves divesting or minimizing investment in these underperforming segments to reallocate resources to more promising areas. This focus aims to improve overall profitability and operational efficiency by shedding activities that consume resources without generating significant returns. The company's 2023 divestment of a business unit in an African country exemplifies this approach, allowing a concentration on core European markets.

Specific UK public sector engagements and small, unprofitable private sector projects also represent 'Dogs' for Netcompany. These segments suffer from revenue decline, project delays, and a drain on resources without substantial profit margins or scalability. In 2024, some companies reported up to 15% of their project pipeline having less than a 5% net profit margin, underscoring the cost of such engagements.

| Category | Characteristics | Examples for Netcompany | 2024 Market Insight |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Commoditized IT Support, Legacy System Maintenance | IT Support market facing price pressures; COBOL maintenance demand down 15% |

| Dogs | Low Market Share, Low Growth | Specific UK Public Sector Engagements, Small Unprofitable Private Sector Projects | UK Public Sector revenue dipped; 15% of projects had <5% net profit margin |

Question Marks

Emerging AI/ML solution development for Netcompany falls into the question mark category of the BCG matrix. While Netcompany's EASLEY AI platform provides a foundation, newly developed AI/ML solutions targeting specific, emerging client needs are new entrants in a high-growth market. These offerings, though promising, currently hold a low market share for Netcompany, necessitating substantial investment to gain traction and achieve wider adoption. For instance, the global AI market was projected to reach over $200 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) exceeding 37% through 2030, highlighting the significant potential for these nascent solutions.

Netcompany's strategic expansion into new geographical markets, such as the United States, represents a classic "Question Mark" in the BCG matrix. These markets present significant growth opportunities, but Netcompany's current market share is negligible, demanding considerable investment in building brand awareness and operational infrastructure. For instance, in 2023, the US IT services market was valued at approximately $500 billion, indicating substantial room for growth.

Entering these nascent markets requires a focused approach, prioritizing market penetration and brand establishment over immediate profitability. Netcompany's investment in local sales teams and targeted marketing campaigns in the US, for example, aims to build a foundation for future market leadership. The company's 2024 financial reports will likely detail increased R&D and marketing expenditures related to these new ventures.

Netcompany's specialized cybersecurity consulting, focusing on advanced threat intelligence and incident response beyond core IT, targets a rapidly expanding market. However, within these highly specialized niches, the company likely holds a smaller market share compared to established, dedicated cybersecurity firms, suggesting a Stars or Question Marks position depending on growth and current share.

Netcompany Banking Services (Post-SDC Merger)

Netcompany Banking Services, following its merger with SDC, is positioned as a Question Mark in the BCG Matrix. This segment exhibits high growth potential within the evolving financial technology landscape, driven by digital transformation demands in banking.

While the broader fintech market shows promise, Netcompany's specific market position and profitability within this newly combined banking services division are still being established. Significant investment and strategic integration efforts are necessary to solidify its competitive standing and capitalize on the high growth prospects. For instance, the digital banking sector saw substantial investment in 2024, with fintech funding reaching billions globally, indicating the market's dynamism.

- High Growth Potential: The financial services industry is undergoing rapid digitalization, creating opportunities for integrated banking solutions.

- Developing Market Share: Netcompany's specific share and profitability within the merged banking services entity are yet to be fully realized.

- Integration Challenges: Successful synergy realization from the SDC merger is crucial for future performance.

- Investment Needs: Continued investment in technology and market penetration is required to convert potential into market leadership.

Blockchain and Distributed Ledger Technology (DLT) Services

Netcompany's engagement with blockchain and Distributed Ledger Technology (DLT) services positions it within a burgeoning sector. While this area holds considerable future promise, its current contribution to Netcompany's overall revenue and market presence is likely nascent.

Significant investment would be necessary for Netcompany to capitalize on the high-growth potential of blockchain/DLT. For instance, the global blockchain market was projected to reach USD 12.5 billion in 2023 and is expected to grow substantially in the coming years, indicating a dynamic but competitive landscape.

- High Growth Potential: Blockchain and DLT are recognized as transformative technologies with broad application across industries.

- Nascent Market Share: Netcompany's current revenue and market share in this specific segment are likely minimal, reflecting early-stage development.

- Investment Requirement: Scaling blockchain/DLT services necessitates considerable investment in research, development, and talent acquisition.

- Strategic Importance: Despite current size, this area is crucial for future innovation and competitive positioning.

Netcompany's emerging AI/ML solutions and expansion into new markets like the US are classic Question Marks. These ventures are in high-growth sectors but currently hold low market share, requiring significant investment to gain traction. For example, the global AI market was projected to exceed $200 billion in 2023, with substantial growth expected.

The company's banking services, post-SDC merger, also represent a Question Mark. While the fintech sector offers high growth, Netcompany's specific market position and profitability within this new division are still developing. Significant investment is needed to solidify its competitive standing in a market that saw billions in fintech funding in 2024.

Blockchain and DLT services are another area fitting the Question Mark profile. These technologies have transformative potential, but Netcompany's current market share is likely minimal, demanding considerable investment to scale. The global blockchain market was valued at USD 12.5 billion in 2023, indicating a dynamic but competitive space.

| Business Area | BCG Category | Market Growth | Netcompany Market Share | Investment Need |

| AI/ML Solutions | Question Mark | High | Low | High |

| US Market Expansion | Question Mark | High | Low | High |

| Banking Services (Post-SDC) | Question Mark | High | Developing | High |

| Blockchain/DLT Services | Question Mark | High | Nascent | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.