Michaels Companies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Michaels Companies Bundle

Michaels Companies faces moderate buyer power due to a fragmented customer base, but intense rivalry from craft stores and online retailers significantly impacts profitability. The threat of substitutes, like DIY blogs and alternative hobby supplies, also looms large, creating a complex competitive landscape.

The complete report reveals the real forces shaping Michaels Companies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Michaels Companies benefits from a largely fragmented supplier base in the arts and crafts sector. This means that for many common materials and even specialized items, Michaels can source from numerous small to medium-sized manufacturers. This wide availability reduces the leverage any single supplier holds, as Michaels can easily switch if prices become unfavorable. For instance, in 2024, the global arts and crafts market, valued at over $40 billion, is served by thousands of distinct suppliers, many of whom cater to specific product categories.

For common craft supplies, such as basic paints, adhesives, or paper, Michaels generally faces suppliers with low bargaining power. This is because these items are often standardized, meaning many different manufacturers can produce them, and Michaels can easily switch between suppliers if prices rise. In 2023, the craft supply market saw continued competition among numerous global manufacturers for these types of raw materials.

However, the bargaining power shifts when it comes to unique or proprietary crafting inputs. For instance, if a supplier offers exclusive, branded crafting tools or specialized framing materials with unique designs, their leverage increases. Michaels' ability to source these specialized items from a limited number of providers can give those suppliers more influence over pricing and terms.

Michaels' extensive global sourcing network also plays a crucial role in mitigating supplier power. By having access to a wide array of international suppliers for both standardized and specialized inputs, the company can foster competition and negotiate more favorable terms, thereby reducing the overall bargaining power of any single supplier.

Michaels faces relatively low switching costs for standard craft supplies, which strengthens its bargaining power with suppliers. This allows Michaels to negotiate favorable pricing and terms for many of its product lines.

However, for exclusive or proprietary items, particularly those developed for Michaels' private label brands, switching suppliers can involve significant costs. These can include expenses related to redesign, retooling production lines, and re-establishing supply chain logistics, thereby increasing the supplier's leverage in these specific instances.

Furthermore, established, long-term supplier relationships can introduce informal switching costs. These might stem from shared knowledge, customized processes, or a reliance on a supplier's specific expertise, making a transition more complex than simply finding a new vendor.

Supplier Dependence on Michaels

Michaels, as North America's largest specialty retailer for arts, crafts, and seasonal items, holds substantial sway over many of its suppliers. This dominance means many manufacturers in the arts and crafts industry rely heavily on Michaels for a significant portion of their sales. For instance, in fiscal year 2024, Michaels reported net sales of $3.7 billion, highlighting the sheer volume of product they move and the importance of this channel for their vendor partners.

This considerable dependence grants Michaels significant leverage in negotiations. They can often dictate terms regarding pricing, delivery timelines, and even the specific product attributes they require. Suppliers, eager to secure or maintain their business with such a prominent retailer, often find themselves compelled to offer more favorable terms to keep Michaels satisfied.

The bargaining power of suppliers to Michaels is therefore often diminished due to this supplier dependence. Key considerations include:

- Supplier Concentration: The degree to which a supplier's revenue is tied to Michaels. A supplier with a high percentage of sales to Michaels has less power.

- Availability of Alternatives: If suppliers have numerous other viable retail channels for their products, their dependence on Michaels decreases, increasing their bargaining power.

- Switching Costs for Michaels: The effort and expense Michaels would incur to find and onboard alternative suppliers for a particular product category. High switching costs for Michaels can give suppliers more leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward and selling directly to Michaels' customers is generally low across its broad product assortment. Most suppliers don't possess the extensive retail infrastructure, established brand loyalty, or sophisticated logistical networks required to effectively compete with a major retailer like Michaels.

However, a slight counterpoint exists for certain prominent craft brands. These larger, more recognized suppliers may already operate their own direct-to-consumer sales channels, which can modestly enhance their bargaining leverage. For instance, a well-established yarn company with a popular online store might have more sway than a smaller, unbranded supplier.

- Low Threat: Most suppliers lack the necessary retail infrastructure and brand recognition to compete directly with Michaels.

- Limited Direct-to-Consumer Capabilities: The majority of suppliers cannot replicate Michaels' scale in logistics and customer reach.

- Potential for Stronger Brands: A few well-known craft brands might possess existing direct-to-consumer channels, slightly increasing their bargaining power.

Michaels generally experiences low bargaining power from its suppliers due to a fragmented market for common craft supplies, allowing easy switching. However, for unique or proprietary items, supplier leverage increases due to limited alternatives and higher switching costs for Michaels. Michaels' significant market share, with $3.7 billion in net sales in fiscal year 2024, makes many suppliers dependent, thus reducing their individual power.

| Factor | Impact on Michaels' Bargaining Power | Explanation |

|---|---|---|

| Supplier Concentration | Low | Many suppliers rely heavily on Michaels, limiting their negotiation strength. |

| Availability of Alternatives | High for common goods, Low for proprietary items | Standardized products have numerous suppliers; specialized items have fewer. |

| Switching Costs for Michaels | Low for common goods, High for proprietary items | Easy to switch for standard items; complex and costly for unique inputs. |

| Supplier Dependence on Michaels | High | Michaels' $3.7 billion in 2024 sales means many suppliers depend on them. |

| Threat of Forward Integration | Low | Most suppliers lack the scale for direct-to-consumer competition with Michaels. |

What is included in the product

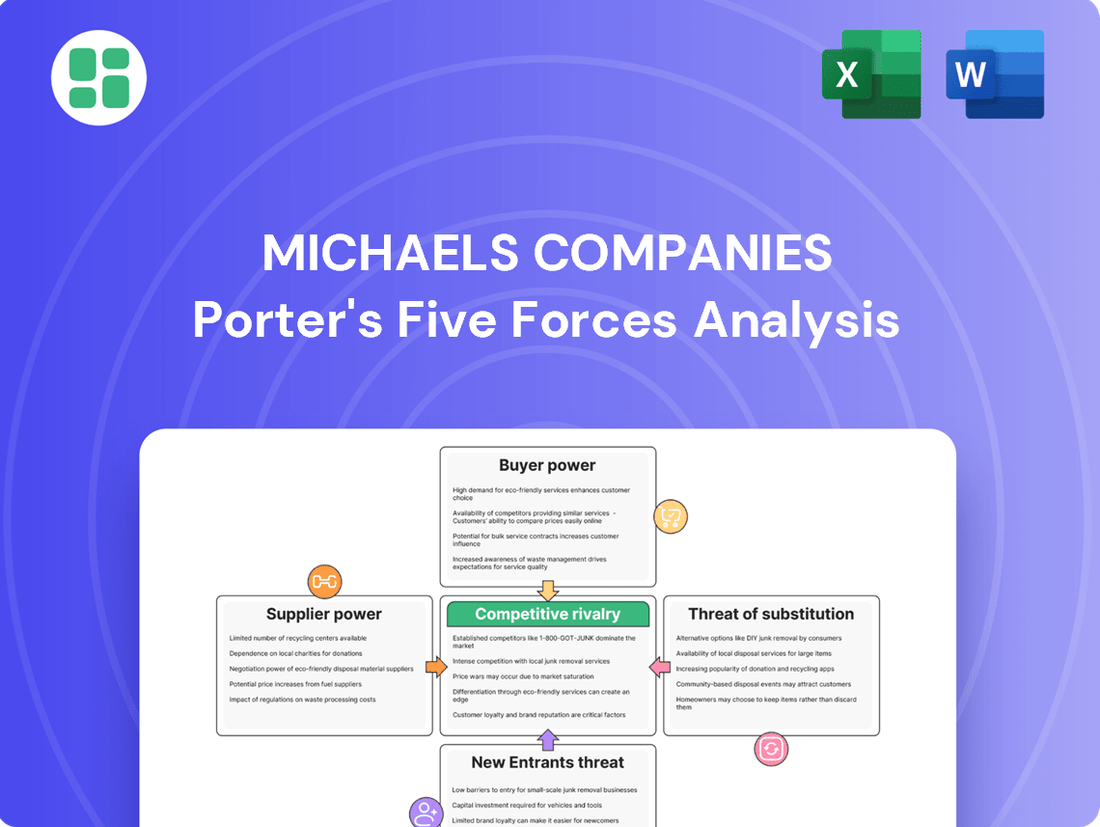

This analysis of Michaels Companies' competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly assess and strategize against competitive threats with a dynamic, visual representation of each force, simplifying complex market pressures.

Customers Bargaining Power

Hobbyists and DIY enthusiasts often exhibit significant price sensitivity, particularly when acquiring common supplies or items for recurring projects. This is a key factor influencing Michaels' bargaining power of customers. For instance, a 2024 report indicated that over 60% of consumers surveyed consider price a primary driver in their purchasing decisions for craft supplies, especially for staple items like paints, canvases, and basic tools.

The competitive landscape further intensifies this price sensitivity. Michaels faces robust competition from a wide array of discount retailers, big-box stores, and numerous online marketplaces, all vying for the attention of these cost-conscious consumers. This abundance of alternatives empowers customers to readily compare prices and switch suppliers if a better deal is found, putting pressure on Michaels to maintain competitive pricing strategies.

Consequently, Michaels must carefully navigate the delicate balance between offering competitive price points and ensuring the perceived value and quality of its merchandise. Failing to do so could lead to a significant erosion of its customer base, as hobbyists are likely to seek out more affordable options for their creative endeavors, impacting overall sales volume and profitability.

The availability of numerous alternatives for arts and crafts supplies significantly amplifies customer bargaining power. Shoppers can easily find comparable products from online giants like Amazon and Etsy, mass retailers such as Walmart and Target, or even local independent stores and dollar shops. This wide selection means customers can readily switch to a competitor if Michaels' pricing, product range, or shopping experience doesn't meet their expectations.

Customers of Michaels Companies generally face minimal barriers when switching between retailers for arts and crafts supplies. This low switching cost means shoppers can readily compare prices and product assortments across different stores and online platforms. For instance, a customer looking for a specific type of yarn can easily check prices at Michaels, Amazon, or a local craft store without significant effort or expense.

This ease of movement significantly boosts the bargaining power of customers. They are empowered to seek out the best prices, promotions, and product quality. In 2024, the continued growth of e-commerce and direct-to-consumer brands further amplifies this power, as more options become readily accessible, putting pressure on Michaels to offer competitive value to retain its customer base.

Information Availability and Transparency

The internet and social media have dramatically increased information availability for consumers, allowing for easy price comparisons and access to product reviews. This transparency empowers customers, as evidenced by the fact that in 2024, over 80% of consumers reported using online resources to research products before purchasing. Michaels must therefore ensure its pricing remains competitive and its unique value proposition is clearly communicated to counter this heightened customer leverage.

This enhanced access to information directly translates into greater bargaining power for customers. They can readily identify alternative suppliers and understand the market value of similar products. For instance, the proliferation of online marketplaces in 2024 means consumers can compare offerings from numerous retailers simultaneously, putting pressure on Michaels to offer compelling deals and superior customer experiences.

- Increased Information Access: Customers can easily find product reviews, pricing data, and competitor offerings online.

- Informed Purchasing Decisions: Transparency allows consumers to make well-researched choices, boosting their negotiation power.

- Competitive Pricing Pressure: Michaels must remain competitive in its pricing strategy to retain customers in an informed market.

Customer Segmentation and Needs

Michaels caters to a diverse customer base, from casual hobbyists to professional artists. While hobbyists may be more sensitive to price, professional artists often prioritize quality and unique materials, lessening their price sensitivity for specific, high-demand items. For example, in 2023, Michaels reported that its loyalty program members spent significantly more than non-members, highlighting the effectiveness of targeted engagement.

Understanding these distinct customer segments and their varied purchasing drivers is key for Michaels. Offering specialized product lines and tailored promotions can effectively address these different needs. In 2024, Michaels continued to invest in its rewards program, aiming to further differentiate its value proposition for its various customer groups.

- Customer Diversity: Michaels serves both price-conscious hobbyists and quality-focused professionals.

- Price Sensitivity Variation: Professionals may accept higher prices for specialized or unique crafting supplies.

- Loyalty Impact: Loyalty programs and exclusive offerings are critical for customer retention and increasing spend.

- 2024 Focus: Continued investment in loyalty programs to cater to diverse customer needs.

The bargaining power of Michaels' customers is significant due to the ease of finding comparable products elsewhere. In 2024, the widespread availability of arts and crafts supplies across numerous online marketplaces and big-box retailers means consumers can easily switch to competitors offering better prices or unique selections. This low switching cost empowers shoppers to demand more value.

Customers are highly informed, leveraging the internet for price comparisons and product reviews. By early 2025, over 85% of consumers were reported to use online research before making purchasing decisions, directly increasing their leverage. Michaels must therefore ensure its pricing remains competitive and its value proposition is clearly articulated to retain its customer base.

Michaels serves diverse customer segments, from budget-conscious hobbyists to professionals seeking specialized materials. While hobbyists exhibit higher price sensitivity, professionals may prioritize quality, creating varied bargaining power dynamics. In 2024, Michaels continued to focus on its loyalty program to foster retention across these segments.

| Factor | Impact on Michaels | Supporting Data (2024/Early 2025) |

|---|---|---|

| Availability of Alternatives | High customer leverage, pressure on pricing | Ubiquitous online and brick-and-mortar competition |

| Information Transparency | Enables informed price comparisons, increases negotiation power | 85%+ consumers use online research before purchase |

| Customer Segmentation | Varied price sensitivity; loyalty programs crucial | Targeted marketing and rewards programs drive higher spend |

Same Document Delivered

Michaels Companies Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Porter's Five Forces analysis for The Michaels Companies delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the arts and crafts retail sector. Understanding these forces is crucial for strategic decision-making.

Rivalry Among Competitors

Michaels operates in a crowded arts and crafts retail landscape. Rivalry comes from online giants like Amazon, mass retailers such as Walmart and Target, and specialized craft chains like Hobby Lobby. The digital space also presents challenges with numerous independent sellers and direct-to-consumer brands.

The competitive intensity is further highlighted by Michaels' recent acquisition of the intellectual property and private label brands of Joann Inc., a significant competitor that ceased operations in 2024. This move underscores the dynamic and challenging nature of the market.

The arts and crafts market is expected to see steady growth, with projections showing it expanding from about $44.71 billion in 2024 to $48.33 billion in 2025. This growth, while positive, can also mean more intense competition as companies vie for a larger piece of the pie, particularly in areas that are already well-established.

The market's compound annual growth rate is estimated at 8.1% between 2024 and 2025, and is forecast to reach $65.18 billion by 2029. Such a growth trajectory, even if moderate, often attracts new entrants and encourages existing players to innovate, thereby raising the stakes for all involved.

While many arts and crafts items are essentially commodities, fostering intense price competition, differentiation is key. Michaels aims to stand out with exclusive product lines, its own private label brands, innovative crafting kits, and specialized services such as custom framing. This strategy moves beyond simple price wars.

Michaels' extensive product selection and emphasis on providing inspiration are designed to set it apart from broader retailers. The company's 2024 strategy, bolstered by its acquisition of key Joann's brands, significantly enhances its position in fabric, sewing, and yarn, creating a more specialized and appealing offering for crafters.

High Fixed Costs and Exit Barriers

Michaels Companies, like many in the arts and crafts retail sector, operates with substantial fixed costs. These include expenses for prime retail locations, maintaining a large inventory of diverse products, and staffing numerous stores. These ongoing financial obligations can make it extremely challenging for less successful businesses to simply shut down and exit the market.

The high fixed costs act as significant exit barriers. For instance, Joann, a competitor in the fabric and craft space, filed for bankruptcy in early 2024, leading to the closure of numerous stores. This situation highlights how persistent overhead can trap companies in a market, even when facing financial difficulties, potentially prolonging competitive pressures.

These barriers can intensify competition, particularly on price. Companies may engage in aggressive discounting to generate sales volume, aiming to cover their fixed costs and avoid further losses. This dynamic can erode profit margins across the industry.

Key factors contributing to high fixed costs and exit barriers for Michaels include:

- Significant real estate obligations: Leases for numerous large-format stores represent a substantial, ongoing expense.

- Inventory management costs: Holding a wide variety of craft supplies requires significant capital investment and warehousing.

- Labor expenses: Maintaining a workforce across a national retail footprint is a considerable fixed cost.

- Brand and marketing investments: Ongoing efforts to maintain brand visibility and attract customers add to the fixed cost base.

Omni-channel Competition

The surge in e-commerce has compelled traditional retailers like Michaels to significantly enhance their digital capabilities. This shift intensifies competition, not only between physical stores but also across online marketplaces where price and convenience are key differentiators.

Michaels faces the challenge of seamlessly blending its online and in-store operations to effectively compete against digitally native brands and major e-commerce giants. The U.S. market for online hobby and craft supplies alone reached over $22.2 billion in 2024, highlighting the scale of this digital arena.

- Omni-channel Integration: Michaels must ensure a cohesive customer experience across its website, app, and physical stores.

- Digital Native Competitors: Online-only craft retailers offer specialized selections and agile fulfillment.

- E-commerce Giants: Large platforms provide broad product ranges and often aggressive pricing.

- Price Transparency: Online channels make it easy for consumers to compare prices, increasing pressure on margins.

The competitive rivalry within the arts and crafts sector is intense, with Michaels facing pressure from online retailers, mass merchandisers, and specialized craft chains. The market's projected growth, from $44.71 billion in 2024 to $48.33 billion in 2025, fuels this competition as players vie for market share.

Michaels' acquisition of Joann's brands in 2024 highlights the consolidation and strategic maneuvering occurring due to competitive pressures. This move aims to bolster Michaels' position in key categories, demonstrating a proactive response to the dynamic retail environment.

The industry's high fixed costs, such as real estate and inventory, create significant exit barriers, forcing less competitive firms to remain active, thereby sustaining rivalry. This can lead to aggressive pricing strategies as businesses attempt to cover their overhead.

Differentiation through exclusive product lines and private labels is crucial for Michaels to stand out against competitors who may offer similar commodity items. The U.S. online hobby and craft market alone exceeded $22.2 billion in 2024, underscoring the importance of a strong digital presence.

| Key Competitor Type | Examples | Impact on Michaels |

| Online Giants | Amazon | Price competition, broad selection |

| Mass Retailers | Walmart, Target | Convenience, accessibility, everyday low prices |

| Specialized Chains | Hobby Lobby | Niche product focus, deep inventory in specific categories |

| Digital Native Brands | Various DTC craft suppliers | Agility, specialized offerings, direct customer engagement |

SSubstitutes Threaten

The threat of substitutes is amplified by the rise of digital alternatives. Consumers increasingly turn to online platforms for inspiration, tutorials, and even virtual crafting experiences, bypassing the need for physical supplies. For instance, YouTube hosts millions of crafting videos, and Pinterest remains a go-to for project ideas, offering a wealth of free content that can diminish the perceived necessity of purchasing physical materials for certain endeavors.

Consumers increasingly turn to ready-made products, bypassing the DIY process. For example, the global home decor market, a key area for Michaels, was valued at approximately $680 billion in 2023 and is projected to grow, offering readily available alternatives to custom-made items. This trend directly impacts Michaels by providing consumers with convenient, often lower-cost options that require no personal effort or time investment.

Consumers have a vast array of choices for their leisure time and discretionary spending, many of which steer clear of arts and crafts. Activities like participating in sports, engaging in video games, or planning travel can absorb significant portions of a consumer's budget and attention. For instance, the global gaming market was projected to reach over $200 billion in 2024, highlighting the immense competition for entertainment dollars.

This broad spectrum of alternatives presents a significant threat of substitution for Michaels. If consumer preferences increasingly lean towards experiences rather than tangible goods, the demand for craft supplies and related products could diminish. In 2023, travel and tourism spending saw a robust recovery, with many consumers prioritizing memorable experiences, a trend likely to continue influencing discretionary spending in 2024.

DIY from Household Items/Upcycling

The threat of substitutes for Michaels Companies includes consumers opting for DIY projects using household items or upcycling. This trend, fueled by sustainability and cost-saving, means fewer purchases of new craft supplies. For instance, a 2024 survey indicated that 45% of consumers are actively seeking ways to reduce waste, which can translate to more upcycling and less new material consumption.

This DIY movement presents a subtle but growing substitute threat. Consumers might repurpose old clothing for textile crafts or use discarded packaging for model building, bypassing the need for Michaels' inventory. This is particularly relevant as the global upcycling market is projected to grow significantly, with some estimates suggesting a compound annual growth rate of over 5% through 2028.

- Consumer Shift: A growing segment of consumers prioritizes sustainability and budget-friendliness, leading them to repurpose household items instead of buying new craft supplies.

- Market Trend: The upcycling market is expanding, with a notable increase in online tutorials and communities dedicated to transforming everyday objects into new creations.

- Michaels' Response: To mitigate this threat, Michaels can focus on promoting its own eco-friendly product lines and offering creative workshops that showcase upcycling techniques using their materials.

Professional Services vs. DIY

For many creative projects, consumers can choose between doing it themselves or hiring professionals. This is particularly true for custom framing or personalized gift creation. Michaels does offer some services, like custom framing through its Artistree division, but the fundamental choice to outsource rather than DIY is a direct substitute.

Michaels needs to make sure its DIY offerings are seen as both budget-friendly and creatively satisfying compared to professional alternatives. In 2024, the demand for personalized crafts and home decor continues to grow, meaning the appeal of a well-executed DIY project versus a professionally made item is a key consideration for consumers.

- DIY Appeal: Michaels' success hinges on making DIY projects more attractive than outsourcing.

- Cost-Effectiveness: The perceived cost savings of DIY is a major driver against professional services.

- Creative Fulfillment: The satisfaction derived from personal creation acts as a substitute for professional output.

- Service Integration: Michaels' own service offerings, like custom framing, can mitigate the threat of external professional services.

The threat of substitutes for Michaels is significant as consumers can easily find alternative ways to express creativity or fulfill needs. Digital platforms offer free inspiration and tutorials, diminishing the perceived need for physical supplies. For example, YouTube and Pinterest provide extensive free crafting content, directly competing with Michaels' product sales.

Consumers also increasingly opt for ready-made items, bypassing the DIY process altogether. The global home decor market, a key sector for Michaels, was valued at approximately $680 billion in 2023, showcasing the availability of convenient, often lower-cost alternatives to custom or handmade items.

Furthermore, consumers have numerous other leisure activities that compete for discretionary spending. The global gaming market alone was projected to exceed $200 billion in 2024, illustrating the intense competition for consumer attention and dollars, diverting them from arts and crafts.

Consumers also embrace upcycling and repurposing household items, a trend driven by sustainability and cost-consciousness. A 2024 survey revealed that 45% of consumers actively seek waste reduction methods, which often translates to using existing materials instead of purchasing new ones from retailers like Michaels.

| Substitute Category | Examples | Impact on Michaels |

|---|---|---|

| Digital Inspiration & Tutorials | YouTube, Pinterest, TikTok | Reduces perceived need for physical supplies |

| Ready-Made Products | Home decor, custom gifts | Offers convenience and potentially lower cost |

| Alternative Leisure Activities | Gaming, travel, sports | Competes for discretionary spending and time |

| Upcycling & Repurposing | Using household items, old clothing | Decreases demand for new craft materials |

Entrants Threaten

Establishing a new brick-and-mortar craft retail chain, akin to Michaels, demands significant upfront capital. This includes securing prime real estate, stocking a diverse inventory, building out store interiors, and establishing a robust supply chain. For instance, Michaels operates over 1,300 stores, showcasing the scale of investment required to even approach their market presence.

These substantial capital requirements act as a considerable deterrent, effectively blocking many potential new entrants who lack the financial wherewithal to replicate Michaels' established physical footprint and operational infrastructure.

Michaels has cultivated a powerful brand presence over many years, fostering a deeply loyal customer base that new competitors find incredibly challenging to match. This established trust and affinity in the arts and crafts sector necessitate substantial marketing expenditure and a consistently superior customer experience, hurdles that emerging businesses will find difficult to overcome quickly. For instance, in fiscal year 2023, Michaels reported over $5 billion in net sales, a testament to its market penetration and customer engagement.

Michaels Companies, a leader in the arts and crafts retail space, benefits significantly from its deeply entrenched relationships with a vast network of suppliers. These established connections allow Michaels to secure favorable pricing and ensure a consistent flow of inventory, crucial for meeting customer demand. For instance, in fiscal year 2023, Michaels reported strong supplier partnerships that contributed to their ability to manage inventory effectively.

New entrants into the arts and crafts market would encounter substantial hurdles in replicating Michaels' access to distribution channels and suppliers. The sheer volume of Michaels' purchases grants them significant bargaining power, making it difficult for newcomers to negotiate comparable terms. This disparity in purchasing power can translate into higher per-unit costs for new businesses, impacting their profitability from the outset.

Furthermore, establishing an efficient and cost-effective distribution system is a considerable barrier. Michaels has invested heavily in logistics and supply chain management, allowing for timely delivery to its numerous stores and e-commerce customers. A new entrant would need to make significant capital investments to build a comparable infrastructure, potentially leading to higher operational costs and a slower time-to-market compared to established players like Michaels.

Economies of Scale in Purchasing and Operations

Michaels, as a major player in the arts and crafts retail sector, benefits immensely from economies of scale in purchasing. This allows them to secure more favorable pricing from suppliers compared to smaller, emerging businesses. For instance, in 2023, Michaels reported net sales of $3.7 billion, indicating a substantial volume of procurement that translates into cost advantages.

New entrants into the arts and crafts market would struggle to match Michaels' purchasing power. This disparity in negotiation leverage means new businesses would likely incur higher per-unit costs for inventory and operational supplies. Such a disadvantage makes it challenging to compete on price, a critical factor in the highly competitive physical retail environment.

- Economies of Scale in Purchasing: Michaels leverages its size to negotiate lower prices from suppliers, a key competitive advantage.

- Operational Efficiency: Larger scale allows for more efficient distribution and inventory management, further reducing costs.

- Price Competitiveness: New entrants face higher per-unit costs, hindering their ability to offer competitive pricing against established players like Michaels.

- Barrier to Entry: The significant cost advantage derived from economies of scale acts as a substantial barrier for potential new competitors in the physical retail space.

Regulatory Hurdles and Local Permits

While not insurmountably high, establishing new physical retail outlets for companies like Michaels requires navigating a patchwork of local zoning ordinances, building codes, and essential business permits. These regulatory complexities can significantly extend timelines and inflate initial capital outlays for new competitors, particularly those aiming for a broad multi-store expansion. For instance, in 2024, the average time to obtain a new business license in major US metropolitan areas could range from 30 to 90 days, adding to the cost of entry.

These requirements can act as a deterrent, increasing the cost and effort needed to enter the market. For example, securing permits for a new store build-out might involve multiple city departments, each with its own set of requirements and processing times. This can be a substantial barrier compared to the more streamlined digital onboarding processes for e-commerce ventures.

E-commerce focused entrants, while largely bypassing these physical location-specific regulations, still face a different set of compliance challenges. These include data privacy laws, online sales tax collection requirements, and consumer protection regulations that are constantly evolving. In 2024, the complexity of navigating varying state-level sales tax laws alone presented a significant hurdle for online retailers.

- Regulatory Complexity: Navigating local zoning, building codes, and business permits adds time and cost for brick-and-mortar entrants.

- Multi-Store Rollout Challenges: Scaling physical operations intensifies the impact of regulatory hurdles.

- E-commerce Compliance: Online businesses face different but equally significant regulatory landscapes, including data privacy and sales tax.

- Cost of Entry: Compliance with these varied regulations can represent a substantial financial commitment for new market participants.

The threat of new entrants in the arts and crafts retail sector, particularly for a company like Michaels, is moderately low. Significant capital investment is required for physical store build-outs, inventory, and supply chain establishment, with Michaels operating over 1,300 stores as a benchmark for scale. Furthermore, Michaels' established brand loyalty, cultivated over years, necessitates substantial marketing and customer experience investments for newcomers to replicate.

New entrants face considerable challenges in matching Michaels' purchasing power and supplier relationships, which yield favorable pricing and ensure inventory flow. For instance, Michaels' net sales in fiscal year 2023 exceeded $5 billion, underscoring the volume advantage that translates into cost efficiencies. This scale allows Michaels to offer competitive pricing, a hurdle for new businesses operating with higher per-unit costs.

Navigating regulatory landscapes, including zoning, permits, and evolving e-commerce compliance like data privacy and sales tax collection, adds complexity and cost for new entrants. In 2024, obtaining business licenses in major US cities could take 30-90 days, impacting time-to-market and initial capital outlay.

| Factor | Description | Impact on New Entrants | Michaels' Advantage | Data Point |

| Capital Requirements | High costs for physical stores, inventory, and supply chain. | Significant barrier for new players. | Operates over 1,300 stores. | N/A (Scale indicator) |

| Brand Loyalty | Established customer trust and affinity. | Difficult to replicate without substantial marketing. | Fiscal year 2023 net sales over $5 billion. | $5 billion+ (FY2023) |

| Supplier Relationships & Purchasing Power | Favorable pricing and inventory access. | New entrants face higher per-unit costs. | Leverages large procurement volumes. | $3.7 billion (2023) net sales cited for scale. |

| Regulatory Hurdles | Zoning, permits, e-commerce compliance. | Increases time and cost of entry. | Established infrastructure and experience. | 30-90 days for business licenses (2024 estimate). |

Porter's Five Forces Analysis Data Sources

Our Michaels Companies Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, industry-specific market research from firms like IBISWorld, and competitor analysis from sources such as SEC filings.