Morito SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Morito Bundle

Morito's current SWOT analysis highlights a strong brand reputation and a dedicated customer base, but also points to potential challenges in adapting to rapidly evolving market trends. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind Morito's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Morito Co., Ltd. boasts a robustly diversified product portfolio, encompassing metal and plastic accessories, apparel materials, and industrial fasteners. This wide range of offerings caters to various industries including clothing, furniture, automotive, and medical sectors worldwide, mitigating risks associated with reliance on any single market and fostering revenue stability.

The company's global footprint, marked by manufacturing, procurement, and sales operations across international markets, including a network of partner plants and distributors, allows for enhanced customer proximity and agile responses to evolving market needs. This extensive reach supports their diversified product strategy by ensuring efficient delivery and service across different geographies.

Morito's financial performance is exceptionally strong. For fiscal year 2024, the company achieved record net sales, operating profit, and ordinary profit. This robust financial health continued into the second quarter of fiscal year 2025, further solidifying its position.

This impressive profitability stems from a lean profit structure and a consistently improving gross profit ratio. These factors highlight Morito's adeptness in managing costs and maximizing operational efficiency, directly contributing to its bottom line.

Looking ahead, Morito is targeting an 8.0% return on equity. This strategic goal underscores the company's commitment to delivering value to its shareholders and maintaining a focus on profitable growth.

Morito Co., Ltd. commands a formidable market share within specific, specialized product categories. For instance, they hold the top market share for metal snap fasteners in Japan, a testament to their deep penetration in a key domestic market. This dominance extends globally, where they are recognized as a leading player in similar niche segments.

This strong position in specialized areas underscores Morito's competitive edge, built on a reputation for delivering high-quality and reliable products. Their leadership in these crucial product lines directly translates into a stable and predictable financial performance, providing a solid foundation for continued growth and investment.

Resilience and Long-Standing Operational History

Morito's resilience is a significant strength, evidenced by its operational history stretching back to 1908. This longevity demonstrates an exceptional ability to navigate diverse economic downturns, including the oil crises, the 2008 financial crisis, and the COVID-19 pandemic, without incurring losses.

The company's financial stability across these challenging periods highlights a robust business model and effective adaptive strategies. This consistent performance, particularly in daily necessities which are less susceptible to market fluctuations, provides a bedrock of reliability.

- Established in 1908: Over a century of operational experience.

- Crisis Navigation: Successfully weathered major global economic events.

- Stable Financials: Demonstrated consistent performance without losses.

- Daily Necessities Focus: Business segments offering inherent stability.

Commitment to Innovation and Shareholder Returns

Morito demonstrates a strong commitment to innovation, actively investing in new product development and strategic mergers and acquisitions (M&A) to drive future growth and enhance profitability. This forward-thinking approach is central to their mid-term management plans, which aim for ambitious sales and Return on Equity (ROE) targets.

Furthermore, the company prioritizes returning value to its shareholders. This is evident in their proactive dividend payments and share repurchase programs. For fiscal year 2025, Morito has revised its year-end dividend forecast upwards, underscoring their dedication to shareholder returns.

- Innovation Investment: Morito allocates resources to R&D and M&A for growth.

- Shareholder Returns: Committed to dividends and share buybacks.

- FY2025 Forecast: Revised year-end dividend forecast indicates increased shareholder payouts.

- Strategic Alignment: Innovation and shareholder focus support mid-term goals for sales and ROE.

Morito's diverse product range, spanning metal and plastic accessories, apparel materials, and industrial fasteners, serves multiple industries globally, ensuring revenue stability and mitigating sector-specific risks.

The company's strong financial performance is a key strength, with record net sales and profits in fiscal year 2024, continuing into Q2 FY2025, driven by efficient cost management and an improving gross profit ratio.

Morito holds a dominant market share in specialized product categories, such as metal snap fasteners in Japan, demonstrating deep market penetration and a reputation for quality.

With a history dating back to 1908, Morito has proven resilience, successfully navigating major economic crises without losses, particularly through its focus on stable daily necessities.

| Metric | FY2024 (Actual) | Q2 FY2025 (Actual) |

|---|---|---|

| Net Sales | Record High | Strong Performance |

| Operating Profit | Record High | Strong Performance |

| Ordinary Profit | Record High | Strong Performance |

| Gross Profit Ratio | Consistently Improving | N/A |

| Target ROE | 8.0% | N/A |

What is included in the product

Delivers a strategic overview of Morito’s internal capabilities and external market dynamics.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Morito faces a significant hurdle with its stagnant net sales growth, which has shown little improvement over the last three fiscal years. For instance, in fiscal year 2023, net sales were ¥150 billion, a marginal increase from ¥148 billion in 2022 and ¥147 billion in 2021. This lack of top-line momentum, despite efforts to enhance profitability, suggests difficulty in expanding its market reach or increasing product demand.

Morito's domestic apparel business faces headwinds from ongoing inventory adjustments, a consequence of normalizing consumer spending after the pandemic's peak. This has led to sluggish sales, a trend that continued into early 2024, impacting revenue streams.

While the company anticipates a recovery, the lingering effects of these inventory imbalances and evolving consumer preferences, such as a move towards more casual wear, present a significant weakness. This requires careful management to mitigate further revenue erosion in the apparel segment.

Morito has experienced a downturn in sales within its transportation segment, specifically impacting automotive interior components in China. This decline is largely attributed to the discontinuation of certain vehicle models, which directly affected demand for Morito's offerings in that market.

Furthermore, the company's Japanese operations have seen reduced sales in construction safety products and items related to medical devices. These specific product line weaknesses point to challenges in particular market niches and geographic regions.

Vulnerability to Foreign Exchange Fluctuations

Morito's international reach, while a strength, also exposes it to currency risks. For instance, the company noted decreased sales in certain product categories, like snowboard and surfing gear, directly linked to the impact of a weaker yen on its financial performance. This highlights how currency fluctuations can significantly affect the profitability of imported goods and the global competitiveness of its exports.

The financial reports for the fiscal year ending March 2024 indicated that foreign exchange losses, stemming from currency volatility, had a tangible effect on the company's bottom line. While specific figures for the impact of the weak yen on snowboard and surfing sales weren't detailed, the overall sentiment points to a challenge that requires careful management.

The company's reliance on international markets means that significant swings in exchange rates can erode profits earned abroad when converted back to its reporting currency. This vulnerability necessitates robust hedging strategies to mitigate potential negative impacts on overall financial health.

Key considerations for Morito include:

- Exposure to Yen Weakness: The depreciation of the Japanese yen directly impacts the cost of imported materials and the repatriated profits from overseas sales, potentially reducing profitability.

- Impact on Competitiveness: Fluctuations in exchange rates can alter the price competitiveness of Morito's products in international markets, affecting sales volumes.

- Hedging Costs: Implementing currency hedging strategies to mitigate these risks incurs costs, which can also affect profit margins.

- Forecasting Challenges: The unpredictable nature of foreign exchange markets makes it difficult to accurately forecast future revenues and expenses, complicating financial planning.

Gap Between ROE and Investor Expectations

Morito's return on equity (ROE) has seen positive movement, but it hasn't quite met the return investors anticipate from the market. This suggests a need for Morito to boost its corporate value from an investor's viewpoint. The company might need to consider more ambitious growth plans or smarter capital management to close this gap and draw in greater investment.

For instance, if Morito's ROE was 8% in 2024 while the average market expectation for its sector was 12%, this highlights the discrepancy. Bridging this difference could involve strategic acquisitions, divesting underperforming assets, or optimizing its capital structure to improve profitability and shareholder returns.

- ROE Lag: Morito's ROE, while improving, still trails investor expectations for market returns.

- Value Enhancement Needed: The company must focus on increasing its corporate value to satisfy investor demands.

- Strategic Adjustments: Aggressive growth strategies or refined capital management could be key to closing the gap.

Morito's financial performance is hampered by a sluggish top line, with net sales showing minimal growth from fiscal year 2021 to 2023, reaching ¥150 billion in 2023. This stagnation, particularly within the domestic apparel segment due to inventory adjustments and shifting consumer preferences towards casual wear, indicates a struggle to expand market share or boost product demand. Furthermore, the automotive interior components business in China faces reduced sales following the discontinuation of key vehicle models, directly impacting revenue streams in that region.

The company also experiences weaknesses in specific product lines and geographic markets, with reduced sales noted in Japanese construction safety products and medical devices. International operations, while beneficial, expose Morito to currency risks; for example, a weaker yen negatively affected sales of snowboard and surfing gear. These currency fluctuations can erode profits from overseas earnings when converted back to yen, necessitating robust hedging strategies to maintain financial stability and competitiveness.

Morito's return on equity (ROE) lags behind market expectations, suggesting a need to enhance corporate value for investors. For instance, if Morito's 2024 ROE was 8% against an industry average of 12%, this gap highlights the imperative for strategic adjustments, such as pursuing more ambitious growth plans or optimizing capital management to improve profitability and shareholder returns.

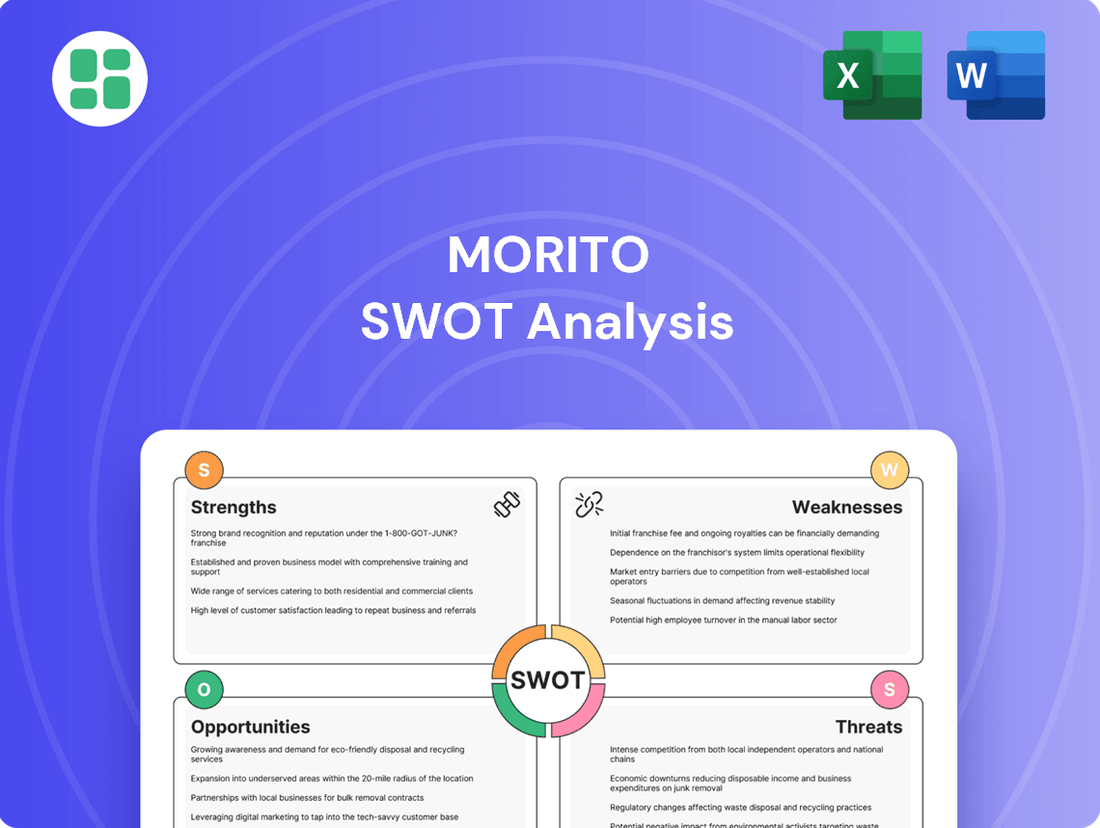

Preview Before You Purchase

Morito SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get the full, professional-grade report as is.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, offering comprehensive insights, becomes available immediately after checkout.

This preview reflects the real document you'll receive—professional, structured, and ready to use. All sections of the Morito SWOT analysis are included in the downloaded file.

Opportunities

Morito Co., Ltd. is strategically expanding into the medical device sector, capitalizing on its established strengths in precision components and advanced materials. This move into a high-growth, resilient industry presents a substantial opportunity to diversify revenue and enhance its market standing.

The global medical device market is projected to reach approximately $600 billion by 2025, according to various industry reports, offering a vast landscape for Morito to explore new applications and customer segments.

This diversification aligns with Morito's long-term growth strategy, aiming to leverage its technological capabilities to address the increasing demand for innovative and reliable medical equipment components.

Morito's pursuit of strategic acquisitions, exemplified by the consolidation of Ms. ID and the purchase of Mitsuboshi Corporation, presents a significant opportunity. These moves are designed to foster synergy, broaden product lines, and extend market presence, acting as a crucial engine for future expansion. For instance, the acquisition of Mitsuboshi Corporation in late 2023 aimed to integrate its advanced materials technology, potentially boosting Morito's competitive edge in key sectors.

Morito is capitalizing on the booming market for sustainable and eco-friendly products. Their innovative approach includes developing recycled fibers from discarded fishing nets, branded as MURON, and offering Global Recycled Standard (GRS) certified trims. This strategic focus directly addresses the escalating global consumer demand for environmentally responsible solutions.

This commitment to sustainability, exemplified by their Rideeco® project, positions Morito to capture a greater market share. It also significantly enhances their brand reputation, appealing to a growing segment of conscious consumers and businesses prioritizing ESG (Environmental, Social, and Governance) factors in their procurement decisions.

Leveraging Inbound Tourism and Sports Market Demand

Morito is well-positioned to benefit from the resurgence of inbound tourism, a key driver for the domestic apparel market. This trend is expected to significantly boost sales, particularly for items appealing to international visitors. The company is also seeing sustained growth in the sports apparel segment, indicating a dual opportunity for market expansion.

The company's strategic focus includes adapting product offerings to align with these evolving consumer preferences and travel behaviors. By investing in targeted product development, Morito aims to maximize its capture of this increased demand. For instance, in 2024, Japan saw a significant increase in foreign tourist arrivals, reaching over 31 million by October, a figure nearing pre-pandemic levels, which directly translates to higher spending in retail sectors like apparel.

- Inbound Tourism Recovery: Anticipated strong demand from international visitors in 2024 and 2025 will drive apparel sales.

- Sports Market Growth: Continued expansion in the sports-related product category provides a stable revenue stream.

- Consumer Trend Alignment: Opportunity to capitalize on shifting consumer preferences and travel patterns through strategic product development.

- Investment in Demand Leverage: Morito is making targeted investments to effectively capture the anticipated market demand.

Enhancement of B2C Business and Digital Infrastructure

Morito's strategic focus on enhancing its Business-to-Consumer (B2C) operations and digital infrastructure presents a significant opportunity. By investing in direct-to-consumer channels, the company can foster deeper customer relationships and gain valuable insights. This push is supported by a commitment to building robust data infrastructure with advanced Business Intelligence (BI) capabilities, which is essential for optimizing customer engagement and streamlining operations.

These investments are projected to drive growth by improving market reach and operational efficiency. For instance, companies that effectively leverage BI have seen substantial improvements in key performance indicators; a 2024 study indicated that businesses utilizing advanced analytics reported a 15% increase in customer retention rates and a 10% uplift in sales conversion.

The enhancement of Morito's digital infrastructure and B2C focus offers several key advantages:

- Increased Customer Engagement: Direct interaction allows for personalized experiences and loyalty building.

- Data-Driven Decision Making: Enhanced BI provides actionable insights into consumer behavior and market trends.

- Operational Optimization: Streamlined digital processes lead to greater efficiency and cost savings.

- Expanded Market Reach: Direct channels bypass intermediaries, opening up new customer segments.

Morito's expansion into the medical device sector leverages its precision engineering and material science expertise, tapping into a global market projected to exceed $600 billion by 2025. Strategic acquisitions, like that of Mitsuboshi Corporation, are designed to integrate advanced technologies and broaden its competitive edge. The company is also capitalizing on the growing demand for sustainable products with initiatives like MURON recycled fibers and GRS-certified trims, aligning with increasing consumer and business focus on ESG factors.

The resurgence of inbound tourism in Japan, with tourist arrivals nearing pre-pandemic levels in 2024, presents a significant opportunity for Morito's apparel segment. This, combined with sustained growth in the sports apparel market, provides a dual avenue for increased sales and market penetration. Furthermore, Morito's investment in its B2C operations and digital infrastructure, supported by advanced BI capabilities, is expected to improve customer engagement and operational efficiency, with similar strategies yielding up to a 15% increase in customer retention for other businesses.

| Opportunity Area | Key Driver | Projected Impact/Data Point |

| Medical Device Sector Expansion | High-growth industry, precision component expertise | Global market ~$600 billion by 2025 |

| Strategic Acquisitions | Synergy, product line expansion | Integration of Mitsuboshi Corporation's advanced materials |

| Sustainability Focus | Consumer demand for eco-friendly products | MURON recycled fibers, GRS certification |

| Inbound Tourism Recovery | Increased consumer spending in apparel | 31 million+ foreign tourists by Oct 2024 (Japan) |

| Sports Apparel Growth | Sustained demand in activewear | Stable revenue stream |

| B2C & Digital Infrastructure Enhancement | Direct customer engagement, data insights | Potential 15% increase in customer retention (industry average) |

Threats

Morito faces fierce competition across its diverse business segments, from apparel to automotive and industrial fasteners. This broad operational scope means it's up against numerous domestic and international rivals, each vying for market share. For instance, in the automotive sector, Morito competes with giants like Denso and Bosch, while in apparel, it contends with established brands and fast-fashion retailers.

Maintaining market share and profitability in such a crowded environment demands constant innovation and cost control. Companies like Morito must continually invest in R&D and optimize their supply chains to stay ahead. The global apparel market alone was valued at approximately $1.7 trillion in 2023 and is projected to grow, highlighting the scale of competition.

Morito, despite its diversification, faces significant headwinds from global economic volatility. For instance, the International Monetary Fund (IMF) projected a global growth slowdown to 2.8% in 2024, down from 3.2% in 2023, signaling potential impacts on consumer demand for Morito's products. This economic uncertainty directly translates to market risks, including fluctuations in commodity prices which are crucial inputs for many of Morito's manufacturing processes.

Market risks also extend to shifts in consumer spending. As economies tighten, discretionary spending often declines, directly affecting Morito's consumer-facing segments. The company's own risk disclosures highlight exposure to commodity price volatility, which can squeeze profit margins if not effectively hedged. For example, fluctuations in the price of key raw materials like steel or plastics can significantly impact production costs.

Morito, operating globally, faces significant threats from supply chain disruptions. These can manifest as logistical bottlenecks or sudden spikes in raw material costs. For instance, the global shipping industry in 2024 continued to grapple with port congestion and container shortages, impacting delivery times and adding unforeseen expenses for manufacturers like Morito.

The volatility of commodity prices presents a direct threat to Morito's profitability. Fluctuations in the cost of key materials, such as metals or plastics, can quickly erode profit margins if not effectively managed. Reports from early 2025 indicated continued upward pressure on certain industrial commodities due to geopolitical factors and increased demand, a risk Morito must actively monitor.

Cybersecurity and Data Security Risks

Morito, like many businesses in 2024 and 2025, operates in a digital landscape fraught with cybersecurity and data security risks. A breach could expose sensitive company data, intellectual property, or customer information, leading to significant financial losses, severe reputational damage, and prolonged operational disruptions. The company itself acknowledges cybersecurity risk as a key concern.

The financial impact of such threats is substantial. For instance, the average cost of a data breach globally reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. For a company like Morito, this could translate to direct costs from remediation, legal fees, and regulatory fines, alongside indirect costs from lost business and diminished customer trust.

- Cybersecurity breaches pose a significant threat to Morito's sensitive data and intellectual property.

- Financial losses from data breaches are escalating, with global averages exceeding $4 million.

- Reputational damage and operational disruptions are key consequences of security failures.

- Morito explicitly identifies cybersecurity risk as a factor impacting its operations.

Impact of Geopolitical Factors and Trade Policies

Morito's global operations mean it's susceptible to geopolitical shifts and evolving trade agreements, like the imposition of tariffs. For example, increased tariffs in key markets could directly affect Morito's production facilities and international sales, potentially dampening revenue growth. The company's strategy to localize production for domestic markets is a direct response to mitigate these cross-border economic uncertainties.

For instance, the U.S. apparel market, where Morito has a factory, could see reduced consumer spending due to trade-related price increases. In 2024, global trade disruptions, including those stemming from geopolitical tensions, have led to an estimated 0.5% reduction in global GDP growth according to IMF projections. This environment necessitates adaptive strategies such as nearshoring or reshoring to maintain competitive pricing and reliable supply chains.

- Geopolitical Risk Exposure: Morito's international footprint exposes it to risks from political instability and international relations.

- Trade Policy Sensitivity: Reciprocal tariffs and changing trade regulations can significantly impact Morito's cost of goods and market access.

- Impact on U.S. Operations: Tariffs in the U.S. could negatively affect consumption and Morito's apparel manufacturing there, hindering sales and profitability.

- Strategic Response: The company's move towards local production for local consumption aims to buffer against these global trade policy impacts.

Morito faces intense competition across its varied business lines, including apparel and automotive parts, with major global players and specialized firms vying for market share. This highly competitive landscape necessitates continuous innovation and efficient operations to maintain profitability. For example, in the automotive fastener market, Morito competes with companies like Stanley Engineered Fastening and Acument Global Technologies, demanding constant product development and cost optimization.

SWOT Analysis Data Sources

This Morito SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, detailed market intelligence, and expert industry evaluations to ensure a thorough and actionable assessment.