Match Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Match Group Bundle

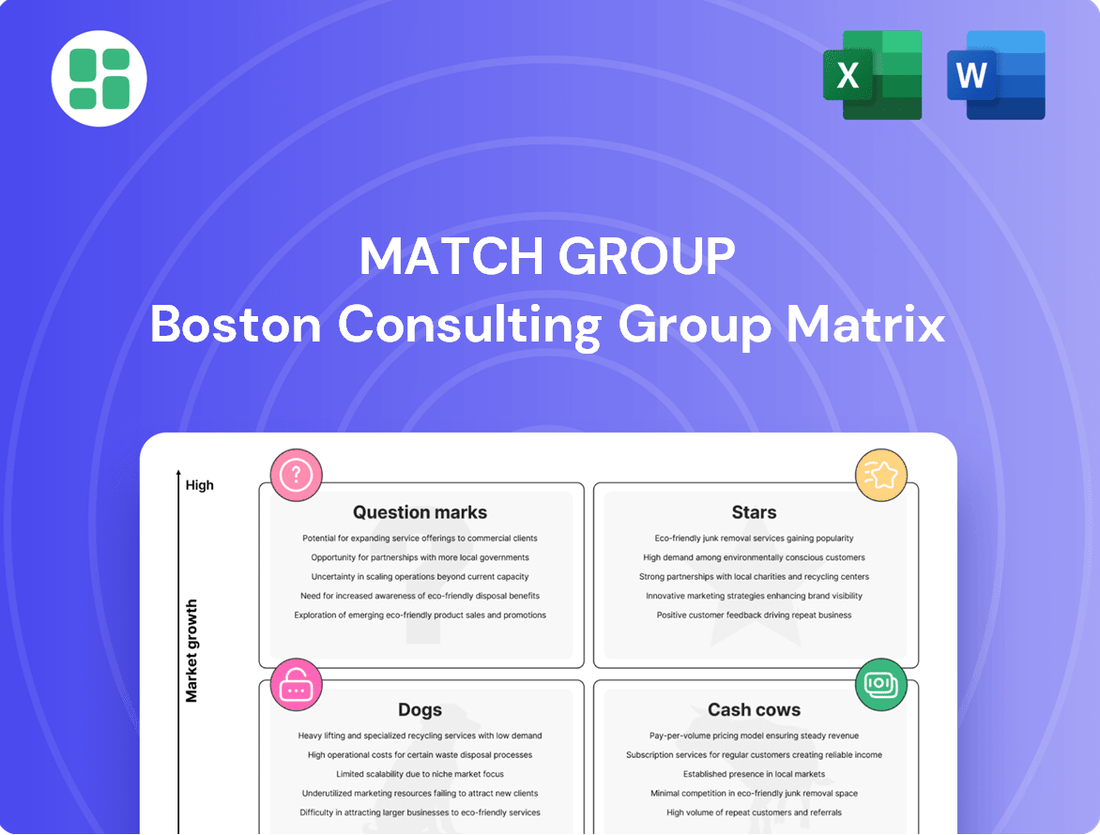

Discover the strategic positioning of Match Group's diverse portfolio through its BCG Matrix. See which dating apps are booming Stars, which are reliable Cash Cows, and which might be struggling Dogs. This preview offers a glimpse into their market performance.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain detailed quadrant placements, understand the dynamics of each brand, and receive actionable insights to guide your investment and product development strategies.

Don't miss out on a comprehensive understanding of Match Group's competitive landscape. The full report provides a clear roadmap for optimizing their product mix and maximizing market share.

Stars

Hinge experienced remarkable financial acceleration in 2024, achieving a 38% revenue increase to $550 million. This growth significantly outpaced the broader Match Group's performance, highlighting Hinge's emerging dominance within the portfolio.

The dating app's strategic emphasis on fostering intentional relationships and its appeal to the Gen Z demographic have clearly struck a chord with consumers. This strong market reception positions Hinge as a critical engine for Match Group's future expansion and revenue generation.

Hinge is a significant growth driver for Match Group, actively increasing its market share. In the U.S., Hinge holds an 18% market share, positioning it as the third-largest dating app. This impressive growth is further highlighted by its status as the second most downloaded dating app in the U.S. and its top downloaded ranking in key international markets such as the UK and France.

Hinge's strategic focus on Gen Z and 'intentional daters' is a key differentiator, attracting users seeking genuine connections amidst a landscape of dating app fatigue. This demographic, known for its high engagement and openness to new platforms, represents a significant growth opportunity within the online dating market. In 2024, Hinge continued to build on this by emphasizing authentic user experiences and success stories in its marketing, resonating strongly with this valuable user base.

International Expansion Initiatives

Hinge is making significant strides in its international expansion, a key driver for its Star status within the BCG matrix. The company has concrete plans to enter Latin America, with launches slated for Mexico in the third quarter and Brazil in the fourth quarter of 2025.

This strategic geographic push is designed to tap into new, high-growth markets, thereby enhancing Hinge's global footprint and market share potential.

- Hinge's Latin America Expansion: Targeting Mexico (Q3 2025) and Brazil (Q4 2025).

- Strategic Rationale: Capitalizing on high-growth emerging markets.

- Impact on BCG Matrix: Reinforces its Star classification through aggressive market penetration.

Significant Investment and Product Innovation

Match Group is strategically channeling significant investment into Hinge, focusing on advanced product development and the integration of AI-driven features. This commitment aims to elevate the user experience and boost engagement on the platform.

These substantial investments are vital for Match Group to solidify its competitive advantage and translate its impressive growth trajectory into enduring market leadership. The company's forward-looking strategy for 2025 is centered on accelerating growth across its key brands, Tinder and Hinge, alongside its developing portfolio.

- Hinge Product Development: Match Group is heavily investing in Hinge's product roadmap, including AI-powered matching and enhanced user interaction tools.

- AI Integration: The company is leveraging artificial intelligence to personalize user experiences and improve matching algorithms on Hinge.

- Competitive Edge: These innovations are designed to maintain Hinge's strong growth and differentiate it in the crowded dating app market.

- 2025 Strategic Focus: Match Group's primary growth drivers for 2025 are identified as Tinder, Hinge, and other emerging brands within its portfolio.

Hinge is a clear Star in Match Group's BCG Matrix due to its exceptional growth and strong market position. In 2024, it achieved a 38% revenue increase, reaching $550 million, significantly outperforming the group. Its strategic focus on Gen Z and intentional dating resonates deeply, driving its status as the second most downloaded dating app in the U.S. and a top performer internationally.

Hinge's aggressive international expansion, including planned launches in Mexico and Brazil in 2025, further solidifies its Star classification. Match Group's substantial investment in AI-driven features and product development for Hinge underscores its commitment to maintaining this high-growth trajectory and competitive edge.

| Metric | 2024 Value | Significance |

|---|---|---|

| Revenue Growth | 38% | Outpacing industry averages, indicating strong market demand. |

| Total Revenue | $550 million | Demonstrates significant financial contribution to Match Group. |

| U.S. Market Share | 18% | Positions Hinge as a leading player in a competitive market. |

| International Downloads | Top ranked in UK and France | Highlights global appeal and expansion potential. |

What is included in the product

This BCG Matrix overview analyzes Match Group's portfolio, highlighting which dating apps are Stars to invest in and which are Dogs to divest.

A clear Match Group BCG Matrix visually clarifies which dating apps are stars and which are dogs, easing the pain of resource allocation decisions.

Cash Cows

Tinder continues to dominate the dating app landscape, consistently ranking as the most downloaded globally and the highest-grossing lifestyle app worldwide. In 2024, its market share in the U.S. hovers between a significant 25% and 40%.

This immense user base and brand recognition translate into a robust and dependable revenue stream for Match Group, solidifying Tinder's status as a cash cow. Even with minor fluctuations in paying users, Tinder's sheer scale guarantees substantial and consistent income.

Tinder stands as Match Group's undisputed Cash Cow, a title solidified by its impressive revenue generation. In 2024, Tinder brought in a substantial $1.94 billion, representing the lion's share of Match Group's income. This figure, despite a modest 1.1% year-over-year increase, highlights Tinder's enduring market dominance and its capacity to consistently generate significant cash flow.

The platform's ability to maintain such high revenue, even with a maturing growth rate, is a testament to its robust user base and effective monetization strategies. Features like premium subscriptions and in-app purchases continue to be powerful drivers of its financial success. For the first quarter of 2025, Tinder's direct revenue reached $447 million, underscoring its ongoing financial strength.

Tinder, a cornerstone of Match Group's portfolio, exemplifies an established and mature user base. As of 2024, it commands roughly 75 million monthly active users and 9.6 million subscribers. This significant and loyal user base, deeply familiar with Tinder's core swipe-based functionality, requires less aggressive marketing spend and fewer product development investments compared to newer, high-growth ventures.

The sheer scale of Tinder's user engagement translates directly into consistent revenue streams. This maturity signifies a dependable cash flow, allowing Match Group to allocate resources from Tinder to other areas of its business, such as investing in emerging markets or developing new product lines.

Strong Brand Recognition and Loyalty

Tinder benefits from significant brand recognition and loyalty, making it a true cash cow for Match Group. Its presence in global pop culture, especially among younger users, ensures a steady stream of new sign-ups and high retention rates. This strong brand equity means less money is needed for user acquisition, boosting its profitability.

The app's straightforward and proven approach to online dating has cemented its enduring popularity. In 2024, Tinder continued to be a dominant force in the dating app market, consistently ranking among the top-grossing apps. Its ability to attract and retain a vast user base without excessive marketing expenditure is a testament to its cash-generating power.

- High Brand Awareness: Tinder is a household name, reducing the cost of attracting new users.

- Strong User Retention: The app's established user base and consistent engagement contribute to its cash flow.

- Global Pop Culture Presence: This cultural integration drives organic growth and loyalty.

- Efficient User Acquisition: Lower marketing costs enhance its profitability as a cash cow.

Optimized Monetization Strategies

Tinder, a quintessential cash cow for Match Group, boasts a robust monetization strategy centered on its premium subscription tiers, Tinder Gold and Tinder Plus. These offerings unlock enhanced features, driving substantial revenue per paying user.

While Tinder experienced a dip in paying subscribers starting in 2022, its established premium user base and ongoing feature development ensure a consistent and strong cash flow. The current emphasis is on refining these premium features and boosting user engagement to maintain revenue stability.

- Tinder's Monetization: Premium features like Tinder Gold and Plus are key revenue drivers.

- Subscriber Trends: A decline in paying subscribers was noted from 2022 onwards.

- Revenue Optimization: Focus is on enhancing existing features and user engagement to stabilize income.

- Cash Flow Generation: Despite subscriber fluctuations, Tinder remains a significant cash generator due to its established user base.

Tinder's position as a cash cow for Match Group is undeniable, driven by its massive user base and consistent revenue generation. In 2024, Tinder's revenue reached approximately $1.94 billion, a testament to its enduring market dominance and ability to consistently produce significant cash flow.

This substantial income stream allows Match Group to reinvest in other ventures, leveraging Tinder's stability. The platform's mature growth rate is offset by its robust user engagement and effective monetization, ensuring its continued role as a primary cash generator.

Tinder's success is further cemented by its vast user numbers, with around 75 million monthly active users and 9.6 million subscribers as of 2024. This loyal user base requires less aggressive marketing, enhancing profitability and reinforcing its cash cow status.

The app's premium features, such as Tinder Gold and Plus, are key revenue drivers, contributing significantly to its financial performance. Despite a noted dip in paying subscribers from 2022, the focus on enhancing existing features and user engagement aims to maintain this strong cash flow.

| Metric | 2024 Data | Significance for Cash Cow Status |

|---|---|---|

| Total Revenue | $1.94 billion | Primary indicator of strong and consistent cash generation. |

| Monthly Active Users | ~75 million | Vast user base supports consistent monetization opportunities. |

| Subscribers | 9.6 million | Represents a core paying customer segment driving recurring revenue. |

| Premium Feature Revenue | Significant contributor | Monetization strategy effectively converts users to paying customers. |

What You See Is What You Get

Match Group BCG Matrix

The Match Group BCG Matrix preview you are currently viewing is the precise, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring you get a ready-to-use strategic analysis. The report is designed for professional clarity, offering actionable insights into Match Group's portfolio of dating apps and services. You can confidently rely on this preview as an accurate representation of the comprehensive BCG Matrix you will acquire.

Dogs

PlentyOfFish (POF) is facing a considerable challenge with its active user base, which has fallen to around 7.5 million monthly users in 2024. This decline from previous years signifies a waning market presence and engagement, impacting its ability to drive revenue and attract new members.

This shrinking user pool directly translates to a diminished market share for PlentyOfFish. The platform's reduced relevance makes it harder to compete effectively within the online dating industry, a critical factor when considering its position within Match Group's portfolio.

POF, formerly known as Plenty of Fish, is experiencing a significant revenue contraction. Its revenue is estimated to have fallen to $198 million in 2024, a continuation of a steep decline that saw a 23% drop in 2023. This persistent revenue decrease, coupled with a shrinking user base, indicates that POF is struggling to effectively monetize its users and is losing its competitive edge in the online dating industry.

PlentyOfFish, with a mere 7% market share in the U.S. as of 2024, finds itself in a challenging position. Its user base is shrinking, and the platform operates within a low-growth segment compared to other Match Group offerings and the broader dating app market.

The decline in PlentyOfFish's appeal is further underscored by a significant drop in downloads over the last five years. This trend points to a struggle in attracting new users, a critical factor for growth in any digital platform.

Part of Underperforming 'Evergreen' Portfolio

PlentyOfFish falls into Match Group's 'Evergreen & Emerging' category, a segment that saw its collective revenue drop by 10% year-over-year in the fourth quarter of 2023. This performance indicates that established brands within this group are struggling to keep pace with evolving market trends and consumer preferences.

The underperformance of the 'Evergreen' portfolio, including PlentyOfFish, highlights a need for strategic re-evaluation. This segment represents a significant portion of Match Group's offerings, and its current trajectory suggests a need for innovation or repositioning to regain market competitiveness.

- Underperforming Segment: The 'Evergreen' portion of Match Group's portfolio, which includes brands like PlentyOfFish, experienced a 10% year-over-year revenue decline in Q4 2023.

- Systemic Challenges: This decline points to broader issues within older, established brands failing to adapt to current market dynamics.

- Strategic Concern: The underperformance of this portfolio segment necessitates a closer look at strategies for revitalization or potential divestment.

Limited Strategic Investment Focus

Match Group's strategic investment focus appears concentrated on its core growth drivers, primarily Tinder and Hinge, alongside investments in newer, promising brands. This deliberate allocation of capital suggests a move away from platforms experiencing decline, such as PlentyOfFish, which may see reduced investment or a strategy of passive management.

This approach aligns with the characteristics of a "Dogs" category within the BCG matrix. Companies in this quadrant typically have low market share and low market growth, often leading to decisions to divest, liquidate, or simply minimize ongoing investment to preserve capital.

- Limited Investment in Declining Assets: Match Group's investor communications indicate a strategic shift, prioritizing resources for high-potential platforms like Tinder and Hinge.

- Potential Divestiture or Passive Management: Platforms like PlentyOfFish, showing signs of decline, may be candidates for divestiture or a strategy of minimal investment to extract remaining value.

- BCG Matrix Alignment: This focus on core growth and reduced investment in underperforming assets mirrors the typical management strategy for "Dogs" in the BCG matrix.

- 2024 Financial Context: While specific platform-level financial data for PlentyOfFish isn't always granularly disclosed, Match Group's overall revenue in Q1 2024 was $785 million, with adjusted EBITDA of $293 million, demonstrating the importance of focusing on profitable growth areas.

PlentyOfFish (POF) fits the 'Dog' quadrant of the BCG matrix due to its declining user base, revenue, and market share. With only 7% U.S. market share in 2024 and revenue down to an estimated $198 million, POF struggles to compete. Match Group's strategic focus on growth drivers like Tinder and Hinge suggests minimal future investment in POF, aligning with typical 'Dog' management strategies of divestment or passive management.

| Metric | 2023 (Approx.) | 2024 (Estimated) | BCG Classification |

|---|---|---|---|

| Monthly Active Users (POF) | N/A (Declining) | ~7.5 million | Low |

| U.S. Market Share (POF) | N/A (Declining) | 7% | Low |

| Revenue (POF) | ~$257 million (2023, down 23% from 2022) | ~$198 million | Low |

| Portfolio Segment Performance (Evergreen) | -10% YoY Revenue (Q4 2023) | N/A | Low Growth |

Question Marks

Match Group's recent acquisitions of Salams in April 2025 and HER in May 2025 exemplify a strategic move into niche dating markets. These platforms, serving Muslim singles and the LGBTQIA+ sapphic community respectively, highlight Match Group's intent to capture high-growth potential within underserved demographics. While these niche apps may currently hold a smaller market share compared to Match Group's established brands, their targeted approach positions them as potential stars within the broader portfolio, offering avenues for significant future expansion and user base diversification.

Match Group's emerging brands, such as Archer and Azar, are showing impressive momentum, with direct revenue climbing 30% year-over-year by late 2023. Their strategic push into markets like Europe and the U.S. highlights their potential for substantial future growth.

While these newer ventures are expanding rapidly, they still represent a smaller portion of Match Group's total revenue compared to their more established platforms like Tinder.

Match Group is channeling substantial resources into promising new brands and innovative initiatives, like AI integration, aiming to propel them into high-growth Star categories. This aggressive investment strategy is a hallmark of the Question Mark quadrant in the BCG Matrix, where significant capital is deployed to build market share and validate future potential.

The company’s commitment to these ventures reflects a long-term vision, seeking to cultivate sustained user engagement and revenue streams. For instance, Match Group's investment in emerging dating technologies and user experience enhancements is designed to capture future market leadership.

Uncertain Market Share Trajectory

While brands like Hinge and Chispa within Match Group’s portfolio demonstrate impressive growth, their future market share remains a question mark. Success is contingent on their ability to consistently innovate and integrate effectively into the broader Match Group strategy.

These ventures are significant cash consumers but have yet to carve out a commanding presence in their respective markets. For instance, Hinge, while a strong contender in the modern dating app space, still faces competition from established players.

- Hinge's user growth has been robust, but its market share is still developing compared to giants like Tinder.

- Chispa, targeting the Hispanic dating market, shows potential but requires substantial investment to solidify its position.

- Match Group's overall revenue in Q1 2024 was $874 million, with the Tinder segment still being the largest contributor, highlighting the need for other brands to scale.

- Continued investment in AI-driven matching and user experience will be crucial for these brands to capture larger market shares.

Experimentation with New Features and Markets

Match Group is actively experimenting with new features like 1:1 video chat and live-streaming across its dating platforms. This strategy is designed to enhance user engagement and attract new demographics. For instance, Tinder's introduction of features like "Swipe Night" and "Festival Mode" in 2023 aimed to create more interactive experiences.

The company is also exploring new geographic markets to broaden its reach and tap into untapped user bases. These experiments are crucial for identifying future growth avenues and expanding the total addressable market. While these initiatives show promise, their ultimate success in capturing new user segments and driving significant revenue growth is still unfolding.

- Feature Innovation: Match Group's platforms are testing interactive features like live-streaming and video chat to boost user engagement.

- Market Expansion: The company is venturing into new geographic regions to discover and capture new user segments.

- Unrealized Outcomes: The full impact of these experimental features and market entries on user acquisition and revenue is yet to be determined.

- Strategic Exploration: This phase of experimentation is a standard practice for companies looking to innovate and grow their market share.

Question Marks in Match Group's portfolio represent emerging brands with high growth potential but currently low market share. These ventures, like Salams and HER, require significant investment to build user bases and establish market presence. Their success hinges on continued innovation and effective integration into Match Group's broader strategy.

Match Group is actively investing in these Question Marks, aiming to transform them into future Stars. This strategy involves substantial capital allocation for market expansion and feature development, such as AI-driven matching. For example, Archer and Azar demonstrated 30% year-over-year revenue growth by late 2023, indicating their potential.

While these newer brands are growing rapidly, they still represent a smaller revenue contribution compared to established platforms like Tinder. Match Group's Q1 2024 revenue was $874 million, with Tinder remaining the primary revenue driver. This underscores the need for these Question Marks to scale effectively.

The company's exploration of new features, like live-streaming and video chat, and expansion into new geographic markets are all part of nurturing these Question Marks. The ultimate impact of these experiments on user acquisition and revenue is still unfolding, making them key areas to watch for future growth.

| Brand Example | Market Focus | Growth Potential | Current Market Share | Investment Focus |

|---|---|---|---|---|

| Salams | Muslim Singles | High | Low | Niche Market Penetration |

| HER | LGBTQIA+ Sapphic Community | High | Low | Targeted User Acquisition |

| Archer | Emerging Market Entry | High (30% YoY revenue growth late 2023) | Low | Geographic Expansion |

| Azar | Global Social Discovery | High (30% YoY revenue growth late 2023) | Low | Feature Innovation |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth projections, to accurately position each business unit.