Michaels Companies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Michaels Companies Bundle

Michaels Companies leverages its strong brand recognition and diverse product offering as key strengths, but faces challenges from increasing competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Michaels' market position, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your business decisions.

Strengths

Michaels Companies, Inc. stands as the undisputed leader in North America's arts and crafts sector, boasting an expansive network of over 1,290 stores across 49 states and Canada as of November 2024. This vast retail footprint, projected to include 1,237 U.S. locations by 2025, ensures unparalleled market penetration and customer accessibility.

The company's dominance is further solidified by its significant market share, capturing an estimated 38.3% of the total revenue within the Fabric, Craft & Sewing Supplies Stores industry. This commanding position highlights Michaels' established brand recognition and deep customer loyalty.

Michaels has really leaned into its online presence, making its e-commerce platform a major revenue driver. In 2025, they saw online sales jump by 15%, showing how important digital channels are becoming. This growth is a clear strength, demonstrating their ability to adapt to how customers want to shop today.

The company’s commitment to a strong omnichannel approach is evident in its investment in customer-friendly features. Initiatives like Buy Online Pick-Up In Store (BOPIS) are now available at all U.S. locations, making it easier for customers to get what they need quickly. This seamless integration of online and in-store experiences is crucial for meeting modern consumer expectations.

Michaels boasts an extensive selection of products catering to crafting, home decor, and gifting, attracting a wide audience from casual hobbyists to seasoned professionals. This broad appeal is a significant advantage.

The company's strength lies in its numerous private brands, like Recollections and Creatology, which not only differentiate its offerings but also enhance profitability. These exclusive lines are key to its financial performance.

Michaels actively introduces new product categories and private label collections, ensuring it stays relevant by adapting to evolving consumer tastes and market trends. For instance, in fiscal year 2023, private label penetration remained a core focus for driving margin improvement.

Strategic Investments in Innovation and Partnerships

Michaels is making significant investments in innovation and forming strategic alliances to stay ahead. A prime example is MakerPlace, their online platform for handmade items, workshops, and tutorials, designed to foster a creative community and drive digital engagement. This push into e-commerce and digital content is crucial for reaching a wider audience and catering to evolving consumer preferences.

Further strengthening its market position, Michaels is integrating new technologies within its physical stores, such as self-checkout options, to improve the customer shopping experience and operational efficiency. These in-store enhancements, coupled with their digital initiatives, aim to create a seamless omnichannel strategy.

The company's strategic partnerships also play a vital role in expanding its reach. Collaborations, like the one with the Dallas Cowboys for exclusive merchandise and with OMNIA Partners to provide educational supplies, open up new revenue streams and introduce the Michaels brand to different demographic and market segments. For instance, the OMNIA Partners agreement in 2023 aimed to provide art and craft supplies to K-12 schools, potentially tapping into a substantial educational market.

Key strategic investments and partnerships include:

- MakerPlace Launch: An online marketplace focused on handmade goods, classes, and educational content to foster community and digital sales.

- In-Store Technology Integration: Implementation of self-checkout kiosks and other technologies to enhance the physical retail experience and streamline operations.

- Dallas Cowboys Partnership: Collaboration for exclusive merchandise, broadening brand appeal and reaching new fan bases.

- OMNIA Partners Alliance: Agreement to supply educational institutions with art and craft materials, expanding into the K-12 market.

Improved Financial Performance and Operational Efficiency

Michaels Companies has demonstrated notable financial improvements, highlighted by S&P Global Ratings' upgrade of its corporate credit rating in April 2024. This upgrade was directly linked to significant gains in operating margin and cash generation observed throughout fiscal 2023.

The company's strategic focus on supply chain optimization and the implementation of various cost-saving initiatives are key drivers behind this enhanced performance. These measures are anticipated to sustain steady adjusted EBITDA and foster positive free operating cash flow.

- Enhanced Financial Health: S&P Global Ratings upgraded Michaels' corporate credit rating in April 2024, recognizing improved operating margins and cash generation in fiscal 2023.

- Operational Efficiency Gains: The company's efforts in supply chain optimization and cost reduction are expected to bolster adjusted EBITDA and free operating cash flow.

- Projected Growth: These operational improvements are contributing to a forecast of revenue growth and an estimated net income of $424.83 million for the year 2025.

Michaels' extensive North American retail presence, with over 1,290 stores as of November 2024, provides unparalleled customer access and market penetration. Its estimated 38.3% market share in the Fabric, Craft & Sewing Supplies Stores industry underscores its strong brand recognition and customer loyalty.

What is included in the product

Analyzes Michaels Companies’s competitive position through key internal and external factors, highlighting its brand strength and customer loyalty against e-commerce competition and changing consumer trends.

Offers a clear, actionable framework to identify and address Michaels' competitive challenges and leverage its market strengths.

Weaknesses

Michaels has faced challenges with its top-line sales, experiencing muted demand in the arts and crafts sector. In 2023, the company saw a notable decline in same-store sales, dropping by 6.4%.

Looking ahead to 2024, projections suggest a continued revenue dip of around 1%. While new store openings are planned, they are not expected to fully counteract the negative trend in comparable store sales, highlighting a post-pandemic cooling of the crafting surge.

To combat this slowdown and encourage customer visits, Michaels has been relying on promotional activities, indicating a need to stimulate purchasing behavior in a less robust market environment.

Michaels Companies' reliance on discretionary spending makes it vulnerable. When the economy tightens, as seen with persistent inflation in 2023 and early 2024, consumers often cut back on non-essential items like craft supplies. This directly impacts Michaels' sales volume.

For instance, a significant portion of Michaels' revenue is tied to hobbies and creative projects, which are easily deferred when household budgets are strained. This sensitivity to economic cycles means that during periods of reduced consumer confidence, the company's top-line performance can see a noticeable decline.

Michaels faces a fierce battle for customers, going head-to-head with giants like Walmart and Amazon, alongside specialized players such as Hobby Lobby and the burgeoning online craft marketplace, Etsy. The recent bankruptcy of competitor Joann underscores the significant financial strain within the sector.

Ongoing Supply Chain Optimization Needs

Michaels continues to work on making its supply chain more efficient, aiming to cut costs and speed up deliveries. However, this is an ongoing process, and the company has had past issues with managing its inventory effectively.

Supply chain efficiency is really important for Michaels to be profitable and keep customers happy. Any hiccups or delays in this area can make it harder for them to meet customer demand and control their expenses.

- Ongoing Optimization: Michaels is investing in supply chain improvements, but these are long-term projects.

- Historical Inventory Challenges: Past difficulties in inventory management highlight the need for continued focus.

- Impact on Profitability: Supply chain inefficiencies directly affect the company's ability to manage costs and generate profits.

- Customer Satisfaction Link: Efficient delivery is crucial for meeting customer expectations and maintaining satisfaction levels.

Reliance on Traditional Retail Model

Michaels Companies' reliance on its traditional brick-and-mortar retail model presents a significant weakness. Despite e-commerce expansion, the company's substantial physical store network, which numbered around 1,260 stores as of early 2024, represents a considerable ongoing operational expense. This heavy dependence on physical retail can strain profit margins, particularly if same-store sales growth remains sluggish, necessitating ongoing investment in store modernization and experiential retail to compete in a rapidly evolving market.

Michaels faces intense competition from large retailers like Walmart and Amazon, as well as specialized craft stores and online platforms like Etsy. The recent bankruptcy of Joann, a key competitor, highlights the financial pressures within the arts and crafts sector, indicating a challenging market environment for Michaels.

The company's heavy reliance on its extensive brick-and-mortar store base, with approximately 1,260 locations as of early 2024, represents a significant ongoing operational cost. This dependence on physical retail can pressure profit margins, especially if comparable store sales continue to stagnate, requiring sustained investment in store upkeep and new retail experiences.

Michaels' performance is sensitive to economic downturns, as consumers often cut back on discretionary spending for hobbies and crafts during periods of inflation or reduced consumer confidence. This vulnerability was evident in 2023, with a 6.4% decline in same-store sales, and projections for 2024 suggest a continued revenue decrease of around 1%.

| Competitor | Market Position | Impact on Michaels |

|---|---|---|

| Walmart | Mass Retailer, Broad Product Offering | Price competition, convenience |

| Amazon | E-commerce Giant, Vast Selection | Online sales dominance, convenience |

| Hobby Lobby | Specialty Craft Retailer | Direct competition for craft enthusiasts |

| Etsy | Online Marketplace for Handmade Goods | Niche market appeal, unique products |

Preview the Actual Deliverable

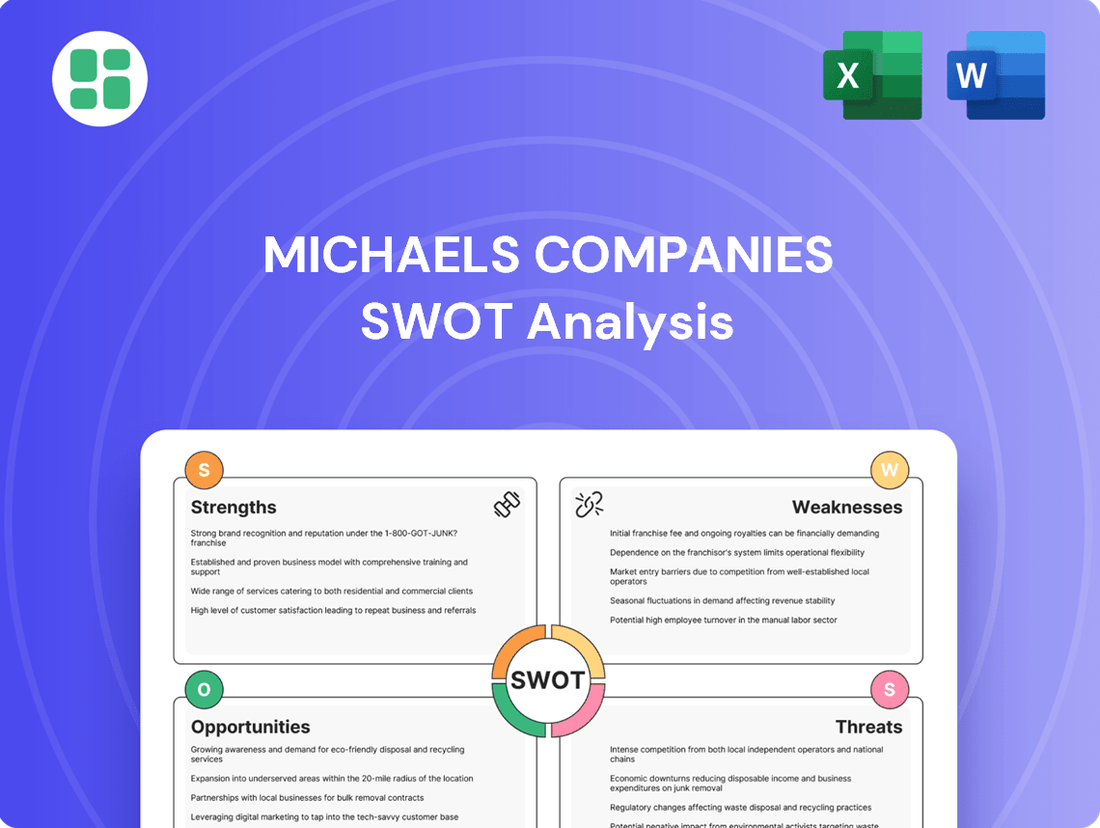

Michaels Companies SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This comprehensive SWOT analysis of The Michaels Companies is presented in its entirety, offering a clear view of strengths, weaknesses, opportunities, and threats.

You are viewing a live preview of the actual SWOT analysis file for The Michaels Companies. The complete version, detailing each aspect of the business, becomes available after checkout, ensuring you get the full, unedited report.

Opportunities

The arts and crafts retail market is booming, with an expected 8.1% growth in 2024-2025 and a projected compound annual growth rate of 4.7% from 2025 to 2033. This surge is fueled by the expanding DIY culture and a rising desire for unique, personalized goods.

Michaels is perfectly positioned to leverage this trend, offering a wide array of supplies and creative inspiration that caters to hobbyists and crafters alike. The company's broad product selection supports various artistic pursuits, from painting and scrapbooking to knitting and jewelry making.

Michaels is strategically expanding its physical footprint, aiming for a 4-5% annual growth in store count through 2025. This expansion isn't just about more stores; it includes testing smaller, more accessible formats in urban and suburban centers to better serve diverse customer needs. This move targets underserved regions, potentially increasing market penetration and fostering deeper community connections.

Consumers are increasingly prioritizing environmentally friendly and sustainable options in their purchases, including in the arts and crafts sector. This growing awareness means a significant portion of the market is actively looking for products made from recycled, biodegradable, or non-toxic materials.

This shift in consumer preference offers Michaels a prime opportunity to expand its range of eco-conscious products. By developing and promoting sustainable arts and crafts supplies, Michaels can tap into this expanding market segment, attracting environmentally aware shoppers and setting itself apart from competitors.

For instance, a 2024 survey indicated that over 60% of consumers are willing to pay a premium for products with sustainable attributes. This data underscores the financial incentive for Michaels to invest in and highlight its green initiatives and product lines.

Further Digital Transformation and AI Integration

Michaels can capitalize on further digital transformation by enhancing its e-commerce platform and leveraging data analytics for personalized customer experiences. This includes optimizing its website and mobile app, as seen in the 2023 fiscal year where digital sales contributed a significant portion of revenue, aiming to further increase this share in 2024 and 2025.

Integrating artificial intelligence (AI) presents a key opportunity to streamline operations, from inventory management to customer service chatbots. Michaels’ MakerPlace, a digital platform for handmade goods and creative content, can be further developed with AI to recommend personalized projects and classes, aligning with the growing demand for tech-integrated crafting experiences.

- Enhanced E-commerce: Continued investment in digital channels, aiming to boost online sales by a projected 10-15% in the 2024-2025 period.

- AI-Driven Personalization: Utilizing AI for tailored product recommendations and content, potentially increasing customer engagement by 20%.

- MakerPlace Expansion: Growing MakerPlace’s user base and class offerings, targeting a 25% increase in active participants by end of 2025.

- Data Analytics Optimization: Implementing advanced analytics to improve supply chain efficiency and marketing ROI, aiming for a 5% reduction in operational costs.

Acquisition and Integration of Competitor Assets

Michaels' acquisition of Joann's intellectual property and private label brands in June 2025, following Joann's bankruptcy, is a significant opportunity. This strategic acquisition is poised to bolster Michaels' offerings in crucial categories like fabric, sewing, and yarn.

The integration allows Michaels to not only broaden its product assortment but also to potentially absorb a considerable segment of Joann's former customer base. This consolidation is expected to strengthen Michaels' market position and alleviate competitive pressures, particularly within its core product segments.

- Expanded Product Assortment: Gain control of valuable Joann private label brands, enhancing Michaels' fabric, sewing, and yarn selections.

- Market Share Consolidation: Capture a significant portion of Joann's customer base, increasing overall market share.

- Reduced Competitive Landscape: Diminish direct competition in key product categories, leading to a more favorable market environment.

The booming arts and crafts market, projected for 8.1% growth in 2024-2025, presents a significant opportunity for Michaels to expand its reach and product offerings. The company's strategic store expansion, targeting 4-5% annual growth through 2025, aims to capture new customer segments and increase market penetration.

Michaels can leverage the growing consumer demand for sustainable products by expanding its eco-conscious offerings, a move supported by data showing over 60% of consumers willing to pay more for such items in 2024. Furthermore, continued investment in its e-commerce platform and AI-driven personalization, aiming for 10-15% online sales growth in 2024-2025, will enhance customer engagement.

The acquisition of Joann's intellectual property and private label brands in June 2025 is a game-changer, set to bolster Michaels' fabric, sewing, and yarn categories and consolidate market share. This move is expected to reduce direct competition, creating a more favorable market environment for Michaels.

| Opportunity Area | Projected Impact (2024-2025) | Supporting Data |

|---|---|---|

| Market Growth | Leverage 8.1% market growth | DIY culture and demand for personalized goods |

| Store Expansion | 4-5% annual store count growth | Targeting urban and suburban centers |

| Sustainability | Tap into eco-conscious consumer segment | 60%+ consumers willing to pay premium for sustainable products (2024) |

| Digital & AI | 10-15% online sales growth | AI for 20% customer engagement increase; MakerPlace 25% participant growth |

| Acquisition | Strengthen fabric, sewing, yarn categories | Acquisition of Joann IP in June 2025 |

Threats

Persistent inflation and the resulting squeeze on consumer discretionary income present a considerable threat to Michaels. As arts and crafts supplies are often viewed as non-essential, economic pressures can directly translate into lower spending on their products, impacting sales volumes and overall revenue. For instance, in early 2024, consumer confidence surveys indicated ongoing concerns about inflation, suggesting consumers are prioritizing essential goods over discretionary items.

Michaels operates in a highly competitive environment, facing pressure from direct competitors like Hobby Lobby, alongside giants such as Walmart and Amazon, and niche online platforms like Etsy. This intense rivalry often spills into price wars, which can significantly squeeze profit margins and make it difficult to hold onto market share.

The recent bankruptcy of Joann in early 2024 serves as a stark reminder of the precarious position many specialty craft retailers find themselves in. This event underscores the vulnerability of businesses in this sector when faced with relentless competition and shifting consumer spending habits.

While the DIY movement remains robust, consumer tastes are dynamic and could pivot away from traditional arts and crafts or favor experiences over tangible products. For instance, in 2024, there's a growing interest in experiential retail, potentially drawing consumers away from purely product-based purchases.

A downturn in demand for specific craft segments or an oversaturated market could diminish Michaels' appeal and revenue. The company needs to stay vigilant, tracking consumer behavior and market shifts to maintain its competitive edge.

Supply Chain Disruptions and Increased Costs

Michaels faces ongoing threats from global supply chain vulnerabilities. Rising transportation costs, persistent labor shortages, and the potential for new trade tariffs continue to impact operational efficiency and profitability. For instance, the cost of shipping a container from Asia to the US has seen significant fluctuations, with some periods in 2023 and early 2024 seeing rates well above pre-pandemic levels, directly increasing Michaels' cost of goods sold.

While Michaels actively pursues supply chain optimization, external disruptions remain a significant risk. These disruptions can lead to inventory challenges, meaning products might not be available when customers want them, and can also drive up operational expenses. The company's ability to manage these external factors directly influences its capacity to control product costs, which in turn affects consumer pricing and overall demand for its merchandise.

- Rising Freight Costs: Ocean freight rates, a key component of supply chain expenses, have shown volatility. For example, the Shanghai Containerized Freight Index, while down from pandemic peaks, has experienced upward pressure in late 2023 and early 2024 due to geopolitical events and increased demand, impacting Michaels' landed costs.

- Labor Shortages: Shortages in trucking and warehouse labor across North America continue to create bottlenecks, increasing delivery times and associated costs for Michaels.

- Inventory Management Challenges: Unforeseen disruptions can lead to stockouts of popular items or an oversupply of others, complicating inventory management and potentially leading to markdowns.

Cybersecurity Risks and Data Breaches

Michaels, with its substantial e-commerce operations, manages a vast repository of customer data, making it a prime target for cybersecurity threats and data breaches. A successful breach could result in substantial financial penalties, severe reputational harm, and a significant decline in customer confidence, negatively affecting both online and physical store performance.

The financial services sector, for instance, saw the average cost of a data breach reach $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. For a retailer like Michaels, such an event would not only incur direct costs but also lead to lost sales and increased operational expenses to rectify the situation.

- Cybersecurity Vulnerabilities: As a large retailer with a significant online presence, Michaels is exposed to a high volume of sensitive customer information, increasing its susceptibility to cyberattacks.

- Financial and Reputational Impact: Data breaches can lead to direct financial losses from remediation efforts and potential fines, alongside severe damage to brand reputation and customer loyalty.

- Erosion of Customer Trust: Incidents involving customer data can erode trust, potentially causing customers to shift their spending to competitors perceived as more secure.

The intense competition from both direct rivals and large general retailers like Walmart and Amazon poses a significant threat to Michaels' market share and pricing power. This competitive landscape, coupled with the potential for consumers to shift towards experiential purchases rather than traditional crafts, as seen in the growing experiential retail trend of 2024, could negatively impact sales volumes.

Supply chain disruptions, including rising freight costs and labor shortages, continue to be a major concern. For instance, ocean freight rates have seen upward pressure in late 2023 and early 2024, directly increasing Michaels' cost of goods sold and impacting profitability.

Michaels' substantial e-commerce operations make it a target for cybersecurity threats. A data breach in 2024 could cost millions, as seen in the financial services sector where the average breach cost reached $4.45 million, severely damaging reputation and customer trust.

SWOT Analysis Data Sources

This Michaels Companies SWOT analysis is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and insightful commentary from industry experts.