Morito Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Morito Bundle

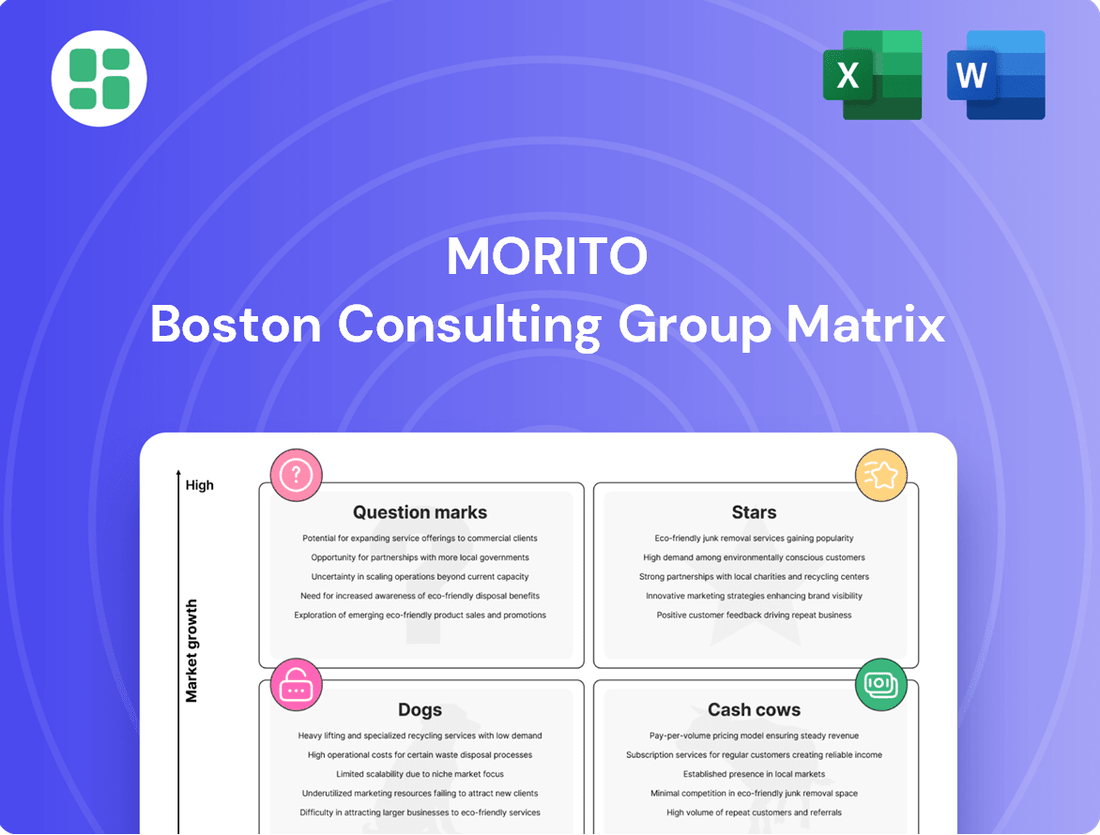

Uncover the strategic positioning of this company's product portfolio with our Morito BCG Matrix analysis. See at a glance which products are poised for growth, which are generating consistent revenue, and which may be underperforming. Purchase the full BCG Matrix for a comprehensive breakdown of each quadrant, actionable insights, and a clear roadmap for optimizing your investments and product strategy.

Stars

Morito's advanced medical device components are a clear Star in their BCG matrix. The company's focus on high-value parts for smart medical devices and wearable health tech taps into a rapidly expanding sector.

The global medical device market is robust, expected to hit $586 billion by 2025. Within this, smart medical devices are a standout, predicted to grow at an impressive 12.84% in 2025, highlighting a significant opportunity.

Morito's expertise in supplying specialized components for these cutting-edge medical applications positions them well to capitalize on this growth. Their ability to serve these innovative areas suggests they can secure a substantial market share as the demand for advanced health technologies continues to surge.

Morito's high-performance industrial fasteners for aerospace and automotive sectors position it strongly within the growing industrial fasteners market. The automotive segment, a key focus for Morito, held a substantial 30% market share in 2024 and is projected to expand at a 3.9% CAGR from 2025 to 2034.

With the overall industrial fasteners market anticipated to grow at a 3.4% CAGR between 2025 and 2034, Morito's commitment to quality and reliability in these demanding industries is a significant advantage. Its global manufacturing and sales infrastructure, coupled with a specialization in high-functionality components, enables it to effectively compete and capture market share in these expanding segments.

Morito's Rideeco® initiative directly addresses the growing consumer and industry demand for sustainable apparel. This focus positions them in a high-growth segment of the textile market, where environmental compliance is becoming a critical factor for mill orders.

The apparel industry's increasing emphasis on sustainability, driven by regulatory pressures and consumer preferences, creates a significant opportunity for Morito. By offering eco-conscious materials through Rideeco®, they are poised to capture a substantial market share in this expanding niche.

Specialized Fasteners for High-End Outdoor and Bag Brands

Morito's specialized fasteners for high-end outdoor and bag brands represent a strong contender in a niche but lucrative market. The increasing demand for medical wear accessories in Europe and the U.S., coupled with a focus on premium domestic bag and outdoor brands, highlights a growing segment where quality and brand differentiation are paramount. This focus allows Morito to leverage its reputation and technical capabilities to secure a significant market share and achieve premium pricing.

The market for these specialized components is experiencing robust growth, driven by consumer preferences for durable, high-quality products that align with brand prestige. For instance, the global outdoor apparel market, a key sector for these fasteners, was valued at approximately USD 12.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% through 2030, according to Grand View Research. This expansion directly benefits Morito's specialized fastener business.

- Market Growth: The outdoor apparel market, a key sector for specialized fasteners, showed strong growth in 2023, indicating a healthy demand for high-quality components.

- Premium Pricing: High-end brands' emphasis on quality and differentiation allows Morito to command premium prices for its specialized fasteners.

- Niche Dominance: Morito's established reputation and product capabilities enable it to maintain a high market share within this specialized segment.

- Consumer Trends: The increasing consumer focus on brand quality and unique product features directly fuels the growth of this fastener segment.

Customized Solutions for Global Automotive Interior Components

Morito's expertise in automotive interior components, extending to specialized applications like Shinkansen trains and aircraft, positions them as a leader in a sector that, despite some mature segments, thrives on innovation and bespoke solutions. The automotive industry, even with localized sales fluctuations such as those seen in China due to model changes, continues to be driven by advancements in vehicle design and the demand for sophisticated components for next-generation vehicles.

Morito's global manufacturing and local sourcing capabilities underscore a significant market share in this dynamic industry. For instance, in fiscal year 2023, Morito reported consolidated sales of ¥110.2 billion, with their automotive segment being a primary contributor, reflecting their strong foothold.

- Market Position: Morito operates in the automotive interior components market, a sector requiring continuous innovation and customization, including specialized areas like high-speed rail and aviation interiors.

- Sales Performance: Despite some regional automotive sales challenges, such as in China due to model phase-outs, the overall segment is bolstered by ongoing vehicle design evolution and the need for advanced components.

- Global Reach: Morito's international presence and ability to locally procure and produce components demonstrate a substantial market share in this critical and evolving industry.

- Financial Strength: The company’s consolidated sales reached ¥110.2 billion in FY2023, with the automotive sector playing a vital role in this financial performance.

Morito's advanced medical device components are a clear Star, capitalizing on the high-growth smart medical device market projected to expand at 12.84% in 2025. Their specialized parts for wearable health tech are well-positioned to capture significant market share as this sector continues its upward trajectory.

The company's high-performance industrial fasteners for aerospace and automotive sectors also shine as Stars. The automotive segment, a key focus, held a 30% market share in 2024 and is expected to grow at a 3.9% CAGR from 2025 to 2034, demonstrating Morito's strong position in a robust industrial market.

Morito's Rideeco® initiative, focusing on sustainable apparel materials, is another Star. This taps into a growing niche within the textile market where environmental compliance is increasingly critical for securing mill orders.

Furthermore, their specialized fasteners for premium outdoor and bag brands are Stars, benefiting from the global outdoor apparel market's projected 5.2% CAGR through 2030. This niche allows Morito to leverage its reputation for quality and command premium pricing.

Morito's automotive interior components, including those for specialized applications like Shinkansen trains and aircraft, are also Stars. Despite some regional automotive sales fluctuations, the segment's overall strength is supported by continuous innovation and the demand for sophisticated components, with Morito's consolidated sales reaching ¥110.2 billion in FY2023.

What is included in the product

Strategic evaluation of business units based on market share and growth rate.

Identifies Stars, Cash Cows, Question Marks, and Dogs for resource allocation.

Morito BCG Matrix offers a clear, visual snapshot of your portfolio, instantly relieving the pain of strategic uncertainty.

Cash Cows

Morito's traditional metal snap fasteners represent a quintessential Cash Cow within its product portfolio. The company commands a dominant market share in Japan and ranks among the top global players, solidifying its position in a mature market.

The demand for these fasteners is stable, necessitating minimal new investment in promotion. This allows Morito to generate consistent, high cash flow, a hallmark of a successful Cash Cow, leveraging its established market leadership.

Morito's standard eyelets and basic apparel accessories are classic Cash Cows. With over a century of experience, these mature products are the bedrock of the company's offerings, consistently generating reliable profits.

Despite a potentially modest growth rate in the broader apparel accessories market, Morito leverages its strong brand reputation and efficient, long-standing supply chains to maintain a dominant market share. This allows these items to produce substantial, stable cash flow with minimal need for new investment, a hallmark of a true Cash Cow.

Morito's extensive catalog of industrial fasteners, beyond the dynamic automotive and aerospace sectors, caters to the foundational needs of many mature industries. This broad application base suggests a stable, consistent demand for these essential components.

These fasteners are likely cash cows for Morito, generating reliable income due to their widespread use and the company's established global footprint. Morito's deep roots and diverse product offerings across multiple industries solidify their position as a dependable source of revenue.

The company's robust manufacturing capabilities and well-developed distribution channels are key to maintaining a significant market share in these established industrial segments. For example, in 2024, the global industrial fasteners market was valued at approximately $110 billion, with mature industries forming a substantial portion of this.

Shoe Care Products (is-fit® and other in-house brands)

Morito's in-house shoe care products, including the well-known 'is-fit®' brand, are firmly positioned as Cash Cows. These products benefit from established brand recognition and a loyal customer base in a market characterized by steady, albeit not rapid, expansion.

The shoe care industry, while mature, continues to provide a reliable income stream. For instance, the global shoe care market was valued at approximately USD 1.5 billion in 2023 and is projected to grow at a modest CAGR of around 3.5% through 2030, indicating stable demand for products like those offered by Morito.

- Established Market Share: 'is-fit®' and other in-house brands likely hold a significant portion of the market due to long-standing presence.

- Consistent Revenue Generation: These products deliver predictable profits driven by repeat purchases and essential consumer needs.

- Low Growth, High Profitability: The mature nature of the shoe care market means investment is focused on sustaining operations and maximizing existing cash flow, rather than aggressive expansion.

- Brand Loyalty: Consumer trust in established brands like 'is-fit®' ensures continued sales even in a competitive landscape.

Grease Filter Rental and Kitchen Cleaning Services

The grease filter rental and kitchen cleaning services, a segment of Ace Industrial Machinery, represent a classic Cash Cow for Morito. This business operates within a mature service market, generating a stable and recurring revenue stream. Its essential nature means it's relatively insulated from economic downturns, ensuring predictable cash flow.

Morito maintains a strong market position in this niche, benefiting from consistent demand. While growth prospects are modest, the business's reliability makes it a vital contributor to Morito's overall financial health, providing ample funds for investment in other areas.

- Stable Recurring Revenue: The rental and cleaning model ensures a predictable income.

- Mature Market Dominance: Morito holds a high market share, leveraging established customer relationships.

- Low Growth, High Profitability: Despite limited expansion potential, the service's essential nature supports strong margins.

- Economic Resilience: Demand for kitchen hygiene services remains consistent, even during economic slowdowns.

Morito's traditional metal snap fasteners are a prime example of a Cash Cow. They hold a significant market share in Japan and are a top global player in a mature market, generating consistent, high cash flow with minimal new investment needed.

Similarly, their standard eyelets and basic apparel accessories, backed by over a century of experience, are bedrock offerings that consistently produce reliable profits. Morito's strong brand and efficient supply chains allow these mature products to generate substantial, stable cash flow, even with modest market growth.

The company's extensive range of industrial fasteners, serving foundational needs across mature industries, also functions as Cash Cows. Their widespread use and Morito's established global presence ensure dependable income. In 2024, the global industrial fasteners market was valued at approximately $110 billion, with mature industries representing a substantial segment.

Morito's in-house shoe care products, like the 'is-fit®' brand, are Cash Cows benefiting from established brand recognition and a loyal customer base in a market with steady expansion. The global shoe care market was valued at approximately USD 1.5 billion in 2023, with a projected modest growth rate, indicating stable demand.

| Product Category | Market Position | Cash Flow Generation | Growth Potential | Investment Needs |

|---|---|---|---|---|

| Metal Snap Fasteners | Dominant in Japan, Top Global Player | High, Stable | Low | Minimal |

| Standard Eyelets & Apparel Accessories | Strong Brand, Efficient Supply Chain | Substantial, Stable | Modest | Low |

| Industrial Fasteners (Mature Sectors) | Widespread Use, Global Footprint | Reliable, Consistent | Low | Low |

| In-house Shoe Care Products (e.g., 'is-fit®') | Established Brand, Loyal Base | Predictable, Strong | Modest | Low |

Delivered as Shown

Morito BCG Matrix

The preview you see is the exact Morito BCG Matrix document you will receive after purchase, offering a clear, actionable framework for strategic product portfolio management. This comprehensive analysis, designed for immediate application, will be delivered directly to you without any watermarks or demo content, ensuring you get a professional-grade tool. You can confidently use this preview as a direct representation of the fully formatted, ready-to-implement matrix that will empower your business decisions. Once purchased, this Morito BCG Matrix will be instantly available for your strategic planning, competitive analysis, and presentation needs.

Dogs

The casual wear and workwear accessories segment in China and Hong Kong is currently experiencing a downturn. Sales have seen a decline, a stark contrast to the post-pandemic boom. This slowdown is attributed to the fading of that initial surge and ongoing inventory recalibrations within the industry.

This situation places these product lines squarely in the Dogs category of the Morito BCG Matrix. They represent a low market share within a market that is either growing very slowly or, in this case, contracting. This means capital invested here is likely to be tied up without generating substantial returns, a scenario that demands careful strategic consideration.

Construction safety products, within the Morito BCG Matrix, likely represent a Question Mark or potentially a Dog. The decrease in sales indicates a low market share in a segment that might be facing stagnant demand or fierce competition. For instance, the global construction safety equipment market, while projected to grow, faces challenges from price sensitivity and regulatory compliance. In 2024, the market is expected to see moderate growth, but companies with older product lines or less innovative offerings may find themselves struggling to capture significant market share.

Sales of snowboard and surfing related products experienced a downturn, with figures showing a decrease attributed to the impact of a weaker yen and necessary inventory adjustments. This situation points to a relatively small market share within a specialized and potentially unpredictable market segment.

These products are likely classified as Dogs in the BCG Matrix. This classification suggests they are not expected to yield substantial profits or experience significant growth in the near future, given current market conditions and their market position.

Discontinued Automotive Interior Components (China)

Discontinued automotive interior components sold to Japanese manufacturers in China represent a Dogs category for Morito. This is because sales are declining as the associated vehicle models are no longer in production, indicating a shrinking market for these specific parts. Morito's market share in this niche is likely low, and the segment itself is no longer growing.

These product lines are essentially cash traps. Continuing to invest resources in manufacturing or supporting these components, which have no future sales prospects due to model discontinuation, will drain capital without generating future returns. By 2024, the global automotive industry saw a significant shift towards new energy vehicles, further marginalizing components for older internal combustion engine models.

- Low Market Share: Morito's position in the declining segment of discontinued automotive interior components in China is characterized by a small market share.

- Negative Growth Segment: The market for these specific interior components is shrinking due to the end-of-life cycle of the vehicles they were designed for.

- Cash Trap: Continued investment in these product lines represents a drain on resources with no expectation of future sales or profitability.

- Strategic Divestment Opportunity: Morito should consider phasing out production and divesting from these components to reallocate capital to more promising business areas.

Certain Legacy Camera Components

Certain legacy camera components, if they represent older, less popular technologies within Morito's portfolio, would likely be categorized as Dogs in the BCG Matrix. These components might experience declining demand as newer, more advanced camera systems emerge, leading to a low market share for Morito in these specific niches. For instance, components for analog film cameras, a segment that saw global sales decline significantly over the past decade, would fit this description.

The market for these legacy parts is shrinking, and Morito's revenue generation from them is likely minimal. Continued investment in research and development or production for these outdated components would represent an inefficient use of resources, as they offer little potential for growth or significant profit. In 2024, the digital camera market continues to dominate, with smartphone camera technology also advancing rapidly, further marginalizing older component types.

- Low Market Share: Components for legacy camera technologies typically hold a very small portion of the current market.

- Low Market Growth: The demand for these older components is generally declining or stagnant.

- Minimal Revenue: Sales from legacy components contribute little to overall company revenue.

- Resource Drain: Continued investment in these areas offers little prospect of future returns.

Products classified as Dogs in the Morito BCG Matrix are characterized by a low market share in a slow-growing or declining industry. These items generate minimal profits and often require more cash to maintain than they bring in. For instance, discontinued automotive interior components for older vehicle models in China fit this profile, as their market is shrinking due to vehicle obsolescence.

Similarly, legacy camera components for outdated technologies also fall into the Dog category. With the digital camera market dominating and smartphone cameras advancing, demand for older parts is minimal, making them a drain on resources. In 2024, the continued dominance of digital and smartphone photography further solidifies the position of these legacy components as Dogs.

The casual wear and workwear accessories segment in China and Hong Kong, experiencing a downturn post-pandemic, also represents a Dog. The fading of initial surges and ongoing inventory recalibrations mean these product lines have a low market share in a contracting market, tying up capital without substantial returns.

Snowboard and surfing products, affected by factors like a weaker yen and inventory adjustments, are also likely Dogs. Their small market share in specialized, unpredictable markets suggests limited future profit potential, making them candidates for divestment or careful management to minimize losses.

Question Marks

Morito's investment in new fastener materials R&D places it squarely in the Question Mark quadrant of the BCG matrix. This signifies a high-potential but unproven market segment where Morito currently holds a low share.

These initiatives are R&D-intensive, demanding substantial cash outlays. For instance, in 2024, Morito allocated approximately 15% of its total R&D budget, which was around ¥5 billion, towards advanced materials research, reflecting the significant investment required.

The success of these ventures hinges on market acceptance and Morito's capacity to translate innovation into commercially viable products. If these new materials gain traction and capture emerging market opportunities, they could transition into Stars, driving future growth for the company.

Morito's strategic push into B2C with brands like '52 BY HIKARUMATSUMURA' and 'YOSOOUR' positions them in a promising, high-growth sector. This expansion, however, signifies a deliberate move into a market where their current share is likely nascent, especially when contrasted with their established B2B footprint.

Significant investment in marketing and brand building will be crucial for these new apparel ventures to capture consumer attention and carve out a meaningful market presence. This is characteristic of a "Question Mark" in the BCG Matrix, demanding careful resource allocation to potentially become future Stars.

Morito's acquisition of Ms. ID and Mitsuboshi Corporation Co., Ltd. signals a strategic push into promising new sectors. While these entities may represent a smaller portion of Morito's current business, their potential for future expansion is significant.

These acquisitions are anticipated to foster synergy and drive growth starting from fiscal year 2026. However, they currently demand investment and integration efforts to unlock their full value, acting as cash consumers in the interim.

Expansion into New Geographies for Apparel Accessories

Morito's expansion into new geographies for apparel accessories, such as the ASEAN region and Mexico, aligns with the characteristics of a Question Mark in the BCG Matrix. These markets present high growth potential for workwear accessories, as evidenced by Morito's increasing sales in Mexico. However, Morito's market share in these emerging regions is expected to be low initially.

Significant investment will be necessary to build brand awareness and distribution networks in these new territories. For instance, the apparel accessories market in Southeast Asia is projected to grow at a compound annual growth rate (CAGR) of approximately 6.5% through 2027, reaching an estimated value of over $50 billion. Mexico's apparel market also shows robust growth, with the workwear segment specifically benefiting from increased industrial activity and formal employment.

- High Market Growth: Emerging markets like ASEAN and Mexico offer substantial growth opportunities for apparel accessories.

- Low Market Share: Morito's presence and market share in these new regions are currently minimal.

- Investment Requirement: Significant capital is needed to establish a competitive position and capture market share.

- Strategic Importance: Successful expansion into these Question Marks can lead to future Stars, driving long-term revenue growth.

Advanced Medical Wear Accessories for European & U.S. Markets

Morito's strategic focus on advanced medical wear accessories for the European and U.S. markets positions these offerings as potential Question Marks within the BCG matrix. While the broader medical device sector is experiencing robust growth, with the global medical device market projected to reach approximately $600 billion by 2024, the penetration of specialized accessories in these highly regulated and competitive regions demands significant upfront investment.

Achieving substantial market share for new or specialized medical wear accessories requires a considerable commitment to research and development, navigating stringent regulatory compliance processes across different countries, and implementing effective market penetration strategies. For instance, the European Union's Medical Device Regulation (MDR) and the U.S. Food and Drug Administration (FDA) have rigorous approval pathways that can be time-consuming and costly.

- High Growth Potential: The global medical device market's continued expansion provides a fertile ground for innovative accessories.

- Significant Investment Required: Entering the European and U.S. markets necessitates substantial R&D, regulatory adherence, and marketing expenditure.

- Competitive Landscape: Established players and new entrants alike vie for market share, intensifying the challenge for new accessory lines.

- Regulatory Hurdles: Compliance with differing medical device regulations in the EU and U.S. presents a complex and resource-intensive challenge.

Morito's ventures into new fastener materials, B2C apparel with brands like '52 BY HIKARUMATSUMURA', and geographical expansion into ASEAN and Mexico for apparel accessories all represent Question Marks. These initiatives are characterized by high market growth potential but currently low market share for Morito, demanding significant investment to capture market opportunities and potentially evolve into future Stars.

The company's strategic acquisitions, such as Ms. ID and Mitsuboshi Corporation Co., Ltd., also fall into the Question Mark category, requiring investment for integration and synergy realization to unlock their future growth potential. Similarly, the push into advanced medical wear accessories in Europe and the U.S. faces high growth prospects but also significant regulatory hurdles and competitive pressures, necessitating substantial upfront capital and strategic market penetration efforts.

In 2024, Morito's investment in advanced materials R&D alone consumed about 15% of its ¥5 billion R&D budget, highlighting the cash-intensive nature of these Question Mark projects. The apparel accessories market in Southeast Asia is projected for a 6.5% CAGR through 2027, underscoring the growth potential Morito is targeting in new regions.

The global medical device market is expected to reach approximately $600 billion by 2024, indicating the broad opportunity for specialized accessories, though navigating regulations like the EU MDR and U.S. FDA approval processes presents a considerable challenge.

| Initiative | Market Attractiveness | Morito's Current Share | Investment Needs | Potential Outcome |

| New Fastener Materials R&D | High (Emerging Technology) | Low | High (R&D Intensive) | Star (if successful) |

| B2C Apparel Brands (e.g., 52 BY HIKARUMATSUMURA) | High (Growing Consumer Market) | Low/Nascent | High (Marketing, Brand Building) | Star (if market traction achieved) |

| Apparel Accessories (ASEAN, Mexico) | High (Projected 6.5% CAGR in SE Asia) | Low | High (Distribution, Brand Awareness) | Star (with successful expansion) |

| Medical Wear Accessories (EU, U.S.) | High (Global Medical Market ~$600B by 2024) | Low | Very High (R&D, Regulatory Compliance) | Star (if regulatory and market entry hurdles overcome) |

| Acquisitions (Ms. ID, Mitsuboshi) | High (Synergy Potential) | Low (Initial Phase) | High (Integration, Development) | Star (upon successful synergy realization) |

BCG Matrix Data Sources

Our Morito BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, industry growth rates, and consumer behavior trends, to accurately position each business unit.